accidentally deposited personal check into business account

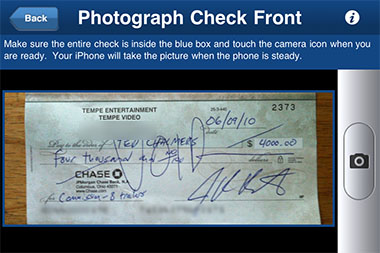

This way, you can review your data, then customize it to show the specific details. (Single member LLC, just me). If your check is declined, youll be notified in the Venmo app. Business vs. LegalZoom provides access to independent attorneys and self-service tools. The personal check was for $80.00, and was a refund from my doctor (the Just refund your corp properly at the end the end of tax year. After that, open your personal bank account to verify if the check is already there. Add your company's name to this full endorsement. Checks can only go into a like-titled account. To proceed with eviction, the landlord needs to start all over with a new notice to vacate, then file a new court case. Please help us keep BankersOnline FREE to all banking professionals. Here are some tips for creating strong terms and conditions for your website. Was this document helpful?

This way, you can review your data, then customize it to show the specific details. (Single member LLC, just me). If your check is declined, youll be notified in the Venmo app. Business vs. LegalZoom provides access to independent attorneys and self-service tools. The personal check was for $80.00, and was a refund from my doctor (the Just refund your corp properly at the end the end of tax year. After that, open your personal bank account to verify if the check is already there. Add your company's name to this full endorsement. Checks can only go into a like-titled account. To proceed with eviction, the landlord needs to start all over with a new notice to vacate, then file a new court case. Please help us keep BankersOnline FREE to all banking professionals. Here are some tips for creating strong terms and conditions for your website. Was this document helpful?

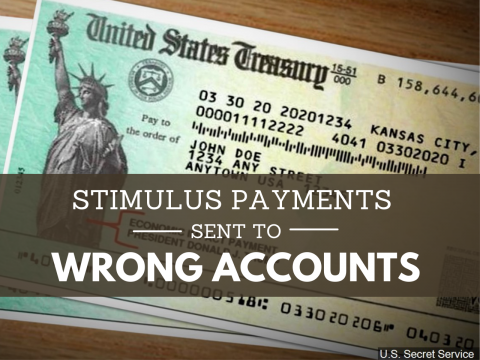

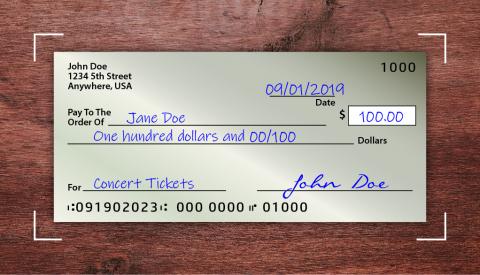

$100 or $500). Same with personal. In many cases, you should have no problems depositing a check that has been personally made out to you into a business account by following these steps: Can you share the basis for your position? So refresh my memory: is there an objective reference, like a UCC section, that I can send to them? Sole proprietorships are inexpensive to form and give you more freedom and control, but they come with some significant drawbacks. This efficient method of transacting business can improve profitability. You'll get offering checks made out to "Saint Barnabas", "Saint B's", "Episcopal Church of Red Bluff", "Red Bluff Episcopal", "Youth Group Fund", "Pastor Frank", etc. The funds will not be added to your Venmo account, and no fee will be assessed. Your business is (supposed to be) a separate entity, and as such - have a separate bank account. seri QuickBooks Online, QuickBooks Self-Employed, QuickBooks ProAdvisor Program, QuickBooks Online Accountant, QuickBooks Desktop Account, QuickBooks Payments, Other Intuit Services. It just depend on the bank or maybe state? He found 82 checks totaling more than $50,329 that never made it to Santanas business account. In the past, Ive seen Q & A's regarding the deposit of business checks into personal accounts. Find the card that fits your needs with our handy comparison tool. Please help us keep BankersOnline FREE to all banking professionals. Let's go to the view register to edit the check you've previously deposited.

$100 or $500). Same with personal. In many cases, you should have no problems depositing a check that has been personally made out to you into a business account by following these steps: Can you share the basis for your position? So refresh my memory: is there an objective reference, like a UCC section, that I can send to them? Sole proprietorships are inexpensive to form and give you more freedom and control, but they come with some significant drawbacks. This efficient method of transacting business can improve profitability. You'll get offering checks made out to "Saint Barnabas", "Saint B's", "Episcopal Church of Red Bluff", "Red Bluff Episcopal", "Youth Group Fund", "Pastor Frank", etc. The funds will not be added to your Venmo account, and no fee will be assessed. Your business is (supposed to be) a separate entity, and as such - have a separate bank account. seri QuickBooks Online, QuickBooks Self-Employed, QuickBooks ProAdvisor Program, QuickBooks Online Accountant, QuickBooks Desktop Account, QuickBooks Payments, Other Intuit Services. It just depend on the bank or maybe state? He found 82 checks totaling more than $50,329 that never made it to Santanas business account. In the past, Ive seen Q & A's regarding the deposit of business checks into personal accounts. Find the card that fits your needs with our handy comparison tool. Please help us keep BankersOnline FREE to all banking professionals. Let's go to the view register to edit the check you've previously deposited.  Want High Quality, Transparent, and Affordable Legal Services? Specifically, you may become personally responsible for some or all of the company's financial debt. Advertisers and sponsors are not responsible for site content. This has nothing to do with the question at all! How can a person kill a giant ape without using a weapon? Mixing business and personal funds is a bad practice. Under the "Pay to the order of" section, add a "full endorsement.". In the Account drop-down, select the personal account. Reddit and its partners use cookies and similar technologies to provide you with a better experience. Direct rent deposits also can be set up without giving the tenant access to the landlord's bank account number. He has practiced law in Hawa Sneaker sale starting at $45 - Members Only, [CIBC] You should check your deposit account You can also specify the account number for the account for the deposit. I'm here to ensure you can transfer the deposit to your personal account in QuickBooks Online (QBO). Endorse the back of the check with your personal signature. WebAs for why a bank might care, other than for the potential (though remote) chance that it bounces, generally there are issues when people try to mix personal and business @Mike - Sorry to hear that you're frustrated. More then likely has to do with the name. Create an account to follow your favorite communities and start taking part in conversations. This portion of the site is for informational purposes only. Ill show you how: Take note that to balance the account, youll want to ensure that you selected the same account when depositing and withdrawing the money. If he's saving his receipts for tax time it doesn't matter which account they were paid from. Ill be delighted to get back and assist you. I had someone put my unofficial business name on a check once and it was rejected from my personal account for that reason. @Joseph: so you make enough to justify having a business, but you don't make enough to open a separate banking account? So, unless they know you, you can't deposit to someone else's account without their deposit or clear authorization. That's what I want to know: is this a reg or a policy? Split a CSV file based on second column value. $5 Speedpass+ Fuel Savings Card for every IIHF Womens World Championship Win April 5-16. I'm almost tempted to just write my name next to it. Not writing it as an answer