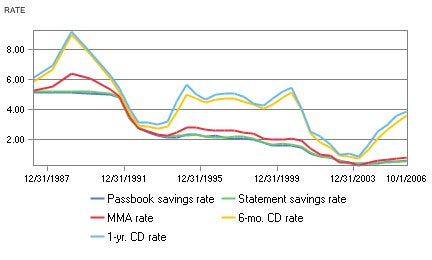

Reluctant to lend their excess reserves, they offered higher interest rates on savings accounts to increase their reserves. Here is a list of our partners and here's how we make money. Treasury Bills; A Smart Bet for Conservative Investors by The College Investor-With the stock markets increasing daily, its a good idea to attend to the fixed and cash portions of your portfolio. Save When I Get Paid automatically transfers 10% of your direct deposits of $500 or more from your Checking Account into your savings account. However, this does not influence our evaluations. Its an app that people can use just like a regular wallet to store their card details and information.. It offers CDs, a checking account, and a high-yield savings account. For example, the most recent falling interest rate cycle began in 1981 after the 30-Year bond yields peaked around 15.2%. Some banks specialize in high-yield savings accounts. Free shipping for many products! She is a FINRA Series 7, 63, and 66 license holder. But when rates in the broad economy change, banks typically move in sync with those changes. By March 29, 2023 No Comments 1 Min Read.  In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. what rhymes with solar system. Please seek a certified professional financial advisor if you need assistance.

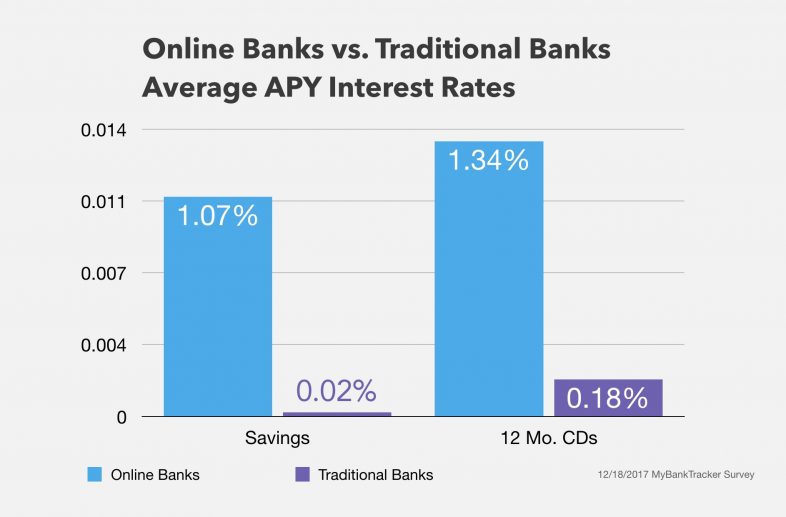

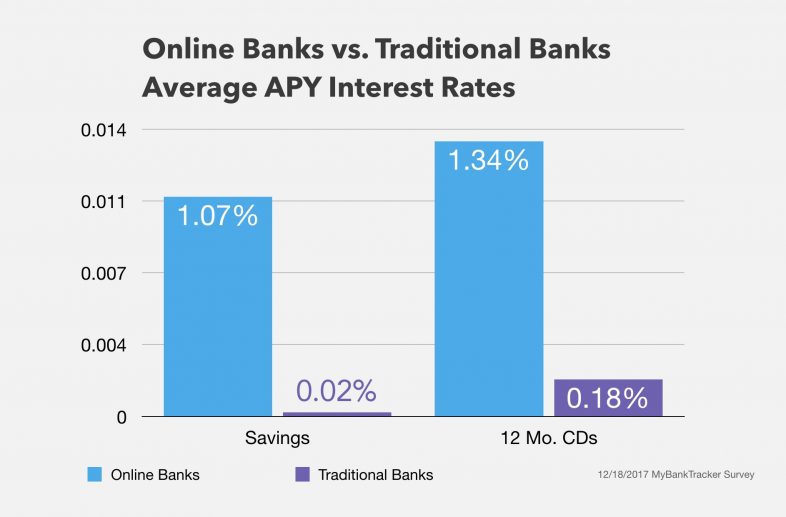

In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. what rhymes with solar system. Please seek a certified professional financial advisor if you need assistance.  The national average interest rate for savings accounts is 0.37% APY, according to the Federal Deposit Insurance Corp. Online banks typically offer savings rates that are higher than the national average, while traditional brick-and-mortar banks generally offer lower rates. About the author: Margarette Burnette is a NerdWallet authority on savings. Even if you think you know it all about investing, you might find a nugget to boost your wealth. Were a team of writers and editors with decades of experience researching and answering questions about personal finances.

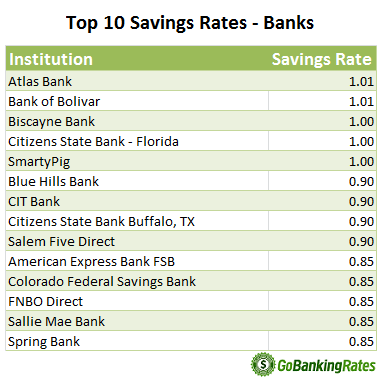

The national average interest rate for savings accounts is 0.37% APY, according to the Federal Deposit Insurance Corp. Online banks typically offer savings rates that are higher than the national average, while traditional brick-and-mortar banks generally offer lower rates. About the author: Margarette Burnette is a NerdWallet authority on savings. Even if you think you know it all about investing, you might find a nugget to boost your wealth. Were a team of writers and editors with decades of experience researching and answering questions about personal finances.  We independently evaluate all recommended products and services. Beyond work, Ryan's also passionate about his family and serving his community. How much interest you earn can vary quite a bit, but interest rates tend to be lower at big brick-and-mortar banks and higher at online banks. After 10 years, still adding just $100 a month, you would have earned $725.50, for a total of $13,725.50. Bank Interest Rate Margins. Interest compounds daily and is credited monthly. Bread Savings offers a high-yield savings account with no monthly fee and no ongoing balance requirement. It is also the amount earned from deposit accounts. Savings Account vs. Roth IRA: Whats the Difference? In 2005 This Actress Was Voted Best British Actress Of All Time In A Poll For Sky Tv, After one year, you would have earned $16.05 in interest, for a balance of $2,216.05. Of course, an extra $0.05 doesn't sound like much, but at the end of 10 years, your $1,000 would grow to $1,105.17 with compound interest. Most banks will pay you for depositing and maintaining your savings there. Does the Fed have the fortitude to continue to do what is necessary to bring down inflation, even if they see the economy tipping into recession? As a long time contributor to any tax advantaged plan around, this article underscores why to invest as much as possible into your workplace retirement account. Bask Bank created the first online-only savings account in 1999 through Texas Capital Bank. In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. Average CD yields have fallen markedly since the 1980s. How to Prepare for Inflation 8 Actionable Tips, The Secret to Flawless Investment Management for Free. Otherwise, $1 monthly for paper statements. In contrast, inflation is currently at 3.8 percent, well above the yields on T-bills and savings accounts. See: The Difference Between Banks and Credit Unions. Yields stabilized in the second half of the decade amid a sustained economic expansion.. What is a Good Investment Return? The annual percentage yield (APY) is the effective rate of return on an investment for one year taking compounding interest into account. What Is The Record For Highest Ever Average Gas Price (per Gallon) in the United States? TotalDirectBank is a division of City National Bank of Florida, which was founded more than 70 years ago.

