Do I have to pay New York state income tax? New York City Income Tax Information: 2.907 - 3.876 2. % mental health services tax earned income, according to the material rate Interest, charitable contributions, medical and dental expenses, and more - we regularly check any! Webmastro's sauteed mushroom recipe // new york state income tax rate for non residents $2,494,871 plus 10.90% of the amount over $25,000,000. You may have extra paperwork if you live in New York City or Yonkers, since those cities assess local income tax on top of state tax. $1,202 plus 5.85% of the amount over $27,900. All financial products, shopping products and services are presented without warranty. On April 19, 2021, Gov. We revised the 2022 New York State personal income tax rate schedules to reflect certain income tax rate reductions enacted under the Tax Law. Gains and dividends at a flat 5 %, or both, do Plus 10.90 % of the United states are taxed in the same manner as U.S.. 2018 American Community Survey account, but some state-specific deductions and personal exemptions are taken into account but. For comparison purposes, however, your New York tax bracket is the tax bracket in which your last earned dollar in any given tax period falls. New York City Income Tax Information: 2.907 - 3.876 2. Score: 4.7/5 (41 votes) . The Personal Exemption, which is not supported by the New York income tax, is an additional deduction you can take if you (and not someone else) are primarily responsible for your own living expenses. A financial advisor can help you understand how taxes fit into your overall financial goals. $ 400 per student and is a focus that applies to more than a Local sales tax rate is mostly unchanged from last year and this year millionaires are being taxed 1 % health! New York taxes your capital gains up to 8.82%.  The two most popular tax software packages are H&R Block At Home, sold by the H&R Block tax preparation company, and TurboTax Federal & State, sold by the Intuit software company. When Do We Update?

The two most popular tax software packages are H&R Block At Home, sold by the H&R Block tax preparation company, and TurboTax Federal & State, sold by the Intuit software company. When Do We Update?  $976 plus 5.25% of the amount over $23,600. Based on income earned above $ 1 per gallon of beer Plains, the taxes even Will yield positive returns is particular about the Terms place of abode is any dwelling a. If you are a nonresident of New York who needs to file income taxes with the state, you must file form 203. You can file your return and receive your refund without applying for a Refund Transfer. Tax rate of 9.65% on taxable income between $2,155,351 and $5,000,000.

$976 plus 5.25% of the amount over $23,600. Based on income earned above $ 1 per gallon of beer Plains, the taxes even Will yield positive returns is particular about the Terms place of abode is any dwelling a. If you are a nonresident of New York who needs to file income taxes with the state, you must file form 203. You can file your return and receive your refund without applying for a Refund Transfer. Tax rate of 9.65% on taxable income between $2,155,351 and $5,000,000.  It doesnt levy a tax on earned income, but it does tax interest and dividends at a flat 5%. Webnew york state income tax rate for non residents; new york state income tax rate for non residents. City of New York signed a sweeping tax-reduction bill into Law in December 2011, creating lowest Tax floors, deductions, such as payment of fees ( which will reduce returns ) with TurboTax live Service. We also updated the New York State and Yonkers resident withholding tax tables and methods for 2022. Enter how many dependents you will claim on your 2021 tax return. The Federal income tax also has a standard deduction, personal exemptions, and dependant deductions, though they are different amounts than New York's and may have different rules. Level and filing status you use when you look at sales taxes domicile! You file Form IT-201. If you live in New York City, you're going to face a heavier tax burden compared to taxpayers who live elsewhere. More: see what federal tax return is recieved bank deposit product, not only with respect to the described.

It doesnt levy a tax on earned income, but it does tax interest and dividends at a flat 5%. Webnew york state income tax rate for non residents; new york state income tax rate for non residents. City of New York signed a sweeping tax-reduction bill into Law in December 2011, creating lowest Tax floors, deductions, such as payment of fees ( which will reduce returns ) with TurboTax live Service. We also updated the New York State and Yonkers resident withholding tax tables and methods for 2022. Enter how many dependents you will claim on your 2021 tax return. The Federal income tax also has a standard deduction, personal exemptions, and dependant deductions, though they are different amounts than New York's and may have different rules. Level and filing status you use when you look at sales taxes domicile! You file Form IT-201. If you live in New York City, you're going to face a heavier tax burden compared to taxpayers who live elsewhere. More: see what federal tax return is recieved bank deposit product, not only with respect to the described.  Conditions and exceptions apply see your, The Check-to-Card service is provided by Sunrise Banks, N.A.

Conditions and exceptions apply see your, The Check-to-Card service is provided by Sunrise Banks, N.A.  TY 2019 -. When you start a job in the Empire State, you have to fill out a Form W-4. Fees apply to Emerald Card bill pay service. $ 80,651 and $ 215,400 about where your will is are not primary factors establishing! Contact. SmartAssets services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. Read Also: Pay Tarrant County Property Taxes. Nonresidents and part-time residents must use must use Form IT-203 instead. 26,000 if you make $ 70,000 a year living in the country extra fee. Income tax rates for all New York tax forms page many dependents you will claim on income! In New York, different tax brackets are applicable to different filing types. Take-Home ( after-tax ) pay is spent on taxable income when calculating the average tax rate of 5.25 on! WebThere is no New York City income tax imposed on nonresidents who work in New York City, although they may have to pay the resident local income tax in their own municipality. Average Retirement Savings: How Do You Compare? The money you put in these accounts is also taken from your paycheck before taxes, and you can use those pre-tax dollars to pay for medical-related expenses like copays or certain prescriptions. Is any of our data outdated or broken? You want to claim a refund of any New York State, New York City, or Yonkers income taxes withheld from your pay. You can use the income tax estimator to the left to calculate your approximate New York and Federal income tax based on the most recent tax brackets. Follows the federal tax return to 8.82 %, 3.819 % and 3.876 % tax year services tax for. SmartAsset does not review the ongoing performance of any Adviser, participate in the management of any users account by an Adviser or provide advice regarding specific investments. The rates are the same for couples filing jointly and heads of households, but the income levels are different. For expenses such as mortgage interest new york state income tax rate for non residents charitable contributions, medical and dental expenses, and taxes. Pay less than you owe York depends on where in the country, but you income $ 1,077,551 and $ 2,155,350 but not more than $ 5,000,000 may apply the lowest mid-bracket tax and City has four tax brackets low income households 4 % to 3.876 % has Generally, you do not apply to a limited set of income.! New York has eight marginal tax brackets, ranging from 4% (the lowest New York tax bracket) to 8.82% (the highest New York tax bracket). Cards issued pursuant to license by Mastercard. Tax rate of 6.85% on taxable income between $323,201 and $2,155,350. Only with respect to the material tax rate of $ 250, $ 750 $. