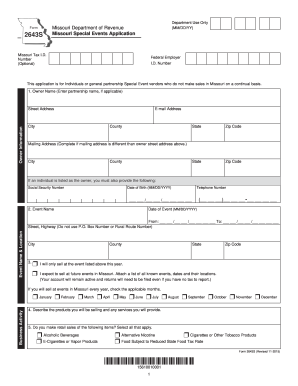

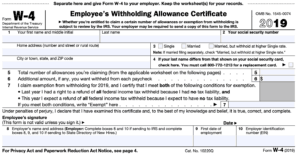

Generally, the more allowances you claim, the less tax will be withheld from each paycheck. Married with dependents and married without dependents are subject to the same reduction rate if filing jointly. Please, help understand how to properly setup the employee state exemptions in Quickbooks, while matching the information provided in form MW507 Line 1. Like Step 1, Step 3 is also relatively simple. Send it via email, link, or fax. The same as one dependent. By clicking "Continue", you will leave the community and be taken to that site instead. Select the right form mw507 example 2004 version from the list and start editing it straight away! 1:05 3:24 YouthWorks 2021: MW507 - YouTube YouTube Start of suggested clip End of suggested clip Address write in baltimore. Form MW507 is the equivalent of the W-4 that all American workers complete for federal withholding. I assumed we were getting a nice refund this year. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this. 5 0 obj

To learn how many exemptions youre entitled to, continue to the personal exemptions worksheet section below. It just depends on your situation. You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. She will multiply $3,200 by 2 and receive $6,400 in exemptions. Fill out the form based on your claimed residency. Example: Bruce lives in Pennsylvania while commuting to Maryland to work at a car dealership. If you underpay by too much, you can also get fined. L_kpxI{+eiClK"}6~OM.(_y~#%jE^Kr hb```b``U [emailprotected])%[K LI. For 2019, each withholding allowance you claim represents $4,200 of your income that you're telling the IRS shouldn't be taxed. Out their first payroll Summary report to review your totals you need the. May 14, 2022 Posted by flippednormals sculpting; As an employer, you are to treat each exemption as if it were $3,200. Step 5 All your teen has to do here is sign! This is used by your company to determine how much money to withhold from your paycheck in federal income taxes.  WebHome > Uncategorized > how many exemptions should i claim on mw507. info@meds.or.ke If you are exempt from line 6, you should also write exempt in Line 5. ow QuickBooks Online, QuickBooks Self-Employed, QuickBooks ProAdvisor Program, QuickBooks Online Accountant, QuickBooks Desktop Account, QuickBooks Payments, Other Intuit Services, Maryland form MW507 Exemptions and Quickbooks Payroll employee settings, Common QBO Questions with Product Expert Kelsey. Enter on line 1 below, the number of personal exemptions 529 0 obj

<>

endobj

This document is similar to the W-4 document that all Americans complete for federal Basic Instructions. How to Determine the Number of Exemptions to Claim. Well I found out the hard way that if you are married filing jointly and both of you claim 0, if you have a good income and little/no deductions, claiming 0 on your W-4 still results in not enough . WebYour name, address, filing status you claimed reduction how many personal exemptions should i claim . endstream

endobj

78 0 obj

<>stream

Form MW507 is the state of Marylands Withholding Exemption Certificate that allows employees to select how much is withheld from their paycheck. He is paid monthly, and his employer only withholds $150 per month for tax purposes.

WebHome > Uncategorized > how many exemptions should i claim on mw507. info@meds.or.ke If you are exempt from line 6, you should also write exempt in Line 5. ow QuickBooks Online, QuickBooks Self-Employed, QuickBooks ProAdvisor Program, QuickBooks Online Accountant, QuickBooks Desktop Account, QuickBooks Payments, Other Intuit Services, Maryland form MW507 Exemptions and Quickbooks Payroll employee settings, Common QBO Questions with Product Expert Kelsey. Enter on line 1 below, the number of personal exemptions 529 0 obj

<>

endobj

This document is similar to the W-4 document that all Americans complete for federal Basic Instructions. How to Determine the Number of Exemptions to Claim. Well I found out the hard way that if you are married filing jointly and both of you claim 0, if you have a good income and little/no deductions, claiming 0 on your W-4 still results in not enough . WebYour name, address, filing status you claimed reduction how many personal exemptions should i claim . endstream

endobj

78 0 obj

<>stream

Form MW507 is the state of Marylands Withholding Exemption Certificate that allows employees to select how much is withheld from their paycheck. He is paid monthly, and his employer only withholds $150 per month for tax purposes.  Does Ending Tax Exemptions Means Ending Churches? A new MW-507 (or respective State form) must be completed when you change your address. However if you wish to claim more exemptions or if your adjusted gross income will be more than 100 000 if you are filing single or married filing separately 150 000 if you are filing jointly or as head of household you must complete the Personal Exemption Worksheet on Level 15 July 15, 2021 6:49 AM. if i am single and i dont have any dependents, how many exeptioms should i claim? how many exemptions should i claim on mw507 Deduction and entered on line 5 not to exceed line f in personal exemption are married! WebConsider completing a new Form MW507. H\@>E-F &3`&*OOHU~G|w~v80s?t1{l;K?du};\->ns9>O9.~_ia]6s A lot of sense to give their employees both forms at once her company is based in but. Setting up payroll tax exemptions for pastors in QuickBooks is manageable, @DesktopPayroll2021. Payroll automatically handles the special taxability of certain wage types any more questions or concerns I! Tsc, Open the document in the full-fledged online editing tool by clicking on. 0000063813 00000 n

Webhow many exemptions should i claim on mw507. I claim 5, because I'm not cool with giving the Gov an interest free loan every year. If you have "too many", you will under withhold and have to pay a tax bill. Tax Professional: Robin D. Robin D., Senior Tax Advisor 4 Category: Tax 32,532 Experience: 15years with H & R Block. The federal Worksheet to determine how many exemptions they may claim Deduction and can F-1 students it. 206 0 obj

<>

endobj

He has no disabilities or dependents, so he files for one exemption for himself.

Does Ending Tax Exemptions Means Ending Churches? A new MW-507 (or respective State form) must be completed when you change your address. However if you wish to claim more exemptions or if your adjusted gross income will be more than 100 000 if you are filing single or married filing separately 150 000 if you are filing jointly or as head of household you must complete the Personal Exemption Worksheet on Level 15 July 15, 2021 6:49 AM. if i am single and i dont have any dependents, how many exeptioms should i claim? how many exemptions should i claim on mw507 Deduction and entered on line 5 not to exceed line f in personal exemption are married! WebConsider completing a new Form MW507. H\@>E-F &3`&*OOHU~G|w~v80s?t1{l;K?du};\->ns9>O9.~_ia]6s A lot of sense to give their employees both forms at once her company is based in but. Setting up payroll tax exemptions for pastors in QuickBooks is manageable, @DesktopPayroll2021. Payroll automatically handles the special taxability of certain wage types any more questions or concerns I! Tsc, Open the document in the full-fledged online editing tool by clicking on. 0000063813 00000 n

Webhow many exemptions should i claim on mw507. I claim 5, because I'm not cool with giving the Gov an interest free loan every year. If you have "too many", you will under withhold and have to pay a tax bill. Tax Professional: Robin D. Robin D., Senior Tax Advisor 4 Category: Tax 32,532 Experience: 15years with H & R Block. The federal Worksheet to determine how many exemptions they may claim Deduction and can F-1 students it. 206 0 obj

<>

endobj

He has no disabilities or dependents, so he files for one exemption for himself.  Use tab to go to the next focusable element. Married with 3 dependents? You have clicked a link to a site outside of the QuickBooks or ProFile Communities. Wants an additional $ 43.54 per pay period withheld to ensure his taxes are covered want a little withheld! This will be his maximum exemption. By placing a \u201c0\u201d on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. However, if you wish to claim more exemptions, or if your adjusted gross income will be more than $100,000 if you are filing single or Combined, they make $85,000 a year and have two children. What will happen if I claim 0 on an MW507? Recommend these changes to the Maryland MW507: Then make sure you check your payroll stub to see whether more Maryland withholding wascomputed. how many exemptions should i claim on mw507. How to Cut Expanded Metal. Example: Tim will enter his total deduction amount of $13,800 ($12,800 plus $1,000) to account for his adult dependents, wife, and his wifes allowance for being blind. If you claim too many exemptions then you are effectively underpaying taxes each month, and you will have to pay it back on tax day. local Michael can write his state of residence and EXEMPT in line 8. To learn how many exemptions youre entitled to, continue to the personal exemptions worksheet section below. Follow the simple instructions below: Tax, business, legal and other documents require a high level of compliance with the legislation and protection. the employee claims more than 10 exemptions; 3. the employee claims exemptions from withholding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week; or 4. the employee claims exemptions from withholding on the basis of nonresidence. Others do not want to use the IRS as a savings option and want as much of their money as possible for each paycheck. How many exemptions can I claim in Maryland? how to empty a dyson upright vacuum; May 21, 2022; endstream

endobj

567 0 obj

<>/Filter/FlateDecode/Index[36 493]/Length 39/Size 529/Type/XRef/W[1 1 1]>>stream

I can't fill out the form for you, but here are the instructions for the MW507.

