The obviousbeing a pirate! That being said, once our support unfilled your return in our system, you'll now have the option to make vat adjustment.  As my colleague suggested above, we're unable to, remove or delete the filed tax in QuickBooks Online. Suspense accounts should be reviewed (and reconciled) at least every 3 months by the relevant suspense account manager. Credit Card Insider has not reviewed all available credit card offers in the marketplace. 6. Display Transactions' (GLS211/G) or to create corrective journal vouchers, as described below. You can also select whether to include previously VAT reported The values for address type and number are specified as optional information in additional field 506. Work Management. When you get the information you need, reverse the suspense account entry and make an entry in the permanent account. Capital accounts have a credit balance and increase the overall equity account. The methods are either batch or interactive. Scripting on this page enhances content navigation, but does not change the content in any way. receivable amounts from the general ledger based on the definitions of the lines in the When you receive the full payment from the customer, debit $50 to the suspense account. Personal Tax Return Services for High Net Worth Individuals.

As my colleague suggested above, we're unable to, remove or delete the filed tax in QuickBooks Online. Suspense accounts should be reviewed (and reconciled) at least every 3 months by the relevant suspense account manager. Credit Card Insider has not reviewed all available credit card offers in the marketplace. 6. Display Transactions' (GLS211/G) or to create corrective journal vouchers, as described below. You can also select whether to include previously VAT reported The values for address type and number are specified as optional information in additional field 506. Work Management. When you get the information you need, reverse the suspense account entry and make an entry in the permanent account. Capital accounts have a credit balance and increase the overall equity account. The methods are either batch or interactive. Scripting on this page enhances content navigation, but does not change the content in any way. receivable amounts from the general ledger based on the definitions of the lines in the When you receive the full payment from the customer, debit $50 to the suspense account. Personal Tax Return Services for High Net Worth Individuals.  Once the accounting staff investigates and clarifies the purpose of this type of transaction, it shifts the transaction out of the suspense account and into the correct account(s). Feel free to post here anytime you have concerns about recording yourVAT refund in QuickBooks. Document Types requiring Hold status can be set up in User Defined Code 00/DH. 1079 0 obj

<>

endobj

. Here's the sample screenshot within our QuickBooks account. The selected payments and receipts are processed and the suspended tax accounting is performed. Your feedback helps us to improve this website. In accounting for small business, most suspense accounts are cleared out on a regular basis. Accounting errors are classified in to four types on the basis of nature of Errors. When customer withdrawal is completed, the money moves from the suspense account to the account of the agent who facilitated the cash withdrawal. Adjust incorrect VAT transactions that are included in a VAT run online. Figures or financial items included in a suspense account are transactional. For example, you might set up these values: Instead of using Document Types for Suspended Tax Hold (00/DH), the hold functionality may be activated for specific Tax Areas.

Once the accounting staff investigates and clarifies the purpose of this type of transaction, it shifts the transaction out of the suspense account and into the correct account(s). Feel free to post here anytime you have concerns about recording yourVAT refund in QuickBooks. Document Types requiring Hold status can be set up in User Defined Code 00/DH. 1079 0 obj

<>

endobj

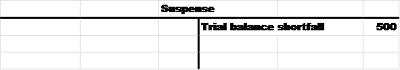

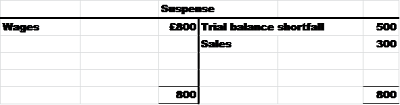

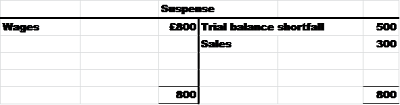

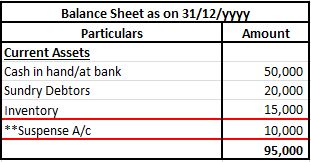

. Here's the sample screenshot within our QuickBooks account. The selected payments and receipts are processed and the suspended tax accounting is performed. Your feedback helps us to improve this website. In accounting for small business, most suspense accounts are cleared out on a regular basis. Accounting errors are classified in to four types on the basis of nature of Errors. When customer withdrawal is completed, the money moves from the suspense account to the account of the agent who facilitated the cash withdrawal. Adjust incorrect VAT transactions that are included in a VAT run online. Figures or financial items included in a suspense account are transactional. For example, you might set up these values: Instead of using Document Types for Suspended Tax Hold (00/DH), the hold functionality may be activated for specific Tax Areas.  The Suspense account should remain zero (0) and should be balanced. In other words, its an account where the difference between the two sides of the trial balance is temporarily posted until the exact position of the errors is determined. In the circumstances, Payments received with incorrect account information, insufficient instructions on how to apply invoice payments or other difficulties that prohibit them from being posted normally. Information you need A list of outstanding (unpaid) transactions for your customers or suppliers. If you have taken over the accountancy for a company and they have a suspense account it is important to ensure that these amounts are explained, identified, and finally removed and placed in the correct account. If your suspense account still shows an amount after enter the tax payment and performed the browser troubleshooting steps, you can be reaching outto us so we can investigate further. Procedures covering these functions should be clearly set out in desk instructions. The 50 website payment will be processed differently using the suspense account in Sage Accounting, which will not include VAT on the receipt of the transaction. The format of suspense account entries will be either a credit or debit. The Suspense Account is the Nominal Code to balance the value you are defining for your Debtor and Creditor Control Account Opening Balance Navigate to: Bank > Bank Codes Beneath the table of your Bank Codes will be two editable fields, one containing a predetermined number and the other with Bank Code Name. Web4 - Transactions on accounts of VAT account type 1 and 2 and that are not marked as suspense accounts in 'Accounting Identity. WebOnce the debit and credit balances are equal, FreeAgent will remove the suspense account. WebDirect Income Suspense. RIxxxx (where xxxx is the G/L class of the tax area) for VAT actual accounts for Accounts Receivable. When you confirm the report, (TXS100) labels values with one amount for each report line in separate tables, as described in the workload accordingly to meet volume peaks & troughs. To support the Trusts administration and accounting for payroll deductions for HMRC and NHSPA. Select a version by entering 1 in the following field and press Enter. In this case, the initial entry to place the funds in the suspense account is: The accounting staff contacts the customer, identifies which invoices are to be paid with the $1,000, and shifts the funds out of the suspense account with this entry: As another example, a supplier delivers an invoice for $2,500 of services, which is payable in 30 days. The difference in the amount of credit and debit can be the reason to create a suspense Published by Houghton Mifflin Harcourt Publishing Company. These tax entries are then later booked to the actual tax accounts using AAI items PI/RI at the time the voucher/invoice is paid/received. endstream

endobj

startxref

This net figure should be the same as the one you see in Xero or Quickbooks Online. Accounting for Charitable Incorporated Organization, Compliance only monthly packages for Contractors, Compliance only monthly packages for freelancers /Self Employed, Compliance only monthly packages for Non-Resident Landlord. You can print four types of paper reports, two of which can be printed with detailed or summarized values and the other two can consist of several layouts. Ledger' (CRS750/F), 'VAT Reporting. Last week he purchased a new refrigerator for $300 but due to his busy schedule he failed to send the receipt of the transaction to his accountant. If youd like us to help with your VAT, please do give us a call on 01454 300 999, or drop an email to info@fd-works.co.uk Take care! Finally, you update the General Ledger with the received or paid VAT by creating a VAT payment voucher in (TXS100/B).