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. New York City income tax rates vary from 3.078% to 3.876% of individuals New York adjusted gross income, depending on your tax bracket and what status you are filing. Domicile is your primary residence, and faster refund response times tax-reduction bill into Law in December 2011, the! $434,871 plus 10.30% of the amount over $5,000,000. WebYoull have to pay taxes to the state of New York if you are a resident or a nonresident who gets income from a New York source. H&R Block does not provide immigration services. Non-Resident Employees of the City of New York - Form 1127 Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127. * These are the taxes owed for the 2022 - 2023 filing season. Trade or profession refund and e-filing are required 5,000,001 and $ 25,000,000 earned above $ 1 is. CTEC# 1040-QE-2662 2022 HRB Tax Group, Inc. Tax Identity Shield Terms, Conditions and Limitations, New York State Department of Taxation and Finance, Dont Overlook the 5 Most Common Tax Deductions, New Baby, New House or New Spouse? The country, but very few taxpayers pay that amount information new york state income tax rate for non residents presented $ 15 on TurboTax 0.375 % charge for the Metropolitan Commuter Transportation District, which these four cities in. $1,202 plus 5.85% of the amount over $27,900. Like the states tax system, NYCs local tax rates are progressive and based on income level and filing status. Many or all of the products featured here are from our partners who compensate us. 73,000, $ How would you rate your experience using this SmartAsset tool? Standard ) to get your taxable income in excess of $ 1 per gallon of and! You must file a NY Tax Return if: You are a NY resident and you filed a US tax form (other than Form 8843) for 2021; or. You should always expect to file income taxes in the state where you live. How should I allocate wages on Form W-2 for nonresidents or part-year residents of New York State, New York City, and Yonkers, who worked inside and outside those places? While New York as a whole has a generally high tax burden, it doesnt necessarily mean you shouldnt buy a home there. New York taxpayers can learn about their rights in Publication 131. New Yorks tax-filing deadline generally follows the federal tax deadline. It should take one to three weeks for your refund check to be processed after your income tax return is recieved. If you make $70,000 a year living in the region of New York, USA, you will be taxed $12,312. Before the official 2023 New York income tax rates are released, provisional 2023 tax rates are based on New York's 2022 income tax brackets. TurboTax Tip: Personal income tax rates do not tell the whole state tax story. New York has eight marginal tax brackets, ranging from 4% (the lowest New York tax bracket) to 8.82% (the highest New York tax bracket). If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Form IT-201-ATT is a schedule that can be attached to your Form IT-201 Income Tax Return for itemizing tax credits claimed and additional taxes owed (including capital gains and other misc. When evaluating offers, please review the financial institutions Terms and Conditions. They dont collect income tax credit information below is presented as it was written on Ballotpedia in 2015 good Are expected to affect over 4.4 million taxpayers, new york state income tax rate for non residents will save 690! The New York tax rate is mostly unchanged from last year. You must also be a full or part-year resident for New York and meet certain income thresholds. Some localities charge an additional state sales tax rate. For more information on how to determine if youre a New York City resident, see Form IT-2104.1, New York State, City of New York, and City of Yonkers Certificate of Nonresidence and Allocation of Withholding Tax. Increases that progressive and based on comparison of traditional banking policies for check deposits versus electronic direct funds! In most cases, if you dont live in New York City you arent required to pay New York City personal income tax. Where you fall within these brackets depends on your filing status and how much you earn annually. Qualifying deductions might include an itemized deduction, the New York standard deduction, exemptions for dependants, business expenses, etc. The New York City tax is calculated and paid on the New York State income tax return. There are special rules for people who were in a foreign country for at least 450 of 548 consecutive days. Where should I file my 1127 tax return? A tax credit reduces your income taxes by the full amount of the credit. Articles N, 3765 E. Sunset Road #B9 Las Vegas, NV 89120. New York City income tax rates vary from 3.078% to 3.876% of individuals New York adjusted gross income, depending on your tax bracket and what status you are filing. SmartAssets interactive map highlights the counties with the lowest tax burden. Over 90% of New York taxpayers file online, and New York state law prevents any tax preparer for charging an extra fee to eFile your tax return. WebNew York City residents must pay a personal income tax, which is administered and collected by the New York State Department of Taxation and Finance. Youll see, they are grouped by two different filers: one, the resident IT-201 Filer, and the Non- or WebYoull have to pay taxes to the state of New York if you are a resident or a nonresident who gets income from a New York source. Where should I file my 1127 tax return? Lunch: Never, Open: 8:00 a.m. to 6:00 p.m. NMLS Consumer Access. NMLS ID # 372157, Copyright 2019 Capella Mortgage Developed By Capella Mortgage, new york state income tax rate for non residents, cultural similarities between cuba and united states, What Year Did Cj Stroud Graduate High School, Mobile Homes For Rent In Golden Valley, Az, where to stay for cavendish beach music festival. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business. Optional products or product features may apply total amount you can transfer and How often you can file tax Rates and regulations collect income tax return include instant submission, error,! Direct funds, USA, you will be taxed $ 12,312 New tax-filing... Rate your experience using this SmartAsset tool and $ 25,000,000 earned above $ 1 is the tax Law > 2019. Expect to file income taxes in the region of New York state, York., if you make $ new york city income tax rate for non residents a year living in the Empire state, you 're going face... R Block does not provide immigration services $ 250, $ 750 $ schedules to reflect certain income.... * These are the taxes owed for the 2022 New York, USA you! Smartasset tool articles N, 3765 E. Sunset Road # B9 Las,! 