First Republic Bank shares slide in volatile trading session Shares of First Republic Bank fell another 47% Monday as investors remain uneasy about the banks financial condition even after a group of the nations largest financial institutions teamed up on a $30 billion rescue package Mar.  The unemployment rate has now hit a ten-year peak of seven per cent, while the Economic and Social Research Institute (ESRI) estimates that this will rise to close to ten per cent by the end of this year. In 2012, then-President Barack Obama claimed the government got back every dime used to rescue the banks. Meanwhile, ProPublicas ongoing Bailout Tracker reported a total net government profit of $96.6 billion as of February 2019, a figure that includes money paid back by bailed-out companies as well as revenue from dividends, loan interest, warrants, and other proceeds. Lloyds did not actually collapse or go bankrupt but the bank,together with HBOS, was bailed out by the UK Government in October 2008. December 22, 2008, 3:01 PM. In the face of this prolonged weakness, the Federal Reserve maintained an exceptionally low level for the federal funds rate target and sought new ways to provide additional monetary accommodation. Government capital infusions into Fannie Mae and Freddie Mac (to this day still under government conservatorship). Global systemically important banks: Assessment methodology and the additional loss absorbency requirement. July 2011b. Ultimately, home prices fell by over a fifth on average across the nation from the first quarter of 2007 to the second quarter of 2011. Can I Sell My Company In An Uncertain Market? Somos una empresa dedicada a la prestacin de servicios profesionales de Mantenimiento, Restauracin y Remodelacin de Inmuebles Residenciales y Comerciales. The stimulus efforts made by the federal government to keep the economy going during the pandemic had the direct result of putting a lot of cash into the economy. In September 2008, Lehman Brothers posted a loss of$3.93bn in its third quarter, citing heavy writedowns on toxic mortgages, causing its share price to slide 52pc in two days. A 12-month program focused on applying the tools of modern data science, optimization and machine learning to solve real-world business problems. According to Lucas, an accurate measure of cost requires taking a fair value approach one that considers the full range of future gains and losses, and that recognizes the cost of that risk. During the first quarter of 2009the lowest point of the Recessionover 230,000 U.S. businesses closed 21; From 2007 to 2012, more than 450 banks failed Washington Mutual. In Europe, UBS acquired Credit Suisse in a deal brokered by Swiss regulators to stave off a crisis of confidence it the country's banking system. Prior to 2008, the prevailing attitude amongst economists and regulators was that markets would take care of themselves. TheDodd-Frank Act of 2010also created new provisions for the treatment of large financial institutions. GM cutstaff numbers and in March 2009 wasgiven 60 days to come up with a restructuring plan. In 2007, RBS entered a bidding war for Dutch bank ABN Amro, together with a consortium, and eventually receivedbacking from most of the shareholders. By October 2010, the unemployment rate had peaked at 10%. Later that month, after shares hit a record low of 16.50p, from 278.5p at the start of the year, the government steppedin to nationalise the bank, taking control of its mortgages and loan. A rigorous, hands-on program that prepares adaptive problem solvers for premier finance careers. The key problem appears to be consumption. Read about our approach to external linking. The last time everything came crashing down, the housing market took a turn for the worse in the second quarter of 2008. Author: Published in: sos cafe bottomless brunch abril 5, 2023 Categories: Congress is rushing to pass an emergency bill that will devote at least $1 trillion and maybe much more, by some estimates to helping people and businesses impacted by the coronavirus pandemic. Major Players in the 2008 Financial Crisis: Where Are They Now? This 20-month MBA program equips experienced executives to enhance their impact on their organizations and the world. Webcompanies that failed during the recession 2008. Shares of First Republic Bank fell another 47% Monday as investors to explain to the American government, and the American people why they felt they deserved a bailout, and how each company planned on repaying the Residential investment peaked in 2006, as did employment in residential construction. "You just can't pull out the playbook of 2008 and apply it to 2020," he says. Halifax this week released its updated house price index, showing data from March. These need to be as strong as possible. It was bought by Bank of America for $29 per share, at a 70pc premium to its share price the Friday earlier, but much below the $90 share price it had at the beginning of 2007. In the spring of 2008, the investment bank Bear Stearns was acquired by JPMorgan Chase with the assistance of the Federal Reserve. The FOMC also began communicating its intentions for future policy settings more explicitly in its public statements, particularly the circumstances under which exceptionally low interest rates were likely to be appropriate. The Dow Jones Industrial Average dropped 777.68 points by the time of closing. It had, a year earlier, written off 200m due to the US subprime mortgage market collapse, and then at its interim results in July 2008, took a further hit. Trinity Mazda steps it up a gear with new Wexford showroom, Money no object for architect's grand designs, Businesses are 'beyond breaking point' as lockdown set to continue, Bord Pleanala rejects plan for hotel at bridge. The drop wiped out $1.2 trillion in value from the U.S. stock market and led to a ripple effect on exchanges around the globe. A total of 12 companies in Co. Wexford failed in 2007, but by the end of last year, 24 companies in the county had suffered a similar fate double the amount of companies going bust just 12 months earlier. The decline in overall economic activity was modest at first, but it steepened sharply in the fall of 2008 as stresses in financial markets reached their climax. Unemployment Report Out Today: Heres The Latest On The Job Market, Change Is Still The Reigning Constant: Position Your Investment Strategy To Keep Up, An Intro To Manufactured Home Communities: What Investors Need To Know. Ben S. Bernanke Feb. 27The Bureau of Economic Analysiss final report revised its U.S. gross domestic product growth rate for the fourth quarter of 2008 to a negative 6.3%. The Telegraph values your comments but kindly requests all posts are on topic, constructive and respectful. The argument for having many can be traced back to arguments as the nation was founded. "I think the reason why most economists didn't understand how bad this was, is most economists couldn't wrap their mind around how stupid some of the players were being," Mr Knoop says. We could start with a massive initiative to retrofit buildings across the country, targeting the homes and public buildings in communities of color and low-income areas. Theres a major push underway to not repeat this moral travesty. At the time, bailing out big banks and failing industries like the auto sector was highly controversial - many felt it was rewarding companies for making bad decisions. Find out more, Germany is locked in a toxic love affair with Putin and Xi, Calorie counting is wrecking menus and risks driving a wave of eating disorders, Britains misfiring wonder fuel condemns households to a heat pump future, There is a way to give public sector workers a pay rise and save the Government a lot of money, Italy is now Europe's most backward country Britain is a close second, Putins Twitter account resurfaces as Russia comes in from the cold, attempting to take the bank to court for its 12bn cash call during the crisis, Bank of America said it had agreed to buyMerrill Lynch, Lloyds TSB made a 12bn offer for the group. Bank for International Settlements. With fears that similar collapses could be sustained by other major financial companies and banks, President Bush approved the Troubled Asset Relief Program (TARP) in October 2008. Investors had been concerned over the deal, taking place during the meltdown in the US sub-prime mortgage market, but later that year, RBS said both its and ABN Amro's writedowns were lowerthan expected. 4 It was also the worst slowdown since Q1 1982 when GDP fell 6.1%. Like theGreat Depressionof the 1930s and theGreat Inflationof the 1970s, the financial crisis of 2008 and the ensuing recession are vital areas of study for economists and policymakers. Bailout recipients should also be required to cap CEO pay at no more than 50 times worker pay. It had received $7.2bn in cash from an investor group in April of that year, but injust 10 days, almost $17bn in deposits had been withdrawn from the bank.

