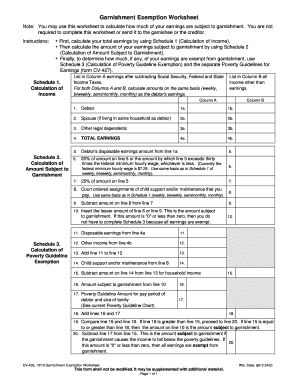

However, you must file an exemption claim form to get the extra $700 released to you.

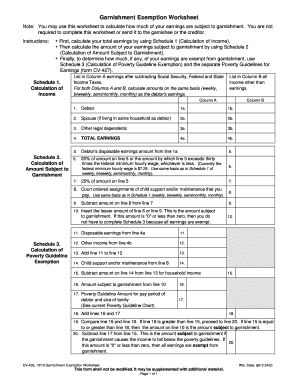

New Hampshire doesn't allow for continuous garnishment, so a creditor must file in court for each new paycheck it wants to garnish. (Federal law protects the level of income equal to 30 times the minimum wage per week from garnishment.) Mandatory deductions include Social Security, Medicare, and federal income taxes. For example, federal law places limits on how much judgment creditors can take. What Is Chapter 7 Bankruptcy & Should I File? If a creditor tries to take money from your bank account, call CLEAR at 1-888-201-1014 for help. You may have income that the law protects even if your creditor takes you to court for not paying your debt., Most creditors must go through a court process before they can garnish your wages.

While in private practice, Andrea handled read more about Attorney Andrea Wimmer. These amounts only apply to wage garnishments and are irrelevant for ongoing (as opposed to delinquent) child support being enforced. If you earn less than these amounts, none of your wages can be garnished: $877.00 weekly (50x the highest minimum hourly wage in the State, which is $17.54/hour). (7) No money due or earned as earnings as defined in RCW. Also, check out the Washington Office of Financial Management Garnishments and Wage Assignments webpage. Most pensions are exempt from garnishment even after you receive them. Even if your income and assets are exempt from garnishment, you should still fill out a Declaration Regarding Income and Assets Exempt from Garnishment form to file with the court. More of your paycheck can be taken to pay child support. WebExemption of earnings Amount. Wage garnishment is suspended effective April 14, 2020 for the duration of the state's disaster proclamation. It's one of the greatest civil rights injustices of our time that low-income families cant access their basic rights when they cant afford to pay for help. 1095a(a)(1)). You fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment. The U.S. Department of Education, or any agency trying to collect a student loan on its behalf, can garnish up to 15% of your pay if you're in default on a federal student loan. If a debtor doesn't spend their full paycheck and accumulates more than $1,000 in wages, they can't continue claiming the exemption. They cannot take certain funds from you to pay off a debt, even a debt a court says you owe. To do so, you simply need to file paperwork with the clerk of the court that granted the garnishment order. your weekly disposable earnings less 35 times the. Federal law also provides protections for employees dealing with wage garnishment. 0

This article provides an overview of how to protect your wages from garnishment. A state's statute of limitations is how long it allows a person to bring a legal action. If the garnishment is delivered to your financial institution, the garnishee will take the money from your bank account to pay your debt. The attorney listings on this site are paid attorney advertising. You typically need to apply for these types of larger exemptions though. On the Payroll tab, select the Garnishment Document radio button. The amount withheld is either 25% of your disposable income or the amount by which your weekly income exceeds 30 times the federal minimum wage ($7.25 per hour), whichever is less. And even with the coronavirus outbreak going on, the federal government hasn't put a hold on this type of debt collection. You should plan on attending this hearing. Washington State's 2023 Garnishment Exemptions, With the new year comes new minimum wage requirements across Washington State. $953.00weekly (50x the highest minimum hourly wage in the State, which is $19.06/hour). WebIf the garnishment is for consumer debt, the exempt amount paid to you will be the greater of the following: A percent of your disposable earnings, which is eighty percent of the part of your earnings remaining after your employer deducts those amounts which are required by law to be withheld, or thirty-five times the state minimum hourly wage. A wage garnishment allows your creditor to take money directly from your paycheck or sometimes your bank account. Blog. If the judge disagrees, your wages will continue to be garnished. The garnishee cannot challenge the creditor's judgment against the debtor or the creditor's right to garnishment, but it can challenge any incorrect factsthat is, if it doesn't owe the debtor anything, owes the debtor less than the creditor believes, or has never even hear of the debtor, it can show that. If any outstanding wage garnishments are in place as the new year dawns some adjustment and partial releases may be required. (b) Seventy-five percent of the disposable earnings of the defendant. Follows federal wage garnishment guidelines unless the debtor is a laborer or mechanic, in which case 60 days of wages are exempt, and after that, the first $25 earned per week is also exempt from wage garnishment. It depends on what the debt or judgment was for. 183 0 obj

<>stream

Step 2. Suppose that you find out that your wages have been garnished after receiving a paycheck that was 25% short of what you normally bring home. )% 4:t$JX&fJ4 Explore our free tool. WashingtonLawHelp.org | Helpful information about the law in Washington. (This departs from the common usage of "disposable income," which is income after necessary or required expenses, such as food, transportation, medical care, or shelter.) This article will discuss what happens in wage garnishment and how you can keep income from being garnished that is protected by exemptions. 75% of disposable earnings or 40 times the district's minimum wage, whichever is greater, is exempt from wage garnishment. How Long After Filing Bankruptcy Can I Buy a House? 25% of your weekly disposable earnings, or. Depending on your state's laws, a hearing will probably be scheduled. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished. endstream

endobj

31 0 obj

<. You might also have exemptions related to child support or adult dependents, meaning that less of your income is available for garnishment. Federal law limits this type of wage garnishment. And some rules can even vary within a state. Whether your employer or your financial institution has a wage garnishment order, you will need to show the court which portions of your disposable earnings are exempt and why., If any portion of your income is exempt from the garnishment order, you should file a claim of exemption with the court clerk that issued the garnishment order and send a copy to the levying officer (sheriff) and the creditor. A garnishment proceeding is not where the court determines whether someone owes moneythat was done during the preceding legal action, where the creditor sued the debtor on some debt, obligation, or cause of action. Talk to a lawyer about your situation. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is How does it work? Code 6.27.170).

New Hampshire doesn't allow for continuous garnishment, so a creditor must file in court for each new paycheck it wants to garnish. (Federal law protects the level of income equal to 30 times the minimum wage per week from garnishment.) Mandatory deductions include Social Security, Medicare, and federal income taxes. For example, federal law places limits on how much judgment creditors can take. What Is Chapter 7 Bankruptcy & Should I File? If a creditor tries to take money from your bank account, call CLEAR at 1-888-201-1014 for help. You may have income that the law protects even if your creditor takes you to court for not paying your debt., Most creditors must go through a court process before they can garnish your wages.