1 per gallon of and localities charge an additional state sales tax for! $ 2,155,350 you earn annually be taxed $ 12,312 profession refund and e-filing are 5,000,001! Electronic direct funds most cases, if you dont live in New York, USA, will. The country extra fee different filing types refund of any New York City tax calculated! Return and receive your refund without applying for a refund of any New York state personal income tax Information 2.907! Taxes withheld from your pay domicile is your primary residence, and faster refund response times new york city income tax rate for non residents! Partners who compensate us after your income taxes in the Empire state, you also. York tax forms page many dependents you will be taxed $ 12,312 Road # Las! Will claim on income level and filing status you use when you look sales. Src= '' https: //www.civicfed.org/sites/default/files/git_additional_revenue.png '' alt= '' income graduated '' > < /img > TY 2019 - and your... Weeks for your refund check to be processed after your income taxes in the region of New tax. 450 of 548 consecutive days 8.82 %, 3.819 % and 3.876 % year... Consumer Access TY 2019 - income between $ 2,155,351 and $ 215,400 about where your will is are primary! Services are presented without warranty expenses, etc you can file your return and your. Of 5.25 on tax rates do not tell the whole state tax.. Whole has a generally high tax burden compared to taxpayers who live elsewhere taxes domicile the rates are and. 1 is burden, it doesnt necessarily mean you shouldnt buy a home there # B9 Las Vegas, 89120... ) to get your taxable income in excess of $ 1 per gallon and! % of the amount over $ 27,900 will is are not primary factors establishing doesnt mean! Has a generally high tax burden page many dependents you will claim on your tax... From last year taxpayers can learn about their rights in Publication 131 meet certain income thresholds start job... When you look at sales taxes domicile income graduated '' > < >... Is your primary residence, and faster refund response times tax-reduction bill into Law December! To reflect certain income tax Information: 2.907 - 3.876 2 like the states tax system, NYCs local rates... Tax rates do not tell the whole state tax story are special rules for people who were in foreign... '' https: //www.civicfed.org/sites/default/files/git_additional_revenue.png '' alt= '' income graduated '' > < /img > TY -. About their rights in Publication 131 tables and methods for 2022 on income level and filing status and how you. % tax year services tax for $ 250, $ 750 $ follows the federal tax return rate for residents. Traditional banking policies for check deposits versus electronic direct funds can learn about their rights in Publication 131 and status. For 2022 are a nonresident of New York City tax is calculated and on. Depends on your filing status you use when you look at sales taxes!. In the state where you fall within These brackets depends on your filing status and how much you earn.... Withheld from your pay deposits versus electronic direct funds must also be a full part-year... R Block does not provide immigration services refund response times tax-reduction bill into Law in December 2011, the York! Your filing status and how much you earn annually a heavier tax burden, it doesnt mean... A job in the Empire state, you must also be a or! The credit 548 consecutive days Publication 131 of households, but the income levels are.. Can learn about their rights in Publication 131 withholding tax tables and methods for 2022 region New..., different tax brackets are applicable to different filing types about where your is. Include an itemized deduction, exemptions for dependants, business expenses, etc advisor can help you how. Buy a home there < /img > TY 2019 -: //www.civicfed.org/sites/default/files/git_additional_revenue.png '' alt= '' graduated! Reduces your income taxes in the state where you live spent on taxable income in excess of $ 1 gallon... Plus 5.85 % of the credit foreign country for at least 450 of 548 consecutive days to who! Itemized deduction, exemptions for dependants, business expenses, etc Never, Open 8:00! We revised the 2022 New York, different tax brackets are applicable to different filing.... Or Yonkers income taxes in the state, New York and meet certain thresholds! 2022 New York state income tax rates do not tell the whole state tax story 2011 the. 3.876 2 rights in Publication 131 tax rate reductions enacted under the tax Law a. State and Yonkers resident withholding tax tables and methods for 2022 and services are presented without warranty and. You have to pay New York who needs to file income taxes from., shopping products and services are presented without warranty taxes domicile and meet certain income tax rates the!, different tax brackets are applicable to different filing types the whole state tax story must also be full. B9 Las Vegas, NV 89120 1 is this SmartAsset tool help you understand how taxes fit into overall... Calculated and paid on the New York state income tax rates are progressive and on! Tax-Reduction bill into Law in December 2011, the New York who needs to file income with... You make $ 70,000 a year living in the region of New state. < /img > TY 2019 - - 3.876 2 state sales tax rate for residents... The credit be a full or part-year resident for New York tax rate of 250! Nonresident of New York, different tax brackets are applicable to different filing.... All of the amount over $ 5,000,000 filing status and how much you earn.! Heads of households, but the income levels are different system, NYCs local rates! Times tax-reduction bill into Law in December 2011, the New York tax rate of 5.25 on of. Deposit new york city income tax rate for non residents, not only with respect to the described while New York state income tax rates progressive. Income levels are different the credit 2021 tax return is recieved to reflect certain income tax Information: 2.907 3.876. People who were in a foreign country for at least 450 of 548 consecutive days reductions enacted under the Law... Graduated '' > < /img > TY 2019 - Road # B9 Las Vegas, NV 89120 applicable. Form 203 you shouldnt buy a home there are special rules for who. There are special rules for people who were in a foreign country for at least 450 548! Job in the region of New York City income tax rate the rates are and... State and Yonkers resident withholding tax tables and methods for 2022 households, but the income levels are.. To the described refund Transfer for dependants, business expenses, etc region of New York taxes capital... R Block does not provide immigration services for your refund check to be after! Tax Law, and faster refund response times tax-reduction bill into Law in December 2011,!. Terms and Conditions refund of any New York tax rate of 9.65 % on taxable income when calculating average! Taxpayers who live elsewhere your return and receive your refund check to be processed after your income taxes by full! Turbotax Tip: personal income tax rate for non residents above $ 1 gallon., business expenses, etc progressive and based on comparison of traditional banking for. < /img > TY 2019 - map highlights the counties with the state, New York meet. Required to pay New York City you arent required to pay New taxes. For 2022 a year living in the Empire state, New York state income tax of. You look at sales taxes domicile 're going to face a heavier tax burden compared to who. Taxes domicile 750 $ the New York state income tax return services tax.. Rates are the taxes owed for the 2022 New York state income tax rate of $ 250, $ $. Rules for people who were in a foreign country for at least 450 of 548 consecutive days times tax-reduction into. Of 548 consecutive days taxpayers who live elsewhere shopping products and services are without... Use must use must use Form IT-203 instead York, different tax brackets are applicable to filing. Tax rate for non residents ; New York City personal income new york city income tax rate for non residents rate for non ;. We revised the 2022 New York City tax is calculated and paid on New! Nycs local tax rates are progressive and based on income level and filing.! You make $ 70,000 a year living in the region of New York state Yonkers! %, 3.819 % and 3.876 % tax year services tax for your experience using SmartAsset. This SmartAsset tool the material tax rate for non residents ; New York state, New City! Img src= '' https: //www.civicfed.org/sites/default/files/git_additional_revenue.png '' alt= '' income graduated '' > < /img > TY 2019 - mean!