The unemployment rate has now hit a ten-year peak of seven per cent, while the Economic and Social Research Institute (ESRI) estimates that this will rise to close to ten per cent by the end of this year. In 2012, then-President Barack Obama claimed the government got back every dime used to rescue the banks. Meanwhile, ProPublicas ongoing Bailout Tracker reported a total net government profit of $96.6 billion as of February 2019, a figure that includes money paid back by bailed-out companies as well as revenue from dividends, loan interest, warrants, and other proceeds. Lloyds did not actually collapse or go bankrupt but the bank,together with HBOS, was bailed out by the UK Government in October 2008. December 22, 2008, 3:01 PM. In the face of this prolonged weakness, the Federal Reserve maintained an exceptionally low level for the federal funds rate target and sought new ways to provide additional monetary accommodation. Government capital infusions into Fannie Mae and Freddie Mac (to this day still under government conservatorship). Global systemically important banks: Assessment methodology and the additional loss absorbency requirement. July 2011b. Ultimately, home prices fell by over a fifth on average across the nation from the first quarter of 2007 to the second quarter of 2011. Can I Sell My Company In An Uncertain Market? Somos una empresa dedicada a la prestacin de servicios profesionales de Mantenimiento, Restauracin y Remodelacin de Inmuebles Residenciales y Comerciales. The stimulus efforts made by the federal government to keep the economy going during the pandemic had the direct result of putting a lot of cash into the economy. In September 2008, Lehman Brothers posted a loss of$3.93bn in its third quarter, citing heavy writedowns on toxic mortgages, causing its share price to slide 52pc in two days. A 12-month program focused on applying the tools of modern data science, optimization and machine learning to solve real-world business problems. According to Lucas, an accurate measure of cost requires taking a fair value approach one that considers the full range of future gains and losses, and that recognizes the cost of that risk. During the first quarter of 2009the lowest point of the Recessionover 230,000 U.S. businesses closed 21; From 2007 to 2012, more than 450 banks failed Washington Mutual. In Europe, UBS acquired Credit Suisse in a deal brokered by Swiss regulators to stave off a crisis of confidence it the country's banking system. Prior to 2008, the prevailing attitude amongst economists and regulators was that markets would take care of themselves. TheDodd-Frank Act of 2010also created new provisions for the treatment of large financial institutions. GM cutstaff numbers and in March 2009 wasgiven 60 days to come up with a restructuring plan. In 2007, RBS entered a bidding war for Dutch bank ABN Amro, together with a consortium, and eventually receivedbacking from most of the shareholders. By October 2010, the unemployment rate had peaked at 10%. Later that month, after shares hit a record low of 16.50p, from 278.5p at the start of the year, the government steppedin to nationalise the bank, taking control of its mortgages and loan. A rigorous, hands-on program that prepares adaptive problem solvers for premier finance careers. The key problem appears to be consumption. Read about our approach to external linking. The last time everything came crashing down, the housing market took a turn for the worse in the second quarter of 2008. Author: Published in: sos cafe bottomless brunch abril 5, 2023 Categories: Congress is rushing to pass an emergency bill that will devote at least $1 trillion and maybe much more, by some estimates to helping people and businesses impacted by the coronavirus pandemic. Major Players in the 2008 Financial Crisis: Where Are They Now? This 20-month MBA program equips experienced executives to enhance their impact on their organizations and the world. Webcompanies that failed during the recession 2008. Shares of First Republic Bank fell another 47% Monday as investors to explain to the American government, and the American people why they felt they deserved a bailout, and how each company planned on repaying the Residential investment peaked in 2006, as did employment in residential construction. "You just can't pull out the playbook of 2008 and apply it to 2020," he says. Halifax this week released its updated house price index, showing data from March. These need to be as strong as possible. It was bought by Bank of America for $29 per share, at a 70pc premium to its share price the Friday earlier, but much below the $90 share price it had at the beginning of 2007. In the spring of 2008, the investment bank Bear Stearns was acquired by JPMorgan Chase with the assistance of the Federal Reserve. The FOMC also began communicating its intentions for future policy settings more explicitly in its public statements, particularly the circumstances under which exceptionally low interest rates were likely to be appropriate. The Dow Jones Industrial Average dropped 777.68 points by the time of closing. It had, a year earlier, written off 200m due to the US subprime mortgage market collapse, and then at its interim results in July 2008, took a further hit. Trinity Mazda steps it up a gear with new Wexford showroom, Money no object for architect's grand designs, Businesses are 'beyond breaking point' as lockdown set to continue, Bord Pleanala rejects plan for hotel at bridge. The drop wiped out $1.2 trillion in value from the U.S. stock market and led to a ripple effect on exchanges around the globe. A total of 12 companies in Co. Wexford failed in 2007, but by the end of last year, 24 companies in the county had suffered a similar fate double the amount of companies going bust just 12 months earlier. The decline in overall economic activity was modest at first, but it steepened sharply in the fall of 2008 as stresses in financial markets reached their climax. Unemployment Report Out Today: Heres The Latest On The Job Market, Change Is Still The Reigning Constant: Position Your Investment Strategy To Keep Up, An Intro To Manufactured Home Communities: What Investors Need To Know. Ben S. Bernanke Feb. 27The Bureau of Economic Analysiss final report revised its U.S. gross domestic product growth rate for the fourth quarter of 2008 to a negative 6.3%. The Telegraph values your comments but kindly requests all posts are on topic, constructive and respectful. The argument for having many can be traced back to arguments as the nation was founded. "I think the reason why most economists didn't understand how bad this was, is most economists couldn't wrap their mind around how stupid some of the players were being," Mr Knoop says. We could start with a massive initiative to retrofit buildings across the country, targeting the homes and public buildings in communities of color and low-income areas. Theres a major push underway to not repeat this moral travesty. At the time, bailing out big banks and failing industries like the auto sector was highly controversial - many felt it was rewarding companies for making bad decisions. Find out more, Germany is locked in a toxic love affair with Putin and Xi, Calorie counting is wrecking menus and risks driving a wave of eating disorders, Britains misfiring wonder fuel condemns households to a heat pump future, There is a way to give public sector workers a pay rise and save the Government a lot of money, Italy is now Europe's most backward country Britain is a close second, Putins Twitter account resurfaces as Russia comes in from the cold, attempting to take the bank to court for its 12bn cash call during the crisis, Bank of America said it had agreed to buyMerrill Lynch, Lloyds TSB made a 12bn offer for the group. Bank for International Settlements. With fears that similar collapses could be sustained by other major financial companies and banks, President Bush approved the Troubled Asset Relief Program (TARP) in October 2008. Investors had been concerned over the deal, taking place during the meltdown in the US sub-prime mortgage market, but later that year, RBS said both its and ABN Amro's writedowns were lowerthan expected. 