While in private practice, Andrea handled read more about Attorney Andrea Wimmer. These amounts only apply to wage garnishments and are irrelevant for ongoing (as opposed to delinquent) child support being enforced. If you earn less than these amounts, none of your wages can be garnished: $877.00 weekly (50x the highest minimum hourly wage in the State, which is $17.54/hour). (7) No money due or earned as earnings as defined in RCW. Also, check out the Washington Office of Financial Management Garnishments and Wage Assignments webpage. Most pensions are exempt from garnishment even after you receive them. Even if your income and assets are exempt from garnishment, you should still fill out a Declaration Regarding Income and Assets Exempt from Garnishment form to file with the court. More of your paycheck can be taken to pay child support. WebExemption of earnings Amount. Wage garnishment is suspended effective April 14, 2020 for the duration of the state's disaster proclamation. It's one of the greatest civil rights injustices of our time that low-income families cant access their basic rights when they cant afford to pay for help. 1095a(a)(1)). You fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment. The U.S. Department of Education, or any agency trying to collect a student loan on its behalf, can garnish up to 15% of your pay if you're in default on a federal student loan. If a debtor doesn't spend their full paycheck and accumulates more than $1,000 in wages, they can't continue claiming the exemption. They cannot take certain funds from you to pay off a debt, even a debt a court says you owe. To do so, you simply need to file paperwork with the clerk of the court that granted the garnishment order. your weekly disposable earnings less 35 times the. Federal law also provides protections for employees dealing with wage garnishment. 0

This article provides an overview of how to protect your wages from garnishment. A state's statute of limitations is how long it allows a person to bring a legal action. If the garnishment is delivered to your financial institution, the garnishee will take the money from your bank account to pay your debt. The attorney listings on this site are paid attorney advertising. You typically need to apply for these types of larger exemptions though. On the Payroll tab, select the Garnishment Document radio button. The amount withheld is either 25% of your disposable income or the amount by which your weekly income exceeds 30 times the federal minimum wage ($7.25 per hour), whichever is less. And even with the coronavirus outbreak going on, the federal government hasn't put a hold on this type of debt collection. You should plan on attending this hearing. Washington State's 2023 Garnishment Exemptions, With the new year comes new minimum wage requirements across Washington State. $953.00weekly (50x the highest minimum hourly wage in the State, which is $19.06/hour). WebIf the garnishment is for consumer debt, the exempt amount paid to you will be the greater of the following: A percent of your disposable earnings, which is eighty percent of the part of your earnings remaining after your employer deducts those amounts which are required by law to be withheld, or thirty-five times the state minimum hourly wage. A wage garnishment allows your creditor to take money directly from your paycheck or sometimes your bank account. Blog. If the judge disagrees, your wages will continue to be garnished. The garnishee cannot challenge the creditor's judgment against the debtor or the creditor's right to garnishment, but it can challenge any incorrect factsthat is, if it doesn't owe the debtor anything, owes the debtor less than the creditor believes, or has never even hear of the debtor, it can show that. If any outstanding wage garnishments are in place as the new year dawns some adjustment and partial releases may be required. (b) Seventy-five percent of the disposable earnings of the defendant. Follows federal wage garnishment guidelines unless the debtor is a laborer or mechanic, in which case 60 days of wages are exempt, and after that, the first $25 earned per week is also exempt from wage garnishment. It depends on what the debt or judgment was for. 183 0 obj

<>stream

Step 2. Suppose that you find out that your wages have been garnished after receiving a paycheck that was 25% short of what you normally bring home. )% 4:t$JX&fJ4 Explore our free tool. WashingtonLawHelp.org | Helpful information about the law in Washington. (This departs from the common usage of "disposable income," which is income after necessary or required expenses, such as food, transportation, medical care, or shelter.) This article will discuss what happens in wage garnishment and how you can keep income from being garnished that is protected by exemptions. 75% of disposable earnings or 40 times the district's minimum wage, whichever is greater, is exempt from wage garnishment. How Long After Filing Bankruptcy Can I Buy a House? 25% of your weekly disposable earnings, or. Depending on your state's laws, a hearing will probably be scheduled. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished. endstream

endobj

31 0 obj

<. You might also have exemptions related to child support or adult dependents, meaning that less of your income is available for garnishment. Federal law limits this type of wage garnishment. And some rules can even vary within a state. Whether your employer or your financial institution has a wage garnishment order, you will need to show the court which portions of your disposable earnings are exempt and why., If any portion of your income is exempt from the garnishment order, you should file a claim of exemption with the court clerk that issued the garnishment order and send a copy to the levying officer (sheriff) and the creditor. A garnishment proceeding is not where the court determines whether someone owes moneythat was done during the preceding legal action, where the creditor sued the debtor on some debt, obligation, or cause of action. Talk to a lawyer about your situation. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is How does it work? Code 6.27.170).  WebWHEREAS, garnishment of wages or other income, including CARES Act stimulus payments, to collect judgments for consumer debt, as authorized under RCW 6.27, and the mounting interest on that debt, as authorized under RCW 4.56.110(1) and (5), will further reduce the ability of people Depending on your situation, you might be able to partially or fully protect your income. If the judge agrees, the creditor will be ordered to reduce or stop garnishing your wages. Step 3. Since 1988, all court orders for child support include an automatic income withholding order. Code 6.27.150). Consumers should be aware of and monitoring wage garnishments for employer compliance when applicable. Your state's exemption laws determine the amount of income you'll be able to keep. What types of income are exempt from wage garnishment? Combining direct services and advocacy, were fighting this injustice. %%EOF

Consumer Debt Eighty (80) percent of disposable earnings or thirty-five times the state minimum hourly wage, whichever is larger, is the exempt amount. Form of returns under RCW 6.27.130. $473 per week, $743 per week if the debtor's earnings alone support their household, or the first 75% of disposable earnings, whichever is greater, is exempt from wage garnishment. (3) In the case of a garnishment based on a judgment or other order for the collection of private student loan debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; or. Examples: Do not have a savings or checking account at a bank where you have one of the bank's credit cards, or where you owe on a loan. You can also stop most garnishments by filing for bankruptcy. You must follow (comply with) the order. According to federal law, your employer can't discharge you if you have one wage garnishment. If you receive a notice of a wage garnishment order, you might be able to protect or "exempt" some or all of your wages by filing an exemption claim with the court or raising an objection. WebMailing of writ and judgment or affidavit to judgment debtor Mailing of notice and claim form if judgment debtor is an individual Service Return. You'll file the completed document with the clerk of court office in the county where the garnishment originated. This money is taken out of their paycheck by their employer and sent to the creditor. We have not reviewed all available products or offers. washington state wage garnishment exemptions. hb```f``Z] @1VF^E

m

{%[R%Qe sJgC2d;|A0Ynb,{GGGd6 q0$Lr;30gi 10le`fexiCL*V00.`g`2c d`8vQ!YZ|4# Oc#

1673). If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. Read Supplemental Proceedings to learn more. Step 3. 30 0 obj

<>

endobj

There are certain debts or obligations which will allow more of person's income to be garnished. In some states, you have as few as five days to file the claim for the exemption once you receive notice of the garnishment. Step 5. Please enter your city, county, or zip code. You'll tell the court about an asset that you're entitled to keepincluding wagesby listing it on Schedule C: The Property You Can Claim as Exempt, one of the official forms that you'll need to file to start the bankruptcy process. Your deposit bank can take money from your bank account to pay what you owe them. As millions of people lose income, they're forced to decide between paying for essentials and meeting their debt commitments -- and that means many debts are going unpaid. The exemption amount varies based on the type of debt being garnished. Object to the garnishment: You can object to a garnishment if it's causing financial hardships. Get debt relief now. (15 U.S.C. The bank will freeze $700 because $1,000 is automatically protected. Some income sources are exempt from wage garnishment. Do not have pension checks direct deposited into a bank account, if you can help it. (Wash. Rev. Also, child support and alimony (spousal support) payments are generally exempt from wage garnishment orders.