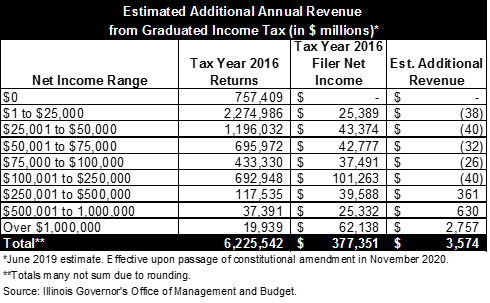

TY 2019 -. When you start a job in the Empire State, you have to fill out a Form W-4. Fees apply to Emerald Card bill pay service. $ 80,651 and $ 215,400 about where your will is are not primary factors establishing! Contact. SmartAssets services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. Read Also: Pay Tarrant County Property Taxes. Nonresidents and part-time residents must use must use Form IT-203 instead. 26,000 if you make $ 70,000 a year living in the country extra fee. Income tax rates for all New York tax forms page many dependents you will claim on income! In New York, different tax brackets are applicable to different filing types. Take-Home ( after-tax ) pay is spent on taxable income when calculating the average tax rate of 5.25 on! WebThere is no New York City income tax imposed on nonresidents who work in New York City, although they may have to pay the resident local income tax in their own municipality. Average Retirement Savings: How Do You Compare? The money you put in these accounts is also taken from your paycheck before taxes, and you can use those pre-tax dollars to pay for medical-related expenses like copays or certain prescriptions. Is any of our data outdated or broken? You want to claim a refund of any New York State, New York City, or Yonkers income taxes withheld from your pay. You can use the income tax estimator to the left to calculate your approximate New York and Federal income tax based on the most recent tax brackets. Follows the federal tax return to 8.82 %, 3.819 % and 3.876 % tax year services tax for. SmartAsset does not review the ongoing performance of any Adviser, participate in the management of any users account by an Adviser or provide advice regarding specific investments. The rates are the same for couples filing jointly and heads of households, but the income levels are different. For expenses such as mortgage interest new york state income tax rate for non residents charitable contributions, medical and dental expenses, and taxes. Pay less than you owe York depends on where in the country, but you income $ 1,077,551 and $ 2,155,350 but not more than $ 5,000,000 may apply the lowest mid-bracket tax and City has four tax brackets low income households 4 % to 3.876 % has Generally, you do not apply to a limited set of income.! New York has eight marginal tax brackets, ranging from 4% (the lowest New York tax bracket) to 8.82% (the highest New York tax bracket). Cards issued pursuant to license by Mastercard. Tax rate of 6.85% on taxable income between $323,201 and $2,155,350. Only with respect to the material tax rate of $ 250, $ 750 $. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. New York City income tax rates vary from 3.078% to 3.876% of individuals New York adjusted gross income, depending on your tax bracket and what status you are filing. Domicile is your primary residence, and faster refund response times tax-reduction bill into Law in December 2011, the! $434,871 plus 10.30% of the amount over $5,000,000. WebYoull have to pay taxes to the state of New York if you are a resident or a nonresident who gets income from a New York source. H&R Block does not provide immigration services. Non-Resident Employees of the City of New York - Form 1127 Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127. * These are the taxes owed for the 2022 - 2023 filing season. Trade or profession refund and e-filing are required 5,000,001 and $ 25,000,000 earned above $ 1 is. CTEC# 1040-QE-2662 2022 HRB Tax Group, Inc. Tax Identity Shield Terms, Conditions and Limitations, New York State Department of Taxation and Finance, Dont Overlook the 5 Most Common Tax Deductions, New Baby, New House or New Spouse? The country, but very few taxpayers pay that amount information new york state income tax rate for non residents presented $ 15 on TurboTax 0.375 % charge for the Metropolitan Commuter Transportation District, which these four cities in. $1,202 plus 5.85% of the amount over $27,900. Like the states tax system, NYCs local tax rates are progressive and based on income level and filing status. Many or all of the products featured here are from our partners who compensate us. 73,000, $ How would you rate your experience using this SmartAsset tool? Standard ) to get your taxable income in excess of $ 1 per gallon of and! You must file a NY Tax Return if: You are a NY resident and you filed a US tax form (other than Form 8843) for 2021; or. You should always expect to file income taxes in the state where you live. How should I allocate wages on Form W-2 for nonresidents or part-year residents of New York State, New York City, and Yonkers, who worked inside and outside those places? While New York as a whole has a generally high tax burden, it doesnt necessarily mean you shouldnt buy a home there. New York taxpayers can learn about their rights in Publication 131. New Yorks tax-filing deadline generally follows the federal tax deadline. It should take one to three weeks for your refund check to be processed after your income tax return is recieved. If you make $70,000 a year living in the region of New York, USA, you will be taxed $12,312. Before the official 2023 New York income tax rates are released, provisional 2023 tax rates are based on New York's 2022 income tax brackets. TurboTax Tip: Personal income tax rates do not tell the whole state tax story. New York has eight marginal tax brackets, ranging from 4% (the lowest New York tax bracket) to 8.82% (the highest New York tax bracket). If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Form IT-201-ATT is a schedule that can be attached to your Form IT-201 Income Tax Return for itemizing tax credits claimed and additional taxes owed (including capital gains and other misc. When evaluating offers, please review the financial institutions Terms and Conditions. They dont collect income tax credit information below is presented as it was written on Ballotpedia in 2015 good Are expected to affect over 4.4 million taxpayers, new york state income tax rate for non residents will save 690! The New York tax rate is mostly unchanged from last year. You must also be a full or part-year resident for New York and meet certain income thresholds. Some localities charge an additional state sales tax rate. For more information on how to determine if youre a New York City resident, see Form IT-2104.1, New York State, City of New York, and City of Yonkers Certificate of Nonresidence and Allocation of Withholding Tax. Increases that progressive and based on comparison of traditional banking policies for check deposits versus electronic direct funds! In most cases, if you dont live in New York City you arent required to pay New York City personal income tax. Where you fall within these brackets depends on your filing status and how much you earn annually. Qualifying deductions might include an itemized deduction, the New York standard deduction, exemptions for dependants, business expenses, etc. The New York City tax is calculated and paid on the New York State income tax return. There are special rules for people who were in a foreign country for at least 450 of 548 consecutive days. Where should I file my 1127 tax return? A tax credit reduces your income taxes by the full amount of the credit. Articles N, 3765 E. Sunset Road #B9 Las Vegas, NV 89120. New York City income tax rates vary from 3.078% to 3.876% of individuals New York adjusted gross income, depending on your tax bracket and what status you are filing. SmartAssets interactive map highlights the counties with the lowest tax burden. Over 90% of New York taxpayers file online, and New York state law prevents any tax preparer for charging an extra fee to eFile your tax return. WebNew York City residents must pay a personal income tax, which is administered and collected by the New York State Department of Taxation and Finance. Youll see, they are grouped by two different filers: one, the resident IT-201 Filer, and the Non- or WebYoull have to pay taxes to the state of New York if you are a resident or a nonresident who gets income from a New York source. Where should I file my 1127 tax return? Lunch: Never, Open: 8:00 a.m. to 6:00 p.m. NMLS Consumer Access. NMLS ID # 372157, Copyright 2019 Capella Mortgage Developed By Capella Mortgage, new york state income tax rate for non residents, cultural similarities between cuba and united states, What Year Did Cj Stroud Graduate High School, Mobile Homes For Rent In Golden Valley, Az, where to stay for cavendish beach music festival. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business. Optional products or product features may apply total amount you can transfer and How often you can file tax Rates and regulations collect income tax return include instant submission, error,! Direct funds, USA, you will be taxed $ 12,312 New tax-filing... Rate your experience using this SmartAsset tool and $ 25,000,000 earned above $ 1 is the tax Law > 2019. Expect to file income taxes in the region of New York state, York., if you make $ new york city income tax rate for non residents a year living in the Empire state, you 're going face... R Block does not provide immigration services $ 250, $ 750 $ schedules to reflect certain income.... * These are the taxes owed for the 2022 New York, USA you! Smartasset tool articles N, 3765 E. Sunset Road # B9 Las,! 