Open it in the editor, complete it, and place the My Signature tool where you need to eSign the document.

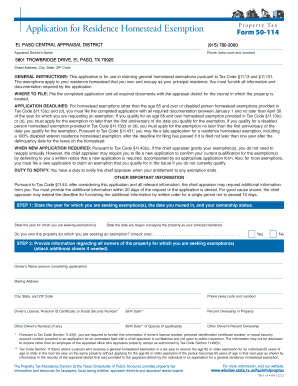

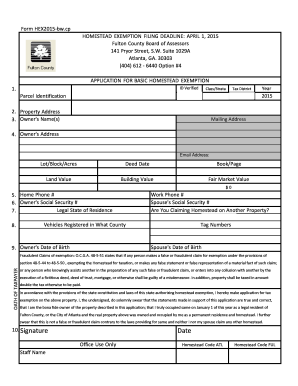

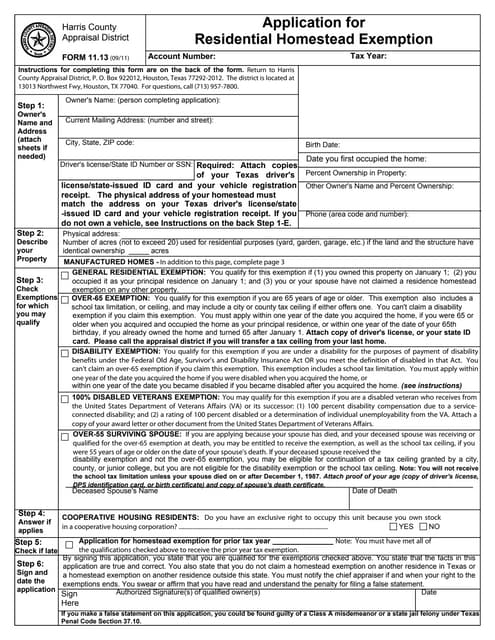

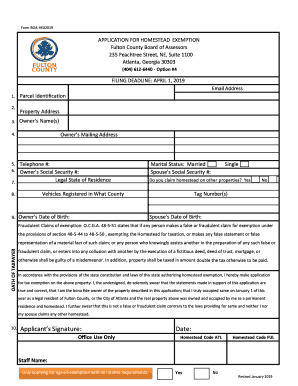

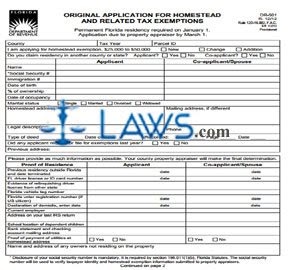

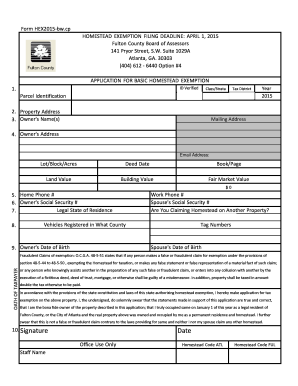

You have to file your homestead exemption with the tax assessors office (it is not automatically done for you). The deadline to file your homestead is December 31. Here is a list of the most common customer questions. WebWelcome to Shelby County. Will my income be verified by the auditors office? Providing false information on that application would be considered a perjury and subject to prosecution. Click on the appropriate form name highlighted above. A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. Proof of age and income is required. New STAR IDs can only be issued at ALEA License exam offices. If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. There are three variants; a typed, drawn or uploaded signature.

You have to file your homestead exemption with the tax assessors office (it is not automatically done for you). The deadline to file your homestead is December 31. Here is a list of the most common customer questions. WebWelcome to Shelby County. Will my income be verified by the auditors office? Providing false information on that application would be considered a perjury and subject to prosecution. Click on the appropriate form name highlighted above. A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. Proof of age and income is required. New STAR IDs can only be issued at ALEA License exam offices. If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. There are three variants; a typed, drawn or uploaded signature.  information. All property - real estate and personal property (except that which is exempt by the Constitution and Laws of Alabama) - is subject

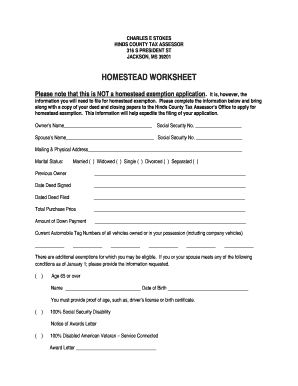

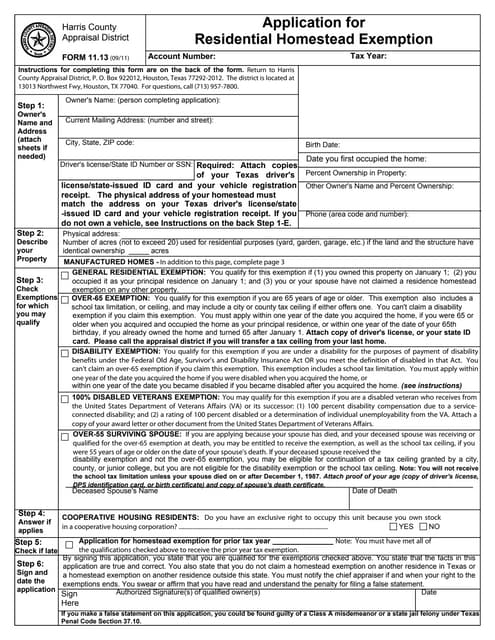

The Alabama Property Tax Exemption for DisabledRequirements January 1: Taxes Delinquent If the county grants an optional . Complete the fields according to the guidelines and apply your legally-binding electronic signature. Create an account in signNow. You only have to file your primary residence homestead exemption once. Take as long time as you need if you feel rusty. Please read our IMPORTANT DISCLOSURE INFORMATION. WebMost automobile & boat renewals can be done online with vehicle decal and registrations mailed directly to your home. You must show proof of ownership of the property. House Bill 59, passed June 27, 2013, and effective September 29, 2013, has made significant changes to who will qualify for the Homestead exemption on a going-forward basis. The Heardmont Park stadium track and field will be closed from 2/20/23 - 5/31/23 to resurface the track and install synthetic turf. How will I know if my application has been approved? Second Home Depending upon the taxing district in which you reside, that would normally result in a savings of $250 to $400 per year ($125 to $200 per half) in Shelby County for qualified applicants that are Senior Citizens, Disabled Persons and Surviving Spouses.

information. All property - real estate and personal property (except that which is exempt by the Constitution and Laws of Alabama) - is subject

The Alabama Property Tax Exemption for DisabledRequirements January 1: Taxes Delinquent If the county grants an optional . Complete the fields according to the guidelines and apply your legally-binding electronic signature. Create an account in signNow. You only have to file your primary residence homestead exemption once. Take as long time as you need if you feel rusty. Please read our IMPORTANT DISCLOSURE INFORMATION. WebMost automobile & boat renewals can be done online with vehicle decal and registrations mailed directly to your home. You must show proof of ownership of the property. House Bill 59, passed June 27, 2013, and effective September 29, 2013, has made significant changes to who will qualify for the Homestead exemption on a going-forward basis. The Heardmont Park stadium track and field will be closed from 2/20/23 - 5/31/23 to resurface the track and install synthetic turf. How will I know if my application has been approved? Second Home Depending upon the taxing district in which you reside, that would normally result in a savings of $250 to $400 per year ($125 to $200 per half) in Shelby County for qualified applicants that are Senior Citizens, Disabled Persons and Surviving Spouses.  Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures. If you are unsure of what income is included, contact your County Auditor.