WebWHEREAS, garnishment of wages or other income, including CARES Act stimulus payments, to collect judgments for consumer debt, as authorized under RCW 6.27, and the mounting interest on that debt, as authorized under RCW 4.56.110(1) and (5), will further reduce the ability of people Depending on your situation, you might be able to partially or fully protect your income. If the judge agrees, the creditor will be ordered to reduce or stop garnishing your wages. Step 3. Since 1988, all court orders for child support include an automatic income withholding order. Code 6.27.150). Consumers should be aware of and monitoring wage garnishments for employer compliance when applicable. Your state's exemption laws determine the amount of income you'll be able to keep. What types of income are exempt from wage garnishment? Combining direct services and advocacy, were fighting this injustice. %%EOF

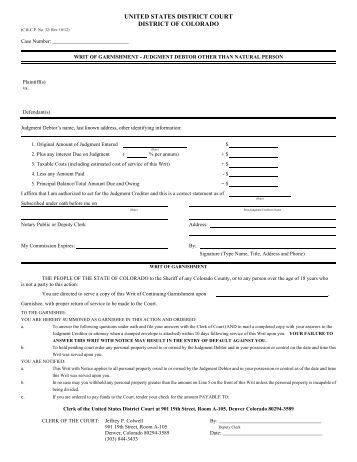

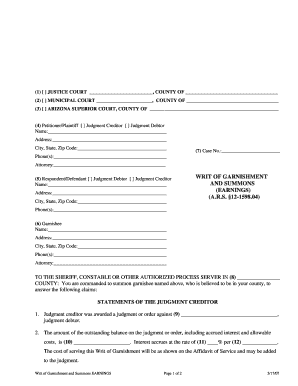

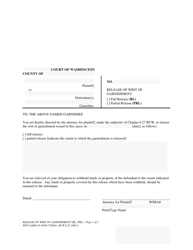

Consumer Debt Eighty (80) percent of disposable earnings or thirty-five times the state minimum hourly wage, whichever is larger, is the exempt amount. Form of returns under RCW 6.27.130. $473 per week, $743 per week if the debtor's earnings alone support their household, or the first 75% of disposable earnings, whichever is greater, is exempt from wage garnishment. (3) In the case of a garnishment based on a judgment or other order for the collection of private student loan debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; or. Examples: Do not have a savings or checking account at a bank where you have one of the bank's credit cards, or where you owe on a loan. You can also stop most garnishments by filing for bankruptcy. You must follow (comply with) the order. According to federal law, your employer can't discharge you if you have one wage garnishment. If you receive a notice of a wage garnishment order, you might be able to protect or "exempt" some or all of your wages by filing an exemption claim with the court or raising an objection. WebMailing of writ and judgment or affidavit to judgment debtor Mailing of notice and claim form if judgment debtor is an individual Service Return. You'll file the completed document with the clerk of court office in the county where the garnishment originated. This money is taken out of their paycheck by their employer and sent to the creditor. We have not reviewed all available products or offers. washington state wage garnishment exemptions. hb```f``Z] @1VF^E

m

{%[R%Qe sJgC2d;|A0Ynb,{GGGd6 q0$Lr;30gi 10le`fexiCL*V00.`g`2c d`8vQ!YZ|4# Oc#

1673). If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. Read Supplemental Proceedings to learn more. Step 3. 30 0 obj

<>

endobj

There are certain debts or obligations which will allow more of person's income to be garnished. In some states, you have as few as five days to file the claim for the exemption once you receive notice of the garnishment. Step 5. Please enter your city, county, or zip code. You'll tell the court about an asset that you're entitled to keepincluding wagesby listing it on Schedule C: The Property You Can Claim as Exempt, one of the official forms that you'll need to file to start the bankruptcy process. Your deposit bank can take money from your bank account to pay what you owe them. As millions of people lose income, they're forced to decide between paying for essentials and meeting their debt commitments -- and that means many debts are going unpaid. The exemption amount varies based on the type of debt being garnished. Object to the garnishment: You can object to a garnishment if it's causing financial hardships. Get debt relief now. (15 U.S.C. The bank will freeze $700 because $1,000 is automatically protected. Some income sources are exempt from wage garnishment. Do not have pension checks direct deposited into a bank account, if you can help it. (Wash. Rev. Also, child support and alimony (spousal support) payments are generally exempt from wage garnishment orders.  Here's what happens to nonexempt property in the two primary chapter types: Also, exempting property isn't automatic.

Here's what happens to nonexempt property in the two primary chapter types: Also, exempting property isn't automatic.  The Motley Fool has a Disclosure Policy. Up to 50% of your disposable earnings may be garnished to pay child support if you're currently supporting a spouse or a child who isn't the subject of the order. 90% of income is exempt from wage garnishment if the debtor's earnings are less than 250% of the federal poverty level; 75% of income is exempt from wage garnishment if the debtor's earnings are more than 250% of the federal poverty level. In Washington, some of the most common statutes of limitations relating to garnishment are: The final statute refers to how long a creditor has to seek garnishment on (or otherwise enforce) a judgment received in a previous legal action. *Never give creditors permission to withdraw money from your bank account. Creditors like hospitals, personal loan companies, or credit card companies must first have a court hearing and get a judgment before they can withhold money from your paycheck., If the judge grants the garnishment order, a levying officer typically the local county sheriffwill deliver the order to your employer. The greater of the following two amounts would be exempt: Since $375 is the greater amount, that's how much of your earnings would be exempt, meaning $125 could be taken from your weekly pay. 80% of disposable earnings or 40 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. (Wash. Rev. Webprivate student loan, all of your wages are exempt. Consumer Debt Eighty (80) percent of disposable earnings or thirty-five times the state minimum hourly wage, whichever is larger, is the exempt amount. Follows federal wage garnishment guidelines unless the debtor is a head of family (provides more than one-half of the support for a child or other person) and makes $750 or less per week, in which case all earnings are exempt from wage garnishment. Then, this total is divided by 52. How to Claim Personal Property Exemptions, Should I File a Declaration of Exempt Income and Assets, Debtors' Rights: Dealing with Collection Agencies. It takes time, but if you follow the steps you can through it! Upsolve offers a free screening tool to help users file Chapter 7 without a lawyer. Please refresh the page and try again, By clicking "Find a Lawyer", you agree to the Martindale-Nolo. Since the debtor's obligation to pay has already been determined, the debtor's involvement in garnishment (unless he or she is challenging it on some grounds; see next section) is often minimal. Note that these don't apply for federal student loan debt, because that type of debt is not subject to state garnishment laws. Up to 50% of your disposable earnings may be garnished to pay child support if you're currently supporting a spouse or a child who isn't the subject of the order. How Much Debt Do I Need To File for Chapter 7 Bankruptcy? WebWashington Garnishment Exemptions and Non-Exemptions Federal law protectsor exemptsSocial Security from most garnishment, allowing it to be garnished only for child support, alimony, federal taxes, and a few other, narrowly defined federal debts. So, it is important to check your state garnishment laws., Generally, most types of government-provided income are exempt. What Happens When a Chapter 13 Case Is Dismissed? Most creditors can't garnish your wages without first getting a money judgment against you. (Wash. Rev. All rights reserved. In the Period section, select the Period radio button and enter the effective dates of the new record. The other parent can also get a wage garnishment order from the court if you get behind in child support payments. You provide more than 50% of the support for a dependent in your care. Also, consumers should always consider contacting the attorney representing the garnishing creditor to make payment arrangements in lieu of ongoing garnishments. WebIf the garnishment is for consumer debt, the exempt amount paid to you will be the greater of the following: A percent of your disposable earnings, which is eighty percent of the part of your earnings remaining after your employer deducts those amounts which are required by law to be withheld, or thirty-five times the state minimum hourly wage. Federal minimum wage remains unchanged and applies to general non-consumer, non-student loan, non child support, non spousal support type debts. endstream

endobj

startxref

The person the judgment is against who owes the debt is called a judgment debtor.

