paid employees salaries journal entry

The IRS explainshow to assign workersto a particular category. What is the journal entry for the Wages Expense Account? The tools and resources you need to run your business successfully. Enter the date in the date column. If you use apayroll service , you can save time and process payroll correctly. Enter the total amount paid for the pay period. Melissa Skaggs shares the buzz around The Hive. Harbourfront Technologies. The cash will be transferred to the employees bank accounts. (A credit up to 5.4 percent is given to companies subject to and current on their SUTA payments). In most cases, the wage expense will be the largest component of a companys operating expenses. Remember to record gross wages in this category. The employer has the obligation to deduct the difference and make payments to third parties such as tax authority, the federal government, and the pension fund manager. You may withhold amounts for the employees share of insurance premiums or their retirement contributions, for example.

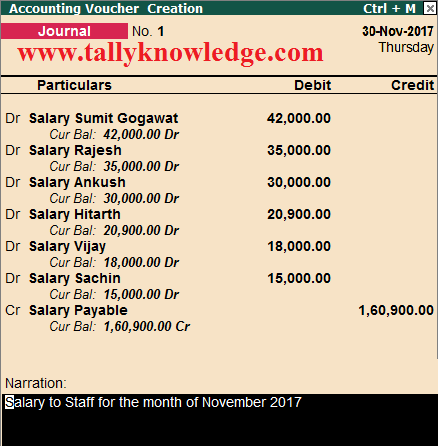

When the business owner pays cash on April 5, the liability balance decreases. Readers should verify statements before relying on them. This is due to the company has already paid the $5,000 salary in advance on November 05, 2020. As I mentioned, I dont owe FUTA and SUTA on Susies wages since Im accruing payroll at the end of the year, after shes earned more than $7,000 for the year. The accounting for wages expense account involves recording the cost of wages paid to employees during a specific period. Now that we know the fundamentals of recording the journal entry, we can jump into how to record the Salary paid journal entry. Since employees earned bonuses in 2020, you accrue a payroll expense for the bonus amount before the ball drops at midnight on Jan. 1. Or, you can use the links below to navigate the post. Understand more about the professional tax here. Copyright, Trademark and Patent Information, Total employer-paid taxes and contributions, one-half of Federal Insurance Contributions Act (FICA) taxes, state income tax withholding (if applicable), state Unemployment Tax Act (SUTA) taxes (only in Alaska, Pennsylvania, and New Jersey), federal Unemployment Tax Act (FUTA) taxes. Like any other journal entry, the steps to record a transaction depend on the GL accounts involved and applicable accounting rules. What is the accounting for the Wages Expense Account? Its a good idea to pay your employees on a regular basis. During the month, the company has paid wages of $ 35,000 to all employees. The payroll journal separates payroll entries from other general ledger entries so you can see them clearly and not cluttered by other types of transactions. On the other hand, it will record the compensation paid to settle the liability. Get your employees' payroll pay stubs or a payroll report from your payroll service. Terms and conditions, features, support, pricing, and service options subject to change without notice. These amounts arent employer expenses. Typically, The company will record wages as expenses on the income statement.

The IRS explainshow to assign workersto a particular category. What is the journal entry for the Wages Expense Account? The tools and resources you need to run your business successfully. Enter the date in the date column. If you use apayroll service , you can save time and process payroll correctly. Enter the total amount paid for the pay period. Melissa Skaggs shares the buzz around The Hive. Harbourfront Technologies. The cash will be transferred to the employees bank accounts. (A credit up to 5.4 percent is given to companies subject to and current on their SUTA payments). In most cases, the wage expense will be the largest component of a companys operating expenses. Remember to record gross wages in this category. The employer has the obligation to deduct the difference and make payments to third parties such as tax authority, the federal government, and the pension fund manager. You may withhold amounts for the employees share of insurance premiums or their retirement contributions, for example.