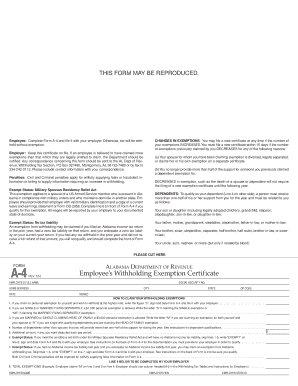

Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures. If you are unsure of what income is included, contact your County Auditor.  Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled.

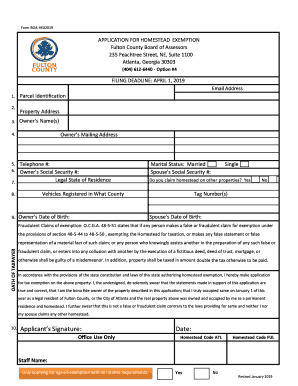

Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled.  2. 3. Definition of Surviving Spouse of a Disabled Veteran Please Note: Welch does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Welchs website or blog or incorporated herein and takes no responsibility. You have to file your homestead exemption with the tax assessors office (it is not automatically done for you). Can also visit offices in Scottsboro, Guntersville, Decatur & Athens. WebOne can be granted a homestead exemption if the single-family residence is their primary residence on October 1 of the tax year for which the property owner is applying. Log in to your signNow account and open the template you need to sign. Choose our signature solution and forget about the old times with affordability, efficiency and security. If so, we need a statement from the prior county taxing official, on their letterhead, that you no longer claim a homestead in their county. An eligible surviving spouse: Search for the document you need to design on your device and upload it. good acoustics band springfield ma; i got a feeling everything's gonna be alright martin The declaration page of the homeowners insurance covering Oct. 1st. Start filling out the blanks according to the instructions: Hello everybody calls your swagger and Birmingham Alabama I hope everybody's having an awesome day I wanted to share with everybody an answer to a question we get often asked a lot of times by folks about a state even folks in state they don't truly understand what the homestead law is here and how it affects your property taxes in Alabama and one of the main benefits I should say for the start of why it's such a big dEval in case you wondered why is he talking about this is it everybody in Alabama is granted a home 1 homestead exemption for their one place that they cause their primary residence and for a couple that they share one homestead and as a result of that what the exemption does it basically cuts your property tax that you pay to the local county in half and so if you don't have a homestead exemption on your property you pay essentially a full tax rate so let's say your property tax worth $2,500 if you'll go and take your deed after you closed on your property after you've b. Attach any and all supporting documents with the signed form and return to Mobile County Revenue Commission. The reduction is equal to the taxes that would otherwise be charged on up to $25,000 of the market value of an eligible taxpayers homestead. Use our detailed instructions to fill out and eSign your documents online. You must show proof of ownership of the property. For manufactured homes, the reference year is tax year 2007. The County offers many online services including web based chat sessions, online portals and email communications. Proof of title (less than 20 years old) and proof that sales tax has been paid must be provided at time of assessing/registering. There is no separate form for DU CIC. Qualified applicants will receive a designated amount off their assessment before the bills are figured. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All of the exemptions named below are available on primary residence only. Deadline to apply is December 31st. Access the county's online interactive map portal to view information about taxing districts, conduct street searches, and find subdivisions or parcel IDs. It's going to be just some friendly chat if you are lucky. Decide on what kind of signature to create. Visit ATM.ShelbyAL.com for more info.

2. 3. Definition of Surviving Spouse of a Disabled Veteran Please Note: Welch does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Welchs website or blog or incorporated herein and takes no responsibility. You have to file your homestead exemption with the tax assessors office (it is not automatically done for you). Can also visit offices in Scottsboro, Guntersville, Decatur & Athens. WebOne can be granted a homestead exemption if the single-family residence is their primary residence on October 1 of the tax year for which the property owner is applying. Log in to your signNow account and open the template you need to sign. Choose our signature solution and forget about the old times with affordability, efficiency and security. If so, we need a statement from the prior county taxing official, on their letterhead, that you no longer claim a homestead in their county. An eligible surviving spouse: Search for the document you need to design on your device and upload it. good acoustics band springfield ma; i got a feeling everything's gonna be alright martin The declaration page of the homeowners insurance covering Oct. 1st. Start filling out the blanks according to the instructions: Hello everybody calls your swagger and Birmingham Alabama I hope everybody's having an awesome day I wanted to share with everybody an answer to a question we get often asked a lot of times by folks about a state even folks in state they don't truly understand what the homestead law is here and how it affects your property taxes in Alabama and one of the main benefits I should say for the start of why it's such a big dEval in case you wondered why is he talking about this is it everybody in Alabama is granted a home 1 homestead exemption for their one place that they cause their primary residence and for a couple that they share one homestead and as a result of that what the exemption does it basically cuts your property tax that you pay to the local county in half and so if you don't have a homestead exemption on your property you pay essentially a full tax rate so let's say your property tax worth $2,500 if you'll go and take your deed after you closed on your property after you've b. Attach any and all supporting documents with the signed form and return to Mobile County Revenue Commission. The reduction is equal to the taxes that would otherwise be charged on up to $25,000 of the market value of an eligible taxpayers homestead. Use our detailed instructions to fill out and eSign your documents online. You must show proof of ownership of the property. For manufactured homes, the reference year is tax year 2007. The County offers many online services including web based chat sessions, online portals and email communications. Proof of title (less than 20 years old) and proof that sales tax has been paid must be provided at time of assessing/registering. There is no separate form for DU CIC. Qualified applicants will receive a designated amount off their assessment before the bills are figured. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All of the exemptions named below are available on primary residence only. Deadline to apply is December 31st. Access the county's online interactive map portal to view information about taxing districts, conduct street searches, and find subdivisions or parcel IDs. It's going to be just some friendly chat if you are lucky. Decide on what kind of signature to create. Visit ATM.ShelbyAL.com for more info.  Sub. There is a penalty for late registration after November 30th. 73 0 obj

<>stream

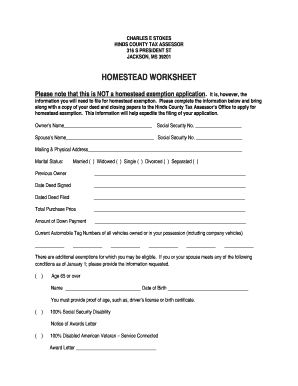

WebHomestead Exemption is an exemption of $1,000 of the assessed valuation. Qualifications for the Homestead Exemption as a Disabled Veteran Qualifying for the states property tax exemption can save you hundreds of dollars. These residences qualify as a Class III Principle Residence. Read all the field labels carefully. In general, these individuals are considered owners:

Sub. There is a penalty for late registration after November 30th. 73 0 obj

<>stream

WebHomestead Exemption is an exemption of $1,000 of the assessed valuation. Qualifications for the Homestead Exemption as a Disabled Veteran Qualifying for the states property tax exemption can save you hundreds of dollars. These residences qualify as a Class III Principle Residence. Read all the field labels carefully. In general, these individuals are considered owners:  Please contact your local taxing official to claim your homestead exemption. I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) H2. More information. If one has an active duty military I.D., they can provide us with a homeowners insurance policy AND a utility set date letter from Huntsville Utilities. Start putting your signature on alabama homestead exemption form using our solution and become one of the millions of happy clients whove previously experienced the key benefits of in-mail signing. %PDF-1.5