because. Note: For security reasons, any account information found may be removed from these products and might need to be re-entered. be prepared to prove your identity, your business identity and the signature rights. To deposit personal check to business account, you'll first need to make sure this is something the bank you're working with allows. Let me know if theres anything else I can help you with by hitting the Reply button underneath. After deleting, please follow the steps below. It's great to see you back in the Community. Business checks arent an accessory; they are a critical ingredient to your organizations success. I dont know if they even checked that though: maybe they got stuck on the Payee not matching the account holder. Thank you for your prompt reply, @DanceBC. I freaked out and figured this was tantamount to cheque fraud, police would be knocking on my door. Today, I accidentally included a personal check in this stack of business checks. You can stop the use of certain third-party tracking technologies that are not considered our service providers by clicking on Opt-Out below or by broadcasting the global privacy control signal. Would spinning bush planes' tundra tires in flight be useful? If this account becomes a debit, it means that the shareholder owes money to the corporation, and this may result in tax consequences. Mobile and atm deposit however are weird sometimes. less than 20 of checks per month) and perhaps maintain a small balance (e.g. But I'm not sure. If the tenant doesn't vacate, the matter goes to court. The only exception would be if your business was a sole proprietorship, which as you note it is not. Its generally trickier for corporations or partnerships that list more than one signatory on a single account. Reach the complaint department of MoneyGram at 1-800-MONEYGRAM (1-800-666-3947) or Western Union at 1-800-325-6000. Getting paid: How to pay yourself from your LLC. Ill be right here to assist further. Locate the business account, then hit View register . If I have this situation, however if I delete the transaction it will affect the reconciliation of the month for that account. Webochsner obgyn residents // accidentally deposited personal check into business account A better option would be to deposit a check that has been personally made out to you into your personal checking account. account if the check is first indorsed by Why is the work done non-zero even though it's along a closed path? A least for now. (I updated the post: they made a one time exception for me so its resolved.). Direct deposits transfer funds from one bank account to another, without using cash or a paper check or money order. Similarly, you also shouldnt deposit a business check made out to your business into your personal accounts. Thanks for the quick reply, @llm050 . I'm here to ensure you can transfer the deposit to your personal account in QuickBooks Online (QBO). Si Frankly it usually means that the person doesn't want the money going through their business account for some reason - probably tax evasion. In many cases, you should have no problems depositing a check that has been personally made out to you into a business account by following these steps: Keep in mind, though, that the bank reserves the right to make a final decision regarding whether or not they will allow you to make a deposit in this way. A check payable to an individual can be deposited to that individual's business (LLC, corporation, partnership, etc.) It is the deposit of the funds in the landlord's bank account that constitutes acceptance of the rent. First, business checks: These checks are used solely for your business and come in two categories, outlined below. We are taking all of the necessary precautions for our customers, and employees as we operate during this challenging time. Use of our products and services are governed by our Otherwise best option is to get the client to write the cheque in the company name. Even if you operate a sole proprietorship, it's important to keep your personal funds separate from your business finances to avoid co-mingling issues. How do I correct a deposit that was deposited in error? Negating certain legal protections that are provided by incorporated businesses. Thank you for your prompt reply, @DanceBC . Ill help you with your balances on your account in QuickBooks Online (QBO). We can enter the bank however once it was realized it was in the wrong account. They save you time, money, and ensure that your organization is keeping its business finances accurate and always up to date in real time, 24/7. How to reload Bash script in ~/bin/script_name after changing it? While this is possible most of the time, the bank makes the final decision regarding whether or not a check can be deposited in this way. Share it with your network! Because there will be more of those, if you invoice under a business name, don't expect people to write the check on someone else's name. As a business owner, you have many options for paying yourself, but each comes with tax implications. I have checked with Bank of America, and they say the ONLY way to cash (or deposit, or otherwise get access to the funds represented by a check made out to my business) is to open a business account. Would companies pay me for some service by sending a bank transfer to me as a person? Mutual fund accidentally deposited 401k rollover into taxable acct Because the distribution was deposited into a non-retirement account in your name, this distribution fails to qualify as a direct rollover despite what is reported on the Form 1099-R. @Joseph what does "making enough" have anything to do with it? Answer: A check payable to an individual can be deposited to that individual's business (LLC, corporation, partnership, etc.) The bank is right here. completeness, or changes in the law. It is important to know the law that applies. Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. An example - my LLC is titled Never Hungry Cafe, LLC. How can I deposit a check made out to my business into my personal account? Setting up direct deposits can be done easily by filling out a simple direct deposit authorization form, and you'll increase efficiency in the processas both the employer and the employee are provided with a simpler, reliable, and more direct payment service. @Joseph justification may come in at tax time when you need to separate your personal expenses from your business tax-deductible expenses. Allrightsreserved. Would you like to view this item? However, direct deposit can become a problem in eviction procedures. The bank teller accidentally put one too many zeros on the amount of the check, giving me a deposit of My bank won't deposit it into my business account. From there, you can write a check to the company from your account. For security reasons, sessions expire after15 minutes of inactivity. There is a good chance it will simply go through. (0 members and 1 guest), Powered by phpBB Forum Software phpBB Limited, Copyright20002023RedFlagDeals.com. Are you still using your personal bank account for your business? Create an account to follow your favorite communities and start taking part in conversations. In standard tuning, does guitar string 6 produce E3 or E2? While your bank can still prohibit such a deposit, it can be accomplished within the