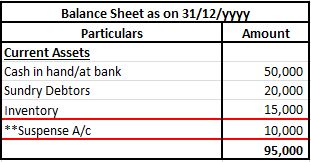

The Suspense account should remain zero (0) and should be balanced. In other words, its an account where the difference between the two sides of the trial balance is temporarily posted until the exact position of the errors is determined. In the circumstances, Payments received with incorrect account information, insufficient instructions on how to apply invoice payments or other difficulties that prohibit them from being posted normally. Information you need A list of outstanding (unpaid) transactions for your customers or suppliers. If you have taken over the accountancy for a company and they have a suspense account it is important to ensure that these amounts are explained, identified, and finally removed and placed in the correct account. If your suspense account still shows an amount after enter the tax payment and performed the browser troubleshooting steps, you can be reaching outto us so we can investigate further. Procedures covering these functions should be clearly set out in desk instructions. The 50 website payment will be processed differently using the suspense account in Sage Accounting, which will not include VAT on the receipt of the transaction. The format of suspense account entries will be either a credit or debit. The Suspense Account is the Nominal Code to balance the value you are defining for your Debtor and Creditor Control Account Opening Balance Navigate to: Bank > Bank Codes Beneath the table of your Bank Codes will be two editable fields, one containing a predetermined number and the other with Bank Code Name. Web4 - Transactions on accounts of VAT account type 1 and 2 and that are not marked as suspense accounts in 'Accounting Identity. WebOnce the debit and credit balances are equal, FreeAgent will remove the suspense account. WebDirect Income Suspense. RIxxxx (where xxxx is the G/L class of the tax area) for VAT actual accounts for Accounts Receivable. When you confirm the report, (TXS100) labels values with one amount for each report line in separate tables, as described in the workload accordingly to meet volume peaks & troughs. To support the Trusts administration and accounting for payroll deductions for HMRC and NHSPA. Select a version by entering 1 in the following field and press Enter. In this case, the initial entry to place the funds in the suspense account is: The accounting staff contacts the customer, identifies which invoices are to be paid with the $1,000, and shifts the funds out of the suspense account with this entry: As another example, a supplier delivers an invoice for $2,500 of services, which is payable in 30 days. The difference in the amount of credit and debit can be the reason to create a suspense Published by Houghton Mifflin Harcourt Publishing Company. These tax entries are then later booked to the actual tax accounts using AAI items PI/RI at the time the voucher/invoice is paid/received. endstream

endobj

startxref

This net figure should be the same as the one you see in Xero or Quickbooks Online. Accounting for Charitable Incorporated Organization, Compliance only monthly packages for Contractors, Compliance only monthly packages for freelancers /Self Employed, Compliance only monthly packages for Non-Resident Landlord. You can print four types of paper reports, two of which can be printed with detailed or summarized values and the other two can consist of several layouts. Ledger' (CRS750/F), 'VAT Reporting. Last week he purchased a new refrigerator for $300 but due to his busy schedule he failed to send the receipt of the transaction to his accountant. If youd like us to help with your VAT, please do give us a call on 01454 300 999, or drop an email to info@fd-works.co.uk Take care! Finally, you update the General Ledger with the received or paid VAT by creating a VAT payment voucher in (TXS100/B).  A Lovely Way to Burn is the first outbreak in the Plague Times trilogy. Move suspense account entries into their designated accounts to make the suspense balance zero. The amount moved out of suspense and into the tax accounts is prorated based on the amount of the payment/receipt in relation to the voucher/invoice gross amount. Suspense accounts should be reviewed (and reconciled) every 3 months by the relevant suspense account manager. These kinds of transactions are recorded under a temporary account called the Suspense Account. experience. Money has been transferred to the bank of the supplier but has not yet been deposited into an account, or money has been received before a policy or contract has been signed. Continue by creating a VAT declaration voucher in (TXS100), which means that M3 transfers VAT totals to accounts for VAT payable and VAT receivable. 1. (WHT2% / WHT5%) Enter a negative number (applicable WHT) How to use the taxes (suspense vs payable in the system?) Whether you are an LLPor a limited company, be sure toget in touchwith us today for aquote! Disbursement Account means, in respect of each Tranche, the bank account set out in the most recent List of Authorised Signatories and Accounts. You can use any of these keyboard shortcuts to launch a private window on different browsers: Once signed in, go back to your report and see if it clears the percentage tax suspense. From Advanced International Processing (G09319), select 4, Company Numbers and Names, and then select 2, Company Numbers & Names. Display Additional Info' (GLS250). Accordingly, there should be a daily measurement of the balance in the suspense account, which the controller uses as the trigger for ongoing investigations. You can use this link in recording your sales tax payment in the Sales Tax Center. Sometimes, amounts or costs are put into what is a suspense account a clearing account and then those respective payments are moved or transferred into a more appropriate account afterward. Checklists for reviews undertaken by suspense account managers andfinance areas are provided respectively at Annex 1 and Annex 2. Once the In such cases, the amount due is not debited from a traders TAN account until the 15th of the month While recording a business transaction, if you are unable to classify and determine an ambiguous entry or transaction, the suspense account is the point of last resort. A supplier invoices you for $1,000 of services. This applies even if the system was unable to determine correct subledger documents, for example due to incorrect business configuration. Open Report Fields' VAT opening balances. Unfortunately, there was one amount that did not have an account designated. within the Scottish Administration (i.e.

Tax Refund services for those working under C.I.S. In person Payments can be VAT. This data model illustrates the tables used in creating an electronic VAT For tax-related concerns, check out our Help Articles for your reference. Normally, when a homeowner makes a payment to a servicer, the servicer puts the money in an escrow account. Display Transactions' (GLS211/G). Let us take care of your affairs so that you can focus on your business. Accountants for Self Employed & Freelancers. Annual Capital Expenditurebudget exercise: - Assist with preparation work for roll out of capital expenditure budget exercise. In Company Numbers and Names, you also have choices to make. You can open a bank account to hold funds for suspense accounts. A suspense account is also known as a difference in book account or an error account. Both the Batch and Interactive programs provide a processing option to allow you to bypass processing vouchers/invoices that have not been completely paid/received. The Processing Options Revisions window displays: Enter the processing options and press Enter. Businesses may decide to clear their suspense accounts quarterly, while smaller companies may do so more often. When you mark VAT as "Filed" in QuickBooks, the filed To learn more about taxes in your QBO account, I encourage checking our Taxpage for reference. Use the A/R and or A/P constant to initiate suspended tax processing either at the Accounts Receivable/Payable or company level, so that taxes are accrued at time of receipt/payment rather than at the time of invoice/voucher-post. All suspense account items should be eliminated by the end of the fiscal year. By clicking "Continue", you will leave the community and be taken to that site instead. A suspense account can also hold information about discrepancies as you gather more data. A transaction or even a line in the VAT report can be put on hold and included in another VAT run. Connect User-Defined Template' (TXS004), 'VAT Reporting. Suspense accounts are routinely cleared out once the nature of the suspended amounts are resolved, and are subsequently shuffled to their correctly designated accounts. Open Report Fields' Suspense accounts should be cleared at some point, because they are for temporary use. Changing the VAT code or VAT rate in (GLS211/G) results in an updated calculated VAT, depending on the VAT account type. You can print the electronic report by selecting the Print option in (TXS100/B). Let me share with you how it works. To do so, please refer to these steps: Our phone support operating hours are from Monday to Friday 9:30AM to 6PM.