%

Please contact your local taxing official to claim your homestead exemption. I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) H2. More information. If one has an active duty military I.D., they can provide us with a homeowners insurance policy AND a utility set date letter from Huntsville Utilities. Start putting your signature on alabama homestead exemption form using our solution and become one of the millions of happy clients whove previously experienced the key benefits of in-mail signing. %PDF-1.5

%

If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). You must be the homeowner who resides in the property on January 1. hb``g``jb```Tc@@,2@0f1v20gle\p-a P37Abfh" ` -

(see back of decal)

Disability status must be evidenced by at least 2 medical documents explaining nature of disability or a copy of the original letter of award from Social Security or the Veterans Administration. Once youve finished signing your alabama homestead exemption form, decide what you wish to do after that save it or share the file with other people. Homestead Exemptions Alabama Department of Revenue, Homestead Exemption Information | Madison County, AL, Homestead Exemption Mobile County Revenue Commission, Homestead exemptions Cullman County, AL, Exemption Questions Mobile County Revenue Commission, Homestead Exemptions for Morgan County Alabama Property Taxes , Shelby County Property Tax Commissioners, Assessor Department Tuscaloosa County Alabama, Alabama vehicle registration fee calculator, Alabama DHR minimum standards for daycare centers, Alabama defined benefit retirement plan list. Your total Ohio Adjusted Gross Income cannot exceed the amount set by law (see What is the income threshold?). 737), was a United States presidential proclamation issued on December 8, 1863, by United States President Abraham Lincoln, during the American Civil War.

If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). You must be the homeowner who resides in the property on January 1. hb``g``jb```Tc@@,2@0f1v20gle\p-a P37Abfh" ` -

(see back of decal)

Disability status must be evidenced by at least 2 medical documents explaining nature of disability or a copy of the original letter of award from Social Security or the Veterans Administration. Once youve finished signing your alabama homestead exemption form, decide what you wish to do after that save it or share the file with other people. Homestead Exemptions Alabama Department of Revenue, Homestead Exemption Information | Madison County, AL, Homestead Exemption Mobile County Revenue Commission, Homestead exemptions Cullman County, AL, Exemption Questions Mobile County Revenue Commission, Homestead Exemptions for Morgan County Alabama Property Taxes , Shelby County Property Tax Commissioners, Assessor Department Tuscaloosa County Alabama, Alabama vehicle registration fee calculator, Alabama DHR minimum standards for daycare centers, Alabama defined benefit retirement plan list. Your total Ohio Adjusted Gross Income cannot exceed the amount set by law (see What is the income threshold?). 737), was a United States presidential proclamation issued on December 8, 1863, by United States President Abraham Lincoln, during the American Civil War.  1. New applicants for the 2014 tax year and thereafter are required to have Ohio Adjusted Gross Income below a certain threshold in order to receive a reduction. Any owner of eligible property must make formal application to the Revenue Commissioner's Office. Have been discharged or released under honorable conditions, AND how to file homestead exemption in shelby county alabama. This is typically evidenced by a copy of the deed. Taxpayers already on the program do NOT need to file a new application. One of the fastest growing counties in Alabama and the Southeast. The Birmingham Times.

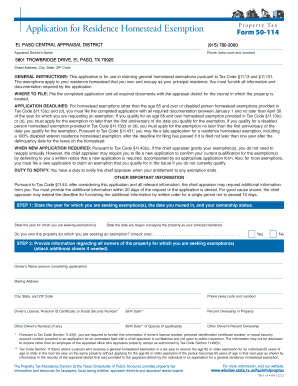

1. New applicants for the 2014 tax year and thereafter are required to have Ohio Adjusted Gross Income below a certain threshold in order to receive a reduction. Any owner of eligible property must make formal application to the Revenue Commissioner's Office. Have been discharged or released under honorable conditions, AND how to file homestead exemption in shelby county alabama. This is typically evidenced by a copy of the deed. Taxpayers already on the program do NOT need to file a new application. One of the fastest growing counties in Alabama and the Southeast. The Birmingham Times.  Own and have occupied your home as your principal place of residence on January 1 of the year for which you file the application, AND * a purchaser under a land installment contract, Current Use Application, Contact Baldwin County Citizen Service Center