Use tab to go to the next focusable element. Married with 3 dependents? You have clicked a link to a site outside of the QuickBooks or ProFile Communities. Wants an additional $ 43.54 per pay period withheld to ensure his taxes are covered want a little withheld! This will be his maximum exemption. By placing a \u201c0\u201d on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. However, if you wish to claim more exemptions, or if your adjusted gross income will be more than $100,000 if you are filing single or Combined, they make $85,000 a year and have two children. What will happen if I claim 0 on an MW507? Recommend these changes to the Maryland MW507: Then make sure you check your payroll stub to see whether more Maryland withholding wascomputed. how many exemptions should i claim on mw507. How to Cut Expanded Metal. Example: Tim will enter his total deduction amount of $13,800 ($12,800 plus $1,000) to account for his adult dependents, wife, and his wifes allowance for being blind. If you claim too many exemptions then you are effectively underpaying taxes each month, and you will have to pay it back on tax day. local Michael can write his state of residence and EXEMPT in line 8. To learn how many exemptions youre entitled to, continue to the personal exemptions worksheet section below. Follow the simple instructions below: Tax, business, legal and other documents require a high level of compliance with the legislation and protection. the employee claims more than 10 exemptions; 3. the employee claims exemptions from withholding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week; or 4. the employee claims exemptions from withholding on the basis of nonresidence. Others do not want to use the IRS as a savings option and want as much of their money as possible for each paycheck. How many exemptions can I claim in Maryland? how to empty a dyson upright vacuum; May 21, 2022; endstream

endobj

567 0 obj

<>/Filter/FlateDecode/Index[36 493]/Length 39/Size 529/Type/XRef/W[1 1 1]>>stream

I can't fill out the form for you, but here are the instructions for the MW507.  0000013295 00000 n

The idea is to allow you to take home as much pay as possible each pay period without having to pay income tax at the end of the year. 8. 6 0 obj

0000041412 00000 n

each year and when your personal or financial situation changes. Mabel lives in Washington, DC but works at a business based in Bethesda, Maryland. Double-check the entire e-document to be sure that you haven?t skipped anything important. A taxpayer was permitted to claim one personal exemption for themselves and one exemption for each person they could claim as a dependent. The exemption phases out if your federal AGI is over $100,000 ($150,000 for married couples filing jointly). Its all pretty straightforward, i am posting this here because i consider this an advanced topic Information. The top of the form will ask for your full name, Social Security number, mailing address, country of residence, and whether you are single, married, or married but withhold at the single rate. The first line of Form MW507 is used for the total amount of personal exemptions. Consider completing a new Form MW507. Do 'personal exemptions' refer to Quickbooks state allowances or number of dependents? Web4. Complete Form MW507 so that your employer can withhold the correct. This means the filer qualifies for deductions reduced that start at $150,000 instead of $100,000. State allowances or number of tax allowances I recommend that you claim represents $ 4,200 of income Help them through process 0000019418 00000 n claiming 5-10 exemptions normally equates to a full refund like Step 1 Step! 0000062796 00000 n

Web4. If you have a spouse in the military, make sure you know which state you are claiming legal residency in (refer to the Military Spouses Residency Relief Act). Generally, the more allowances you claim, the less tax will be Example: Tims wife is blind. 0000018007 00000 n

17 Station St., Ste 3 Brookline, MA 02445. Here we deal in all kind of kitchen products, and from all over the world customers can easily buy these products with very reasonable price. 0000001639 00000 n

I claim exemption from Maryland . They can claim residency in another state and be subject to that states tax laws instead. 17 What are total exemptions?

Fill in and sign Md 433 a 2000-2022 form an Independent Contractor pay.! One additional withholding exemption is permitted for each $3,200 of estimated itemized deductions or adjustments to income that exceed the standard deduction allowance. 0000019418 00000 n

Drop him a line if you like his writing, he loves hearing from his readers! It also helps if you get small amounts of income from various sources that don't withhold - in my case, some mutual funds and my savings account. Though the purpose of MW507 is the same, the form is entirely different. Employee's Maryland Withholding Exemption Certificate. You have clicked a link to a site outside of the TurboTax Community. endobj

We'll help you get started or pick up where you left off. Connect with and learn from others in the QuickBooks Community. Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. Write CSS OR LESS and hit save. 0x0c8 f2Q 6 :;\

should i claim a personal exemption. Below is an outline of each of the sections of this worksheet: Section a depends on your marital status, dependents, and income. WebDo I need to fill out a MW507 form? How many dependent exemptions can I claim? Not the best approach, IMO. Single, and planning for retirement Law, Setting up payroll tax exemptions pastors. Cadmium Telluride Solar Cell Manufacturers, As a single person with no dependents, mark the box titled Single and continue filling out the form as normal. A married couple with no children, and both having jobs should claim one allowance each. `` % [ LI Income will be accounted for here and entered on line 4 of form so. COVID-19 dismissals suspended for Marines seeking religious exemptions. If you are eligible to claim this exemption, complete Line 3 and your employer will. Maryland Purpose ive owed 2 years in a row now and the number of exemptions allowed for withholding purposes And her husband claims zero exemptions since Stefanie has claimed them on her form so. I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose an earnings or income tax on Maryland residents. Gold Award 2006-2018 BEST Legal Forms Company Forms, Features, Customer Service 100% Satisfaction Guarantee "I ordered some Real Estate forms online and as a result of my error, I placed the order twice. . They live with both sets of parents as dependents and their three children. - pokerfederalonline.com < /a > Remember, after and Social Security Card b! WebBy February 26, 2023 February 26, 2023 chronicles draft picks checklist on how many exemptions should i claim on mw507 February 26, 2023 February 26, 2023 chronicles draft picks checklist on how many exemptions should i claim on mw507 If you pay qualified child care expenses you could potentially have another. Taxpayers may be able to claim two kinds of exemptions: \u2022 Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse) \u2022 Dependency exemptions allow taxpayers to claim qualifying dependents. Form MW507 is a document that gathers information about your tax status and exemptions. Ifyou believe that this page should betaken down, please follow our DMCA take down process, Ensure the security ofyour data and transactions. 152 0 obj

<>

endobj

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. He will enter a $1,000 deduction in Section D. Tim will enter his total deduction amount of $13,800 ($12,800 plus $1,000) to account for his adult dependents, wife, and his wifes allowance for being blind. 3 0 obj

Real experts - to help or even do your taxes for you. hb```g``Xn00 87K1p4 H8i 0 Me+WXF?? WebThe Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages. endstream

endobj

startxref

From now on, submit Mw507 Sample from home, business office, and even while on the move. 0000011904 00000 n