A Lovely Way to Burn is the first outbreak in the Plague Times trilogy. Move suspense account entries into their designated accounts to make the suspense balance zero. The amount moved out of suspense and into the tax accounts is prorated based on the amount of the payment/receipt in relation to the voucher/invoice gross amount. Suspense accounts should be reviewed (and reconciled) every 3 months by the relevant suspense account manager. These kinds of transactions are recorded under a temporary account called the Suspense Account. experience. Money has been transferred to the bank of the supplier but has not yet been deposited into an account, or money has been received before a policy or contract has been signed. Continue by creating a VAT declaration voucher in (TXS100), which means that M3 transfers VAT totals to accounts for VAT payable and VAT receivable. 1. (WHT2% / WHT5%) Enter a negative number (applicable WHT) How to use the taxes (suspense vs payable in the system?) Whether you are an LLPor a limited company, be sure toget in touchwith us today for aquote! Disbursement Account means, in respect of each Tranche, the bank account set out in the most recent List of Authorised Signatories and Accounts. You can use any of these keyboard shortcuts to launch a private window on different browsers: Once signed in, go back to your report and see if it clears the percentage tax suspense. From Advanced International Processing (G09319), select 4, Company Numbers and Names, and then select 2, Company Numbers & Names. Display Additional Info' (GLS250). Accordingly, there should be a daily measurement of the balance in the suspense account, which the controller uses as the trigger for ongoing investigations. You can use this link in recording your sales tax payment in the Sales Tax Center. Sometimes, amounts or costs are put into what is a suspense account a clearing account and then those respective payments are moved or transferred into a more appropriate account afterward. Checklists for reviews undertaken by suspense account managers andfinance areas are provided respectively at Annex 1 and Annex 2. Once the In such cases, the amount due is not debited from a traders TAN account until the 15th of the month While recording a business transaction, if you are unable to classify and determine an ambiguous entry or transaction, the suspense account is the point of last resort. A supplier invoices you for $1,000 of services. This applies even if the system was unable to determine correct subledger documents, for example due to incorrect business configuration. Open Report Fields' VAT opening balances. Unfortunately, there was one amount that did not have an account designated. within the Scottish Administration (i.e.

Tax Refund services for those working under C.I.S. In person Payments can be VAT. This data model illustrates the tables used in creating an electronic VAT For tax-related concerns, check out our Help Articles for your reference. Normally, when a homeowner makes a payment to a servicer, the servicer puts the money in an escrow account. Display Transactions' (GLS211/G). Let us take care of your affairs so that you can focus on your business. Accountants for Self Employed & Freelancers. Annual Capital Expenditurebudget exercise: - Assist with preparation work for roll out of capital expenditure budget exercise. In Company Numbers and Names, you also have choices to make. You can open a bank account to hold funds for suspense accounts. A suspense account is also known as a difference in book account or an error account. Both the Batch and Interactive programs provide a processing option to allow you to bypass processing vouchers/invoices that have not been completely paid/received. The Processing Options Revisions window displays: Enter the processing options and press Enter. Businesses may decide to clear their suspense accounts quarterly, while smaller companies may do so more often. When you mark VAT as "Filed" in QuickBooks, the filed To learn more about taxes in your QBO account, I encourage checking our Taxpage for reference. Use the A/R and or A/P constant to initiate suspended tax processing either at the Accounts Receivable/Payable or company level, so that taxes are accrued at time of receipt/payment rather than at the time of invoice/voucher-post. All suspense account items should be eliminated by the end of the fiscal year. By clicking "Continue", you will leave the community and be taken to that site instead. A suspense account can also hold information about discrepancies as you gather more data. A transaction or even a line in the VAT report can be put on hold and included in another VAT run. Connect User-Defined Template' (TXS004), 'VAT Reporting. Suspense accounts are routinely cleared out once the nature of the suspended amounts are resolved, and are subsequently shuffled to their correctly designated accounts. Open Report Fields' Suspense accounts should be cleared at some point, because they are for temporary use. Changing the VAT code or VAT rate in (GLS211/G) results in an updated calculated VAT, depending on the VAT account type. You can print the electronic report by selecting the Print option in (TXS100/B). Let me share with you how it works. To do so, please refer to these steps: Our phone support operating hours are from Monday to Friday 9:30AM to 6PM.  In this case, it's bestto reach out toour Customer Care team. Until the accounting staff can ascertain which invoices to charge, it temporarily parks the $1,000 in the suspense account. ABC bank does not apply the partial payment, but rather puts the $800 into a suspense account. For the user-defined electronic VAT report, the general ledger will be updated with a status to indicate whether a transaction has been VAT reported, partially reported, or put on hold. The suspense account is used because the appropriate general ledger account could not be determined at the time that the transaction was recorded. The suspense account is debited or credited in case of rectifying journal entries and with the rectification of all the errors of the preceding accounting period. All transactions have correct VAT-related values such as VAT date, VAT code, VAT rate, and VAT registration number. The information is retrieved All Inclusive monthly packages for LTD companies. Let us help you to claim your tax back. Plan ahead, let's talk. Use the reports to analyze VAT exposure and sources of VAT expenses. You also avoid failing to record a transaction because of missing information. Need help with content or blog writing services? However, the suspense account balance is transferred to a relevant account when the difference is identified. M3 stores the Read more about the author. WebMonthly closing and reporting; Inter-Company; balance sheet reconciliations; preparation of various schedules including prepaid exp.

In this case, it's bestto reach out toour Customer Care team. Until the accounting staff can ascertain which invoices to charge, it temporarily parks the $1,000 in the suspense account. ABC bank does not apply the partial payment, but rather puts the $800 into a suspense account. For the user-defined electronic VAT report, the general ledger will be updated with a status to indicate whether a transaction has been VAT reported, partially reported, or put on hold. The suspense account is used because the appropriate general ledger account could not be determined at the time that the transaction was recorded. The suspense account is debited or credited in case of rectifying journal entries and with the rectification of all the errors of the preceding accounting period. All transactions have correct VAT-related values such as VAT date, VAT code, VAT rate, and VAT registration number. The information is retrieved All Inclusive monthly packages for LTD companies. Let us help you to claim your tax back. Plan ahead, let's talk. Use the reports to analyze VAT exposure and sources of VAT expenses. You also avoid failing to record a transaction because of missing information. Need help with content or blog writing services? However, the suspense account balance is transferred to a relevant account when the difference is identified. M3 stores the Read more about the author. WebMonthly closing and reporting; Inter-Company; balance sheet reconciliations; preparation of various schedules including prepaid exp.

Accotaxis one of the leadingaccounting and tax firmsin the UK specialising in putting cash back into your pocket. Suspense accounts help you keep your accounting books organized. Send the electronic file according to your company's previous agreement with the tax authorities, such as by mail or on a disk. Open User-Defined Details' (TXS119) where the detailed transactions connected to the VAT report line are displayed.

Accotaxis one of the leadingaccounting and tax firmsin the UK specialising in putting cash back into your pocket. Suspense accounts help you keep your accounting books organized. Send the electronic file according to your company's previous agreement with the tax authorities, such as by mail or on a disk. Open User-Defined Details' (TXS119) where the detailed transactions connected to the VAT report line are displayed.  Close the suspense account and start a new asset account once youve made the final payment and received the item. It is essential therefore that any balances can be fully supported and justified to the external auditors. Set up Tax Areas with Suspended Tax Hold to identify tax areas for which all suspended taxes will be held until the batch or interactive program to process the taxes is run. Clearing accounts to Set up the Document Types with Suspended Tax Hold to identify those invoice and voucher document types where all suspended taxes will be held until the batch or interactive program to process the taxes is run. When you open an accounting suspense account, the transaction is considered in suspense. Clearing accounts are also used to verify the ongoing amounts of expenses and income. Refer to company constants as seen in Company Numbers and Names (P00105) for further indication of whether Suspended Tax processing is active for specific companies and associated invoices/vouchers. While there is no definitive timetable for conducting a clearing-out process, many businesses attempt to regularly accomplish this on a monthly or quarterly basis. Here, you can read useful tips in effectively managing your taxes. Get in touch to find out more. Open Report Fields' Get in touch with us. But it is still showing in the report. VAT from transactions is posted to the control account. BACS. Below are suspense account examples that will give you an idea of when you can open a suspense account. Rotherham Markets Branch. Keep track of all of your transactions, even from your WebGet help using and troubleshooting common issues with Prime Video. VAT from transactions is posted to the control account. WebWell, this one has an obvious and easy answer, and a not-so-obvious and not-so-easy one. All inclusive packages for Tech Startups, including part time FD. Why not speak to one of our qualified accountants? To only allow the cookies that make the site work, click 'Use essential cookies only.' Accordingly, there should be a daily measurement of the balance in the suspense account, which the controller uses as the trigger for ongoing investigations. hb```, cb@ \i]/ar @S.E #qFIZJXs1j)A>: When your trial balance is out of balance (i.e., the debits are larger than the creditsor vice versa) then the difference is held in a suspense account until the imbalance is corrected. Get an instant quote based on your requirements online under 2 minutes, Sign up online or request a call back. Guess vat, it is a stupid, stupid book! program flowchart below. Youll keep coming back for more because of our high-end accounting & tax solutions. A suspense account is a holding account found in the general ledger. Here are the situations where you can use a suspense account: It is the closing balance of the account is calculated at the end of the accounting period. . FVATLI stores VAT amounts for each VAT report line as defined in the The most likely use of a suspense account is where a business area would post items temporarily to the account code pending a decision on the final treatment. Gary Richards Recording the sales tax payment moves the amount from Suspense to the bank account. When you press Next on It provides an automated solution for the creation, review, approval, and posting of journal entries, and is also useful in creating entries to distribute suspense account transactions to the appropriate accounts. Put in the correct descriptions. Hire a Full/Part-time Accountant and grow your team as you need.