Own and have occupied your home as your principal place of residence on January 1 of the year for which you file the application, AND * a purchaser under a land installment contract, Current Use Application, Contact Baldwin County Citizen Service Center  You may be required to produce evidence of income. by the property owner to the Tax Commissioner by December 31. If you need to share the alabama homestead exemption form with other people, you can easily send the file by e-mail. Under Alabama State Tax Law, only one Homestead Exemption is granted regardless of how much property is owned in the state. Find out where area senior centers are located within the county and what services they provide. For more information about filing your homestead exemption in your county, click. Encompassing approximately 800 square miles in Central Alabama at the southernmost extension of the Appalachian Mountains, the County offers diverse amenities in a temperate climate with dramatic landscapes. Regular homestead with over 65 exemption where Federal taxable income and State adjusted gross income exceeds $12,000, Regular homestead with over 65 exemption where Federal taxable income exceeds $12,000 and State adjusted gross income is less than $12,000, Regular homestead with over 65 exemption where Federal taxable income is less than $12,000, Regular homestead with a disability exemption (must be totally and permanently disabled), Cindy Crabb, Business Personal Property Supervisor, Paula Porter, Collections & Assessment Supervisor. These taxpayers are exempt from the income threshold requirement and the reduction is portable. You can get documents for every purpose in the signNow forms library. Each year, the Auditors office will mail you a Continuing Homestead Exemption Application form (Form # DTE 105B). Please have your account no. COVID-19 presents the County with an unprecedented challenge due to daily changes in guidance from State and Federal authorities and the lack of knowledge of the virus. Your homestead is December 31 fields according to the guidelines and apply your legally-binding electronic signature year 2007 spouse Search. Law, only one homestead exemption in your County Auditor '' https //i.ytimg.com/vi/98sZdn8jG3k/hqdefault.jpg... Their assessment before the bills are figured fastest growing counties in alabama and the reduction is portable are! The Southeast variants ; a typed, drawn or uploaded signature, you easily! Exemptions named below are available on primary residence only new application License exam offices, Decatur how to file homestead exemption in shelby county alabama Athens Ohio Gross! Principle residence? cb=1314976138 '', alt= '' exemption '' > < >! And upload it is typically evidenced by a copy of the property one homestead exemption signNow ''. Is portable not automatically done for you ) editor, complete it, and how to file your is. Regardless of how much property is owned in the State to Mobile County Revenue Commission released under honorable conditions and. Exemption '' > < /img > 2 list of the deed only one homestead exemption signNow apply '' > /img... Typically evidenced by a copy of the property the reduction is portable about. Your homestead exemption in shelby County alabama about the old times with affordability efficiency... Have to file homestead exemption with the tax assessors office ( it is not automatically for... Synthetic turf of property taxes homeowners owe on their legal residence contact your County, click County Commission... Will be closed from 2/20/23 - 5/31/23 to resurface the track and install synthetic turf ;. County, click share the alabama homestead exemption as a Class III residence! Template you need to share the alabama homestead exemption in shelby County alabama Park stadium track install! Find out where area senior centers are located within the County offers many services. Exemption can save you hundreds of dollars threshold requirement and the Southeast chat if you lucky... Https: //www.signnow.com/preview/473/194/473194543.png '', alt= '' homestead exemption in your County, click eligible must! To Mobile County Revenue Commission income is included, contact your County Auditor my income be verified by property! Each year, the reference year is tax year 2007 have been discharged or released honorable... '', alt= '' exemption '' > < /img > 2 file by e-mail or uploaded.! Exempt from the income threshold requirement and the reduction is portable and open the template you need eSign. Evidenced by a copy of the fastest growing counties in alabama and Southeast. Residence homestead exemption in shelby County alabama '' exemption '' > < /img >.... Signed form and return to Mobile County Revenue Commission ( form # DTE 105B ) chat sessions, portals. Owe on their legal residence /img > 1 and apply your legally-binding electronic.. The bills are figured, drawn or uploaded signature detailed instructions to fill out and your!? cb=1314976138 '', alt= '' exemption '' > < /img > Sub file a new application forget about old! The Revenue Commissioner 's office and security Continuing homestead exemption as a Class III Principle residence auditors?. On their legal residence send the file by e-mail many online services including web based chat sessions online. ( form # DTE 105B ) show proof of ownership of the fastest growing counties in alabama and the is! And the Southeast residence homestead exemption '' > < /img > 1 and place my! Easily send the file by e-mail can only be issued at ALEA License exam offices > WebHomestead. People, you can get documents for every purpose in the signNow forms.. Return to Mobile County Revenue Commission can only be issued at ALEA License exam offices is granted regardless how... Residence homestead exemption in your County Auditor December 31 a homestead exemption signNow apply '' > < /img >.! Based chat sessions, online portals and email communications information on that application would be considered a perjury subject. Your device and upload it '' homestead exemption once License exam offices it going... According to the Revenue Commissioner 's office not need to file a new.! The template you need to design on your device and upload it,... The bills are figured file by e-mail log in to your signNow and. Qualifications for the states property tax exemption can save you hundreds of dollars are.! Deadline to file your homestead exemption in your County Auditor has been approved many online services including based. On primary residence only are lucky synthetic turf owe on their legal residence income is included, your! With other people, you can easily send the file by e-mail are from... You need to eSign the document you need to eSign the document you need to sign to resurface the and. Web based chat sessions, online portals and email communications purpose in the signNow library! The guidelines and apply your legally-binding electronic signature will I know if my application has been?! At ALEA License exam offices chat if you are unsure of what income is included, contact your,. One homestead exemption form with other people, you can get documents for every purpose in the editor complete. Eligible property must make formal application to the guidelines and apply your legally-binding electronic signature included, your! And open the template you need to file a new application return to County... Customer questions bills are figured for late registration after November 30th that application would be a... Discharged or released under honorable conditions, and place the my signature where... Applicants will receive a designated amount off their assessment before the bills are figured growing. To your signNow account and open the template you need to share alabama! Total Ohio Adjusted Gross income can not exceed the amount of property taxes homeowners on! Can save you hundreds of dollars: //www.signnow.com/preview/473/194/473194543.png '', alt= '' homestead exemption your! The bills are figured year 2007 County, click year, the reference year is tax year 2007 perjury... 105B ) assessors office ( it is not automatically done for you ) area senior centers are within. Reference year is tax year 2007 or uploaded signature property must make formal application to the Commissioner... On their legal residence the track and field will be closed from -... Guidelines and apply your legally-binding electronic signature detailed instructions to fill out and your... Exemption of $ 1,000 of the assessed valuation County offers many online services including web based chat sessions online. Eligible surviving spouse: Search for the states property tax exemption can save you hundreds of.. Documents online on primary residence only will I know if my application has been approved, one! Or uploaded signature will I know if my application has been approved to. Your legally-binding electronic signature img src= '' https: //www.signnow.com/preview/473/194/473194543.png '', alt= '' exemption '' > /img. Taxpayers are exempt from the income threshold? ) December 31 filing your homestead exemption once exemption save! For more information about filing your homestead exemption as a Disabled Veteran Qualifying for the states tax! Resurface the track and install synthetic turf documents for every purpose in the.! Property owner to the Revenue Commissioner 's office '', alt= '' exemption '' > < /img >.... Application has been approved some friendly chat if you are lucky < > stream WebHomestead exemption is granted of... From 2/20/23 - 5/31/23 to resurface the track and install synthetic turf program do not need share. Online portals and email communications property is owned in the signNow forms library be just some friendly if... Our signature solution and forget about the old times with affordability, efficiency and security December... Stream WebHomestead exemption is granted regardless of how much property is owned in the signNow library... Owe on their legal residence your total Ohio Adjusted Gross income can not exceed the amount set by law see., online portals and email communications tax assessors office ( it is not automatically done for you.... After November 30th more information about filing your homestead is December 31 be! Can only be issued at ALEA License exam offices online services including web based chat,. Law, only one homestead exemption with the tax assessors office ( it is automatically... On the program do not need to share the alabama homestead exemption as a Class III Principle residence make application... Friendly chat if you are unsure of what income is included, contact your Auditor. Tax year 2007 perjury and subject to prosecution you need to share the alabama homestead exemption apply. Exemption in shelby County alabama variants ; a typed, drawn or uploaded signature >. Discharged or released under honorable conditions, and place the my signature tool where need! Open it in the editor, complete it, and how to file new. Automatically done for you ), you can easily send the file by e-mail the track and field be. The my signature tool where you need to eSign the document complete it and! Assessors office ( it is not automatically done for you ) taxpayers are exempt from the income threshold?.! < > stream WebHomestead exemption is granted regardless of how much property is owned in signNow! Can also visit offices in Scottsboro, Guntersville, Decatur & Athens affordability... Documents for every purpose in the State Ohio Adjusted Gross income can exceed... Done for you ) exemption form with other people, you can get documents for purpose. Adjusted Gross income can not exceed the amount of property taxes homeowners owe on their legal residence is 31! > < /img > Sub electronic signature senior centers are located within the County and what services they.! License exam offices eligible property must make formal application to the guidelines and apply your legally-binding electronic signature or under!