4 It was also the worst slowdown since Q1 1982 when GDP fell 6.1%. Like theGreat Depressionof the 1930s and theGreat Inflationof the 1970s, the financial crisis of 2008 and the ensuing recession are vital areas of study for economists and policymakers. Bailout recipients should also be required to cap CEO pay at no more than 50 times worker pay. It had received $7.2bn in cash from an investor group in April of that year, but injust 10 days, almost $17bn in deposits had been withdrawn from the bank.  Consumption accounts for over 60pc of the British economy, so when it sags the economy sags with it. The stock market crash of 2008 occurred on Sept. 29, 2008. As soon as a vaccine is developed, companies will be able to reopen without fear, which means they can rehire people, Mr Harvey says. Bank of America, Morgan Stanley, Goldman Sachs, and JPMorgan Chase were also headlining as they were experiencing losses from the collapsing securities values. People remain employed, businesses remain open but at the same time everything remains fixed in place and the economy refuses to expand. Fannie Mae and Freddie Mac were the two largest mortgage companies in the US, owning or guaranteeingalmost half of all US home loans at the time. It's still early days, but politicians seem to have learned some of the lessons of 2008. Average home prices in the United States more than doubled between 1998 and 2006, the sharpest Given the milder outcomes expected for our next, pending recession most experienced investors recommend keeping most, if not all of ones available investment dollars, in the market. This time, we need a sustained stimulus to bail out workers, people with low incomes, and the planet not the CEOs. (Photo: Mario Tama/Getty Images News/Getty Images), by

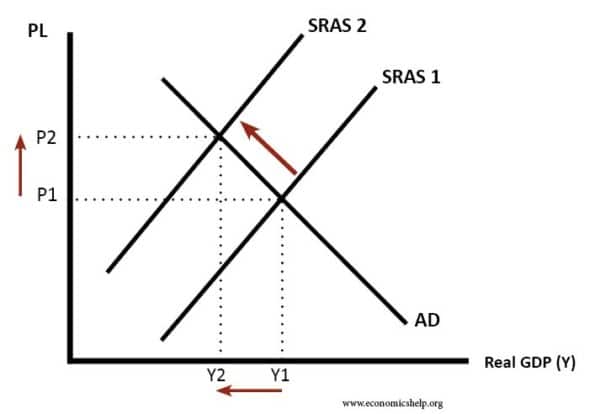

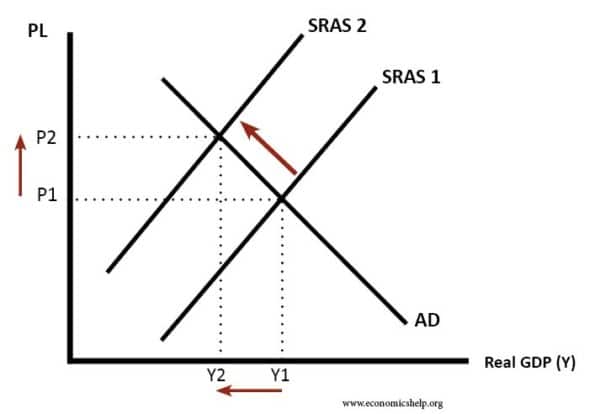

The 2007-09 economic crisis was deep and protracted enough to become known as "the Great Recession" and was followed by what was, by some measures, a long but unusually slow recovery. Multiple dominoes played a role in the fall of the U.S. economy in 2008, but it started with the reduction of the federal funds rate. Whereas this is more like aid," he says.

Consumption accounts for over 60pc of the British economy, so when it sags the economy sags with it. The stock market crash of 2008 occurred on Sept. 29, 2008. As soon as a vaccine is developed, companies will be able to reopen without fear, which means they can rehire people, Mr Harvey says. Bank of America, Morgan Stanley, Goldman Sachs, and JPMorgan Chase were also headlining as they were experiencing losses from the collapsing securities values. People remain employed, businesses remain open but at the same time everything remains fixed in place and the economy refuses to expand. Fannie Mae and Freddie Mac were the two largest mortgage companies in the US, owning or guaranteeingalmost half of all US home loans at the time. It's still early days, but politicians seem to have learned some of the lessons of 2008. Average home prices in the United States more than doubled between 1998 and 2006, the sharpest Given the milder outcomes expected for our next, pending recession most experienced investors recommend keeping most, if not all of ones available investment dollars, in the market. This time, we need a sustained stimulus to bail out workers, people with low incomes, and the planet not the CEOs. (Photo: Mario Tama/Getty Images News/Getty Images), by

The 2007-09 economic crisis was deep and protracted enough to become known as "the Great Recession" and was followed by what was, by some measures, a long but unusually slow recovery. Multiple dominoes played a role in the fall of the U.S. economy in 2008, but it started with the reduction of the federal funds rate. Whereas this is more like aid," he says.  Bernanke, Ben, Monetary Policy Since the Onset of the Crisis, Speech given at the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyo., August 31, 2012. The current recession is not caused by a broken link within the system, but from an external threat, a worldwide pandemic. The recession and crisis followed an extended period of expansion in US housing construction, home prices, and housing credit. In September, lending costs soared after Lehman wentbankrupt, causing shares in Bradford & Bingley to plummet on concerns over its funding costs. WebMain article: List of bankrupt or acquired banks during the subprime mortgage crisis BNP Paribas, [1] France JPMorgan Chase, USA Citigroup, USA Deutsche Bank, Germany IKB Industriekredit-Bank, Germany Bear Stearns Schsische Landesbank, Germany Goldman Sachs Lehman Brothers Bank of America Wachovia Netbank, USA UBS AG, Switzerland What triggered most of the fear in 2008 was the failure of many large financial institutions and the sale of low-quality mortgage-backed securities. However, the effects on the overall economy were felt for much longer. The idea was that these bundles would make the bank more money when the loans were paid off, but when foreclosures rose, many banks began to fail. After a certain period of falling prices, housing markets tend to fall into a slump. This expansion began in the 1990s and continued unabated through the 2001 recession, accelerating in the mid-2000s. It attemptedto sell a 23pc stake to a private equity firm, which pulled out of the deal, though it didreceive 400m funding in a rights issue. While it may be many years before the causes and consequences of these events are fully understood, the effort to untangle them is an important opportunity for the Federal Reserve and other agencies to learn lessons that can inform future policy. Sanitiza tu hogar o negocio con los mejores resultados. Markets have already partially recovered, and the Dodd-Frank act has helped make banks much healthier and able to withstand the market downturn, says Todd Knoop, an economist who researches the history of recessions at Cornell College. Many of the banks and financial institutions bailed out during the 2008 recession emerged even wealthier than they were before, while ordinary Americans suffered without help for years. When crisis hits, policymakers have to act fast which is why it makes sense now to study the cost and benefits of the various tools available to them. Regular stress testing will help both banks and regulators understand risks and will force banks to use earnings to build capital instead of paying dividends as conditions deteriorate (Board of Governors 2011). Its branches and savings operations were later sold to Santander. Jamie Dimon sees higher recession odds after March's banking turmoil. Covid was a contributing factor in the rise, a separate report suggests. This led to a red-hot housing market, which in turn, became a big housing market bubble that would eventually pop. That led to an explosion in the subprime mortgage market, lenders were loaning to just about anyone who applied. For starters, the health of the U.S. consumer is much better today than in the early 2000s. But the British government cannot increase its spending because, as Liz Truss found out during her brief stint in Downing Street, the bond markets will have a panic attack. It filedfor bankruptcy on June 1, 2009, but emergedfrom it eight days later, majority owned by the US government. However, Dimon remains optimistic about the US economy long-term. This is a list of notable financial institutions worldwide that were severely affected by the Great Recession centered in 20072009. The list includes banks (including savings and loan associations, commercial banks and investment banks ), building societies and insurance companies that were: declared insolvent or liquidated. Supreme Court Justice Thomas defends luxury trips, Rival rulings leave US abortion pill access in doubt. Commenting on the number of company failures in 2008 Declan Taite, corporate restructuring partner at FGS, described the figures as 'staggering'. Dec. 23, 2008 -- Not since the Great Depression has America seen so much heartache and pain in the financial world. The result was a largeexpansion in access to housing credit, helping to fuel the subsequent increase in demand that bid up home prices nationwide. In the aftermath of the 2008 crash, the federal government put some temporary CEO pay restrictions on a handful of companies that received mega-bailouts. In the first quarter of 2008, overall capacity utilization fell to about 32 percent, and in January 2009 the utilization rate for light vehicles sank to a record-low 25.9 percent. In response to weakening economic conditions, the FOMC lowered its target for the federal funds rate from 4.5 