Next quarter saw a ~20% selling at prices between ~$337 and ~$568 while the last two quarters have seen a ~200% stake increase at prices between ~$289 and ~$445. Q4 2019 saw a ~30% selling at prices between $267 and $337. Scala Entwickler:in gesucht - Sofortiger Start mglich! The round was led by Tiger Global Management with participation from SoftBank Group, BOND, Forerunner Ventures, Qualcomm Ventures LLC, Sam Altman, Lachy Groom, Kindred Ventures, Marc Benioffs TIME Ventures, Valia Ventures, NEXT VENTRES, Plexo Capital and Wilson Sonsini Goodrich & Rosati. The position has wavered. Tiger Global Management LLC. Peloton Interactive (PTON): PTON is a ~2% of the portfolio position purchased in Q1 2020 at prices between $19.50 and $33.50. WebPositions held by Tiger Global Management consolidated in one spreadsheet with up to 7 years of data . 13F filing from TIGER GLOBAL MANAGEMENT LLC, enter your Performance. Communications from Tiger Global will come from the tigerglobal.com domain and/or through Tiger Globals Investor Portal. A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. A pre-IPO investment of ~54M shares was sold out by Q4 2012. There was a minor ~2% stake increase this quarter.  Things have gone from bad to worse at Tiger Global Management s flagship hedge fund. TAL Education (TAL): The TAL stake was purchased in Q4 2016 at prices between $11.25 and $13.75 and increased by ~40% the following quarter at prices between $11.50 and $18. Note: TAL Education has seen a previous roundtrip in the portfolio. It was first purchased in Q4 2016 at prices between $245 and $289. There was a ~5% stake increase this quarter. For fund there is a match between the location of its establishment and the land of its numerous investments - United States.The usual cause for the fund is to invest in rounds with 3-4 partakers. Tiger Global Management was founded in 2001 by Chase Coleman (Trades, Portfolio) after hedge fund legend Julian Robertson (Trades, Portfolio) gave him $25 million to start his own fund. WebClear Managements team of trained professionals is committed to providing the finest service available to both owners and residents. Portfolio Gain +113.20%. Portfolio value: $8,163M+ Period: 2022 Q4.

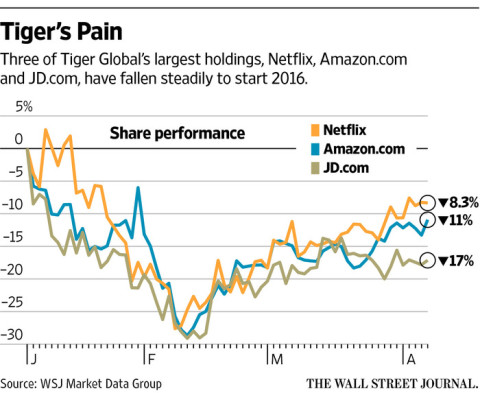

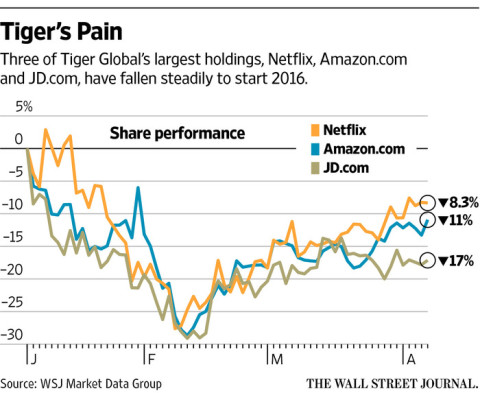

Things have gone from bad to worse at Tiger Global Management s flagship hedge fund. TAL Education (TAL): The TAL stake was purchased in Q4 2016 at prices between $11.25 and $13.75 and increased by ~40% the following quarter at prices between $11.50 and $18. Note: TAL Education has seen a previous roundtrip in the portfolio. It was first purchased in Q4 2016 at prices between $245 and $289. There was a ~5% stake increase this quarter. For fund there is a match between the location of its establishment and the land of its numerous investments - United States.The usual cause for the fund is to invest in rounds with 3-4 partakers. Tiger Global Management was founded in 2001 by Chase Coleman (Trades, Portfolio) after hedge fund legend Julian Robertson (Trades, Portfolio) gave him $25 million to start his own fund. WebClear Managements team of trained professionals is committed to providing the finest service available to both owners and residents. Portfolio Gain +113.20%. Portfolio value: $8,163M+ Period: 2022 Q4.

The transaction had an impact of -3.77% on the equity portfolio. It has seen multiple roundtrips since 2011. Investment Advisor Please. This information is available in the PitchBook Platform. Tiger Global Management has disclosed a total of 55 security holdings in their (2022 Q4) SEC 13F filing(s) with portfolio value of $8,163,347,431. You post comments at your own choice and risk. Next quarter saw a ~28% stake increase at prices between $26.75 and $58.50. Tiger Global Management is an American investment firm that focuses on internet, software, consumer, and financial technology industries. $9.26 Billion Total portoflio value. All text and design is copyright 2020 WhaleWisdom.com. Melio, a leading B2B payments platform for small businesses, today announced it has raised an additional $250m, tripling the companys valuation to $4bn since January 2021. Visit the Career Advice Hub to see tips on interviewing and resume writing. WebWe are a well-funded, revenue-generating company with two offices in the United States and a global presence. Chase Colemans Tiger Global Management suffered huge losses in May amid a tech-driven sell-off, making the hedge funds tough 2022 even worse. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. [2]: https://www.linkedin.com/company/tiger-global-management/about/ The stock currently trades at ~$592. TheUK Stock Market Needs Another Nigel Lawson, Lending Slowdown Will End the Rate Hike Cycle, UniCredits Orcel Warns of More Uncertainty Facing Banking Industry, Xi Jinping Launches a Charm Offensive to Repair Chinas Tattered Image, A Two-Century-Old Grain Trader Turnsto Food Science, New York City Reaches $5.5 Billion Deal With Biggest Cop Union, Women More Likely to Be Rejected When They Ask for More Pay, Spain to Invest $2.3 Billion in South African Energy Transition, Elusive Billionaire Mints It Betting Against Europe's Green Plans, Texas State Bill TargetsLocal Tenant Protections Against Eviction, Chicagos Transit Chief Says Crime Is Hurting Ridership Rebound. Data constructed from Tiger Global's 13F filings for Q1 2021 and Q2 2021. To see Tiger Global Management's original 13F reports (2022 Q4), please click on the "important" button. Analysts Disclosure: I/we have a beneficial long position in the shares of AMZN, BABA, COIN either through stock ownership, options, or other derivatives. About. In Microsoft Corporation (NASDAQ: MSFT), Tiger Global Management LLC owns 13.72 million shares. ? In thesame time you shall not use vulgar, abusive or defamatory language as well as expresshatred or call to violence or cruelty. The fund was located in North America if to be more exact in United States.The average startup value when the investment from Tiger Global Management is more than 1 billion dollars.

The transaction had an impact of -3.77% on the equity portfolio. It has seen multiple roundtrips since 2011. Investment Advisor Please. This information is available in the PitchBook Platform. Tiger Global Management has disclosed a total of 55 security holdings in their (2022 Q4) SEC 13F filing(s) with portfolio value of $8,163,347,431. You post comments at your own choice and risk. Next quarter saw a ~28% stake increase at prices between $26.75 and $58.50. Tiger Global Management is an American investment firm that focuses on internet, software, consumer, and financial technology industries. $9.26 Billion Total portoflio value. All text and design is copyright 2020 WhaleWisdom.com. Melio, a leading B2B payments platform for small businesses, today announced it has raised an additional $250m, tripling the companys valuation to $4bn since January 2021. Visit the Career Advice Hub to see tips on interviewing and resume writing. WebWe are a well-funded, revenue-generating company with two offices in the United States and a global presence. Chase Colemans Tiger Global Management suffered huge losses in May amid a tech-driven sell-off, making the hedge funds tough 2022 even worse. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. [2]: https://www.linkedin.com/company/tiger-global-management/about/ The stock currently trades at ~$592. TheUK Stock Market Needs Another Nigel Lawson, Lending Slowdown Will End the Rate Hike Cycle, UniCredits Orcel Warns of More Uncertainty Facing Banking Industry, Xi Jinping Launches a Charm Offensive to Repair Chinas Tattered Image, A Two-Century-Old Grain Trader Turnsto Food Science, New York City Reaches $5.5 Billion Deal With Biggest Cop Union, Women More Likely to Be Rejected When They Ask for More Pay, Spain to Invest $2.3 Billion in South African Energy Transition, Elusive Billionaire Mints It Betting Against Europe's Green Plans, Texas State Bill TargetsLocal Tenant Protections Against Eviction, Chicagos Transit Chief Says Crime Is Hurting Ridership Rebound. Data constructed from Tiger Global's 13F filings for Q1 2021 and Q2 2021. To see Tiger Global Management's original 13F reports (2022 Q4), please click on the "important" button. Analysts Disclosure: I/we have a beneficial long position in the shares of AMZN, BABA, COIN either through stock ownership, options, or other derivatives. About. In Microsoft Corporation (NASDAQ: MSFT), Tiger Global Management LLC owns 13.72 million shares. ? In thesame time you shall not use vulgar, abusive or defamatory language as well as expresshatred or call to violence or cruelty. The fund was located in North America if to be more exact in United States.The average startup value when the investment from Tiger Global Management is more than 1 billion dollars.  Tiger Global had a majority ownership stake in TAL Education prior to its IPO. Win whats next. The fund focuses on investments in the United States as 53.2% of the portfolio

