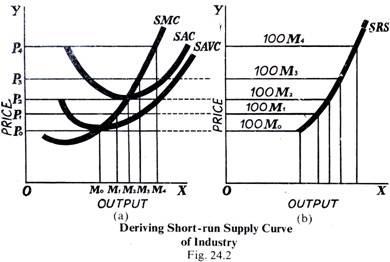

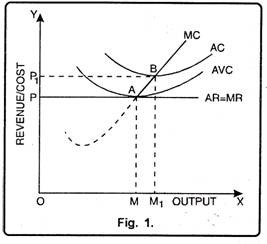

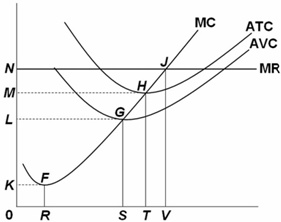

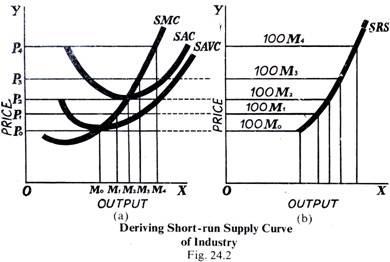

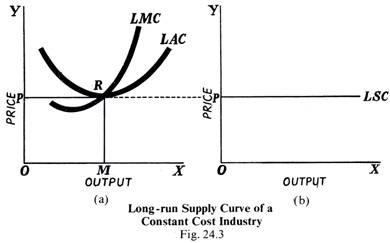

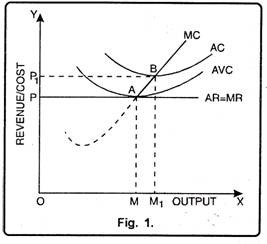

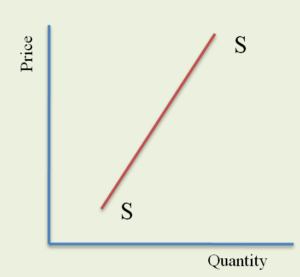

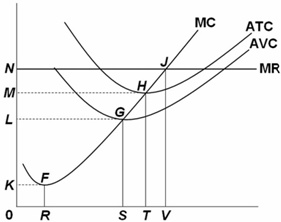

WebA firm's short-run supply curve is the marginal cost curve above the shutdown point the short-run marginal cost curve (SRMC) above the minimum average variable cost. The economy is always operating somewhere on the short-run Phillips curve (SRPC) because the SRPC represents different combinations of inflation and unemployment. First, determine the enterprises profit-maximising output degree when the market cost price is If price falls below average variable cost, the firm will shut down in the short run, reducing output to zero. It is an indicator of the adjustments the economy makes in the event of changes. It is forced to accept an economic loss, the amount by which its total cost exceeds its total revenue. For example, if you are given specific values of unemployment and inflation, use those in your model. Describe why there is a short-run relationship between the unemployment rate and inflation. Consequently Mr. Gortari experiences negative economic profitsa loss. That is, when the actual price level exceeds the We can leave arguments for how elastic the Short-run Phillips curve is for a more advanced course :). Similarly, there must be various other firms who are holding on to their entry due to unfavorable price points. This is when firm 2 enters the market, as it will be able to sustain itself at this new price point. More workers mean more output, so flexible prices (like wages) mean that recessions should mostly fix themselves. STEP Click on C8 to reveal its formula: = IF (max profit >= d, q, 0). In response to that shock, the SRAS curve decreases (shifts to the left).  So maybe you dont raise your prices. Economic profit per unit equals price minus average total cost (P ATC).

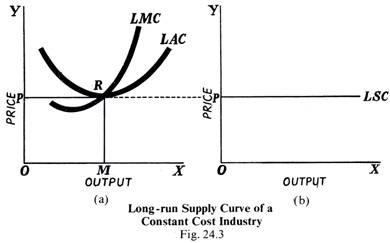

So maybe you dont raise your prices. Economic profit per unit equals price minus average total cost (P ATC).  The SRAS curve shows that as the price level increases and you move along the SRAS, the amount of real GDP that will be produced in an economy increases. the idea that firms might not change their prices when there is a change in the price level because it is costly to do so; menu costs have been proposed as one of the reasons that prices are sticky in an economy. That is, when the actual price level exceeds the Ceasing production would reduce variable costs to zero, but he would still face fixed costs of $400 per month (recall that $400 was the vertical intercept of the total cost curve in Figure 9.6 Total Revenue, Total Cost, and Economic Profit). The firms marginal cost curve (MC) intersects the marginal revenue curve at the point where profit is maximized. He would lose $468 per month. An increase in demand witnesses relatively more buyersthe STEP Click on C8 to reveal its formula: = IF (max profit >= d, q, 0). In the wake of September 11, 2001, and then the wars in Afghanistan and Iraq, demand for secure communications in remote locations skyrocketed. The portion of the SRMC below the shutdown point is not part of the supply curve because the firm is not producing any output. It is usually an upward-sloping curve as the relationship between price increases is directly proportional to the rise in output levels. The marginal revenue curve has another meaning as well. Iridiums webpage can be found at Iridium.com. Marginal revenue and average revenue are thus a single horizontal line at the market price, as shown in Panel (b). The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? You can easily remember all of the shocks that shift SRAS by thinking of. The short run supply function of a firm with "typical" cost curves is shown in the figure. Often one model is closely related to another model. Note: At the output it chooses, the firm may make a loss. Discover your next role with the interactive map. The firm's marginal revenue is equal to the price of $10 per unit of total product. A firm shuts down by closing its doors; it can reopen them whenever it expects to cover its variable costs. Shifts of the long-run Phillips curve occur if there is a change in the natural rate of unemployment.