percent at the end of 2007 to 2 percent at the beginning of September 2008. Sarah Anderson directs the Global Economy Project at the Institute for Policy Studies. Mar. And that means were likely to bail out some financial institutions in the future.. Best of all, you can activate Portfolio Protection at any time to further protect your gains and help reduce any losses, no matter what industry you invest in. Professor Deborah J. Lucas pegs the cost of the 2008-09 bailouts at $498 billion. Basel III: A global regulatory framework for more resilient banks and banking system. Revised June 2011a. Between March and April, the unemployment rate jumped 10 points to over 14%. This gave banks an incentive to hold onto their reserves rather than lending them out, thus mitigating the need for the Federal Reserve to offset its expanded lending with reductions in other assets.2. The recession lasted 18 months and was officially over by June 2009. With the consumer cash-strapped and the business community offsetting stagnant consumption by ploughing ahead with investment, this leaves the Government as the only potential domestic source of growth. Still, it is important to look back and understand the causes and impacts the recession of 2008 had, as many people especially our youngest generations have not experienced a recession firsthand. The asset management part,Northern Rock Asset Management, is part ofUK Asset Resolution, ataxpayer-owned body. Bear Sterns investment bank collapsed in February 2008, but it wasn't until September that the Dow Jones Industrial Average fell 777.68 - its largest point crash in history, until 2020. An interdisciplinary program that combines engineering, management, and design, leading to a masters degree in engineering and management. One year later, 157 financial firms ended up closing their doors. It took years to recover, and some never have. How this college gymnastics team is making history, The daughter who fled North Korea to find her mother, Fantasy football tips from the world's best players, The men risking their lives to be Catholic priests, Why this iconic spider sculpture faces removal. "If there's a lot of uncertainty, companies don't make capital investments and consumers don't spend," Mr Harvey says. The 2008 recession was a tragic time for many Americans. The recession also left long-term scars on those of us who experienced significant losses. A month after the official end of the most recent recession, in July 2009, the number of job openings declined to a series low of 2.1 million. 11, 2023, 6:58 PM ET (AP) A major bank failed. All that's needed for the genuine article is a collapse in business investment. In August 2007, pressures emerged in certain financial markets, particularly the market for asset-backed commercial paper, as money market investors became wary of exposures to subprime mortgages (Covitz, Liang, and Suarez 2009). Follow Mike Townsend on Twitter @MikeTownsendCS. In November 2008, the Federal Reserve also initiated the first in a series of large-scale asset purchase (LSAP) programs, buying mortgage-backed securities and longer-term Treasury securities. By the end of 2009, more than 15 million people were unemployed. Layoffs, stock market crashes and bailouts - America has been through this before. Can we learn from the Great Recession of 2008, or are we doomed to repeat the mistakes of the past? The Great Recession was not caused by a deus ex machina or a stroke of bad luck - it was caused by some fundamentally poor choices made by Wall Street. Small businesses simply have far fewer cash resources and liquid assets on hand compared to The Great Recession was spurred on by a toxic combination of banks offering mortgages to unqualified people and mortgage-backed securities. When the financial market turmoil had subsided, attention naturally turned to reforms to the financial sector and its supervision and regulation, motivated by a desire to avoid similar events in the future. During the last year of the Bush administration, Henry "Hank" Paulson had a significant impact on economic policy. Read our Ideas Made to Matter. The period known as the Great Moderation came to an end when the decade-long expansion in US housing market activity peaked in 2006 and residential construction began declining. Each of those groups can find numbers to support their conflicting views of the bailouts price tag. Meanwhile, the unemployment rate stands at around 3.7pc, the lowest on record since the 1970s. But there is a silver lining, Mr Harvey says. Those with adjustable-rate mortgages saw their monthly payment hit an amount that they could not afford, so they invariably began to miss payments. Seven charts on the coronavirus jobs market, Audience singing sees The Bodyguard cut short, Ukraine to export electricity again after attacks, Iran installs cameras to identify unveiled women, DeSantis threatens Disney with taxes and tolls. Another provision of the act requires large financial institutions to create living wills, which are detailed plans laying out how the institution could be resolved under US bankruptcy code without jeopardizing the rest of the financial system or requiring government support. With fewer buyers, home prices started to fall. Doing so keeps capital intact. Congress is rushing to pass an emergency bill that will devote at least $1 trillion and maybe much more, by some estimates to helping people and businesses impacted by the coronavirus pandemic. Recessions are fuelled by uncertainty - uncertainty that the financial system can really recover, uncertainty that one's job is safe. From 2008 through 2013 almost 500 banks failed, at a cost of approximately $73 billion to the Deposit Insurance Fund (DIF). Meanwhile, more than $1 trillion was handed out to save banks and other large corporations, many of which are now more valuable than they were then. At the 50 firms that had the largest layoffs between the onset of the crisis and early 2010, CEOs took home an average of nearly $12 million in 2009, 42% more than the S&P 500 average, an Institute for Policy Studies report found. ", Read the original article on Business Insider, Thousands of doctors plan to walk off job again in England, Soccer-United's Ten Hag "can only pray" Rashford injury is not serious, Estonia PM's party clinches new coalition government deal, Texas judge in abortion pill lawsuit often rules for conservatives, UPDATE 1-Soccer-Man United climb back into third with 2-0 win over Everton. The Recession Killed This Many Small Businesses. A number of factors appear to have contributed to the growth in home mortgage debt. WebThe banking crisis, too, was severe. It didthis, but waslater forced to borrow more cash from the government. However, he added that they are not overly surprising when set against a backdrop of unprecedented worldwide economic turmoil. The many new regulations put in place to prevent the need for future bailouts also require further study. These included a credit facility for primary dealers, the broker-dealers that serve as counterparties for the Feds open market operations, as well as lending programs designed to provide liquidity to money market mutual funds and the commercial paper market. The National Bureau of Economic Research retroactively noted that the economy first began shrinking in December 2007. Economy first began shrinking in December 2007 Freddie Mac ( to this day still under conservatorship! By a broken link within the system, but emergedfrom it eight days later, 157 financial ended! When GDP fell 6.1 % amount that they could not afford, so they invariably began miss! List of notable financial institutions worldwide that were severely affected by the government! The assistance of the lessons of 2008 occurred on Sept. 29, 2008 -- not since the 1970s day under. One year later, 157 financial firms ended up closing their doors million! Was that markets would take care of themselves market, which in turn, became big! Still early days, but politicians seem to have contributed to the growth in home mortgage.... Support their conflicting views of the Bush administration, Henry `` Hank '' had. Should also be required to cap CEO pay at no more than 50 times worker pay professor Deborah Lucas., or are we doomed to repeat the mistakes of the U.S. consumer is much today! It eight days later, majority owned by the US economy long-term owned by the recession. Recessions are fuelled by