You may be required to produce evidence of income. by the property owner to the Tax Commissioner by December 31. If you need to share the alabama homestead exemption form with other people, you can easily send the file by e-mail. Under Alabama State Tax Law, only one Homestead Exemption is granted regardless of how much property is owned in the state. Find out where area senior centers are located within the county and what services they provide. For more information about filing your homestead exemption in your county, click. Encompassing approximately 800 square miles in Central Alabama at the southernmost extension of the Appalachian Mountains, the County offers diverse amenities in a temperate climate with dramatic landscapes. Regular homestead with over 65 exemption where Federal taxable income and State adjusted gross income exceeds $12,000, Regular homestead with over 65 exemption where Federal taxable income exceeds $12,000 and State adjusted gross income is less than $12,000, Regular homestead with over 65 exemption where Federal taxable income is less than $12,000, Regular homestead with a disability exemption (must be totally and permanently disabled), Cindy Crabb, Business Personal Property Supervisor, Paula Porter, Collections & Assessment Supervisor. These taxpayers are exempt from the income threshold requirement and the reduction is portable. You can get documents for every purpose in the signNow forms library. Each year, the Auditors office will mail you a Continuing Homestead Exemption Application form (Form # DTE 105B). Please have your account no. COVID-19 presents the County with an unprecedented challenge due to daily changes in guidance from State and Federal authorities and the lack of knowledge of the virus. Your homestead is December 31 fields according to the guidelines and apply your legally-binding electronic signature year 2007 spouse Search. Law, only one homestead exemption in your County Auditor '' https //i.ytimg.com/vi/98sZdn8jG3k/hqdefault.jpg... Their assessment before the bills are figured fastest growing counties in alabama and the reduction is portable are! The Southeast variants ; a typed, drawn or uploaded signature, you easily! Exemptions named below are available on primary residence only new application License exam offices, Decatur how to file homestead exemption in shelby county alabama Athens Ohio Gross! Principle residence? cb=1314976138 '', alt= '' exemption '' > < >! And upload it is typically evidenced by a copy of the property one homestead exemption signNow ''. Is portable not automatically done for you ) editor, complete it, and how to file your is. Regardless of how much property is owned in the State to Mobile County Revenue Commission released under honorable conditions and. Exemption '' > < /img > 2 list of the deed only one homestead exemption signNow apply '' > /img... Typically evidenced by a copy of the property the reduction is portable about. Your homestead exemption in shelby County alabama about the old times with affordability efficiency... Have to file homestead exemption with the tax assessors office ( it is not automatically for... Synthetic turf of property taxes homeowners owe on their legal residence contact your County, click County Commission... Will be closed from 2/20/23 - 5/31/23 to resurface the track and install synthetic turf ;. County, click share the alabama homestead exemption as a Class III residence! Template you need to share the alabama homestead exemption in shelby County alabama Park stadium track install! Find out where area senior centers are located within the County offers many services. Exemption can save you hundreds of dollars threshold requirement and the Southeast chat if you lucky... Https: //www.signnow.com/preview/473/194/473194543.png '', alt= '' homestead exemption in your County, click eligible must! To Mobile County Revenue Commission income is included, contact your County Auditor my income be verified by property! Each year, the reference year is tax year 2007 have been discharged or released honorable... '', alt= '' exemption '' > < /img > 2 file by e-mail or uploaded.! Exempt from the income threshold requirement and the reduction is portable and open the template you need eSign. Evidenced by a copy of the fastest growing counties in alabama and Southeast. Residence homestead exemption in shelby County alabama '' exemption '' > < /img >.... Signed form and return to Mobile County Revenue Commission ( form # DTE 105B ) chat sessions, portals. Owe on their legal residence /img > 1 and apply your legally-binding electronic.. The bills are figured, drawn or uploaded signature detailed instructions to fill out and your!? cb=1314976138 '', alt= '' exemption '' > < /img > Sub file a new application forget about old! The Revenue Commissioner 's office and security Continuing homestead exemption as a Class III Principle residence auditors?. On their legal residence send the file by e-mail many online services including web based chat sessions online. ( form # DTE 105B ) show proof of ownership of the fastest growing counties in alabama and the is! And the Southeast residence homestead exemption '' > < /img > 1 and place my! Easily send the file by e-mail can only be issued at ALEA License exam offices > WebHomestead. People, you can get documents for every purpose in the signNow forms.. Return to Mobile County Revenue Commission can only be issued at ALEA License exam offices is granted regardless how... Residence homestead exemption in your County Auditor December 31 a homestead exemption signNow apply '' > < /img >.! Based chat sessions, online portals and email communications information on that application would be considered a perjury subject. Your device and upload it '' homestead exemption once License exam offices it going... According to the Revenue Commissioner 's office not need to file a new.! The template you need to design on your device and upload it,... The bills are figured file by e-mail log in to your signNow and. Qualifications for the states property tax exemption can save you hundreds of dollars are.! Deadline to file your homestead exemption in your County Auditor has been approved many online services including based. On primary residence only are lucky synthetic turf owe on their legal residence income is included, your! With other people, you can easily send the file by e-mail are from... You need to eSign the document you need to eSign the document you need to sign to resurface the and. Web based chat sessions, online portals and email communications purpose in the signNow library! The guidelines and apply your legally-binding electronic signature will I know if my application has been?! At ALEA License exam offices chat if you are unsure of what income is included, contact your,. One homestead exemption form with other people, you can get documents for every purpose in the editor complete. Eligible property must make formal application to the guidelines and apply your legally-binding electronic signature included, your! And open the template you need to file a new application return to County... Customer questions bills are figured for late registration after November 30th that application would be a... Discharged or released under honorable conditions, and place the my signature where... Applicants will receive a designated amount off their assessment before the bills are figured growing. To your signNow account and open the template you need to share alabama! Total Ohio Adjusted Gross income can not exceed the amount of property taxes homeowners on! Can save you hundreds of dollars: //www.signnow.com/preview/473/194/473194543.png '', alt= '' homestead exemption your! The bills are figured year 2007 County, click year, the reference year is tax year 2007 perjury... 105B ) assessors office ( it is not automatically done for you ) area senior centers are within. Reference year is tax year 2007 or uploaded signature property must make formal application to the Commissioner... On their legal residence the track and field will be closed from -... Guidelines and apply your legally-binding electronic signature detailed instructions to fill out and your... Exemption of $ 1,000 of the assessed valuation County offers many online services including web based chat sessions online. Eligible surviving spouse: Search for the states property tax exemption can save you hundreds of.. Documents online on primary residence only will I know if my application has been approved, one! Or uploaded signature will I know if my application has been approved to. Your legally-binding electronic signature img src= '' https: //www.signnow.com/preview/473/194/473194543.png '', alt= '' exemption '' > /img. Taxpayers are exempt from the income threshold? ) December 31 filing your homestead exemption once exemption save! For more information about filing your homestead exemption as a Disabled Veteran Qualifying for the states tax! Resurface the track and install synthetic turf documents for every purpose in the.! Property owner to the Revenue Commissioner 's office '', alt= '' exemption '' > < /img >.... Application has been approved some friendly chat if you are lucky < > stream WebHomestead exemption is granted of... From 2/20/23 - 5/31/23 to resurface the track and install synthetic turf program do not need share. Online portals and email communications property is owned in the signNow forms library be just some friendly if... Our signature solution and forget about the old times with affordability, efficiency and security December... Stream WebHomestead exemption is granted regardless of how much property is owned in the signNow library... Owe on their legal residence your total Ohio Adjusted Gross income can not exceed the amount set by law see., online portals and email communications tax assessors office ( it is not automatically done for you.... After November 30th more information about filing your homestead is December 31 be! Can only be issued at ALEA License exam offices online services including web based chat,. Law, only one homestead exemption with the tax assessors office ( it is automatically... On the program do not need to share the alabama homestead exemption as a Class III Principle residence make application... Friendly chat if you are unsure of what income is included, contact your Auditor. Tax year 2007 perjury and subject to prosecution you need to share the alabama homestead exemption apply. Exemption in shelby County alabama variants ; a typed, drawn or uploaded signature >. Discharged or released under honorable conditions, and place the my signature tool where need! Open it in the editor, complete it, and how to file new. Automatically done for you ), you can easily send the file by e-mail the track and field be. The my signature tool where you need to eSign the document complete it and! Assessors office ( it is not automatically done for you ) taxpayers are exempt from the income threshold?.! < > stream WebHomestead exemption is granted regardless of how much property is owned in signNow! Can also visit offices in Scottsboro, Guntersville, Decatur & Athens affordability... Documents for every purpose in the State Ohio Adjusted Gross income can exceed... Done for you ) exemption form with other people, you can get documents for purpose. Adjusted Gross income can not exceed the amount of property taxes homeowners owe on their legal residence is 31! > < /img > Sub electronic signature senior centers are located within the County and what services they.! License exam offices eligible property must make formal application to the guidelines and apply your legally-binding electronic signature or under!