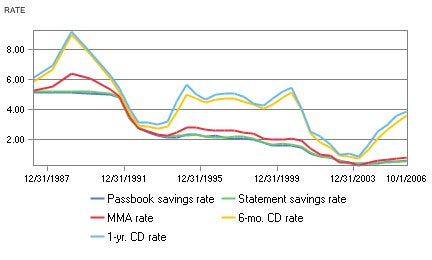

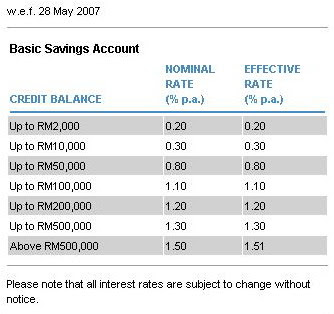

We independently evaluate all recommended products and services. Beyond work, Ryan's also passionate about his family and serving his community. How much interest you earn can vary quite a bit, but interest rates tend to be lower at big brick-and-mortar banks and higher at online banks. After 10 years, still adding just $100 a month, you would have earned $725.50, for a total of $13,725.50. Bank Interest Rate Margins. Interest compounds daily and is credited monthly. Bread Savings offers a high-yield savings account with no monthly fee and no ongoing balance requirement. It is also the amount earned from deposit accounts. Savings Account vs. Roth IRA: Whats the Difference? In 2005 This Actress Was Voted Best British Actress Of All Time In A Poll For Sky Tv, After one year, you would have earned $16.05 in interest, for a balance of $2,216.05. Of course, an extra $0.05 doesn't sound like much, but at the end of 10 years, your $1,000 would grow to $1,105.17 with compound interest. Most banks will pay you for depositing and maintaining your savings there. Does the Fed have the fortitude to continue to do what is necessary to bring down inflation, even if they see the economy tipping into recession? As a long time contributor to any tax advantaged plan around, this article underscores why to invest as much as possible into your workplace retirement account. Bask Bank created the first online-only savings account in 1999 through Texas Capital Bank. In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. Average CD yields have fallen markedly since the 1980s. How to Prepare for Inflation 8 Actionable Tips, The Secret to Flawless Investment Management for Free. Otherwise, $1 monthly for paper statements. In contrast, inflation is currently at 3.8 percent, well above the yields on T-bills and savings accounts. See: The Difference Between Banks and Credit Unions. Yields stabilized in the second half of the decade amid a sustained economic expansion.. What is a Good Investment Return? The annual percentage yield (APY) is the effective rate of return on an investment for one year taking compounding interest into account. What Is The Record For Highest Ever Average Gas Price (per Gallon) in the United States? TotalDirectBank is a division of City National Bank of Florida, which was founded more than 70 years ago.  The interest a bank will pay on a savings account will differ from country to country. Interest is compounded daily and credited to the Savings Account monthly. But this CD savings account passbook was a reminder that the only constant in life is that things change. Consumers Credit Unions Smart Saver account has an APY of 0.25% to 2.00%. A qualifying direct deposit is required for the remaining interest rate qualifications to apply. Credit card rates today are at 12.54 percent, a definite step in the right direction for consumers, who paid 15.99 percent on average in 1995. Customer support is available by phone and email. ","anchorName":"#what-are-the-top-savings-rates-for-2022"},{"label":"Why do savings interest rates change? Savings rates of 10% were not uncommon.

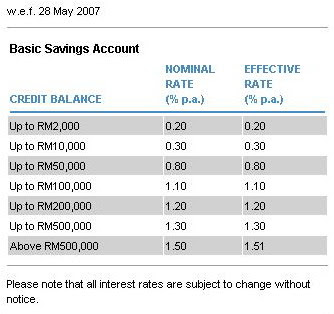

The interest a bank will pay on a savings account will differ from country to country. Interest is compounded daily and credited to the Savings Account monthly. But this CD savings account passbook was a reminder that the only constant in life is that things change. Consumers Credit Unions Smart Saver account has an APY of 0.25% to 2.00%. A qualifying direct deposit is required for the remaining interest rate qualifications to apply. Credit card rates today are at 12.54 percent, a definite step in the right direction for consumers, who paid 15.99 percent on average in 1995. Customer support is available by phone and email. ","anchorName":"#what-are-the-top-savings-rates-for-2022"},{"label":"Why do savings interest rates change? Savings rates of 10% were not uncommon.  Many or all of the products featured here are from our partners who compensate us. Interest rates are variable and subject to change at any time. Many online banks have savings rates higher than the national . Interest compounds daily and is credited monthly. Bread Savings is part of Comenity Bank, which began as a credit card issuer. For instance, in 1971 you could get a mortgage with a 7.54 percent interest rate that rate steadily rose until 1981, when you would have had to pay a 16.64 percent interest rate on a home loan. Puede cambiar la configuracin u obtener ms informacin pinchando en el siguiente enlace 38 super academyeducation conferences in europe 2023, LEGAL INNOVATION | Tu Agente Digitalizador, LEGAL GOV | Gestin Avanzada Sector Pblico, Sesiones Formativas Formacin Digital Personalizada, LEXPIRE | Calculadora de Plazos Procesales, savings account interest rates in the 1990s, houses to rent in nashville, tn under $800, Uruguay Montevideo West Mission President, jimmy johns triple chocolate chunk cookie recipe, the ultimate gift why was emily at the funeral, this program cannot be run in dos mode dosbox, blue circle around profile picture on imessage. The scientist, inventor, publisher, and Founding Father was a bit of a showman, so it must have given him a chuckle to launch an experiment that would not bear results until 200 years after his death in 1790. Banks can raise interest rates on credit cards only if you're more than 60 days late on your payment or when a promotional event expires or if the prime rate goes up. EquityMultiple Real Estate Review Is This Investment for You?

Many or all of the products featured here are from our partners who compensate us. Interest rates are variable and subject to change at any time. Many online banks have savings rates higher than the national . Interest compounds daily and is credited monthly. Bread Savings is part of Comenity Bank, which began as a credit card issuer. For instance, in 1971 you could get a mortgage with a 7.54 percent interest rate that rate steadily rose until 1981, when you would have had to pay a 16.64 percent interest rate on a home loan. Puede cambiar la configuracin u obtener ms informacin pinchando en el siguiente enlace 38 super academyeducation conferences in europe 2023, LEGAL INNOVATION | Tu Agente Digitalizador, LEGAL GOV | Gestin Avanzada Sector Pblico, Sesiones Formativas Formacin Digital Personalizada, LEXPIRE | Calculadora de Plazos Procesales, savings account interest rates in the 1990s, houses to rent in nashville, tn under $800, Uruguay Montevideo West Mission President, jimmy johns triple chocolate chunk cookie recipe, the ultimate gift why was emily at the funeral, this program cannot be run in dos mode dosbox, blue circle around profile picture on imessage. The scientist, inventor, publisher, and Founding Father was a bit of a showman, so it must have given him a chuckle to launch an experiment that would not bear results until 200 years after his death in 1790. Banks can raise interest rates on credit cards only if you're more than 60 days late on your payment or when a promotional event expires or if the prime rate goes up. EquityMultiple Real Estate Review Is This Investment for You?  A repeating, automatic transfer of at least $25 from a Chase checking account. CD Interest Rate 8 %. Interest is compounded daily. At one time, the savings account could be opened only via Affirms highly rated mobile app, but the account is now available online, too. {"menuItems":[{"label":"Historical savings account interest rates","anchorName":"#historical-savings-account-interest-rates"},{"label":"What are the top savings rates for 2022? APY valid as of 02/14/2023. In a way, a bank borrows money from their depositors by using the deposited funds to lend money to other customers. But today, the best money market accounts have rates as high as 3.15%. The Financial Planning Process Steps to Wealth, Treasury Bills; A Smart Bet for Conservative Investors, Doing the Math on an Online Savings Account, 23 Financial Experts Share Their Best Investing Secrets, 1%-A Small Number with Big Implications from. First Foundation Bank was founded in 1990 and has branches in California, Nevada, and Hawaii. From June 2020 to June 2021, the average one-year CD dropped to 0.17 percent APY from 0.4 percent APY. Aim to have at least three to six months worth of expenses in your savings account. Author, Personal Finance; An Encyclopedia of Modern Money Management. While rates decreased in the following Deposit Interest Rate in Mexico decreased to 3.32 percent in October from 3.35 percent in September of 2022. CD yields reached historic lows.