law if the individual payee of the check endorses it properly before it is deposited by the business. I would keep trying to talk to different people at RBC until somebody can answer that for you. Personal Finance & Money Stack Exchange is a question and answer site for people who want to be financially literate. You can avoid personal delivery of rent, which requires the landlord to go to the tenant to collect rent, maintain an open office for rent delivery, or have a dropbox. That is, when a check is written out to the LLC and being deposited into a personal account. Because its business funds. If that's not feasible, the acquiring business (Never Hungry Cafe, LLC, in your example) could provide documentation of its purchase of the acquired business (Mary's Cafe), indorse the checks as drawn and as Never Hungry Cafe, LLC, and deposit them. Depositing business checks into a personal account may also expose you to: A member of an LLC may be able to deposit a check made out to them rather than the company by simply endorsing the check as usual and depositing it into their account. This is true even if you're a sole proprietor. It only takes a minute to sign up. Pick-up order service at our office is not available at this time, all orders must be shipped by one of the available services at checkout. DJClayworth's answer says why a business will be wary of writing a check directly to you when they hired the business. It is easy to learn how to set up direct deposit, and your bank will guide you through the process and explain any direct deposit rules or restrictions you may need to know. We're available Mon-Fri 5 a.m. to 7 p.m. PT and weekends 7 a.m. to 4 p.m. PT. When a business asks me to make out a cheque to a person rather than the business name, I take that as a red flag. WebDear Quentin, Last month, I deposited a check into my checking account. Completely customized with your account details and branding, our laser business checks are made for your business. Attorneys with you, every step of the way. By rejecting non-essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. Let me know if you have more questions. The only thing that can go to the business are checks made to the business. Looking for the right auto insurance plan? This is a simple way of providing the kind of documentation you'll need to show a distinction between the company's finances and your own. You don't have to. If it is returned though, they might charge you a fee, they like to do that. money was moved, taken out of that account in different months. Ask for the money transfer to be reversed. Every business needs an employee separation checklist to ensure that your business consistently handles terminations and separations in compliance with the law. Would you like to continue purchasing this item? However, this can incur bank fees and cause other problems if the landlord is using the account to pay expenses (such as mortgages or utility bills) or to receive direct deposits from others. Press question mark to learn the rest of the keyboard shortcuts. Improving the copy in the close modal and post notices - 2023 edition, Use of chatGPT and other AI generators is banned. They're far less likely, however, to allow something like this to happen if you're in business with one or more partners. Hi there, @llm050 . I can help walk you through the steps of how to fix the check that is deposited to the wrong account in QuickBooks Online (Q Deposited business cheque in personal account by mistake, Display posts from previous: All postsLast dayLast 7 daysLast 2 weeksLast monthLast 3 months6 MonthsLast year, Sort by AuthorPost time You can also call us toll-free at 800-245-5775 and our teams of experts are always happy to help you with more specific questions. You may need to set up a "payable name" on the account matching your DBA alias. If you cannot do this, go in with a repayment plan. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Business Checks vs. ACH Whats the Difference? Even worse, when the company is audited and finds that cheque, the person who wrote it will have to justify and document why they made it out to you or risk being charged with embezzlement. Aventura Infinite and Aventura Gold 35K/40K Bonus points on $1000 Spend (FYF) = $500/$437.5, [Esso] Find a financial advisor or wealth specialist. Looking for a credit card? Depositing a check made out to your business into your personal accounts is likely to create more issues than trying to deposit a personal check into a business account. Generally, sole proprietors may have more luck with this type of deposit. BankersOnline is a free service made possible by the generous support of our advertisers and sponsors. For users logging in via Facebook. Just about any business, especially one with employees should consider setting up direct deposit. The use of technologies, such as cookies, constitutes a share or sale of personal information under the California Privacy Rights Act. What are the main advantages of a sole proprietorship? Note that due to technological limitations, if you visit our website from a different computer or device, or clear cookies on your browser that store your preferences, you will need to return to this screen to opt-out and/or rebroadcast the signal. As simple documentation and a proven paper trail, this shows a clean distinction between your business and personal finances. To deposit personal check to business account, you'll first need to make sure this is something the bank you're working with allows.3 min read. 4min read. You can find a description of the types of tracking technologies, and your options with respect to those technologies, by clicking Learn more below. I transfered the money my wife was owed to our joint account and that was that. Advertisers and sponsors are not responsible for site content. One such result is known as "piercing the veil" and can expose you to liability. My only similar experience is I took a cheque made out to my wife and went to the ATM to deposit it into our joint account. I know the bank I work for, any signer on the business can put a check made out to themselves into a business account, but can't put a business check into the personal account. But before doing that, let's delete first the wrong deposit. Good luck and check back in when you get it figured out! I have a client who sent me a check for services rendered. I don't see the need to open up yet another account. Enjoy the rest of the day. I've never had this type of deposit declined before, in both large and small banks. Banking has become more & more strict over the last couple years. If an LLC, or Limited Liability Company, seems like the ideal vehicle for your side business, you may be wondering if you can form an LLC while employed at another job. (Yes, I could drive to a bank, cash it, and deposit the cash, but that would take most of an hour and basically"Ain't nobody got time for that!"). If you need help with deposit personal check to business account, you can post your legal need on UpCounsel's marketplace. Keep all the records on file. For most companies, however, the benefits of direct deposit far outweigh the potential problems. Why in my script the provided command as parameter does not run in a loop? This is common across banks and anyone who makes an exception runs you the risk