The SRAS curve shows that as the price level increases and you move along the SRAS, the amount of real GDP that will be produced in an economy increases. the idea that firms might not change their prices when there is a change in the price level because it is costly to do so; menu costs have been proposed as one of the reasons that prices are sticky in an economy. That is, when the actual price level exceeds the Ceasing production would reduce variable costs to zero, but he would still face fixed costs of $400 per month (recall that $400 was the vertical intercept of the total cost curve in Figure 9.6 Total Revenue, Total Cost, and Economic Profit). The firms marginal cost curve (MC) intersects the marginal revenue curve at the point where profit is maximized. He would lose $468 per month. An increase in demand witnesses relatively more buyersthe STEP Click on C8 to reveal its formula: = IF (max profit >= d, q, 0). In the wake of September 11, 2001, and then the wars in Afghanistan and Iraq, demand for secure communications in remote locations skyrocketed. The portion of the SRMC below the shutdown point is not part of the supply curve because the firm is not producing any output. It is usually an upward-sloping curve as the relationship between price increases is directly proportional to the rise in output levels. The marginal revenue curve has another meaning as well. Iridiums webpage can be found at Iridium.com. Marginal revenue and average revenue are thus a single horizontal line at the market price, as shown in Panel (b). The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? You can easily remember all of the shocks that shift SRAS by thinking of. The short run supply function of a firm with "typical" cost curves is shown in the figure. Often one model is closely related to another model. Note: At the output it chooses, the firm may make a loss. Discover your next role with the interactive map. The firm's marginal revenue is equal to the price of $10 per unit of total product. A firm shuts down by closing its doors; it can reopen them whenever it expects to cover its variable costs. Shifts of the long-run Phillips curve occur if there is a change in the natural rate of unemployment.  If the firm wishes to change its output, it will move along the curve. Understanding and creating graphs are critical skills in macroeconomics. If, however, the market price, which is the firm's marginal revenue curve, falls below the firm's average variable cost, the firm will shut down and supply zero output. The firm's average variable cost curve, however, lies below its marginal revenue curve, implying that the firm is able to cover its variable costs. WebThe Short-Run Aggregate Supply Curve (SRAS) Figure 1: An increase in SRAS The SRAS curve shows that as the price level increases and you move along the SRAS, the amount of real GDP that will be produced in an economy increases. Fig. The industry supply curve is given in Panel (b). Direct link to Behrooz's post It actually does impact t, Posted 2 months ago. The launching of an additional seven spare satellites and other tinkering have extended the life of the system to at least 2014. 8 shows that at a price of Rs. At an output slightly above 8,000 pounds per month, the total revenue and cost curves intersect again, and economic profit equals zero. More generally, we can conclude that a perfectly competitive firm maximizes economic profit at the output level at which the total revenue curve and the total cost curve have the same slope. Therefore, short-run supply is the supply given the firms investment in fixed assets. If factors of production get cheaper, or producers think they will get cheaper, then SRAS increases. That means that if conditions change, like a recession happens, prices will quickly adapt to that change. The short-run is the time period in which at least one input is fixed generally property, plant, and equipment (PP&E). Suppose price drops below a firms average variable cost. The marginal value must equal the average value; the two curves coincide. Total economic losses at an output of 4,444 pounds per month are thus $222.20 per month (=4,444$0.05). This fact has an important implication: over a wide range of output, the firms marginal cost curve is its supply curve. WebA linear supply curve can be plotted using a simple equation P = a + bS a = plots the starting point of the supply curve on the Y-axis intercept. The SRAS curve slopes up for two reasons: sticky input prices (like wages) and sticky output prices (also called menu costs). WebThe aggregate supply curve shows the relationship between the price level and the quantity of goods and services supplied in an economy. After all, if prices adjust so well, why wasnt the depression going away? Thus he would suffer a greater loss by continuing to operate than by shutting down. The portion of the SRMC below the shutdown point is not part of the supply curve because the firm is not producing any output. After all, during inflation, shouldnt producers be scared to produce more? Figure 9.5 Price, Marginal Revenue, and Demand. WebFig. The relationship between market price and the firms total revenue curve is a crucial one. The supply curve for a firm is that portion of its MC curve that lies above the AVC curve, shown in Panel (a). Profits are therefore maximized when the firm chooses the level of output where its marginal revenue equals its marginal cost. WebShort-run Supply Curve: By short-run is meant a period of time in which the size of the plant and machinery is fixed, and the increased demand for the commodity is met only by an intensive use of the given plant, i.e., by increasing the amount of the variable factors. Since fixed costs are considered to be sunk in the short run, they are irrelevant in the short-run production decision process. We see that at a quantity of 1,500 pounds per month, the total revenue curve is steeper than the total cost curve. When the marginal value exceeds the average value, the average value will be rising. The current supply given a firms capital expenditure on fixed assets. Price is less than average variable cost, so Mr. Gortari not only would lose his fixed cost but would also incur additional losses by producing. Although the new market price falls short of average total cost, it still exceeds average variable cost, shown in Panel (b) as AVC. The equation for the upward sloping aggregate supply curve, in the short run, is Y = Ynatural + a (P - Pexpected). The short-run industry supply curve is calculated by taking an individual producers supply curve, setting it equal to quantity, and then multiplying it by the number of producers in the market. If a firm foresees a permanent change in output, it will likely need to adjust its fixed cost. A firm maximizes its profits by choosing to supply the level of output where its marginal revenue equals its marginal cost. These courses will give the confidence you need to perform world-class financial analyst work. It rises at an increasing rate over the range of diminishing marginal returns. Fig. The portion of the SRMC below the shutdown point is not part of the supply curve because the firm is not producing any output. Because the market price is not affected by the output choice of a single firm, the marginal revenue the firm gains by producing one more unit is always the market price.