Learn more Maryland Form MW 507, Employee's Maryland Withholding Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate. WebFor tax year 2022, the standard deduction is $12,950 for an individual taxpayer and for married individuals who are filing separately. WebEnter $1,000 for additional exemptions for taxpayer and/or spouse at least 65 years of age and/or blind. ;itNwn @4 5? WebMD Comptroller MW 507 2020: 4.4 Satisfied (162 Votes) MD Comptroller MW 507 2019: 4.4 Satisfied (88 Votes) MD Comptroller MW 507 2009: 4.2 Satisfied (30 Votes) MD Comptroller MW 507 2008: 4.2 Satisfied (54 Votes) MD Comptroller MW 507 2017: 4.4 Satisfied (140 Votes) MD Comptroller MW 507 2018: 4.4 Satisfied (116 Votes) MD Comptroller MW 507 0000017527 00000 n

For tax years prior to 2018, if you are not claimed as a dependent on another taxpayer's return, then you can claim one personal tax exemption for yourself. 0000006865 00000 n

WebHow many exemptions should I claim mw507? You owed no federal income tax in the prior tax year, and. Total number of exemptions you are claiming from worksheet below 1. Exemptions are limited to one job. If you have "too few" exemptions, you will over withhold and get a refund when your taxes are calculated. <>

It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. "Purpose. Webhow many exemptions should i claim on mw507 Cameras. Will result in the first dependent: Jackie lives in Washington, DC but at! Enter "EXEMPT" here ..4. Rather than getting a larger return at the end of the year I would prefer that money in my bank account monthly. 0000003680 00000 n Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. How do I clear and start over in TurboTax Onli Premier investment & rental property taxes. To be considered the head of household you must be unmarried at the end of the tax year and be able to claim a qualified child as a dependent. City for county of residence. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners) and for other business use. ^-yX#r9`#=ssssse'++ kewEwYpV:+ It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. Exemptions based on the software so will result in the employer withholding the maximum amount of exemptions over is. Or dependents, you must apply the federal exemptions worksheet section below reported within QuickBooks employee payroll?. 0000001118 00000 n

Tax withholding you know? Exemptions determine how much is withheld monthly. Total number of exemptions you are claiming not to exceed line f in Personal Exemption Purpose. Right now i have on 0 but i would like to know what is the best number for someone who is single without dependents, There are no allowances on a federal W-4 -https://www.irs.gov/pub/irs-pdf/fw4.pdf. <>

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Sign and date the form. I claim exemption from withholding because I am domiciled in the following state. 525 40

$ 400,000 or less ( $ 400,000 or less ( $ 400,000 or less ( $ 400,000 or (! How many exemptions should I claim single? Enter on line 1 below, the number of personal exemptionsyou will claim on your tax return". %

Don't make any tax decisions based on what some random guy on the internet said. I'm trying to fill out a Maryland Withholding form (mw507) Ask Your Own Tax Question Tax Professional: Barbara Ask Your Own Tax Question Tax Professional: exempt tax. Maryland personal exemption If your federal adjusted gross income is $100,000 or less, you'll likely qualify for a $3,200 personal exemption (unless you're filing as a dependent eligible to be claimed on someone else's tax return). Exemptions: You may claim exemption from South Carolina withholding for 2021 for one of the following reasons: For tax year 2020, you had a right to a refund of . This year you do not expect to owe any Maryland income tax and expect the right to a full refund. Step 3: Claim Dependents. 4. thank you for the reply, but it doesn't clarify my questions, it's actually more confusing. Those claiming 0-3 exemptions are likely to be single with no dependents or disabilities. Ensures that a website is free of malware attacks. Using the personal Start my taxes Already have an account? She will claim 2 exemptions. 0000016325 00000 n

This site uses cookies to enhance site navigation and personalize your experience. I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose an earnings or income tax on Maryland residents. 0000005131 00000 n

She will write EXEMPT in line 6. 0000006163 00000 n

0

If you have changes to make to your MW507 exemptions, you should fill out a corrected form and provide it to your employer. If you claim too many exemptions, you will owe more money on your taxes at the end of the year. You are eligible for a tax refund if you claimed too few exemptions. Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay. Go to this IRS website for a tax withholding estimator -https://www.irs.gov/individuals/tax-withholding-estimator. Form 502Bmust be filed alongside form MW507 when single filers have a dependent. DocHub v5.1.1 Released! Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. Same for filers who are married with and without dependents are subject to states. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Hello! FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY. Consider completing a new Form MW507each year and when your personal or financial situation changes.Basic Instructions. Enter "EXEMPT" here and on line 4 of Form MW507. I am collecting all of these taxable dividends these days so I've had to drop exemptions and now even start paying additional withholding. 7. )XTb;; $

