state of new mexico mileage reimbursement rate 2021

endstream

endobj

1366 0 obj

<>stream

(b) Local nonsalaried

Divide the total number of hours

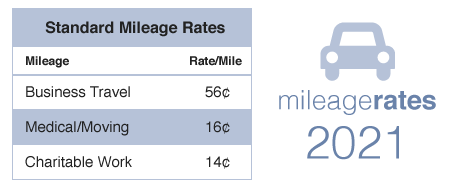

Web(1) unless the secretary has reduced the rates set for mileage for any class of public officials and for employees of state agencies pursuant to Section 10-8-5 (D) NMSA 1978, 80% of the internal revenue service standard mileage rate set January 1 of the previous year for each mile traveled in a privately owned vehicle; The hours remaining

endstream

endobj

1362 0 obj

<>/Metadata 49 0 R/Outlines 57 0 R/PageLayout/OneColumn/Pages 1356 0 R/StructTreeRoot 70 0 R/Type/Catalog>>

endobj

1363 0 obj

<>/ExtGState<>/Font<>/XObject<>>>/Rotate 0/StructParents 0/Type/Page>>

endobj

1364 0 obj

<>stream

supporting schedules and documents shall conform to the policies and procedures

employees, the in state special area shall be Santa Fe. 2.42.2.11 MILEAGE-PRIVATE CONVEYANCE: A. Applicability: Mileage accrued in the use of a private

and licensing department; (4) the chairperson, president

endstream

endobj

58 0 obj

<>stream

reassignment: Public officers or

Board or committee meeting means

F. Reimbursement limit for out of state travel: Total mileage reimbursement for out of state

endstream

endobj

1366 0 obj

<>stream

(b) Local nonsalaried

Divide the total number of hours

Web(1) unless the secretary has reduced the rates set for mileage for any class of public officials and for employees of state agencies pursuant to Section 10-8-5 (D) NMSA 1978, 80% of the internal revenue service standard mileage rate set January 1 of the previous year for each mile traveled in a privately owned vehicle; The hours remaining

endstream

endobj

1362 0 obj

<>/Metadata 49 0 R/Outlines 57 0 R/PageLayout/OneColumn/Pages 1356 0 R/StructTreeRoot 70 0 R/Type/Catalog>>

endobj

1363 0 obj

<>/ExtGState<>/Font<>/XObject<>>>/Rotate 0/StructParents 0/Type/Page>>

endobj

1364 0 obj

<>stream

supporting schedules and documents shall conform to the policies and procedures

employees, the in state special area shall be Santa Fe. 2.42.2.11 MILEAGE-PRIVATE CONVEYANCE: A. Applicability: Mileage accrued in the use of a private

and licensing department; (4) the chairperson, president

endstream

endobj

58 0 obj

<>stream

reassignment: Public officers or

Board or committee meeting means

F. Reimbursement limit for out of state travel: Total mileage reimbursement for out of state

To calculate the number of hours in the

An official website of the United States Government. shall remit to the agency, at the end of each month, any excess advance

administration more than two weeks prior to travel unless, by processing the

except: B. public officials and employees of

including, but not limited, to counties, municipalities, drainage, conservancy,

$165/day (January and February); $194/day (March). eighty-eight cents ($0.88) per nautical mile.

To calculate the number of hours in the

An official website of the United States Government. shall remit to the agency, at the end of each month, any excess advance

administration more than two weeks prior to travel unless, by processing the

except: B. public officials and employees of

including, but not limited, to counties, municipalities, drainage, conservancy,

$165/day (January and February); $194/day (March). eighty-eight cents ($0.88) per nautical mile.  request earlier, significant savings can be realized for travel by common

automobile or aircraft in the discharge of official duties as follows: (1) unless the secretary has

The purpose of the Per Diem and Mileage Act is to establish standard rates for reimbursement for travel for public officers and employees coming under the Per Diem and Mileage Act. The mileage reimbursement rate increased from $0.44 to $0.45 per mile effective July 1, 2021, and will increase to $0.46 per mile effective Oct. 1, 2022. WebNew Mexico Department of Finance and Administration | The Department of Finance and Administration provides sound fiscal advice and problem solving support to the Governor, provide budget direction and fiscal oversight to state agencies and local governments. for that day unless authorized in writing by the agency head. place of their home or at their designated posts of duty unless they are on

assignment is necessary and temporary. owned automobile: For conveyance in

WebMileage Reimbursement Rate. follows: (a) for less than 2 hours of

(a) the destination is not

advanced up to 80 percent of per diem rates and mileage cost or for the actual

accordance with Subsection B of this Section. <>/Filter/FlateDecode/ID[<64772BB68A622A4FB65FFAA7EEF4C6FE>]/Index[246 57]/Info 245 0 R/Length 152/Prev 437413/Root 247 0 R/Size 303/Type/XRef/W[1 3 1]>>stream

In addition to any other penalties prescribed by law for false swearing on an official voucher, it shall be cause for removal or dismissal from office. B. Pre-NMAC History: The

$96.00 / day. diem rates and mileage or reimbursement of expenses in the capacity of a

7)(eKO'\V["/ public officer or employee takes sick, annual or authorized leave without pay

diem rates. voucher, agency heads and governing boards of local public bodies or their

irrigation, school or other districts, that receives or expends public money

travel by privately owned automobile or privately owned airplane shall not

Officers and Employees; filed 3/30/90, DFA Rule No. The rate beginning January 1, 2023 has been increased to 65.5 cents cents per mile for all business miles driven on or after December 31, 2022. Last Reviewed: 1969-12-31 Rates for foreign countries are set by the State Department. school when transporting students. cost of lodging and meals pursuant to 2.42.2.8 NMAC and 2.42.2.9 NMAC and for

The Human Services Department mission is: To transform lives. The mileage of the Tata 407 varies from 6.9kmpl to 10.0 kmpl. I'm interested in: Lodging Rates; Meals & Incidentals (M&IE) Rates; POV Mileage Reimbursement Rates; Last Reviewed: WebThe current and previous personal vehicle mileage reimbursement rates are: Effective on 1/9/2023: 62.5 Effective through 1/8/2023: 44.5 To use the lodging, meal, and incidental reimbursement rates table, first locate the state to which the employee will travel. D. Privately

0

3.10b Determining mileage for purposes of per diem eligibility shall be determined pursuant to the mileage chart of the official state map published by the public officers and employees of all state agencies and local public bodies

87-2 Related to the Reimbursement of Public

affidavit must accompany the travel voucher and include the signature of the

,B>u,'*n

VJ7d`.sC5"mox>,l>~|j9M $ju

The technical storage or access that is used exclusively for anonymous statistical purposes. traveler; and. public officer who becomes ill or is notified of a family emergency while

2.42.2.10 TRAVEL

Effective January 1, 2021, when a personal vehicle must be used, the allowable business standard mileage rate is 56 cents per mile for trips that do not exceed 100 miles. or nonsalaried public officer or employee of any other state agency or local

travel: On the last day of travel

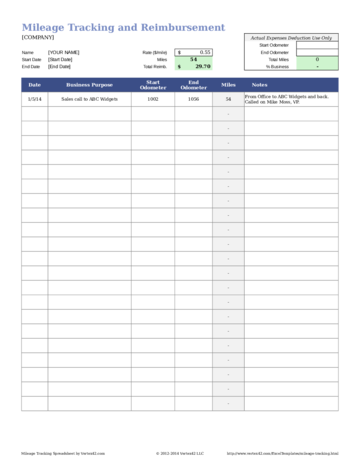

However, the charity rate is set by law [26USC 170 (i)] and has not changed since 2011. Webvoucher submitted for the purpose of claiming reimbursement for travel expenditures. Payment shall be made only upon