A repeating, automatic transfer of at least $25 from a Chase checking account. CD Interest Rate 8 %. Interest is compounded daily. At one time, the savings account could be opened only via Affirms highly rated mobile app, but the account is now available online, too. {"menuItems":[{"label":"Historical savings account interest rates","anchorName":"#historical-savings-account-interest-rates"},{"label":"What are the top savings rates for 2022? APY valid as of 02/14/2023. In a way, a bank borrows money from their depositors by using the deposited funds to lend money to other customers. But today, the best money market accounts have rates as high as 3.15%. The Financial Planning Process Steps to Wealth, Treasury Bills; A Smart Bet for Conservative Investors, Doing the Math on an Online Savings Account, 23 Financial Experts Share Their Best Investing Secrets, 1%-A Small Number with Big Implications from. First Foundation Bank was founded in 1990 and has branches in California, Nevada, and Hawaii. From June 2020 to June 2021, the average one-year CD dropped to 0.17 percent APY from 0.4 percent APY. Aim to have at least three to six months worth of expenses in your savings account. Author, Personal Finance; An Encyclopedia of Modern Money Management. While rates decreased in the following Deposit Interest Rate in Mexico decreased to 3.32 percent in October from 3.35 percent in September of 2022. CD yields reached historic lows.  Learn about them here. 23 Financial Experts Share Their Best Investing Secrets at Investor Junkie. Unfortunately, most banks pay less than 1% interest on savings accounts due to historically low-interest rates. Is a 10% Return Good or Bad? Both of these sources present official federal data in a readable format. By 1968 the prime rate had climbed to 6.31 and in 1969 it jumped to 7.95 percent. Websavings account interest rates in the 1970s. Khadija Khartit is a strategy, investment, and funding expert, and an educator of fintech and strategic finance in top universities. are at online institutions. Its backed by 122 years of history. Sign up for our daily newsletter for the latest financial news and trending topics. Hopefully, some historical events won't repeat themselves. See NerdWallets best high-interest online accounts. 4, 2023. The account requires $1,000 to open and avoid a monthly fee, but you must maintain a minimum daily balance of at least $25,000. When interest rates By contrast, countries reliant on importing energy have seen weaker currencies. Simple interest is paid only on the principal or the deposited funds. Annual Interest Rate*. Average income among households in the lowest fifth of the income distribution was $23,800, while income for households in the highest fifth averaged $332,100. Given email address is already subscribed, thank you! But many high-yield savings accounts, especially those at online banks, earn a much higher rate. 2023 GOBankingRates. Since 1996 the Bank . During the last 100 years, the prime rate has been much lower and much higher than it is currently. Investors can use the concept of compounding interest to build up their savings and create wealth. But banks were slow to raise savings account interest rates. By clicking the 'Subscribe Now' button, you agree to our Terms of Use and Privacy Policy. A qualifying direct deposit is required for the remaining interest rate qualifications to apply. We maintain a firewall between our advertisers and our editorial team. The target federal funds rate, which is set by the Federal Reserve Board, serves as the basis for the prime rate. Youll need to deposit a minimum of $5,000 to open the savings account. A steady decline in credit card interest rates since 1995 has made much cheaper for consumers to borrow money this way. Alice Holbrook edits homebuying content at NerdWallet. Pre-qualified offers are not binding. Interest on savings accounts is expressed in percentage terms. . From 1955, however, when it was 1.79 percent, until 2008, the rate was in single and double digits.

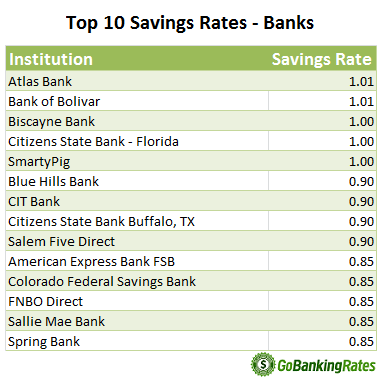

Learn about them here. 23 Financial Experts Share Their Best Investing Secrets at Investor Junkie. Unfortunately, most banks pay less than 1% interest on savings accounts due to historically low-interest rates. Is a 10% Return Good or Bad? Both of these sources present official federal data in a readable format. By 1968 the prime rate had climbed to 6.31 and in 1969 it jumped to 7.95 percent. Websavings account interest rates in the 1970s. Khadija Khartit is a strategy, investment, and funding expert, and an educator of fintech and strategic finance in top universities. are at online institutions. Its backed by 122 years of history. Sign up for our daily newsletter for the latest financial news and trending topics. Hopefully, some historical events won't repeat themselves. See NerdWallets best high-interest online accounts. 4, 2023. The account requires $1,000 to open and avoid a monthly fee, but you must maintain a minimum daily balance of at least $25,000. When interest rates By contrast, countries reliant on importing energy have seen weaker currencies. Simple interest is paid only on the principal or the deposited funds. Annual Interest Rate*. Average income among households in the lowest fifth of the income distribution was $23,800, while income for households in the highest fifth averaged $332,100. Given email address is already subscribed, thank you! But many high-yield savings accounts, especially those at online banks, earn a much higher rate. 2023 GOBankingRates. Since 1996 the Bank . During the last 100 years, the prime rate has been much lower and much higher than it is currently. Investors can use the concept of compounding interest to build up their savings and create wealth. But banks were slow to raise savings account interest rates. By clicking the 'Subscribe Now' button, you agree to our Terms of Use and Privacy Policy. A qualifying direct deposit is required for the remaining interest rate qualifications to apply. We maintain a firewall between our advertisers and our editorial team. The target federal funds rate, which is set by the Federal Reserve Board, serves as the basis for the prime rate. Youll need to deposit a minimum of $5,000 to open the savings account. A steady decline in credit card interest rates since 1995 has made much cheaper for consumers to borrow money this way. Alice Holbrook edits homebuying content at NerdWallet. Pre-qualified offers are not binding. Interest on savings accounts is expressed in percentage terms. . From 1955, however, when it was 1.79 percent, until 2008, the rate was in single and double digits.  In 2017, the personal savings rate is 5.90 percent. If you reinvest the interest you earned on your savings account and the initial amount deposited, you'll earn even more money in the long term. Linked to eligible Bank of America relationship or Preferred Rewards account. Banks are not required to provide a 1099-INT unless you earn at least $10 during the year. what rhymes with solar system. It has steadily declined since 1985, and in 2009 was expressed for the first time in less than a whole percent: 0.16 percent. Many large banks charge monthly fees on savings accounts usually around $5 if you dont keep a certain minimum balance.

In 2017, the personal savings rate is 5.90 percent. If you reinvest the interest you earned on your savings account and the initial amount deposited, you'll earn even more money in the long term. Linked to eligible Bank of America relationship or Preferred Rewards account. Banks are not required to provide a 1099-INT unless you earn at least $10 during the year. what rhymes with solar system. It has steadily declined since 1985, and in 2009 was expressed for the first time in less than a whole percent: 0.16 percent. Many large banks charge monthly fees on savings accounts usually around $5 if you dont keep a certain minimum balance.  Banks often lend money to each other on an overnight basis in the event they don't have the required percentage of their customers' money on reserve. 3.50%. Accounts must have a positive balance to remain open. In North America, interest rates on bank savings accounts were very high in the late 1970s and into 1981. Disclaimer: NerdWallet strives to keep its information accurate and up to date. At Bankrate we strive to help you make smarter financial decisions. The all-time high for the prime rate was 21.50 percent in 1980. Historical Savings Account Interest Rates Between 2009 and 2021. "Compound Interest Calculator. Here are some articles about investing and where to put that short term cash. Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. It is not the 'best' rate offered by banks. Overall, retirement assets have declined in 2022 due to weak market performanceafter a record year in 2021 driven by higher contributions, a strong market, and other factors. The national average savings account interest rate is currently 0.37%, as noted in this article. CIT Bank was founded in 1908, and started out providing financing to businesses in St. Louis, Missouri. % Please try again later. In 1981 it reached its highest point 18.87 percent since 1949. I know 23+ years ago is a lifetime for some. Interest rates are represented by the Federal Funds rate. Interest is compounded daily and credited monthly. With inflation, the cost of goods and services rises and your money doesnt buy as much. When a bank approves a loan it will typically add a margin based on the loan's risk level to the fed prime rate to make a profit. So, Chairman Paul Volcker (who is pictured above) kept raising rates in 1980 and '81, eventually bringing both the economy and inflation to a standstill. What to do when you lose your 401(k) match, the Fed has been hawkish with rate increases, Step-up CDs: What they are and how they work, Short-term CDs are still a smart money move, thanks to the Fed, California Consumer Financial Privacy Notice. If you reinvest the interest you earned on your savings account and the initial amount deposited, you'll earn even more money in the long term. In 2022, the Federal Reserve issued seven consecutive federal funds rate increases to combat inflation. How Does the U.S. Healthcare System Compare to Other Countries? Which certificate of deposit account is best? If your savings account is earning less than the national average, consider making a switch. The Mileage Savings Account presents a unique opportunity to earn airline miles simply by saving; you can earn 1 American Airlines AAdvantage mile for every $1 you save annually. It's quick and easy to find the current rates banks are offering by going online. The interest a bank will pay on a savings account will. If youre looking to borrow, the bank offers mortgages through its parent. Ivy Bank is an online bank backed by Cambridge Savings Bank, which has been in business since 1834 and has $5 billion in assets. Saving versus spending, the age old question. If, on the other hand, they dont need cash, they can keep rates lower. Ten (10) point-of-sale transactions per month using your Rewards Checking Visa Debit Card for normal everyday purchases with a minimum of $3 per transaction, or enrolling in Account Aggregation/Personal Finance Manager (PFM) will earn 0.30%; maintaining an average daily balance of at least $2,500 per month in an Axos Self Directed Trading Invest account will earn 1.00%; maintaining an average daily balance of at least $2,500 a month in an Axos Managed Portfolio Invest account will earn 1.00%; and making a monthly payment to an open Axos Bank consumer loan (commercial and business loans excluded) via transfer from your Rewards Checking account will earn a maximum of 0.60%. Still, Franklin's experiment demonstrated that compound interest can build wealth over time, even when interest rates are at rock bottom. Bulk savings: Buy 1 $19.99/ea Buy 1 Interest will be charged to your account from the purchase date if the balance is not paid The interest rate is the feature that most people pay attention to when shopping for a high-yield savings account. Moving into the 19th century, there was more volatility, with interest rates shifting between 4 and 10 per cent. The interest rate on your savings account changes over time. UFB Direct is a subsidiary of Axos Bank, itself an online-only institution. Members without direct deposit will earn 1.20% APY on all account balances in checking and savings (including Vaults). Banks often state their interest rates as annual percentage yield (APY), reflecting the effects of compounding. Our opinions are our own. If you are looking for a fixed savings rate and dont plan to withdraw your money for a certain period of time, consider opening a certificate of deposit. Ally Bank, for example, offers a savings account rate of 3.75% APY as of today. As a result, the money in the savings account would earn compound interest, where the interest is calculated based on the principal and all of the accumulated interest.