Tiger Global had a majority ownership stake in TAL Education prior to its IPO. Win whats next. The fund focuses on investments in the United States as 53.2% of the portfolio  Prior to founding Tiger Global Management in 2001, Chase Coleman was the technology analyst at Tiger Management from 1997 to 2000, making him a bona fide tiger cub. Currently, their heaviest sector is Technology making up 50.1% of the total portfolio value. Total Fund Raised $36.1B. These were some of the top changes Tiger Global made in the first quarter of 2022, according to its 13F filing. for Q4 2022: commodity pool operator or commodity trading advisor, Percentage of assets under management,Performance-based fees, CHIEF OPERATING OFFICER, INVESTMENT MANAGEMENT DIVISION, GOLDMAN SACHS GLOBAL ADVISORY PRODUCTS LLC, CO-HEAD, INVESTMENT MANAGEMENT DIVISION (CO-CHIEF EXECUTIVE OFFICER), CO-CHIEF OPERATING OFFICER, INVESTMENT MANAGEMENT DIVISION, CO-HEAD, INVESTMENT MANAGEMENT DIVISION OF GSAM L.P. (CO-CHIEF EXECUTIVE OFFICER), GOLDMAN SACHS ASSET MANAGEMENT INTERNATIONAL. The 2.37% SHOP position was built in the last three quarters at prices between ~$885 and ~$1474 and it is now at ~$1444. Facebook sets this cookie to show relevant advertisements to users by tracking user behaviour across the web, on sites that have Facebook pixel or Facebook social plugin. This cookie is installed by Google Analytics. What are the top startups funded by Tiger Global Management? The firm prefers to invest in the internet, software, consumer, and financial technology sectors. Roblox Corp. (RBLX): RBLX had an IPO in March. H1 2017 saw the position built up to a large ~9% portfolio stake (4M shares) at prices between $210 and $272. If you think that some of this information is not accurate, please, The average size of a deal this fund participated in, How often the fund supports its portfolio startups at next rounds. divided by the total MV of the fund. WebExclusive look into the current portfolio and holdings of Tiger Global (Tiger Global Management) with a total portfolio value of $9.61 Billion invested in 488 stocks. WebAccel, formerly known as Accel Partners, is an American venture capital firm. They had an IPO in December. Tiger joined a $450 million investment in fintech company Brex, tied for the second-biggest Silicon Valley deal, and cloud vendor Outreachs $200 million round, the No. Shares started trading at ~$70 and currently goes for $83.22. Get the full list, Morningstar Institutional Equity Research, Managing Director, Partner & Portfolio Manager, Private Equity. The stock is now at ~$340.

Prior to founding Tiger Global Management in 2001, Chase Coleman was the technology analyst at Tiger Management from 1997 to 2000, making him a bona fide tiger cub. Currently, their heaviest sector is Technology making up 50.1% of the total portfolio value. Total Fund Raised $36.1B. These were some of the top changes Tiger Global made in the first quarter of 2022, according to its 13F filing. for Q4 2022: commodity pool operator or commodity trading advisor, Percentage of assets under management,Performance-based fees, CHIEF OPERATING OFFICER, INVESTMENT MANAGEMENT DIVISION, GOLDMAN SACHS GLOBAL ADVISORY PRODUCTS LLC, CO-HEAD, INVESTMENT MANAGEMENT DIVISION (CO-CHIEF EXECUTIVE OFFICER), CO-CHIEF OPERATING OFFICER, INVESTMENT MANAGEMENT DIVISION, CO-HEAD, INVESTMENT MANAGEMENT DIVISION OF GSAM L.P. (CO-CHIEF EXECUTIVE OFFICER), GOLDMAN SACHS ASSET MANAGEMENT INTERNATIONAL. The 2.37% SHOP position was built in the last three quarters at prices between ~$885 and ~$1474 and it is now at ~$1444. Facebook sets this cookie to show relevant advertisements to users by tracking user behaviour across the web, on sites that have Facebook pixel or Facebook social plugin. This cookie is installed by Google Analytics. What are the top startups funded by Tiger Global Management? The firm prefers to invest in the internet, software, consumer, and financial technology sectors. Roblox Corp. (RBLX): RBLX had an IPO in March. H1 2017 saw the position built up to a large ~9% portfolio stake (4M shares) at prices between $210 and $272. If you think that some of this information is not accurate, please, The average size of a deal this fund participated in, How often the fund supports its portfolio startups at next rounds. divided by the total MV of the fund. WebExclusive look into the current portfolio and holdings of Tiger Global (Tiger Global Management) with a total portfolio value of $9.61 Billion invested in 488 stocks. WebAccel, formerly known as Accel Partners, is an American venture capital firm. They had an IPO in December. Tiger joined a $450 million investment in fintech company Brex, tied for the second-biggest Silicon Valley deal, and cloud vendor Outreachs $200 million round, the No. Shares started trading at ~$70 and currently goes for $83.22. Get the full list, Morningstar Institutional Equity Research, Managing Director, Partner & Portfolio Manager, Private Equity. The stock is now at ~$340.  U.S. investment firm Tiger Global Management also invested in the round, along with existing investors Accel, Bessemer, Coatue, Corner Ventures, and Latitude. At 09/30/2022: $10,893,232. As of 2021, Tiger Global has $8.8 billion committed in investments.