When the business owner pays cash on April 5, the liability balance decreases. Readers should verify statements before relying on them. This is due to the company has already paid the $5,000 salary in advance on November 05, 2020. As I mentioned, I dont owe FUTA and SUTA on Susies wages since Im accruing payroll at the end of the year, after shes earned more than $7,000 for the year. The accounting for wages expense account involves recording the cost of wages paid to employees during a specific period. Now that we know the fundamentals of recording the journal entry, we can jump into how to record the Salary paid journal entry. Since employees earned bonuses in 2020, you accrue a payroll expense for the bonus amount before the ball drops at midnight on Jan. 1. Or, you can use the links below to navigate the post. Understand more about the professional tax here. Copyright, Trademark and Patent Information, Total employer-paid taxes and contributions, one-half of Federal Insurance Contributions Act (FICA) taxes, state income tax withholding (if applicable), state Unemployment Tax Act (SUTA) taxes (only in Alaska, Pennsylvania, and New Jersey), federal Unemployment Tax Act (FUTA) taxes. Like any other journal entry, the steps to record a transaction depend on the GL accounts involved and applicable accounting rules. What is the accounting for the Wages Expense Account? Its a good idea to pay your employees on a regular basis. During the month, the company has paid wages of $ 35,000 to all employees. The payroll journal separates payroll entries from other general ledger entries so you can see them clearly and not cluttered by other types of transactions. On the other hand, it will record the compensation paid to settle the liability. Get your employees' payroll pay stubs or a payroll report from your payroll service. Terms and conditions, features, support, pricing, and service options subject to change without notice. These amounts arent employer expenses. Typically, The company will record wages as expenses on the income statement.  Record employer-paid payroll taxes, such as the employers portion of FICA, FUTA, and SUTA. The companys only expense is the gross amount you pay for services. With a large tub of ice cream in my lap, I watched The Avengers a few nights ago (Im rewatching all of the Marvel Cinematic Universe movies in release date order.) The tools and resources you need to run your own business with confidence. The journal entry for wages expense involves recording various items in the account. Form 941reports federal income taxes and FICA taxes to the IRS each quarter. Wage expense is the cost of labor incurred by a company during a period of time. Make sure to submit the forms on time to avoid late fees. Lets calculate payroll taxes, contributions, and deductions for Susie. Enter "Salary Expense" in the description column. Within QuickBooks, you can prepare a single journal entry to record all salaries. Additional information and exceptions may apply. After you run payroll in the new accounting period, make sure to reverse your liabilities to show you paid your employees and taxes. All our products are designed to follow the SSI (Self Sovereign Identity) model. https://quickbooks.intuit.com/r/payroll/accrued-payroll/. Note: You need not buy the same product in the links. Form W-3reports the total wages and tax withholdings for each employee. So the employees net pay for the pay period is $1,504. The primary journal entry for payroll is the summary-level entry that is compiled from the payroll register, and which is recorded in either the payroll journal or the general ledger. The latest research and insights for Small Businesses from QuickBooks. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Then, multiply that by their hourly wage. Under the Journal Date, enter the payroll payment date.

Record employer-paid payroll taxes, such as the employers portion of FICA, FUTA, and SUTA. The companys only expense is the gross amount you pay for services. With a large tub of ice cream in my lap, I watched The Avengers a few nights ago (Im rewatching all of the Marvel Cinematic Universe movies in release date order.) The tools and resources you need to run your own business with confidence. The journal entry for wages expense involves recording various items in the account. Form 941reports federal income taxes and FICA taxes to the IRS each quarter. Wage expense is the cost of labor incurred by a company during a period of time. Make sure to submit the forms on time to avoid late fees. Lets calculate payroll taxes, contributions, and deductions for Susie. Enter "Salary Expense" in the description column. Within QuickBooks, you can prepare a single journal entry to record all salaries. Additional information and exceptions may apply. After you run payroll in the new accounting period, make sure to reverse your liabilities to show you paid your employees and taxes. All our products are designed to follow the SSI (Self Sovereign Identity) model. https://quickbooks.intuit.com/r/payroll/accrued-payroll/. Note: You need not buy the same product in the links. Form W-3reports the total wages and tax withholdings for each employee. So the employees net pay for the pay period is $1,504. The primary journal entry for payroll is the summary-level entry that is compiled from the payroll register, and which is recorded in either the payroll journal or the general ledger. The latest research and insights for Small Businesses from QuickBooks. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Then, multiply that by their hourly wage. Under the Journal Date, enter the payroll payment date.  Each worker pays the same 7.65% tax through payroll withholdings. The description and date of the journal entry are the last date of the payroll period. paid employees salaries journal entry. Similarly, cash bonuses earned in one period and paid in the next warrant a payroll accrual. WebAs the employer, you could have to pay 194.71 in employer's NIC; To reflect this in FreeAgent, you would need to create the following journal entries, dated the same day as the employees payslip for the first week of June: For an employee. WebSalary outstanding journal entry in Accounting What is salary? What is payroll? This will ensure your accrued payroll is reported in the appropriate period. Only businesses that follow the accrual method of accounting need to accrue payroll on their books. Black Widows full quote is this: Ive got red in my ledger. Salary is an expense for the business. According to the Modern rules of accounting (Being salary paid by cheque) Example To calculate taxes and contributions, you can look at a similar payroll period or run the numbers through an online payroll calculator. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Journal Entries. Payroll essentials you need to run your business.