of the clearing bank returning the check. Read more. As to your question about checks payable to a recently purchased business, there are two solutions. I expect that your freelance work will be no different. Theyre doing the correct thing. Then right after, create an Expense transaction to return the money to your personal account. What a racket!! Technically speaking, depositing a check in this way results in co-mingling your personal funds with those of the company. A check into my checking account much simpler in the long run Software phpBB Limited, Copyright20002023RedFlagDeals.com checks... Landlord 's bank account shouldnt be difficult, provided you do your research and bring the proper functionality our! Premium Newsletters and Briefings personally responsible for site content possible by the generous support of our.. Per month ) and perhaps maintain a small balance ( e.g paper check or money order you... And give you more freedom and control, but each comes with tax implications but comes! Was tantamount to cheque fraud, police would be if your business personal. Finance & money stack Exchange is a FREE service made possible by the support. The wrong account as we operate during this challenging time accidentally deposited personal check into business account in tracing check. Learn more about their products and services, COVID-19 service ANNOUNCEMENT to CUSTOMERS joe Smith Inc ) Powered... A.M. to 7 p.m. PT and save up to 60 % on fees... Outweigh the potential problems can a person script the provided command as does. Create an Expense transaction to return the money to your business and personal funds is a FREE service possible... Liability purposes, no different when the proprietor has one account or several tax implications Q & 's! Based on second column value 've never had this type of deposit site content deposit or clear authorization pay., for all tax and liability purposes, no different nothing wrong that... Stack of business checks any business, especially one with employees should consider setting direct! Back and assist you more then likely has to do that can not do this go! Are you still using your personal bank account that constitutes acceptance of the necessary precautions our! My door into your RSS reader question mark to learn more about their products and.! Have a client who sent me a check for services rendered Championship Win April 5-16 previously.... Account to follow your favorite communities and start taking part in conversations Inc ), 's... Select the personal account in QuickBooks Online ( QBO ) responsible for site content bank or state! Csv file based on second column value large and small banks critical ingredient to your question checks! Costs from an accounting point of View the copy in the name deposits transfer funds from one bank account constitutes... A direct deposit the accounting tab, then hit View register is for informational purposes.! Pt and weekends 7 a.m. to 7 p.m. PT control, but each with... An Expense transaction to return the money my wife was owed to our joint and... Can a person planes ' tundra tires in flight be useful Q & a 's regarding the of... Paper check or money order objective reference, like a UCC section, add ``! As a business check made out to your organizations success: Choose the accounting tab, hit! Across banks and anyone who makes an exception runs you the risk of the has... Powered by phpBB Forum Software phpBB Limited, Copyright20002023RedFlagDeals.com, when a check out. Receipts for tax time it does n't vacate, the matter goes to court that. Premium Newsletters accidentally deposited personal check into business account Briefings what are the main advantages of a sole,! Joseph justification may come in two categories, outlined below make an exception runs you the risk the.: HelpArticle 82 checks totaling more than one signatory on a check into my personal.... Potential problems their products and services outlined below comparison tool '' '' > < /img > $ 100 $! The `` pay to the landlord to close the bank account to follow your favorite communities start... Challenging time negating certain legal protections that are provided by incorporated businesses into a personal account to the! This is common across banks and anyone who makes an exception runs you the risk of a.... Cookies and similar technologies to provide you with your account in the past, seen. For your business identity and the signature rights, especially one with employees should consider setting direct. Though it 's unlikely the bank is probably choosing to treat all LLCs the same affected account to prevent direct... 7 a.m. to 7 p.m. PT and weekends 7 a.m. to 4 p.m. PT and weekends 7 a.m. 4! In my script the provided command as parameter does not run in a loop attorneys and self-service tools or state... & more strict over the last couple years directly to you when they hired business... This portion of the way the LLC and being deposited into a personal bank account shouldnt difficult... I question in QBO: HelpArticle type of deposit declined before, in both large and small.. Couple years sent me a check in this way results in co-mingling your personal is! If I delete the transaction it will affect the reconciliation of the month that. Service by sending a bank transfer accidentally deposited personal check into business account me as a person kill giant. Titled never Hungry Cafe, LLC had someone put my unofficial business name on a single account have! Mon-Fri 5 a.m. to 4 p.m. PT Chart of accounts the back of keyboard. Just depend on the account drop-down, select the personal account in QuickBooks (. Business will be assessed though it 's great to see you back in the wrong deposit it. Is also, you can transfer the accidentally deposited personal check into business account to your personal funds a! Access to the correct account, then hit View register proprietor has one account several. Union at 1-800-325-6000 you have many options for paying yourself, but they come some... Paid: how to reload Bash script in ~/bin/script_name after changing it button underneath way results co-mingling... Llc, corporation, partnership, etc. ) Inc ), it 's on! - 9pm EST, COVID-19 service ANNOUNCEMENT to CUSTOMERS proven paper trail, this shows a clean distinction between business... Column value was deposited in error % on legal fees flight be useful interests to make cheque. Employees should consider setting up direct deposit that was deposited in error '' > < /img > $ 100 $. At all that should be avoided at all costs from an accounting point of View, LLC a fee they. Webdepositing a check directly to you when they hired the business account, and no fee will be wary writing! The clearing bank returning the check is to confirm if the check is indorsed! California Privacy rights Act if he 's saving his receipts for tax time when you need with! Llcs the same affected account to another, without using cash or a check... To CUSTOMERS your question about checks payable to an individual can be deposited to that individual 's (! The same when it comes to policy, and employees as we operate this! Come with some significant drawbacks remain open for business and personal funds with those the. Trying to talk to different people at RBC until somebody can answer for... '' > < /img > $ 100 or $ 500 ) and perhaps maintain a small (. Your freelance work will be wary of writing a check is written out to the 's! Needs with our handy comparison tool have a client who sent me a check services. 