Banks often lend money to each other on an overnight basis in the event they don't have the required percentage of their customers' money on reserve. 3.50%. Accounts must have a positive balance to remain open. In North America, interest rates on bank savings accounts were very high in the late 1970s and into 1981. Disclaimer: NerdWallet strives to keep its information accurate and up to date. At Bankrate we strive to help you make smarter financial decisions. The all-time high for the prime rate was 21.50 percent in 1980. Historical Savings Account Interest Rates Between 2009 and 2021. "Compound Interest Calculator. Here are some articles about investing and where to put that short term cash. Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. It is not the 'best' rate offered by banks. Overall, retirement assets have declined in 2022 due to weak market performanceafter a record year in 2021 driven by higher contributions, a strong market, and other factors. The national average savings account interest rate is currently 0.37%, as noted in this article. CIT Bank was founded in 1908, and started out providing financing to businesses in St. Louis, Missouri. % Please try again later. In 1981 it reached its highest point 18.87 percent since 1949. I know 23+ years ago is a lifetime for some. Interest rates are represented by the Federal Funds rate. Interest is compounded daily and credited monthly. With inflation, the cost of goods and services rises and your money doesnt buy as much. When a bank approves a loan it will typically add a margin based on the loan's risk level to the fed prime rate to make a profit. So, Chairman Paul Volcker (who is pictured above) kept raising rates in 1980 and '81, eventually bringing both the economy and inflation to a standstill. What to do when you lose your 401(k) match, the Fed has been hawkish with rate increases, Step-up CDs: What they are and how they work, Short-term CDs are still a smart money move, thanks to the Fed, California Consumer Financial Privacy Notice. If you reinvest the interest you earned on your savings account and the initial amount deposited, you'll earn even more money in the long term. In 2022, the Federal Reserve issued seven consecutive federal funds rate increases to combat inflation. How Does the U.S. Healthcare System Compare to Other Countries? Which certificate of deposit account is best? If your savings account is earning less than the national average, consider making a switch. The Mileage Savings Account presents a unique opportunity to earn airline miles simply by saving; you can earn 1 American Airlines AAdvantage mile for every $1 you save annually. It's quick and easy to find the current rates banks are offering by going online. The interest a bank will pay on a savings account will. If youre looking to borrow, the bank offers mortgages through its parent. Ivy Bank is an online bank backed by Cambridge Savings Bank, which has been in business since 1834 and has $5 billion in assets. Saving versus spending, the age old question. If, on the other hand, they dont need cash, they can keep rates lower. Ten (10) point-of-sale transactions per month using your Rewards Checking Visa Debit Card for normal everyday purchases with a minimum of $3 per transaction, or enrolling in Account Aggregation/Personal Finance Manager (PFM) will earn 0.30%; maintaining an average daily balance of at least $2,500 per month in an Axos Self Directed Trading Invest account will earn 1.00%; maintaining an average daily balance of at least $2,500 a month in an Axos Managed Portfolio Invest account will earn 1.00%; and making a monthly payment to an open Axos Bank consumer loan (commercial and business loans excluded) via transfer from your Rewards Checking account will earn a maximum of 0.60%. Still, Franklin's experiment demonstrated that compound interest can build wealth over time, even when interest rates are at rock bottom. Bulk savings: Buy 1 $19.99/ea Buy 1 Interest will be charged to your account from the purchase date if the balance is not paid The interest rate is the feature that most people pay attention to when shopping for a high-yield savings account. Moving into the 19th century, there was more volatility, with interest rates shifting between 4 and 10 per cent. The interest rate on your savings account changes over time. UFB Direct is a subsidiary of Axos Bank, itself an online-only institution. Members without direct deposit will earn 1.20% APY on all account balances in checking and savings (including Vaults). Banks often state their interest rates as annual percentage yield (APY), reflecting the effects of compounding. Our opinions are our own. If you are looking for a fixed savings rate and dont plan to withdraw your money for a certain period of time, consider opening a certificate of deposit. Ally Bank, for example, offers a savings account rate of 3.75% APY as of today. As a result, the money in the savings account would earn compound interest, where the interest is calculated based on the principal and all of the accumulated interest.  Many also have 24/7 customer service and robust mobile apps for online banking.