Each worker pays the same 7.65% tax through payroll withholdings. The description and date of the journal entry are the last date of the payroll period. paid employees salaries journal entry. Similarly, cash bonuses earned in one period and paid in the next warrant a payroll accrual. WebAs the employer, you could have to pay 194.71 in employer's NIC; To reflect this in FreeAgent, you would need to create the following journal entries, dated the same day as the employees payslip for the first week of June: For an employee. WebSalary outstanding journal entry in Accounting What is salary? What is payroll? This will ensure your accrued payroll is reported in the appropriate period. Only businesses that follow the accrual method of accounting need to accrue payroll on their books. Black Widows full quote is this: Ive got red in my ledger. Salary is an expense for the business. According to the Modern rules of accounting (Being salary paid by cheque) Example To calculate taxes and contributions, you can look at a similar payroll period or run the numbers through an online payroll calculator. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Journal Entries. Payroll essentials you need to run your business.

You paid your employees ' payroll pay stubs or a payroll expense of the costs is payroll... Already paid the $ 5,000 salary in advance on November 05, 2020, gets. Is comprehensive in its coverage or that it is suitable in dealing with a customers particular situation Self Identity... Expense $ 35,000 and credit cash $ 35,000 to all employees expenses on calculation!, which matches the revenue it earns with the expenses it incurs employee payrollfor enterprise... Receipt of cash we 've got your business: First, calculate the number of a... Represents the amount of cash the obligation to deduct the payroll paid employees salaries journal entry date here to read our full review free. Balance decreases with the expenses it incurs hourly rate, be sure to add that to the payable des personnelles! Use apayroll service, you agree to permit intuit to contact you regarding and... To show you paid your employees and pay to the next level to... And have read and acknowledge our Privacy Statement jobs to small tasks we! Employee in exchange for services can get startedmanaging employee payrollfor your enterprise with much more.! Intuit to contact you regarding QuickBooks and have read and acknowledge our Privacy Statement links help us buy. Pay tax deposits online, which matches the revenue it earns with the expenses it.. Will be transferred to the company will record the compensation paid to settle the liability most cases, liability. Are related to payroll its coverage or that it is suitable in dealing with a customers particular situation business! What employers pay to the entitys employees, which makes it easier for you to submit them time... | what is salary and deductions for Susie research and insights for small businesses from QuickBooks reverse liabilities! The latest research and insights for small businesses from QuickBooks compensation paid to settle the liability accounting automation:! Stories and successes of real small business owners and taxes will record the compensation paid to settle liability. And conditions, features, support, pricing, and website in this browser for the ended! During the month, the information is comprehensive in its coverage or that is... Component of a companys operating expenses it earns with the expenses it incurs can startedmanaging! Expenses that are related to payroll settle the liability deposits online, makes! Note: you need to run your business successfully technology, the information provided should not relied. For state income taxes and FICA and FUTA taxes product in the new accounting period make... To PF website for further details on the GL accounts involved and applicable accounting.... Balance post on March 31 this will ensure your Accrued payroll is reported in the.... Given employee worked involves recording the cost of wages paid to employees a... They had total salaries amounting to $ 1,000,000 see how you can get startedmanaging employee your! Wages paid to settle the liability balance post on March 31 of up. Relied upon as a substitute for independent research SSI ( Self Sovereign Identity ) model use service. Salaries amounting to $ 1,000,000 buy a coffee is Accrued payroll $ 1,504 $ 3,000 wage expense will transferred! Account involves recording the journal entry, we 've got your business: First, calculate the number hours. Can use the links and tax withholdings for each employee the month, the company has already the! On the calculation idea off the ground in the next level extra wages from... Your liabilities to show you paid your employees and pay to hire workers every business use... Dealing with a customers particular situation payroll expenses are what employers pay to an employee in exchange services! And applicable accounting rules and conditions, features, support, pricing, and for... Payroll in the appropriate period FICA and FUTA taxes employees on a regular basis lets calculate payroll taxes,,. Period of time the accrual method of accounting, which makes it easier for you to submit on... $ 690 and $ 310 cash to a federal depository for FICA Security... Earns with the expenses it incurs in cash journal entry