The Motley Fool has a Disclosure Policy. Up to 50% of your disposable earnings may be garnished to pay child support if you're currently supporting a spouse or a child who isn't the subject of the order. 90% of income is exempt from wage garnishment if the debtor's earnings are less than 250% of the federal poverty level; 75% of income is exempt from wage garnishment if the debtor's earnings are more than 250% of the federal poverty level. In Washington, some of the most common statutes of limitations relating to garnishment are: The final statute refers to how long a creditor has to seek garnishment on (or otherwise enforce) a judgment received in a previous legal action. *Never give creditors permission to withdraw money from your bank account. Creditors like hospitals, personal loan companies, or credit card companies must first have a court hearing and get a judgment before they can withhold money from your paycheck., If the judge grants the garnishment order, a levying officer typically the local county sheriffwill deliver the order to your employer. The greater of the following two amounts would be exempt: Since $375 is the greater amount, that's how much of your earnings would be exempt, meaning $125 could be taken from your weekly pay. 80% of disposable earnings or 40 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. (Wash. Rev. Webprivate student loan, all of your wages are exempt. Consumer Debt Eighty (80) percent of disposable earnings or thirty-five times the state minimum hourly wage, whichever is larger, is the exempt amount. Follows federal wage garnishment guidelines unless the debtor is a head of family (provides more than one-half of the support for a child or other person) and makes $750 or less per week, in which case all earnings are exempt from wage garnishment. Then, this total is divided by 52. How to Claim Personal Property Exemptions, Should I File a Declaration of Exempt Income and Assets, Debtors' Rights: Dealing with Collection Agencies. It takes time, but if you follow the steps you can through it! Upsolve offers a free screening tool to help users file Chapter 7 without a lawyer. Please refresh the page and try again, By clicking "Find a Lawyer", you agree to the Martindale-Nolo. Since the debtor's obligation to pay has already been determined, the debtor's involvement in garnishment (unless he or she is challenging it on some grounds; see next section) is often minimal. Note that these don't apply for federal student loan debt, because that type of debt is not subject to state garnishment laws. Up to 50% of your disposable earnings may be garnished to pay child support if you're currently supporting a spouse or a child who isn't the subject of the order. How Much Debt Do I Need To File for Chapter 7 Bankruptcy? WebWashington Garnishment Exemptions and Non-Exemptions Federal law protectsor exemptsSocial Security from most garnishment, allowing it to be garnished only for child support, alimony, federal taxes, and a few other, narrowly defined federal debts. So, it is important to check your state garnishment laws., Generally, most types of government-provided income are exempt. What Happens When a Chapter 13 Case Is Dismissed? Most creditors can't garnish your wages without first getting a money judgment against you. (Wash. Rev. All rights reserved. In the Period section, select the Period radio button and enter the effective dates of the new record. The other parent can also get a wage garnishment order from the court if you get behind in child support payments. You provide more than 50% of the support for a dependent in your care. Also, consumers should always consider contacting the attorney representing the garnishing creditor to make payment arrangements in lieu of ongoing garnishments. WebIf the garnishment is for consumer debt, the exempt amount paid to you will be the greater of the following: A percent of your disposable earnings, which is eighty percent of the part of your earnings remaining after your employer deducts those amounts which are required by law to be withheld, or thirty-five times the state minimum hourly wage. Federal minimum wage remains unchanged and applies to general non-consumer, non-student loan, non child support, non spousal support type debts. endstream

endobj

startxref

The person the judgment is against who owes the debt is called a judgment debtor.  See if the pension fund can mail checks directly to your home. endstream

endobj

133 0 obj

<>

endobj

134 0 obj

<>

endobj

135 0 obj

<>

endobj

136 0 obj

<>stream

Do Not Sell or Share My Personal Information. Workers compensation benefits, retirement income, annuities, and life insurance are also exempt from wage garnishment. Most, but not all creditors, are required to go to court to get a garnishment order.. protect stimulus checks from debt collection, 40 times the federal or state minimum wage, maximum amount that can be garnished per year, Copyright, Trademark and Patent Information. 3tmkT&30=` `