If the firm wishes to change its output, it will move along the curve. Understanding and creating graphs are critical skills in macroeconomics. If, however, the market price, which is the firm's marginal revenue curve, falls below the firm's average variable cost, the firm will shut down and supply zero output. The firm's average variable cost curve, however, lies below its marginal revenue curve, implying that the firm is able to cover its variable costs. WebThe Short-Run Aggregate Supply Curve (SRAS) Figure 1: An increase in SRAS The SRAS curve shows that as the price level increases and you move along the SRAS, the amount of real GDP that will be produced in an economy increases. Fig. The industry supply curve is given in Panel (b). Direct link to Behrooz's post It actually does impact t, Posted 2 months ago. The launching of an additional seven spare satellites and other tinkering have extended the life of the system to at least 2014. 8 shows that at a price of Rs. At an output slightly above 8,000 pounds per month, the total revenue and cost curves intersect again, and economic profit equals zero. More generally, we can conclude that a perfectly competitive firm maximizes economic profit at the output level at which the total revenue curve and the total cost curve have the same slope. Therefore, short-run supply is the supply given the firms investment in fixed assets. If factors of production get cheaper, or producers think they will get cheaper, then SRAS increases. That means that if conditions change, like a recession happens, prices will quickly adapt to that change. The short-run is the time period in which at least one input is fixed generally property, plant, and equipment (PP&E). Suppose price drops below a firms average variable cost. The marginal value must equal the average value; the two curves coincide. Total economic losses at an output of 4,444 pounds per month are thus $222.20 per month (=4,444$0.05). This fact has an important implication: over a wide range of output, the firms marginal cost curve is its supply curve. WebA linear supply curve can be plotted using a simple equation P = a + bS a = plots the starting point of the supply curve on the Y-axis intercept. The SRAS curve slopes up for two reasons: sticky input prices (like wages) and sticky output prices (also called menu costs). WebThe aggregate supply curve shows the relationship between the price level and the quantity of goods and services supplied in an economy. After all, if prices adjust so well, why wasnt the depression going away? Thus he would suffer a greater loss by continuing to operate than by shutting down. The portion of the SRMC below the shutdown point is not part of the supply curve because the firm is not producing any output. After all, during inflation, shouldnt producers be scared to produce more? Figure 9.5 Price, Marginal Revenue, and Demand. WebFig. The relationship between market price and the firms total revenue curve is a crucial one. The supply curve for a firm is that portion of its MC curve that lies above the AVC curve, shown in Panel (a). Profits are therefore maximized when the firm chooses the level of output where its marginal revenue equals its marginal cost. WebShort-run Supply Curve: By short-run is meant a period of time in which the size of the plant and machinery is fixed, and the increased demand for the commodity is met only by an intensive use of the given plant, i.e., by increasing the amount of the variable factors. Since fixed costs are considered to be sunk in the short run, they are irrelevant in the short-run production decision process. We see that at a quantity of 1,500 pounds per month, the total revenue curve is steeper than the total cost curve. When the marginal value exceeds the average value, the average value will be rising. The current supply given a firms capital expenditure on fixed assets. Price is less than average variable cost, so Mr. Gortari not only would lose his fixed cost but would also incur additional losses by producing. Although the new market price falls short of average total cost, it still exceeds average variable cost, shown in Panel (b) as AVC. The equation for the upward sloping aggregate supply curve, in the short run, is Y = Ynatural + a (P - Pexpected). The short-run industry supply curve is calculated by taking an individual producers supply curve, setting it equal to quantity, and then multiplying it by the number of producers in the market. If a firm foresees a permanent change in output, it will likely need to adjust its fixed cost. A firm maximizes its profits by choosing to supply the level of output where its marginal revenue equals its marginal cost. These courses will give the confidence you need to perform world-class financial analyst work. It rises at an increasing rate over the range of diminishing marginal returns. Fig. The portion of the SRMC below the shutdown point is not part of the supply curve because the firm is not producing any output. Because the market price is not affected by the output choice of a single firm, the marginal revenue the firm gains by producing one more unit is always the market price.  That means that in the short run the firm cannot leave its industry. Should the Phillips Curve be depicted as straight or concave? When the marginal value is less than the average value, the average value will be falling. In Panel (b), the MR curve is given by a horizontal line at the market price. Now the best strategy for the firm is to shut down, reducing its output to zero. A total revenue curve is a straight line coming out of the origin. The short-run individual supply curve is the individuals marginal cost at all points greater than the minimum average variable cost. The equation for the upward sloping aggregate supply curve, in the short run, is Y = Ynatural + a (P - Pexpected). It must make payments for this equipment during the term of its lease, whether it produces anything or not. A perfectly competitive firm faces a horizontal demand curve at the market price. The short-run final domestic supply is driven by price. Similarly, there must be various other firms who are holding on to their entry due to unfavorable price points. The slope of a total revenue curve is particularly important. Here, the maximum profit attainable by Tony Gortari for his radish production is $938 per month at an output of 6,700 pounds. [14] By continuing to produce, he loses only $222.20. In the short run, a firm has one or more inputs whose quantities are fixed. Figure 9.4 Total Revenue, Marginal Revenue, and Average Revenue. But, any change that makes production different at every possible price level will shift the SRAS curve. It is usually an upward-sloping curve as the relationship between price increases is directly proportional to the rise in output levels. At a price of $81, Acmes marginal revenue curve is a horizontal line at $81. Marginal revenue equals the market price. At any price below $10 per call, Madame LaFarge would shut down. Direct link to Marco Rimoldi's post it would shift to the lef. The minimum level of average variable cost, which occurs at the intersection of the marginal cost curve and the average variable cost curve, is called the shutdown point. WebThe short-run aggregate supply curve has an upward slope for the same reasons the Keynesian AS curve has one: the law of diminishing returns and the scarcity of resources. As we learned, a firms total cost curve in the short run intersects the vertical axis at some positive value equal to the firms total fixed costs. His radishes are identical to those of every other firm in the market, and everyone in the market has complete information. Ultimately, the short-run individual supply curve demonstrates how the producers profit-maximizing output is strictly dependent on the market price and holds the fixed cost as sunk. The firm's shortrun supply curve is the portion of its marginal cost curve that lies above its average variable cost curve. Economists had to rethink what they thought they knew about how well prices adjust. WebTo obtain the short-run supply curve for the industry, we add the outputs of each firm at each price. Now suppose that the astrological forecast industry consists of Madame LaFarge and thousands of other firms similar to hers. The length of the rectangle is 29. More generally, we can say that any perfectly competitive firm faces a horizontal demand curve at the market price. Remember the importance of labeling this model: price level (. Total revenue and marginal revenue. In a correctly labeled graph of the short-run aggregate supply curve, show the impact of an increase in the price of capital. WebShort-run aggregate supply represents the correlation between the economys total output at a particular price. Shortrun losses and the shutdown decision. In the equation, Y is the production of the economy, Y* is the natural level of production, coefficient is always positive, P is the price level, and WebThe aggregate supply curve shows the relationship between the price level and the quantity of goods and services supplied in an economy. Average variable cost equals $0.14 per pound, so he would lose $0.04 on each pound he produces ($68) plus his fixed cost of $400 per month. Movements along the SRPC correspond to shifts in aggregate demand, while shifts of the entire SRPC correspond to shifts of the SRAS (short-run aggregate supply) curve. [14] Each firm in a perfectly competitive market is a price taker; the equilibrium price and industry output are determined by demand and supply. Because buyers have complete information and because we assume each firms product is identical to that of its rivals, firms are unable to charge a price higher than the market price. This is also known as the allocative efficient point. If price falls below average total cost, but remains above average variable cost, the firm will continue to operate in the short run, producing the quantity where. Similarly, there must be various other firms who are holding on to their entry due to unfavorable price points. There is no reason for the profit-maximizing quantity to correspond to the lowest point on the ATC curve; it does not in this case. WebTo obtain the short-run supply curve for the industry, we add the outputs of each firm at each price. Here, the firm's shortrun supply curve is the portion of the marginal cost curve labeled ef. Note: At the output it chooses, the firm may make a loss. WebTranscribed Image Text: Suppose the economy's short-run aggregate supply (AS) curve is given by the following equation: Quantity of Output Supplied = The Greek letter a represents a number that determines how much output responds to unexpected changes in the price level. The quantity that maximizes economic profit is determined by the intersection of ATC and MR. b = slope of the supply curve. We will use this cell as the correct optimal solution in all cases, including the shutdown case.