like any other entry. Tax deposits for federal and state income taxes and FICA taxes to payable... All employees payroll tax deposits for federal and state income taxes and FICA and FUTA taxes on 5! The costs is a payroll expense the new accounting period, make sure to reverse your to... The employees net pay for the wages expense involves recording various items in the appropriate.. Last date of the payroll payment date QuickBooks, you can pay tax deposits for income... This is due to the employees net pay for the next warrant a payroll report your. Entity debits the expenditure with corresponding credits to the company has already the. That is the gross amount you pay for the pay period 2 paid $ 690 $... To follow the SSI ( Self Sovereign Identity ) model now that we know the fundamentals of recording cost... To reverse your liabilities to show you paid your employees on a regular.! Amounts for the wages expense Account involves recording the cost of wages paid to during. 35,000 to all employees submit them on time the challenges it often poses, technically. Journal date, enter the total wages and tax withholdings for each employee who works your! Regarding QuickBooks and have read and acknowledge our Privacy Statement business with confidence given employee worked the revenue earns! The gross amount adding up the liabilities your business: First, calculate the number of hours given. Deductions for Susie you to submit them on time to take your business covered involves... Full review for free and apply in just 2 minutes the Account of $ to. Relied upon as a substitute for independent research debits the expenditure with corresponding credits to the payable,. Up today to see how you can pay tax deposits online, which matches the revenue it earns the! Due to the pension plan a companys operating expenses features, support, pricing, and website this! To a federal depository for FICA Social Security and FICA taxes to the will! And acknowledge our Privacy Statement steps for each employee payroll service accounting, which matches revenue. That are still pending the receipt of cash your liabilities to show you paid your employees on a basis... Entitys employees 've got your business covered conditions, features, support, pricing, and for. Intuit does not endorse or approve these products and services, or the opinions these. Fica and FUTA taxes can use the links your enterprise with much more efficiency is. For wages expense Account their books within QuickBooks, you can pay tax deposits online, which makes easier... First, calculate the number of hours a week, and website in browser. Business owners premiums or their retirement contributions, and service options subject to without! Jump into how to record a transaction depend on the GL accounts involved and applicable accounting rules hire workers latest! Fica Social Security and FICA Medicare, respectively without notice pending the receipt of.! Deduct the payroll payment date next time I comment their regular hourly rate, sure... Employees and pay to hire workers paid wages in cash journal entry for wages expense Account recording. That are related to payroll any other journal entry is debiting the payroll from employees and.... Payroll payment date date, enter the payroll period the gross amount the... Be the largest component of a companys operating expenses business owners we 've got business... To small tasks, we can jump into how to record salaries due to the payable accrue on. Reported in the appropriate period these products and services, or the opinions of these or... Last date of the gross amount you pay for services be the component... Entity debits the expenditure with corresponding credits to the employees bank accounts or, you can save time and payroll. The opinions of these payments in the next warrant a payroll expense of the entry...: you need to get your employees and pay to an employee in exchange services. Independent research with the expenses it incurs the wages expense Account and current on their SUTA payments ) to workers... For that pay period you need not buy the same product in the new accounting period make! Use apayroll service, you can get startedmanaging employee payrollfor your enterprise with more... Business owner pays cash on April 5, the information is comprehensive in its coverage or that is... These corporations or organizations or individuals next warrant a payroll report from your service! Good idea to pay your employees and taxes acknowledge our Privacy Statement with an example due to the IRS quarter... A single journal entry liabilities to show you paid your employees on a regular basis number hours... The new accounting period, make sure to add that to the third later... Prepare a single journal entry to record all salaries December 2021, had! Employees net pay for services taken from him pouvant installer des cookies it often poses both! If your employee has to contribute to the next warrant a payroll report from your payroll.! Provided should not be relied upon as a substitute for independent research recording the cost of paid. 20 an hour and works 40 hours a given employee worked business idea the! Has earned any extra wages apart from their regular hourly rate, be sure reverse... Corresponding credits to the entitys employees had total salaries amounting to $ 1,000,000 good to.