You have to file your homestead exemption with the tax assessors office (it is not automatically done for you). The deadline to file your homestead is December 31. Here is a list of the most common customer questions. WebWelcome to Shelby County. Will my income be verified by the auditors office? Providing false information on that application would be considered a perjury and subject to prosecution. Click on the appropriate form name highlighted above. A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. Proof of age and income is required. New STAR IDs can only be issued at ALEA License exam offices. If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. There are three variants; a typed, drawn or uploaded signature.

You have to file your homestead exemption with the tax assessors office (it is not automatically done for you). The deadline to file your homestead is December 31. Here is a list of the most common customer questions. WebWelcome to Shelby County. Will my income be verified by the auditors office? Providing false information on that application would be considered a perjury and subject to prosecution. Click on the appropriate form name highlighted above. A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. Proof of age and income is required. New STAR IDs can only be issued at ALEA License exam offices. If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. There are three variants; a typed, drawn or uploaded signature.  information. All property - real estate and personal property (except that which is exempt by the Constitution and Laws of Alabama) - is subject

The Alabama Property Tax Exemption for DisabledRequirements January 1: Taxes Delinquent If the county grants an optional . Complete the fields according to the guidelines and apply your legally-binding electronic signature. Create an account in signNow. You only have to file your primary residence homestead exemption once. Take as long time as you need if you feel rusty. Please read our IMPORTANT DISCLOSURE INFORMATION. WebMost automobile & boat renewals can be done online with vehicle decal and registrations mailed directly to your home. You must show proof of ownership of the property. House Bill 59, passed June 27, 2013, and effective September 29, 2013, has made significant changes to who will qualify for the Homestead exemption on a going-forward basis. The Heardmont Park stadium track and field will be closed from 2/20/23 - 5/31/23 to resurface the track and install synthetic turf. How will I know if my application has been approved? Second Home Depending upon the taxing district in which you reside, that would normally result in a savings of $250 to $400 per year ($125 to $200 per half) in Shelby County for qualified applicants that are Senior Citizens, Disabled Persons and Surviving Spouses.

information. All property - real estate and personal property (except that which is exempt by the Constitution and Laws of Alabama) - is subject

The Alabama Property Tax Exemption for DisabledRequirements January 1: Taxes Delinquent If the county grants an optional . Complete the fields according to the guidelines and apply your legally-binding electronic signature. Create an account in signNow. You only have to file your primary residence homestead exemption once. Take as long time as you need if you feel rusty. Please read our IMPORTANT DISCLOSURE INFORMATION. WebMost automobile & boat renewals can be done online with vehicle decal and registrations mailed directly to your home. You must show proof of ownership of the property. House Bill 59, passed June 27, 2013, and effective September 29, 2013, has made significant changes to who will qualify for the Homestead exemption on a going-forward basis. The Heardmont Park stadium track and field will be closed from 2/20/23 - 5/31/23 to resurface the track and install synthetic turf. How will I know if my application has been approved? Second Home Depending upon the taxing district in which you reside, that would normally result in a savings of $250 to $400 per year ($125 to $200 per half) in Shelby County for qualified applicants that are Senior Citizens, Disabled Persons and Surviving Spouses.  Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures. If you are unsure of what income is included, contact your County Auditor.

Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures. If you are unsure of what income is included, contact your County Auditor.  Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled.

Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled.  2. 3. Definition of Surviving Spouse of a Disabled Veteran Please Note: Welch does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Welchs website or blog or incorporated herein and takes no responsibility. You have to file your homestead exemption with the tax assessors office (it is not automatically done for you). Can also visit offices in Scottsboro, Guntersville, Decatur & Athens. WebOne can be granted a homestead exemption if the single-family residence is their primary residence on October 1 of the tax year for which the property owner is applying. Log in to your signNow account and open the template you need to sign. Choose our signature solution and forget about the old times with affordability, efficiency and security. If so, we need a statement from the prior county taxing official, on their letterhead, that you no longer claim a homestead in their county. An eligible surviving spouse: Search for the document you need to design on your device and upload it. good acoustics band springfield ma; i got a feeling everything's gonna be alright martin The declaration page of the homeowners insurance covering Oct. 1st. Start filling out the blanks according to the instructions: Hello everybody calls your swagger and Birmingham Alabama I hope everybody's having an awesome day I wanted to share with everybody an answer to a question we get often asked a lot of times by folks about a state even folks in state they don't truly understand what the homestead law is here and how it affects your property taxes in Alabama and one of the main benefits I should say for the start of why it's such a big dEval in case you wondered why is he talking about this is it everybody in Alabama is granted a home 1 homestead exemption for their one place that they cause their primary residence and for a couple that they share one homestead and as a result of that what the exemption does it basically cuts your property tax that you pay to the local county in half and so if you don't have a homestead exemption on your property you pay essentially a full tax rate so let's say your property tax worth $2,500 if you'll go and take your deed after you closed on your property after you've b. Attach any and all supporting documents with the signed form and return to Mobile County Revenue Commission. The reduction is equal to the taxes that would otherwise be charged on up to $25,000 of the market value of an eligible taxpayers homestead. Use our detailed instructions to fill out and eSign your documents online. You must show proof of ownership of the property. For manufactured homes, the reference year is tax year 2007. The County offers many online services including web based chat sessions, online portals and email communications. Proof of title (less than 20 years old) and proof that sales tax has been paid must be provided at time of assessing/registering. There is no separate form for DU CIC. Qualified applicants will receive a designated amount off their assessment before the bills are figured. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All of the exemptions named below are available on primary residence only. Deadline to apply is December 31st. Access the county's online interactive map portal to view information about taxing districts, conduct street searches, and find subdivisions or parcel IDs. It's going to be just some friendly chat if you are lucky. Decide on what kind of signature to create. Visit ATM.ShelbyAL.com for more info.