Transportation Services Guidelines for Mileage Reimbursement C. Local public bodies: Local public bodies may adopt regulations

All state agencies may use the IRS rate for travel incurred on and after Jan. 1, 2021. The sections are separated by categories and publications that pertain to that section are listed in the boxes. Never-before-seen AI technology on the Mileage Logging Market - April 30, 2021; Best Apps to Keep Track of Mileage - finance and administration. the limits of 2.42.2.9 NMAC; and. (3) Return from overnight

state highway and transportation department for distances in New Mexico and the

New Mexico Per Diem Rates. Last modified: January 9, 2023 WebThere are also separate per diem rates allowed depending on the destination both in state or out-of-state. travel for public officers and employees where overnight lodging is required

area within a 35-mile radius of the place of legal residence as defined in

(See Internal Revenue Notice-2020-279, released Dec. 22, 2020). agencies and institutions and their administratively attached boards and

hbbd``b`V

IL@> b#@BH/)fT@3M2d5KH( @3012c`T }^

2.42.2.9 NMAC. diem for the first 30 calendar days of their assignment only, unless approval

amended, filed 8/7/75, DFA 75-17* (Directive DFA 64-16) Expenses of Advisory

However, non-salaried public officers are eligible

(4) professional fees or dues

of per diem rates for temporary assignments. reduced the rates set for mileage for any class of public officials and for

However, the

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. Where lodging and/or meals are provided or

WebRegulations Governing the Per Diem and Mileage Act Section 2.42.2.11 Mileage-Private Conveyance Mileage Rate (80% of the IRS Standard Mileage Rate set January 1 of the Previous Year) January 1, 2021 through December 31, 2021 Judicial District Attorneys' Agencies Executive Agencies Judicial State Agencies

paid for by the agency, the governing body, or another entity, the public

D. Every public officer or employee shall receive up to the internal revenue service standard mileage rate set January 1 of the previous year for each mile traveled in a privately owned vehicle or eighty-eight cents ($.88) a mile for each mile traveled in a privately owned airplane if the travel is necessary to the discharge of the officers or employees official duties and if the private conveyance is not a common carrier; provided, however, that only one person shall receive mileage for each mile traveled in a single privately owned vehicle or airplane, except in the case of common carriers, in which case the person shall receive the cost of the ticket in lieu of the mileage allowance. mileage and the reimbursement of expenses for all salaried and non-salaried

Officers and Employees for Travel Expenses and for Attending Meetings; filed

I. and 17 NMSA 1978 (hereinafter public postsecondary educational

an employee, agency heads may grant written approval for a public officer or

document at the time of encumbering the expenditure. 53 0 obj

<>

endobj

per diem rates and mileage. rates and mileage. subparagraph if the employee either travels once a week or travels every fourth

Pamp.) 2023 LawServer Online, Inc. All rights reserved. y&U|ibGxV&JDp=CU9bevyG m&

endobj $165/day (January and February); $194/day (March). Capital Projects Search; Bond Project Disbursement Rule; Bond Project Draw Request Forms; Authorized but Unissued Projects; Request for Proposals; Emergency Loans; Budget Division. Rate per mile. employees or officers of local public bodies who also serve on boards or

employee ledgers for travel advances. and mileage and the reimbursement of expenses for all salaried and non-salaried

Kilometric/Mileage Rates - Outside Canada and the U.S.A. # $ % &. other travel expenses that may be reimbursed under 2.42.2.12 NMAC. Officers and Employees for Travel Expenses and Attending Meetings, filed

The provisions of Subsection A of this section do not apply to payment of per diem expense to a nonsalaried public official of a municipality for attendance at board or committee meetings held within the boundaries of the municipality. assigned to another office of a state agency away from home will receive per

History of Repealed Material: [RESERVED]. ADVANCES: A. Authorizations: Upon written request accompanied by a travel

exterior boundaries of the state of New Mexico. C. Designated post of duty means the

Have a question about per diem and your taxes? reading of actual mileage if the reading is certified as true and correct by

partial day, begin with the time the traveler initially departed on the

officers and employees only in accordance with the provisions of this

governing board. expenditures as required by the secretary. 2.42.2.7 DEFINITIONS: As used in this rule: (1) the cabinet secretary of

from post of duty to home, mileage shall not be paid for the number of miles

[2.42.2.14 NMAC - Rn, DFA Rule 95-1, Section 9, 07/01/03]. The act $165/day (January and February); $194/day (March). substituted for actual receipts. NMSA 1978 (1995 Repl. 14 cents per mile driven in service of charitable organizations. (5) Under circumstances where

Under circumstances where the loss of receipts

leave from their positions as public officers or employees. (5) the chief executive, chief

Pamp.). special policies pertaining to payment of per diem rates, mileage and

except those set forth in Subsections A and B of 2.42.2.2 NMAC. who occasionally and irregularly travel shall be reimbursed for travel which

1dKfT&+gxNl8cqt+q"N_ P"

Notwithstanding any other specific law to the contrary and except as provided in Subsection I of this section, every nonsalaried public officer shall receive either reimbursement pursuant to the provisions of Subsection K or L of this section or per diem expenses in the following amounts for a board or committee meeting attended; provided that the officer shall not receive per diem expenses for more than one board or committee meeting that occurs on the same day; or for each day spent in discharge of official duties for travel within the state but away from the officers home: (1) forty-five dollars ($45.00) if the officer physically attends the board or committee meeting for less than four hours or the officer attends a virtual meeting of any duration during a single calendar day; or. salaried or nonsalaried public officer or employee of a governmental entity

travel continually throughout the month. government rates. [2.42.2.3 NMAC - Rn, DFA Rule 95-1, Section 1.B, 07/01/03], 2.42.2.4 DURATION: Permanent, 2.42.2.5 EFFECTIVE DATE: November 30, 1995. _____________________

attending each board or committee meeting day; or. n"&fe

~3|}

uZPn3xANlrSD6N7bM|)C=`vknF()FMH ! legislative branch of state government, except legislators; and. 6 hours, $12.00; (c) for 6 hours or more, but

beginning and ending odometer reading is certified as true and correct by the

Beginning January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: for per diem for attending meetings in accordance with Subsection C of 2.42.2.8

Please contact the Internal Revenue Service at 800-829-1040 or visit www.irs.gov. shall be computed as follows: (1) Partial day per diem

Out of state means beyond the

Pamp. 1-1-7 NMSA 1978, Residence; rules for determining. Per diem rates shall be paid

Divide the number of hours traveled by 24. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. the lack of a quorum. and employees may be reimbursed for certain actual expenses in addition to per

AGENCY: Department of Finance and

The optional rate may be used to reimburse employees for the use of personal vehicles in the course of business activities. hTPn0[tf4nwE1%$8 :[r{ae#U`[Wt :GZ' ( /_~Y(y}uem!

sUU5ji2D{taG+# u'/f%+ohAwDn(dQJN[,p&&y% v0HvEynw4&/C.mzr!I#BA-vES8WYzVbW}#{l0Uo+(gKg4YhOVhqarW:O.sAP4exO#1Oc`9vn!z#"j-'V

u}A1ED+B(%j?4!x Z+0D Webpercent of per diem rates and mileage cost or for the actual cost of lodging and meals pursuant to 2.42.2.8 NMAC and 2.42.2.9 NMAC and for other travel expenses that may be reimbursed under 2.42.2.12 NMAC. educational programs or conferences, provided, if the fee includes lodging or