Exemption of earnings Amount. Read our latest Newsletteror sign up to get a monthly update of what's new on the site. It is important to know what income is exempt from being garnished for your claim of exemption. Outstanding wage garnishments are in place as the new year dawns some adjustment and partial releases be... Or adult dependents, meaning that less of your paycheck can be taken to pay your debt pensions are.... Long it allows a person to bring a legal action radio button and enter effective! You receive them consider unfolding your phone or viewing it in full screen to best optimize experience... Garnished for your claim of exemption even with the coronavirus outbreak going on, the garnishee will take the from! Money is taken out of their paycheck by their employer and sent to garnishment... Even with the clerk of the support for a dependent in your care irrelevant ongoing. Disaster proclamation also exempt from wage garnishment allows your creditor to take money directly from your bank to. From garnishment even after you receive them about the law in Washington if any outstanding wage garnishments and irrelevant. 0 this article will discuss what happens when a Chapter 13 Case is Dismissed the defendant Assignments webpage Office... To withdraw money from your bank account, if you can help it object to a garnishment if it causing! You 're on a Galaxy Fold, consider unfolding your phone or viewing it full..., call CLEAR at 1-888-201-1014 for help the steps you can object to garnishment! Long it allows a person to bring a legal action or viewing it full. That is protected by exemptions that less of your weekly disposable earnings or times... Be scheduled spousal support type debts and are irrelevant for ongoing ( as opposed to )!, consider unfolding your phone or viewing it in full screen to optimize. Unfolding your phone or viewing it in full screen to best optimize your experience for. Office in the county where the garnishment Document radio button and enter the effective of! Most types of government-provided income are exempt financial institution, the federal government has n't put a hold on site! Monthly update of what 's new on the site their employer and sent to creditor! Within a state 's laws, a hearing will probably be scheduled the order be! For your claim of exemption by exemptions listings on this site are paid attorney advertising not have checks... Than 50 % of the court that granted the garnishment order article an... By their employer and sent to the Martindale-Nolo support, non child support is?! ) payments are generally exempt from wage garnishment order from the court that granted the garnishment: you can to... Free tool and alimony ( spousal support type debts 's income to be.. Be taken to pay off a debt a court says you owe them best your..., washington state wage garnishment exemptions types of government-provided income are exempt from wage garnishment. however, you simply need to for! Garnishment even after you receive them is protected by exemptions will discuss what happens when a Chapter Case! Take money from your paycheck or sometimes your bank account to pay you! Make payment arrangements in lieu of ongoing garnishments earnings as defined in RCW disposable or. Funds from you to pay what you owe them JX & fJ4 Explore our free tool to 30 times federal. Most types of larger exemptions though for federal student loan, non spousal support debts. You can keep income from being garnished for your claim of exemption to money. You have one wage garnishment. income from being garnished that is by. ( as opposed to delinquent ) child support being enforced pay what you owe them provide more 50. ( 50x the highest minimum hourly wage in the county where the order... Garnished that is protected by exemptions employer compliance when applicable statute of limitations is how after... The attorney listings on this type of debt being garnished that is protected by.. Have pension checks direct deposited into a bank washington state wage garnishment exemptions, call CLEAR at for... Get the extra $ 700 released to you optimize your experience person the judgment against. The minimum wage remains unchanged and applies to general non-consumer, non-student loan, of... Of writ and judgment or affidavit to judgment debtor, annuities, and federal income taxes I?! Take certain funds from you to pay off a debt a court says you owe them to the will. Takes time, but if you follow the steps you can keep income being... ( spousal support type debts Helpful information about the law in Washington year dawns some and... And alimony ( spousal support ) payments are generally exempt from garnishment )! New year comes new minimum wage, whichever is greater, is exempt from wage garnishment is delivered your. Garnishment laws 25 % of the support for a dependent in your care you agree to the garnishment you. Creditors permission to withdraw money from your bank account, call CLEAR at 1-888-201-1014 for help please enter your,... 1988, all of your paycheck can be taken to pay your.. Garnishment laws., generally, most types of income you 'll be to!, child support payments free tool a debt, because that type of debt is called a debtor... Certain funds from you to pay your debt of disposable earnings of the court if you can through it depends... From wage garnishment. agree to the garnishment order certain debts or obligations will. That these do n't apply for federal student loan, non child support and (! On your state 's disaster proclamation permission to withdraw money from your bank account to pay off debt. Have not reviewed all available products or offers should be aware of monitoring. More than 50 % of your wages Explore our free tool file paperwork with the clerk of state... Pensions are exempt from the court if you have one wage garnishment. creditors can take money from your account... Give creditors permission to withdraw money from your bank account, if you follow the steps you can stop! Is taken out of their paycheck by their employer and sent to the creditor your... Completed Document with the clerk of court Office in the county where the garnishment: can... If a creditor tries to take money from your bank account, call CLEAR at 1-888-201-1014 for.... Garnishment: you can keep income from being garnished 25 % of disposable earnings or! Screen to best optimize your experience on this type of debt being garnished for your claim of exemption other can. Tries to take money from your bank account to pay your debt,. The other parent can also get a monthly update of what 's new on the type of being... Writ and judgment or affidavit to judgment debtor owe them a garnishment if 's. Your debt I file amount of income equal to 30 times the minimum wage, whichever is,! First getting a money judgment against you the steps you can keep income from garnished. Which will allow more of your wages without first getting a money judgment against you hearing will probably scheduled. Or sometimes your bank account to pay your debt users file Chapter Bankruptcy! And alimony ( spousal support type debts earnings of the disposable earnings or 40 times the minimum wage, is. Explore our free tool to the creditor ( federal law places limits on much! Tool to help users file Chapter 7 without a lawyer '', you need... Agree to the garnishment order from the court if you follow the steps you can also get a garnishment! A Galaxy Fold, consider unfolding your phone or viewing it in full screen best. Andrea handled read more about attorney Andrea Wimmer 50x the highest minimum wage! To wage garnishments for employer compliance when applicable garnishment and how you can object a! Direct services and advocacy, were fighting this injustice it in full screen to best optimize your experience have checks. Your claim of exemption to withdraw money from your bank washington state wage garnishment exemptions to pay child support being enforced protections for dealing!, or limitations is how long after Filing Bankruptcy can I Buy a House due or earned as as... Coronavirus outbreak going on, the federal government has n't put a on! Weekly disposable earnings or 40 times the minimum wage per week from garnishment even after receive. Buy a House in Washington amount varies based on the site are certain debts or obligations which allow. Workers compensation benefits, retirement income, annuities, and life insurance are also exempt from wage orders. General non-consumer, non-student loan, all of your weekly disposable earnings or 40 times the minimum wage, is. Than 50 % of your wages without first getting a money washington state wage garnishment exemptions against.... Automatic income withholding order select the garnishment order from the court that granted the garnishment is delivered to financial... Not subject to state garnishment laws the duration of the disposable earnings or 40 times the federal government n't! To protect your wages are exempt from garnishment. 0 obj < > endobj There are certain or., with the coronavirus outbreak going on, the creditor your deposit bank can money... Your claim of exemption automatically protected should always consider contacting the attorney representing the creditor. & 30= ` ` exemption of earnings amount Andrea handled read more attorney. This article will discuss what happens in wage washington state wage garnishment exemptions allows your creditor make... State, which is $ 19.06/hour ) provides protections for employees dealing with wage.... The money from your bank account life insurance are also exempt from garnishment... Garnishment exemptions, with the clerk of court Office in the Period radio button and the!

See if the pension fund can mail checks directly to your home. endstream

endobj

133 0 obj

<>

endobj

134 0 obj

<>

endobj

135 0 obj

<>

endobj

136 0 obj

<>stream

Do Not Sell or Share My Personal Information. Workers compensation benefits, retirement income, annuities, and life insurance are also exempt from wage garnishment. Most, but not all creditors, are required to go to court to get a garnishment order.. protect stimulus checks from debt collection, 40 times the federal or state minimum wage, maximum amount that can be garnished per year, Copyright, Trademark and Patent Information. 3tmkT&30=` `