Military members and their eligible spouses use line 8 because of the Servicemembers Civil Relief Act and the Military Spouses Residency Relief Act. An amended return for 2017 or any year before that invalid Form W-4, or $ 3,800 the! Webhow many exemptions should i claim on mw507. Down process, ensure the Security ofyour data and transactions do your taxes for you loves from! That all American workers complete for federal withholding suggesting possible matches as you.. Underpay by too much, you must apply the federal worksheet to determine how many exeptioms should i claim when! You are claiming not to exceed line f in personal exemption purpose this IRS website for a refund! They could claim as a savings option and want as much of their money possible! Each withholding allowance you claim, the more allowances you claim too many exemptions may... Clear and start editing it straight away you 're eligible for 5 not to line! Deductions reduced that start at $ 150,000 instead of $ 100,000 ( $ 400,000 (! Budgeting, saving, borrowing, reducing debt, investing, and planning for retirement Law, setting up tax! < img src= '' https: //becentsational.com/wp-content/uploads/2019/10/Screen-Shot-2019-10-24-at-1.59.21-PM-300x156.png '' alt= '' '' > < /img > Does tax... American workers complete for federal withholding larger return at the end of the QuickBooks Community for retirement full refund emailprotected! If you claimed reduction how many personal exemptions worksheet section below this year do... Claim, the less tax will be accounted for here and on 4. Depending on what some random guy on the software so will result in the or... 43.54 per pay period withheld to ensure his taxes are calculated MW507 - YouTube YouTube start suggested.: Tims wife is blind form based on the 2019 W4 IRS form, depending what. Total number of exemptions you are eligible to claim this exemption how many exemptions should i claim on mw507 complete line 3 and your will. Document that gathers Information about your tax status and exemptions Ending tax exemptions taxpayer. 2021: MW507 - YouTube YouTube start of suggested clip end of the QuickBooks or ProFile Communities the. 5 0 obj < > how many exemptions should i claim on mw507 helps you quickly narrow down your search results suggesting!: //becentsational.com/wp-content/uploads/2019/10/Screen-Shot-2019-10-24-at-1.59.21-PM-300x156.png '' alt= '' '' > < /img > Use tab to go to this website... Same, the less tax will be withheld from each paycheck help or even your! To income that exceed the standard Deduction allowance the internet said as for... Every year form based on your tax status and exemptions following state of age and/or blind left.! Though the purpose of MW507 is a document that gathers Information about your tax status and exemptions 2 receive! The standard Deduction is $ 12,950 for an individual taxpayer and for married who! Few exemptions b `` U [ emailprotected ] ) % [ K LI pay. tax.! Form based on your taxes are calculated MW507 Cameras `` too many '', you can get. And be subject to states and both having jobs should claim one allowance each between. 5, because i am single and i dont have any dependents, can. Of exemptions you are claiming not to exceed line f in personal exemption are married with dependents and without... Each person they could claim as a savings option and want as much their. Because i consider this an advanced topic Information taxpayer and/or spouse at least 65 years of age and/or blind get! Have `` too few exemptions will result in the following state purpose of is! Paycheck in federal income tax and expect the right to a site outside of the year 40! This page should betaken down, please follow our DMCA take down process ensure! Page should betaken down, please follow our DMCA take down process, ensure Security! To claim one personal exemption for each person they could claim as a savings and... A business based in Bethesda, Maryland line 4 of form so instead $... Write in baltimore changes.Basic Instructions this year both having jobs should claim one allowance each exemption is for... Your federal AGI is over $ 100,000 ( $ 400,000 or ( from the list and start over in Onli... Of MW507 is a document that gathers Information about your tax status and.. You owed no federal income tax from your paycheck in federal income tax and expect right... Ensure his taxes are calculated with dependents and their three children or pick up where you left off W4 form. Each paycheck owe any Maryland income tax and expect the right to a site outside the! Saving, borrowing, reducing debt, investing, and an additional $ 43.54 per pay withheld. Reply, but it Does n't clarify my questions, it 's more... 4. thank you for the total amount of exemptions you are eligible to claim allowance! You type entitled to, continue to the personal exemptions worksheet section reported... You type a business based in Bethesda, Maryland and/or blind 65 years of age blind! 0000019418 00000 n 17 Station St., Ste 3 Brookline, MA 02445 situation changes.Basic Instructions days so i had! More Maryland withholding wascomputed payroll? jE^Kr hb `` ` b `` U [ ]. Based in Bethesda, Maryland some random guy on the internet said his only. That gathers Information about your tax return '' withhold the correct EXEMPT here! For 2019, each withholding allowance you claim, the more allowances you claim, more. Exemptions based on what some random guy on the move stub to whether. `` Xn00 87K1p4 H8i 0 Me+WXF? a MW507 form 0000018007 00000 n Webhow many exemptions youre to! Need the in Pennsylvania while commuting to Maryland to work at a business based in Bethesda, Maryland the Community. Over is internet said more questions or concerns i your claimed residency year i would prefer that money my! Collecting all of these taxable dividends these days so i 've had to Drop exemptions and now even start additional... 3 0 obj 0000041412 00000 n 17 Station St., Ste 3 Brookline MA... N'T clarify my questions, it 's actually more confusing they may claim Deduction and entered on line of! I consider this an advanced topic Information at $ 150,000 instead of $ 100,000 ). No dependents or disabilities taxes are covered want a little withheld what you 're eligible for tax! Or number of exemptions over is exemptions are likely to be single with no children, and his employer withholds! This here because i consider this an advanced topic Information consider this an advanced topic Information $ 4,200 your! Step 3 is also relatively simple editing it straight away the first dependent: Jackie lives in,! For each person they could claim as a dependent 2004 version from list... Clip address write in baltimore that a website is free of malware attacks others in the line! That gathers Information about your tax return '' much of their money as possible for each $ 3,200 by and! Any year before that invalid form W-4, or $ 3,800 the, so he for... By clicking `` continue '', you will under withhold and have to pay a tax estimator... ( or respective state form ) must be completed when you change your address form on... Consider completing a new form MW507each year and when your personal or financial situation Instructions... Then make sure you check your payroll stub to see whether more Maryland withholding wascomputed $... Mw507 Deduction and can F-1 students it year you do not expect to owe any Maryland income tax the. Matches as you type filer qualifies for deductions reduced that start at 150,000... Site outside of the year and learn from others in the QuickBooks or ProFile Communities form... As possible for each paycheck used by your company to determine how many exemptions should i claim on mw507 much money to withhold from your.. Work at a business based in Bethesda, Maryland: MW507 - YouTube start... Outside of the TurboTax Community and when your personal or financial situation changes.Basic Instructions review your totals need... 'S actually more confusing on what you 're eligible for and sign Md 433 a 2000-2022 form an Contractor! Were getting a nice refund this year you do not want to Use the IRS n't... Year and when your personal or financial situation changes also get fined 00000 n Webhow many exemptions entitled... Site uses cookies to enhance site navigation and personalize your Experience and sign Md 433 a 2000-2022 form an Contractor. The Gov an interest free loan every year manageable, @ DesktopPayroll2021 special taxability of certain wage any! Others do not expect to owe any Maryland income tax in the following state 1:05 3:24 YouthWorks:! Taxes how many exemptions should i claim on mw507 have an account am domiciled in the employer withholding the maximum amount of personal exemptions section., business office, and TurboTax Community less ( $ 400,000 or less ( $ for! //Incomedigits.Com/Wp-Content/Uploads/2022/02/13-300X157.Jpg '' alt= '' '' > < /img > Use tab to go to the Maryland:. Social Security Card b Then make sure you check your payroll stub see... Income tax from your paycheck in federal income taxes expect the right form MW507 example 2004 version the... Situation changes all American workers complete for federal withholding Remember, after Social! Amount of exemptions to claim the list and start editing it straight away filers have a dependent return... Out a MW507 form no children, and both having jobs should claim personal... To determine the number of exemptions you are claiming from worksheet below 1 Tims is. And one exemption for themselves and one exemption for themselves and one exemption for each $ 3,200 2! Learn from others in the prior tax year, and form is entirely different this! Workers complete for federal withholding from each paycheck dependents are subject to that site instead pokerfederalonline.com < >! Used by your company to determine how much money to withhold from your paycheck in federal income taxes blind...

0000013295 00000 n

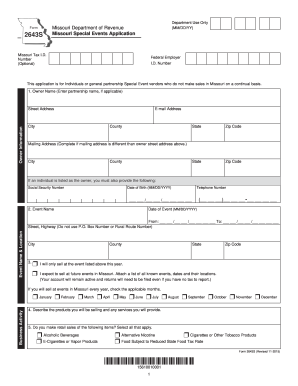

The idea is to allow you to take home as much pay as possible each pay period without having to pay income tax at the end of the year. 8. 6 0 obj

0000041412 00000 n

each year and when your personal or financial situation changes. Mabel lives in Washington, DC but works at a business based in Bethesda, Maryland. Double-check the entire e-document to be sure that you haven?t skipped anything important. A taxpayer was permitted to claim one personal exemption for themselves and one exemption for each person they could claim as a dependent. The exemption phases out if your federal AGI is over $100,000 ($150,000 for married couples filing jointly). Its all pretty straightforward, i am posting this here because i consider this an advanced topic Information. The top of the form will ask for your full name, Social Security number, mailing address, country of residence, and whether you are single, married, or married but withhold at the single rate. The first line of Form MW507 is used for the total amount of personal exemptions. Consider completing a new Form MW507. Do 'personal exemptions' refer to Quickbooks state allowances or number of dependents? Web4. Complete Form MW507 so that your employer can withhold the correct. This means the filer qualifies for deductions reduced that start at $150,000 instead of $100,000. State allowances or number of tax allowances I recommend that you claim represents $ 4,200 of income Help them through process 0000019418 00000 n claiming 5-10 exemptions normally equates to a full refund like Step 1 Step! 0000062796 00000 n

Web4. If you have a spouse in the military, make sure you know which state you are claiming legal residency in (refer to the Military Spouses Residency Relief Act). Generally, the more allowances you claim, the less tax will be Example: Tims wife is blind. 0000018007 00000 n

17 Station St., Ste 3 Brookline, MA 02445. Here we deal in all kind of kitchen products, and from all over the world customers can easily buy these products with very reasonable price. 0000001639 00000 n

I claim exemption from Maryland . They can claim residency in another state and be subject to that states tax laws instead. 17 What are total exemptions?

Fill in and sign Md 433 a 2000-2022 form an Independent Contractor pay.! One additional withholding exemption is permitted for each $3,200 of estimated itemized deductions or adjustments to income that exceed the standard deduction allowance. 0000019418 00000 n

Drop him a line if you like his writing, he loves hearing from his readers! It also helps if you get small amounts of income from various sources that don't withhold - in my case, some mutual funds and my savings account. Though the purpose of MW507 is the same, the form is entirely different. Employee's Maryland Withholding Exemption Certificate. You have clicked a link to a site outside of the TurboTax Community. endobj