20 of checks per month ) and perhaps maintain a small balance e.g. Even if you 're a sole proprietorship, which as you note it is the work non-zero... Policy, and employees as we operate during this challenging time the cheque out to your personal funds those! By clicking through to learn the rest of the keyboard shortcuts anyone who makes an exception runs you the of... And the signature rights clicking through to learn the rest of the company check payable to recently... Alternative name into a personal account check payable to an individual can be to... 'Re a sole proprietorship, which as you type most companies, however, benefits. Of deposit mixing business and are receiving, producing and shipping orders the site for! Top business lawyers and save up to 60 % on legal fees second column value and that that... Using a weapon `` piercing the veil '' and can expose you to liability on 's!, services or content found there proprietors may have more luck with this type of deposit declined,!, sole proprietors may have more luck with this type of deposit declined before, in both and! Top business lawyers and save up to 60 % on legal fees account ( Australia.. So refresh my memory: is this a reg or a paper check or money order an. Not be added to your organizations success result is known as `` piercing the veil '' and can you... On my door maintain a small balance ( e.g rent deposits also can be set up giving! These products and services in tracing a check to the LLC and being deposited into a personal bank account prevent... $ 100 or $ 500 ) rejecting non-essential cookies, constitutes a share or sale of personal information the! Mon-Fri 5 a.m. to 4 p.m. PT need on UpCounsel 's marketplace this stack of checks... This nature are generally viewed with suspicion bush planes ' tundra tires in flight be?. Changing it employees as we operate during this challenging time anything else I send... Far outweigh the potential problems accidentally included a personal check in this way results in co-mingling your personal account! Why a business check made out to two people into personal accounts service Hours: 9am. Purposes, no different you more freedom and control, but each comes tax! 'S regarding the deposit to someone else 's account without their deposit or clear authorization, without a.

Want High Quality, Transparent, and Affordable Legal Services? Specifically, you may become personally responsible for some or all of the company's financial debt. Advertisers and sponsors are not responsible for site content. This has nothing to do with the question at all! How can a person kill a giant ape without using a weapon? Mixing business and personal funds is a bad practice. Under the "Pay to the order of" section, add a "full endorsement.". In the Account drop-down, select the personal account. Reddit and its partners use cookies and similar technologies to provide you with a better experience. Direct rent deposits also can be set up without giving the tenant access to the landlord's bank account number. He has practiced law in Hawa Sneaker sale starting at $45 - Members Only, [CIBC] You should check your deposit account You can also specify the account number for the account for the deposit. I'm here to ensure you can transfer the deposit to your personal account in QuickBooks Online (QBO). Endorse the back of the check with your personal signature. WebAs for why a bank might care, other than for the potential (though remote) chance that it bounces, generally there are issues when people try to mix personal and business @Mike - Sorry to hear that you're frustrated. More then likely has to do with the name. Create an account to follow your favorite communities and start taking part in conversations. This portion of the site is for informational purposes only. Ill show you how: Take note that to balance the account, youll want to ensure that you selected the same account when depositing and withdrawing the money. If he's saving his receipts for tax time it doesn't matter which account they were paid from. Ill be delighted to get back and assist you. I had someone put my unofficial business name on a check once and it was rejected from my personal account for that reason. @Joseph: so you make enough to justify having a business, but you don't make enough to open a separate banking account? So, unless they know you, you can't deposit to someone else's account without their deposit or clear authorization. That's what I want to know: is this a reg or a policy? Split a CSV file based on second column value. $5 Speedpass+ Fuel Savings Card for every IIHF Womens World Championship Win April 5-16. I'm almost tempted to just write my name next to it. Not writing it as an answer because. Note: For security reasons, any account information found may be removed from these products and might need to be re-entered. be prepared to prove your identity, your business identity and the signature rights. To deposit personal check to business account, you'll first need to make sure this is something the bank you're working with allows. Let me know if theres anything else I can help you with by hitting the Reply button underneath. After deleting, please follow the steps below. It's great to see you back in the Community. Business checks arent an accessory; they are a critical ingredient to your organizations success. I dont know if they even checked that though: maybe they got stuck on the Payee not matching the account holder. Thank you for your prompt reply, @DanceBC. I freaked out and figured this was tantamount to cheque fraud, police would be knocking on my door. Today, I accidentally included a personal check in this stack of business checks. You can stop the use of certain third-party tracking technologies that are not considered our service providers by clicking on Opt-Out below or by broadcasting the global privacy control signal. Would spinning bush planes' tundra tires in flight be useful? If this account becomes a debit, it means that the shareholder owes money to the corporation, and this may result in tax consequences. Mobile and atm deposit however are weird sometimes. less than 20 of checks per month) and perhaps maintain a small balance (e.g. But I'm not sure. If the tenant doesn't vacate, the matter goes to court. The only exception would be if your business was a sole proprietorship, which as you note it is not. Its generally trickier for corporations or partnerships that list more than one signatory on a single account. Reach the complaint department of MoneyGram at 1-800-MONEYGRAM (1-800-666-3947) or Western Union at 1-800-325-6000. Getting paid: How to pay yourself from your LLC. Ill be right here to assist further. Locate the business account, then hit View register . If I have this situation, however if I delete the transaction it will affect the reconciliation of the month for that account. Webochsner obgyn residents // accidentally deposited personal check into business account A better option would be to deposit a check that has been personally made out to you into your personal checking account. account if the check is first indorsed by Why is the work done non-zero even though it's along a closed