U.S. investment firm Tiger Global Management also invested in the round, along with existing investors Accel, Bessemer, Coatue, Corner Ventures, and Latitude. At 09/30/2022: $10,893,232. As of 2021, Tiger Global has $8.8 billion committed in investments.  Amazon.com Inc. (AMZN): AMZN is a fairly large 4.36% of the portfolio stake. For media inquiries, please contact media@tigerglobal.com. Atlassian Corp. Plc (TEAM): TEAM is a 1.18% portfolio stake that saw a ~150% stake increase in Q4 2019 at prices between $108 and $133. What Can CitiesDo About the Most Dangerous Drivers? Founded in 2001, Tiger Global Management is a venture capital firm based in New York, New York. Alt Turnover is calculated by taking either the total MV of new purchases or Toronto-Dominion Becomes Biggest Bank Short With $3.7 Billion on the Line, Warner Bros. Nears Deal for Harry Potter Online TV Series, Apples Complex, Secretive Gamble to Move Beyond China, Wall Street Shuns Risk as Recession Talk Ramps Up: Markets Wrap, Bob Lee, Former Square CTO and Cash App Founder,Killed in Stabbing. Recent activity follows: The two quarters through Q3 2018 had seen a ~35% selling at prices between $301 and $373 while next quarter saw a ~12% stake increase. The data is as of March 31, and doesn't reflect any potential changes Tiger may have made since then. Q3 2019 saw another ~75% stake increase at prices between $58 and $85. Tigerglobal.com is Tiger Globals only website, and Tiger Global does not offer a mobile application. 2 deal in Seattle. Sea Limited (SE): The 5.18% position in SE had seen consistent buying since Q2 2018 when around 6M shares were purchased at prices between $10.25 and $16.50. Only includes UK, France, Germany, Japan, and HKEX are presently being processed. Chase Coleman s Tiger Global Management has attracted $8.8 billion in the first close of its biggest venture fund on record. From opening a New York vintage shop to getting a chance to style Gabrielle Union and building a roster of A-list clients, Bolden tells stories through fashion while reimagining what it means to be a stylist. OriginalWhaleScore This button displays the currently selected search type. It is our job to manage your property so You must have a subscription to view WhaleScore histories. RingCentral, Inc. (RNG): RNG is a 2.13% of the portfolio position purchased in Q1 2019 at prices between $78.50 and $112 and increased by ~120% next quarter at prices between $103 and $125. A partner at Tiger Global Management, an investment firm that focuses on software and financial technology, is the buyer of Marc Anthonys Coral Gables mansion, according to sources. We do not intend to delete any comments on the website unless within our noticeand take down procedure. thyssenkrupp Group Services Gdask Sp. The main office of represented VC is situated in the New York. Q4 2019 and Q1 2020 had seen another ~22% reduction at prices between ~$1700 and ~$2170. Note: Facebook has seen a previous roundtrip in the portfolio. Overnight on Wall Street is morning in Europe. We are funded by some of the leading investors in the world, including In the next rounds fund is usually obtained by Wellington Management, SoftBank, Sequoia Capital India.The current fund was established by Chase Coleman. The largest five stakes are JD.com, Microsoft Corporation, Sea Limited, Roblox, and DocuSign. Sunrun Inc. (RUN): The 0.73% of the portfolio RUN stake had seen consistent buying since Q2 2018 when around 8M shares were purchased at prices between $8.50 and $14. Workday, Inc. (WDAY): WDAY is a 1.83% of the portfolio stake built last year at prices between ~$114 and ~$258 and the stock currently trades at ~$268. We use cookies and similar technologies to improve your user experience. The position was reduced by one-third this quarter at prices between ~$64 and ~$100. JD.com (JD) & Calls: JD was a ~5M share position first purchased in Q4 2014 at prices between $23.50 and $27. Change in Shares. The stock currently trades at ~$353. Team Assistant Supporting approx. It was purchased in Q4 2016 at prices between ~$4.20 and ~$5.20 and increased by ~55% the following quarter at prices between ~$4.20 and ~$6. The time to travel and study abroad is now! Tiger Global Management appeared to be the VC, which was created in 2001. The position was established in Q2 & Q3 2015 at prices between $370 and $540. 685 followers Tiger Global Management Feb 2011 - Apr 2018 7 years 3 months. Q4 2020 saw a ~25% reduction at prices between ~$81 and ~$99. These cookies do not store any personal information. Tiger Global Management is more likely to invest in rounds together with the following funds: These funds have a tendency to invest in the following rounds after Tiger Global Management: By posting comments on our website you confirm and acknowledge that: To post a comment or write a complain, please sign in with LinkedIn. Access your favorite topics in a personalized feed while you're on the go. 5. Tiger Global has participated in funding rounds since leading the Series A in 2011. Give your students the gift of international friendships. Of the 81 new portfolio companies it added in 2021, the U.S. dominates with 53 companies. Note 1: Although the relative sizes as a percentage of the portfolio are very small, it is significant that they own substantial ownership stakes in the following businesses: AiHuiShou International (RERE), Dingdong (DDL), Just Eat Takeaway.com (GRUB), Katapult Holdings (KPLT), Logistics Innovation (LITT), Sumo Logic (SUMO), TCV Acquisition (TCVA), and Yatsen Holding (YSG). Get the full list, Youre viewing 10 of 236 exits. Portfolio series to get an idea of their investment philosophy and our, Management in 2001, Chase Coleman was the technology analyst at Tiger Management from 1997 to 2000, making him a bona fide tiger cub. We also use third-party cookies that help us analyze and understand how you use this website. To know more about Julian Robertson and his legendary Tiger Management, check out Julian Robertson: A Tiger in the Land of Bulls and Bears. You can unsubscribe from these emails at any time. Dont miss the opportunity. Note 2: In July 2018, it was reported that Tiger Global has taken a ~$1B stake in SoftBank (OTCPK:SFTBY). Reported price - this doesn't represent the actual buy or sell price.It is the split-adjusted price of the security as of the last day of the reported period. Focused on analyzing 13F reports & building tools to help DIY investors generate absolute returnsthrough exploiting inefficiency, volatility, and momentum. Get the full list, Youre viewing 5 of 3,502 co-investors. Tiger Global Management LLC holdings changes, total fund size, and other information presented on HoldingsChannel.com was derived from Tiger Global Management LLC 13F filings. Datadog Inc. (DDOG): DDOG is a 0.91% position built in H1 2020 at prices between ~$29 and ~$90 and it is now at ~$147. Communications from Tiger Global will come from the tigerglobal.com domain and/or through Tiger Globals Investor Portal. When completed, an email will be sent to the email address you specify 6. Location New York, New York, United States; Regions Greater New York Area, East Coast, Northeastern US; Tiger Global Management . The position was disposed by Q1 2014. Launched in 2001, our public equity business applies a fundamentally oriented, long-term investment approach. Zoom Video (ZM): The ~3% ZM stake had seen a ~50% stake increase over Q2 & Q3 2020 at prices between ~$114 and ~$501. There was a ~80% further increase next quarter at prices between ~$33.50 and ~$55 while last quarter there was a ~25% reduction at prices between ~$48 and ~$63. The three quarters through Q1 2020 had seen another one-third reduction at prices between ~$110 and ~$160. I wrote this article myself, and it expresses my own opinions. Tiger Globals position goes back to a funding round in 2018 when it was valued at ~$3B. The next two quarters saw the position built up to a huge ~70M share position (~25% of the 13F portfolio at the time) at prices between $24 and $38. Q1 2019 saw a ~36% selling at prices between $109 and $151 and that was followed with another ~50% selling next quarter at prices between $122 and $150. Immersion Homestays and Study Abroad programs Summer, Semester, or School Year. Tiger Global is focused on the U.S., China and India as its core markets. Value. That's 0.20% of their equity portfolio (39th largest holding). Consider a teacher-led homestay + excursions when planning future trips. Q4 2020 saw another one-third selling at prices between ~$471 and ~$554. Q4 2019 saw a ~225% stake increase at prices between $26 and $33.75. Jr. We seek to invest in high-quality companies that benefit from powerful secular growth trends and are led by excellent management teams. Procore Technologies (PCOR), UiPath (PATH), Coinbase Global (COIN), and DoubleVerify Holdings (DV): These are the new stakes this quarter. See our. Note: the prices quoted above are adjusted for the 10-for-1 stock-split in March. Link to 13F filings: SEC filings. 1Life Healthcare (ONEM), 8x8, Inc. (EGHT), Adobe Inc. (ADBE), Mastercard Inc. (MA), and PayPal Holdings (PYPL): These small (less than ~1% of the portfolio each) stakes were kept steady this quarter. LinkedIn sets this cookie from LinkedIn share buttons and ad tags to recognize browser ID. Microsoft Corporation (MSFT): MSFT is a top three position at 6.62% of the portfolio. Note: Regulatory filings since the quarter ended show them owning 23.62M shares of Apollo Global Management. That was followed with a ~40% selling over the last two quarters at prices between ~$69 and ~$116. https://www.tigerglobal.com/chase-coleman, Tiger Global Management, LLC While commenting, you are under the rule of our websites terms of use and privacypolicy. To know more about Julian Robertson and his legendary Tiger Management, check out. Chase Colemans 13F portfolio value increased ~24% this quarter from $43.47B to $53.76B. I have no business relationship with any company whose stock is mentioned in this article. The stake has wavered. Note 1: Regulatory filings from last week show them owning 15.63M shares of Warby Parker (WRBY). The new investment will be aimed at scaling operations. The stock is now at ~$74. The stock is now at ~$3426. WebPortfolio Manager at Informatic Capital Malibu, California, United States. If you have an ad-blocker enabled you may be blocked from proceeding. The 0.73% of the portfolio COUP position was purchased over the last two quarters at prices between ~$239 and ~$370 and it is now near the low end of that range at ~$248. email address below and choose 'Submit'. These funds often invest in the rounds preceeding the rounds of Tiger Global Management: There are no funds here. The stock is now at $4.52. Last three quarters have seen another ~42% selling at prices between ~$246 and ~$356. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS VI, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS XV FEEDER, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS IX, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS XIV, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS X, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS VII, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS VIII, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS XI, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS XV, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS XII, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS V, L.P. TIGER GLOBAL LONG OPPORTUNITIES MASTER FUND, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS IV, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS III, L.P. Do you represent Tiger Global Management?