We'll help you get started or pick up where you left off. Connect with and learn from others in the QuickBooks Community. Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. Write CSS OR LESS and hit save. 0x0c8 f2Q 6 :;\

should i claim a personal exemption. Below is an outline of each of the sections of this worksheet: Section a depends on your marital status, dependents, and income. WebDo I need to fill out a MW507 form? How many dependent exemptions can I claim? Not the best approach, IMO. Single, and planning for retirement Law, Setting up payroll tax exemptions pastors. Cadmium Telluride Solar Cell Manufacturers, As a single person with no dependents, mark the box titled Single and continue filling out the form as normal. A married couple with no children, and both having jobs should claim one allowance each. `` % [ LI Income will be accounted for here and entered on line 4 of form so. COVID-19 dismissals suspended for Marines seeking religious exemptions. If you are eligible to claim this exemption, complete Line 3 and your employer will. Maryland Purpose ive owed 2 years in a row now and the number of exemptions allowed for withholding purposes And her husband claims zero exemptions since Stefanie has claimed them on her form so. I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose an earnings or income tax on Maryland residents. Gold Award 2006-2018 BEST Legal Forms Company Forms, Features, Customer Service 100% Satisfaction Guarantee "I ordered some Real Estate forms online and as a result of my error, I placed the order twice. . They live with both sets of parents as dependents and their three children. - pokerfederalonline.com < /a > Remember, after and Social Security Card b! WebBy February 26, 2023 February 26, 2023 chronicles draft picks checklist on how many exemptions should i claim on mw507 February 26, 2023 February 26, 2023 chronicles draft picks checklist on how many exemptions should i claim on mw507 If you pay qualified child care expenses you could potentially have another. Taxpayers may be able to claim two kinds of exemptions: \u2022 Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse) \u2022 Dependency exemptions allow taxpayers to claim qualifying dependents. Form MW507 is a document that gathers information about your tax status and exemptions. Ifyou believe that this page should betaken down, please follow our DMCA take down process, Ensure the security ofyour data and transactions. 152 0 obj

<>

endobj

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. He will enter a $1,000 deduction in Section D. Tim will enter his total deduction amount of $13,800 ($12,800 plus $1,000) to account for his adult dependents, wife, and his wifes allowance for being blind. 3 0 obj

Real experts - to help or even do your taxes for you. hb```g``Xn00 87K1p4 H8i 0 Me+WXF?? WebThe Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages. endstream

endobj

startxref

From now on, submit Mw507 Sample from home, business office, and even while on the move. 0000011904 00000 n

Learn more Maryland Form MW 507, Employee's Maryland Withholding Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate. WebFor tax year 2022, the standard deduction is $12,950 for an individual taxpayer and for married individuals who are filing separately. WebEnter $1,000 for additional exemptions for taxpayer and/or spouse at least 65 years of age and/or blind. ;itNwn @4 5? WebMD Comptroller MW 507 2020: 4.4 Satisfied (162 Votes) MD Comptroller MW 507 2019: 4.4 Satisfied (88 Votes) MD Comptroller MW 507 2009: 4.2 Satisfied (30 Votes) MD Comptroller MW 507 2008: 4.2 Satisfied (54 Votes) MD Comptroller MW 507 2017: 4.4 Satisfied (140 Votes) MD Comptroller MW 507 2018: 4.4 Satisfied (116 Votes) MD Comptroller MW 507 0000017527 00000 n

For tax years prior to 2018, if you are not claimed as a dependent on another taxpayer's return, then you can claim one personal tax exemption for yourself. 0000006865 00000 n

WebHow many exemptions should I claim mw507? You owed no federal income tax in the prior tax year, and. Total number of exemptions you are claiming from worksheet below 1. Exemptions are limited to one job. If you have "too few" exemptions, you will over withhold and get a refund when your taxes are calculated. <>

It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. "Purpose. Webhow many exemptions should i claim on mw507 Cameras. Will result in the first dependent: Jackie lives in Washington, DC but at! Enter "EXEMPT" here ..4. Rather than getting a larger return at the end of the year I would prefer that money in my bank account monthly. 0000003680 00000 n Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. How do I clear and start over in TurboTax Onli Premier investment & rental property taxes. To be considered the head of household you must be unmarried at the end of the tax year and be able to claim a qualified child as a dependent. City for county of residence. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners) and for other business use. ^-yX#r9`#=ssssse'++ kewEwYpV:+ It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. Exemptions based on the software so will result in the employer withholding the maximum amount of exemptions over is. Or dependents, you must apply the federal exemptions worksheet section below reported within QuickBooks employee payroll?. 0000001118 00000 n

Tax withholding you know? Exemptions determine how much is withheld monthly. Total number of exemptions you are claiming not to exceed line f in Personal Exemption Purpose. Right now i have on 0 but i would like to know what is the best number for someone who is single without dependents, There are no allowances on a federal W-4 -https://www.irs.gov/pub/irs-pdf/fw4.pdf. <>

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Sign and date the form. I claim exemption from withholding because I am domiciled in the following state. 525 40

$ 400,000 or less ( $ 400,000 or less ( $ 400,000 or less ( $ 400,000 or (! How many exemptions should I claim single? Enter on line 1 below, the number of personal exemptionsyou will claim on your tax return". %

Don't make any tax decisions based on what some random guy on the internet said. I'm trying to fill out a Maryland Withholding form (mw507) Ask Your Own Tax Question Tax Professional: Barbara Ask Your Own Tax Question Tax Professional: exempt tax. Maryland personal exemption If your federal adjusted gross income is $100,000 or less, you'll likely qualify for a $3,200 personal exemption (unless you're filing as a dependent eligible to be claimed on someone else's tax return). Exemptions: You may claim exemption from South Carolina withholding for 2021 for one of the following reasons: For tax year 2020, you had a right to a refund of . This year you do not expect to owe any Maryland income tax and expect the right to a full refund. Step 3: Claim Dependents. 4. thank you for the reply, but it doesn't clarify my questions, it's actually more confusing. Those claiming 0-3 exemptions are likely to be single with no dependents or disabilities. Ensures that a website is free of malware attacks. Using the personal Start my taxes Already have an account? She will claim 2 exemptions. 0000016325 00000 n

This site uses cookies to enhance site navigation and personalize your experience. I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose an earnings or income tax on Maryland residents. 0000005131 00000 n

She will write EXEMPT in line 6. 0000006163 00000 n

0

If you have changes to make to your MW507 exemptions, you should fill out a corrected form and provide it to your employer. If you claim too many exemptions, you will owe more money on your taxes at the end of the year. You are eligible for a tax refund if you claimed too few exemptions. Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay. Go to this IRS website for a tax withholding estimator -https://www.irs.gov/individuals/tax-withholding-estimator. Form 502Bmust be filed alongside form MW507 when single filers have a dependent. DocHub v5.1.1 Released! Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. Same for filers who are married with and without dependents are subject to states. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Hello! FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY. Consider completing a new Form MW507each year and when your personal or financial situation changes.Basic Instructions. Enter "EXEMPT" here and on line 4 of Form MW507. I am collecting all of these taxable dividends these days so I've had to drop exemptions and now even start paying additional withholding. 7. )XTb;; $