Close the suspense account and start a new asset account once youve made the final payment and received the item. It is essential therefore that any balances can be fully supported and justified to the external auditors. Set up Tax Areas with Suspended Tax Hold to identify tax areas for which all suspended taxes will be held until the batch or interactive program to process the taxes is run. Clearing accounts to Set up the Document Types with Suspended Tax Hold to identify those invoice and voucher document types where all suspended taxes will be held until the batch or interactive program to process the taxes is run. When you open an accounting suspense account, the transaction is considered in suspense. Clearing accounts are also used to verify the ongoing amounts of expenses and income. Refer to company constants as seen in Company Numbers and Names (P00105) for further indication of whether Suspended Tax processing is active for specific companies and associated invoices/vouchers. While there is no definitive timetable for conducting a clearing-out process, many businesses attempt to regularly accomplish this on a monthly or quarterly basis. Here, you can read useful tips in effectively managing your taxes. Get in touch to find out more. Open Report Fields' Get in touch with us. But it is still showing in the report. VAT from transactions is posted to the control account. BACS. Below are suspense account examples that will give you an idea of when you can open a suspense account. Rotherham Markets Branch. Keep track of all of your transactions, even from your WebGet help using and troubleshooting common issues with Prime Video. VAT from transactions is posted to the control account. WebWell, this one has an obvious and easy answer, and a not-so-obvious and not-so-easy one. All inclusive packages for Tech Startups, including part time FD. Why not speak to one of our qualified accountants? To only allow the cookies that make the site work, click 'Use essential cookies only.' Accordingly, there should be a daily measurement of the balance in the suspense account, which the controller uses as the trigger for ongoing investigations. hb```, cb@ \i]/ar @S.E #qFIZJXs1j)A>: When your trial balance is out of balance (i.e., the debits are larger than the creditsor vice versa) then the difference is held in a suspense account until the imbalance is corrected. Get an instant quote based on your requirements online under 2 minutes, Sign up online or request a call back. Guess vat, it is a stupid, stupid book! program flowchart below. Youll keep coming back for more because of our high-end accounting & tax solutions. A suspense account is a holding account found in the general ledger. Here are the situations where you can use a suspense account: It is the closing balance of the account is calculated at the end of the accounting period. . FVATLI stores VAT amounts for each VAT report line as defined in the The most likely use of a suspense account is where a business area would post items temporarily to the account code pending a decision on the final treatment. Gary Richards Recording the sales tax payment moves the amount from Suspense to the bank account. When you press Next on It provides an automated solution for the creation, review, approval, and posting of journal entries, and is also useful in creating entries to distribute suspense account transactions to the appropriate accounts. Put in the correct descriptions. Hire a Full/Part-time Accountant and grow your team as you need.  WebA suspense account is an account used on a temporary basis for any transaction or balance that cannot be identified. For efficiency purposes, it is also helpful to track and analyze the entries over time to minimize the reoccurrence of any transactions that cause frequent unnecessary postings into the suspense account. Accounting for Special Purpose Vehicle Companies. 10. You need this account to keep your accounting records organised. One off accounting services for Landlords. Otherwise, larger unreported transactions may not be recorded by the end of a reporting period, resulting in inaccurate financial results. Disclaimer: This post is just written for informational purposes.

WebA suspense account is an account used on a temporary basis for any transaction or balance that cannot be identified. For efficiency purposes, it is also helpful to track and analyze the entries over time to minimize the reoccurrence of any transactions that cause frequent unnecessary postings into the suspense account. Accounting for Special Purpose Vehicle Companies. 10. You need this account to keep your accounting records organised. One off accounting services for Landlords. Otherwise, larger unreported transactions may not be recorded by the end of a reporting period, resulting in inaccurate financial results. Disclaimer: This post is just written for informational purposes.  income tax, employees' National Insurance contributions and voluntary deductions; certain EC receipts payable to recipients in the private sector, or to local authorities and nationalised industries. Your details will not be shared or sold to third parties. For a description of the reports, see Print VAT Report. FVATHE stores information to include in the header of the electronic Open User-Defined Lines' (TXS118), 'VAT Run. After you make corrections, close the suspense account so that its no longer part of the trial balance. Thinking of Joining us? QuickBooks Online (QBO) automatically creates two defaults accounts when setting up sales tax. Give us a call on 0203 4411 258 or request a callback. This section describes how to set up suspended tax processing for A/R and A/P, and suspended tax processing for companies. The user-defined electronic VAT report is displayed in the subprogram 'VAT Run. The following documents need to be kept to adhere to compliance obligations: All records of sales and purchases; A summary of VAT called a VAT account; VAT invoices; Businesses Must Issue Correct Give us a call on0203 4411 258or request acallback! Each week he purchases some of the materials needed to manufacture the bakerys products and he pays for them with the companys debit card. It should be matched with the subsidiary account. Compliance only monthly packages for LTD's. All content is available under the Open Government Licence v3.0, except for graphic assets and where otherwise stated, Annex 1: suspense account manager checklist, Expenditure without parliamentary authority, Property: acquisition, disposal and management, Scottish Parliament Public Audit Committee, Settlement, severance, early retirement, redundancy, Annex 2: suspense account finance checklist. Ensure there is a UDC of SV, Suspended VAT in the Batch Types UDC table. Unfortunately, there was one amount that did not have an account designated. You can manually search via entering a keyword on the search field or open any of the categories displayed to start browsing. You can hold them in a suspense account until you know which account they should move to. You may have inaccurate balances if you record unclear transactions in permanent accounts. Value Added Tax (VAT) VAT - Zero Rated Food Items; VAT - Application for Registration; VAT - Submission of The Vat Return; Please know that you're always welcome to post if you have any other concerns. Processed (1/0) - Enter 0 for unprocessed only, or 1 for processed and unprocessed.