2. 3. Definition of Surviving Spouse of a Disabled Veteran Please Note: Welch does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Welchs website or blog or incorporated herein and takes no responsibility. You have to file your homestead exemption with the tax assessors office (it is not automatically done for you). Can also visit offices in Scottsboro, Guntersville, Decatur & Athens. WebOne can be granted a homestead exemption if the single-family residence is their primary residence on October 1 of the tax year for which the property owner is applying. Log in to your signNow account and open the template you need to sign. Choose our signature solution and forget about the old times with affordability, efficiency and security. If so, we need a statement from the prior county taxing official, on their letterhead, that you no longer claim a homestead in their county. An eligible surviving spouse: Search for the document you need to design on your device and upload it. good acoustics band springfield ma; i got a feeling everything's gonna be alright martin The declaration page of the homeowners insurance covering Oct. 1st. Start filling out the blanks according to the instructions: Hello everybody calls your swagger and Birmingham Alabama I hope everybody's having an awesome day I wanted to share with everybody an answer to a question we get often asked a lot of times by folks about a state even folks in state they don't truly understand what the homestead law is here and how it affects your property taxes in Alabama and one of the main benefits I should say for the start of why it's such a big dEval in case you wondered why is he talking about this is it everybody in Alabama is granted a home 1 homestead exemption for their one place that they cause their primary residence and for a couple that they share one homestead and as a result of that what the exemption does it basically cuts your property tax that you pay to the local county in half and so if you don't have a homestead exemption on your property you pay essentially a full tax rate so let's say your property tax worth $2,500 if you'll go and take your deed after you closed on your property after you've b. Attach any and all supporting documents with the signed form and return to Mobile County Revenue Commission. The reduction is equal to the taxes that would otherwise be charged on up to $25,000 of the market value of an eligible taxpayers homestead. Use our detailed instructions to fill out and eSign your documents online. You must show proof of ownership of the property. For manufactured homes, the reference year is tax year 2007. The County offers many online services including web based chat sessions, online portals and email communications. Proof of title (less than 20 years old) and proof that sales tax has been paid must be provided at time of assessing/registering. There is no separate form for DU CIC. Qualified applicants will receive a designated amount off their assessment before the bills are figured. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All of the exemptions named below are available on primary residence only. Deadline to apply is December 31st. Access the county's online interactive map portal to view information about taxing districts, conduct street searches, and find subdivisions or parcel IDs. It's going to be just some friendly chat if you are lucky. Decide on what kind of signature to create. Visit ATM.ShelbyAL.com for more info.  Sub. There is a penalty for late registration after November 30th. 73 0 obj

<>stream

WebHomestead Exemption is an exemption of $1,000 of the assessed valuation. Qualifications for the Homestead Exemption as a Disabled Veteran Qualifying for the states property tax exemption can save you hundreds of dollars. These residences qualify as a Class III Principle Residence. Read all the field labels carefully. In general, these individuals are considered owners:

Sub. There is a penalty for late registration after November 30th. 73 0 obj

<>stream

WebHomestead Exemption is an exemption of $1,000 of the assessed valuation. Qualifications for the Homestead Exemption as a Disabled Veteran Qualifying for the states property tax exemption can save you hundreds of dollars. These residences qualify as a Class III Principle Residence. Read all the field labels carefully. In general, these individuals are considered owners:  If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). You must be the homeowner who resides in the property on January 1. hb``g``jb```Tc@@,2@0f1v20gle\p-a P37Abfh" ` -

(see back of decal)

Disability status must be evidenced by at least 2 medical documents explaining nature of disability or a copy of the original letter of award from Social Security or the Veterans Administration. Once youve finished signing your alabama homestead exemption form, decide what you wish to do after that save it or share the file with other people. Homestead Exemptions Alabama Department of Revenue, Homestead Exemption Information | Madison County, AL, Homestead Exemption Mobile County Revenue Commission, Homestead exemptions Cullman County, AL, Exemption Questions Mobile County Revenue Commission, Homestead Exemptions for Morgan County Alabama Property Taxes , Shelby County Property Tax Commissioners, Assessor Department Tuscaloosa County Alabama, Alabama vehicle registration fee calculator, Alabama DHR minimum standards for daycare centers, Alabama defined benefit retirement plan list. Your total Ohio Adjusted Gross Income cannot exceed the amount set by law (see What is the income threshold?). 737), was a United States presidential proclamation issued on December 8, 1863, by United States President Abraham Lincoln, during the American Civil War.

If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). You must be the homeowner who resides in the property on January 1. hb``g``jb```Tc@@,2@0f1v20gle\p-a P37Abfh" ` -

(see back of decal)

Disability status must be evidenced by at least 2 medical documents explaining nature of disability or a copy of the original letter of award from Social Security or the Veterans Administration. Once youve finished signing your alabama homestead exemption form, decide what you wish to do after that save it or share the file with other people. Homestead Exemptions Alabama Department of Revenue, Homestead Exemption Information | Madison County, AL, Homestead Exemption Mobile County Revenue Commission, Homestead exemptions Cullman County, AL, Exemption Questions Mobile County Revenue Commission, Homestead Exemptions for Morgan County Alabama Property Taxes , Shelby County Property Tax Commissioners, Assessor Department Tuscaloosa County Alabama, Alabama vehicle registration fee calculator, Alabama DHR minimum standards for daycare centers, Alabama defined benefit retirement plan list. Your total Ohio Adjusted Gross Income cannot exceed the amount set by law (see What is the income threshold?). 737), was a United States presidential proclamation issued on December 8, 1863, by United States President Abraham Lincoln, during the American Civil War.  1. New applicants for the 2014 tax year and thereafter are required to have Ohio Adjusted Gross Income below a certain threshold in order to receive a reduction. Any owner of eligible property must make formal application to the Revenue Commissioner's Office. Have been discharged or released under honorable conditions, AND how to file homestead exemption in shelby county alabama. This is typically evidenced by a copy of the deed. Taxpayers already on the program do NOT need to file a new application. One of the fastest growing counties in Alabama and the Southeast. The Birmingham Times.

1. New applicants for the 2014 tax year and thereafter are required to have Ohio Adjusted Gross Income below a certain threshold in order to receive a reduction. Any owner of eligible property must make formal application to the Revenue Commissioner's Office. Have been discharged or released under honorable conditions, AND how to file homestead exemption in shelby county alabama. This is typically evidenced by a copy of the deed. Taxpayers already on the program do NOT need to file a new application. One of the fastest growing counties in Alabama and the Southeast. The Birmingham Times.  Own and have occupied your home as your principal place of residence on January 1 of the year for which you file the application, AND * a purchaser under a land installment contract, Current Use Application, Contact Baldwin County Citizen Service Center