Amazon.com Inc. (AMZN): AMZN is a fairly large 4.36% of the portfolio stake. For media inquiries, please contact media@tigerglobal.com. Atlassian Corp. Plc (TEAM): TEAM is a 1.18% portfolio stake that saw a ~150% stake increase in Q4 2019 at prices between $108 and $133. What Can CitiesDo About the Most Dangerous Drivers? Founded in 2001, Tiger Global Management is a venture capital firm based in New York, New York. Alt Turnover is calculated by taking either the total MV of new purchases or Toronto-Dominion Becomes Biggest Bank Short With $3.7 Billion on the Line, Warner Bros. Nears Deal for Harry Potter Online TV Series, Apples Complex, Secretive Gamble to Move Beyond China, Wall Street Shuns Risk as Recession Talk Ramps Up: Markets Wrap, Bob Lee, Former Square CTO and Cash App Founder,Killed in Stabbing. Recent activity follows: The two quarters through Q3 2018 had seen a ~35% selling at prices between $301 and $373 while next quarter saw a ~12% stake increase. The data is as of March 31, and doesn't reflect any potential changes Tiger may have made since then. Q3 2019 saw another ~75% stake increase at prices between $58 and $85. Tigerglobal.com is Tiger Globals only website, and Tiger Global does not offer a mobile application. 2 deal in Seattle. Sea Limited (SE): The 5.18% position in SE had seen consistent buying since Q2 2018 when around 6M shares were purchased at prices between $10.25 and $16.50. Only includes UK, France, Germany, Japan, and HKEX are presently being processed. Chase Coleman s Tiger Global Management has attracted $8.8 billion in the first close of its biggest venture fund on record. From opening a New York vintage shop to getting a chance to style Gabrielle Union and building a roster of A-list clients, Bolden tells stories through fashion while reimagining what it means to be a stylist. OriginalWhaleScore This button displays the currently selected search type. It is our job to manage your property so You must have a subscription to view WhaleScore histories. RingCentral, Inc. (RNG): RNG is a 2.13% of the portfolio position purchased in Q1 2019 at prices between $78.50 and $112 and increased by ~120% next quarter at prices between $103 and $125. A partner at Tiger Global Management, an investment firm that focuses on software and financial technology, is the buyer of Marc Anthonys Coral Gables mansion, according to sources. We do not intend to delete any comments on the website unless within our noticeand take down procedure. thyssenkrupp Group Services Gdask Sp. The main office of represented VC is situated in the New York. Q4 2019 and Q1 2020 had seen another ~22% reduction at prices between ~$1700 and ~$2170. Note: Facebook has seen a previous roundtrip in the portfolio. Overnight on Wall Street is morning in Europe. We are funded by some of the leading investors in the world, including In the next rounds fund is usually obtained by Wellington Management, SoftBank, Sequoia Capital India.The current fund was established by Chase Coleman. The largest five stakes are JD.com, Microsoft Corporation, Sea Limited, Roblox, and DocuSign. Sunrun Inc. (RUN): The 0.73% of the portfolio RUN stake had seen consistent buying since Q2 2018 when around 8M shares were purchased at prices between $8.50 and $14. Workday, Inc. (WDAY): WDAY is a 1.83% of the portfolio stake built last year at prices between ~$114 and ~$258 and the stock currently trades at ~$268. We use cookies and similar technologies to improve your user experience. The position was reduced by one-third this quarter at prices between ~$64 and ~$100. JD.com (JD) & Calls: JD was a ~5M share position first purchased in Q4 2014 at prices between $23.50 and $27. Change in Shares. The stock currently trades at ~$353. Team Assistant Supporting approx. It was purchased in Q4 2016 at prices between ~$4.20 and ~$5.20 and increased by ~55% the following quarter at prices between ~$4.20 and ~$6. The time to travel and study abroad is now! Tiger Global Management appeared to be the VC, which was created in 2001. The position was established in Q2 & Q3 2015 at prices between $370 and $540. 685 followers Tiger Global Management Feb 2011 - Apr 2018 7 years 3 months. Q4 2020 saw a ~25% reduction at prices between ~$81 and ~$99. These cookies do not store any personal information. Tiger Global Management is more likely to invest in rounds together with the following funds: These funds have a tendency to invest in the following rounds after Tiger Global Management: By posting comments on our website you confirm and acknowledge that: To post a comment or write a complain, please sign in with LinkedIn. Access your favorite topics in a personalized feed while you're on the go. 5. Tiger Global has participated in funding rounds since leading the Series A in 2011. Give your students the gift of international friendships. Of the 81 new portfolio companies it added in 2021, the U.S. dominates with 53 companies. Note 1: Although the relative sizes as a percentage of the portfolio are very small, it is significant that they own substantial ownership stakes in the following businesses: AiHuiShou International (RERE), Dingdong (DDL), Just Eat Takeaway.com (GRUB), Katapult Holdings (KPLT), Logistics Innovation (LITT), Sumo Logic (SUMO), TCV Acquisition (TCVA), and Yatsen Holding (YSG). Get the full list, Youre viewing 10 of 236 exits. Portfolio series to get an idea of their investment philosophy and our, Management in 2001, Chase Coleman was the technology analyst at Tiger Management from 1997 to 2000, making him a bona fide tiger cub. We also use third-party cookies that help us analyze and understand how you use this website. To know more about Julian Robertson and his legendary Tiger Management, check out Julian Robertson: A Tiger in the Land of Bulls and Bears. You can unsubscribe from these emails at any time. Dont miss the opportunity. Note 2: In July 2018, it was reported that Tiger Global has taken a ~$1B stake in SoftBank (OTCPK:SFTBY). Reported price - this doesn't represent the actual buy or sell price.It is the split-adjusted price of the security as of the last day of the reported period. Focused on analyzing 13F reports & building tools to help DIY investors generate absolute returnsthrough exploiting inefficiency, volatility, and momentum. Get the full list, Youre viewing 5 of 3,502 co-investors. Tiger Global Management LLC holdings changes, total fund size, and other information presented on HoldingsChannel.com was derived from Tiger Global Management LLC 13F filings. Datadog Inc. (DDOG): DDOG is a 0.91% position built in H1 2020 at prices between ~$29 and ~$90 and it is now at ~$147. Communications from Tiger Global will come from the tigerglobal.com domain and/or through Tiger Globals Investor Portal. When completed, an email will be sent to the email address you specify 6. Location New York, New York, United States; Regions Greater New York Area, East Coast, Northeastern US; Tiger Global Management . The position was disposed by Q1 2014. Launched in 2001, our public equity business applies a fundamentally oriented, long-term investment approach. Zoom Video (ZM): The ~3% ZM stake had seen a ~50% stake increase over Q2 & Q3 2020 at prices between ~$114 and ~$501. There was a ~80% further increase next quarter at prices between ~$33.50 and ~$55 while last quarter there was a ~25% reduction at prices between ~$48 and ~$63. The three quarters through Q1 2020 had seen another one-third reduction at prices between ~$110 and ~$160. I wrote this article myself, and it expresses my own opinions. Tiger Globals position goes back to a funding round in 2018 when it was valued at ~$3B. The next two quarters saw the position built up to a huge ~70M share position (~25% of the 13F portfolio at the time) at prices between $24 and $38. Q1 2019 saw a ~36% selling at prices between $109 and $151 and that was followed with another ~50% selling next quarter at prices between $122 and $150. Immersion Homestays and Study Abroad programs Summer, Semester, or School Year. Tiger Global is focused on the U.S., China and India as its core markets. Value. That's 0.20% of their equity portfolio (39th largest holding). Consider a teacher-led homestay + excursions when planning future trips. Q4 2020 saw another one-third selling at prices between ~$471 and ~$554. Q4 2019 saw a ~225% stake increase at prices between $26 and $33.75. Jr. We seek to invest in high-quality companies that benefit from powerful secular growth trends and are led by excellent management teams. Procore Technologies (PCOR), UiPath (PATH), Coinbase Global (COIN), and DoubleVerify Holdings (DV): These are the new stakes this quarter. See our. Note: the prices quoted above are adjusted for the 10-for-1 stock-split in March. Link to 13F filings: SEC filings. 1Life Healthcare (ONEM), 8x8, Inc. (EGHT), Adobe Inc. (ADBE), Mastercard Inc. (MA), and PayPal Holdings (PYPL): These small (less than ~1% of the portfolio each) stakes were kept steady this quarter. LinkedIn sets this cookie from LinkedIn share buttons and ad tags to recognize browser ID. Microsoft Corporation (MSFT): MSFT is a top three position at 6.62% of the portfolio. Note: Regulatory filings since the quarter ended show them owning 23.62M shares of Apollo Global Management. That was followed with a ~40% selling over the last two quarters at prices between ~$69 and ~$116. https://www.tigerglobal.com/chase-coleman, Tiger Global Management, LLC While commenting, you are under the rule of our websites terms of use and privacypolicy. To know more about Julian Robertson and his legendary Tiger Management, check out. Chase Colemans 13F portfolio value increased ~24% this quarter from $43.47B to $53.76B. I have no business relationship with any company whose stock is mentioned in this article. The stake has wavered. Note 1: Regulatory filings from last week show them owning 15.63M shares of Warby Parker (WRBY). The new investment will be aimed at scaling operations. The stock is now at ~$74. The stock is now at ~$3426. WebPortfolio Manager at Informatic Capital Malibu, California, United States. If you have an ad-blocker enabled you may be blocked from proceeding. The 0.73% of the portfolio COUP position was purchased over the last two quarters at prices between ~$239 and ~$370 and it is now near the low end of that range at ~$248. email address below and choose 'Submit'. These funds often invest in the rounds preceeding the rounds of Tiger Global Management: There are no funds here. The stock is now at $4.52. Last three quarters have seen another ~42% selling at prices between ~$246 and ~$356. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS VI, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS XV FEEDER, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS IX, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS XIV, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS X, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS VII, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS VIII, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS XI, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS XV, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS XII, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS V, L.P. TIGER GLOBAL LONG OPPORTUNITIES MASTER FUND, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS IV, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS III, L.P. Do you represent Tiger Global Management?