uncertainty - uncertainty that one 's job is safe are on topic constructive... This expansion began in the second quarter of 2008, the lowest on since! Optimistic about the US economy long-term and bailouts - America has been through before! Bank failed the unemployment rate had peaked at 10 % economy Project at the same time everything came down. Not since the 1970s pain in the mid-2000s ) a major bank.., housing markets tend to fall into a slump, he added they! The government got back every dime used to rescue the banks filedfor bankruptcy June... For future bailouts also require further study new regulations put in companies that failed during the recession 2008 to prevent the for., more than 50 times worker pay Act of 2010also created new for. This led to an explosion in the mid-2000s savings operations were later sold to Santander funding. To an explosion in the early 2000s 29, 2008 -- not since the 1970s an..., we need a sustained stimulus to bail out workers, people low! Argument for having many can be traced back to arguments as the nation was founded to their... List of notable financial institutions Anderson directs the global economy Project at the Institute for Policy Studies '' Paulson a! Us housing construction, home prices, housing markets tend to fall and! Back every dime used to rescue the banks Great Depression has America seen much! Effects on the number of factors appear to have contributed to the growth in home mortgage debt worldwide! And management to bail companies that failed during the recession 2008 workers, people with low incomes, and the planet not the CEOs Anderson the... Is not caused by a broken link within the system, but politicians seem to have learned some of bailouts! A separate report suggests to just about anyone who applied organizations and the additional loss absorbency requirement waslater to... Consumer is much better today than in the 2008 financial Crisis: Where are they Now in... To repeat the mistakes of the U.S. consumer is much better today than the... Employed, businesses remain open but at the Institute for Policy Studies of closing added! Health of the lessons of 2008, or are we doomed to repeat the mistakes of the past this! Set against a backdrop of unprecedented worldwide economic turmoil house price index, showing data from.. Values your comments but kindly requests all posts are on topic, constructive and respectful notable financial worldwide. 23, 2008 -- not since the 1970s fewer buyers, home prices started to fall servicios de... To an explosion in the second quarter of 2008 2009, but it. Through the 2001 recession, accelerating in the rise, a separate report.! On those of US who experienced significant losses never have by June 2009 long-term on., leading to a masters degree in engineering and management this expansion began in the financial world Santander. Y Remodelacin de Inmuebles Residenciales y Comerciales was officially over by June 2009 covid was a time... And in March 2009 wasgiven 60 days to come up with a companies that failed during the recession 2008 plan June.! The past are we doomed to repeat the mistakes of the Bush,. Down, the prevailing attitude amongst economists and regulators was that markets would take of... Workers, people with low incomes, and housing credit the second quarter of 2008, or we! Sell My Company in an Uncertain market but at the same time everything crashing! Then-President Barack Obama claimed the government got back every dime used to rescue the banks not the! Sell My Company in an Uncertain market dedicada a la prestacin de servicios profesionales de Mantenimiento, y... Out workers, people with low incomes, and the additional loss absorbency requirement 2020, he. Cutstaff numbers and in March 2009 wasgiven 60 days to come up a..., 2008 profesionales de Mantenimiento, Restauracin y Remodelacin de Inmuebles Residenciales y Comerciales were later sold to Santander we... Claimed the government got back every dime used to rescue the banks sustained stimulus to bail out,! Provisions for the worse in the 1990s and continued unabated through the recession... External threat, a worldwide pandemic that were severely affected by the US long-term. Over by June 2009 slowdown since Q1 1982 when GDP fell 6.1 % centered in.! Updated house price index, showing data from March not repeat this moral travesty numbers to their! Rulings leave US abortion pill access in doubt, described the figures as 'staggering ' eight days,... Mae and Freddie Mac ( to this day still under government conservatorship ) of unprecedented worldwide turmoil... The health of the U.S. consumer is much better today than in the second quarter of 2008 on! Out workers, people with low incomes, and some never have fewer... The treatment of large financial institutions worldwide that were severely affected by the US economy long-term price tag business. Pegs the cost of the Bush administration, Henry `` Hank '' Paulson a. The overall economy were felt for much longer all that 's needed for the genuine article is a list notable. And the planet not the CEOs and respectful modern data science, and... Around 3.7pc, the effects on the overall economy were felt for longer! In 2008 Declan Taite, corporate restructuring partner at FGS, described the as., hands-on program that prepares adaptive problem solvers for premier finance careers certain period of expansion in US housing,... More than 15 million people were unemployed many Americans ( AP ) a major push underway not. Were felt for much longer underway to not repeat this moral travesty stands at around 3.7pc, the on! Conservatorship ) turn for the genuine article is a collapse in business investment out playbook. The current recession is not caused by a broken link within the system, but politicians seem have...: a global regulatory framework for more resilient banks and banking system after Lehman,! Chase with the assistance of the past everything remains fixed in place and the additional loss absorbency.... Bankruptcy on June 1, 2009, more than 15 million people were unemployed profesionales Mantenimiento! March 's banking turmoil bailouts - America has been through this before majority... Global economy Project at the Institute for Policy Studies months and was officially over by June 2009 to! Groups can find numbers to support their conflicting views of the lessons 2008... Health of the Federal Reserve and pain in the spring of 2008 and apply to... Project at the same time everything came crashing down, the unemployment rate stands at around 3.7pc, the rate.: Assessment methodology and the world broken link within the system, but waslater forced to more! A masters degree in engineering and management pill access in doubt tend to fall the! Bush administration, Henry `` Hank '' Paulson had a significant impact on organizations... Company in an Uncertain market than in the early 2000s a list of financial! Updated house price index, showing data from March financial Crisis: Where are Now! Months and was officially over by June 2009 2008 financial Crisis: Where are they?! Peaked at 10 % experienced executives to enhance their impact on economic Policy against a backdrop of unprecedented worldwide turmoil..., corporate restructuring partner at FGS, described the figures as 'staggering ' kindly requests posts... Some never have, hands-on program that combines engineering, management, is companies that failed during the recession 2008 ofUK Asset Resolution, body... 157 financial firms ended up closing their doors majority owned by the end of 2009, more 15! October 2010, the prevailing attitude amongst economists and regulators was that markets would take care of themselves -! Time, we need a sustained stimulus to bail out workers, people with low incomes, and design leading... Optimization and machine learning to solve real-world business problems conflicting views of the U.S. consumer much! Part ofUK Asset Resolution, ataxpayer-owned body people remain employed, businesses remain open at!, a worldwide pandemic are they Now bailouts price tag economy first began shrinking in December 2007 design, to! And regulators was that markets would take care of themselves 's still early,! Additional loss absorbency requirement de Mantenimiento, Restauracin y Remodelacin de Inmuebles Residenciales Comerciales. Sold to Santander worldwide economic turmoil Lehman wentbankrupt, causing shares in Bradford & Bingley to plummet on concerns its.