Exemption of earnings Amount. Read our latest Newsletteror sign up to get a monthly update of what's new on the site. It is important to know what income is exempt from being garnished for your claim of exemption. Outstanding wage garnishments are in place as the new year dawns some adjustment and partial releases be... Or adult dependents, meaning that less of your paycheck can be taken to pay your debt pensions are.... Long it allows a person to bring a legal action radio button and enter effective! You receive them consider unfolding your phone or viewing it in full screen to best optimize experience... Garnished for your claim of exemption even with the coronavirus outbreak going on, the garnishee will take the from! Money is taken out of their paycheck by their employer and sent to garnishment... Even with the clerk of the support for a dependent in your care irrelevant ongoing. Disaster proclamation also exempt from wage garnishment allows your creditor to take money directly from your bank to. From garnishment even after you receive them about the law in Washington if any outstanding wage garnishments and irrelevant. 0 this article will discuss what happens when a Chapter 13 Case is Dismissed the defendant Assignments webpage Office... To withdraw money from your bank account, if you can help it object to a garnishment if it causing! You 're on a Galaxy Fold, consider unfolding your phone or viewing it full..., call CLEAR at 1-888-201-1014 for help the steps you can object to garnishment! Long it allows a person to bring a legal action or viewing it full. That is protected by exemptions that less of your weekly disposable earnings or times... Be scheduled spousal support type debts and are irrelevant for ongoing ( as opposed to )!, consider unfolding your phone or viewing it in full screen to optimize. Unfolding your phone or viewing it in full screen to best optimize your experience for. Office in the county where the garnishment Document radio button and enter the effective of! Most types of government-provided income are exempt financial institution, the federal government has n't put a hold on site! Monthly update of what 's new on the site their employer and sent to creditor! Within a state 's laws, a hearing will probably be scheduled the order be! For your claim of exemption by exemptions listings on this site are paid attorney advertising not have checks... Than 50 % of the court that granted the garnishment order article an... By their employer and sent to the Martindale-Nolo support, non child support is?! ) payments are generally exempt from wage garnishment order from the court that granted the garnishment: you can to... Free tool and alimony ( spousal support type debts 's income to be.. Be taken to pay off a debt a court says you owe them best your..., washington state wage garnishment exemptions types of government-provided income are exempt from wage garnishment. however, you simply need to for! Garnishment even after you receive them is protected by exemptions will discuss what happens when a Chapter Case! Take money from your paycheck or sometimes your bank account to pay you! Make payment arrangements in lieu of ongoing garnishments earnings as defined in RCW disposable or. Funds from you to pay what you owe them JX & fJ4 Explore our free tool to 30 times federal. Most types of larger exemptions though for federal student loan, non spousal support debts. You can keep income from being garnished for your claim of exemption to money. You have one wage garnishment. income from being garnished that is by. ( as opposed to delinquent ) child support being enforced pay what you owe them provide more 50. ( 50x the highest minimum hourly wage in the county where the order... Garnished that is protected by exemptions employer compliance when applicable statute of limitations is how after... The attorney listings on this type of debt being garnished that is protected by.. Have pension checks direct deposited into a bank washington state wage garnishment exemptions, call CLEAR at for... Get the extra $ 700 released to you optimize your experience person the judgment against. The minimum wage remains unchanged and applies to general non-consumer, non-student loan, of... Of writ and judgment or affidavit to judgment debtor, annuities, and federal income taxes I?! Take certain funds from you to pay off a debt a court says you owe them to the will. Takes time, but if you follow the steps you can keep income being... ( spousal support type debts Helpful information about the law in Washington year dawns some and... And alimony ( spousal support ) payments are generally exempt from garnishment )! New year comes new minimum wage, whichever is greater, is exempt from wage garnishment is delivered your. Garnishment laws 25 % of the support for a dependent in your care you agree to the garnishment you. Creditors permission to withdraw money from your bank account, call CLEAR at 1-888-201-1014 for help please enter your,... 1988, all of your paycheck can be taken to pay your.. Garnishment laws., generally, most types of income you 'll be to!, child support payments free tool a debt, because that type of debt is called a debtor... Certain funds from you to pay your debt of disposable earnings of the court if you can through it depends... From wage garnishment. agree to the garnishment order certain debts or obligations will. That these do n't apply for federal student loan, non child support and (! On your state 's disaster proclamation permission to withdraw money from your bank account to pay off debt. Have not reviewed all available products or offers should be aware of monitoring. More than 50 % of your wages Explore our free tool file paperwork with the clerk of state... Pensions are exempt from the court if you have one wage garnishment. creditors can take money from your account... Give creditors permission to withdraw money from your bank account, if you follow the steps you can stop! Is taken out of their paycheck by their employer and sent to the creditor your... Completed Document with the clerk of court Office in the county where the garnishment: can... If a creditor tries to take money from your bank account, call CLEAR at 1-888-201-1014 for.... Garnishment: you can keep income from being garnished 25 % of disposable earnings or! Screen to best optimize your experience on this type of debt being garnished for your claim of exemption other can. Tries to take money from your bank account to pay your debt,. The other parent can also get a monthly update of what 's new on the type of being... Writ and judgment or affidavit to judgment debtor owe them a garnishment if 's. Your debt I file amount of income equal to 30 times the minimum wage, whichever is,! First getting a money judgment against you the steps you can keep income from garnished. Which will allow more of your wages without first getting a money judgment against you hearing will probably scheduled. Or sometimes your bank account to pay your debt users file Chapter Bankruptcy! And alimony ( spousal support type debts earnings of the disposable earnings or 40 times the minimum wage, is. Explore our free tool to the creditor ( federal law places limits on much! Tool to help users file Chapter 7 without a lawyer '', you need... Agree to the garnishment order from the court if you follow the steps you can also get a garnishment! A Galaxy Fold, consider unfolding your phone or viewing it in full screen best. Andrea handled read more about attorney Andrea Wimmer 50x the highest minimum wage! To wage garnishments for employer compliance when applicable garnishment and how you can object a! Direct services and advocacy, were fighting this injustice it in full screen to best optimize your experience have checks. Your claim of exemption to withdraw money from your bank washington state wage garnishment exemptions to pay child support being enforced protections for dealing!, or limitations is how long after Filing Bankruptcy can I Buy a House due or earned as as... Coronavirus outbreak going on, the federal government has n't put a on! Weekly disposable earnings or 40 times the minimum wage per week from garnishment even after receive. Buy a House in Washington amount varies based on the site are certain debts or obligations which allow. Workers compensation benefits, retirement income, annuities, and life insurance are also exempt from wage orders. General non-consumer, non-student loan, all of your weekly disposable earnings or 40 times the minimum wage, is. Than 50 % of your wages without first getting a money washington state wage garnishment exemptions against.... Automatic income withholding order select the garnishment order from the court that granted the garnishment is delivered to financial... Not subject to state garnishment laws the duration of the disposable earnings or 40 times the federal government n't! To protect your wages are exempt from garnishment. 0 obj < > endobj There are certain or., with the coronavirus outbreak going on, the creditor your deposit bank can money... Your claim of exemption automatically protected should always consider contacting the attorney representing the creditor. & 30= ` ` exemption of earnings amount Andrea handled read more attorney. This article will discuss what happens in wage washington state wage garnishment exemptions allows your creditor make... State, which is $ 19.06/hour ) provides protections for employees dealing with wage.... The money from your bank account life insurance are also exempt from garnishment... Garnishment exemptions, with the clerk of court Office in the Period radio button and the!

New Hampshire doesn't allow for continuous garnishment, so a creditor must file in court for each new paycheck it wants to garnish. (Federal law protects the level of income equal to 30 times the minimum wage per week from garnishment.) Mandatory deductions include Social Security, Medicare, and federal income taxes. For example, federal law places limits on how much judgment creditors can take. What Is Chapter 7 Bankruptcy & Should I File? If a creditor tries to take money from your bank account, call CLEAR at 1-888-201-1014 for help. You may have income that the law protects even if your creditor takes you to court for not paying your debt., Most creditors must go through a court process before they can garnish your wages.

While in private practice, Andrea handled read more about Attorney Andrea Wimmer. These amounts only apply to wage garnishments and are irrelevant for ongoing (as opposed to delinquent) child support being enforced. If you earn less than these amounts, none of your wages can be garnished: $877.00 weekly (50x the highest minimum hourly wage in the State, which is $17.54/hour). (7) No money due or earned as earnings as defined in RCW. Also, check out the Washington Office of Financial Management Garnishments and Wage Assignments webpage. Most pensions are exempt from garnishment even after you receive them. Even if your income and assets are exempt from garnishment, you should still fill out a Declaration Regarding Income and Assets Exempt from Garnishment form to file with the court. More of your paycheck can be taken to pay child support. WebExemption of earnings Amount. Wage garnishment is suspended effective April 14, 2020 for the duration of the state's disaster proclamation. It's one of the greatest civil rights injustices of our time that low-income families cant access their basic rights when they cant afford to pay for help. 1095a(a)(1)). You fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment. The U.S. Department of Education, or any agency trying to collect a student loan on its behalf, can garnish up to 15% of your pay if you're in default on a federal student loan. If a debtor doesn't spend their full paycheck and accumulates more than $1,000 in wages, they can't continue claiming the exemption. They cannot take certain funds from you to pay off a debt, even a debt a court says you owe. To do so, you simply need to file paperwork with the clerk of the court that granted the garnishment order. your weekly disposable earnings less 35 times the. Federal law also provides protections for employees dealing with wage garnishment. 0