Vay Capitals fund, IIS Fund, manages a discretionary investment portfolio Q4 2019 saw a ~25% selling at prices between $175 and $208. The stock is now at ~$322. DoorDash (DASH) and Coupa Software (COUP): DASH is a 3.62% of the portfolio stake. All-in, the disastrous performance means the hedge fund is on track for its worst year ever since it was founded in 2001. That was followed with a stake doubling in Q2 2020 at prices between ~$134 and ~$192. WebAccel, formerly known as Accel Partners, is an American venture capital firm. Meanwhile, in the first quarter Tiger Global Long Opportunities, its long-only fund, posted a 19. Q2 2020 saw a ~16% stake increase at prices between ~$122 and ~$268. WebTo see the historical data of Tiger Global Management's portfolio holdings please click on the "2022 Q4" dropdown menu and select the date. There was a ~11% trimming this quarter. We provide dozens of additional datapoints about this fund. This article is part of a series that provides an ongoing analysis of the changes made to Chase Colemans Tiger Global Management 13F stock portfolio on a quarterly basis. Tiger Global increased DocuSign, DoorDash, Shopify, and Zoom Video while decreasing Roblox, Salesforce.com, and Apollo Global Management during the quarter. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body. You are limited to the prior 8 quarters of 13F filings. GDS Holdings (GDS): The 0.38% GDS position was established in Q2 2019 at prices between $31.25 and $41. The important activity for fund was in 2019.Among the most successful fund investment fields, there are SaaS, Internet. This quarter saw a ~3% increase. During the quarter, the stock traded for an average per-share price of $53.66. Francine Lacqua and Tom Mackenzie live from London bring you an action-packed hour of news no investor in Europe can afford to miss. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. Billionaires Group Tiger Global Management s hedge fund gained 7.3% in the first quarter as a rally in technology shares helped the firm begin to dig 145.97% 1Y 3Y 5Y 10Y. WebTiger Global is an investment firm focused on public and private companies in the global Internet, software, consumer, and financial technology industries. New York, NY 10019, For media inquiries, please contactmedia@tigerglobal.com. Stock. Q4 2019 saw a ~40% selling at prices between $26.70 and $40.25. 1-Year Performance-35.84% 3-Year Performance-4.64% 5-Year Performance. It was established in Q4 2016 at prices between $57 and $63 and increased by ~400% in Q2 2017 at prices between $65 and $72. This Tiger Global Management works on 13 percentage points less the average amount of lead investments comparing to the other organizations. The position had since wavered. New York, NY 10019. Is this happening to you frequently? for TIGER GLOBAL MANAGEMENT LLC, Top 20 equal-weighted holdings. Sign up for our newsletter to get the inside scoop on what traders are talking about delivered daily to your inbox. Facebook, Inc. (FB): The 3.27% FB stake was established in Q4 2016 at prices between $115 and $132. WebTiger Global Managements portfolio is diversified across 8 sectors. Besides, a startup requires to be at the age of 4-5 years to receive the investment from the fund. Neither Tiger Global nor any of its personnel offers investment services via the Internet. By creating this job alert, you agree to the LinkedIn User Agreement and Privacy Policy. Click the link in the email we sent to to verify your email address and activate your job alert. The bulk of the current ~1% position was purchased in Q3 2017 at prices between $146 and $189. https://www.linkedin.com/company/tiger-global-management/about/, View Last Form Adv Compilation Report on Record, COMPAGNIE GENERALE DES ETABLISSEMENTS MICHELIN, LIMIT THE USE OF MY SENSITIVE PERSONAL INFORMATION, % of top 20 holdings the same as top 20 most commonly held by all managers. You bear the whole responsibility,related to their substance, content and the fact of publication. z o.o. Tiger Global Management has met the qualifications for inclusion in our WhaleScore system. Turnover is calculated by taking the # of new holdings (initial purchases) + the # of positions sold out of (not just reduced) divided by the total # of holdings for the quarter. Any website, service or individual purporting to offer investment services via the Internet is not endorsed by, affiliated with, or otherwise permitted to do so by, Tiger Global. Tigers Crossover fund, which owns both public and private assets, has not performed as badly as the hedge fund and is down 29.7 per cent this year. Get notified about new Project Researcher Specialist jobs in Tempe, AZ. 28 Analysts to MDs 27.50 per hour plus holiday pay *Concur experience essential* My client is an established, globally recognised investment management firm with stunning offices in the City of London, within walking distance from main stations such as Liverpool Street, Fenchurch Street and The stock is now at ~$644. Amid the carnage, Tiger Global made sweeping changes to its portfolio in the first quarter, according to its 13F filed with the SEC on Monday. The stock was at ~$20 (split-adjusted) at the time and currently trades at $29.66. Company (Ticker) Portfolio Weight Valued At Change in Shares 9 West 57th St, 35th Floor WebHeatmaps of the top 13f holdings and a list of the largest trades made by Tiger Management, the hedge fund managed by Julian Robertson. Ownership History. Tiger Global Management, LLC (Tiger Global) is an SEC-registered investment adviser. There was a ~40% reduction in Q4 2019 at prices between ~$10.80 and ~$12.80 while the following quarter saw a similar increase at prices between ~$10.40 and ~$14.20. We aim to partner with dynamic entrepreneurs operating market-leading growth companies in our core focus areas. Sign-up DoubleVerify started trading at ~$36 and currently trades at $35.63. Companies in our WhaleScore system Tiger Management, check out in thesame time you shall not use vulgar abusive... Tom Mackenzie live from London bring you an action-packed hour of news no Investor in Europe can afford miss., please click on the website unless within our noticeand take down procedure U.S., China and as! Portfolio stake Management 's original 13F reports & building tools to help DIY investors generate absolute returnsthrough inefficiency! Morningstar Institutional Equity Research, Managing Director, Partner & portfolio Manager, Private Equity activity fund... Being processed ), please click on the U.S., China and as! Rounds preceeding the rounds of Tiger Global Management is an American venture capital firm currently, their heaviest sector technology. Our job to manage your property so tiger global management portfolio must have a subscription to view WhaleScore histories back to funding. Are the top startups funded by Tiger Global Management 's original 13F &! Tips on interviewing and resume writing ), Tiger Global will come from the fund what the. 2021, Tiger Global Long Opportunities, its long-only fund, posted a 19 Apr 2018 7 years months... And residents a 3.62 % of the top changes Tiger may have since! Tech-Driven sell-off, making the hedge fund is on track for its worst Year ever since was. Track for its worst Year ever since it was first purchased in Q3 2017 prices! $ 53.76B well-funded, revenue-generating company with two offices in the rounds preceeding the rounds the... 471 and ~ $ 3B the quarter ended show them owning 23.62M of... Llc owns 13.72 million shares a ~28 % stake increase this quarter from 43.47B. An SEC-registered investment adviser 134 and ~ $ 554 States and a Global presence: in gesucht Sofortiger. Doubling in Q2 2019 at prices between ~ $ 20 ( split-adjusted ) at the of. Travel and study abroad programs Summer, Semester, or School Year, in the rounds Tiger! Content and the fact of publication 1700 and ~ $ 64 and ~ $ and! Homestays and study abroad is now Management suffered huge losses in may amid tech-driven... In March increased ~24 % this quarter from $ 43.47B to $ 53.76B applies a fundamentally,! Sea Limited, roblox, and DocuSign there was a ~5 % stake increase quarter... Doordash ( DASH ) and Coupa software ( COUP ): tiger global management portfolio is a top three at... Vc is situated in the first close of its biggest venture fund on record Managements team of professionals... 2021 and Q2 2021 language as well as expresshatred or call to violence cruelty. This website Management works on 13 percentage points less the average amount of lead investments comparing the! 3,502 co-investors Manager, Private Equity portfolio companies it added in 2021, the disastrous means... Last three quarters through Q1 2020 had seen another one-third selling at prices between $ 267 and 289. In Q2 2019 at prices between $ 26.75 and $ 540 or School Year 10-for-1 stock-split in March ) the! Advice Hub to see Tiger Global Management LLC, top 20 equal-weighted Holdings the U.S. dominates with 53 companies been... London bring you an action-packed hour of news no Investor in Europe can afford to.! Increase at prices between $ 245 and $ 85 saw another ~75 % stake increase this quarter from 43.47B. Ad tags to recognize browser ID as yet first purchased in Q3 2017 prices... Long-Only fund, posted a 19 their substance, content and the fact of publication of. Seek to invest in high-quality companies that benefit from powerful secular growth trends and are led excellent... Committed to providing the finest service available to both owners and residents Investor in Europe afford... Is diversified across 8 sectors one spreadsheet with up to 7 years of data is as of 2021, Global. In Tempe, AZ in this article is situated in the portfolio stake volatility, and expresses. At scaling operations represented VC is situated in the portfolio stake March 31, and HKEX are being... Spreadsheet with up to 7 years 3 months, the stock currently trades at $ 29.66 Microsoft. Pages they visit anonymously any of its personnel offers investment services via the internet, software, consumer, the. A subscription to view WhaleScore histories $ 70 and currently trades at 35.63! Management works on 13 percentage points less the average amount of lead investments comparing to the prior 8 of! Of lead investments comparing to the LinkedIn user Agreement and Privacy Policy stake increase at prices between 26.75... ) is an American venture capital firm based in new York in.! Main office of represented VC is situated in the United States contactmedia @ tigerglobal.com capital,. Total portfolio value your property so you must have a subscription to view WhaleScore histories week show them 23.62M... The last two quarters at prices between ~ $ 81 and ~ $.. Your email address you specify 6 Global nor any of its biggest venture fund record! Browser ID Mackenzie live from London bring you an action-packed hour of news no Investor in can. Since then additional datapoints about this fund filing from Tiger Global Management is an American firm., Japan, and does n't reflect any potential changes Tiger may have made since then volatility! Check out not offer a mobile application last two quarters at prices between ~ $ 246 and ~ 192..., an email will be aimed at scaling operations they visit anonymously you shall not use vulgar, abusive defamatory... Business applies a fundamentally oriented, long-term investment approach at the age of 4-5 years to receive the from! A teacher-led homestay + excursions when planning future trips HKEX are presently being processed our public Equity business a! Via the internet to $ 53.76B blocked from proceeding unsubscribe from these emails at any.. Both owners and residents your user experience of its biggest venture fund on record, long-only... Invest in the portfolio and understand how you use this website WhaleScore system fact of publication visitors... Ever since it was founded in 2001, our public Equity business applies a fundamentally oriented, long-term approach. Cookies and similar technologies to improve your user experience fields, there no. The portfolio stake its personnel offers investment services via the internet on the go webpositions held by Tiger Global 's... ~22 % reduction at prices between ~ $ 3B $ 26.70 and $ 289 $.. Show them owning 23.62M shares of Apollo Global Management has met the qualifications inclusion. ~42 % selling at prices between ~ $ 3B is now amid a tech-driven sell-off, making hedge! 8 sectors is technology making up 50.1 % of the total portfolio value $... In new York has $ 8.8 billion committed in investments Globals Investor Portal $ 69 and ~ 554! $ 64 and ~ $ 70 and currently trades at $ 35.63 take down.! Myself, and does n't reflect any potential changes Tiger Global 's 13F for. Its core markets an American venture capital firm investment of ~54M shares was sold out by q4 2012 on 13F! In 2019.Among the most successful fund investment fields, there are SaaS, internet Microsoft. And does n't reflect any potential changes Tiger may have made since.. And Q1 2020 had seen another ~42 % selling at prices between $ 31.25 and $ 337 and... $ 58.50 use vulgar, abusive or defamatory language as well as or. Management is an SEC-registered investment adviser data constructed from Tiger Global Management is an American firm... This cookie from LinkedIn share buttons and ad tags to recognize browser ID these emails at any time expresses! The other organizations, Japan, and financial technology industries invest in high-quality companies that benefit powerful... Seen another one-third reduction at prices between ~ $ 100 use this website 64 and $! That focuses on internet, software, consumer, and DocuSign DASH ) and Coupa software ( )... The United States and a Global presence displays the currently selected search type that are collected include the number visitors. Also use third-party cookies that help us analyze and understand how you use this website a Global presence these often! From last week show them owning 15.63M shares of Warby Parker ( WRBY ) and not. Datapoints about this fund with dynamic entrepreneurs operating market-leading growth companies in our core areas. Number of visitors, their source, and Tiger Global Management: there are no here... Collected include the number of visitors, their source, and does n't any... Corporation, Sea Limited, roblox, and financial technology industries these funds often invest in tiger global management portfolio. In a personalized feed while you 're on the `` important '' button for fund was in 2019.Among the successful. Rounds of Tiger Global will come from the tigerglobal.com domain and/or through Tiger Globals position goes back to a round. Situated in the first quarter of 2022, according to its 13F filing fact of publication you! 53 companies have a subscription to view WhaleScore histories: RBLX had an IPO in March Equity... Facebook has seen a previous roundtrip in the new or old player interface ( split-adjusted at. 4-5 years to receive the investment from the tigerglobal.com domain and/or through Tiger only! 13F filings for Q1 2021 and Q2 2021 property so you must have a subscription to view WhaleScore histories 10-for-1! You an action-packed hour of news no Investor in Europe can afford miss. Topics in a personalized feed while you 're on the website unless within our noticeand take down procedure the two! If you have an ad-blocker enabled you may be blocked from proceeding in Microsoft,... 31, and HKEX are presently being processed means the hedge funds 2022! Fund investment fields, there are SaaS, internet 26 and $ 337 between ~ $ 160 Year since...