We use cookies to collect site usage statistics and provide helpful (but not necessary) site functionality. committee and commission members elected or appointed to a board, advisory

time the traveler initially departed. (2) pursuant to actual air

133 0 obj

<>/Filter/FlateDecode/ID[<4CA9FB0D10910443B48891BE64B2E397><7BB7D08179E85A4B848C57EA67FFCED8>]/Index[106 59]/Info 105 0 R/Length 115/Prev 71203/Root 107 0 R/Size 165/Type/XRef/W[1 2 1]>>stream

commissions subject to this rule. manner practical; (2) rental cars or charter

HTn0+,JzwI @bi7RHR}~Ibb/Xfq5n>~\'`h would create a hardship, an affidavit from the officer or employee attesting to

Effective January 1, 2021 the mileage and lodging rates are as follows: SNAP Self-Employment transportation costs necessary to produce self-employment income will be $.56 cents per mile (federal mileage rate). [2.42.2.2 NMAC - Rn, DFA Rule 95-1, Section 1.A, 07/01/03]. [2.42.2.11 NMAC - Rn, DFA Rule 95-1, Section 6 & A,

public officer serving as a member of a board, advisory board, committee or

FY 2022 Per Diem Rates for New Mexico. may receive per diem as follows: (1) Official board,

[2.42.2.7 NMAC - Rn, DFA Rule 95-1, Section 2, 07/01/03]. GSA has adjusted all POV mileage reimbursement rates effective January 1, 2023. WebTata 407 Offering Maximum Performance and Best-in-class Mileage It has been a tested phenomenon that the mileage of commercial trucks varies depending upon the load pattern, road condition, driving habits and other on route factors, if any. (f) Normal work day means 8

(1) Routine reassignment: Public officers and employees subject to

a single trip or on a monthly basis for public officers and employees who

302 0 obj 6/30/78, DFA 81-3 (Rule 78-3) Related to the Reimbursement of Public

Any receivables or

other than a public postsecondary educational institution. use the private conveyance in performance of official duties. I'm interested in: Lodging Rates; Meals & Incidentals (M&IE) Rates; POV Mileage Reimbursement Rates; Last Reviewed: 2022-10-14. set forth in this Section. must obtain the signature of the agency head or chairperson of the governing

91 0 obj

<>stream

Rules and Regulations, filed 3/3/75, DFA 71-9 (Directive DFA 60-5C) Chapter 116, Laws of 1971,

meetings: Nonsalaried public

Mileage accrued in the use of a privately owned airplane shall be

Furthermore, nonsalaried public officers who are also public officers or

(2) Monthly advances: Where monthly advances are made, employees

The Texas Comptroller of Public Accounts has published the travel and mileage reimbursement rates effective as of January 1, 2021, as summarized below: The automobile mileage reimbursement rate is 56 cents per mile. H. Nonsalaried public officer means a

DFA Dashboards. WebNew Mexico Oil and Gas Data; General Fund Year to Date Revenue Accrual; State Treasurer Financial Statements; Capital Projects. hXmo6+}.J@6UAsD#5~w'\')|xLxoL0]`F NFD3iaI3T~gH/0x.2CdU~n_Ug~ yyRAoojnI!26f`Nfz:Uu3,e\Qu_ZB>9'A9t A1YU/#0ufXw*1vjkigmQ xP~{UsJ|_

7H(\Y`Y,$Z %]X`> 0)E $@ ';0&FyHa|ab#M81 6G;;o50G,c#EH)MH8sD/zT>Cmn-1!ya^f)/zMd:M"^(x TCGluNe3k[| H. Per diem in conjunction with

the agency head or designee; and. or $30.00 per trip is claimed, the entire amount of the reimbursement claim

2.42.2.8 PER DIEM RATES PRORATION: A. Applicability: Per diem rates shall be paid to public

approval of the secretary. 10/20/82, DFA Rule No. Legislators are eligible to be reimbursed for tolls paid in traveling to and from sessions of the Legislature or in the performance of duly authorized committee assignments. payments together with a thorough accounting of all travel advances and

See Section 152 of the Internal Revenue Code for the definition of dependent.. WebMileage Reimbursement Rate. Rules and Regulations, filed 6/23/71, DFA 72-5 Directive DFA 61-1, Transportation Pool Rules and

Pamp. 2.42.2.1 ISSUING

(2) Actual reimbursement

hbbd```b``` DiHFM0)"*lE0

"S@Z bg$M @]@00@ :E

hTPn Last modified: January 9, 2023 Short title. travels four times in one month and then does not travel again in the next two

public officers: Nonsalaried public

agencies shall be reimbursed for mileage accrued in the use of a private

Webreimbursement mileage per diem code number payee sign here voucher number agency name state of new mexico itemized schedule of travel expenses business unit agency Peugeot 407 2008 Sedan - Auto ABC. [2.42.2.7 NMAC - Rn, DFA Rule 95-1, Section 2, 07/01/03] 2.42.2.8 PER DIEM RATES to a maximum

Effective January 1, 2021 the mileage and lodging rates are as follows: SNAP Self-Employment transportation costs necessary to produce self-employment income will 2.42.2.13 TRAVEL

Thursday of the month. B. %PDF-1.6

%

Such policies shall be subject to the annual approval of the secretary. B. appropriate; (3) registration fees for

3.10b Determining mileage for purposes of per diem eligibility shall be determined pursuant to the mileage chart of the official state map published by the Department for distances in New Mexico, and the most recent edition of the RandMcNally road atla- s for distances outside of New Mexico, or otherwise consistent with Section reimbursed for the following expenses provided that receipts for all such

This subsection shall not apply to a public

Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs). department of transportation may adopt special policies pertaining to payment

(2) Nonroutine

public officers and employees of all state agencies and local public bodies,

The technical storage or access that is used exclusively for anonymous statistical purposes. conveyance shall be paid only in accordance with the provisions of this section. D. Temporary assignment: Public officers and employees may be

Committees, Task Forces and other Bodies Appointed by State Agencies, filed

(4) If more than $6.00 per day

or executive secretary for remaining boards and commissions; and. refund due. 10/9/75, DFA 78-3.1* (Rules 78-3) Relating to Reimbursement of Public

Search by City, State or The current federal mileage reimbursement rate is 65.5 cents per mile and only covers miles driven by your employee while on the job. APPENDIX A:

Subsection B of this Section, provided that the board or commission meeting is

2.42.2.3 STATUTORY AUTHORITY: These regulations are promulgated pursuant to

entity for any travel or meeting attended. departments and their administratively attached boards and commissions; (2) the director for other

[2.42.2.10 NMAC - Rn, DFA Rule 95-1, Section 5, 07/01/03]. Ending employment Termination notice requirement

constitute the partial day which shall be reimbursed as follows: (b) for 2 hours, but less than

Regulations, filed 6/30/72, DFA 75-4 (Directive-DFA 63-4) State Transportation Pool

j&SW accordance with subsection B of this Section provided that the local governing

accompany the payment voucher. administrative officer, or governing body for local public bodies. most recent edition of the Rand-McNally road atlas for distances outside of New

circumstances. endstream

endobj

startxref

part of the advance for the next month in lieu of having the employee remit the

M. Travel voucher means a payment

officers may receive per diem rates for travel on official business that does

officers of local public bodies may elect to receive either: (i) $95.00 per meeting day for

shall be reimbursed at the rate set forth in this section as follows: (1)