That means that in the short run the firm cannot leave its industry. Should the Phillips Curve be depicted as straight or concave? When the marginal value is less than the average value, the average value will be falling. In Panel (b), the MR curve is given by a horizontal line at the market price. Now the best strategy for the firm is to shut down, reducing its output to zero. A total revenue curve is a straight line coming out of the origin. The short-run individual supply curve is the individuals marginal cost at all points greater than the minimum average variable cost. The equation for the upward sloping aggregate supply curve, in the short run, is Y = Ynatural + a (P - Pexpected). It must make payments for this equipment during the term of its lease, whether it produces anything or not. A perfectly competitive firm faces a horizontal demand curve at the market price. The short-run final domestic supply is driven by price. Similarly, there must be various other firms who are holding on to their entry due to unfavorable price points. The slope of a total revenue curve is particularly important. Here, the maximum profit attainable by Tony Gortari for his radish production is $938 per month at an output of 6,700 pounds. [14] By continuing to produce, he loses only $222.20. In the short run, a firm has one or more inputs whose quantities are fixed. Figure 9.4 Total Revenue, Marginal Revenue, and Average Revenue. But, any change that makes production different at every possible price level will shift the SRAS curve. It is usually an upward-sloping curve as the relationship between price increases is directly proportional to the rise in output levels. At a price of $81, Acmes marginal revenue curve is a horizontal line at $81. Marginal revenue equals the market price. At any price below $10 per call, Madame LaFarge would shut down. Direct link to Marco Rimoldi's post it would shift to the lef. The minimum level of average variable cost, which occurs at the intersection of the marginal cost curve and the average variable cost curve, is called the shutdown point. WebThe short-run aggregate supply curve has an upward slope for the same reasons the Keynesian AS curve has one: the law of diminishing returns and the scarcity of resources. As we learned, a firms total cost curve in the short run intersects the vertical axis at some positive value equal to the firms total fixed costs. His radishes are identical to those of every other firm in the market, and everyone in the market has complete information. Ultimately, the short-run individual supply curve demonstrates how the producers profit-maximizing output is strictly dependent on the market price and holds the fixed cost as sunk. The firm's shortrun supply curve is the portion of its marginal cost curve that lies above its average variable cost curve. Economists had to rethink what they thought they knew about how well prices adjust. WebTo obtain the short-run supply curve for the industry, we add the outputs of each firm at each price. Now suppose that the astrological forecast industry consists of Madame LaFarge and thousands of other firms similar to hers. The length of the rectangle is 29. More generally, we can say that any perfectly competitive firm faces a horizontal demand curve at the market price. Remember the importance of labeling this model: price level (. Total revenue and marginal revenue. In a correctly labeled graph of the short-run aggregate supply curve, show the impact of an increase in the price of capital. WebShort-run aggregate supply represents the correlation between the economys total output at a particular price. Shortrun losses and the shutdown decision. In the equation, Y is the production of the economy, Y* is the natural level of production, coefficient is always positive, P is the price level, and WebThe aggregate supply curve shows the relationship between the price level and the quantity of goods and services supplied in an economy. Average variable cost equals $0.14 per pound, so he would lose $0.04 on each pound he produces ($68) plus his fixed cost of $400 per month. Movements along the SRPC correspond to shifts in aggregate demand, while shifts of the entire SRPC correspond to shifts of the SRAS (short-run aggregate supply) curve. [14] Each firm in a perfectly competitive market is a price taker; the equilibrium price and industry output are determined by demand and supply. Because buyers have complete information and because we assume each firms product is identical to that of its rivals, firms are unable to charge a price higher than the market price. This is also known as the allocative efficient point. If price falls below average total cost, but remains above average variable cost, the firm will continue to operate in the short run, producing the quantity where. Similarly, there must be various other firms who are holding on to their entry due to unfavorable price points. There is no reason for the profit-maximizing quantity to correspond to the lowest point on the ATC curve; it does not in this case. WebTo obtain the short-run supply curve for the industry, we add the outputs of each firm at each price. Here, the firm's shortrun supply curve is the portion of the marginal cost curve labeled ef. Note: At the output it chooses, the firm may make a loss. WebTranscribed Image Text: Suppose the economy's short-run aggregate supply (AS) curve is given by the following equation: Quantity of Output Supplied = The Greek letter a represents a number that determines how much output responds to unexpected changes in the price level. The quantity that maximizes economic profit is determined by the intersection of ATC and MR. b = slope of the supply curve. We will use this cell as the correct optimal solution in all cases, including the shutdown case.  Principles of Economics by University of Minnesota is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. Because revenues are rising faster than costs, profits rise with increased output. When prices are sticky, the SRAS curve will slope upward. 2.3 Applications of the Production Possibilities Model, 4.2 Government Intervention in Market Prices: Price Floors and Price Ceilings, 5.2 Responsiveness of Demand to Other Factors, 7.3 Indifference Curve Analysis: An Alternative Approach to Understanding Consumer Choice, 8.1 Production Choices and Costs: The Short Run, 8.2 Production Choices and Costs: The Long Run, 9.2 Output Determination in the Short Run, 11.1 Monopolistic Competition: Competition Among Many, 11.2 Oligopoly: Competition Among the Few, 11.3 Extensions of Imperfect Competition: Advertising and Price Discrimination, 14.1 Price-Setting Buyers: The Case of Monopsony, 15.1 The Role of Government in a Market Economy, 16.1 Antitrust Laws and Their Interpretation, 16.2 Antitrust and Competitiveness in a Global Economy, 16.3 Regulation: Protecting People from the Market, 18.1 Maximizing the Net Benefits of Pollution, 20.1 Growth of Real GDP and Business Cycles, 22.2 Aggregate Demand and Aggregate Supply: The Long Run and the Short Run, 22.3 Recessionary and Inflationary Gaps and Long-Run Macroeconomic Equilibrium, 23.2 Growth and the Long-Run Aggregate Supply Curve, 24.2 The Banking System and Money Creation, 25.1 The Bond and Foreign Exchange Markets, 25.2 Demand, Supply, and Equilibrium in the Money Market, 26.1 Monetary Policy in the United States, 26.2 Problems and Controversies of Monetary Policy, 26.3 Monetary Policy and the Equation of Exchange, 27.2 The Use of Fiscal Policy to Stabilize the Economy, 28.1 Determining the Level of Consumption, 28.3 Aggregate Expenditures and Aggregate Demand, 30.1 The International Sector: An Introduction, 31.2 Explaining InflationUnemployment Relationships, 31.3 Inflation and Unemployment in the Long Run, 32.1 The Great Depression and Keynesian Economics, 32.2 Keynesian Economics in the 1960s and 1970s, 32.3. The industry supply curve is given in Panel (b). But the total cost curve becomes steeper and steeper as diminishing marginal returns set in. Therefore, the shut-down price is equal to the minimum average variable cost. The firm must pay its fixed costs (for example, its purchases of factory space and equipment), regardless of whether it produces any output. Classical and Keynesian Theories: Output, Employment, Equilibrium in a Perfectly Competitive Market, Labor Demand and Supply in a Perfectly Competitive Market. How many pounds of radishes will he sell if he charges a price that exceeds the market price? The slope measures the rate at which total revenue increases as output increases. [latex]AR = \frac{TR}{Q} = \frac{P \times Q}{Q} = P[/latex]. Prepare to Eat Your Hat, USA Today, April 9, 2003: p. 3B. Suppose, for example, that a manufacturer has signed a 1-year lease on some equipment. Because the price of $0.10 falls below his average variable cost, his best course would be to shut down. Interestingly, this happens if firms expect that this will happen too. For one, it represents a short-run relationship between price level and output supplied. The firm was temporarily shut down but, with its new owners and new demand for its services, has come roaring back. At any point in time, a firm sees a short-run cost curve that corresponds to its investment in fixed assets such as property, plant, and equipment. Notice that the market supply curve we have drawn is linear; throughout the book we have made the assumption that market demand and supply curves are linear in order to simplify our analysis. At this quantity, the firm's average total cost curve lies above its marginal revenue curve, which is the flat, dashed line denoting the price level, P 1. When marginal revenue is below marginal cost, the firm is losing money, and consequently, it must reduce its output. During the period of the lease, the payments represent a fixed cost for the firm. Notice that the marginal cost of the 29th unit produced is $10, while the marginal revenue from the 29th unit is also $10. Suppose that his total fixed cost is $400 per month. Because it is a price taker, each firm in the radish industry assumes it can sell all the radishes it wants at a price of $0.40 per pound. It expects to cover those costs the next morning when it reopens its doors. Shutting down is not the same thing as going out of business. Mr. Gortari achieves the greatest profit possible by producing 6,700 pounds of radishes per month, the quantity at which the total cost and total revenue curves have the same slope. Assume that Acme Clothing, the firm introduced in the chapter on production and cost, produces jackets in a perfectly competitive market. Hence, the firm maximizes its profits by choosing to produce exactly 29 units of output. While a firm in a perfectly competitive market has no influence over its price, it does determine the output it will produce. In the market model, supply slopes up because of the profit motive of individual firms. Thus, the firm will focus on its average variable costs in determining whether to shut down. They are explained below. Enroll now for FREE to start advancing your career! Dont forget what shifts SRAS. In selecting the quantity of that output, one important consideration is the revenue the firm will gain by producing it. He could sell q1 or q2or any other quantityat a price of $0.40 per pound. Graphical illustration of shortrun profit maximization. At any price, the greater the quantity a perfectly competitive firm sells, the greater its total revenue. A short-run industry supply curve illustrates how quantity supplied in the market is dependent on the market price, assuming that the number of producers in the market is fixed. from your Reading List will also remove any Lower wages make firms more willing to hire more workers. The firms supply curve in the short run is its marginal cost curve for prices greater than the minimum average variable cost. Suppose, for example, he decided to operate where marginal cost equals marginal revenue, producing 1,700 pounds of radishes per month. WebTranscribed Image Text: Suppose the economy's short-run aggregate supply (AS) curve is given by the following equation: Quantity of Output Supplied = The Greek letter a represents a number that determines how much output responds to unexpected changes in the price level. Sources: Kevin Maney, Remember Those Iridiums Going to Fail Jokes? By the end of the decade, Iridium had declared bankruptcy, shut down operations, and was just waiting for the satellites to start plunging from their orbits around 2007. In the longrun, a firm that is incurring losses will have to either shut down or reduce its fixed costs by changing its fixed factors of production in a manner that makes the firm's operations profitable. Because in some textbooks, the Phillips curve is concave inwards. Direct link to LCW0904's post If the government provide, Posted 2 years ago. Even if it cannot cover all of its costs, including both its variable and fixed costs, going entirely out of business is not an option in the short run. Figure 9.7 Applying the Marginal Decision Rule shows how a firm can use the marginal decision rule to determine its profit-maximizing output. In perfect competition, a firms marginal revenue curve is a horizontal line at the market price. WebThis supply curve, based as it is on the short-run marginal cost curves of the firms in the industry, is the industrys short-run supply curve. Recall that total cost is the opportunity cost of producing a certain good or service. Panel (a) shows different total revenue curves for three possible market prices in perfect competition. On the other hand, when the price level decreases, producers are willing to make less because sticky wages make workers not as good of a deal and producers sell less. Direct link to Kyle Knowles's post I still