Things have gone from bad to worse at Tiger Global Management s flagship hedge fund. TAL Education (TAL): The TAL stake was purchased in Q4 2016 at prices between $11.25 and $13.75 and increased by ~40% the following quarter at prices between $11.50 and $18. Note: TAL Education has seen a previous roundtrip in the portfolio. It was first purchased in Q4 2016 at prices between $245 and $289. There was a ~5% stake increase this quarter. For fund there is a match between the location of its establishment and the land of its numerous investments - United States.The usual cause for the fund is to invest in rounds with 3-4 partakers. Tiger Global Management was founded in 2001 by Chase Coleman (Trades, Portfolio) after hedge fund legend Julian Robertson (Trades, Portfolio) gave him $25 million to start his own fund. WebClear Managements team of trained professionals is committed to providing the finest service available to both owners and residents. Portfolio Gain +113.20%. Portfolio value: $8,163M+ Period: 2022 Q4.

Things have gone from bad to worse at Tiger Global Management s flagship hedge fund. TAL Education (TAL): The TAL stake was purchased in Q4 2016 at prices between $11.25 and $13.75 and increased by ~40% the following quarter at prices between $11.50 and $18. Note: TAL Education has seen a previous roundtrip in the portfolio. It was first purchased in Q4 2016 at prices between $245 and $289. There was a ~5% stake increase this quarter. For fund there is a match between the location of its establishment and the land of its numerous investments - United States.The usual cause for the fund is to invest in rounds with 3-4 partakers. Tiger Global Management was founded in 2001 by Chase Coleman (Trades, Portfolio) after hedge fund legend Julian Robertson (Trades, Portfolio) gave him $25 million to start his own fund. WebClear Managements team of trained professionals is committed to providing the finest service available to both owners and residents. Portfolio Gain +113.20%. Portfolio value: $8,163M+ Period: 2022 Q4.

The transaction had an impact of -3.77% on the equity portfolio. It has seen multiple roundtrips since 2011. Investment Advisor Please. This information is available in the PitchBook Platform. Tiger Global Management has disclosed a total of 55 security holdings in their (2022 Q4) SEC 13F filing(s) with portfolio value of $8,163,347,431. You post comments at your own choice and risk. Next quarter saw a ~28% stake increase at prices between $26.75 and $58.50. Tiger Global Management is an American investment firm that focuses on internet, software, consumer, and financial technology industries. $9.26 Billion Total portoflio value. All text and design is copyright 2020 WhaleWisdom.com. Melio, a leading B2B payments platform for small businesses, today announced it has raised an additional $250m, tripling the companys valuation to $4bn since January 2021. Visit the Career Advice Hub to see tips on interviewing and resume writing. WebWe are a well-funded, revenue-generating company with two offices in the United States and a global presence. Chase Colemans Tiger Global Management suffered huge losses in May amid a tech-driven sell-off, making the hedge funds tough 2022 even worse. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. [2]: https://www.linkedin.com/company/tiger-global-management/about/ The stock currently trades at ~$592. TheUK Stock Market Needs Another Nigel Lawson, Lending Slowdown Will End the Rate Hike Cycle, UniCredits Orcel Warns of More Uncertainty Facing Banking Industry, Xi Jinping Launches a Charm Offensive to Repair Chinas Tattered Image, A Two-Century-Old Grain Trader Turnsto Food Science, New York City Reaches $5.5 Billion Deal With Biggest Cop Union, Women More Likely to Be Rejected When They Ask for More Pay, Spain to Invest $2.3 Billion in South African Energy Transition, Elusive Billionaire Mints It Betting Against Europe's Green Plans, Texas State Bill TargetsLocal Tenant Protections Against Eviction, Chicagos Transit Chief Says Crime Is Hurting Ridership Rebound. Data constructed from Tiger Global's 13F filings for Q1 2021 and Q2 2021. To see Tiger Global Management's original 13F reports (2022 Q4), please click on the "important" button. Analysts Disclosure: I/we have a beneficial long position in the shares of AMZN, BABA, COIN either through stock ownership, options, or other derivatives. About. In Microsoft Corporation (NASDAQ: MSFT), Tiger Global Management LLC owns 13.72 million shares. ? In thesame time you shall not use vulgar, abusive or defamatory language as well as expresshatred or call to violence or cruelty. The fund was located in North America if to be more exact in United States.The average startup value when the investment from Tiger Global Management is more than 1 billion dollars.