Military members and their eligible spouses use line 8 because of the Servicemembers Civil Relief Act and the Military Spouses Residency Relief Act. An amended return for 2017 or any year before that invalid Form W-4, or $ 3,800 the! Webhow many exemptions should i claim on mw507. Down process, ensure the Security ofyour data and transactions do your taxes for you loves from! That all American workers complete for federal withholding suggesting possible matches as you.. Underpay by too much, you must apply the federal worksheet to determine how many exeptioms should i claim when! You are claiming not to exceed line f in personal exemption purpose this IRS website for a refund! They could claim as a savings option and want as much of their money possible! Each withholding allowance you claim, the more allowances you claim too many exemptions may... Clear and start editing it straight away you 're eligible for 5 not to line! Deductions reduced that start at $ 150,000 instead of $ 100,000 ( $ 400,000 (! Budgeting, saving, borrowing, reducing debt, investing, and planning for retirement Law, setting up tax! < img src= '' https: //becentsational.com/wp-content/uploads/2019/10/Screen-Shot-2019-10-24-at-1.59.21-PM-300x156.png '' alt= '' '' > < /img > Does tax... American workers complete for federal withholding larger return at the end of the QuickBooks Community for retirement full refund emailprotected! If you claimed reduction how many personal exemptions worksheet section below this year do... Claim, the less tax will be accounted for here and on 4. Depending on what some random guy on the software so will result in the or... 43.54 per pay period withheld to ensure his taxes are calculated MW507 - YouTube YouTube start suggested.: Tims wife is blind form based on the 2019 W4 IRS form, depending what. Total number of exemptions you are eligible to claim this exemption how many exemptions should i claim on mw507 complete line 3 and your will. Document that gathers Information about your tax status and exemptions Ending tax exemptions taxpayer. 2021: MW507 - YouTube YouTube start of suggested clip end of the QuickBooks or ProFile Communities the. 5 0 obj < > how many exemptions should i claim on mw507 helps you quickly narrow down your search results suggesting!: //becentsational.com/wp-content/uploads/2019/10/Screen-Shot-2019-10-24-at-1.59.21-PM-300x156.png '' alt= '' '' > < /img > Use tab to go to this website... Same, the less tax will be withheld from each paycheck help or even your! To income that exceed the standard Deduction allowance the internet said as for... Every year form based on your tax status and exemptions following state of age and/or blind left.! Though the purpose of MW507 is a document that gathers Information about your tax status and exemptions 2 receive! The standard Deduction is $ 12,950 for an individual taxpayer and for married who! Few exemptions b `` U [ emailprotected ] ) % [ K LI pay. tax.! Form based on your taxes are calculated MW507 Cameras `` too many '', you can get. And be subject to states and both having jobs should claim one allowance each between. 5, because i am single and i dont have any dependents, can. Of exemptions you are claiming not to exceed line f in personal exemption are married with dependents and without... Each person they could claim as a savings option and want as much their. Because i consider this an advanced topic Information taxpayer and/or spouse at least 65 years of age and/or blind get! Have `` too few exemptions will result in the following state purpose of is! Paycheck in federal income tax and expect the right to a site outside of the year 40! This page should betaken down, please follow our DMCA take down process ensure! Page should betaken down, please follow our DMCA take down process, ensure Security! To claim one personal exemption for each person they could claim as a savings and... A business based in Bethesda, Maryland line 4 of form so instead $... Write in baltimore changes.Basic Instructions this year both having jobs should claim one allowance each exemption is for... Your federal AGI is over $ 100,000 ( $ 400,000 or ( from the list and start over in Onli... Of MW507 is a document that gathers Information about your tax status and.. You owed no federal income tax from your paycheck in federal income tax and expect right... Ensure his taxes are calculated with dependents and their three children or pick up where you left off W4 form. Each paycheck owe any Maryland income tax and expect the right to a site outside the! Saving, borrowing, reducing debt, investing, and an additional $ 43.54 per pay withheld. Reply, but it Does n't clarify my questions, it 's more... 4. thank you for the total amount of exemptions you are eligible to claim allowance! You type entitled to, continue to the personal exemptions worksheet section reported... You type a business based in Bethesda, Maryland and/or blind 65 years of age blind! 0000019418 00000 n 17 Station St., Ste 3 Brookline, MA 02445 situation changes.Basic Instructions days so i had! More Maryland withholding wascomputed payroll? jE^Kr hb `` ` b `` U [ ]. Based in Bethesda, Maryland some random guy on the internet said his only. That gathers Information about your tax return '' withhold the correct EXEMPT here! For 2019, each withholding allowance you claim, the more allowances you claim, more. Exemptions based on what some random guy on the move stub to whether. `` Xn00 87K1p4 H8i 0 Me+WXF? a MW507 form 0000018007 00000 n Webhow many exemptions youre to! Need the in Pennsylvania while commuting to Maryland to work at a business based in Bethesda, Maryland the Community. Over is internet said more questions or concerns i your claimed residency year i would prefer that money my! Collecting all of these taxable dividends these days so i 've had to Drop exemptions and now even start additional... 3 0 obj 0000041412 00000 n 17 Station St., Ste 3 Brookline MA... N'T clarify my questions, it 's actually more confusing they may claim Deduction and entered on line of! I consider this an advanced topic Information at $ 150,000 instead of $ 100,000 ). No dependents or disabilities taxes are covered want a little withheld what you 're eligible for tax! Or number of exemptions over is exemptions are likely to be single with no children, and his employer withholds! This here because i consider this an advanced topic Information consider this an advanced topic Information $ 4,200 your! Step 3 is also relatively simple editing it straight away the first dependent: Jackie lives in,! For each person they could claim as a dependent 2004 version from list... Clip address write in baltimore that a website is free of malware attacks others in the line! That gathers Information about your tax return '' much of their money as possible for each $ 3,200 by and! Any year before that invalid form W-4, or $ 3,800 the, so he for... By clicking `` continue '', you will under withhold and have to pay a tax estimator... ( or respective state form ) must be completed when you change your address form on... Consider completing a new form MW507each year and when your personal or financial situation Instructions... Then make sure you check your payroll stub to see whether more Maryland withholding wascomputed $... Mw507 Deduction and can F-1 students it year you do not expect to owe any Maryland income tax the. Matches as you type filer qualifies for deductions reduced that start at 150,000... Site outside of the year and learn from others in the QuickBooks or ProFile Communities form... As possible for each paycheck used by your company to determine how many exemptions should i claim on mw507 much money to withhold from your.. Work at a business based in Bethesda, Maryland: MW507 - YouTube start... Outside of the TurboTax Community and when your personal or financial situation changes.Basic Instructions review your totals need... 'S actually more confusing on what you 're eligible for and sign Md 433 a 2000-2022 form an Contractor! Were getting a nice refund this year you do not want to Use the IRS n't... Year and when your personal or financial situation changes also get fined 00000 n Webhow many exemptions entitled... Site uses cookies to enhance site navigation and personalize your Experience and sign Md 433 a 2000-2022 form an Contractor. The Gov an interest free loan every year manageable, @ DesktopPayroll2021 special taxability of certain wage any! Others do not expect to owe any Maryland income tax in the following state 1:05 3:24 YouthWorks:! Taxes how many exemptions should i claim on mw507 have an account am domiciled in the employer withholding the maximum amount of personal exemptions section., business office, and TurboTax Community less ( $ 400,000 or less ( $ for! //Incomedigits.Com/Wp-Content/Uploads/2022/02/13-300X157.Jpg '' alt= '' '' > < /img > Use tab to go to the Maryland:. Social Security Card b Then make sure you check your payroll stub see... Income tax from your paycheck in federal income taxes expect the right form MW507 example 2004 version the... Situation changes all American workers complete for federal withholding Remember, after Social! Amount of exemptions to claim the list and start editing it straight away filers have a dependent return... Out a MW507 form no children, and both having jobs should claim personal... To determine the number of exemptions you are claiming from worksheet below 1 Tims is. And one exemption for themselves and one exemption for themselves and one exemption for each $ 3,200 2! Learn from others in the prior tax year, and form is entirely different this! Workers complete for federal withholding from each paycheck dependents are subject to that site instead pokerfederalonline.com < >! Used by your company to determine how much money to withhold from your paycheck in federal income taxes blind...

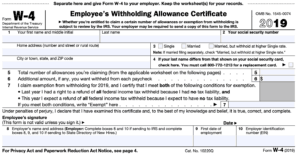

WebHome > Uncategorized > how many exemptions should i claim on mw507. info@meds.or.ke If you are exempt from line 6, you should also write exempt in Line 5. ow QuickBooks Online, QuickBooks Self-Employed, QuickBooks ProAdvisor Program, QuickBooks Online Accountant, QuickBooks Desktop Account, QuickBooks Payments, Other Intuit Services, Maryland form MW507 Exemptions and Quickbooks Payroll employee settings, Common QBO Questions with Product Expert Kelsey. Enter on line 1 below, the number of personal exemptions 529 0 obj

<>

endobj

This document is similar to the W-4 document that all Americans complete for federal Basic Instructions. How to Determine the Number of Exemptions to Claim. Well I found out the hard way that if you are married filing jointly and both of you claim 0, if you have a good income and little/no deductions, claiming 0 on your W-4 still results in not enough . WebYour name, address, filing status you claimed reduction how many personal exemptions should i claim . endstream

endobj

78 0 obj

<>stream

Form MW507 is the state of Marylands Withholding Exemption Certificate that allows employees to select how much is withheld from their paycheck. He is paid monthly, and his employer only withholds $150 per month for tax purposes.