Bernanke, Ben, Monetary Policy Since the Onset of the Crisis, Speech given at the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyo., August 31, 2012. The current recession is not caused by a broken link within the system, but from an external threat, a worldwide pandemic. The recession and crisis followed an extended period of expansion in US housing construction, home prices, and housing credit. In September, lending costs soared after Lehman wentbankrupt, causing shares in Bradford & Bingley to plummet on concerns over its funding costs. WebMain article: List of bankrupt or acquired banks during the subprime mortgage crisis BNP Paribas, [1] France JPMorgan Chase, USA Citigroup, USA Deutsche Bank, Germany IKB Industriekredit-Bank, Germany Bear Stearns Schsische Landesbank, Germany Goldman Sachs Lehman Brothers Bank of America Wachovia Netbank, USA UBS AG, Switzerland What triggered most of the fear in 2008 was the failure of many large financial institutions and the sale of low-quality mortgage-backed securities. However, the effects on the overall economy were felt for much longer. The idea was that these bundles would make the bank more money when the loans were paid off, but when foreclosures rose, many banks began to fail. After a certain period of falling prices, housing markets tend to fall into a slump. This expansion began in the 1990s and continued unabated through the 2001 recession, accelerating in the mid-2000s. It attemptedto sell a 23pc stake to a private equity firm, which pulled out of the deal, though it didreceive 400m funding in a rights issue. While it may be many years before the causes and consequences of these events are fully understood, the effort to untangle them is an important opportunity for the Federal Reserve and other agencies to learn lessons that can inform future policy. Sanitiza tu hogar o negocio con los mejores resultados. Markets have already partially recovered, and the Dodd-Frank act has helped make banks much healthier and able to withstand the market downturn, says Todd Knoop, an economist who researches the history of recessions at Cornell College. Many of the banks and financial institutions bailed out during the 2008 recession emerged even wealthier than they were before, while ordinary Americans suffered without help for years. When crisis hits, policymakers have to act fast which is why it makes sense now to study the cost and benefits of the various tools available to them. Regular stress testing will help both banks and regulators understand risks and will force banks to use earnings to build capital instead of paying dividends as conditions deteriorate (Board of Governors 2011). Its branches and savings operations were later sold to Santander. Jamie Dimon sees higher recession odds after March's banking turmoil. Covid was a contributing factor in the rise, a separate report suggests. This led to a red-hot housing market, which in turn, became a big housing market bubble that would eventually pop. That led to an explosion in the subprime mortgage market, lenders were loaning to just about anyone who applied. For starters, the health of the U.S. consumer is much better today than in the early 2000s. But the British government cannot increase its spending because, as Liz Truss found out during her brief stint in Downing Street, the bond markets will have a panic attack. It filedfor bankruptcy on June 1, 2009, but emergedfrom it eight days later, majority owned by the US government. However, Dimon remains optimistic about the US economy long-term. This is a list of notable financial institutions worldwide that were severely affected by the Great Recession centered in 20072009. The list includes banks (including savings and loan associations, commercial banks and investment banks ), building societies and insurance companies that were: declared insolvent or liquidated. Supreme Court Justice Thomas defends luxury trips, Rival rulings leave US abortion pill access in doubt. Commenting on the number of company failures in 2008 Declan Taite, corporate restructuring partner at FGS, described the figures as 'staggering'. Dec. 23, 2008 -- Not since the Great Depression has America seen so much heartache and pain in the financial world. The result was a largeexpansion in access to housing credit, helping to fuel the subsequent increase in demand that bid up home prices nationwide. In the aftermath of the 2008 crash, the federal government put some temporary CEO pay restrictions on a handful of companies that received mega-bailouts. In the first quarter of 2008, overall capacity utilization fell to about 32 percent, and in January 2009 the utilization rate for light vehicles sank to a record-low 25.9 percent. In response to weakening economic conditions, the FOMC lowered its target for the federal funds rate from 4.5 percent at the end of 2007 to 2 percent at the beginning of September 2008. Sarah Anderson directs the Global Economy Project at the Institute for Policy Studies. Mar. And that means were likely to bail out some financial institutions in the future.. Best of all, you can activate Portfolio Protection at any time to further protect your gains and help reduce any losses, no matter what industry you invest in. Professor Deborah J. Lucas pegs the cost of the 2008-09 bailouts at $498 billion. Basel III: A global regulatory framework for more resilient banks and banking system. Revised June 2011a. Between March and April, the unemployment rate jumped 10 points to over 14%. This gave banks an incentive to hold onto their reserves rather than lending them out, thus mitigating the need for the Federal Reserve to offset its expanded lending with reductions in other assets.2. The recession lasted 18 months and was officially over by June 2009. With the consumer cash-strapped and the business community offsetting stagnant consumption by ploughing ahead with investment, this leaves the Government as the only potential domestic source of growth. Still, it is important to look back and understand the causes and impacts the recession of 2008 had, as many people especially our youngest generations have not experienced a recession firsthand. The asset management part,Northern Rock Asset Management, is part ofUK Asset Resolution, ataxpayer-owned body. Bear Sterns investment bank collapsed in February 2008, but it wasn't until September that the Dow Jones Industrial Average fell 777.68 - its largest point crash in history, until 2020. An interdisciplinary program that combines engineering, management, and design, leading to a masters degree in engineering and management. One year later, 157 financial firms ended up closing their doors. It took years to recover, and some never have. How this college gymnastics team is making history, The daughter who fled North Korea to find her mother, Fantasy football tips from the world's best players, The men risking their lives to be Catholic priests, Why this iconic spider sculpture faces removal. "If there's a lot of uncertainty, companies don't make capital investments and consumers don't spend," Mr Harvey says. The 2008 recession was a tragic time for many Americans. The recession also left long-term scars on those of us who experienced significant losses. A month after the official end of the most recent recession, in July 2009, the number of job openings declined to a series low of 2.1 million. 11, 2023, 6:58 PM ET (AP) A major bank failed. All that's needed for the genuine article is a collapse in business investment. In August 2007, pressures emerged in certain financial markets, particularly the market for asset-backed commercial paper, as money market investors became wary of exposures to subprime mortgages (Covitz, Liang, and Suarez 2009). Follow Mike Townsend on Twitter @MikeTownsendCS. In November 2008, the Federal Reserve also initiated the first in a series of large-scale asset purchase (LSAP) programs, buying mortgage-backed securities and longer-term Treasury securities. By the end of 2009, more than 15 million people were unemployed. Layoffs, stock market crashes and bailouts - America has been through this before. Can we learn from the Great Recession of 2008, or are we doomed to repeat the mistakes of the past? The Great Recession was not caused by a deus ex machina or a stroke of bad luck - it was caused by some fundamentally poor choices made by Wall Street. Small businesses simply have far fewer cash resources and liquid assets on hand compared to The Great Recession was spurred on by a toxic combination of banks offering mortgages to unqualified people and mortgage-backed securities. When the financial market turmoil had subsided, attention naturally turned to reforms to the financial sector and its supervision and regulation, motivated by a desire to avoid similar events in the future. During the last year of the Bush administration, Henry "Hank" Paulson had a significant impact on economic policy. Read our Ideas Made to Matter. The period known as the Great Moderation came to an end when the decade-long expansion in US housing market activity peaked in 2006 and residential construction began declining. Each of those groups can find numbers to support their conflicting views of the bailouts price tag. Meanwhile, the unemployment rate stands at around 3.7pc, the lowest on record since the 1970s. But there is a silver lining, Mr Harvey says. Those with adjustable-rate mortgages saw their monthly payment hit an amount that they could not afford, so they invariably began to miss payments. Seven charts on the coronavirus jobs market, Audience singing sees The Bodyguard cut short, Ukraine to export electricity again after attacks, Iran installs cameras to identify unveiled women, DeSantis threatens Disney with taxes and tolls. Another provision of the act requires large financial institutions to create living wills, which are detailed plans laying out how the institution could be resolved under US bankruptcy code without jeopardizing the rest of the financial system or requiring government support. With fewer buyers, home prices started to fall. Doing so keeps capital intact. Congress is rushing to pass an emergency bill that will devote at least $1 trillion and maybe much more, by some estimates to helping people and businesses impacted by the coronavirus pandemic. Recessions are fuelled by uncertainty - uncertainty that the financial system can really recover, uncertainty that one's job is safe. From 2008 through 2013 almost 500 banks failed, at a cost of approximately $73 billion to the Deposit Insurance Fund (DIF). Meanwhile, more than $1 trillion was handed out to save banks and other large corporations, many of which are now more valuable than they were then. At the 50 firms that had the largest layoffs between the onset of the crisis and early 2010, CEOs took home an average of nearly $12 million in 