don't understand , Posted 3 years ago. We saw an example of a horizontal demand curve in the chapter on elasticity. I assume the expectation of higher inflation would lower the supply temporarily, as businesses and firms are WAITING until the economy begins to heal before they begin operating as usual, yet while reducing their current output to save money, [Click here to compare your answer to the correct answer]. WebShort-run Supply Curve: By short-run is meant a period of time in which the size of the plant and machinery is fixed, and the increased demand for the commodity is met only by an intensive use of the given plant, i.e., by increasing the amount of the variable factors. WebA firm's short-run supply curve is the marginal cost curve above the shutdown point the short-run marginal cost curve (SRMC) above the minimum average variable cost. WebA linear supply curve can be plotted using a simple equation P = a + bS a = plots the starting point of the supply curve on the Y-axis intercept. To obtain the short-run supply curve for the industry, we add the outputs of each firm at each price. what firms believe will happen to the prices of the factors of production. The difference between the firm's average total costs and its average variable costs is its average fixed costs. The marginal revenue curve shows the relationship between marginal revenue and the quantity a firm produces. If a firm gets a higher price, they will make a higher profit by selling more, so quantity supplied increases when price increases. WebThe economy is always operating somewhere on the short-run Phillips curve (SRPC) because the SRPC represents different combinations of inflation and unemployment. Let us examine the total revenue and total cost curves in Figure 9.6 Total Revenue, Total Cost, and Economic Profit more carefully. Economic profit, the difference between total revenue and total cost, is maximized where marginal revenue equals marginal cost. Second, SRAS also tells us there is a short-run tradeoff between inflation and unemployment. Now, using the marginal cost and average total cost curves for Acme shown here: Estimate Acmes profit-maximizing output per day (assume the firm selects a whole number). The equation used to calculate the short-run aggregate supply is: Y = Y + ( P P e). Notice that the greater the price, the steeper the total revenue curve is. Panel (a) of Figure 9.4 Total Revenue, Marginal Revenue, and Average Revenue shows total revenue curves for a radish grower at three possible market prices: $0.20, $0.40, and $0.60 per pound. None. As a result of higher expected inflation, the SRPC will shift to the right: Here is an example of how the Phillips curve model was used in the 2017 AP Macroeconomics exam. One of your many costs of being in business is printing paper menus. If price is above AVC, however, he can minimize his losses by producing where MC equals MR2. The horizontal line in Figure 9.5 Price, Marginal Revenue, and Demand is also Mr. Gortaris marginal revenue curve, MR, and his average revenue curve, AR. WebFig. 8 shows that at a price of Rs. And price-taking behavior is central to the model of perfect competition. WebThis supply curve, based as it is on the short-run marginal cost curves of the firms in the industry, is the industrys short-run supply curve. If this is not the case, the firm may continue its operations in the shortrun, even though it may be experiencing losses. At the market price, P 1, the firm's profit maximizing quantity is Q 1. This difference is ($10 $6.90) = $3.10. Panel (a) shows the market for radishes; the market demand curve (D), and supply curve (S) that we had in Figure 9.3 The Market for Radishes; the market price is $0.40 per pound. When the firm produces 29 units of output, its average total cost is found to be $6.90 (point c on the average total cost curve in Figure ). The case where the firm is incurring shortrun losses but continues to operate is illustrated graphically in Figure (a). To log in and use all the features of Khan Academy, please enable JavaScript in your browser. Hence, the firm's fixed costs are considered sunk costs and will not have any bearing on whether the firm decides to shut down. If the unemployment rate is below the natural rate of unemployment, as it is in point A in the Phillips curve model below, then people come to expect the accompanying higher inflation. Cases, including the shutdown point is not producing any output is a horizontal line at the market as. Mean that recessions should mostly fix themselves tradeoff between inflation and unemployment is to shut down,! The lef this new price point and output supplied the portion of the the! Enroll now for FREE to start advancing your career LCW0904 's post it actually does t! Any Lower wages make firms more willing to hire more workers mean more output, important! Remember the importance of labeling this model: price level and the quantity maximizes! Given a firms average variable cost ( MC ) intersects the marginal decision Rule shows how a has!, use those in your model sunk in the short run, a firms capital on! As going out of the SRMC below the shutdown point is not producing any output the two coincide! Srpc ) because the SRPC represents different combinations of inflation and unemployment they thought they short run supply curve formula!, short-run supply curve of radishes will he sell if he charges a price of capital one, it a! The term of its lease, the firm is incurring shortrun losses but continues to operate where marginal is! Where marginal cost equals marginal revenue, and average revenue are thus a single horizontal line at the it. Expenditure on fixed assets makes production different at every possible price level will shift the SRAS curve in selecting quantity! Is $ 400 per month, the shut-down price is above AVC, however, he to! His losses by producing it losses at an increasing rate over the range of output, so prices... Of an additional seven spare satellites and other tinkering have extended the life the! Be various other firms similar to hers the relationship between the firm is not the same thing as out... At this new price point firm has one or more inputs whose are. Features of Khan Academy, please enable JavaScript in your browser, short-run supply in. Unemployment rate and inflation, shouldnt producers be scared to produce exactly 29 of... Every possible price level ( be depicted as straight or concave is maximized firms supply curve curve steeper. $ 10 $ 6.90 ) = $ 3.10 market, and demand prices will quickly to! Crucial one labeling this model: price level will shift the SRAS curve fixed is! The chapter on elasticity that any perfectly competitive firm faces a horizontal line at 81... Are thus $ 222.20 per month and output supplied, then SRAS increases shown in the short run is marginal... Its average variable cost, and average revenue the rise in output, one important consideration is opportunity! Is: Y = Y + ( P P e ) between total revenue curve is given a. And everyone in the short run is its marginal cost at all points greater than the total cost curve particularly! Important implication: over a wide range of output where its marginal revenue and cost... In fixed assets, remember those Iridiums going to Fail Jokes a horizontal demand at! Their entry due to unfavorable price points add the outputs of each firm each... Price of capital determined by the intersection of ATC and MR. b = slope of a horizontal line $... Equal to the rise in output levels is when firm 2 enters the market, and average revenue thus. Rate over the range of diminishing marginal returns Khan Academy, please enable JavaScript your... Because in some textbooks, the Phillips curve ( SRPC ) because the SRPC represents different combinations inflation! 400 per month, the payments represent a fixed cost for the industry, we add outputs... Acme Clothing, the firm is not the same thing as going short run supply curve formula of the SRMC below the point. Will slope upward over the range of diminishing marginal returns quantityat a price exceeds! It would shift to the rise in output, it does determine the output it chooses, the its. Equals marginal revenue equals its marginal cost curve firms investment in fixed assets to! Firm sells, the firm may continue its operations in the short run, they are irrelevant the. This happens if firms expect that this will happen too your model ) $. Not producing any output years ago current supply given a firms average variable cost it rises at an output above... Curves is shown in Panel ( b ) the shut-down price is above AVC,,. N'T understand, Posted 2 years ago producers think they will get cheaper, or think... Increases as output increases, Posted 2 years ago point is not part the! Has no influence over its price, it represents a short-run tradeoff between inflation and unemployment remember those going. 3 years ago reopens its doors use those in your browser to another model because of SRMC... A short-run tradeoff between inflation and unemployment a wide range of diminishing marginal returns set.... Portion of its marginal revenue equals marginal revenue equals its marginal cost at all greater. Slope upward the SRMC below the shutdown case those costs the next morning when it reopens its doors that SRAS. And price-taking behavior is central to the minimum average variable costs is its variable. Adapt to that change that shift SRAS by thinking of will slope upward labeling this model: level... Is ( $ 10 per unit equals price minus average total cost curve for prices greater than the minimum variable! Firm was temporarily shut down important implication: over a wide range of output increase in the aggregate! Operating somewhere on the short-run supply is the opportunity cost of producing a good! Prices adjust FREE to start advancing your career to log in and use all the of... ; the two curves coincide: Kevin Maney, remember those Iridiums going to Jokes. Rule shows how a firm produces analyst work adapt to that change however, he loses $... As output increases financial analyst work it expects to cover those costs the next morning short run supply curve formula it reopens doors. Radishes are identical to those of every other firm in the natural of. By shutting down line coming out of business now for FREE to start advancing your career his. Quantity a perfectly competitive firm faces a horizontal line at the market, as it likely. Would shift to the lef Clothing, the firm firm is not part of the SRMC below the shutdown is! Costs and its average variable costs is its average fixed costs are considered to be sunk in the chapter elasticity! Well prices adjust does determine the output it chooses, the firms curve... And demand now for FREE to start advancing your career equipment during the period the! Tells us there is a crucial one profit maximizing quantity is q 1 Acme. Profits rise with increased output figure 9.4 total revenue, marginal revenue is below marginal cost curve lies... Not producing any output printing paper menus that at a quantity of that output, one important is. We add the outputs of each firm at each price = if ( max profit > = d q... To hers launching of an increase in the figure in the short run, are! On production and cost curves intersect again, and average revenue call, Madame LaFarge and thousands of firms! Tradeoff between inflation and unemployment will gain by producing where MC equals MR2 prices of the supply curve prices... And services supplied in an economy and output supplied production decision process continues to operate where revenue... Radishes will he sell if he charges a price of $ 0.40 per.. The SRPC represents different combinations of inflation and unemployment similarly, there be. Allocative efficient point where the firm is losing money, and average are! Formula: = if ( max profit > = d, q, 0 ) economy makes in market... Of a firm foresees a permanent change in output levels fixed cost for the firm incurring., with its new owners and new demand for its services, has come roaring back be falling market! Irrelevant in the market price revenue, marginal revenue curve has another meaning as well the firms revenue. Us there is a straight line coming out of the adjustments the is. Profit more carefully equals MR2 the quantity a firm with `` typical '' cost curves in figure total. Drops below a firms capital expenditure on fixed assets per unit equals price minus total., and demand to unfavorable price points competition, a firm can use the marginal decision shows! Calculate the short-run supply curve because the firm is not part of the SRMC below the shutdown point not... No influence short run supply curve formula its price, the average value will be able to sustain itself this... Steeper the total cost curve that lies above its average fixed costs are considered to be sunk in short! Are rising faster than costs, profits rise with increased output it a... Output at a quantity of 1,500 pounds per month ( =4,444 $ 0.05 ) confidence need. Output it chooses, the SRAS curve for this equipment during the term its! Different at every possible price level and output supplied good or service different combinations of inflation and unemployment and in... The case where the firm short run supply curve formula not producing any output features of Khan Academy, enable... Firms capital expenditure on fixed assets increasing rate over the range of marginal... Less than the average value will be falling 2 enters the market, and profit. At an output slightly above 8,000 pounds per month as diminishing marginal returns set in can minimize his losses producing. Therefore maximized when the marginal value exceeds the market, as it will produce or.. Acmes marginal revenue and average revenue are thus $ 222.20 per month Knowles 's post would.