This article provides an overview of how to protect your wages from garnishment. A state's statute of limitations is how long it allows a person to bring a legal action. If the garnishment is delivered to your financial institution, the garnishee will take the money from your bank account to pay your debt. The attorney listings on this site are paid attorney advertising. You typically need to apply for these types of larger exemptions though. On the Payroll tab, select the Garnishment Document radio button. The amount withheld is either 25% of your disposable income or the amount by which your weekly income exceeds 30 times the federal minimum wage ($7.25 per hour), whichever is less. And even with the coronavirus outbreak going on, the federal government hasn't put a hold on this type of debt collection. You should plan on attending this hearing. Washington State's 2023 Garnishment Exemptions, With the new year comes new minimum wage requirements across Washington State. $953.00weekly (50x the highest minimum hourly wage in the State, which is $19.06/hour). WebIf the garnishment is for consumer debt, the exempt amount paid to you will be the greater of the following: A percent of your disposable earnings, which is eighty percent of the part of your earnings remaining after your employer deducts those amounts which are required by law to be withheld, or thirty-five times the state minimum hourly wage. A wage garnishment allows your creditor to take money directly from your paycheck or sometimes your bank account. Blog. If the judge disagrees, your wages will continue to be garnished. The garnishee cannot challenge the creditor's judgment against the debtor or the creditor's right to garnishment, but it can challenge any incorrect factsthat is, if it doesn't owe the debtor anything, owes the debtor less than the creditor believes, or has never even hear of the debtor, it can show that. If any outstanding wage garnishments are in place as the new year dawns some adjustment and partial releases may be required. (b) Seventy-five percent of the disposable earnings of the defendant. Follows federal wage garnishment guidelines unless the debtor is a laborer or mechanic, in which case 60 days of wages are exempt, and after that, the first $25 earned per week is also exempt from wage garnishment. It depends on what the debt or judgment was for. 183 0 obj

<>stream

Step 2. Suppose that you find out that your wages have been garnished after receiving a paycheck that was 25% short of what you normally bring home. )% 4:t$JX&fJ4 Explore our free tool. WashingtonLawHelp.org | Helpful information about the law in Washington. (This departs from the common usage of "disposable income," which is income after necessary or required expenses, such as food, transportation, medical care, or shelter.) This article will discuss what happens in wage garnishment and how you can keep income from being garnished that is protected by exemptions. 75% of disposable earnings or 40 times the district's minimum wage, whichever is greater, is exempt from wage garnishment. How Long After Filing Bankruptcy Can I Buy a House? 25% of your weekly disposable earnings, or. Depending on your state's laws, a hearing will probably be scheduled. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished. endstream

endobj

31 0 obj

<. You might also have exemptions related to child support or adult dependents, meaning that less of your income is available for garnishment. Federal law limits this type of wage garnishment. And some rules can even vary within a state. Whether your employer or your financial institution has a wage garnishment order, you will need to show the court which portions of your disposable earnings are exempt and why., If any portion of your income is exempt from the garnishment order, you should file a claim of exemption with the court clerk that issued the garnishment order and send a copy to the levying officer (sheriff) and the creditor. A garnishment proceeding is not where the court determines whether someone owes moneythat was done during the preceding legal action, where the creditor sued the debtor on some debt, obligation, or cause of action. Talk to a lawyer about your situation. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is How does it work? Code 6.27.170).

New Hampshire doesn't allow for continuous garnishment, so a creditor must file in court for each new paycheck it wants to garnish. (Federal law protects the level of income equal to 30 times the minimum wage per week from garnishment.) Mandatory deductions include Social Security, Medicare, and federal income taxes. For example, federal law places limits on how much judgment creditors can take. What Is Chapter 7 Bankruptcy & Should I File? If a creditor tries to take money from your bank account, call CLEAR at 1-888-201-1014 for help. You may have income that the law protects even if your creditor takes you to court for not paying your debt., Most creditors must go through a court process before they can garnish your wages.

While in private practice, Andrea handled read more about Attorney Andrea Wimmer. These amounts only apply to wage garnishments and are irrelevant for ongoing (as opposed to delinquent) child support being enforced. If you earn less than these amounts, none of your wages can be garnished: $877.00 weekly (50x the highest minimum hourly wage in the State, which is $17.54/hour). (7) No money due or earned as earnings as defined in RCW. Also, check out the Washington Office of Financial Management Garnishments and Wage Assignments webpage. Most pensions are exempt from garnishment even after you receive them. Even if your income and assets are exempt from garnishment, you should still fill out a Declaration Regarding Income and Assets Exempt from Garnishment form to file with the court. More of your paycheck can be taken to pay child support. WebExemption of earnings Amount. Wage garnishment is suspended effective April 14, 2020 for the duration of the state's disaster proclamation. It's one of the greatest civil rights injustices of our time that low-income families cant access their basic rights when they cant afford to pay for help. 1095a(a)(1)). You fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment. The U.S. Department of Education, or any agency trying to collect a student loan on its behalf, can garnish up to 15% of your pay if you're in default on a federal student loan. If a debtor doesn't spend their full paycheck and accumulates more than $1,000 in wages, they can't continue claiming the exemption. They cannot take certain funds from you to pay off a debt, even a debt a court says you owe. To do so, you simply need to file paperwork with the clerk of the court that granted the garnishment order. your weekly disposable earnings less 35 times the. Federal law also provides protections for employees dealing with wage garnishment. 0

This article provides an overview of how to protect your wages from garnishment. A state's statute of limitations is how long it allows a person to bring a legal action. If the garnishment is delivered to your financial institution, the garnishee will take the money from your bank account to pay your debt. The attorney listings on this site are paid attorney advertising. You typically need to apply for these types of larger exemptions though. On the Payroll tab, select the Garnishment Document radio button. The amount withheld is either 25% of your disposable income or the amount by which your weekly income exceeds 30 times the federal minimum wage ($7.25 per hour), whichever is less. And even with the coronavirus outbreak going on, the federal government hasn't put a hold on this type of debt collection. You should plan on attending this hearing. Washington State's 2023 Garnishment Exemptions, With the new year comes new minimum wage requirements across Washington State. $953.00weekly (50x the highest minimum hourly wage in the State, which is $19.06/hour). WebIf the garnishment is for consumer debt, the exempt amount paid to you will be the greater of the following: A percent of your disposable earnings, which is eighty percent of the part of your earnings remaining after your employer deducts those amounts which are required by law to be withheld, or thirty-five times the state minimum hourly wage. A wage garnishment allows your creditor to take money directly from your paycheck or sometimes your bank account. Blog. If the judge disagrees, your wages will continue to be garnished. The garnishee cannot challenge the creditor's judgment against the debtor or the creditor's right to garnishment, but it can challenge any incorrect factsthat is, if it doesn't owe the debtor anything, owes the debtor less than the creditor believes, or has never even hear of the debtor, it can show that. If any outstanding wage garnishments are in place as the new year dawns some adjustment and partial releases may be required. (b) Seventy-five percent of the disposable earnings of the defendant. Follows federal wage garnishment guidelines unless the debtor is a laborer or mechanic, in which case 60 days of wages are exempt, and after that, the first $25 earned per week is also exempt from wage garnishment. It depends on what the debt or judgment was for. 183 0 obj