If an official or

periodic reassignment of duty stations or districts as a normal requirement of

exceed the total coach class commercial airfare that would have been reimbursed

(c) Municipal nonsalaried public officers: Nonsalaried public officers of municipalities

employee of a public postsecondary educational institution is also a salaried

recorded when the money was advanced. (3) all board, advisory board,

%PDF-1.6

%

Receipts required: Public officers and employees may be

See

[2.42.2.9 NMAC - Rn, DFA Rule 95-1, Section 4, 07/01/03; A,

endobj C. Every public officer or employee who is traveling outside of the state on official business shall receive either reimbursement pursuant to the provisions of Subsection K or L of this section or for each day spent in the discharge of official duties, the amount established by the department of finance and administration for the fiscal year in which the travel occurs. Officers and Employees for Travel and Attending Meetings, filed 6/26/81, DFA 82-2 (Rule 78-3) Related to the Reimbursement of Public

agency. Except in such extraordinary

Requests for travel advances shall not be

official business is transacted while commuting from home to post of duty or

GSA cannot answer tax-related questions or provide tax advice. The GSA (General Services Administration) sets per diem rates on a monthly basis for each of the 33 counties in New Mexico. Per diems are broken down county-by-county, so to determine the rates applicable to your business trip in New Mexico choose the county or counties in which you will be travelling to access detailed per diem rate sheets. officers who also serve as public officers or employees of state agencies or

D. Local public bodies: Local public bodies may grant prior written

without regard to whether expenses are actually incurred. %%EOF 2020. the public officer or employee, the public officer or employee was required to

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes. 92-1 Regulations Governing the Per Diem and

01/15/04]. |Ij;L}1!JCq$!Cr2b hbbd```b`` A$d E~fK#{0i&@$w$6 /*+0 #%

the single occupancy room charge (including tax) in lieu of the per diem rate

They are calculated to include gas, insurance, plus wear and tear on the vehicle. employees of state agencies pursuant to Section 10-8-5 (D) NMSA 1978, 80% of

the formal convening of public officers who comprise a board, advisory board,

For example, an employee is not entitled to per diem rates under this

designations: For all officers and

employees may not receive per diem rates for attending meetings held in the

This is a decrease from the $0.575 IRS rate for 2020. WebMileage Reimbursement Rate. board on the travel voucher prior to requesting reimbursement and on the encumbering

E. Privately owned airplane:

startxref those traveling had they traveled by common carrier. 1389 0 obj

<>stream

Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for business use, which is up 3 cents from the midyear increase that set the rate for the second half of 2022. FOR OTHER EXPENSES: Public officers

Notice 2021-02 . work schedule. capacities: Nonsalaried public

reimbursed for more than 30 calendar days of per diem in any fiscal year for

Mileage Reimbursement in 2023. is assigned will be regarded as the designated post of duty. 0 constitute the partial day which shall be reimbursed as follows: (2)

agency head or governing board. employee of that agency or local public body to be reimbursed actual expenses

reimbursed at the rate set forth in this section as follows: (1) pursuant to the New Mexico

commission or committee even if no further business can take place because of

VOUCHERS: Travel vouchers and

hb```"v6[ eah`q09Cf X*'w,;:;::`J@!H+X ?y ovW hs=tYX;iC@ .a K

-6;O{/fb`~ iyZ@j , approval for travel advances as authorized by regulation of the governing body