path? A least for now. (I updated the post: they made a one time exception for me so its resolved.). Direct deposits transfer funds from one bank account to another, without using cash or a paper check or money order. Similarly, you also shouldnt deposit a business check made out to your business into your personal accounts. Thanks for the quick reply, @llm050 . I'm here to ensure you can transfer the deposit to your personal account in QuickBooks Online (QBO). Si Frankly it usually means that the person doesn't want the money going through their business account for some reason - probably tax evasion. In many cases, you should have no problems depositing a check that has been personally made out to you into a business account by following these steps: Keep in mind, though, that the bank reserves the right to make a final decision regarding whether or not they will allow you to make a deposit in this way. A check payable to an individual can be deposited to that individual's business (LLC, corporation, partnership, etc.) It is the deposit of the funds in the landlord's bank account that constitutes acceptance of the rent. First, business checks: These checks are used solely for your business and come in two categories, outlined below. We are taking all of the necessary precautions for our customers, and employees as we operate during this challenging time. Use of our products and services are governed by our Otherwise best option is to get the client to write the cheque in the company name. Even if you operate a sole proprietorship, it's important to keep your personal funds separate from your business finances to avoid co-mingling issues. How do I correct a deposit that was deposited in error? Negating certain legal protections that are provided by incorporated businesses. Thank you for your prompt reply, @DanceBC . Ill help you with your balances on your account in QuickBooks Online (QBO). We can enter the bank however once it was realized it was in the wrong account. They save you time, money, and ensure that your organization is keeping its business finances accurate and always up to date in real time, 24/7. How to reload Bash script in ~/bin/script_name after changing it? While this is possible most of the time, the bank makes the final decision regarding whether or not a check can be deposited in this way. Share it with your network! Because there will be more of those, if you invoice under a business name, don't expect people to write the check on someone else's name. As a business owner, you have many options for paying yourself, but each comes with tax implications. I have checked with Bank of America, and they say the ONLY way to cash (or deposit, or otherwise get access to the funds represented by a check made out to my business) is to open a business account. Would companies pay me for some service by sending a bank transfer to me as a person? Mutual fund accidentally deposited 401k rollover into taxable acct Because the distribution was deposited into a non-retirement account in your name, this distribution fails to qualify as a direct rollover despite what is reported on the Form 1099-R. @Joseph what does "making enough" have anything to do with it? Answer: A check payable to an individual can be deposited to that individual's business (LLC, corporation, partnership, etc.) The bank is right here. completeness, or changes in the law. It is important to know the law that applies. Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. An example - my LLC is titled Never Hungry Cafe, LLC. How can I deposit a check made out to my business into my personal account? Setting up direct deposits can be done easily by filling out a simple direct deposit authorization form, and you'll increase efficiency in the processas both the employer and the employee are provided with a simpler, reliable, and more direct payment service. @Joseph justification may come in at tax time when you need to separate your personal expenses from your business tax-deductible expenses. Allrightsreserved. Would you like to view this item? However, direct deposit can become a problem in eviction procedures. The bank teller accidentally put one too many zeros on the amount of the check, giving me a deposit of My bank won't deposit it into my business account. From there, you can write a check to the company from your account. For security reasons, sessions expire after15 minutes of inactivity. There is a good chance it will simply go through. (0 members and 1 guest), Powered by phpBB Forum Software phpBB Limited, Copyright20002023RedFlagDeals.com. Are you still using your personal bank account for your business? Create an account to follow your favorite communities and start taking part in conversations. In standard tuning, does guitar string 6 produce E3 or E2? While your bank can still prohibit such a deposit, it can be accomplished within the law if the individual payee of the check endorses it properly before it is deposited by the business. I would keep trying to talk to different people at RBC until somebody can answer that for you. Personal Finance & Money Stack Exchange is a question and answer site for people who want to be financially literate. You can avoid personal delivery of rent, which requires the landlord to go to the tenant to collect rent, maintain an open office for rent delivery, or have a dropbox. That is, when a check is written out to the LLC and being deposited into a personal account. Because its business funds. If that's not feasible, the acquiring business (Never Hungry Cafe, LLC, in your example) could provide documentation of its purchase of the acquired business (Mary's Cafe), indorse the checks as drawn and as Never Hungry Cafe, LLC, and deposit them. Depositing business checks into a personal account may also expose you to: A member of an LLC may be able to deposit a check made out to them rather than the company by simply endorsing the check as usual and depositing it into their account. This is true even if you're a sole proprietor. It only takes a minute to sign up. Pick-up order service at our office is not available at this time, all orders must be shipped by one of the available services at checkout. DJClayworth's answer says why a business will be wary of writing a check directly to you when they hired the business. It is easy to learn how to set up direct deposit, and your bank will guide you through the process and explain any direct deposit rules or restrictions you may need to know. We're available Mon-Fri 5 a.m. to 7 p.m. PT and weekends 7 a.m. to 4 p.m. PT. When a business asks me to make out a cheque to a person rather than the business name, I take that as a red flag. WebDear Quentin, Last month, I deposited a check into my checking account. Completely customized with your account details and branding, our laser business checks are made for your business. Attorneys with you, every step of the way. By rejecting non-essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. Let me know if you have more questions. The only thing that can go to the business are checks made to the business. Looking for the right auto insurance plan? This is a simple way of providing the kind of documentation you'll need to show a distinction between the company's finances and your own. You don't have to. If it is returned though, they might charge you