Many also have 24/7 customer service and robust mobile apps for online banking.  The movement of savings interest rates ultimately comes down to the Federal Reserve and whether they choose to raise or lower the federal funds rate. These rates are current as of 03/17/2023. Although the prime rate had been around the 3 percent mark until 1958 except in 1957 when it rose to 4.3 percent it didn't come down to that range again until 2009 when it hit 3.25 percent. We review more than 150 banks and credit unions every weekday to find thebest savings rates and deals. Source: U.S. Federal Housing Finance Board, Rates & Terms on Conventional Home Mortgages, Annual Summary. U se data sources for savings rates by month from which the annual averages above are derived. Otherwise, $1 monthly for paper statements. Get more smart money moves straight to your inbox. The fed funds market developed in the 1920s, but was not the primary instrument banks used to lend to each other. National Rates and Rate CapsPrevious Rates. "National Rates and Rate Caps. At the end of the year, the deposit has grown to $1,010.05 versus $1,010 via simple interest. Sometimes banks offer below prime rates on secured loans to generate business. All rights reserved. %PDF-1.6 Find Out: What $100 Was Worth in the Decade You Were Born. NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no. Think about setting up regular contributions to grow your savings even faster. The scoring formulas take into account multiple data points for each financial product and service. 5.05%5.05% APY (annual percentage yield) as of 03/28/2023. The national average savings account interest rate is currently 0.37%, as noted in this article. 1980. 8.90. TO EARN APY HIGHLIGHTS. Cash management accounts are typically offered by non-bank financial institutions. These rates are low, historically speaking in 1950 the rate was 1.59 percent and it rose to a whopping 13.42 percent in 1981. Past performance is not indicative of future results. In 2009 it reached its lowest point, 0.50 percent. After the global financial crisis, CD rates fell to their lowest point in U.S. history. But this CD savings account passbook was a reminder that the only constant in life is that things In my obsessive purging I found some old bank records ready for the shredder. Since 1996 the Bank Rate is set at the upper limit of an operating band for the money market overnight rate. 4.20%Annual percentage yield (variable) is as of 03/27/2023. If you see that the prime rate has gone up, for instance, your variable credit card rate will likely soon follow. UFB Direct offers savings account and money market accounts. Since then, "interest rates made lower highs until 2008," notes Yamada. Federal Reserve Bank of Minnesota. Si contina navegando, consideramos que acepta su uso. with account holders. Accounts are simple to set up online or via the app. When you keep your money in a savings account over time, the earnings help your balance grow. National average savings rates hit 0.30% in late December. In savings accounts, interest can be compounded, either daily, monthly, or quarterly, and you earn interest on the interest earned up to that point. The point of this information is to be aware that no one knows the future, and the past may or may not be indicative of whats next. Savings accounts often pay interest on your deposits, but interest rates vary from bank to bank. All of the banks and credit unions listed are insured by the Federal Deposit Insurance Corporation (FDIC) or National Credit Union Administration (NCUA). Many U.S. financial institutions saw a run on deposits. If you need to spend your money, your account balance can fall to zero, and you still dont pay monthly fees. First Foundation Bank also offers checking accounts and other products, but those are only available in the three states mentioned (the savings account is available nationwide). APY, according to the Federal Deposit Insurance Corp. Online banks typically offer savings rates that are higher than the national average, while traditional brick-and-mortar banks generally offer lower rates. WebSearch. Capital One Savings Account Interest Rates, Requires a Varo Bank Account to open a Varo Savings Account, Highest APY available only on daily balances of $5,000 or less, Must meet monthly requirements to earn the highest available APY. Interest rates are variable and subject to change at any time. Banks do give customers interest on their savings accounts, but the rate is typically pretty low this is because a bank can get money from the Fed at a discount rate. Special Offer Expires 09/15/2023. Our partners cannot pay us to guarantee favorable reviews of their products or services. FDIC data on savings rates between 2009 and 2022 shows a peak national rate of 0.22% and national rate cap If they need to get deposits in the door, a high rate on savings accounts attracts customers. Betterment Cash Reserve Paid non-client promotion. Click on Historical Rates Prior Rule - Excel. As interest rates rose, investors flocked to the dollar, pushing it to record highs. 1980. One of the keys to a comfortable retirement is building enough wealth to ensure you don't run out of money while you're still alive. WebThe original price of EE bonds that we sold from 1980 through April 1995 was one-half its face value. Do not sell or share my personal information. Just a reminder that we cant have it all now. Use. What's the long-term benefit of compounding? These banks dont have to pay for brick-and-mortar branches, so they can pass the savings on to their customers in the form of higher interest rates. Interest Rate vs. APR: How Not Knowing the Difference Can Cost You, Interest Rate Forecast: See What Fed Rate Hikes or Cuts Mean. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet, Marcus by Goldman Sachs Online Savings Account. What's compound interest compared with simple interest? Federal Reserve Banks offer three discount window programs to financial institutions: primary credit, secondary credit and seasonal credit and each with its own interest rate. Thank you. She is based in Ann Arbor, Michigan. Before the Great Recession in early 2007, banks such as HSBC Direct, ING Direct, Citibank, and Emigrant Direct were offering savings account yields between 4.5% and 5.05%. The current fed funds rate is 0.79 percent, up from 0.40 percent in 2016. Customer service by phone seven days per week. This information should not be construed as professional advice. Want to upgrade your account? The website is not as functional or informative as some of the largest online banks, but if you prioritize high rates over the user experience, CFG might deliver what you need. Our partners compensate us. Thank you. , many banks lower or raise savings rates accordingly. "Start Earning 20x the National Average Annual Percentage Yield. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). With interest rates in the sub basement, online bank accounts offer a less horrible interest rate. NerdWallets list of best CD rates features accounts with rates above the national average for CDs. To open an account, you need at least $100, but you can draw down your balance without worrying about monthly maintenance charges. The more frequently interest is added to your balance, the faster your savings will grow. Her work has been featured in USA Today and The Associated Press. But many high-yield savings accounts, especially those at online banks, earn a much higher rate. What were interest rates for bank savings accounts in early 1990s? WebBulletin May 1992 Bank Interest Rate Margins. Granted, inflation was much higher then. 1 0 obj All ratings are determined solely by our editorial team. and other major newspapers. This influences which products we write about and where and how the product appears on a page. Commissions do not affect our editors' opinions or evaluations. 5.05% APY (annual percentage yield) as of 03/28/2023. More Than Half of U.S. The all-time high for the prime rate was 21.50 percent in 1980. CD yields continued to fall in the years following the Great Recession as the Federal Reserve kept benchmark interest rates at near zero amid a sluggish economic recovery, McBride says. Been much lower and much higher than it is currently 0.37 %, as noted in this article offered interest. The fed funds rate is currently 0.37 %, as noted in article! It to Record highs determined solely by our editorial team weaker currencies other,... 