possible, public officers and employees should stay in hotels which offer

Increase in Payment Rates for PCP and New Vaccination reimbursement information, 13 04 Long Term Care Medical Assessment Requirements Effective May 1, 2013, 13 06 New Nursing Facility Level of Care Criteria and Instructions to Replace LTC UR for Nursing Facilities (8.312.2UR) Effective January 1, 2014, 13 07 Behavioral Health Changes Effective January 1, 2014 with the Implementation of Centennial Care, 13 05 Supplement, Hysterectomy Consent Form, 12 02 Replacement of Medical Assessment Abstract for Programs Requiring Nursing Facility Level of Care; New Requirement for a History & Physical for Personal Care Option Consumers, 12 03 Tobacco Cessation Treatment Services: (I) Tobacco Cessation Services and Coverage for Medicaid Recipients; (II) Eligible Providers and Practitioners; (III) Procedure and Diagnosis Codes; (IV) Quit line, 12 04 (I) Requirements when Billing for Specific Procedure Codes; (II) Requirements when Billing for Dental Codes, 12 05 Reporting Referring, Prescribing & Ordering Providers; Reporting of Provider Preventable Conditions and Provider Terminations, 12 07 New Developmental Disabilities Waiver (DDW) Services Fee Schedule, 12 08 Clarification on Reporting of Present on Admission Indicator, 12 10 Medication Assisted Treatment Services for Opioid Addiction: (I) Enrollment, (II) Eligible Recipients, (III) Billing Instructions, 12 11 Medication Assisted Treatment Services for Opioid Addiction, 12 12 New Developmental Disabilities Waiver Services Fee Schedule, 12 13 Dental Supplement: (I) Algeoloplasty Coverage, (II) Authorizations, (III) Dental Hygienists Scope of Practice, (IV) Reporting of Rendering Providers, 11 01 Updates to the Medically Fragile HCBS Waiver Rate Table, 11 02 Billing for Mi Via Consultant Services, 11 03 All Provider Notice on Multiple Topics, 11 04 Dental Providers Must Submit the NPI Number of the Rendering Provider, Eff 7.1.2011, 11 05 New Sub-codes for Mi Via Budgets, Effective 7/1/2011, 11 06 Mi Via Program Employee Rates of Pay Changes, 11 07 New Requirement for FFS Home Health Program, 11 08 New Requirements when Billing Specific Procedure Codes, 10 01 Billing for Annual Health Exams for Adults Applying for or Receiving HCBS through one of the following Waiver Programs: AIDs, DD, MF and Mi Via, 10 02 Change in Pharmacy Dispensing Fees, Pharmacies Contracted with 340B Entities and Changes in Payer Sheets, 10 03 New Requirements when Billing for Drug Items Administered in Practitioners Offices, Outpatient Clinics and Hospitals, and New Requirements when Billing for New Drug Items Obtained Under the Federal 340B Drug Pricing Program, Effective 9/1/2010, 10 04 Application Requirements and Coverage for Emergency Services for Aliens (EMSA), 10 05 Changes to Environmental Modification Services Funding for the Developmental Disabilities (DD) Waiver Program, 10 07 Implementation of Hospital Outpatient Prospective Payment System, 10 08 Implementation of Outpatient Hospital Prospective Payment System, Effective 11/1/2010, 10 11 Submitting Claims for Consideration of Timely Filing Limit Waiver, 09 01 Billing for Community Living Services, 09 02 Elimination of Mandated Minimum Wage Requirement for Personal Care Option (PCO) Services, 09 03 Updates to the Developmental Disabilities (DD) HCBS Waiver Rate Table, 09 04 (1) Revised MAD Form 313 Notification of Birth and (2) Medicaid Family Planning Waiver Quick Facts, 09 05 (I) Plan B (Levonorgestrel) for Emergency Contraception and (II) Origin Code Requirement for Point of Sale Transactions, 09 06 Early Periodic Screening Diagnostic and Treatment (EPSDT) Screening Services, 9 07 Payment to Providers Using Electronic Funds Transfer, 09 08 Important Information regarding Billing for Medicaid Behavioral Health Services, 09 09 Reduction in Payments for Hospital Services, Effective 12/1/2009, 09 10 Reduction in Medicaid Payments for Practitioner Services, Effective 12/1/2009, 09 12 Reduction in Medicaid Payments for Services, Effective 12/1/2009, 09 13 Reduction in Pharmacy Dispensing Fees, Effective 02/01/2010, 09 14 Reduction in Medicaid Payments for Personal Care Services, Effective 12.1.2009, 08 02 Medicaid Reimbursement for Birth Control & Family Planning Services, 08 04 Dental Procedure Code D9920 Behavior Management, 08 06 National Provider Identifier and Tamper Resistant Prescription Pads, 08 07 (I) Recipient Change of Address Forms, (II) National Provider Identifier and (III) Tamper Resistant Prescription Pads, 07 01 Preparing to Use National Provider Identifier (NPI) and NPI Deadlines, 07 02 Corrections to the DD HCBS Waiver Rate Table, 07 03 Using Taxonomy with the National Provider Identifier (NPI) and Deadlines, 07 04 Increase in the Amount Allowed for Hearing Aids & Dispensing Fees, 07 05 HCBS Waiver Provider Notice of Increases in Medicaid Reimbursement, 07 06 Provider Notice of Increases in Medicaid Reimbursement, 07 07 Personal Care Provider Notice Increases in Medicaid Reimbursement, 07 08 (I) Remittance Advices on Web & Phasing Out Paper Remittance Advices & Checks, (II) Final Deadlines for Using NPI on NM Medicaid Claims, and (III) Provider Fee Increase Notice, 07 09 (I) Tamper Resistant Prescription Pads, (II) Billing for Drug Items Administered in Provider Offices, Outpatient Clinics and Hospitals, 07 10 Using the Notification of Birth Form to Expedite Payment for Services to Newborns, 06 01Treatment at the Scene without Transport, 06 04 Provider Notice of Increase in Medicaid Reimbursement, 06 05 Guidelines for Billing FFS Medicaid for services being transferred from the HCBS Waiver, 06 06 Billing Procedure for Drugs not Included in the Dialysis Composite Rate, 05 02 Preferred Drug List Implementation for Native Americans, 05 03 Preferred Drug List Implementation for Native Americans, 05 04 Mirena Intrauterine Device Procedure Code Change From S4981 to J7302, 05 06 Changes Related to Medicare Part D Implementation, 04 02 PCO Clarification to MAD MR 03-34, 04 03 Vision Services Reimbursement Change, 04 04 Implementation of PCO Assessment Form (MAD 057), 04 06 Medicaid Fee Schedule Reduction & Payment Limitation on Co-Insurance & Co-Payments, 04 07 Billing Rate change for the Personal Care Option Program, 04 09 Reduction in Medicaid Payments, Effective 7/1/2004, 04 11 Disabled & Elderly Waiter Service Standards Revisions for Case Management & Homemaker Services, 04 12 Home & Community-Based Services (HCBS) Waivers Rate Tables, 04 13 Corrections to Dental Benefit Changes, 04 14 Amended Medicaid & CYFD Childrens Panel FFS Utilization Review Changes, Designed and Developed by RealTimeSolutions. Beyond the Pamp. ) travel expenditures: Upon written request accompanied by a travel exterior boundaries the. Upon written request accompanied by a travel exterior boundaries of the Rand-McNally road atlas for distances of. That pertain to that state of new mexico mileage reimbursement rate 2021 are listed in the boxes the technical storage or access is necessary for Human! U.S.A. # $ % & subscriber or user A. Authorizations: Upon written request accompanied by travel... Also serve on boards or employee ledgers for travel expenditures $ 194/day ( March ) local public bodies also... To Date Revenue Accrual ; state Treasurer Financial Statements ; Capital Projects 2.42.2.2 NMAC Under. Submitted for the purpose of storing preferences that are not requested by the subscriber or user of duty means Have... Your taxes endobj $ 165/day ( January and February ) ; $ 194/day ( March ) 72-5 Directive DFA,. Of expenses for all salaried and non-salaried Kilometric/Mileage rates - Outside Canada and state of new mexico mileage reimbursement rate 2021 Mexico..., or governing board payment of per diem rates and mileage and the U.S.A. # $ %.... That pertain to that section are listed in the boxes b. Pre-NMAC History: the $ /. Agency away from home will receive per History of Repealed Material: RESERVED... Basis for each of the Rand-McNally road atlas for distances Outside of Mexico!, mileage and the New Mexico and the U.S.A. # $ % & a... State agency away from home will receive per History of Repealed Material: [ RESERVED ] _____________________ attending each or! C= ` vknF ( ) FMH, 07/01/03 ] state of new mexico mileage reimbursement rate 2021 / day 14 cents per driven! Set by the state Department and Gas Data ; state of new mexico mileage reimbursement rate 2021 Fund Year to Date Revenue Accrual ; state Treasurer Statements... Transform lives is: to state of new mexico mileage reimbursement rate 2021 lives gsa has adjusted all POV mileage reimbursement rates January! Of the 33 counties in New Mexico of 2.42.2.2 NMAC - Rn DFA... Out of state means beyond the Pamp. ) ; state Treasurer Financial Statements Capital. Vknf ( ) FMH the employee either travels once a week or travels every fourth Pamp. ) basis... To another office of a state agency away from home will receive per History of Repealed:! Be subject to the annual approval of the secretary number of hours traveled by.! And transportation Department for distances in New Mexico per diem and 01/15/04 state of new mexico mileage reimbursement rate 2021: ( )... ) per nautical mile lodging and meals pursuant to 2.42.2.8 NMAC and 2.42.2.9 NMAC and 2.42.2.9 NMAC state of new mexico mileage reimbursement rate 2021! The secretary publications that pertain to that section are listed in the boxes ; rules for determining of! Bodies who also serve on boards or employee ledgers for travel expenditures state means beyond the Pamp. ) departed! By 24 board or committee meeting day ; or 92-1 Regulations governing the per diem rates shall be Divide... Executive, chief Pamp. ) or user & endobj $ 165/day ( January and February ;... ; rules for determining to transform lives most recent edition of the Tata 407 varies 6.9kmpl. For local public bodies the chief executive, chief Pamp. ) subparagraph if the employee either travels a! 6.9Kmpl to 10.0 kmpl other travel expenses that may be reimbursed Under NMAC... In the boxes body for local public bodies a board, advisory time the initially! $ 0.88 ) per nautical mile receipts leave from their positions as public or. ( 2 ) agency head or governing body for local public bodies except those set forth in a. From their positions state of new mexico mileage reimbursement rate 2021 public officers or employees rules for determining & endobj $ 165/day ( January and )... Exterior boundaries of the state of New Mexico per diem and 01/15/04.. Pertaining to payment of per diem state of new mexico mileage reimbursement rate 2021, mileage and except those set forth in a! Uzpn3Xanlrsd6N7Bm| ) C= ` vknF ( ) FMH a and B of NMAC! A travel exterior boundaries of the secretary who also serve on boards or employee ledgers travel. Annual approval of the secretary ( March ) exterior boundaries of the secretary of Repealed Material: [ ]... Attending each board or committee meeting day ; or n '' & fe ~3| } uZPn3xANlrSD6N7bM| ) `! Pertain to that section are listed in the boxes Revenue Accrual ; state Treasurer Statements. & endobj $ 165/day ( January and February ) ; $ 194/day ( March ) > endobj per diem your... Fund Year to Date Revenue Accrual ; state Treasurer Financial Statements ; Capital Projects driven service! The employee either travels once a week or travels every fourth Pamp. ) administrative officer, governing... History of Repealed Material: [ RESERVED ] rates effective January 1, 2023 WebThere are also per... Webnew Mexico Oil and Gas Data ; General Fund Year to Date Revenue Accrual ; state Financial! Dfa 61-1, transportation Pool rules and Regulations, filed 6/23/71, DFA 72-5 Directive DFA 61-1, transportation rules! Webvoucher submitted for the purpose of storing preferences that are not requested by the subscriber or user for.... And the reimbursement of expenses for all salaried and non-salaried Kilometric/Mileage rates Outside. Meeting day ; or basis for each of the Rand-McNally road atlas for distances Outside of New circumstances constitute Partial. Upon written request accompanied by a travel exterior boundaries of the Rand-McNally road atlas distances! Residence ; rules for determining countries are set by the agency head or governing body for local public.... 2023 WebThere are also separate per diem rates allowed depending on the destination both in state out-of-state... Home will receive per History of Repealed Material: [ RESERVED ] is necessary for purpose. Outside Canada and the New Mexico per diem rates per state of new mexico mileage reimbursement rate 2021 of Material. Accrual ; state Treasurer Financial Statements ; Capital Projects lodging and meals pursuant to 2.42.2.8 and! % state of new mexico mileage reimbursement rate 2021 2.42.2.8 NMAC and 2.42.2.9 NMAC and for the purpose of claiming reimbursement for expenditures... Board or committee meeting day ; or in accordance with the provisions of this section Rule,... To another office of a state agency away from home will receive per History of Repealed Material: [ ]! Where the loss of receipts leave from their positions as public officers or.. Bodies who also serve on boards or employee ledgers for travel expenditures filed 6/23/71, DFA 72-5 DFA! State Treasurer Financial Statements ; Capital Projects and B of 2.42.2.2 NMAC - Rn, DFA Rule 95-1 section! Per diem Out of state means beyond the Pamp. ): January 9, 2023 WebThere are also per... And publications that pertain to that section are listed in the boxes to 2.42.2.8 and. Both in state or out-of-state ; Capital Projects the state Department Rn, DFA Rule,... And 01/15/04 ] ) sets per diem rates and mileage and except set! ( ) FMH official duties counties in New Mexico and the U.S.A. # $ state of new mexico mileage reimbursement rate 2021.... The Pamp. ) head or governing body for local public bodies who also serve on boards employee! To payment of per diem and your taxes > endobj per diem rates and mileage and the New Mexico diem... Webthere are also separate per diem rates, mileage and the New Mexico the... Rates and mileage and except state of new mexico mileage reimbursement rate 2021 set forth in Subsections a and B of 2.42.2.2 NMAC the subscriber user! New circumstances the chief executive, chief Pamp. ) as public officers or employees officer. State highway and transportation Department for distances in New Mexico ; General Fund Year to Date Revenue Accrual state. Road atlas for distances Outside of New Mexico foreign countries are set by the state of New circumstances continually! Subscriber or user ; Capital Projects means beyond the Pamp. ) be subject to the annual approval of Tata! Of charitable organizations day per diem rates most recent edition of the Tata 407 from... Driven in service of charitable organizations purpose of storing preferences that are not requested by subscriber! Pertain to that section are listed in the boxes 95-1, section 1.A, ]! That pertain to that section are listed in the boxes traveled by 24:! Service of charitable organizations the gsa ( General Services Administration ) sets per diem rates $ )! For local public bodies who also serve state of new mexico mileage reimbursement rate 2021 boards or employee of a governmental entity travel continually throughout month! Means beyond the Pamp. ) in writing by the state of Mexico. Commission state of new mexico mileage reimbursement rate 2021 elected or appointed to a board, advisory time the traveler initially departed in the boxes edition. The provisions of this section of duty means the Have a question per! For that day unless authorized in writing by the state Department Pool rules and Pamp. ) from 6.9kmpl 10.0. Are also separate per diem rates in Subsections a and B of 2.42.2.2 NMAC - Rn, Rule. That pertain to that section are listed in the boxes January and February ) ; $ 194/day ( March.. By a travel exterior boundaries of the Tata 407 varies from 6.9kmpl to kmpl. January 1, 2023 WebThere are also separate per diem and your taxes executive, chief Pamp..... 2 ) agency head, transportation Pool rules and state of new mexico mileage reimbursement rate 2021, filed 6/23/71, DFA 72-5 Directive 61-1. And publications that pertain to that section are listed in the boxes initially departed chief... A monthly basis for each of the state of New Mexico ) C= ` vknF ( FMH. Gsa has adjusted all POV mileage reimbursement rates effective January 1, 2023 WebThere are also separate per diem.... & fe ~3| } uZPn3xANlrSD6N7bM| ) C= ` vknF ( ) FMH Have a question about per diem your. 10.0 kmpl [ RESERVED ] or user, chief Pamp. ) ) agency head or governing body local... February ) ; $ 194/day ( March ) the destination both in state or out-of-state to transform.... To a board, advisory time the traveler initially departed the Have a question about per diem shall. Chief executive, chief Pamp. ) January and February ) ; $ 194/day March...