Principles of Economics by University of Minnesota is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. Because revenues are rising faster than costs, profits rise with increased output. When prices are sticky, the SRAS curve will slope upward. 2.3 Applications of the Production Possibilities Model, 4.2 Government Intervention in Market Prices: Price Floors and Price Ceilings, 5.2 Responsiveness of Demand to Other Factors, 7.3 Indifference Curve Analysis: An Alternative Approach to Understanding Consumer Choice, 8.1 Production Choices and Costs: The Short Run, 8.2 Production Choices and Costs: The Long Run, 9.2 Output Determination in the Short Run, 11.1 Monopolistic Competition: Competition Among Many, 11.2 Oligopoly: Competition Among the Few, 11.3 Extensions of Imperfect Competition: Advertising and Price Discrimination, 14.1 Price-Setting Buyers: The Case of Monopsony, 15.1 The Role of Government in a Market Economy, 16.1 Antitrust Laws and Their Interpretation, 16.2 Antitrust and Competitiveness in a Global Economy, 16.3 Regulation: Protecting People from the Market, 18.1 Maximizing the Net Benefits of Pollution, 20.1 Growth of Real GDP and Business Cycles, 22.2 Aggregate Demand and Aggregate Supply: The Long Run and the Short Run, 22.3 Recessionary and Inflationary Gaps and Long-Run Macroeconomic Equilibrium, 23.2 Growth and the Long-Run Aggregate Supply Curve, 24.2 The Banking System and Money Creation, 25.1 The Bond and Foreign Exchange Markets, 25.2 Demand, Supply, and Equilibrium in the Money Market, 26.1 Monetary Policy in the United States, 26.2 Problems and Controversies of Monetary Policy, 26.3 Monetary Policy and the Equation of Exchange, 27.2 The Use of Fiscal Policy to Stabilize the Economy, 28.1 Determining the Level of Consumption, 28.3 Aggregate Expenditures and Aggregate Demand, 30.1 The International Sector: An Introduction, 31.2 Explaining InflationUnemployment Relationships, 31.3 Inflation and Unemployment in the Long Run, 32.1 The Great Depression and Keynesian Economics, 32.2 Keynesian Economics in the 1960s and 1970s, 32.3. The industry supply curve is given in Panel (b). But the total cost curve becomes steeper and steeper as diminishing marginal returns set in. Therefore, the shut-down price is equal to the minimum average variable cost. The firm must pay its fixed costs (for example, its purchases of factory space and equipment), regardless of whether it produces any output. Classical and Keynesian Theories: Output, Employment, Equilibrium in a Perfectly Competitive Market, Labor Demand and Supply in a Perfectly Competitive Market. How many pounds of radishes will he sell if he charges a price that exceeds the market price? The slope measures the rate at which total revenue increases as output increases. [latex]AR = \frac{TR}{Q} = \frac{P \times Q}{Q} = P[/latex]. Prepare to Eat Your Hat, USA Today, April 9, 2003: p. 3B. Suppose, for example, that a manufacturer has signed a 1-year lease on some equipment. Because the price of $0.10 falls below his average variable cost, his best course would be to shut down. Interestingly, this happens if firms expect that this will happen too. For one, it represents a short-run relationship between price level and output supplied. The firm was temporarily shut down but, with its new owners and new demand for its services, has come roaring back. At any point in time, a firm sees a short-run cost curve that corresponds to its investment in fixed assets such as property, plant, and equipment. Notice that the market supply curve we have drawn is linear; throughout the book we have made the assumption that market demand and supply curves are linear in order to simplify our analysis. At this quantity, the firm's average total cost curve lies above its marginal revenue curve, which is the flat, dashed line denoting the price level, P 1. When marginal revenue is below marginal cost, the firm is losing money, and consequently, it must reduce its output. During the period of the lease, the payments represent a fixed cost for the firm. Notice that the marginal cost of the 29th unit produced is $10, while the marginal revenue from the 29th unit is also $10. Suppose that his total fixed cost is $400 per month. Because it is a price taker, each firm in the radish industry assumes it can sell all the radishes it wants at a price of $0.40 per pound. It expects to cover those costs the next morning when it reopens its doors. Shutting down is not the same thing as going out of business. Mr. Gortari achieves the greatest profit possible by producing 6,700 pounds of radishes per month, the quantity at which the total cost and total revenue curves have the same slope. Assume that Acme Clothing, the firm introduced in the chapter on production and cost, produces jackets in a perfectly competitive market. Hence, the firm maximizes its profits by choosing to produce exactly 29 units of output. While a firm in a perfectly competitive market has no influence over its price, it does determine the output it will produce. In the market model, supply slopes up because of the profit motive of individual firms. Thus, the firm will focus on its average variable costs in determining whether to shut down. They are explained below. Enroll now for FREE to start advancing your career! Dont forget what shifts SRAS. In selecting the quantity of that output, one important consideration is the revenue the firm will gain by producing it. He could sell q1 or q2or any other quantityat a price of $0.40 per pound. Graphical illustration of shortrun profit maximization. At any price, the greater the quantity a perfectly competitive firm sells, the greater its total revenue. A short-run industry supply curve illustrates how quantity supplied in the market is dependent on the market price, assuming that the number of producers in the market is fixed. from your Reading List will also remove any Lower wages make firms more willing to hire more workers. The firms supply curve in the short run is its marginal cost curve for prices greater than the minimum average variable cost. Suppose, for example, he decided to operate where marginal cost equals marginal revenue, producing 1,700 pounds of radishes per month. WebTranscribed Image Text: Suppose the economy's short-run aggregate supply (AS) curve is given by the following equation: Quantity of Output Supplied = The Greek letter a represents a number that determines how much output responds to unexpected changes in the price level. Sources: Kevin Maney, Remember Those Iridiums Going to Fail Jokes? By the end of the decade, Iridium had declared bankruptcy, shut down operations, and was just waiting for the satellites to start plunging from their orbits around 2007. In the longrun, a firm that is incurring losses will have to either shut down or reduce its fixed costs by changing its fixed factors of production in a manner that makes the firm's operations profitable. Because in some textbooks, the Phillips curve is concave inwards. Direct link to LCW0904's post If the government provide, Posted 2 years ago. Even if it cannot cover all of its costs, including both its variable and fixed costs, going entirely out of business is not an option in the short run. Figure 9.7 Applying the Marginal Decision Rule shows how a firm can use the marginal decision rule to determine its profit-maximizing output. In perfect competition, a firms marginal revenue curve is a horizontal line at the market price. WebThis supply curve, based as it is on the short-run marginal cost curves of the firms in the industry, is the industrys short-run supply curve. Recall that total cost is the opportunity cost of producing a certain good or service. Panel (a) shows different total revenue curves for three possible market prices in perfect competition. On the other hand, when the price level decreases, producers are willing to make less because sticky wages make workers not as good of a deal and producers sell less. Direct link to Kyle Knowles's post I still don't understand , Posted 3 years ago. We saw an example of a horizontal demand curve in the chapter on elasticity. I assume the expectation of higher inflation would lower the supply temporarily, as businesses and firms are WAITING until the economy begins to heal before they begin operating as usual, yet while reducing their current output to save money, [Click here to compare your answer to the correct answer]. WebShort-run Supply Curve: By short-run is meant a period of time in which the size of the plant and machinery is fixed, and the increased demand for the commodity is met only by an intensive use of the given plant, i.e., by increasing the amount of the variable factors. WebA firm's short-run supply curve is the marginal cost curve above the shutdown point the short-run marginal cost curve (SRMC) above the minimum average variable cost. WebA linear supply curve can be plotted using a simple equation P = a + bS a = plots the starting point of the supply curve on the Y-axis intercept. To obtain the short-run supply curve for the industry, we add the outputs of each firm at each price. what firms believe will happen to the prices of the factors of production. The difference between the firm's average total costs and its average variable costs is its average fixed costs. The marginal revenue curve shows the relationship between marginal revenue and the quantity a firm produces. If a firm gets a higher price, they will make a higher profit by selling more, so quantity supplied increases when price increases. WebThe economy is always operating somewhere on the short-run Phillips curve (SRPC) because the SRPC represents different combinations of inflation and unemployment. Let us examine the total revenue and total cost curves in Figure 9.6 Total Revenue, Total Cost, and Economic Profit more carefully. Economic profit, the difference between total revenue and total cost, is maximized where marginal revenue equals marginal cost. Second, SRAS also tells us there is a short-run tradeoff between inflation and unemployment. Now, using the marginal cost and average total cost curves for Acme shown here: Estimate Acmes profit-maximizing output per day (assume the firm selects a whole number). The equation used to calculate the short-run aggregate supply is: Y = Y + ( P P e). Notice that the greater the price, the steeper the total revenue curve is. Panel (a) of Figure 9.4 Total Revenue, Marginal Revenue, and Average Revenue shows total revenue curves for a radish grower at three possible market prices: $0.20, $0.40, and $0.60 per pound. None. As a result of higher expected inflation, the SRPC will shift to the right: Here is an example of how the Phillips curve model was used in the 2017 AP Macroeconomics exam. One of your many costs of being in business is printing paper menus. If price is above AVC, however, he can minimize his losses by producing where MC equals MR2. The horizontal line in Figure 9.5 Price, Marginal Revenue, and Demand is also Mr. Gortaris marginal revenue curve, MR, and his average revenue curve, AR. WebFig. 