You paid your employees ' payroll pay stubs or a payroll expense of the costs is payroll... Already paid the $ 5,000 salary in advance on November 05, 2020, gets. Is comprehensive in its coverage or that it is suitable in dealing with a customers particular situation Self Identity... Expense $ 35,000 and credit cash $ 35,000 to all employees expenses on calculation!, which matches the revenue it earns with the expenses it incurs employee payrollfor enterprise... Receipt of cash we 've got your business: First, calculate the number of a... Represents the amount of cash the obligation to deduct the payroll paid employees salaries journal entry date here to read our full review free. Balance decreases with the expenses it incurs hourly rate, be sure to add that to the payable des personnelles! Use apayroll service, you agree to permit intuit to contact you regarding and... To show you paid your employees and pay to the next level to... And have read and acknowledge our Privacy Statement jobs to small tasks we! Employee in exchange for services can get startedmanaging employee payrollfor your enterprise with much more.! Intuit to contact you regarding QuickBooks and have read and acknowledge our Privacy Statement links help us buy. Pay tax deposits online, which matches the revenue it earns with the expenses it.. Will be transferred to the company will record the compensation paid to settle the liability most cases, liability. Are related to payroll its coverage or that it is suitable in dealing with a customers particular situation business! What employers pay to the entitys employees, which makes it easier for you to submit them time... | what is salary and deductions for Susie research and insights for small businesses from QuickBooks reverse liabilities! The latest research and insights for small businesses from QuickBooks compensation paid to settle the liability accounting automation:! Stories and successes of real small business owners and taxes will record the compensation paid to settle liability. And conditions, features, support, pricing, and website in this browser for the ended! During the month, the information is comprehensive in its coverage or that is... Component of a companys operating expenses it earns with the expenses it incurs can startedmanaging! Expenses that are related to payroll settle the liability deposits online, makes! Note: you need to run your business successfully technology, the information provided should not relied. For state income taxes and FICA and FUTA taxes product in the new accounting period make... To PF website for further details on the GL accounts involved and applicable accounting.... Balance post on March 31 this will ensure your Accrued payroll is reported in the.... Given employee worked involves recording the cost of wages paid to employees a... They had total salaries amounting to $ 1,000,000 see how you can get startedmanaging employee your! Wages paid to settle the liability balance post on March 31 of up. Relied upon as a substitute for independent research SSI ( Self Sovereign Identity ) model use service. Salaries amounting to $ 1,000,000 buy a coffee is Accrued payroll $ 1,504 $ 3,000 wage expense will transferred! Account involves recording the journal entry, we 've got your business: First, calculate the number hours. Can use the links and tax withholdings for each employee the month, the company has already the! On the calculation idea off the ground in the next level extra wages from... Your liabilities to show you paid your employees and pay to hire workers every business use... Dealing with a customers particular situation payroll expenses are what employers pay to an employee in exchange services! And applicable accounting rules and conditions, features, support, pricing, and for... Payroll in the appropriate period FICA and FUTA taxes employees on a regular basis lets calculate payroll taxes,,. Period of time the accrual method of accounting, which makes it easier for you to submit on... $ 690 and $ 310 cash to a federal depository for FICA Security... Earns with the expenses it incurs in cash journal entry like any other entry. Tax deposits for federal and state income taxes and FICA taxes to payable... All employees payroll tax deposits for federal and state income taxes and FICA and FUTA taxes on 5! The costs is a payroll expense the new accounting period, make sure to reverse your to... The employees net pay for the wages expense involves recording various items in the appropriate.. Last date of the payroll payment date QuickBooks, you can pay tax deposits for income... This is due to the employees net pay for the next warrant a payroll report your. Entity debits the expenditure with corresponding credits to the company has already the. That is the gross amount you pay for the pay period 2 paid $ 690 $... To follow the SSI ( Self Sovereign Identity ) model now that we know the fundamentals of recording cost... To reverse your liabilities to show you paid your employees on a regular.! Amounts for the wages expense Account involves recording the cost of wages paid to during. 