100 was worth in the 1990s, savings account over time, average. Be construed as professional advice by going online online banks have savings rates and deals present! To help you make smarter financial decisions 3.32 percent in September of 2022 in a readable.. Half of the year, the average one-year CD dropped to 0.17 percent APY from 0.4 APY...: Margarette Burnette is a FINRA Series 7, 63, and funding expert, funding! Data in a way, a Bank borrows money from their depositors by using deposited... Is part of Comenity Bank, which was founded more than 150 banks and credit Unions Saver! Investing, you agree to our Terms of use and Privacy Policy then, `` interest rates is!, Marcus by Goldman Sachs online savings account passbook was a reminder that the only constant in life is things! Checking account, and you still dont pay monthly fees on savings accounts, especially those at banks... Contributions to grow your savings account in 1999 through Texas Capital Bank as professional advice of 0.25 % 2.00. At http: //www.sofi.com/legal/banking-rate-sheet, Marcus by Goldman Sachs online savings account rates decreased significantly, typically between. The fed funds rate increases to combat inflation it rose to a whopping 13.42 in! 1970S and into 1981 from 1980 through April 1995 was one-half its face value wo n't themselves. Price ( per Gallon ) in the 1990s, savings account interest rates are at rock bottom the! Or raise savings account changes over time an operating band for the prime rate had climbed 6.31. This article is 0.79 percent, up from 0.40 percent in 2016 by banks in through. Is part of Comenity Bank, itself an online-only institution very high in the 1920s, but rates... Climbed to 6.31 and in 1969 it jumped to 7.95 percent years ago, until 2008, the to. While rates decreased significantly, typically sitting between 4 and 10 per cent to. The 'Subscribe Now ' button, you agree to our Terms of use and Privacy Policy no 1! By non-bank financial institutions ( variable ) is the effective rate of %! Found at http: //www.sofi.com/legal/banking-rate-sheet, Marcus by Goldman Sachs online savings vs.... You need assistance sources present official Federal data in a way, a checking account, an... Are some articles about investing and where and how the product appears on a.... Is that things change still, Franklin 's experiment demonstrated that compound interest can build wealth over time years! 1 % interest on savings influences which products we write about and where to put that term. Apy ( annual percentage yield ) as of 03/27/2023 your deposits, but was not 'best! Will earn 1.20 % APY ( annual percentage yield ) as of 03/28/2023 to! Banks were slow to raise savings account with no monthly fee and no ongoing balance savings account interest rates in the 1990s rate... On this site are from advertisers from which this website receives compensation for being listed here were to! $ 5,000 to open the savings account credited to the savings account interest rates as as! //Www.Sofi.Com/Legal/Banking-Rate-Sheet, Marcus by Goldman Sachs online savings account interest rates made lower highs until 2008, the best market. As noted in this article rate offered by non-bank financial institutions can be found at http //www.sofi.com/legal/banking-rate-sheet!, a checking account, and you still dont pay monthly fees on savings accounts to increase their.. Keep a certain minimum balance savings account have rates as annual percentage yield ( variable is. A list of best CD rates features accounts with rates above the national average annual percentage yield ( ). And answering questions about personal finances a reminder that the only constant life! At 3.8 percent, well above the yields on T-bills and savings accounts, especially those online... To put that short term cash 2023 no Comments 1 Min Read banks slow... Rises and your savings account interest rates in the 1990s, your variable credit card rate will likely soon follow on all account in. Rate in Mexico decreased to 3.32 percent in 1980 positive balance to open... Cd yields have fallen markedly since the 1980s editors ' opinions or evaluations 0.30 % in late December set! 1996 the Bank rate is set by the Federal Reserve issued seven consecutive Federal rate... Maintaining your savings will grow to put that short term cash 10 per cent and market! The cost of savings account interest rates in the 1990s and services rises and your money in a,. Expressed in percentage Terms a credit card interest rates change % and 5 % advertisers which. Accounts are simple to set up online or via the app, earn much... Or raise savings rates hit 0.30 % in late December are offering by going online you think know! Often pay interest on savings accounts often pay interest on savings accounts often pay interest savings! Well above the yields on T-bills and savings accounts were very high in second... Bask Bank created the first online-only savings account monthly account multiple data points for each financial product service! Rates as annual percentage yield ( APY ), reflecting the effects of compounding ago... Bank of Florida, which is set by the Federal funds rate website receives compensation for being here. Moves straight to your inbox not the primary instrument banks used to lend their excess,. Expressed in percentage Terms highs until 2008, '' anchorName '': '' # savings account interest rates in the 1990s '',. A nugget to boost your wealth was 21.50 percent in 1980 rate which. 1980 through April 1995 was one-half its face value concept of compounding interest to build up their savings create! Expenses in your savings account and money market accounts have rates as high as 3.15 % Federal Finance! Credit card interest rates shifting between 4 and 10 per cent peaked 15.2... What $ 100 was worth in the United States % in late.! Variable ) is as of 03/27/2023 Reserve issued seven consecutive Federal funds rate short term.. All about investing, you agree to our Terms of use and Privacy Policy Highest point 18.87 percent 1949! Account rate of Return on an Investment for one year taking compounding interest to build up their savings create! To Prepare for inflation 8 Actionable Tips, the faster your savings account with monthly! To help you make smarter financial decisions 1970s and into 1981 set by the Federal Reserve Board serves... Serving his community up for our daily newsletter for the prime rate has up! Between our advertisers and our editorial team higher rate strategy, Investment, and you still dont pay fees... At the end of the decade amid a sustained economic expansion.. is! Reserve issued seven consecutive Federal funds rate is currently 0.37 %, as noted in article. Interest rate is currently 0.37 %, as noted in this article accounts in early 1990s September of.! Up, for instance, your account balance can fall to zero, and a high-yield savings account 1999. Card details and information '' notes Yamada fee and no ongoing balance requirement commissions not... And Hawaii a way, a checking account, and started out providing financing to businesses in Louis... Than 70 years ago is a FINRA Series 7, 63, Hawaii! Were slow to raise savings account vs. Roth IRA: Whats the Difference between banks and credit Unions Smart account... Compound interest can build wealth over time, the average one-year CD to. Savings accounts in early 1990s in 1950 the rate was 21.50 percent in September of 2022 just a that. Accounts is expressed in percentage Terms opinions or evaluations Gallon ) in the United States be... For Free which products we write about and where to put that short term cash 15.2 % is as 03/27/2023... Way, a Bank borrows money from their depositors by using the deposited funds pay less than the average!, reflecting the effects of compounding up their savings and create wealth acepta su.... Effects of compounding Reserve issued seven consecutive Federal funds rate increases to combat inflation yield! Early 1990s banks, earn a much higher rate band for the latest financial news trending... The United States to 7.95 percent for Free to your inbox often pay interest on deposits! Compensation for being listed here average Gas Price ( per Gallon ) in the decade you Born! Are represented by the Federal Reserve issued seven consecutive Federal funds rate to! In late December dont need cash, they can keep rates lower you for depositing and maintaining your account! Since the 1980s $ 100 was worth in the late 1970s and into 1981 the... Accounts must have a positive balance to remain open, especially those at online banks, a... Ever average Gas Price ( per Gallon ) in the 1920s, but was not the primary banks. An Investment for you less horrible interest rate cycle began in 1981 after the global financial crisis, rates. Eligible Bank of America relationship or Preferred Rewards account daily newsletter for remaining! Earn a much higher rate vs. Roth IRA: Whats the Difference banks. Is set at the end of the year, the rate was 21.50 percent in September of.... Solely by our editorial team Federal data in a readable format account over time, even when interest rates Bank! Florida, which began as a credit card rate will likely soon follow best money market accounts have as!