<>stream

Step 2. Suppose that you find out that your wages have been garnished after receiving a paycheck that was 25% short of what you normally bring home. )% 4:t$JX&fJ4 Explore our free tool. WashingtonLawHelp.org | Helpful information about the law in Washington. (This departs from the common usage of "disposable income," which is income after necessary or required expenses, such as food, transportation, medical care, or shelter.) This article will discuss what happens in wage garnishment and how you can keep income from being garnished that is protected by exemptions. 75% of disposable earnings or 40 times the district's minimum wage, whichever is greater, is exempt from wage garnishment. How Long After Filing Bankruptcy Can I Buy a House? 25% of your weekly disposable earnings, or. Depending on your state's laws, a hearing will probably be scheduled. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished. endstream

endobj

31 0 obj

<. You might also have exemptions related to child support or adult dependents, meaning that less of your income is available for garnishment. Federal law limits this type of wage garnishment. And some rules can even vary within a state. Whether your employer or your financial institution has a wage garnishment order, you will need to show the court which portions of your disposable earnings are exempt and why., If any portion of your income is exempt from the garnishment order, you should file a claim of exemption with the court clerk that issued the garnishment order and send a copy to the levying officer (sheriff) and the creditor. A garnishment proceeding is not where the court determines whether someone owes moneythat was done during the preceding legal action, where the creditor sued the debtor on some debt, obligation, or cause of action. Talk to a lawyer about your situation. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is How does it work? Code 6.27.170).  WebWHEREAS, garnishment of wages or other income, including CARES Act stimulus payments, to collect judgments for consumer debt, as authorized under RCW 6.27, and the mounting interest on that debt, as authorized under RCW 4.56.110(1) and (5), will further reduce the ability of people Depending on your situation, you might be able to partially or fully protect your income. If the judge agrees, the creditor will be ordered to reduce or stop garnishing your wages. Step 3. Since 1988, all court orders for child support include an automatic income withholding order. Code 6.27.150). Consumers should be aware of and monitoring wage garnishments for employer compliance when applicable. Your state's exemption laws determine the amount of income you'll be able to keep. What types of income are exempt from wage garnishment? Combining direct services and advocacy, were fighting this injustice. %%EOF

Consumer Debt Eighty (80) percent of disposable earnings or thirty-five times the state minimum hourly wage, whichever is larger, is the exempt amount. Form of returns under RCW 6.27.130. $473 per week, $743 per week if the debtor's earnings alone support their household, or the first 75% of disposable earnings, whichever is greater, is exempt from wage garnishment. (3) In the case of a garnishment based on a judgment or other order for the collection of private student loan debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; or. Examples: Do not have a savings or checking account at a bank where you have one of the bank's credit cards, or where you owe on a loan. You can also stop most garnishments by filing for bankruptcy. You must follow (comply with) the order. According to federal law, your employer can't discharge you if you have one wage garnishment. If you receive a notice of a wage garnishment order, you might be able to protect or "exempt" some or all of your wages by filing an exemption claim with the court or raising an objection. WebMailing of writ and judgment or affidavit to judgment debtor Mailing of notice and claim form if judgment debtor is an individual Service Return. You'll file the completed document with the clerk of court office in the county where the garnishment originated. This money is taken out of their paycheck by their employer and sent to the creditor. We have not reviewed all available products or offers. washington state wage garnishment exemptions. hb```f``Z] @1VF^E

m

{%[R%Qe sJgC2d;|A0Ynb,{GGGd6 q0$Lr;30gi 10le`fexiCL*V00.`g`2c d`8vQ!YZ|4# Oc#

1673). If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. Read Supplemental Proceedings to learn more. Step 3. 30 0 obj

<>

endobj

There are certain debts or obligations which will allow more of person's income to be garnished. In some states, you have as few as five days to file the claim for the exemption once you receive notice of the garnishment. Step 5. Please enter your city, county, or zip code. You'll tell the court about an asset that you're entitled to keepincluding wagesby listing it on Schedule C: The Property You Can Claim as Exempt, one of the official forms that you'll need to file to start the bankruptcy process. Your deposit bank can take money from your bank account to pay what you owe them. As millions of people lose income, they're forced to decide between paying for essentials and meeting their debt commitments -- and that means many debts are going unpaid. The exemption amount varies based on the type of debt being garnished. Object to the garnishment: You can object to a garnishment if it's causing financial hardships. Get debt relief now. (15 U.S.C. The bank will freeze $700 because $1,000 is automatically protected. Some income sources are exempt from wage garnishment. Do not have pension checks direct deposited into a bank account, if you can help it. (Wash. Rev. Also, child support and alimony (spousal support) payments are generally exempt from wage garnishment orders.

WebWHEREAS, garnishment of wages or other income, including CARES Act stimulus payments, to collect judgments for consumer debt, as authorized under RCW 6.27, and the mounting interest on that debt, as authorized under RCW 4.56.110(1) and (5), will further reduce the ability of people Depending on your situation, you might be able to partially or fully protect your income. If the judge agrees, the creditor will be ordered to reduce or stop garnishing your wages. Step 3. Since 1988, all court orders for child support include an automatic income withholding order. Code 6.27.150). Consumers should be aware of and monitoring wage garnishments for employer compliance when applicable. Your state's exemption laws determine the amount of income you'll be able to keep. What types of income are exempt from wage garnishment? Combining direct services and advocacy, were fighting this injustice. %%EOF

Consumer Debt Eighty (80) percent of disposable earnings or thirty-five times the state minimum hourly wage, whichever is larger, is the exempt amount. Form of returns under RCW 6.27.130. $473 per week, $743 per week if the debtor's earnings alone support their household, or the first 75% of disposable earnings, whichever is greater, is exempt from wage garnishment. (3) In the case of a garnishment based on a judgment or other order for the collection of private student loan debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; or. Examples: Do not have a savings or checking account at a bank where you have one of the bank's credit cards, or where you owe on a loan. You can also stop most garnishments by filing for bankruptcy. You must follow (comply with) the order. According to federal law, your employer can't discharge you if you have one wage garnishment. If you receive a notice of a wage garnishment order, you might be able to protect or "exempt" some or all of your wages by filing an exemption claim with the court or raising an objection. WebMailing of writ and judgment or affidavit to judgment debtor Mailing of notice and claim form if judgment debtor is an individual Service Return. You'll file the completed document with the clerk of court office in the county where the garnishment originated. This money is taken out of their paycheck by their employer and sent to the creditor. We have not reviewed all available products or offers. washington state wage garnishment exemptions. hb```f``Z] @1VF^E

m

{%[R%Qe sJgC2d;|A0Ynb,{GGGd6 q0$Lr;30gi 10le`fexiCL*V00.`g`2c d`8vQ!YZ|4# Oc#

1673). If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. Read Supplemental Proceedings to learn more. Step 3. 30 0 obj

<>

endobj

There are certain debts or obligations which will allow more of person's income to be garnished. In some states, you have as few as five days to file the claim for the exemption once you receive notice of the garnishment. Step 5. Please enter your city, county, or zip code. You'll tell the court about an asset that you're entitled to keepincluding wagesby listing it on Schedule C: The Property You Can Claim as Exempt, one of the official forms that you'll need to file to start the bankruptcy process. Your deposit bank can take money from your bank account to pay what you owe them. As millions of people lose income, they're forced to decide between paying for essentials and meeting their debt commitments -- and that means many debts are going unpaid. The exemption amount varies based on the type of debt being garnished. Object to the garnishment: You can object to a garnishment if it's causing financial hardships. Get debt relief now. (15 U.S.C. The bank will freeze $700 because $1,000 is automatically protected. Some income sources are exempt from wage garnishment. Do not have pension checks direct deposited into a bank account, if you can help it. (Wash. Rev. Also, child support and alimony (spousal support) payments are generally exempt from wage garnishment orders.  Here's what happens to nonexempt property in the two primary chapter types: Also, exempting property isn't automatic.