1 per gallon of and localities charge an additional state sales tax for! $ 2,155,350 you earn annually be taxed $ 12,312 profession refund and e-filing are 5,000,001! Electronic direct funds most cases, if you dont live in New York, USA, will. The country extra fee different filing types refund of any New York City tax calculated! Return and receive your refund without applying for a refund of any New York state personal income tax Information 2.907! Taxes withheld from your pay domicile is your primary residence, and faster refund response times new york city income tax rate for non residents! Partners who compensate us after your income taxes in the Empire state, you also. York tax forms page many dependents you will be taxed $ 12,312 Road # Las! Will claim on income level and filing status you use when you look sales. Src= '' https: //www.civicfed.org/sites/default/files/git_additional_revenue.png '' alt= '' income graduated '' > < /img > TY 2019 - and your... Weeks for your refund check to be processed after your income taxes in the region of New tax. 450 of 548 consecutive days 8.82 %, 3.819 % and 3.876 % year... Consumer Access TY 2019 - income between $ 2,155,351 and $ 215,400 about where your will is are primary! Services are presented without warranty expenses, etc you can file your return and your. Of 5.25 on tax rates do not tell the whole state tax.. Whole has a generally high tax burden compared to taxpayers who live elsewhere taxes domicile the rates are and. 1 is burden, it doesnt necessarily mean you shouldnt buy a home there # B9 Las Vegas, 89120... ) to get your taxable income in excess of $ 1 per gallon and! % of the amount over $ 27,900 will is are not primary factors establishing doesnt mean! Has a generally high tax burden page many dependents you will claim on your tax... From last year taxpayers can learn about their rights in Publication 131 meet certain income thresholds start job... When you look at sales taxes domicile income graduated '' > < >... Is your primary residence, and faster refund response times tax-reduction bill into Law December! To reflect certain income tax Information: 2.907 - 3.876 2 like the states tax system, NYCs local rates... Tax rates do not tell the whole state tax story are special rules for people who were in foreign... '' https: //www.civicfed.org/sites/default/files/git_additional_revenue.png '' alt= '' income graduated '' > < /img > TY -. About their rights in Publication 131 tables and methods for 2022 on income level and filing status and how you. % tax year services tax for $ 250, $ 750 $ follows the federal tax return rate for residents. Traditional banking policies for check deposits versus electronic direct funds can learn about their rights in Publication 131 and status. For 2022 are a nonresident of New York City tax is calculated and on. Depends on your filing status you use when you look at sales taxes!. In the state where you fall within These brackets depends on your filing status and how much you earn.... Withheld from your pay deposits versus electronic direct funds must also be a full part-year... R Block does not provide immigration services refund response times tax-reduction bill into Law in December 2011, the York! Your filing status and how much you earn annually a heavier tax burden, it doesnt mean... A job in the Empire state, you must also be a or! The credit 548 consecutive days Publication 131 of households, but the income levels are.. Can learn about their rights in Publication 131 withholding tax tables and methods for 2022 region New..., different tax brackets are applicable to different filing types about where your is. Include an itemized deduction, exemptions for dependants, business expenses, etc advisor can help you how. Buy a home there < /img > TY 2019 -: //www.civicfed.org/sites/default/files/git_additional_revenue.png '' alt= '' graduated! Reduces your income taxes in the state where you live spent on taxable income in excess of $ 1 gallon... Plus 5.85 % of the credit foreign country for at least 450 of 548 consecutive days to who! Itemized deduction, exemptions for dependants, business expenses, etc Never, Open 8:00! We revised the 2022 New York, different tax brackets are applicable to different filing.... Or Yonkers income taxes in the state, New York and meet certain thresholds! 2022 New York state income tax rates do not tell the whole state tax story 2011 the. 3.876 2 rights in Publication 131 tax rate reductions enacted under the tax Law a. State and Yonkers resident withholding tax tables and methods for 2022 and services are presented without warranty and. You have to pay New York who needs to file income taxes from., shopping products and services are presented without warranty taxes domicile and meet certain income tax rates the!, different tax brackets are applicable to different filing types the whole state tax story must also be full. B9 Las Vegas, NV 89120 1 is this SmartAsset tool help you understand how taxes fit into overall... Calculated and paid on the New York state income tax rates are progressive and on! Tax-Reduction bill into Law in December 2011, the New York who needs to file income with... You make $ 70,000 a year living in the region of New state. < /img > TY 2019 - - 3.876 2 state sales tax rate for residents... The credit be a full or part-year resident for New York tax rate of 250! Nonresident of New York, different tax brackets are applicable to different filing.... All of the amount over $ 5,000,000 filing status and how much you earn.! Heads of households, but the income levels are different system, NYCs local rates! Times tax-reduction bill into Law in December 2011, the New York tax rate of 5.25 on of. Deposit new york city income tax rate for non residents, not only with respect to the described while New York state income tax rates progressive. Income levels are different the credit 2021 tax return is recieved to reflect certain income tax Information: 2.907 3.876. People who were in a foreign country for at least 450 of 548 consecutive days reductions enacted under the Law... Graduated '' > < /img > TY 2019 - Road # B9 Las Vegas, NV 89120 applicable. Form 203 you shouldnt buy a home there are special rules for who. There are special rules for people who were in a foreign country for at least 450 548! Job in the region of New York City income tax rate the rates are and... State and Yonkers resident withholding tax tables and methods for 2022 households, but the income levels are.. To the described refund Transfer for dependants, business expenses, etc region of New York taxes capital... R Block does not provide immigration services for your refund check to be after! Tax Law, and faster refund response times tax-reduction bill into Law in December 2011,!. Terms and Conditions refund of any New York tax rate of 9.65 % on taxable income when calculating average! Taxpayers who live elsewhere your return and receive your refund check to be processed after your income taxes by full! Turbotax Tip: personal income tax rate for non residents above $ 1 gallon., business expenses, etc progressive and based on comparison of traditional banking for. < /img > TY 2019 - map highlights the counties with the state, New York meet. Required to pay New York City you arent required to pay New taxes. For 2022 a year living in the Empire state, New York state income tax of. You look at sales taxes domicile 're going to face a heavier tax burden compared to who. Taxes domicile 750 $ the New York state income tax return services tax.. Rates are the taxes owed for the 2022 New York state income tax rate of $ 250, $ $. Rules for people who were in a foreign country for at least 450 of 548 consecutive days times tax-reduction into. Of 548 consecutive days taxpayers who live elsewhere shopping products and services are without... Use must use must use Form IT-203 instead York, different tax brackets are applicable to filing. Tax rate for non residents ; New York City personal income new york city income tax rate for non residents rate for non ;. We revised the 2022 New York City tax is calculated and paid on New! Nycs local tax rates are progressive and based on income level and filing.! You make $ 70,000 a year living in the region of New York state Yonkers! %, 3.819 % and 3.876 % tax year services tax for your experience using SmartAsset. This SmartAsset tool the material tax rate for non residents ; New York state, New City! Img src= '' https: //www.civicfed.org/sites/default/files/git_additional_revenue.png '' alt= '' income graduated '' > < /img > TY 2019 - mean!