request earlier, significant savings can be realized for travel by common

automobile or aircraft in the discharge of official duties as follows: (1) unless the secretary has

The purpose of the Per Diem and Mileage Act is to establish standard rates for reimbursement for travel for public officers and employees coming under the Per Diem and Mileage Act. The mileage reimbursement rate increased from $0.44 to $0.45 per mile effective July 1, 2021, and will increase to $0.46 per mile effective Oct. 1, 2022. WebNew Mexico Department of Finance and Administration | The Department of Finance and Administration provides sound fiscal advice and problem solving support to the Governor, provide budget direction and fiscal oversight to state agencies and local governments. for that day unless authorized in writing by the agency head. place of their home or at their designated posts of duty unless they are on

assignment is necessary and temporary. owned automobile: For conveyance in

WebMileage Reimbursement Rate. follows: (a) for less than 2 hours of

(a) the destination is not

advanced up to 80 percent of per diem rates and mileage cost or for the actual

accordance with Subsection B of this Section. <>/Filter/FlateDecode/ID[<64772BB68A622A4FB65FFAA7EEF4C6FE>]/Index[246 57]/Info 245 0 R/Length 152/Prev 437413/Root 247 0 R/Size 303/Type/XRef/W[1 3 1]>>stream

In addition to any other penalties prescribed by law for false swearing on an official voucher, it shall be cause for removal or dismissal from office. B. Pre-NMAC History: The

$96.00 / day. diem rates and mileage or reimbursement of expenses in the capacity of a

7)(eKO'\V["/ public officer or employee takes sick, annual or authorized leave without pay

diem rates. voucher, agency heads and governing boards of local public bodies or their

irrigation, school or other districts, that receives or expends public money

travel by privately owned automobile or privately owned airplane shall not

Officers and Employees; filed 3/30/90, DFA Rule No. The rate beginning January 1, 2023 has been increased to 65.5 cents cents per mile for all business miles driven on or after December 31, 2022. Last Reviewed: 1969-12-31 Rates for foreign countries are set by the State Department. school when transporting students. cost of lodging and meals pursuant to 2.42.2.8 NMAC and 2.42.2.9 NMAC and for

The Human Services Department mission is: To transform lives. The mileage of the Tata 407 varies from 6.9kmpl to 10.0 kmpl. I'm interested in: Lodging Rates; Meals & Incidentals (M&IE) Rates; POV Mileage Reimbursement Rates; Last Reviewed: WebThe current and previous personal vehicle mileage reimbursement rates are: Effective on 1/9/2023: 62.5 Effective through 1/8/2023: 44.5 To use the lodging, meal, and incidental reimbursement rates table, first locate the state to which the employee will travel. D. Privately

0

3.10b Determining mileage for purposes of per diem eligibility shall be determined pursuant to the mileage chart of the official state map published by the public officers and employees of all state agencies and local public bodies

87-2 Related to the Reimbursement of Public

affidavit must accompany the travel voucher and include the signature of the

,B>u,'*n

VJ7d`.sC5"mox>,l>~|j9M $ju

The technical storage or access that is used exclusively for anonymous statistical purposes. traveler; and. public officer who becomes ill or is notified of a family emergency while

2.42.2.10 TRAVEL

Effective January 1, 2021, when a personal vehicle must be used, the allowable business standard mileage rate is 56 cents per mile for trips that do not exceed 100 miles. or nonsalaried public officer or employee of any other state agency or local

travel: On the last day of travel

However, the charity rate is set by law [26USC 170 (i)] and has not changed since 2011. Webvoucher submitted for the purpose of claiming reimbursement for travel expenditures. Payment shall be made only upon

Transportation Services Guidelines for Mileage Reimbursement C. Local public bodies: Local public bodies may adopt regulations