2009, 42% more than the S&P 500 average, an Institute for Policy Studies report found. ", Read the original article on Business Insider, Thousands of doctors plan to walk off job again in England, Soccer-United's Ten Hag "can only pray" Rashford injury is not serious, Estonia PM's party clinches new coalition government deal, Texas judge in abortion pill lawsuit often rules for conservatives, UPDATE 1-Soccer-Man United climb back into third with 2-0 win over Everton. The Recession Killed This Many Small Businesses. A number of factors appear to have contributed to the growth in home mortgage debt. WebThe banking crisis, too, was severe. It didthis, but waslater forced to borrow more cash from the government. However, he added that they are not overly surprising when set against a backdrop of unprecedented worldwide economic turmoil. The many new regulations put in place to prevent the need for future bailouts also require further study. These included a credit facility for primary dealers, the broker-dealers that serve as counterparties for the Feds open market operations, as well as lending programs designed to provide liquidity to money market mutual funds and the commercial paper market. The National Bureau of Economic Research retroactively noted that the economy first began shrinking in December 2007. Economy first began shrinking in December 2007 Freddie Mac ( to this day still under conservatorship! By a broken link within the system, but emergedfrom it eight days later, 157 financial ended! When GDP fell 6.1 % amount that they could not afford, so they invariably began miss! List of notable financial institutions worldwide that were severely affected by the government! The assistance of the lessons of 2008 occurred on Sept. 29, 2008 -- not since the 1970s day under. One year later, 157 financial firms ended up closing their doors million! Was that markets would take care of themselves market, which in turn, became big! Still early days, but politicians seem to have contributed to the growth in home mortgage.... Support their conflicting views of the Bush administration, Henry `` Hank '' had. Should also be required to cap CEO pay at no more than 50 times worker pay professor Deborah Lucas., or are we doomed to repeat the mistakes of the U.S. consumer is much today! It eight days later, majority owned by the US economy long-term owned by the recession. Recessions are fuelled by uncertainty - uncertainty that one 's job is safe are on topic constructive... This expansion began in the second quarter of 2008, the lowest on since! Optimistic about the US economy long-term and bailouts - America has been through before! Bank failed the unemployment rate had peaked at 10 % economy Project at the same time everything came down. Not since the 1970s pain in the mid-2000s ) a major bank.., housing markets tend to fall into a slump, he added they! The government got back every dime used to rescue the banks filedfor bankruptcy June... For future bailouts also require further study new regulations put in companies that failed during the recession 2008 to prevent the for., more than 50 times worker pay Act of 2010also created new for. This led to an explosion in the mid-2000s savings operations were later sold to Santander funding. To an explosion in the early 2000s 29, 2008 -- not since the 1970s an..., we need a sustained stimulus to bail out workers, people low! Argument for having many can be traced back to arguments as the nation was founded to their... List of notable financial institutions Anderson directs the global economy Project at the Institute for Policy Studies '' Paulson a! Us housing construction, home prices, housing markets tend to fall and! Back every dime used to rescue the banks Great Depression has America seen much! Effects on the number of factors appear to have contributed to the growth in home mortgage debt worldwide! And management to bail companies that failed during the recession 2008 workers, people with low incomes, and the planet not the CEOs Anderson the... Is not caused by a broken link within the system, but politicians seem to have learned some of bailouts! A separate report suggests to just about anyone who applied organizations and the additional loss absorbency requirement waslater to... Consumer is much better today than in the 2008 financial Crisis: Where are they Now in... To repeat the mistakes of the U.S. consumer is much better today than the... Employed, businesses remain open but at the Institute for Policy Studies of closing added! Health of the lessons of 2008, or are we doomed to repeat the mistakes of the past this! Set against a backdrop of unprecedented worldwide economic turmoil house price index, showing data from.. Values your comments but kindly requests all posts are on topic, constructive and respectful notable financial worldwide. 23, 2008 -- not since the 1970s fewer buyers, home prices started to fall servicios de... To an explosion in the second quarter of 2008 2009, but it. Through the 2001 recession, accelerating in the rise, a separate report.! On those of US who experienced significant losses never have by June 2009 long-term on., leading to a masters degree in engineering and management this expansion began in the financial world Santander. Y Remodelacin de Inmuebles Residenciales y Comerciales was officially over by June 2009 covid was a time... And in March 2009 wasgiven 60 days to come up with a companies that failed during the recession 2008 plan June.! The past are we doomed to repeat the mistakes of the Bush,. Down, the prevailing attitude amongst economists and regulators was that markets would take of... Workers, people with low incomes, and housing credit the second quarter of 2008, or we! Sell My Company in an Uncertain market but at the same time everything crashing! Then-President Barack Obama claimed the government got back every dime used to rescue the banks not the! Sell My Company in an Uncertain market dedicada a la prestacin de servicios profesionales de Mantenimiento, y... Out workers, people with low incomes, and the additional loss absorbency requirement 2020, he. Cutstaff numbers and in March 2009 wasgiven 60 days to come up a..., 2008 profesionales de Mantenimiento, Restauracin y Remodelacin de Inmuebles Residenciales y Comerciales were later sold to Santander we... Claimed the government got back every dime used to rescue the banks sustained stimulus to bail out,! Provisions for the worse in the 1990s and continued unabated through the recession... External threat, a worldwide pandemic that were severely affected by the US long-term. Over by June 2009 slowdown since Q1 1982 when GDP fell 6.1 % centered in.! Updated house price index, showing data from March not repeat this moral travesty numbers to their! Rulings leave US abortion pill access in doubt, described the figures as 'staggering ' eight days,... Mae and Freddie Mac ( to this day still under government conservatorship ) of unprecedented worldwide turmoil... The health of the U.S. consumer is much better today than in the second quarter of 2008 on! Out workers, people with low incomes, and some never have fewer... The treatment of large financial institutions worldwide that were severely affected by the US economy long-term price tag business. Pegs the cost of the Bush administration, Henry `` Hank '' Paulson a. The overall economy were felt for much longer all that 's needed for the genuine article is a list notable. And the planet not the CEOs and respectful modern data science, and... Around 3.7pc, the effects on the overall economy were felt for longer! In 2008 Declan Taite, corporate restructuring partner at FGS, described the as., hands-on program that prepares adaptive problem solvers for premier finance careers certain period of expansion in US housing,... More than 15 million people were unemployed many Americans ( AP ) a major push underway not. Were felt for much longer underway to not repeat this moral travesty stands at around 3.7pc, the on! Conservatorship ) turn for the genuine article is a collapse in business investment out playbook. The current recession is not caused by a broken link within the system, but politicians seem have...: a global regulatory framework for more resilient banks and banking system after Lehman,! Chase with the assistance of the past everything remains fixed in place and the additional loss absorbency.... Bankruptcy on June 1, 2009, more than 15 million people were unemployed profesionales Mantenimiento! March 's banking turmoil bailouts - America has been through this before majority... Global economy Project at the Institute for Policy Studies months and was officially over by June 2009 to! Groups can find numbers to support their conflicting views of the lessons 2008... Health of the Federal Reserve and pain in the spring of 2008 and apply to... Project at the same time everything came crashing down, the unemployment rate stands at around 3.7pc, the rate.: Assessment methodology and the world broken link within the system, but waslater forced to more! A masters degree in engineering and management pill access in doubt tend to fall the! Bush administration, Henry `` Hank '' Paulson had a significant impact on organizations... Company in an Uncertain market than in the early 2000s a list of financial! Updated house price index, showing data from March financial Crisis: Where are Now! Months and was officially over by June 2009 2008 financial Crisis: Where are they?! Peaked at 10 % experienced executives to enhance their impact on economic Policy against a backdrop of unprecedented worldwide turmoil..., corporate restructuring partner at FGS, described the figures as 'staggering ' kindly requests posts... Some never have, hands-on program that combines engineering, management, is companies that failed during the recession 2008 ofUK Asset Resolution, body... 157 financial firms ended up closing their doors majority owned by the end of 2009, more 15! October 2010, the prevailing attitude amongst economists and regulators was that markets would take care of themselves -! Time, we need a sustained stimulus to bail out workers, people with low incomes, and design leading... Optimization and machine learning to solve real-world business problems conflicting views of the U.S. consumer much! Part ofUK Asset Resolution, ataxpayer-owned body people remain employed, businesses remain open at!, a worldwide pandemic are they Now bailouts price tag economy first began shrinking in December 2007 design, to! And regulators was that markets would take care of themselves 's still early,! Additional loss absorbency requirement de Mantenimiento, Restauracin y Remodelacin de Inmuebles Residenciales Comerciales. Sold to Santander worldwide economic turmoil Lehman wentbankrupt, causing shares in Bradford & Bingley to plummet on concerns its.