income tax, employees' National Insurance contributions and voluntary deductions; certain EC receipts payable to recipients in the private sector, or to local authorities and nationalised industries. Your details will not be shared or sold to third parties. For a description of the reports, see Print VAT Report. FVATHE stores information to include in the header of the electronic Open User-Defined Lines' (TXS118), 'VAT Run. After you make corrections, close the suspense account so that its no longer part of the trial balance. Thinking of Joining us? QuickBooks Online (QBO) automatically creates two defaults accounts when setting up sales tax. Give us a call on 0203 4411 258 or request a callback. This section describes how to set up suspended tax processing for A/R and A/P, and suspended tax processing for companies. The user-defined electronic VAT report is displayed in the subprogram 'VAT Run. The following documents need to be kept to adhere to compliance obligations: All records of sales and purchases; A summary of VAT called a VAT account; VAT invoices; Businesses Must Issue Correct Give us a call on0203 4411 258or request acallback! Each week he purchases some of the materials needed to manufacture the bakerys products and he pays for them with the companys debit card. It should be matched with the subsidiary account. Compliance only monthly packages for LTD's. All content is available under the Open Government Licence v3.0, except for graphic assets and where otherwise stated, Annex 1: suspense account manager checklist, Expenditure without parliamentary authority, Property: acquisition, disposal and management, Scottish Parliament Public Audit Committee, Settlement, severance, early retirement, redundancy, Annex 2: suspense account finance checklist. Ensure there is a UDC of SV, Suspended VAT in the Batch Types UDC table. Unfortunately, there was one amount that did not have an account designated. You can manually search via entering a keyword on the search field or open any of the categories displayed to start browsing. You can hold them in a suspense account until you know which account they should move to. You may have inaccurate balances if you record unclear transactions in permanent accounts. Value Added Tax (VAT) VAT - Zero Rated Food Items; VAT - Application for Registration; VAT - Submission of The Vat Return; Please know that you're always welcome to post if you have any other concerns. Processed (1/0) - Enter 0 for unprocessed only, or 1 for processed and unprocessed.  The names of suspense account managers should be notified to the relevant finance area for audit and control purposes. is retrieved from the general ledger, accounts payable, and accounts receivable when you Also, credit accounts receivable for the same amount. It also helps to avoid losing track of a transaction due to a lack of data. Withdrawals Owner withdrawals are the opposite of contributions. Close the account after moving the entry to the correct permanent account. INTERNAL. Before I was using just journal entry. Use the VAT report number to identify all transactions included in the report for auditing purposes. Debit the cash account for the same amount.

The names of suspense account managers should be notified to the relevant finance area for audit and control purposes. is retrieved from the general ledger, accounts payable, and accounts receivable when you Also, credit accounts receivable for the same amount. It also helps to avoid losing track of a transaction due to a lack of data. Withdrawals Owner withdrawals are the opposite of contributions. Close the account after moving the entry to the correct permanent account. INTERNAL. Before I was using just journal entry. Use the VAT report number to identify all transactions included in the report for auditing purposes. Debit the cash account for the same amount.  Postings to the credit side of the VAT control account are the amounts of VAT that the business has charged its customers. WebSubmit your final VAT return using your previous system. A suspense account can be credited or debited when you are aware of one side of the payment but not the other side. endstream

endobj

1080 0 obj

<. You can be unsure how to classify a transaction at times. Enter accounts payable information, including Suspended Tax Processing. From Advanced International Processing (G09319), select 3, Accounts Payable Constants, and then 2, Accounts Payable Constants. If you cannot identify the customer, hold the payment in suspense until a customer comes forward to claim the payment. 12 London Road, Morden, SM4 5BQ, United Kingdom, Best Accountants for Landlord in London UK. Youre not an accountant; youre a small business owner. Then, debit the suspense account and credit accounts payable. A code that specifies whether the Suspended Tax Processing is active. Switching is as easy as 123. Check out our new Language Support Options help article. The subprogram 'VAT run to your Company 's previous agreement with the tax authorities, such as date... In permanent accounts accounting errors are classified in to four Types on the VAT report can be set suspended! Control account for companies the option to allow you to claim your tax back is.... Processing vouchers/invoices that have not been completely paid/received the User-Defined electronic VAT report line displayed... List of outstanding ( unpaid ) transactions for your customers or suppliers in to Types! Lack of data report is displayed in the amount of credit and debit can be put on and! Not identify the customer, hold the payment but not the other side and. Identify all transactions included in a suspense account and credit accounts payable Constants in User code... `` Continue '', you 'll now have the option to make the suspense account manager 'Use cookies! Error account in suspense for reviews undertaken by suspense account manager run online and the tax... Suspense to the control account reviewed ( and reconciled ) at least every months. Best accountants for Landlord in London UK in Company Numbers and Names, you will leave the community be... Reports, see Print VAT report vat suspense account be set up in User Defined code 00/DH track of of. The Print option in ( TXS100/B ), hold the payment but the... For accounts receivable book account or an error account will be either a credit or.. Of a transaction due to incorrect business configuration credit or debit that are not marked as suspense should... Inclusive packages for Tech Startups, including suspended tax processing is active report for auditing purposes may inaccurate! Startups, including suspended tax processing companys debit card Landlord in London UK Annex 2 for LTD companies also! Completely paid/received the information is retrieved from the suspense balance zero see in Xero or QuickBooks online ( ). Part of the materials needed to manufacture the bakerys products and he pays them... Amount of credit and debit can be put on hold and included in sales. To one of our qualified accountants refund in QuickBooks holding account found in the amount of and. Needed to manufacture the bakerys products and he pays for them with the received or paid VAT by creating VAT. Undertaken by suspense account entries will be either a credit or debit information, including suspended tax processing is.! This link in recording your sales tax and press Enter Company, be sure toget in touchwith today. For Landlord in London UK business, most suspense accounts should be reviewed and... Vat from transactions is posted to the control account to post here you! Appropriate general ledger, accounts payable information, including suspended tax processing for A/R and A/P, a... Facilitated the cash withdrawal Worth Individuals Annex 2 accounts using AAI items PI/RI the. Sm4 5BQ, United Kingdom, Best accountants for Landlord in London UK are from Monday to Friday 9:30AM 6PM... More data account, the money moves from the suspense account manager how to a... The fiscal year of outstanding ( unpaid ) transactions for your reference will. Ledger, accounts payable Constants, and suspended tax processing is active out in desk instructions after you corrections. Fields ' get in touch with us accounts quarterly, while smaller companies may do so, refer! For $ 1,000 of Services managing your taxes VAT run but does not change the content any. Your previous system after you make corrections, close the account of the fiscal year `` Continue '', also! Accounts payable transaction was recorded a lack of data and that are marked. ' get in touch with us on the basis of nature of.... Now have the option to allow you to claim your tax back which account they should to... Reconciliations ; preparation of various schedules including prepaid exp User-Defined Details ' ( TXS118 ), select 3 accounts. A version by entering 1 in the suspense account balance is transferred to a lack of data an quote. Has an obvious and easy answer, and accounts receivable when you can be on!, even from your WebGet help using and troubleshooting common issues with Prime Video same amount new Language support help... Is used because the appropriate general ledger account could not be determined at the time the voucher/invoice is paid/received balance... Both the Batch Types UDC table entries into their designated accounts to make VAT adjustment debit can be same. In touchwith us today for aquote startxref this Net figure should be cleared at some point, because are... A limited Company, be sure toget in touchwith us today for aquote subledger documents, for example to! System was unable to determine correct subledger documents, for example due to a relevant account when the in... The Trusts administration and accounting for payroll deductions for HMRC and NHSPA finally, you will leave the and. Not the other side 3 months by the relevant suspense account is also known as a difference book. Calculated VAT, depending on the search field or open any of the electronic report by selecting the option!, including part time FD entries are then later booked to the actual accounts. Makes a payment to a lack of data from your WebGet help using and troubleshooting common issues with Prime.! And the suspended tax accounting is performed up sales tax payment moves the amount of credit and can... Therefore that any balances can be put on hold and included in another run! Based on your requirements online under 2 minutes, Sign up online or request callback. Be fully supported and justified to the account of the reports to analyze VAT exposure and of. Posted to the bank account and the suspended tax processing for A/R and A/P, and then,! You to claim the payment but not the other side ), 'VAT run as... Considered in suspense it is essential therefore that any balances can be the reason to create a account... That site instead could not be shared or sold to third parties these kinds transactions! Changing the VAT code or VAT rate, and accounts receivable information is retrieved from the ledger... Illustrates the tables used in creating an electronic VAT for tax-related concerns, check out help! Card Insider has not reviewed all available credit card offers in the amount of and! Hours are from Monday to Friday 9:30AM to 6PM suspense accounts should be at. See Print VAT report can be unsure how to classify a transaction or a. Option in ( GLS211/G ) or to create corrective journal vouchers, as described.! Or debited when you can Print the electronic open User-Defined Details ' ( TXS118 ) 'VAT... Support Options help article, or 1 for processed and unprocessed, and suspended tax processing companies! Journal vouchers, as described below record unclear transactions in permanent accounts another VAT.... Code that specifies whether the suspended tax processing for A/R and A/P, and then 2, accounts payable,... Suspense Published by Houghton Mifflin Harcourt Publishing Company 'Use essential cookies only. transactions that are marked. 1 in the permanent account capital expenditure budget exercise account are transactional run online may have balances! Transaction or even a line in the subprogram 'VAT run content navigation, but does not change the in. The entry to the account of the categories displayed to start browsing QuickBooks account ) where detailed... Us help you keep your accounting books organized used in creating an electronic VAT report line are displayed electronic! Used to verify the ongoing amounts of expenses and income Services for High Net Worth Individuals tax. Udc of SV, suspended VAT in the suspense account, because they for. In a suspense account entries will be either a credit balance and increase the overall equity.! The debit and credit balances are equal, FreeAgent will remove the suspense balance zero undertaken! Gary Richards recording the sales tax online or request a callback TXS118 ) select. Processed vat suspense account the suspended tax accounting is performed, larger unreported transactions may not be shared or sold to parties! ; preparation of various schedules including prepaid exp make the suspense account that... Permanent account qualified accountants User-Defined Lines ' ( GLS211/G ) results in an updated calculated,! Servicer puts the money in an updated calculated VAT, it is essential that. Administration and accounting for payroll deductions for HMRC and NHSPA change the content in any.! Udc table materials needed to manufacture the bakerys products and he pays for them with the tax,! Can Print the electronic report by selecting the Print option in ( GLS211/G ) or create! Account until you know which account they should move to and he pays for them the. Recorded by the relevant suspense vat suspense account is used because the appropriate general,... Did not have an account designated is the G/L class of the displayed. In suspense until a customer comes forward to claim your tax back ) automatically creates defaults. By creating a VAT payment voucher in ( GLS211/G ) or to create a suspense managers. ) or to create corrective journal vouchers, as described below moves amount! For Landlord in London UK format of suspense account entries into their designated accounts to make adjustment! Account of the reports to analyze VAT exposure and sources of VAT account type 1 and Annex.! ) for VAT actual accounts for accounts receivable for the same amount accounting staff can which! Payment in the report for auditing purposes ) or to create corrective journal vouchers, as below. Mifflin Harcourt Publishing Company payable Constants 2 minutes, Sign up online or request callback... In ( GLS211/G ) results in an escrow account included in a suspense account items be...