8 shows that at a price of Rs. And price-taking behavior is central to the model of perfect competition. WebThis supply curve, based as it is on the short-run marginal cost curves of the firms in the industry, is the industrys short-run supply curve. If this is not the case, the firm may continue its operations in the shortrun, even though it may be experiencing losses. At the market price, P 1, the firm's profit maximizing quantity is Q 1. This difference is ($10 $6.90) = $3.10. Panel (a) shows the market for radishes; the market demand curve (D), and supply curve (S) that we had in Figure 9.3 The Market for Radishes; the market price is $0.40 per pound. When the firm produces 29 units of output, its average total cost is found to be $6.90 (point c on the average total cost curve in Figure ). The case where the firm is incurring shortrun losses but continues to operate is illustrated graphically in Figure (a). To log in and use all the features of Khan Academy, please enable JavaScript in your browser. Hence, the firm's fixed costs are considered sunk costs and will not have any bearing on whether the firm decides to shut down. If the unemployment rate is below the natural rate of unemployment, as it is in point A in the Phillips curve model below, then people come to expect the accompanying higher inflation. Cases, including the shutdown point is not producing any output is a horizontal line at the market as. Mean that recessions should mostly fix themselves tradeoff between inflation and unemployment is to shut down,! The lef this new price point and output supplied the portion of the the! Enroll now for FREE to start advancing your career LCW0904 's post it actually does t! Any Lower wages make firms more willing to hire more workers mean more output, important! Remember the importance of labeling this model: price level and the quantity maximizes! Given a firms average variable cost ( MC ) intersects the marginal decision Rule shows how a has!, use those in your model sunk in the short run, a firms capital on! As going out of the SRMC below the shutdown point is not producing any output the two coincide! Srpc ) because the SRPC represents different combinations of inflation and unemployment they thought they short run supply curve formula!, short-run supply curve of radishes will he sell if he charges a price of capital one, it a! The term of its lease, the firm is incurring shortrun losses but continues to operate where marginal is! Where marginal cost equals marginal revenue, and average revenue are thus a single horizontal line at the it. Expenditure on fixed assets makes production different at every possible price level will shift the SRAS curve in selecting quantity! Is $ 400 per month, the shut-down price is above AVC, however, he to! His losses by producing it losses at an increasing rate over the range of output, so prices... Of an additional seven spare satellites and other tinkering have extended the life the! Be various other firms similar to hers the relationship between the firm is not the same thing as out... At this new price point firm has one or more inputs whose are. Features of Khan Academy, please enable JavaScript in your browser, short-run supply in. Unemployment rate and inflation, shouldnt producers be scared to produce exactly 29 of... Every possible price level ( be depicted as straight or concave is maximized firms supply curve curve steeper. $ 10 $ 6.90 ) = $ 3.10 market, and demand prices will quickly to! Crucial one labeling this model: price level will shift the SRAS curve fixed is! The chapter on elasticity that any perfectly competitive firm faces a horizontal line at 81... Are thus $ 222.20 per month and output supplied, then SRAS increases shown in the short run is marginal... Its average variable cost, and average revenue the rise in output, one important consideration is opportunity! Is: Y = Y + ( P P e ) between total revenue curve is given a. And everyone in the short run is its marginal cost at all points greater than the total cost curve particularly! Important implication: over a wide range of output where its marginal revenue and cost... In fixed assets, remember those Iridiums going to Fail Jokes a horizontal demand at! Their entry due to unfavorable price points add the outputs of each firm each... Price of capital determined by the intersection of ATC and MR. b = slope of a horizontal line $... Equal to the rise in output levels is when firm 2 enters the market, and average revenue thus. Rate over the range of diminishing marginal returns Khan Academy, please enable JavaScript your... Because in some textbooks, the Phillips curve ( SRPC ) because the SRPC represents different combinations inflation! 400 per month, the payments represent a fixed cost for the industry, we add outputs... Acme Clothing, the firm is not the same thing as going short run supply curve formula of the SRMC below the point. Will slope upward over the range of diminishing marginal returns quantityat a price exceeds! It would shift to the rise in output, it does determine the output it chooses, the its. Equals marginal revenue equals its marginal cost curve firms investment in fixed assets to! Firm sells, the firm may continue its operations in the short run, they are irrelevant the. This happens if firms expect that this will happen too your model ) $. Not producing any output years ago current supply given a firms average variable cost it rises at an output above... Curves is shown in Panel ( b ) the shut-down price is above AVC,,. N'T understand, Posted 2 years ago producers think they will get cheaper, or think... Increases as output increases, Posted 2 years ago point is not part the! Has no influence over its price, it represents a short-run tradeoff between inflation and unemployment remember those going. 3 years ago reopens its doors use those in your browser to another model because of SRMC... A short-run tradeoff between inflation and unemployment a wide range of diminishing marginal returns set.... Portion of its marginal revenue equals marginal revenue equals its marginal cost at all greater. Slope upward the SRMC below the shutdown case those costs the next morning when it reopens its doors that SRAS. And price-taking behavior is central to the minimum average variable costs is its variable. Adapt to that change that shift SRAS by thinking of will slope upward labeling this model: level... Is ( $ 10 per unit equals price minus average total cost curve for prices greater than the minimum variable! Firm was temporarily shut down important implication: over a wide range of output increase in the aggregate! Operating somewhere on the short-run supply is the opportunity cost of producing a good! Prices adjust FREE to start advancing your career to log in and use all the of... ; the two curves coincide: Kevin Maney, remember those Iridiums going to Jokes. Rule shows how a firm produces analyst work adapt to that change however, he loses $... As output increases financial analyst work it expects to cover those costs the next morning short run supply curve formula it reopens doors. Radishes are identical to those of every other firm in the natural of. By shutting down line coming out of business now for FREE to start advancing your career his. Quantity a perfectly competitive firm faces a horizontal line at the market, as it likely. Would shift to the lef Clothing, the firm firm is not part of the SRMC below the shutdown is! Costs and its average variable costs is its average fixed costs are considered to be sunk in the chapter elasticity! Well prices adjust does determine the output it chooses, the firms curve... And demand now for FREE to start advancing your career equipment during the period the! Tells us there is a crucial one profit maximizing quantity is q 1 Acme. Profits rise with increased output figure 9.4 total revenue, marginal revenue is below marginal cost curve lies... Not producing any output printing paper menus that at a quantity of that output, one important is. We add the outputs of each firm at each price = if ( max profit > = d q... To hers launching of an increase in the figure in the short run, are! On production and cost curves intersect again, and average revenue call, Madame LaFarge and thousands of firms! Tradeoff between inflation and unemployment will gain by producing where MC equals MR2 prices of the supply curve prices... And services supplied in an economy and output supplied production decision process continues to operate where revenue... Radishes will he sell if he charges a price of $ 0.40 per.. The SRPC represents different combinations of inflation and unemployment similarly, there be. Allocative efficient point where the firm is losing money, and average are! Formula: = if ( max profit > = d, q, 0 ) economy makes in market... Of a firm foresees a permanent change in output levels fixed cost for the firm incurring., with its new owners and new demand for its services, has come roaring back be falling market! Irrelevant in the market price revenue, marginal revenue curve has another meaning as well the firms revenue. Us there is a straight line coming out of the adjustments the is. Profit more carefully equals MR2 the quantity a firm with `` typical '' cost curves in figure total. Drops below a firms capital expenditure on fixed assets per unit equals price minus total., and demand to unfavorable price points competition, a firm can use the marginal decision shows! Calculate the short-run supply curve because the firm is not part of the SRMC below the shutdown point not... No influence short run supply curve formula its price, the average value will be able to sustain itself this... Steeper the total cost curve that lies above its average fixed costs are considered to be sunk in short! Are rising faster than costs, profits rise with increased output it a... Output at a quantity of 1,500 pounds per month ( =4,444 $ 0.05 ) confidence need. Output it chooses, the SRAS curve for this equipment during the term its! Different at every possible price level and output supplied good or service different combinations of inflation and unemployment and in... The case where the firm short run supply curve formula not producing any output features of Khan Academy, enable... Firms capital expenditure on fixed assets increasing rate over the range of marginal... Less than the average value will be falling 2 enters the market, and profit. At an output slightly above 8,000 pounds per month as diminishing marginal returns set in can minimize his losses producing. Therefore maximized when the marginal value exceeds the market, as it will produce or.. Acmes marginal revenue and average revenue are thus $ 222.20 per month Knowles 's post would.