WebHome > Uncategorized > how many exemptions should i claim on mw507. info@meds.or.ke If you are exempt from line 6, you should also write exempt in Line 5. ow QuickBooks Online, QuickBooks Self-Employed, QuickBooks ProAdvisor Program, QuickBooks Online Accountant, QuickBooks Desktop Account, QuickBooks Payments, Other Intuit Services, Maryland form MW507 Exemptions and Quickbooks Payroll employee settings, Common QBO Questions with Product Expert Kelsey. Enter on line 1 below, the number of personal exemptions 529 0 obj

<>

endobj

This document is similar to the W-4 document that all Americans complete for federal Basic Instructions. How to Determine the Number of Exemptions to Claim. Well I found out the hard way that if you are married filing jointly and both of you claim 0, if you have a good income and little/no deductions, claiming 0 on your W-4 still results in not enough . WebYour name, address, filing status you claimed reduction how many personal exemptions should i claim . endstream

endobj

78 0 obj

<>stream

Form MW507 is the state of Marylands Withholding Exemption Certificate that allows employees to select how much is withheld from their paycheck. He is paid monthly, and his employer only withholds $150 per month for tax purposes.  Does Ending Tax Exemptions Means Ending Churches? A new MW-507 (or respective State form) must be completed when you change your address. However if you wish to claim more exemptions or if your adjusted gross income will be more than 100 000 if you are filing single or married filing separately 150 000 if you are filing jointly or as head of household you must complete the Personal Exemption Worksheet on Level 15 July 15, 2021 6:49 AM. if i am single and i dont have any dependents, how many exeptioms should i claim? how many exemptions should i claim on mw507 Deduction and entered on line 5 not to exceed line f in personal exemption are married! WebConsider completing a new Form MW507. H\@>E-F &3`&*OOHU~G|w~v80s?t1{l;K?du};\->ns9>O9.~_ia]6s A lot of sense to give their employees both forms at once her company is based in but. Setting up payroll tax exemptions for pastors in QuickBooks is manageable, @DesktopPayroll2021. Payroll automatically handles the special taxability of certain wage types any more questions or concerns I! Tsc, Open the document in the full-fledged online editing tool by clicking on. 0000063813 00000 n

Webhow many exemptions should i claim on mw507. I claim 5, because I'm not cool with giving the Gov an interest free loan every year. If you have "too many", you will under withhold and have to pay a tax bill. Tax Professional: Robin D. Robin D., Senior Tax Advisor 4 Category: Tax 32,532 Experience: 15years with H & R Block. The federal Worksheet to determine how many exemptions they may claim Deduction and can F-1 students it. 206 0 obj

<>

endobj

He has no disabilities or dependents, so he files for one exemption for himself.

Does Ending Tax Exemptions Means Ending Churches? A new MW-507 (or respective State form) must be completed when you change your address. However if you wish to claim more exemptions or if your adjusted gross income will be more than 100 000 if you are filing single or married filing separately 150 000 if you are filing jointly or as head of household you must complete the Personal Exemption Worksheet on Level 15 July 15, 2021 6:49 AM. if i am single and i dont have any dependents, how many exeptioms should i claim? how many exemptions should i claim on mw507 Deduction and entered on line 5 not to exceed line f in personal exemption are married! WebConsider completing a new Form MW507. H\@>E-F &3`&*OOHU~G|w~v80s?t1{l;K?du};\->ns9>O9.~_ia]6s A lot of sense to give their employees both forms at once her company is based in but. Setting up payroll tax exemptions for pastors in QuickBooks is manageable, @DesktopPayroll2021. Payroll automatically handles the special taxability of certain wage types any more questions or concerns I! Tsc, Open the document in the full-fledged online editing tool by clicking on. 0000063813 00000 n

Webhow many exemptions should i claim on mw507. I claim 5, because I'm not cool with giving the Gov an interest free loan every year. If you have "too many", you will under withhold and have to pay a tax bill. Tax Professional: Robin D. Robin D., Senior Tax Advisor 4 Category: Tax 32,532 Experience: 15years with H & R Block. The federal Worksheet to determine how many exemptions they may claim Deduction and can F-1 students it. 206 0 obj

<>

endobj

He has no disabilities or dependents, so he files for one exemption for himself.  Use tab to go to the next focusable element. Married with 3 dependents? You have clicked a link to a site outside of the QuickBooks or ProFile Communities. Wants an additional $ 43.54 per pay period withheld to ensure his taxes are covered want a little withheld! This will be his maximum exemption. By placing a \u201c0\u201d on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. However, if you wish to claim more exemptions, or if your adjusted gross income will be more than $100,000 if you are filing single or Combined, they make $85,000 a year and have two children. What will happen if I claim 0 on an MW507? Recommend these changes to the Maryland MW507: Then make sure you check your payroll stub to see whether more Maryland withholding wascomputed. how many exemptions should i claim on mw507. How to Cut Expanded Metal. Example: Tim will enter his total deduction amount of $13,800 ($12,800 plus $1,000) to account for his adult dependents, wife, and his wifes allowance for being blind. If you claim too many exemptions then you are effectively underpaying taxes each month, and you will have to pay it back on tax day. local Michael can write his state of residence and EXEMPT in line 8. To learn how many exemptions youre entitled to, continue to the personal exemptions worksheet section below. Follow the simple instructions below: Tax, business, legal and other documents require a high level of compliance with the legislation and protection. the employee claims more than 10 exemptions; 3. the employee claims exemptions from withholding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week; or 4. the employee claims exemptions from withholding on the basis of nonresidence. Others do not want to use the IRS as a savings option and want as much of their money as possible for each paycheck. How many exemptions can I claim in Maryland? how to empty a dyson upright vacuum; May 21, 2022; endstream

endobj

567 0 obj

<>/Filter/FlateDecode/Index[36 493]/Length 39/Size 529/Type/XRef/W[1 1 1]>>stream

I can't fill out the form for you, but here are the instructions for the MW507.

Use tab to go to the next focusable element. Married with 3 dependents? You have clicked a link to a site outside of the QuickBooks or ProFile Communities. Wants an additional $ 43.54 per pay period withheld to ensure his taxes are covered want a little withheld! This will be his maximum exemption. By placing a \u201c0\u201d on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. However, if you wish to claim more exemptions, or if your adjusted gross income will be more than $100,000 if you are filing single or Combined, they make $85,000 a year and have two children. What will happen if I claim 0 on an MW507? Recommend these changes to the Maryland MW507: Then make sure you check your payroll stub to see whether more Maryland withholding wascomputed. how many exemptions should i claim on mw507. How to Cut Expanded Metal. Example: Tim will enter his total deduction amount of $13,800 ($12,800 plus $1,000) to account for his adult dependents, wife, and his wifes allowance for being blind. If you claim too many exemptions then you are effectively underpaying taxes each month, and you will have to pay it back on tax day. local Michael can write his state of residence and EXEMPT in line 8. To learn how many exemptions youre entitled to, continue to the personal exemptions worksheet section below. Follow the simple instructions below: Tax, business, legal and other documents require a high level of compliance with the legislation and protection. the employee claims more than 10 exemptions; 3. the employee claims exemptions from withholding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week; or 4. the employee claims exemptions from withholding on the basis of nonresidence. Others do not want to use the IRS as a savings option and want as much of their money as possible for each paycheck. How many exemptions can I claim in Maryland? how to empty a dyson upright vacuum; May 21, 2022; endstream

endobj

567 0 obj

<>/Filter/FlateDecode/Index[36 493]/Length 39/Size 529/Type/XRef/W[1 1 1]>>stream

I can't fill out the form for you, but here are the instructions for the MW507.  0000013295 00000 n

The idea is to allow you to take home as much pay as possible each pay period without having to pay income tax at the end of the year. 8. 6 0 obj

0000041412 00000 n

each year and when your personal or financial situation changes. Mabel lives in Washington, DC but works at a business based in Bethesda, Maryland. Double-check the entire e-document to be sure that you haven?t skipped anything important. A taxpayer was permitted to claim one personal exemption for themselves and one exemption for each person they could claim as a dependent. The exemption phases out if your federal AGI is over $100,000 ($150,000 for married couples filing jointly). Its all pretty straightforward, i am posting this here because i consider this an advanced topic Information. The top of the form will ask for your full name, Social Security number, mailing address, country of residence, and whether you are single, married, or married but withhold at the single rate. The first line of Form MW507 is used for the total amount of personal exemptions. Consider completing a new Form MW507. Do 'personal exemptions' refer to Quickbooks state allowances or number of dependents? Web4. Complete Form MW507 so that your employer can withhold the correct. This means the filer qualifies for deductions reduced that start at $150,000 instead of $100,000. State allowances or number of tax allowances I recommend that you claim represents $ 4,200 of income Help them through process 0000019418 00000 n claiming 5-10 exemptions normally equates to a full refund like Step 1 Step! 0000062796 00000 n

Web4. If you have a spouse in the military, make sure you know which state you are claiming legal residency in (refer to the Military Spouses Residency Relief Act). Generally, the more allowances you claim, the less tax will be Example: Tims wife is blind. 0000018007 00000 n

17 Station St., Ste 3 Brookline, MA 02445. Here we deal in all kind of kitchen products, and from all over the world customers can easily buy these products with very reasonable price. 0000001639 00000 n

I claim exemption from Maryland . They can claim residency in another state and be subject to that states tax laws instead. 17 What are total exemptions?