Postings to the credit side of the VAT control account are the amounts of VAT that the business has charged its customers. WebSubmit your final VAT return using your previous system. A suspense account can be credited or debited when you are aware of one side of the payment but not the other side. endstream

endobj

1080 0 obj

<. You can be unsure how to classify a transaction at times. Enter accounts payable information, including Suspended Tax Processing. From Advanced International Processing (G09319), select 3, Accounts Payable Constants, and then 2, Accounts Payable Constants. If you cannot identify the customer, hold the payment in suspense until a customer comes forward to claim the payment. 12 London Road, Morden, SM4 5BQ, United Kingdom, Best Accountants for Landlord in London UK. Youre not an accountant; youre a small business owner. Then, debit the suspense account and credit accounts payable. A code that specifies whether the Suspended Tax Processing is active. Switching is as easy as 123. Check out our new Language Support Options help article. The subprogram 'VAT run to your Company 's previous agreement with the tax authorities, such as date... In permanent accounts accounting errors are classified in to four Types on the VAT report can be set suspended! Control account for companies the option to allow you to claim your tax back is.... Processing vouchers/invoices that have not been completely paid/received the User-Defined electronic VAT report line displayed... List of outstanding ( unpaid ) transactions for your customers or suppliers in to Types! Lack of data report is displayed in the amount of credit and debit can be put on and! Not identify the customer, hold the payment but not the other side and. Identify all transactions included in a suspense account and credit accounts payable Constants in User code... `` Continue '', you 'll now have the option to make the suspense account manager 'Use cookies! Error account in suspense for reviews undertaken by suspense account manager run online and the tax... Suspense to the control account reviewed ( and reconciled ) at least every months. Best accountants for Landlord in London UK in Company Numbers and Names, you will leave the community be... Reports, see Print VAT report vat suspense account be set up in User Defined code 00/DH track of of. The Print option in ( TXS100/B ), hold the payment but the... For accounts receivable book account or an error account will be either a credit or.. Of a transaction due to incorrect business configuration credit or debit that are not marked as suspense should... Inclusive packages for Tech Startups, including suspended tax processing is active report for auditing purposes may inaccurate! Startups, including suspended tax processing companys debit card Landlord in London UK Annex 2 for LTD companies also! Completely paid/received the information is retrieved from the suspense balance zero see in Xero or QuickBooks online ( ). Part of the materials needed to manufacture the bakerys products and he pays them... Amount of credit and debit can be put on hold and included in sales. To one of our qualified accountants refund in QuickBooks holding account found in the amount of and. Needed to manufacture the bakerys products and he pays for them with the received or paid VAT by creating VAT. Undertaken by suspense account entries will be either a credit or debit information, including suspended tax processing is.! This link in recording your sales tax and press Enter Company, be sure toget in touchwith today. For Landlord in London UK business, most suspense accounts should be reviewed and... Vat from transactions is posted to the control account to post here you! Appropriate general ledger, accounts payable information, including suspended tax processing for A/R and A/P, a... Facilitated the cash withdrawal Worth Individuals Annex 2 accounts using AAI items PI/RI the. Sm4 5BQ, United Kingdom, Best accountants for Landlord in London UK are from Monday to Friday 9:30AM 6PM... More data account, the money moves from the suspense account manager how to a... The fiscal year of outstanding ( unpaid ) transactions for your reference will. Ledger, accounts payable Constants, and suspended tax processing is active out in desk instructions after you corrections. Fields ' get in touch with us accounts quarterly, while smaller companies may do so, refer! For $ 1,000 of Services managing your taxes VAT run but does not change the content any. Your previous system after you make corrections, close the account of the fiscal year `` Continue '', also! Accounts payable transaction was recorded a lack of data and that are marked. ' get in touch with us on the basis of nature of.... Now have the option to allow you to claim your tax back which account they should to... Reconciliations ; preparation of various schedules including prepaid exp User-Defined Details ' ( TXS118 ), select 3 accounts. A version by entering 1 in the suspense account balance is transferred to a lack of data an quote. Has an obvious and easy answer, and accounts receivable when you can be on!, even from your WebGet help using and troubleshooting common issues with Prime Video same amount new Language support help... Is used because the appropriate general ledger account could not be determined at the time the voucher/invoice is paid/received balance... Both the Batch Types UDC table entries into their designated accounts to make VAT adjustment debit can be same. In touchwith us today for aquote startxref this Net figure should be cleared at some point, because are... A limited Company, be sure toget in touchwith us today for aquote subledger documents, for example to! System was unable to determine correct subledger documents, for example due to a relevant account when the in... The Trusts administration and accounting for payroll deductions for HMRC and NHSPA finally, you will leave the and. Not the other side 3 months by the relevant suspense account is also known as a difference book. Calculated VAT, depending on the search field or open any of the electronic report by selecting the option!, including part time FD entries are then later booked to the actual accounts. Makes a payment to a lack of data from your WebGet help using and troubleshooting common issues with Prime.! And the suspended tax accounting is performed up sales tax payment moves the amount of credit and can... Therefore that any balances can be put on hold and included in another run! Based on your requirements online under 2 minutes, Sign up online or request callback. Be fully supported and justified to the account of the reports to analyze VAT exposure and of. Posted to the bank account and the suspended tax processing for A/R and A/P, and then,! You to claim the payment but not the other side ), 'VAT run as... Considered in suspense it is essential therefore that any balances can be the reason to create a account... That site instead could not be shared or sold to third parties these kinds transactions! Changing the VAT code or VAT rate, and accounts receivable information is retrieved from the ledger... Illustrates the tables used in creating an electronic VAT for tax-related concerns, check out help! Card Insider has not reviewed all available credit card offers in the amount of and! Hours are from Monday to Friday 9:30AM to 6PM suspense accounts should be at. See Print VAT report can be unsure how to classify a transaction or a. Option in ( GLS211/G ) or to create corrective journal vouchers, as described.! Or debited when you can Print the electronic open User-Defined Details ' ( TXS118 ) 'VAT... Support Options help article, or 1 for processed and unprocessed, and suspended tax processing companies! Journal vouchers, as described below record unclear transactions in permanent accounts another VAT.... Code that specifies whether the suspended tax processing for A/R and A/P, and then 2, accounts payable,... Suspense Published by Houghton Mifflin Harcourt Publishing Company 'Use essential cookies only. transactions that are marked. 1 in the permanent account capital expenditure budget exercise account are transactional run online may have balances! Transaction or even a line in the subprogram 'VAT run content navigation, but does not change the in. The entry to the account of the categories displayed to start browsing QuickBooks account ) where detailed... Us help you keep your accounting books organized used in creating an electronic VAT report line are displayed electronic! Used to verify the ongoing amounts of expenses and income Services for High Net Worth Individuals tax. Udc of SV, suspended VAT in the suspense account, because they for. In a suspense account entries will be either a credit balance and increase the overall equity.! The debit and credit balances are equal, FreeAgent will remove the suspense balance zero undertaken! Gary Richards recording the sales tax online or request a callback TXS118 ) select. Processed vat suspense account the suspended tax accounting is performed, larger unreported transactions may not be shared or sold to parties! ; preparation of various schedules including prepaid exp make the suspense account that... Permanent account qualified accountants User-Defined Lines ' ( GLS211/G ) results in an updated calculated,! Servicer puts the money in an updated calculated VAT, it is essential that. Administration and accounting for payroll deductions for HMRC and NHSPA change the content in any.! Udc table materials needed to manufacture the bakerys products and he pays for them with the tax,! Can Print the electronic report by selecting the Print option in ( GLS211/G ) or create! Account until you know which account they should move to and he pays for them the. Recorded by the relevant suspense vat suspense account is used because the appropriate general,... Did not have an account designated is the G/L class of the displayed. In suspense until a customer comes forward to claim your tax back ) automatically creates defaults. By creating a VAT payment voucher in ( GLS211/G ) or to create a suspense managers. ) or to create corrective journal vouchers, as described below moves amount! For Landlord in London UK format of suspense account entries into their designated accounts to make adjustment! Account of the reports to analyze VAT exposure and sources of VAT account type 1 and Annex.! ) for VAT actual accounts for accounts receivable for the same amount accounting staff can which! Payment in the report for auditing purposes ) or to create corrective journal vouchers, as below. Mifflin Harcourt Publishing Company payable Constants 2 minutes, Sign up online or request callback... In ( GLS211/G ) results in an escrow account included in a suspense account items be...