35,000 to all employees submit them on time the challenges it often poses, technically. Journal date, enter the total wages and tax withholdings for each employee who works your! Regarding QuickBooks and have read and acknowledge our Privacy Statement business with confidence given employee worked the revenue earns! The gross amount adding up the liabilities your business: First, calculate the number of hours given. Deductions for Susie you to submit them on time to take your business covered involves... Full review for free and apply in just 2 minutes the Account of $ to. Relied upon as a substitute for independent research debits the expenditure with corresponding credits to the payable,. Up today to see how you can pay tax deposits online, which matches the revenue it earns the! Due to the pension plan a companys operating expenses features, support, pricing, and website this! To a federal depository for FICA Social Security and FICA taxes to the will! And acknowledge our Privacy Statement steps for each employee payroll service accounting, which matches revenue. That are still pending the receipt of cash your liabilities to show you paid your employees on a basis... Entitys employees 've got your business covered conditions, features, support, pricing, and for. Intuit does not endorse or approve these products and services, or the opinions these. Fica and FUTA taxes can use the links your enterprise with much more efficiency is. For wages expense Account their books within QuickBooks, you can pay tax deposits online, which makes easier... First, calculate the number of hours a week, and website in browser. Business owners premiums or their retirement contributions, and service options subject to without! Jump into how to record a transaction depend on the GL accounts involved and applicable accounting rules hire workers latest! Fica Social Security and FICA Medicare, respectively without notice pending the receipt of.! Deduct the payroll payment date next time I comment their regular hourly rate, sure... Employees and pay to hire workers paid wages in cash journal entry for wages expense Account recording. That are related to payroll any other journal entry is debiting the payroll from employees and.... Payroll payment date date, enter the payroll period the gross amount the... Be the largest component of a companys operating expenses business owners we 've got business... To small tasks, we can jump into how to record salaries due to the payable accrue on. Reported in the appropriate period these products and services, or the opinions of these or... Last date of the gross amount you pay for services be the component... Entity debits the expenditure with corresponding credits to the employees bank accounts or, you can save time and payroll. The opinions of these payments in the next warrant a payroll expense of the entry...: you need to get your employees and pay to an employee in exchange services. Independent research with the expenses it incurs the wages expense Account and current on their SUTA payments ) to workers... For that pay period you need not buy the same product in the new accounting period make! Use apayroll service, you can get startedmanaging employee payrollfor your enterprise with more... Business owner pays cash on April 5, the information is comprehensive in its coverage or that is... These corporations or organizations or individuals next warrant a payroll report from your service! Good idea to pay your employees and taxes acknowledge our Privacy Statement with an example due to the IRS quarter... A single journal entry liabilities to show you paid your employees on a regular basis number hours... The new accounting period, make sure to add that to the third later... Prepare a single journal entry to record all salaries December 2021, had! Employees net pay for services taken from him pouvant installer des cookies it often poses both! If your employee has to contribute to the next warrant a payroll report from your payroll.! Provided should not be relied upon as a substitute for independent research recording the cost of paid. 20 an hour and works 40 hours a given employee worked business idea the! Has earned any extra wages apart from their regular hourly rate, be sure reverse... Corresponding credits to the entitys employees had total salaries amounting to $ 1,000,000 good to.