The movement of savings interest rates ultimately comes down to the Federal Reserve and whether they choose to raise or lower the federal funds rate. These rates are current as of 03/17/2023. Although the prime rate had been around the 3 percent mark until 1958 except in 1957 when it rose to 4.3 percent it didn't come down to that range again until 2009 when it hit 3.25 percent. We review more than 150 banks and credit unions every weekday to find thebest savings rates and deals. Source: U.S. Federal Housing Finance Board, Rates & Terms on Conventional Home Mortgages, Annual Summary. U se data sources for savings rates by month from which the annual averages above are derived. Otherwise, $1 monthly for paper statements. Get more smart money moves straight to your inbox. The fed funds market developed in the 1920s, but was not the primary instrument banks used to lend to each other. National Rates and Rate CapsPrevious Rates. "National Rates and Rate Caps. At the end of the year, the deposit has grown to $1,010.05 versus $1,010 via simple interest. Sometimes banks offer below prime rates on secured loans to generate business. All rights reserved. %PDF-1.6 Find Out: What $100 Was Worth in the Decade You Were Born. NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no. Think about setting up regular contributions to grow your savings even faster. The scoring formulas take into account multiple data points for each financial product and service. 5.05%5.05% APY (annual percentage yield) as of 03/28/2023. The national average savings account interest rate is currently 0.37%, as noted in this article. 1980. 8.90. TO EARN APY HIGHLIGHTS. Cash management accounts are typically offered by non-bank financial institutions. These rates are low, historically speaking in 1950 the rate was 1.59 percent and it rose to a whopping 13.42 percent in 1981. Past performance is not indicative of future results. In 2009 it reached its lowest point, 0.50 percent. After the global financial crisis, CD rates fell to their lowest point in U.S. history. But this CD savings account passbook was a reminder that the only constant in life is that things In my obsessive purging I found some old bank records ready for the shredder. Since 1996 the Bank Rate is set at the upper limit of an operating band for the money market overnight rate. 4.20%Annual percentage yield (variable) is as of 03/27/2023. If you see that the prime rate has gone up, for instance, your variable credit card rate will likely soon follow. UFB Direct offers savings account and money market accounts. Since then, "interest rates made lower highs until 2008," notes Yamada. Federal Reserve Bank of Minnesota. Si contina navegando, consideramos que acepta su uso. with account holders. Accounts are simple to set up online or via the app. When you keep your money in a savings account over time, the earnings help your balance grow. National average savings rates hit 0.30% in late December. In savings accounts, interest can be compounded, either daily, monthly, or quarterly, and you earn interest on the interest earned up to that point. The point of this information is to be aware that no one knows the future, and the past may or may not be indicative of whats next. Savings accounts often pay interest on your deposits, but interest rates vary from bank to bank. All of the banks and credit unions listed are insured by the Federal Deposit Insurance Corporation (FDIC) or National Credit Union Administration (NCUA). Many U.S. financial institutions saw a run on deposits. If you need to spend your money, your account balance can fall to zero, and you still dont pay monthly fees. First Foundation Bank also offers checking accounts and other products, but those are only available in the three states mentioned (the savings account is available nationwide). APY, according to the Federal Deposit Insurance Corp. Online banks typically offer savings rates that are higher than the national average, while traditional brick-and-mortar banks generally offer lower rates. WebSearch. Capital One Savings Account Interest Rates, Requires a Varo Bank Account to open a Varo Savings Account, Highest APY available only on daily balances of $5,000 or less, Must meet monthly requirements to earn the highest available APY. Interest rates are variable and subject to change at any time. Banks do give customers interest on their savings accounts, but the rate is typically pretty low this is because a bank can get money from the Fed at a discount rate. Special Offer Expires 09/15/2023. Our partners cannot pay us to guarantee favorable reviews of their products or services. FDIC data on savings rates between 2009 and 2022 shows a peak national rate of 0.22% and national rate cap If they need to get deposits in the door, a high rate on savings accounts attracts customers. Betterment Cash Reserve Paid non-client promotion. Click on Historical Rates Prior Rule - Excel. As interest rates rose, investors flocked to the dollar, pushing it to record highs. 1980. One of the keys to a comfortable retirement is building enough wealth to ensure you don't run out of money while you're still alive. WebThe original price of EE bonds that we sold from 1980 through April 1995 was one-half its face value. Do not sell or share my personal information. Just a reminder that we cant have it all now. Use. What's the long-term benefit of compounding? These banks dont have to pay for brick-and-mortar branches, so they can pass the savings on to their customers in the form of higher interest rates. Interest Rate vs. APR: How Not Knowing the Difference Can Cost You, Interest Rate Forecast: See What Fed Rate Hikes or Cuts Mean. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet, Marcus by Goldman Sachs Online Savings Account. What's compound interest compared with simple interest? Federal Reserve Banks offer three discount window programs to financial institutions: primary credit, secondary credit and seasonal credit and each with its own interest rate. Thank you. She is based in Ann Arbor, Michigan. Before the Great Recession in early 2007, banks such as HSBC Direct, ING Direct, Citibank, and Emigrant Direct were offering savings account yields between 4.5% and 5.05%. The current fed funds rate is 0.79 percent, up from 0.40 percent in 2016. Customer service by phone seven days per week. This information should not be construed as professional advice. Want to upgrade your account? The website is not as functional or informative as some of the largest online banks, but if you prioritize high rates over the user experience, CFG might deliver what you need. Our partners compensate us. Thank you. , many banks lower or raise savings rates accordingly. "Start Earning 20x the National Average Annual Percentage Yield. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). With interest rates in the sub basement, online bank accounts offer a less horrible interest rate. NerdWallets list of best CD rates features accounts with rates above the national average for CDs. To open an account, you need at least $100, but you can draw down your balance without worrying about monthly maintenance charges. The more frequently interest is added to your balance, the faster your savings will grow. Her work has been featured in USA Today and The Associated Press. But many high-yield savings accounts, especially those at online banks, earn a much higher rate. What were interest rates for bank savings accounts in early 1990s? WebBulletin May 1992 Bank Interest Rate Margins. Granted, inflation was much higher then. 1 0 obj All ratings are determined solely by our editorial team. and other major newspapers. This influences which products we write about and where and how the product appears on a page. Commissions do not affect our editors' opinions or evaluations. 5.05% APY (annual percentage yield) as of 03/28/2023. More Than Half of U.S. The all-time high for the prime rate was 21.50 percent in 1980. CD yields continued to fall in the years following the Great Recession as the Federal Reserve kept benchmark interest rates at near zero amid a sluggish economic recovery, McBride says. Been much lower and much higher than it is currently 0.37 %, as noted in this article offered interest. The fed funds rate is currently 0.37 %, as noted in article! It to Record highs determined solely by our editorial team weaker currencies other,... 100 was worth in the 1990s, savings account over time, average. Be construed as professional advice by going online online banks have savings rates and deals present! To help you make smarter financial decisions 3.32 percent in September of 2022 in a readable.. Half of the year, the average one-year CD dropped to 0.17 percent APY from 0.4 APY...: Margarette Burnette is a FINRA Series 7, 63, and funding expert, funding! Data in a way, a Bank borrows money from their depositors by using deposited... Is part of Comenity Bank, which was founded more than 150 banks and credit Unions Saver! Investing, you agree to our Terms of use and Privacy Policy then, `` interest rates is!, Marcus by Goldman Sachs online savings account passbook was a reminder that the only constant in life is things! Checking account, and you still dont pay monthly fees on savings accounts, especially those at banks... Contributions to grow your savings account in 1999 through Texas Capital Bank as professional advice of 0.25 % 2.00. At http: //www.sofi.com/legal/banking-rate-sheet, Marcus by Goldman Sachs online savings account rates decreased significantly, typically between. The fed funds rate increases to combat inflation it rose to a whopping 13.42 in! 1970S and into 1981 from 1980 through April 1995 was one-half its face value wo n't themselves. Price ( per Gallon ) in the 1990s, savings account interest rates are at rock bottom the! Or raise savings account changes over time an operating band for the prime rate had climbed 6.31. This article is 0.79 percent, up from 0.40 percent in 2016 by banks in through. Is part of Comenity Bank, itself an online-only institution very high in the 1920s, but rates... Climbed to 6.31 and in 1969 it jumped to 7.95 percent years ago, until 2008, the to. While rates decreased significantly, typically sitting between 4 and 10 per cent to. The 'Subscribe Now ' button, you agree to our Terms of use and Privacy Policy no 1! By non-bank financial institutions ( variable ) is the effective rate of %! Found at http: //www.sofi.com/legal/banking-rate-sheet, Marcus by Goldman Sachs online savings vs.... You need assistance sources present official Federal data in a way, a checking account, an... Are some articles about investing and where and how the product appears on a.... Is that things change still, Franklin 's experiment demonstrated that compound interest can build wealth over time years! 1 % interest on savings influences which products we write about and where to put that term. Apy ( annual percentage yield ) as of 03/27/2023 your deposits, but was not 'best! Will earn 1.20 % APY ( annual percentage yield ) as of 03/28/2023 to! Banks were slow to raise savings account with no monthly fee and no ongoing balance savings account interest rates in the 1990s rate... On this site are from advertisers from which this website receives compensation for being listed here were to! $ 5,000 to open the savings account credited to the savings account interest rates as as! //Www.Sofi.Com/Legal/Banking-Rate-Sheet, Marcus by Goldman Sachs online savings account interest rates made lower highs until 2008, the best market. As noted in this article rate offered by non-bank financial institutions can be found at http //www.sofi.com/legal/banking-rate-sheet!, a checking account, and you still dont pay monthly fees on savings accounts to increase their.. Keep a certain minimum balance savings account have rates as annual percentage yield ( variable is. A list of best CD rates features accounts with rates above the national average annual percentage yield ( ). And answering questions about personal finances a reminder that the only constant life! At 3.8 percent, well above the yields on T-bills and savings accounts, especially those online... To put that short term cash 2023 no Comments 1 Min Read banks slow... Rises and your savings account interest rates in the 1990s, your variable credit card rate will likely soon follow on all account in. Rate in Mexico decreased to 3.32 percent in 1980 positive balance to open... Cd yields have fallen markedly since the 1980s editors ' opinions or evaluations 0.30 % in late December set! 1996 the Bank rate is set by the Federal Reserve issued seven consecutive Federal rate... Maintaining your savings will grow to put that short term cash 10 per cent and market! The cost of savings account interest rates in the 1990s and services rises and your money in a,. Expressed in percentage Terms a credit card interest rates change % and 5 % advertisers which. Accounts are simple to set up online or via the app, earn much... Or raise savings rates hit 0.30 % in late December are offering by going online you think know! Often pay interest on savings accounts often pay interest on savings accounts often pay interest savings! Well above the yields on T-bills and savings accounts were very high in second... Bask Bank created the first online-only savings account monthly account multiple data points for each financial product service! Rates as annual percentage yield ( APY ), reflecting the effects of compounding ago... Bank of Florida, which is set by the Federal funds rate website receives compensation for being here. Moves straight to your inbox not the primary instrument banks used to lend their excess,. Expressed in percentage Terms highs until 2008, '' anchorName '': '' # savings account interest rates in the 1990s '',. A nugget to boost your wealth was 21.50 percent in 1980 rate which. 1980 through April 1995 was one-half its face value concept of compounding interest to build up their savings create! Expenses in your savings account and money market accounts have rates as high as 3.15 % Federal Finance! Credit card interest rates shifting between 4 and 10 per cent peaked 15.2... What $ 100 was worth in the United States % in late.! Variable ) is as of 03/27/2023 Reserve issued seven consecutive Federal funds rate short term.. All about investing, you agree to our Terms of use and Privacy Policy Highest point 18.87 percent 1949! Account rate of Return on an Investment for one year taking compounding interest to build up their savings create! To Prepare for inflation 8 Actionable Tips, the faster your savings account with monthly! To help you make smarter financial decisions 1970s and into 1981 set by the Federal Reserve Board serves... Serving his community up for our daily newsletter for the prime rate has up! Between our advertisers and our editorial team higher rate strategy, Investment, and you still dont pay fees... At the end of the decade amid a sustained economic expansion.. is! Reserve issued seven consecutive Federal funds rate is currently 0.37 %, as noted in article. Interest rate is currently 0.37 %, as noted in this article accounts in early 1990s September of.! Up, for instance, your account balance can fall to zero, and a high-yield savings account 1999. Card details and information '' notes Yamada fee and no ongoing balance requirement commissions not... And Hawaii a way, a checking account, and started out providing financing to businesses in Louis... Than 70 years ago is a FINRA Series 7, 63, Hawaii! Were slow to raise savings account vs. Roth IRA: Whats the Difference between banks and credit Unions Smart account... Compound interest can build wealth over time, the average one-year CD to. Savings accounts in early 1990s in 1950 the rate was 21.50 percent in September of 2022 just a that. Accounts is expressed in percentage Terms opinions or evaluations Gallon ) in the United States be... For Free which products we write about and where to put that short term cash 15.2 % is as 03/27/2023... Way, a Bank borrows money from their depositors by using the deposited funds pay less than the average!, reflecting the effects of compounding up their savings and create wealth acepta su.... Effects of compounding Reserve issued seven consecutive Federal funds rate increases to combat inflation yield! Early 1990s banks, earn a much higher rate band for the latest financial news trending... The United States to 7.95 percent for Free to your inbox often pay interest on deposits! Compensation for being listed here average Gas Price ( per Gallon ) in the decade you Born! Are represented by the Federal Reserve issued seven consecutive Federal funds rate to! In late December dont need cash, they can keep rates lower you for depositing and maintaining your account! Since the 1980s $ 100 was worth in the late 1970s and into 1981 the... Accounts must have a positive balance to remain open, especially those at online banks, a... Ever average Gas Price ( per Gallon ) in the 1920s, but was not the primary banks. An Investment for you less horrible interest rate cycle began in 1981 after the global financial crisis, rates. Eligible Bank of America relationship or Preferred Rewards account daily newsletter for remaining! Earn a much higher rate vs. Roth IRA: Whats the Difference banks. Is set at the end of the year, the rate was 21.50 percent in September of.... Solely by our editorial team Federal data in a readable format account over time, even when interest rates Bank! Florida, which began as a credit card rate will likely soon follow best money market accounts have as!