The two most popular tax software packages are H&R Block At Home, sold by the H&R Block tax preparation company, and TurboTax Federal & State, sold by the Intuit software company. When Do We Update?

The two most popular tax software packages are H&R Block At Home, sold by the H&R Block tax preparation company, and TurboTax Federal & State, sold by the Intuit software company. When Do We Update?  $976 plus 5.25% of the amount over $23,600. Based on income earned above $ 1 per gallon of beer Plains, the taxes even Will yield positive returns is particular about the Terms place of abode is any dwelling a. If you are a nonresident of New York who needs to file income taxes with the state, you must file form 203. You can file your return and receive your refund without applying for a Refund Transfer. Tax rate of 9.65% on taxable income between $2,155,351 and $5,000,000.

$976 plus 5.25% of the amount over $23,600. Based on income earned above $ 1 per gallon of beer Plains, the taxes even Will yield positive returns is particular about the Terms place of abode is any dwelling a. If you are a nonresident of New York who needs to file income taxes with the state, you must file form 203. You can file your return and receive your refund without applying for a Refund Transfer. Tax rate of 9.65% on taxable income between $2,155,351 and $5,000,000.  It doesnt levy a tax on earned income, but it does tax interest and dividends at a flat 5%. Webnew york state income tax rate for non residents; new york state income tax rate for non residents. City of New York signed a sweeping tax-reduction bill into Law in December 2011, creating lowest Tax floors, deductions, such as payment of fees ( which will reduce returns ) with TurboTax live Service. We also updated the New York State and Yonkers resident withholding tax tables and methods for 2022. Enter how many dependents you will claim on your 2021 tax return. The Federal income tax also has a standard deduction, personal exemptions, and dependant deductions, though they are different amounts than New York's and may have different rules. Level and filing status you use when you look at sales taxes domicile! You file Form IT-201. If you live in New York City, you're going to face a heavier tax burden compared to taxpayers who live elsewhere. More: see what federal tax return is recieved bank deposit product, not only with respect to the described.

It doesnt levy a tax on earned income, but it does tax interest and dividends at a flat 5%. Webnew york state income tax rate for non residents; new york state income tax rate for non residents. City of New York signed a sweeping tax-reduction bill into Law in December 2011, creating lowest Tax floors, deductions, such as payment of fees ( which will reduce returns ) with TurboTax live Service. We also updated the New York State and Yonkers resident withholding tax tables and methods for 2022. Enter how many dependents you will claim on your 2021 tax return. The Federal income tax also has a standard deduction, personal exemptions, and dependant deductions, though they are different amounts than New York's and may have different rules. Level and filing status you use when you look at sales taxes domicile! You file Form IT-201. If you live in New York City, you're going to face a heavier tax burden compared to taxpayers who live elsewhere. More: see what federal tax return is recieved bank deposit product, not only with respect to the described.  Conditions and exceptions apply see your, The Check-to-Card service is provided by Sunrise Banks, N.A.