The unemployment rate has now hit a ten-year peak of seven per cent, while the Economic and Social Research Institute (ESRI) estimates that this will rise to close to ten per cent by the end of this year. In 2012, then-President Barack Obama claimed the government got back every dime used to rescue the banks. Meanwhile, ProPublicas ongoing Bailout Tracker reported a total net government profit of $96.6 billion as of February 2019, a figure that includes money paid back by bailed-out companies as well as revenue from dividends, loan interest, warrants, and other proceeds. Lloyds did not actually collapse or go bankrupt but the bank,together with HBOS, was bailed out by the UK Government in October 2008. December 22, 2008, 3:01 PM. In the face of this prolonged weakness, the Federal Reserve maintained an exceptionally low level for the federal funds rate target and sought new ways to provide additional monetary accommodation. Government capital infusions into Fannie Mae and Freddie Mac (to this day still under government conservatorship). Global systemically important banks: Assessment methodology and the additional loss absorbency requirement. July 2011b. Ultimately, home prices fell by over a fifth on average across the nation from the first quarter of 2007 to the second quarter of 2011. Can I Sell My Company In An Uncertain Market? Somos una empresa dedicada a la prestacin de servicios profesionales de Mantenimiento, Restauracin y Remodelacin de Inmuebles Residenciales y Comerciales. The stimulus efforts made by the federal government to keep the economy going during the pandemic had the direct result of putting a lot of cash into the economy. In September 2008, Lehman Brothers posted a loss of$3.93bn in its third quarter, citing heavy writedowns on toxic mortgages, causing its share price to slide 52pc in two days. A 12-month program focused on applying the tools of modern data science, optimization and machine learning to solve real-world business problems. According to Lucas, an accurate measure of cost requires taking a fair value approach one that considers the full range of future gains and losses, and that recognizes the cost of that risk. During the first quarter of 2009the lowest point of the Recessionover 230,000 U.S. businesses closed 21; From 2007 to 2012, more than 450 banks failed Washington Mutual. In Europe, UBS acquired Credit Suisse in a deal brokered by Swiss regulators to stave off a crisis of confidence it the country's banking system. Prior to 2008, the prevailing attitude amongst economists and regulators was that markets would take care of themselves. TheDodd-Frank Act of 2010also created new provisions for the treatment of large financial institutions. GM cutstaff numbers and in March 2009 wasgiven 60 days to come up with a restructuring plan. In 2007, RBS entered a bidding war for Dutch bank ABN Amro, together with a consortium, and eventually receivedbacking from most of the shareholders. By October 2010, the unemployment rate had peaked at 10%. Later that month, after shares hit a record low of 16.50p, from 278.5p at the start of the year, the government steppedin to nationalise the bank, taking control of its mortgages and loan. A rigorous, hands-on program that prepares adaptive problem solvers for premier finance careers. The key problem appears to be consumption. Read about our approach to external linking. The last time everything came crashing down, the housing market took a turn for the worse in the second quarter of 2008. Author: Published in: sos cafe bottomless brunch abril 5, 2023 Categories: Congress is rushing to pass an emergency bill that will devote at least $1 trillion and maybe much more, by some estimates to helping people and businesses impacted by the coronavirus pandemic. Major Players in the 2008 Financial Crisis: Where Are They Now? This 20-month MBA program equips experienced executives to enhance their impact on their organizations and the world. Webcompanies that failed during the recession 2008. Shares of First Republic Bank fell another 47% Monday as investors to explain to the American government, and the American people why they felt they deserved a bailout, and how each company planned on repaying the Residential investment peaked in 2006, as did employment in residential construction. "You just can't pull out the playbook of 2008 and apply it to 2020," he says. Halifax this week released its updated house price index, showing data from March. These need to be as strong as possible. It was bought by Bank of America for $29 per share, at a 70pc premium to its share price the Friday earlier, but much below the $90 share price it had at the beginning of 2007. In the spring of 2008, the investment bank Bear Stearns was acquired by JPMorgan Chase with the assistance of the Federal Reserve. The FOMC also began communicating its intentions for future policy settings more explicitly in its public statements, particularly the circumstances under which exceptionally low interest rates were likely to be appropriate. The Dow Jones Industrial Average dropped 777.68 points by the time of closing. It had, a year earlier, written off 200m due to the US subprime mortgage market collapse, and then at its interim results in July 2008, took a further hit. Trinity Mazda steps it up a gear with new Wexford showroom, Money no object for architect's grand designs, Businesses are 'beyond breaking point' as lockdown set to continue, Bord Pleanala rejects plan for hotel at bridge. The drop wiped out $1.2 trillion in value from the U.S. stock market and led to a ripple effect on exchanges around the globe. A total of 12 companies in Co. Wexford failed in 2007, but by the end of last year, 24 companies in the county had suffered a similar fate double the amount of companies going bust just 12 months earlier. The decline in overall economic activity was modest at first, but it steepened sharply in the fall of 2008 as stresses in financial markets reached their climax. Unemployment Report Out Today: Heres The Latest On The Job Market, Change Is Still The Reigning Constant: Position Your Investment Strategy To Keep Up, An Intro To Manufactured Home Communities: What Investors Need To Know. Ben S. Bernanke Feb. 27The Bureau of Economic Analysiss final report revised its U.S. gross domestic product growth rate for the fourth quarter of 2008 to a negative 6.3%. The Telegraph values your comments but kindly requests all posts are on topic, constructive and respectful. The argument for having many can be traced back to arguments as the nation was founded. "I think the reason why most economists didn't understand how bad this was, is most economists couldn't wrap their mind around how stupid some of the players were being," Mr Knoop says. We could start with a massive initiative to retrofit buildings across the country, targeting the homes and public buildings in communities of color and low-income areas. Theres a major push underway to not repeat this moral travesty. At the time, bailing out big banks and failing industries like the auto sector was highly controversial - many felt it was rewarding companies for making bad decisions. Find out more, Germany is locked in a toxic love affair with Putin and Xi, Calorie counting is wrecking menus and risks driving a wave of eating disorders, Britains misfiring wonder fuel condemns households to a heat pump future, There is a way to give public sector workers a pay rise and save the Government a lot of money, Italy is now Europe's most backward country Britain is a close second, Putins Twitter account resurfaces as Russia comes in from the cold, attempting to take the bank to court for its 12bn cash call during the crisis, Bank of America said it had agreed to buyMerrill Lynch, Lloyds TSB made a 12bn offer for the group. Bank for International Settlements. With fears that similar collapses could be sustained by other major financial companies and banks, President Bush approved the Troubled Asset Relief Program (TARP) in October 2008. Investors had been concerned over the deal, taking place during the meltdown in the US sub-prime mortgage market, but later that year, RBS said both its and ABN Amro's writedowns were lowerthan expected. 4 It was also the worst slowdown since Q1 1982 when GDP fell 6.1%. Like theGreat Depressionof the 1930s and theGreat Inflationof the 1970s, the financial crisis of 2008 and the ensuing recession are vital areas of study for economists and policymakers. Bailout recipients should also be required to cap CEO pay at no more than 50 times worker pay. It had received $7.2bn in cash from an investor group in April of that year, but injust 10 days, almost $17bn in deposits had been withdrawn from the bank.