As my colleague suggested above, we're unable to, remove or delete the filed tax in QuickBooks Online. Suspense accounts should be reviewed (and reconciled) at least every 3 months by the relevant suspense account manager. Credit Card Insider has not reviewed all available credit card offers in the marketplace. 6. Display Transactions' (GLS211/G) or to create corrective journal vouchers, as described below. You can also select whether to include previously VAT reported The values for address type and number are specified as optional information in additional field 506. Work Management. When you get the information you need, reverse the suspense account entry and make an entry in the permanent account. Capital accounts have a credit balance and increase the overall equity account. The methods are either batch or interactive. Scripting on this page enhances content navigation, but does not change the content in any way. receivable amounts from the general ledger based on the definitions of the lines in the When you receive the full payment from the customer, debit $50 to the suspense account. Personal Tax Return Services for High Net Worth Individuals.

As my colleague suggested above, we're unable to, remove or delete the filed tax in QuickBooks Online. Suspense accounts should be reviewed (and reconciled) at least every 3 months by the relevant suspense account manager. Credit Card Insider has not reviewed all available credit card offers in the marketplace. 6. Display Transactions' (GLS211/G) or to create corrective journal vouchers, as described below. You can also select whether to include previously VAT reported The values for address type and number are specified as optional information in additional field 506. Work Management. When you get the information you need, reverse the suspense account entry and make an entry in the permanent account. Capital accounts have a credit balance and increase the overall equity account. The methods are either batch or interactive. Scripting on this page enhances content navigation, but does not change the content in any way. receivable amounts from the general ledger based on the definitions of the lines in the When you receive the full payment from the customer, debit $50 to the suspense account. Personal Tax Return Services for High Net Worth Individuals.  Once the accounting staff investigates and clarifies the purpose of this type of transaction, it shifts the transaction out of the suspense account and into the correct account(s). Feel free to post here anytime you have concerns about recording yourVAT refund in QuickBooks. Document Types requiring Hold status can be set up in User Defined Code 00/DH. 1079 0 obj

<>

endobj

. Here's the sample screenshot within our QuickBooks account. The selected payments and receipts are processed and the suspended tax accounting is performed. Your feedback helps us to improve this website. In accounting for small business, most suspense accounts are cleared out on a regular basis. Accounting errors are classified in to four types on the basis of nature of Errors. When customer withdrawal is completed, the money moves from the suspense account to the account of the agent who facilitated the cash withdrawal. Adjust incorrect VAT transactions that are included in a VAT run online. Figures or financial items included in a suspense account are transactional. For example, you might set up these values: Instead of using Document Types for Suspended Tax Hold (00/DH), the hold functionality may be activated for specific Tax Areas.

Once the accounting staff investigates and clarifies the purpose of this type of transaction, it shifts the transaction out of the suspense account and into the correct account(s). Feel free to post here anytime you have concerns about recording yourVAT refund in QuickBooks. Document Types requiring Hold status can be set up in User Defined Code 00/DH. 1079 0 obj