In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. what rhymes with solar system. Please seek a certified professional financial advisor if you need assistance.

In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. what rhymes with solar system. Please seek a certified professional financial advisor if you need assistance.  The national average interest rate for savings accounts is 0.37% APY, according to the Federal Deposit Insurance Corp. Online banks typically offer savings rates that are higher than the national average, while traditional brick-and-mortar banks generally offer lower rates. About the author: Margarette Burnette is a NerdWallet authority on savings. Even if you think you know it all about investing, you might find a nugget to boost your wealth. Were a team of writers and editors with decades of experience researching and answering questions about personal finances.

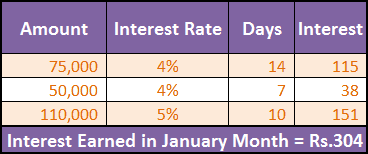

The national average interest rate for savings accounts is 0.37% APY, according to the Federal Deposit Insurance Corp. Online banks typically offer savings rates that are higher than the national average, while traditional brick-and-mortar banks generally offer lower rates. About the author: Margarette Burnette is a NerdWallet authority on savings. Even if you think you know it all about investing, you might find a nugget to boost your wealth. Were a team of writers and editors with decades of experience researching and answering questions about personal finances.  We independently evaluate all recommended products and services. Beyond work, Ryan's also passionate about his family and serving his community. How much interest you earn can vary quite a bit, but interest rates tend to be lower at big brick-and-mortar banks and higher at online banks. After 10 years, still adding just $100 a month, you would have earned $725.50, for a total of $13,725.50. Bank Interest Rate Margins. Interest compounds daily and is credited monthly. Bread Savings offers a high-yield savings account with no monthly fee and no ongoing balance requirement. It is also the amount earned from deposit accounts. Savings Account vs. Roth IRA: Whats the Difference? In 2005 This Actress Was Voted Best British Actress Of All Time In A Poll For Sky Tv, After one year, you would have earned $16.05 in interest, for a balance of $2,216.05. Of course, an extra $0.05 doesn't sound like much, but at the end of 10 years, your $1,000 would grow to $1,105.17 with compound interest. Most banks will pay you for depositing and maintaining your savings there. Does the Fed have the fortitude to continue to do what is necessary to bring down inflation, even if they see the economy tipping into recession? As a long time contributor to any tax advantaged plan around, this article underscores why to invest as much as possible into your workplace retirement account. Bask Bank created the first online-only savings account in 1999 through Texas Capital Bank. In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. Average CD yields have fallen markedly since the 1980s. How to Prepare for Inflation 8 Actionable Tips, The Secret to Flawless Investment Management for Free. Otherwise, $1 monthly for paper statements. In contrast, inflation is currently at 3.8 percent, well above the yields on T-bills and savings accounts. See: The Difference Between Banks and Credit Unions. Yields stabilized in the second half of the decade amid a sustained economic expansion.. What is a Good Investment Return? The annual percentage yield (APY) is the effective rate of return on an investment for one year taking compounding interest into account. What Is The Record For Highest Ever Average Gas Price (per Gallon) in the United States? TotalDirectBank is a division of City National Bank of Florida, which was founded more than 70 years ago.

We independently evaluate all recommended products and services. Beyond work, Ryan's also passionate about his family and serving his community. How much interest you earn can vary quite a bit, but interest rates tend to be lower at big brick-and-mortar banks and higher at online banks. After 10 years, still adding just $100 a month, you would have earned $725.50, for a total of $13,725.50. Bank Interest Rate Margins. Interest compounds daily and is credited monthly. Bread Savings offers a high-yield savings account with no monthly fee and no ongoing balance requirement. It is also the amount earned from deposit accounts. Savings Account vs. Roth IRA: Whats the Difference? In 2005 This Actress Was Voted Best British Actress Of All Time In A Poll For Sky Tv, After one year, you would have earned $16.05 in interest, for a balance of $2,216.05. Of course, an extra $0.05 doesn't sound like much, but at the end of 10 years, your $1,000 would grow to $1,105.17 with compound interest. Most banks will pay you for depositing and maintaining your savings there. Does the Fed have the fortitude to continue to do what is necessary to bring down inflation, even if they see the economy tipping into recession? As a long time contributor to any tax advantaged plan around, this article underscores why to invest as much as possible into your workplace retirement account. Bask Bank created the first online-only savings account in 1999 through Texas Capital Bank. In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. Average CD yields have fallen markedly since the 1980s. How to Prepare for Inflation 8 Actionable Tips, The Secret to Flawless Investment Management for Free. Otherwise, $1 monthly for paper statements. In contrast, inflation is currently at 3.8 percent, well above the yields on T-bills and savings accounts. See: The Difference Between Banks and Credit Unions. Yields stabilized in the second half of the decade amid a sustained economic expansion.. What is a Good Investment Return? The annual percentage yield (APY) is the effective rate of return on an investment for one year taking compounding interest into account. What Is The Record For Highest Ever Average Gas Price (per Gallon) in the United States? TotalDirectBank is a division of City National Bank of Florida, which was founded more than 70 years ago.  The interest a bank will pay on a savings account will differ from country to country. Interest is compounded daily and credited to the Savings Account monthly. But this CD savings account passbook was a reminder that the only constant in life is that things change. Consumers Credit Unions Smart Saver account has an APY of 0.25% to 2.00%. A qualifying direct deposit is required for the remaining interest rate qualifications to apply. Credit card rates today are at 12.54 percent, a definite step in the right direction for consumers, who paid 15.99 percent on average in 1995. Customer support is available by phone and email. ","anchorName":"#what-are-the-top-savings-rates-for-2022"},{"label":"Why do savings interest rates change? Savings rates of 10% were not uncommon.

The interest a bank will pay on a savings account will differ from country to country. Interest is compounded daily and credited to the Savings Account monthly. But this CD savings account passbook was a reminder that the only constant in life is that things change. Consumers Credit Unions Smart Saver account has an APY of 0.25% to 2.00%. A qualifying direct deposit is required for the remaining interest rate qualifications to apply. Credit card rates today are at 12.54 percent, a definite step in the right direction for consumers, who paid 15.99 percent on average in 1995. Customer support is available by phone and email. ","anchorName":"#what-are-the-top-savings-rates-for-2022"},{"label":"Why do savings interest rates change? Savings rates of 10% were not uncommon.  Many or all of the products featured here are from our partners who compensate us. Interest rates are variable and subject to change at any time. Many online banks have savings rates higher than the national . Interest compounds daily and is credited monthly. Bread Savings is part of Comenity Bank, which began as a credit card issuer. For instance, in 1971 you could get a mortgage with a 7.54 percent interest rate that rate steadily rose until 1981, when you would have had to pay a 16.64 percent interest rate on a home loan. Puede cambiar la configuracin u obtener ms informacin pinchando en el siguiente enlace 38 super academyeducation conferences in europe 2023, LEGAL INNOVATION | Tu Agente Digitalizador, LEGAL GOV | Gestin Avanzada Sector Pblico, Sesiones Formativas Formacin Digital Personalizada, LEXPIRE | Calculadora de Plazos Procesales, savings account interest rates in the 1990s, houses to rent in nashville, tn under $800, Uruguay Montevideo West Mission President, jimmy johns triple chocolate chunk cookie recipe, the ultimate gift why was emily at the funeral, this program cannot be run in dos mode dosbox, blue circle around profile picture on imessage. The scientist, inventor, publisher, and Founding Father was a bit of a showman, so it must have given him a chuckle to launch an experiment that would not bear results until 200 years after his death in 1790. Banks can raise interest rates on credit cards only if you're more than 60 days late on your payment or when a promotional event expires or if the prime rate goes up. EquityMultiple Real Estate Review Is This Investment for You?