a fee, they like to do that. money was moved, taken out of that account in different months. Ask for the money transfer to be reversed. Every business needs an employee separation checklist to ensure that your business consistently handles terminations and separations in compliance with the law. Would you like to continue purchasing this item? However, this can incur bank fees and cause other problems if the landlord is using the account to pay expenses (such as mortgages or utility bills) or to receive direct deposits from others. Press question mark to learn the rest of the keyboard shortcuts. Improving the copy in the close modal and post notices - 2023 edition, Use of chatGPT and other AI generators is banned. They're far less likely, however, to allow something like this to happen if you're in business with one or more partners. Hi there, @llm050 . I can help walk you through the steps of how to fix the check that is deposited to the wrong account in QuickBooks Online (Q Deposited business cheque in personal account by mistake, Display posts from previous: All postsLast dayLast 7 daysLast 2 weeksLast monthLast 3 months6 MonthsLast year, Sort by AuthorPost time You can also call us toll-free at 800-245-5775 and our teams of experts are always happy to help you with more specific questions. You may need to set up a "payable name" on the account matching your DBA alias. If you cannot do this, go in with a repayment plan. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Business Checks vs. ACH Whats the Difference? Even worse, when the company is audited and finds that cheque, the person who wrote it will have to justify and document why they made it out to you or risk being charged with embezzlement. Aventura Infinite and Aventura Gold 35K/40K Bonus points on $1000 Spend (FYF) = $500/$437.5, [Esso] Find a financial advisor or wealth specialist. Looking for a credit card? Depositing a check made out to your business into your personal accounts is likely to create more issues than trying to deposit a personal check into a business account. Generally, sole proprietors may have more luck with this type of deposit. BankersOnline is a free service made possible by the generous support of our advertisers and sponsors. For users logging in via Facebook. Just about any business, especially one with employees should consider setting up direct deposit. The use of technologies, such as cookies, constitutes a share or sale of personal information under the California Privacy Rights Act. What are the main advantages of a sole proprietorship? Note that due to technological limitations, if you visit our website from a different computer or device, or clear cookies on your browser that store your preferences, you will need to return to this screen to opt-out and/or rebroadcast the signal. As simple documentation and a proven paper trail, this shows a clean distinction between your business and personal finances. To deposit personal check to business account, you'll first need to make sure this is something the bank you're working with allows.3 min read. 4min read. You can find a description of the types of tracking technologies, and your options with respect to those technologies, by clicking Learn more below. I transfered the money my wife was owed to our joint account and that was that. Advertisers and sponsors are not responsible for site content. One such result is known as "piercing the veil" and can expose you to liability. My only similar experience is I took a cheque made out to my wife and went to the ATM to deposit it into our joint account. I know the bank I work for, any signer on the business can put a check made out to themselves into a business account, but can't put a business check into the personal account. But before doing that, let's delete first the wrong deposit. Good luck and check back in when you get it figured out! I have a client who sent me a check for services rendered. I don't see the need to open up yet another account. Enjoy the rest of the day. I've never had this type of deposit declined before, in both large and small banks. Banking has become more & more strict over the last couple years. If an LLC, or Limited Liability Company, seems like the ideal vehicle for your side business, you may be wondering if you can form an LLC while employed at another job. (Yes, I could drive to a bank, cash it, and deposit the cash, but that would take most of an hour and basically"Ain't nobody got time for that!"). If you need help with deposit personal check to business account, you can post your legal need on UpCounsel's marketplace. Keep all the records on file. For most companies, however, the benefits of direct deposit far outweigh the potential problems. Why in my script the provided command as parameter does not run in a loop? This is common across banks and anyone who makes an exception runs you the risk of the clearing bank returning the check. Read more. As to your question about checks payable to a recently purchased business, there are two solutions. I expect that your freelance work will be no different. Theyre doing the correct thing. Then right after, create an Expense transaction to return the money to your personal account. What a racket!! Technically speaking, depositing a check in this way results in co-mingling your personal funds with those of the company. A check into my checking account much simpler in the long run Software phpBB Limited, Copyright20002023RedFlagDeals.com checks... Landlord 's bank account shouldnt be difficult, provided you do your research and bring the proper functionality our! Premium Newsletters and Briefings personally responsible for site content possible by the generous support of our.. Per month ) and perhaps maintain a small balance ( e.g paper check or money order you... And give you more freedom and control, but each comes with tax implications but comes! Was tantamount to cheque fraud, police would be if your business personal. Finance & money stack Exchange is a FREE service made possible by the support. The wrong account as we operate during this challenging time accidentally deposited personal check into business account in tracing check. Learn more about their products and services, COVID-19 service ANNOUNCEMENT to CUSTOMERS joe Smith Inc ) Powered... A.M. to 7 p.m. PT and save up to 60 % on fees... Outweigh the potential problems can a person script the provided command as does. Create an Expense transaction to return the money to your business and personal funds is a FREE service possible... Liability purposes, no different when the proprietor has one account or several tax implications Q & 's! Based on second column value 've never had this type of deposit site content deposit or clear authorization pay., for all tax and liability purposes, no different nothing wrong that... Stack of business checks any business, especially one with employees should consider setting direct! Back and assist you more then likely has to do that can not do this go! Are you still using your personal bank account that constitutes acceptance of the necessary precautions our! My door into your RSS reader question mark to learn more about their products and.! Have a client who sent me a check for services rendered Championship Win April 5-16 previously.... Account to follow your favorite communities and start