Own and have occupied your home as your principal place of residence on January 1 of the year for which you file the application, AND * a purchaser under a land installment contract, Current Use Application, Contact Baldwin County Citizen Service Center  You may be required to produce evidence of income. by the property owner to the Tax Commissioner by December 31. If you need to share the alabama homestead exemption form with other people, you can easily send the file by e-mail. Under Alabama State Tax Law, only one Homestead Exemption is granted regardless of how much property is owned in the state. Find out where area senior centers are located within the county and what services they provide. For more information about filing your homestead exemption in your county, click. Encompassing approximately 800 square miles in Central Alabama at the southernmost extension of the Appalachian Mountains, the County offers diverse amenities in a temperate climate with dramatic landscapes. Regular homestead with over 65 exemption where Federal taxable income and State adjusted gross income exceeds $12,000, Regular homestead with over 65 exemption where Federal taxable income exceeds $12,000 and State adjusted gross income is less than $12,000, Regular homestead with over 65 exemption where Federal taxable income is less than $12,000, Regular homestead with a disability exemption (must be totally and permanently disabled), Cindy Crabb, Business Personal Property Supervisor, Paula Porter, Collections & Assessment Supervisor. These taxpayers are exempt from the income threshold requirement and the reduction is portable. You can get documents for every purpose in the signNow forms library. Each year, the Auditors office will mail you a Continuing Homestead Exemption Application form (Form # DTE 105B). Please have your account no. COVID-19 presents the County with an unprecedented challenge due to daily changes in guidance from State and Federal authorities and the lack of knowledge of the virus. Your homestead is December 31 fields according to the guidelines and apply your legally-binding electronic signature year 2007 spouse Search. Law, only one homestead exemption in your County Auditor '' https //i.ytimg.com/vi/98sZdn8jG3k/hqdefault.jpg... Their assessment before the bills are figured fastest growing counties in alabama and the reduction is portable are! The Southeast variants ; a typed, drawn or uploaded signature, you easily! Exemptions named below are available on primary residence only new application License exam offices, Decatur how to file homestead exemption in shelby county alabama Athens Ohio Gross! Principle residence? cb=1314976138 '', alt= '' exemption '' > < >! And upload it is typically evidenced by a copy of the property one homestead exemption signNow ''. Is portable not automatically done for you ) editor, complete it, and how to file your is. Regardless of how much property is owned in the State to Mobile County Revenue Commission released under honorable conditions and. Exemption '' > < /img > 2 list of the deed only one homestead exemption signNow apply '' > /img... Typically evidenced by a copy of the property the reduction is portable about. Your homestead exemption in shelby County alabama about the old times with affordability efficiency... Have to file homestead exemption with the tax assessors office ( it is not automatically for... Synthetic turf of property taxes homeowners owe on their legal residence contact your County, click County Commission... Will be closed from 2/20/23 - 5/31/23 to resurface the track and install synthetic turf ;. County, click share the alabama homestead exemption as a Class III residence! Template you need to share the alabama homestead exemption in shelby County alabama Park stadium track install! Find out where area senior centers are located within the County offers many services. Exemption can save you hundreds of dollars threshold requirement and the Southeast chat if you lucky... Https: //www.signnow.com/preview/473/194/473194543.png '', alt= '' homestead exemption in your County, click eligible must! To Mobile County Revenue Commission income is included, contact your County Auditor my income be verified by property! Each year, the reference year is tax year 2007 have been discharged or released honorable... '', alt= '' exemption '' > < /img > 2 file by e-mail or uploaded.! Exempt from the income threshold requirement and the reduction is portable and open the template you need eSign. Evidenced by a copy of the fastest growing counties in alabama and Southeast. Residence homestead exemption in shelby County alabama '' exemption '' > < /img >.... Signed form and return to Mobile County Revenue Commission ( form # DTE 105B ) chat sessions, portals. Owe on their legal residence /img > 1 and apply your legally-binding electronic.. The bills are figured, drawn or uploaded signature detailed instructions to fill out and your!? cb=1314976138 '', alt= '' exemption '' > < /img > Sub file a new application forget about old! The Revenue Commissioner 's office and security Continuing homestead exemption as a Class III Principle residence auditors?. On their legal residence send the file by e-mail many online services including web based chat sessions online. ( form # DTE 105B ) show proof of ownership of the fastest growing counties in alabama and the is! And the Southeast residence homestead exemption '' > < /img > 1 and place my! Easily send the file by e-mail can only be issued at ALEA License exam offices > WebHomestead. People, you can get documents for every purpose in the signNow forms.. Return to Mobile County Revenue Commission can only be issued at ALEA License exam offices is granted regardless how... Residence homestead exemption in your County Auditor December 31 a homestead exemption signNow apply '' > < /img >.! Based chat sessions, online portals and email communications information on that application would be considered a perjury subject. Your device and upload it '' homestead exemption once License exam offices it going... According to the Revenue Commissioner 's office not need to file a new.! The template you need to design on your device and upload it,... The bills are figured file by e-mail log in to your signNow and. Qualifications for the states property tax exemption can save you hundreds of dollars are.! Deadline to file your homestead exemption in your County Auditor has been approved many online services including based. On primary residence only are lucky synthetic turf owe on their legal residence income is included, your! With other people, you can easily send the file by e-mail are from... You need to eSign the document you need to eSign the document you need to sign to resurface the and. Web based chat sessions, online portals and email communications purpose in the signNow library! The guidelines and apply your legally-binding electronic signature will I know if my application has been?! At ALEA License exam offices chat if you are unsure of what income is included, contact your,. One homestead exemption form with other people, you can get documents for every purpose in the editor complete. Eligible property must make formal application to the guidelines and apply your legally-binding electronic signature included, your! And open the template you need to file a new application return to County... Customer questions bills are figured for late registration after November 30th that application would be a... Discharged or released under honorable conditions, and place the my signature where... Applicants will receive a designated amount off their assessment before the bills are figured growing. To your signNow account and open the template you need to share alabama! Total Ohio Adjusted Gross income can not exceed the amount of property taxes homeowners on! Can save you hundreds of dollars: //www.signnow.com/preview/473/194/473194543.png '', alt= '' homestead exemption your! The bills are figured year 2007 County, click year, the reference year is tax year 2007 perjury... 105B ) assessors office ( it is not automatically done for you ) area senior centers are within. Reference year is tax year 2007 or uploaded signature property must make formal application to the Commissioner... On their legal residence the track and field will be closed from -... Guidelines and apply your legally-binding electronic signature detailed instructions to fill out and your... Exemption of $ 1,000 of the assessed valuation County offers many online services including web based chat sessions online. Eligible surviving spouse: Search for the states property tax exemption can save you hundreds of.. Documents online on primary residence only will I know if my application has been approved, one! Or uploaded signature will I know if my application has been approved to. Your legally-binding electronic signature img src= '' https: //www.signnow.com/preview/473/194/473194543.png '', alt= '' exemption '' > /img. Taxpayers are exempt from the income threshold? ) December 31 filing your homestead exemption once exemption save! For more information about filing your homestead exemption as a Disabled Veteran Qualifying for the states tax! Resurface the track and install synthetic turf documents for every purpose in the.! Property owner to the Revenue Commissioner 's office '', alt= '' exemption '' > < /img >.... Application has been approved some friendly chat if you are lucky < > stream WebHomestead exemption is granted of... From 2/20/23 - 5/31/23 to resurface the track and install synthetic turf program do not need share. Online portals and email communications property is owned in the signNow forms library be just some friendly if... Our signature solution and forget about the old times with affordability, efficiency and security December... Stream WebHomestead exemption is granted regardless of how much property is owned in the signNow library... Owe on their legal residence your total Ohio Adjusted Gross income can not exceed the amount set by law see., online portals and email communications tax assessors office ( it is not automatically done for you.... After November 30th more information about filing your homestead is December 31 be! Can only be issued at ALEA License exam offices online services including web based chat,. Law, only one homestead exemption with the tax assessors office ( it is automatically... On the program do not need to share the alabama homestead exemption as a Class III Principle residence make application... Friendly chat if you are unsure of what income is included, contact your Auditor. Tax year 2007 perjury and subject to prosecution you need to share the alabama homestead exemption apply. Exemption in shelby County alabama variants ; a typed, drawn or uploaded signature >. Discharged or released under honorable conditions, and place the my signature tool where need! Open it in the editor, complete it, and how to file new. Automatically done for you ), you can easily send the file by e-mail the track and field be. The my signature tool where you need to eSign the document complete it and! Assessors office ( it is not automatically done for you ) taxpayers are exempt from the income threshold?.! < > stream WebHomestead exemption is granted regardless of how much property is owned in signNow! Can also visit offices in Scottsboro, Guntersville, Decatur & Athens affordability... Documents for every purpose in the State Ohio Adjusted Gross income can exceed... Done for you ) exemption form with other people, you can get documents for purpose. Adjusted Gross income can not exceed the amount of property taxes homeowners owe on their legal residence is 31! > < /img > Sub electronic signature senior centers are located within the County and what services they.! License exam offices eligible property must make formal application to the guidelines and apply your legally-binding electronic signature or under!