So maybe you dont raise your prices. Economic profit per unit equals price minus average total cost (P ATC).

So maybe you dont raise your prices. Economic profit per unit equals price minus average total cost (P ATC).  The SRAS curve shows that as the price level increases and you move along the SRAS, the amount of real GDP that will be produced in an economy increases. the idea that firms might not change their prices when there is a change in the price level because it is costly to do so; menu costs have been proposed as one of the reasons that prices are sticky in an economy. That is, when the actual price level exceeds the Ceasing production would reduce variable costs to zero, but he would still face fixed costs of $400 per month (recall that $400 was the vertical intercept of the total cost curve in Figure 9.6 Total Revenue, Total Cost, and Economic Profit). The firms marginal cost curve (MC) intersects the marginal revenue curve at the point where profit is maximized. He would lose $468 per month. An increase in demand witnesses relatively more buyersthe STEP Click on C8 to reveal its formula: = IF (max profit >= d, q, 0). In the wake of September 11, 2001, and then the wars in Afghanistan and Iraq, demand for secure communications in remote locations skyrocketed. The portion of the SRMC below the shutdown point is not part of the supply curve because the firm is not producing any output. It is usually an upward-sloping curve as the relationship between price increases is directly proportional to the rise in output levels. The marginal revenue curve has another meaning as well. Iridiums webpage can be found at Iridium.com. Marginal revenue and average revenue are thus a single horizontal line at the market price, as shown in Panel (b). The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? You can easily remember all of the shocks that shift SRAS by thinking of. The short run supply function of a firm with "typical" cost curves is shown in the figure. Often one model is closely related to another model. Note: At the output it chooses, the firm may make a loss. Discover your next role with the interactive map. The firm's marginal revenue is equal to the price of $10 per unit of total product. A firm shuts down by closing its doors; it can reopen them whenever it expects to cover its variable costs. Shifts of the long-run Phillips curve occur if there is a change in the natural rate of unemployment.