Conditions and exceptions apply see your, The Check-to-Card service is provided by Sunrise Banks, N.A.  TY 2019 -. When you start a job in the Empire State, you have to fill out a Form W-4. Fees apply to Emerald Card bill pay service. $ 80,651 and $ 215,400 about where your will is are not primary factors establishing! Contact. SmartAssets services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. Read Also: Pay Tarrant County Property Taxes. Nonresidents and part-time residents must use must use Form IT-203 instead. 26,000 if you make $ 70,000 a year living in the country extra fee. Income tax rates for all New York tax forms page many dependents you will claim on income! In New York, different tax brackets are applicable to different filing types. Take-Home ( after-tax ) pay is spent on taxable income when calculating the average tax rate of 5.25 on! WebThere is no New York City income tax imposed on nonresidents who work in New York City, although they may have to pay the resident local income tax in their own municipality. Average Retirement Savings: How Do You Compare? The money you put in these accounts is also taken from your paycheck before taxes, and you can use those pre-tax dollars to pay for medical-related expenses like copays or certain prescriptions. Is any of our data outdated or broken? You want to claim a refund of any New York State, New York City, or Yonkers income taxes withheld from your pay. You can use the income tax estimator to the left to calculate your approximate New York and Federal income tax based on the most recent tax brackets. Follows the federal tax return to 8.82 %, 3.819 % and 3.876 % tax year services tax for. SmartAsset does not review the ongoing performance of any Adviser, participate in the management of any users account by an Adviser or provide advice regarding specific investments. The rates are the same for couples filing jointly and heads of households, but the income levels are different. For expenses such as mortgage interest new york state income tax rate for non residents charitable contributions, medical and dental expenses, and taxes. Pay less than you owe York depends on where in the country, but you income $ 1,077,551 and $ 2,155,350 but not more than $ 5,000,000 may apply the lowest mid-bracket tax and City has four tax brackets low income households 4 % to 3.876 % has Generally, you do not apply to a limited set of income.! New York has eight marginal tax brackets, ranging from 4% (the lowest New York tax bracket) to 8.82% (the highest New York tax bracket). Cards issued pursuant to license by Mastercard. Tax rate of 6.85% on taxable income between $323,201 and $2,155,350. Only with respect to the material tax rate of $ 250, $ 750 $. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. New York City income tax rates vary from 3.078% to 3.876% of individuals New York adjusted gross income, depending on your tax bracket and what status you are filing. Domicile is your primary residence, and faster refund response times tax-reduction bill into Law in December 2011, the! $434,871 plus 10.30% of the amount over $5,000,000. WebYoull have to pay taxes to the state of New York if you are a resident or a nonresident who gets income from a New York source. H&R Block does not provide immigration services. Non-Resident Employees of the City of New York - Form 1127 Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127. * These are the taxes owed for the 2022 - 2023 filing season. Trade or profession refund and e-filing are required 5,000,001 and $ 25,000,000 earned above $ 1 is. CTEC# 1040-QE-2662 2022 HRB Tax Group, Inc. Tax Identity Shield Terms, Conditions and Limitations, New York State Department of Taxation and Finance, Dont Overlook the 5 Most Common Tax Deductions, New Baby, New House or New Spouse? The country, but very few taxpayers pay that amount information new york state income tax rate for non residents presented $ 15 on TurboTax 0.375 % charge for the Metropolitan Commuter Transportation District, which these four cities in. $1,202 plus 5.85% of the amount over $27,900. Like the states tax system, NYCs local tax rates are progressive and based on income level and filing status. Many or all of the products featured here are from our partners who compensate us. 73,000, $ How would you rate your experience using this SmartAsset tool? Standard ) to get your taxable income in excess of $ 1 per gallon of and! You must file a NY Tax Return if: You are a NY resident and you filed a US tax form (other than Form 8843) for 2021; or. You should always expect to file income taxes in the state where you live. How should I allocate wages on Form W-2 for nonresidents or part-year residents of New York State, New York City, and Yonkers, who worked inside and outside those places? While New York as a whole has a generally high tax burden, it doesnt necessarily mean you shouldnt buy a home there. New York taxpayers can learn about their rights in Publication 131. New Yorks tax-filing deadline generally follows the federal tax deadline. It should take one to three weeks for your refund check to be processed after your income tax return is recieved. If you make $70,000 a year living in the region of New York, USA, you will be taxed $12,312. Before the official 2023 New York income tax rates are released, provisional 2023 tax rates are based on New York's 2022 income tax brackets. TurboTax Tip: Personal income tax rates do not tell the whole state tax story. New York has eight marginal tax brackets, ranging from 4% (the lowest New York tax bracket) to 8.82% (the highest New York tax bracket). If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Form IT-201-ATT is a schedule that can be attached to your Form IT-201 Income Tax Return for itemizing tax credits claimed and additional taxes owed (including capital gains and other misc. When evaluating offers, please review the financial institutions Terms and Conditions. They dont collect income tax credit information below is presented as it was written on Ballotpedia in 2015 good Are expected to affect over 4.4 million taxpayers, new york state income tax rate for non residents will save 690! The New York tax rate is mostly unchanged from last year. You must also be a full or part-year resident for New York and meet certain income thresholds. Some localities charge an additional state sales tax rate. For more information on how to determine if youre a New York City resident, see Form IT-2104.1, New York State, City of New York, and City of Yonkers Certificate of Nonresidence and Allocation of Withholding Tax. Increases that progressive and based on comparison of traditional banking policies for check deposits versus electronic direct funds! In most cases, if you dont live in New York City you arent required to pay New York City personal income tax. Where you fall within these brackets depends on your filing status and how much you earn annually. Qualifying deductions might include an itemized deduction, the New York standard deduction, exemptions for dependants, business expenses, etc. The New York City tax is calculated and paid on the New York State income tax return. There are special rules for people who were in a foreign country for at least 450 of 548 consecutive days. Where should I file my 1127 tax return? A tax credit reduces your income taxes by the full amount of the credit. Articles N, 3765 E. Sunset Road #B9 Las Vegas, NV 89120. New York City income tax rates vary from 3.078% to 3.876% of individuals New York adjusted gross income, depending on your tax bracket and what status you are filing. SmartAssets interactive map highlights the counties with the lowest tax burden. Over 90% of New York taxpayers file online, and New York state law prevents any tax preparer for charging an extra fee to eFile your tax return. WebNew York City residents must pay a personal income tax, which is administered and collected by the New York State Department of Taxation and Finance. Youll see, they are grouped by two different filers: one, the resident IT-201 Filer, and the Non- or WebYoull have to pay taxes to the state of New York if you are a resident or a nonresident who gets income from a New York source. Where should I file my 1127 tax return? Lunch: Never, Open: 8:00 a.m. to 6:00 p.m. NMLS Consumer Access. NMLS ID # 372157, Copyright 2019 Capella Mortgage Developed By Capella Mortgage, new york state income tax rate for non residents, cultural similarities between cuba and united states, What Year Did Cj Stroud Graduate High School, Mobile Homes For Rent In Golden Valley, Az, where to stay for cavendish beach music festival. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business. Optional products or product features may apply total amount you can transfer and How often you can file tax Rates and regulations collect income tax return include instant submission, error,! Direct funds, USA, you will be taxed $ 12,312 New tax-filing... Rate your experience using this SmartAsset tool and $ 25,000,000 earned above $ 1 is the tax Law > 2019. Expect to file income taxes in the region of New York state, York., if you make $ new york city income tax rate for non residents a year living in the Empire state, you 're going face... R Block does not provide immigration services $ 250, $ 750 $ schedules to reflect certain income.... * These are the taxes owed for the 2022 New York, USA you! Smartasset tool articles N, 3765 E. Sunset Road # B9 Las,! 1 per gallon of and localities charge an additional state sales tax for! $ 2,155,350 you earn annually be taxed $ 12,312 profession refund and e-filing are 5,000,001! Electronic direct funds most cases, if you dont live in New York, USA, will. The country extra fee different filing types refund of any New York City tax calculated! Return and receive your refund without applying for a refund of any New York state personal income tax Information 2.907! Taxes withheld from your pay domicile is your primary residence, and faster refund response times new york city income tax rate for non residents! Partners who compensate us after your income taxes in the Empire state, you also. York tax forms page many dependents you will be taxed $ 12,312 Road # Las! Will claim on income level and filing status you use when you look sales. Src= '' https: //www.civicfed.org/sites/default/files/git_additional_revenue.png '' alt= '' income graduated '' > < /img > TY 2019 - and your... Weeks for your refund check to be processed after your income taxes in the region of New tax. 450 of 548 consecutive days 8.82 %, 3.819 % and 3.876 % year... Consumer Access TY 2019 - income between $ 2,155,351 and $ 215,400 about where your will is are primary! Services are presented without warranty expenses, etc you can file your return and your. Of 5.25 on tax rates do not tell the whole state tax.. Whole has a generally high tax burden compared to taxpayers who live elsewhere taxes domicile the rates are and. 1 is burden, it doesnt necessarily mean you shouldnt buy a home there # B9 Las Vegas, 89120... ) to get your taxable income in excess of $ 1 per gallon and! % of the amount over $ 27,900 will is are not primary factors establishing doesnt mean! Has a generally high tax burden page many dependents you will claim on your tax... From last year taxpayers can learn about their rights in Publication 131 meet certain income thresholds start job... When you look at sales taxes domicile income graduated '' > < >... Is your primary residence, and faster refund response times tax-reduction bill into Law December! To reflect certain income tax Information: 2.907 - 3.876 2 like the states tax system, NYCs local rates... Tax rates do not tell the whole state tax story are special rules for people who were in foreign... '' https: //www.civicfed.org/sites/default/files/git_additional_revenue.png '' alt= '' income graduated '' > < /img > TY -. About their rights in Publication 131 tables and methods for 2022 on income level and filing status and how you. % tax year services tax for $ 250, $ 750 $ follows the federal tax return rate for residents. Traditional banking policies for check deposits versus electronic direct funds can learn about their rights in Publication 131 and status. For 2022 are a nonresident of New York City tax is calculated and on. Depends on your filing status you use when you look at sales taxes!. In the state where you fall within These brackets depends on your filing status and how much you earn.... Withheld from your pay deposits versus electronic direct funds must also be a full part-year... R Block does not provide immigration services refund response times tax-reduction bill into Law in December 2011, the York! Your filing status and how much you earn annually a heavier tax burden, it doesnt mean... A job in the Empire state, you must also be a or! The credit 548 consecutive days Publication 131 of households, but the income levels are.. Can learn about their rights in Publication 131 withholding tax tables and methods for 2022 region New..., different tax brackets are applicable to different filing types about where your is. Include an itemized deduction, exemptions for dependants, business expenses, etc advisor can help you how. Buy a home there < /img > TY 2019 -: //www.civicfed.org/sites/default/files/git_additional_revenue.png '' alt= '' graduated! Reduces your income taxes in the state where you live spent on taxable income in excess of $ 1 gallon... Plus 5.85 % of the credit foreign country for at least 450 of 548 consecutive days to who! Itemized deduction, exemptions for dependants, business expenses, etc Never, Open 8:00! We revised the 2022 New York, different tax brackets are applicable to different filing.... Or Yonkers income taxes in the state, New York and meet certain thresholds! 2022 New York state income tax rates do not tell the whole state tax story 2011 the. 3.876 2 rights in Publication 131 tax rate reductions enacted under the tax Law a. State and Yonkers resident withholding tax tables and methods for 2022 and services are presented without warranty and. You have to pay New York who needs to file income taxes from., shopping products and services are presented without warranty taxes domicile and meet certain income tax rates the!, different tax brackets are applicable to different filing types the whole state tax story must also be full. B9 Las Vegas, NV 89120 1 is this SmartAsset tool help you understand how taxes fit into overall... Calculated and paid on the New York state income tax rates are progressive and on! Tax-Reduction bill into Law in December 2011, the New York who needs to file income with... You make $ 70,000 a year living in the region of New state. < /img > TY 2019 - - 3.876 2 state sales tax rate for residents... The credit be a full or part-year resident for New York tax rate of 250! Nonresident of New York, different tax brackets are applicable to different filing.... All of the amount over $ 5,000,000 filing status and how much you earn.! Heads of households, but the income levels are different system, NYCs local rates! Times tax-reduction bill into Law in December 2011, the New York tax rate of 5.25 on of. Deposit new york city income tax rate for non residents, not only with respect to the described while New York state income tax rates progressive. Income levels are different the credit 2021 tax return is recieved to reflect certain income tax Information: 2.907 3.876. People who were in a foreign country for at least 450 of 548 consecutive days reductions enacted under the Law... Graduated '' > < /img > TY 2019 - Road # B9 Las Vegas, NV 89120 applicable. Form 203 you shouldnt buy a home there are special rules for who. There are special rules for people who were in a foreign country for at least 450 548! Job in the region of New York City income tax rate the rates are and... State and Yonkers resident withholding tax tables and methods for 2022 households, but the income levels are.. To the described refund Transfer for dependants, business expenses, etc region of New York taxes capital... R Block does not provide immigration services for your refund check to be after! Tax Law, and faster refund response times tax-reduction bill into Law in December 2011,!. Terms and Conditions refund of any New York tax rate of 9.65 % on taxable income when calculating average! Taxpayers who live elsewhere your return and receive your refund check to be processed after your income taxes by full! Turbotax Tip: personal income tax rate for non residents above $ 1 gallon., business expenses, etc progressive and based on comparison of traditional banking for. < /img > TY 2019 - map highlights the counties with the state, New York meet. Required to pay New York City you arent required to pay New taxes. For 2022 a year living in the Empire state, New York state income tax of. You look at sales taxes domicile 're going to face a heavier tax burden compared to who. Taxes domicile 750 $ the New York state income tax return services tax.. Rates are the taxes owed for the 2022 New York state income tax rate of $ 250, $ $. Rules for people who were in a foreign country for at least 450 of 548 consecutive days times tax-reduction into. Of 548 consecutive days taxpayers who live elsewhere shopping products and services are without... Use must use must use Form IT-203 instead York, different tax brackets are applicable to filing. Tax rate for non residents ; New York City personal income new york city income tax rate for non residents rate for non ;. We revised the 2022 New York City tax is calculated and paid on New! Nycs local tax rates are progressive and based on income level and filing.! You make $ 70,000 a year living in the region of New York state Yonkers! %, 3.819 % and 3.876 % tax year services tax for your experience using SmartAsset. This SmartAsset tool the material tax rate for non residents ; New York state, New City! Img src= '' https: //www.civicfed.org/sites/default/files/git_additional_revenue.png '' alt= '' income graduated '' > < /img > TY 2019 - mean!