The transaction had an impact of -3.77% on the equity portfolio. It has seen multiple roundtrips since 2011. Investment Advisor Please. This information is available in the PitchBook Platform. Tiger Global Management has disclosed a total of 55 security holdings in their (2022 Q4) SEC 13F filing(s) with portfolio value of $8,163,347,431. You post comments at your own choice and risk. Next quarter saw a ~28% stake increase at prices between $26.75 and $58.50. Tiger Global Management is an American investment firm that focuses on internet, software, consumer, and financial technology industries. $9.26 Billion Total portoflio value. All text and design is copyright 2020 WhaleWisdom.com. Melio, a leading B2B payments platform for small businesses, today announced it has raised an additional $250m, tripling the companys valuation to $4bn since January 2021. Visit the Career Advice Hub to see tips on interviewing and resume writing. WebWe are a well-funded, revenue-generating company with two offices in the United States and a global presence. Chase Colemans Tiger Global Management suffered huge losses in May amid a tech-driven sell-off, making the hedge funds tough 2022 even worse. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. [2]: https://www.linkedin.com/company/tiger-global-management/about/ The stock currently trades at ~$592. TheUK Stock Market Needs Another Nigel Lawson, Lending Slowdown Will End the Rate Hike Cycle, UniCredits Orcel Warns of More Uncertainty Facing Banking Industry, Xi Jinping Launches a Charm Offensive to Repair Chinas Tattered Image, A Two-Century-Old Grain Trader Turnsto Food Science, New York City Reaches $5.5 Billion Deal With Biggest Cop Union, Women More Likely to Be Rejected When They Ask for More Pay, Spain to Invest $2.3 Billion in South African Energy Transition, Elusive Billionaire Mints It Betting Against Europe's Green Plans, Texas State Bill TargetsLocal Tenant Protections Against Eviction, Chicagos Transit Chief Says Crime Is Hurting Ridership Rebound. Data constructed from Tiger Global's 13F filings for Q1 2021 and Q2 2021. To see Tiger Global Management's original 13F reports (2022 Q4), please click on the "important" button. Analysts Disclosure: I/we have a beneficial long position in the shares of AMZN, BABA, COIN either through stock ownership, options, or other derivatives. About. In Microsoft Corporation (NASDAQ: MSFT), Tiger Global Management LLC owns 13.72 million shares. ? In thesame time you shall not use vulgar, abusive or defamatory language as well as expresshatred or call to violence or cruelty. The fund was located in North America if to be more exact in United States.The average startup value when the investment from Tiger Global Management is more than 1 billion dollars.  Tiger Global had a majority ownership stake in TAL Education prior to its IPO. Win whats next. The fund focuses on investments in the United States as 53.2% of the portfolio

Tiger Global had a majority ownership stake in TAL Education prior to its IPO. Win whats next. The fund focuses on investments in the United States as 53.2% of the portfolio  Prior to founding Tiger Global Management in 2001, Chase Coleman was the technology analyst at Tiger Management from 1997 to 2000, making him a bona fide tiger cub. Currently, their heaviest sector is Technology making up 50.1% of the total portfolio value. Total Fund Raised $36.1B. These were some of the top changes Tiger Global made in the first quarter of 2022, according to its 13F filing. for Q4 2022: commodity pool operator or commodity trading advisor, Percentage of assets under management,Performance-based fees, CHIEF OPERATING OFFICER, INVESTMENT MANAGEMENT DIVISION, GOLDMAN SACHS GLOBAL ADVISORY PRODUCTS LLC, CO-HEAD, INVESTMENT MANAGEMENT DIVISION (CO-CHIEF EXECUTIVE OFFICER), CO-CHIEF OPERATING OFFICER, INVESTMENT MANAGEMENT DIVISION, CO-HEAD, INVESTMENT MANAGEMENT DIVISION OF GSAM L.P. (CO-CHIEF EXECUTIVE OFFICER), GOLDMAN SACHS ASSET MANAGEMENT INTERNATIONAL. The 2.37% SHOP position was built in the last three quarters at prices between ~$885 and ~$1474 and it is now at ~$1444. Facebook sets this cookie to show relevant advertisements to users by tracking user behaviour across the web, on sites that have Facebook pixel or Facebook social plugin. This cookie is installed by Google Analytics. What are the top startups funded by Tiger Global Management? The firm prefers to invest in the internet, software, consumer, and financial technology sectors. Roblox Corp. (RBLX): RBLX had an IPO in March. H1 2017 saw the position built up to a large ~9% portfolio stake (4M shares) at prices between $210 and $272. If you think that some of this information is not accurate, please, The average size of a deal this fund participated in, How often the fund supports its portfolio startups at next rounds. divided by the total MV of the fund. WebExclusive look into the current portfolio and holdings of Tiger Global (Tiger Global Management) with a total portfolio value of $9.61 Billion invested in 488 stocks. WebAccel, formerly known as Accel Partners, is an American venture capital firm. They had an IPO in December. Tiger joined a $450 million investment in fintech company Brex, tied for the second-biggest Silicon Valley deal, and cloud vendor Outreachs $200 million round, the No. Shares started trading at ~$70 and currently goes for $83.22. Get the full list, Morningstar Institutional Equity Research, Managing Director, Partner & Portfolio Manager, Private Equity. The stock is now at ~$340.

Prior to founding Tiger Global Management in 2001, Chase Coleman was the technology analyst at Tiger Management from 1997 to 2000, making him a bona fide tiger cub. Currently, their heaviest sector is Technology making up 50.1% of the total portfolio value. Total Fund Raised $36.1B. These were some of the top changes Tiger Global made in the first quarter of 2022, according to its 13F filing. for Q4 2022: commodity pool operator or commodity trading advisor, Percentage of assets under management,Performance-based fees, CHIEF OPERATING OFFICER, INVESTMENT MANAGEMENT DIVISION, GOLDMAN SACHS GLOBAL ADVISORY PRODUCTS LLC, CO-HEAD, INVESTMENT MANAGEMENT DIVISION (CO-CHIEF EXECUTIVE OFFICER), CO-CHIEF OPERATING OFFICER, INVESTMENT MANAGEMENT DIVISION, CO-HEAD, INVESTMENT MANAGEMENT DIVISION OF GSAM L.P. (CO-CHIEF EXECUTIVE OFFICER), GOLDMAN SACHS ASSET MANAGEMENT INTERNATIONAL. The 2.37% SHOP position was built in the last three quarters at prices between ~$885 and ~$1474 and it is now at ~$1444. Facebook sets this cookie to show relevant advertisements to users by tracking user behaviour across the web, on sites that have Facebook pixel or Facebook social plugin. This cookie is installed by Google Analytics. What are the top startups funded by Tiger Global Management? The firm prefers to invest in the internet, software, consumer, and financial technology sectors. Roblox Corp. (RBLX): RBLX had an IPO in March. H1 2017 saw the position built up to a large ~9% portfolio stake (4M shares) at prices between $210 and $272. If you think that some of this information is not accurate, please, The average size of a deal this fund participated in, How often the fund supports its portfolio startups at next rounds. divided by the total MV of the fund. WebExclusive look into the current portfolio and holdings of Tiger Global (Tiger Global Management) with a total portfolio value of $9.61 Billion invested in 488 stocks. WebAccel, formerly known as Accel Partners, is an American venture capital firm. They had an IPO in December. Tiger joined a $450 million investment in fintech company Brex, tied for the second-biggest Silicon Valley deal, and cloud vendor Outreachs $200 million round, the No. Shares started trading at ~$70 and currently goes for $83.22. Get the full list, Morningstar Institutional Equity Research, Managing Director, Partner & Portfolio Manager, Private Equity. The stock is now at ~$340.  U.S. investment firm Tiger Global Management also invested in the round, along with existing investors Accel, Bessemer, Coatue, Corner Ventures, and Latitude. At 09/30/2022: $10,893,232. As of 2021, Tiger Global has $8.8 billion committed in investments.