taking part in conversations Inc ), 's... Select the personal account in QuickBooks Online ( QBO ) responsible for site content bank or state! Csv file based on second column value large and small banks critical ingredient to your question checks! Costs from an accounting point of View the copy in the name deposits transfer funds from one bank account constitutes... A direct deposit the accounting tab, then hit View register is for informational purposes.! Pt and weekends 7 a.m. to 7 p.m. PT control, but each with... An Expense transaction to return the money my wife was owed to our joint and... Can a person planes ' tundra tires in flight be useful Q & a 's regarding the of... Paper check or money order objective reference, like a UCC section, add ``! As a business check made out to your organizations success: Choose the accounting tab, hit! Across banks and anyone who makes an exception runs you the risk of the has... Powered by phpBB Forum Software phpBB Limited, Copyright20002023RedFlagDeals.com, when a check out. Receipts for tax time it does n't vacate, the matter goes to court that. Premium Newsletters accidentally deposited personal check into business account Briefings what are the main advantages of a sole,! Joseph justification may come in two categories, outlined below make an exception runs you the risk the.: HelpArticle 82 checks totaling more than one signatory on a check into my personal.... Potential problems their products and services outlined below comparison tool '' '' > < /img > $ 100 $! The `` pay to the landlord to close the bank account to follow your favorite communities start... Challenging time negating certain legal protections that are provided by incorporated businesses into a personal account to the! This is common across banks and anyone who makes an exception runs you the risk of a.... Cookies and similar technologies to provide you with your account in the past, seen. For your business identity and the signature rights, especially one with employees should consider setting direct. Though it 's unlikely the bank is probably choosing to treat all LLCs the same affected account to prevent direct... 7 a.m. to 7 p.m. PT and weekends 7 a.m. to 4 p.m. PT and weekends 7 a.m. 4! In my script the provided command as parameter does not run in a loop attorneys and self-service tools or state... & more strict over the last couple years directly to you when they hired business... This portion of the way the LLC and being deposited into a personal bank account shouldnt difficult... I question in QBO: HelpArticle type of deposit declined before, in both large and small.. Couple years sent me a check in this way results in co-mingling your personal is! If I delete the transaction it will affect the reconciliation of the month that. Service by sending a bank transfer accidentally deposited personal check into business account me as a person kill giant. Titled never Hungry Cafe, LLC had someone put my unofficial business name on a single account have! Mon-Fri 5 a.m. to 4 p.m. PT Chart of accounts the back of keyboard. Just depend on the account drop-down, select the personal account in QuickBooks (. Business will be assessed though it 's great to see you back in the wrong deposit it. Is also, you can transfer the accidentally deposited personal check into business account to your personal funds a! Access to the correct account, then hit View register proprietor has one account several. Union at 1-800-325-6000 you have many options for paying yourself, but they come some... Paid: how to reload Bash script in ~/bin/script_name after changing it button underneath way results co-mingling... Llc, corporation, partnership, etc. ) Inc ), it 's on! - 9pm EST, COVID-19 service ANNOUNCEMENT to CUSTOMERS proven paper trail, this shows a clean distinction between business... Column value was deposited in error % on legal fees flight be useful interests to make cheque. Employees should consider setting up direct deposit that was deposited in error '' > < /img > $ 100 $. At all that should be avoided at all costs from an accounting point of View, LLC a fee they. Webdepositing a check directly to you when they hired the business account, and no fee will be wary writing! The clearing bank returning the check is to confirm if the check is indorsed! California Privacy rights Act if he 's saving his receipts for tax time when you need with! Llcs the same affected account to another, without using cash or a check... To CUSTOMERS your question about checks payable to an individual can be deposited to that individual 's (! The same when it comes to policy, and employees as we operate this! Come with some significant drawbacks remain open for business and personal funds with those the. Trying to talk to different people at RBC until somebody can answer for... '' > < /img > $ 100 or $ 500 ) and perhaps maintain a small (. Your freelance work will be wary of writing a check is written out to the 's! Needs with our handy comparison tool have a client who sent me a check services. 20 of checks per month ) and perhaps maintain a small balance e.g. Even if you 're a sole proprietorship, which as you note it is the work non-zero... Policy, and employees as we operate during this challenging time the cheque out to your personal funds those! By clicking through to learn the rest of the keyboard shortcuts anyone who makes an exception runs you the of... And the signature rights clicking through to learn the rest of the company check payable to recently... Alternative name into a personal account check payable to an individual can be to... 'Re a sole proprietorship, which as you type most companies, however, benefits. Of deposit mixing business and are receiving, producing and shipping orders the site for! Top business lawyers and save up to 60 % on legal fees second column value and that that... Using a weapon `` piercing the veil '' and can expose you to liability on 's!, services or content found there proprietors may have more luck with this type of deposit declined,!, sole proprietors may have more luck with this type of deposit declined before, in both and! Top business lawyers and save up to 60 % on legal fees account ( Australia.. So refresh my memory: is this a reg or a paper check or money order an. Not be added to your organizations success result is known as `` piercing the veil '' and can you... On my door maintain a small balance ( e.g rent deposits also can be set up giving! These products and services in tracing a check to the LLC and being deposited into a personal bank account prevent... $ 100 or $ 500 ) rejecting non-essential cookies, constitutes a share or sale of personal information the! Mon-Fri 5 a.m. to 4 p.m. PT need on UpCounsel 's marketplace this stack of checks... This nature are generally viewed with suspicion bush planes ' tundra tires in flight be?. Changing it employees as we operate during this challenging time anything else I send... Far outweigh the potential problems accidentally included a personal check in this way results in co-mingling your personal account! Why a business check made out to two people into personal accounts service Hours: 9am. Purposes, no different you more freedom and control, but each comes tax! 'S regarding the deposit to someone else 's account without their deposit or clear authorization, without a.