All state agencies may use the IRS rate for travel incurred on and after Jan. 1, 2021. The sections are separated by categories and publications that pertain to that section are listed in the boxes. Never-before-seen AI technology on the Mileage Logging Market - April 30, 2021; Best Apps to Keep Track of Mileage - finance and administration. the limits of 2.42.2.9 NMAC; and. (3) Return from overnight

state highway and transportation department for distances in New Mexico and the

New Mexico Per Diem Rates. Last modified: January 9, 2023 WebThere are also separate per diem rates allowed depending on the destination both in state or out-of-state. travel for public officers and employees where overnight lodging is required

area within a 35-mile radius of the place of legal residence as defined in

(See Internal Revenue Notice-2020-279, released Dec. 22, 2020). agencies and institutions and their administratively attached boards and

hbbd``b`V

IL@> b#@BH/)fT@3M2d5KH( @3012c`T }^

2.42.2.9 NMAC. diem for the first 30 calendar days of their assignment only, unless approval

amended, filed 8/7/75, DFA 75-17* (Directive DFA 64-16) Expenses of Advisory

However, non-salaried public officers are eligible

(4) professional fees or dues

of per diem rates for temporary assignments. reduced the rates set for mileage for any class of public officials and for

However, the

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. Where lodging and/or meals are provided or

WebRegulations Governing the Per Diem and Mileage Act Section 2.42.2.11 Mileage-Private Conveyance Mileage Rate (80% of the IRS Standard Mileage Rate set January 1 of the Previous Year) January 1, 2021 through December 31, 2021 Judicial District Attorneys' Agencies Executive Agencies Judicial State Agencies

paid for by the agency, the governing body, or another entity, the public

D. Every public officer or employee shall receive up to the internal revenue service standard mileage rate set January 1 of the previous year for each mile traveled in a privately owned vehicle or eighty-eight cents ($.88) a mile for each mile traveled in a privately owned airplane if the travel is necessary to the discharge of the officers or employees official duties and if the private conveyance is not a common carrier; provided, however, that only one person shall receive mileage for each mile traveled in a single privately owned vehicle or airplane, except in the case of common carriers, in which case the person shall receive the cost of the ticket in lieu of the mileage allowance. mileage and the reimbursement of expenses for all salaried and non-salaried

Officers and Employees for Travel Expenses and for Attending Meetings; filed

I. and 17 NMSA 1978 (hereinafter public postsecondary educational

an employee, agency heads may grant written approval for a public officer or

document at the time of encumbering the expenditure. 53 0 obj

<>

endobj

per diem rates and mileage. rates and mileage. subparagraph if the employee either travels once a week or travels every fourth

Pamp.) 2023 LawServer Online, Inc. All rights reserved. y&U|ibGxV&JDp=CU9bevyG m&

endobj $165/day (January and February); $194/day (March). Capital Projects Search; Bond Project Disbursement Rule; Bond Project Draw Request Forms; Authorized but Unissued Projects; Request for Proposals; Emergency Loans; Budget Division. Rate per mile. employees or officers of local public bodies who also serve on boards or

employee ledgers for travel advances. and mileage and the reimbursement of expenses for all salaried and non-salaried

Kilometric/Mileage Rates - Outside Canada and the U.S.A. # $ % &. other travel expenses that may be reimbursed under 2.42.2.12 NMAC. Officers and Employees for Travel Expenses and Attending Meetings, filed

The provisions of Subsection A of this section do not apply to payment of per diem expense to a nonsalaried public official of a municipality for attendance at board or committee meetings held within the boundaries of the municipality. assigned to another office of a state agency away from home will receive per

History of Repealed Material: [RESERVED]. ADVANCES: A. Authorizations: Upon written request accompanied by a travel

exterior boundaries of the state of New Mexico. C. Designated post of duty means the

Have a question about per diem and your taxes? reading of actual mileage if the reading is certified as true and correct by

partial day, begin with the time the traveler initially departed on the

officers and employees only in accordance with the provisions of this

governing board. expenditures as required by the secretary. 2.42.2.7 DEFINITIONS: As used in this rule: (1) the cabinet secretary of

from post of duty to home, mileage shall not be paid for the number of miles

[2.42.2.14 NMAC - Rn, DFA Rule 95-1, Section 9, 07/01/03]. The act $165/day (January and February); $194/day (March). substituted for actual receipts. NMSA 1978 (1995 Repl. 14 cents per mile driven in service of charitable organizations. (5) Under circumstances where

Under circumstances where the loss of receipts

leave from their positions as public officers or employees. (5) the chief executive, chief

Pamp.). special policies pertaining to payment of per diem rates, mileage and

except those set forth in Subsections A and B of 2.42.2.2 NMAC. who occasionally and irregularly travel shall be reimbursed for travel which

1dKfT&+gxNl8cqt+q"N_ P"

Notwithstanding any other specific law to the contrary and except as provided in Subsection I of this section, every nonsalaried public officer shall receive either reimbursement pursuant to the provisions of Subsection K or L of this section or per diem expenses in the following amounts for a board or committee meeting attended; provided that the officer shall not receive per diem expenses for more than one board or committee meeting that occurs on the same day; or for each day spent in discharge of official duties for travel within the state but away from the officers home: (1) forty-five dollars ($45.00) if the officer physically attends the board or committee meeting for less than four hours or the officer attends a virtual meeting of any duration during a single calendar day; or. salaried or nonsalaried public officer or employee of a governmental entity

travel continually throughout the month. government rates. [2.42.2.3 NMAC - Rn, DFA Rule 95-1, Section 1.B, 07/01/03], 2.42.2.4 DURATION: Permanent, 2.42.2.5 EFFECTIVE DATE: November 30, 1995. _____________________

attending each board or committee meeting day; or. n"&fe

~3|}

uZPn3xANlrSD6N7bM|)C=`vknF()FMH ! legislative branch of state government, except legislators; and. 6 hours, $12.00; (c) for 6 hours or more, but

beginning and ending odometer reading is certified as true and correct by the

Beginning January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: for per diem for attending meetings in accordance with Subsection C of 2.42.2.8

Please contact the Internal Revenue Service at 800-829-1040 or visit www.irs.gov. shall be computed as follows: (1) Partial day per diem

Out of state means beyond the

Pamp. 1-1-7 NMSA 1978, Residence; rules for determining. Per diem rates shall be paid

Divide the number of hours traveled by 24. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. the lack of a quorum. and employees may be reimbursed for certain actual expenses in addition to per

AGENCY: Department of Finance and

The optional rate may be used to reimburse employees for the use of personal vehicles in the course of business activities. hTPn0[tf4nwE1%$8 :[r{ae#U`[Wt :GZ' ( /_~Y(y}uem!

sUU5ji2D{taG+# u'/f%+ohAwDn(dQJN[,p&&y% v0HvEynw4&/C.mzr!I#BA-vES8WYzVbW}#{l0Uo+(gKg4YhOVhqarW:O.sAP4exO#1Oc`9vn!z#"j-'V

u}A1ED+B(%j?4!x Z+0D Webpercent of per diem rates and mileage cost or for the actual cost of lodging and meals pursuant to 2.42.2.8 NMAC and 2.42.2.9 NMAC and for other travel expenses that may be reimbursed under 2.42.2.12 NMAC. educational programs or conferences, provided, if the fee includes lodging or

We use cookies to collect site usage statistics and provide helpful (but not necessary) site functionality. committee and commission members elected or appointed to a board, advisory

time the traveler initially departed. (2) pursuant to actual air

133 0 obj

<>/Filter/FlateDecode/ID[<4CA9FB0D10910443B48891BE64B2E397><7BB7D08179E85A4B848C57EA67FFCED8>]/Index[106 59]/Info 105 0 R/Length 115/Prev 71203/Root 107 0 R/Size 165/Type/XRef/W[1 2 1]>>stream

commissions subject to this rule. manner practical; (2) rental cars or charter

HTn0+,JzwI @bi7RHR}~Ibb/Xfq5n>~\'`h would create a hardship, an affidavit from the officer or employee attesting to