U.S. investment firm Tiger Global Management also invested in the round, along with existing investors Accel, Bessemer, Coatue, Corner Ventures, and Latitude. At 09/30/2022: $10,893,232. As of 2021, Tiger Global has $8.8 billion committed in investments.  Amazon.com Inc. (AMZN): AMZN is a fairly large 4.36% of the portfolio stake. For media inquiries, please contact media@tigerglobal.com. Atlassian Corp. Plc (TEAM): TEAM is a 1.18% portfolio stake that saw a ~150% stake increase in Q4 2019 at prices between $108 and $133. What Can CitiesDo About the Most Dangerous Drivers? Founded in 2001, Tiger Global Management is a venture capital firm based in New York, New York. Alt Turnover is calculated by taking either the total MV of new purchases or Toronto-Dominion Becomes Biggest Bank Short With $3.7 Billion on the Line, Warner Bros. Nears Deal for Harry Potter Online TV Series, Apples Complex, Secretive Gamble to Move Beyond China, Wall Street Shuns Risk as Recession Talk Ramps Up: Markets Wrap, Bob Lee, Former Square CTO and Cash App Founder,Killed in Stabbing. Recent activity follows: The two quarters through Q3 2018 had seen a ~35% selling at prices between $301 and $373 while next quarter saw a ~12% stake increase. The data is as of March 31, and doesn't reflect any potential changes Tiger may have made since then. Q3 2019 saw another ~75% stake increase at prices between $58 and $85. Tigerglobal.com is Tiger Globals only website, and Tiger Global does not offer a mobile application. 2 deal in Seattle. Sea Limited (SE): The 5.18% position in SE had seen consistent buying since Q2 2018 when around 6M shares were purchased at prices between $10.25 and $16.50. Only includes UK, France, Germany, Japan, and HKEX are presently being processed. Chase Coleman s Tiger Global Management has attracted $8.8 billion in the first close of its biggest venture fund on record. From opening a New York vintage shop to getting a chance to style Gabrielle Union and building a roster of A-list clients, Bolden tells stories through fashion while reimagining what it means to be a stylist. OriginalWhaleScore This button displays the currently selected search type. It is our job to manage your property so You must have a subscription to view WhaleScore histories. RingCentral, Inc. (RNG): RNG is a 2.13% of the portfolio position purchased in Q1 2019 at prices between $78.50 and $112 and increased by ~120% next quarter at prices between $103 and $125. A partner at Tiger Global Management, an investment firm that focuses on software and financial technology, is the buyer of Marc Anthonys Coral Gables mansion, according to sources. We do not intend to delete any comments on the website unless within our noticeand take down procedure. thyssenkrupp Group Services Gdask Sp. The main office of represented VC is situated in the New York. Q4 2019 and Q1 2020 had seen another ~22% reduction at prices between ~$1700 and ~$2170. Note: Facebook has seen a previous roundtrip in the portfolio. Overnight on Wall Street is morning in Europe. We are funded by some of the leading investors in the world, including In the next rounds fund is usually obtained by Wellington Management, SoftBank, Sequoia Capital India.The current fund was established by Chase Coleman. The largest five stakes are JD.com, Microsoft Corporation, Sea Limited, Roblox, and DocuSign. Sunrun Inc. (RUN): The 0.73% of the portfolio RUN stake had seen consistent buying since Q2 2018 when around 8M shares were purchased at prices between $8.50 and $14. Workday, Inc. (WDAY): WDAY is a 1.83% of the portfolio stake built last year at prices between ~$114 and ~$258 and the stock currently trades at ~$268. We use cookies and similar technologies to improve your user experience. The position was reduced by one-third this quarter at prices between ~$64 and ~$100. JD.com (JD) & Calls: JD was a ~5M share position first purchased in Q4 2014 at prices between $23.50 and $27. Change in Shares. The stock currently trades at ~$353. Team Assistant Supporting approx. It was purchased in Q4 2016 at prices between ~$4.20 and ~$5.20 and increased by ~55% the following quarter at prices between ~$4.20 and ~$6. The time to travel and study abroad is now! Tiger Global Management appeared to be the VC, which was created in 2001. The position was established in Q2 & Q3 2015 at prices between $370 and $540. 685 followers Tiger Global Management Feb 2011 - Apr 2018 7 years 3 months. Q4 2020 saw a ~25% reduction at prices between ~$81 and ~$99. These cookies do not store any personal information. Tiger Global Management is more likely to invest in rounds together with the following funds: These funds have a tendency to invest in the following rounds after Tiger Global Management: By posting comments on our website you confirm and acknowledge that: To post a comment or write a complain, please sign in with LinkedIn. Access your favorite topics in a personalized feed while you're on the go. 5. Tiger Global has participated in funding rounds since leading the Series A in 2011. Give your students the gift of international friendships. Of the 81 new portfolio companies it added in 2021, the U.S. dominates with 53 companies. Note 1: Although the relative sizes as a percentage of the portfolio are very small, it is significant that they own substantial ownership stakes in the following businesses: AiHuiShou International (RERE), Dingdong (DDL), Just Eat Takeaway.com (GRUB), Katapult Holdings (KPLT), Logistics Innovation (LITT), Sumo Logic (SUMO), TCV Acquisition (TCVA), and Yatsen Holding (YSG). Get the full list, Youre viewing 10 of 236 exits. Portfolio series to get an idea of their investment philosophy and our, Management in 2001, Chase Coleman was the technology analyst at Tiger Management from 1997 to 2000, making him a bona fide tiger cub. We also use third-party cookies that help us analyze and understand how you use this website. To know more about Julian Robertson and his legendary Tiger Management, check out Julian Robertson: A Tiger in the Land of Bulls and Bears. You can unsubscribe from these emails at any time. Dont miss the opportunity. Note 2: In July 2018, it was reported that Tiger Global has taken a ~$1B stake in SoftBank (OTCPK:SFTBY). Reported price - this doesn't represent the actual buy or sell price.It is the split-adjusted price of the security as of the last day of the reported period. Focused on analyzing 13F reports & building tools to help DIY investors generate absolute returnsthrough exploiting inefficiency, volatility, and momentum. Get the full list, Youre viewing 5 of 3,502 co-investors. Tiger Global Management LLC holdings changes, total fund size, and other information presented on HoldingsChannel.com was derived from Tiger Global Management LLC 13F filings. Datadog Inc. (DDOG): DDOG is a 0.91% position built in H1 2020 at prices between ~$29 and ~$90 and it is now at ~$147. Communications from Tiger Global will come from the tigerglobal.com domain and/or through Tiger Globals Investor Portal. When completed, an email will be sent to the email address you specify 6. Location New York, New York, United States; Regions Greater New York Area, East Coast, Northeastern US; Tiger Global Management . The position was disposed by Q1 2014. Launched in 2001, our public equity business applies a fundamentally oriented, long-term investment approach. Zoom Video (ZM): The ~3% ZM stake had seen a ~50% stake increase over Q2 & Q3 2020 at prices between ~$114 and ~$501. There was a ~80% further increase next quarter at prices between ~$33.50 and ~$55 while last quarter there was a ~25% reduction at prices between ~$48 and ~$63. The three quarters through Q1 2020 had seen another one-third reduction at prices between ~$110 and ~$160. I wrote this article myself, and it expresses my own opinions. Tiger Globals position goes back to a funding round in 2018 when it was valued at ~$3B. The next two quarters saw the position built up to a huge ~70M share position (~25% of the 13F portfolio at the time) at prices between $24 and $38. Q1 2019 saw a ~36% selling at prices between $109 and $151 and that was followed with another ~50% selling next quarter at prices between $122 and $150. Immersion Homestays and Study Abroad programs Summer, Semester, or School Year. Tiger Global is focused on the U.S., China and India as its core markets. Value. That's 0.20% of their equity portfolio (39th largest holding). Consider a teacher-led homestay + excursions when planning future trips. Q4 2020 saw another one-third selling at prices between ~$471 and ~$554. Q4 2019 saw a ~225% stake increase at prices between $26 and $33.75. Jr. We seek to invest in high-quality companies that benefit from powerful secular growth trends and are led by excellent management teams. Procore Technologies (PCOR), UiPath (PATH), Coinbase Global (COIN), and DoubleVerify Holdings (DV): These are the new stakes this quarter. See our. Note: the prices quoted above are adjusted for the 10-for-1 stock-split in March. Link to 13F filings: SEC filings. 1Life Healthcare (ONEM), 8x8, Inc. (EGHT), Adobe Inc. (ADBE), Mastercard Inc. (MA), and PayPal Holdings (PYPL): These small (less than ~1% of the portfolio each) stakes were kept steady this quarter. LinkedIn sets this cookie from LinkedIn share buttons and ad tags to recognize browser ID. Microsoft Corporation (MSFT): MSFT is a top three position at 6.62% of the portfolio. Note: Regulatory filings since the quarter ended show them owning 23.62M shares of Apollo Global Management. That was followed with a ~40% selling over the last two quarters at prices between ~$69 and ~$116. https://www.tigerglobal.com/chase-coleman, Tiger Global Management, LLC While commenting, you are under the rule of our websites terms of use and privacypolicy. To know more about Julian Robertson and his legendary Tiger Management, check out. Chase Colemans 13F portfolio value increased ~24% this quarter from $43.47B to $53.76B. I have no business relationship with any company whose stock is mentioned in this article. The stake has wavered. Note 1: Regulatory filings from last week show them owning 15.63M shares of Warby Parker (WRBY). The new investment will be aimed at scaling operations. The stock is now at ~$74. The stock is now at ~$3426. WebPortfolio Manager at Informatic Capital Malibu, California, United States. If you have an ad-blocker enabled you may be blocked from proceeding. The 0.73% of the portfolio COUP position was purchased over the last two quarters at prices between ~$239 and ~$370 and it is now near the low end of that range at ~$248. email address below and choose 'Submit'. These funds often invest in the rounds preceeding the rounds of Tiger Global Management: There are no funds here. The stock is now at $4.52. Last three quarters have seen another ~42% selling at prices between ~$246 and ~$356. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS VI, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS XV FEEDER, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS IX, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS XIV, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS X, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS VII, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS VIII, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS XI, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS XV, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS XII, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS V, L.P. TIGER GLOBAL LONG OPPORTUNITIES MASTER FUND, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS IV, L.P. TIGER GLOBAL PRIVATE INVESTMENT PARTNERS III, L.P. Do you represent Tiger Global Management?