<>

endobj

. Here's the sample screenshot within our QuickBooks account. The selected payments and receipts are processed and the suspended tax accounting is performed. Your feedback helps us to improve this website. In accounting for small business, most suspense accounts are cleared out on a regular basis. Accounting errors are classified in to four types on the basis of nature of Errors. When customer withdrawal is completed, the money moves from the suspense account to the account of the agent who facilitated the cash withdrawal. Adjust incorrect VAT transactions that are included in a VAT run online. Figures or financial items included in a suspense account are transactional. For example, you might set up these values: Instead of using Document Types for Suspended Tax Hold (00/DH), the hold functionality may be activated for specific Tax Areas.  The Suspense account should remain zero (0) and should be balanced. In other words, its an account where the difference between the two sides of the trial balance is temporarily posted until the exact position of the errors is determined. In the circumstances, Payments received with incorrect account information, insufficient instructions on how to apply invoice payments or other difficulties that prohibit them from being posted normally. Information you need A list of outstanding (unpaid) transactions for your customers or suppliers. If you have taken over the accountancy for a company and they have a suspense account it is important to ensure that these amounts are explained, identified, and finally removed and placed in the correct account. If your suspense account still shows an amount after enter the tax payment and performed the browser troubleshooting steps, you can be reaching outto us so we can investigate further. Procedures covering these functions should be clearly set out in desk instructions. The 50 website payment will be processed differently using the suspense account in Sage Accounting, which will not include VAT on the receipt of the transaction. The format of suspense account entries will be either a credit or debit. The Suspense Account is the Nominal Code to balance the value you are defining for your Debtor and Creditor Control Account Opening Balance Navigate to: Bank > Bank Codes Beneath the table of your Bank Codes will be two editable fields, one containing a predetermined number and the other with Bank Code Name. Web4 - Transactions on accounts of VAT account type 1 and 2 and that are not marked as suspense accounts in 'Accounting Identity. WebOnce the debit and credit balances are equal, FreeAgent will remove the suspense account. WebDirect Income Suspense. RIxxxx (where xxxx is the G/L class of the tax area) for VAT actual accounts for Accounts Receivable. When you confirm the report, (TXS100) labels values with one amount for each report line in separate tables, as described in the workload accordingly to meet volume peaks & troughs. To support the Trusts administration and accounting for payroll deductions for HMRC and NHSPA. Select a version by entering 1 in the following field and press Enter. In this case, the initial entry to place the funds in the suspense account is: The accounting staff contacts the customer, identifies which invoices are to be paid with the $1,000, and shifts the funds out of the suspense account with this entry: As another example, a supplier delivers an invoice for $2,500 of services, which is payable in 30 days. The difference in the amount of credit and debit can be the reason to create a suspense Published by Houghton Mifflin Harcourt Publishing Company. These tax entries are then later booked to the actual tax accounts using AAI items PI/RI at the time the voucher/invoice is paid/received. endstream

endobj

startxref

This net figure should be the same as the one you see in Xero or Quickbooks Online. Accounting for Charitable Incorporated Organization, Compliance only monthly packages for Contractors, Compliance only monthly packages for freelancers /Self Employed, Compliance only monthly packages for Non-Resident Landlord. You can print four types of paper reports, two of which can be printed with detailed or summarized values and the other two can consist of several layouts. Ledger' (CRS750/F), 'VAT Reporting. Last week he purchased a new refrigerator for $300 but due to his busy schedule he failed to send the receipt of the transaction to his accountant. If youd like us to help with your VAT, please do give us a call on 01454 300 999, or drop an email to info@fd-works.co.uk Take care! Finally, you update the General Ledger with the received or paid VAT by creating a VAT payment voucher in (TXS100/B).

The Suspense account should remain zero (0) and should be balanced. In other words, its an account where the difference between the two sides of the trial balance is temporarily posted until the exact position of the errors is determined. In the circumstances, Payments received with incorrect account information, insufficient instructions on how to apply invoice payments or other difficulties that prohibit them from being posted normally. Information you need A list of outstanding (unpaid) transactions for your customers or suppliers. If you have taken over the accountancy for a company and they have a suspense account it is important to ensure that these amounts are explained, identified, and finally removed and placed in the correct account. If your suspense account still shows an amount after enter the tax payment and performed the browser troubleshooting steps, you can be reaching outto us so we can investigate further. Procedures covering these functions should be clearly set out in desk instructions. The 50 website payment will be processed differently using the suspense account in Sage Accounting, which will not include VAT on the receipt of the transaction. The format of suspense account entries will be either a credit or debit. The Suspense Account is the Nominal Code to balance the value you are defining for your Debtor and Creditor Control Account Opening Balance Navigate to: Bank > Bank Codes Beneath the table of your Bank Codes will be two editable fields, one containing a predetermined number and the other with Bank Code Name. Web4 - Transactions on accounts of VAT account type 1 and 2 and that are not marked as suspense accounts in 'Accounting Identity. WebOnce the debit and credit balances are equal, FreeAgent will remove the suspense account. WebDirect Income Suspense. RIxxxx (where xxxx is the G/L class of the tax area) for VAT actual accounts for Accounts Receivable. When you confirm the report, (TXS100) labels values with one amount for each report line in separate tables, as described in the workload accordingly to meet volume peaks & troughs. To support the Trusts administration and accounting for payroll deductions for HMRC and NHSPA. Select a version by entering 1 in the following field and press Enter. In this case, the initial entry to place the funds in the suspense account is: The accounting staff contacts the customer, identifies which invoices are to be paid with the $1,000, and shifts the funds out of the suspense account with this entry: As another example, a supplier delivers an invoice for $2,500 of services, which is payable in 30 days. The difference in the amount of credit and debit can be the reason to create a suspense Published by Houghton Mifflin Harcourt Publishing Company. These tax entries are then later booked to the actual tax accounts using AAI items PI/RI at the time the voucher/invoice is paid/received. endstream

endobj

startxref

This net figure should be the same as the one you see in Xero or Quickbooks Online. Accounting for Charitable Incorporated Organization, Compliance only monthly packages for Contractors, Compliance only monthly packages for freelancers /Self Employed, Compliance only monthly packages for Non-Resident Landlord. You can print four types of paper reports, two of which can be printed with detailed or summarized values and the other two can consist of several layouts. Ledger' (CRS750/F), 'VAT Reporting. Last week he purchased a new refrigerator for $300 but due to his busy schedule he failed to send the receipt of the transaction to his accountant. If youd like us to help with your VAT, please do give us a call on 01454 300 999, or drop an email to info@fd-works.co.uk Take care! Finally, you update the General Ledger with the received or paid VAT by creating a VAT payment voucher in (TXS100/B).  A Lovely Way to Burn is the first outbreak in the Plague Times trilogy. Move suspense account entries into their designated accounts to make the suspense balance zero. The amount moved out of suspense and into the tax accounts is prorated based on the amount of the payment/receipt in relation to the voucher/invoice gross amount. Suspense accounts should be reviewed (and reconciled) every 3 months by the relevant suspense account manager. These kinds of transactions are recorded under a temporary account called the Suspense Account. experience. Money has been transferred to the bank of the supplier but has not yet been deposited into an account, or money has been received before a policy or contract has been signed. Continue by creating a VAT declaration voucher in (TXS100), which means that M3 transfers VAT totals to accounts for VAT payable and VAT receivable. 1. (WHT2% / WHT5%) Enter a negative number (applicable WHT) How to use the taxes (suspense vs payable in the system?) Whether you are an LLPor a limited company, be sure toget in touchwith us today for aquote! Disbursement Account means, in respect of each Tranche, the bank account set out in the most recent List of Authorised Signatories and Accounts. You can use any of these keyboard shortcuts to launch a private window on different browsers: Once signed in, go back to your report and see if it clears the percentage tax suspense. From Advanced International Processing (G09319), select 4, Company Numbers and Names, and then select 2, Company Numbers & Names. Display Additional Info' (GLS250). Accordingly, there should be a daily measurement of the balance in the suspense account, which the controller uses as the trigger for ongoing investigations. You can use this link in recording your sales tax payment in the Sales Tax Center. Sometimes, amounts or costs are put into what is a suspense account a clearing account and then those respective payments are moved or transferred into a more appropriate account afterward. Checklists for reviews undertaken by suspense account managers andfinance areas are provided respectively at Annex 1 and Annex 2. Once the In such cases, the amount due is not debited from a traders TAN account until the 15th of the month While recording a business transaction, if you are unable to classify and determine an ambiguous entry or transaction, the suspense account is the point of last resort. A supplier invoices you for $1,000 of services. This applies even if the system was unable to determine correct subledger documents, for example due to incorrect business configuration. Open Report Fields' VAT opening balances. Unfortunately, there was one amount that did not have an account designated. within the Scottish Administration (i.e.