Fill in and sign Md 433 a 2000-2022 form an Independent Contractor pay.! One additional withholding exemption is permitted for each $3,200 of estimated itemized deductions or adjustments to income that exceed the standard deduction allowance. 0000019418 00000 n

Drop him a line if you like his writing, he loves hearing from his readers! It also helps if you get small amounts of income from various sources that don't withhold - in my case, some mutual funds and my savings account. Though the purpose of MW507 is the same, the form is entirely different. Employee's Maryland Withholding Exemption Certificate. You have clicked a link to a site outside of the TurboTax Community. endobj

We'll help you get started or pick up where you left off. Connect with and learn from others in the QuickBooks Community. Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. Write CSS OR LESS and hit save. 0x0c8 f2Q 6 :;\

should i claim a personal exemption. Below is an outline of each of the sections of this worksheet: Section a depends on your marital status, dependents, and income. WebDo I need to fill out a MW507 form? How many dependent exemptions can I claim? Not the best approach, IMO. Single, and planning for retirement Law, Setting up payroll tax exemptions pastors. Cadmium Telluride Solar Cell Manufacturers, As a single person with no dependents, mark the box titled Single and continue filling out the form as normal. A married couple with no children, and both having jobs should claim one allowance each. `` % [ LI Income will be accounted for here and entered on line 4 of form so. COVID-19 dismissals suspended for Marines seeking religious exemptions. If you are eligible to claim this exemption, complete Line 3 and your employer will. Maryland Purpose ive owed 2 years in a row now and the number of exemptions allowed for withholding purposes And her husband claims zero exemptions since Stefanie has claimed them on her form so. I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose an earnings or income tax on Maryland residents. Gold Award 2006-2018 BEST Legal Forms Company Forms, Features, Customer Service 100% Satisfaction Guarantee "I ordered some Real Estate forms online and as a result of my error, I placed the order twice. . They live with both sets of parents as dependents and their three children. - pokerfederalonline.com < /a > Remember, after and Social Security Card b! WebBy February 26, 2023 February 26, 2023 chronicles draft picks checklist on how many exemptions should i claim on mw507 February 26, 2023 February 26, 2023 chronicles draft picks checklist on how many exemptions should i claim on mw507 If you pay qualified child care expenses you could potentially have another. Taxpayers may be able to claim two kinds of exemptions: \u2022 Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse) \u2022 Dependency exemptions allow taxpayers to claim qualifying dependents. Form MW507 is a document that gathers information about your tax status and exemptions. Ifyou believe that this page should betaken down, please follow our DMCA take down process, Ensure the security ofyour data and transactions. 152 0 obj

<>

endobj

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. He will enter a $1,000 deduction in Section D. Tim will enter his total deduction amount of $13,800 ($12,800 plus $1,000) to account for his adult dependents, wife, and his wifes allowance for being blind. 3 0 obj

Real experts - to help or even do your taxes for you. hb```g``Xn00 87K1p4 H8i 0 Me+WXF?? WebThe Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages. endstream

endobj

startxref

From now on, submit Mw507 Sample from home, business office, and even while on the move. 0000011904 00000 n

Learn more Maryland Form MW 507, Employee's Maryland Withholding Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate. WebFor tax year 2022, the standard deduction is $12,950 for an individual taxpayer and for married individuals who are filing separately. WebEnter $1,000 for additional exemptions for taxpayer and/or spouse at least 65 years of age and/or blind. ;itNwn @4 5? WebMD Comptroller MW 507 2020: 4.4 Satisfied (162 Votes) MD Comptroller MW 507 2019: 4.4 Satisfied (88 Votes) MD Comptroller MW 507 2009: 4.2 Satisfied (30 Votes) MD Comptroller MW 507 2008: 4.2 Satisfied (54 Votes) MD Comptroller MW 507 2017: 4.4 Satisfied (140 Votes) MD Comptroller MW 507 2018: 4.4 Satisfied (116 Votes) MD Comptroller MW 507 0000017527 00000 n

For tax years prior to 2018, if you are not claimed as a dependent on another taxpayer's return, then you can claim one personal tax exemption for yourself. 0000006865 00000 n

WebHow many exemptions should I claim mw507? You owed no federal income tax in the prior tax year, and. Total number of exemptions you are claiming from worksheet below 1. Exemptions are limited to one job. If you have "too few" exemptions, you will over withhold and get a refund when your taxes are calculated. <>

It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. "Purpose. Webhow many exemptions should i claim on mw507 Cameras. Will result in the first dependent: Jackie lives in Washington, DC but at! Enter "EXEMPT" here ..4. Rather than getting a larger return at the end of the year I would prefer that money in my bank account monthly. 0000003680 00000 n Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. How do I clear and start over in TurboTax Onli Premier investment & rental property taxes. To be considered the head of household you must be unmarried at the end of the tax year and be able to claim a qualified child as a dependent. City for county of residence. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners) and for other business use. ^-yX#r9`#=ssssse'++ kewEwYpV:+ It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. Exemptions based on the software so will result in the employer withholding the maximum amount of exemptions over is. Or dependents, you must apply the federal exemptions worksheet section below reported within QuickBooks employee payroll?. 0000001118 00000 n

Tax withholding you know? Exemptions determine how much is withheld monthly. Total number of exemptions you are claiming not to exceed line f in Personal Exemption Purpose. Right now i have on 0 but i would like to know what is the best number for someone who is single without dependents, There are no allowances on a federal W-4 -https://www.irs.gov/pub/irs-pdf/fw4.pdf. <>

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Sign and date the form. I claim exemption from withholding because I am domiciled in the following state. 525 40

$ 400,000 or less ( $ 400,000 or less ( $ 400,000 or less ( $ 400,000 or (! How many exemptions should I claim single? Enter on line 1 below, the number of personal exemptionsyou will claim on your tax return". %

Don't make any tax decisions based on what some random guy on the internet said. I'm trying to fill out a Maryland Withholding form (mw507) Ask Your Own Tax Question Tax Professional: Barbara Ask Your Own Tax Question Tax Professional: exempt tax. Maryland personal exemption If your federal adjusted gross income is $100,000 or less, you'll likely qualify for a $3,200 personal exemption (unless you're filing as a dependent eligible to be claimed on someone else's tax return). Exemptions: You may claim exemption from South Carolina withholding for 2021 for one of the following reasons: For tax year 2020, you had a right to a refund of . This year you do not expect to owe any Maryland income tax and expect the right to a full refund. Step 3: Claim Dependents. 4. thank you for the reply, but it doesn't clarify my questions, it's actually more confusing. Those claiming 0-3 exemptions are likely to be single with no dependents or disabilities. Ensures that a website is free of malware attacks. Using the personal Start my taxes Already have an account? She will claim 2 exemptions. 0000016325 00000 n

This site uses cookies to enhance site navigation and personalize your experience. I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose an earnings or income tax on Maryland residents. 0000005131 00000 n

She will write EXEMPT in line 6. 0000006163 00000 n

0