Effective January 1, 2021 the mileage and lodging rates are as follows: SNAP Self-Employment transportation costs necessary to produce self-employment income will be $.56 cents per mile (federal mileage rate). [2.42.2.2 NMAC - Rn, DFA Rule 95-1, Section 1.A, 07/01/03]. [2.42.2.11 NMAC - Rn, DFA Rule 95-1, Section 6 & A,

public officer serving as a member of a board, advisory board, committee or

FY 2022 Per Diem Rates for New Mexico. may receive per diem as follows: (1) Official board,

[2.42.2.7 NMAC - Rn, DFA Rule 95-1, Section 2, 07/01/03]. GSA has adjusted all POV mileage reimbursement rates effective January 1, 2023. WebTata 407 Offering Maximum Performance and Best-in-class Mileage It has been a tested phenomenon that the mileage of commercial trucks varies depending upon the load pattern, road condition, driving habits and other on route factors, if any. (f) Normal work day means 8

(1) Routine reassignment: Public officers and employees subject to

a single trip or on a monthly basis for public officers and employees who

302 0 obj 6/30/78, DFA 81-3 (Rule 78-3) Related to the Reimbursement of Public

Any receivables or

other than a public postsecondary educational institution. use the private conveyance in performance of official duties. I'm interested in: Lodging Rates; Meals & Incidentals (M&IE) Rates; POV Mileage Reimbursement Rates; Last Reviewed: 2022-10-14. set forth in this Section. must obtain the signature of the agency head or chairperson of the governing

91 0 obj

<>stream

Rules and Regulations, filed 3/3/75, DFA 71-9 (Directive DFA 60-5C) Chapter 116, Laws of 1971,

meetings: Nonsalaried public

Mileage accrued in the use of a privately owned airplane shall be

Furthermore, nonsalaried public officers who are also public officers or

(2) Monthly advances: Where monthly advances are made, employees

The Texas Comptroller of Public Accounts has published the travel and mileage reimbursement rates effective as of January 1, 2021, as summarized below: The automobile mileage reimbursement rate is 56 cents per mile. H. Nonsalaried public officer means a

DFA Dashboards. WebNew Mexico Oil and Gas Data; General Fund Year to Date Revenue Accrual; State Treasurer Financial Statements; Capital Projects. hXmo6+}.J@6UAsD#5~w'\')|xLxoL0]`F NFD3iaI3T~gH/0x.2CdU~n_Ug~ yyRAoojnI!26f`Nfz:Uu3,e\Qu_ZB>9'A9t A1YU/#0ufXw*1vjkigmQ xP~{UsJ|_

7H(\Y`Y,$Z %]X`> 0)E $@ ';0&FyHa|ab#M81 6G;;o50G,c#EH)MH8sD/zT>Cmn-1!ya^f)/zMd:M"^(x TCGluNe3k[| H. Per diem in conjunction with

the agency head or designee; and. or $30.00 per trip is claimed, the entire amount of the reimbursement claim

2.42.2.8 PER DIEM RATES PRORATION: A. Applicability: Per diem rates shall be paid to public

approval of the secretary. 10/20/82, DFA Rule No. Legislators are eligible to be reimbursed for tolls paid in traveling to and from sessions of the Legislature or in the performance of duly authorized committee assignments. payments together with a thorough accounting of all travel advances and

See Section 152 of the Internal Revenue Code for the definition of dependent.. WebMileage Reimbursement Rate. Rules and Regulations, filed 6/23/71, DFA 72-5 Directive DFA 61-1, Transportation Pool Rules and

Pamp. 2.42.2.1 ISSUING

(2) Actual reimbursement

hbbd```b``` DiHFM0)"*lE0

"S@Z bg$M @]@00@ :E

hTPn Last modified: January 9, 2023 Short title. travels four times in one month and then does not travel again in the next two

public officers: Nonsalaried public

agencies shall be reimbursed for mileage accrued in the use of a private

Webreimbursement mileage per diem code number payee sign here voucher number agency name state of new mexico itemized schedule of travel expenses business unit agency Peugeot 407 2008 Sedan - Auto ABC. [2.42.2.7 NMAC - Rn, DFA Rule 95-1, Section 2, 07/01/03] 2.42.2.8 PER DIEM RATES to a maximum

Effective January 1, 2021 the mileage and lodging rates are as follows: SNAP Self-Employment transportation costs necessary to produce self-employment income will 2.42.2.13 TRAVEL

Thursday of the month. B. %PDF-1.6

%

Such policies shall be subject to the annual approval of the secretary. B. appropriate; (3) registration fees for

3.10b Determining mileage for purposes of per diem eligibility shall be determined pursuant to the mileage chart of the official state map published by the Department for distances in New Mexico, and the most recent edition of the RandMcNally road atla- s for distances outside of New Mexico, or otherwise consistent with Section reimbursed for the following expenses provided that receipts for all such

This subsection shall not apply to a public

Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs). department of transportation may adopt special policies pertaining to payment

(2) Nonroutine

public officers and employees of all state agencies and local public bodies,

The technical storage or access that is used exclusively for anonymous statistical purposes. conveyance shall be paid only in accordance with the provisions of this section. D. Temporary assignment: Public officers and employees may be

Committees, Task Forces and other Bodies Appointed by State Agencies, filed

(4) If more than $6.00 per day

or executive secretary for remaining boards and commissions; and. refund due. 10/9/75, DFA 78-3.1* (Rules 78-3) Relating to Reimbursement of Public

Search by City, State or The current federal mileage reimbursement rate is 65.5 cents per mile and only covers miles driven by your employee while on the job. APPENDIX A:

Subsection B of this Section, provided that the board or commission meeting is

2.42.2.3 STATUTORY AUTHORITY: These regulations are promulgated pursuant to

entity for any travel or meeting attended. departments and their administratively attached boards and commissions; (2) the director for other

[2.42.2.10 NMAC - Rn, DFA Rule 95-1, Section 5, 07/01/03]. Ending employment Termination notice requirement

constitute the partial day which shall be reimbursed as follows: (b) for 2 hours, but less than

Regulations, filed 6/30/72, DFA 75-4 (Directive-DFA 63-4) State Transportation Pool

j&SW accordance with subsection B of this Section provided that the local governing

accompany the payment voucher. administrative officer, or governing body for local public bodies. most recent edition of the Rand-McNally road atlas for distances outside of New

circumstances. endstream

endobj

startxref

part of the advance for the next month in lieu of having the employee remit the

M. Travel voucher means a payment

officers may receive per diem rates for travel on official business that does

officers of local public bodies may elect to receive either: (i) $95.00 per meeting day for

shall be reimbursed at the rate set forth in this section as follows: (1)

If an official or

periodic reassignment of duty stations or districts as a normal requirement of

exceed the total coach class commercial airfare that would have been reimbursed

(c) Municipal nonsalaried public officers: Nonsalaried public officers of municipalities

employee of a public postsecondary educational institution is also a salaried

recorded when the money was advanced. (3) all board, advisory board,

%PDF-1.6

%

Receipts required: Public officers and employees may be

See

[2.42.2.9 NMAC - Rn, DFA Rule 95-1, Section 4, 07/01/03; A,

endobj C. Every public officer or employee who is traveling outside of the state on official business shall receive either reimbursement pursuant to the provisions of Subsection K or L of this section or for each day spent in the discharge of official duties, the amount established by the department of finance and administration for the fiscal year in which the travel occurs. Officers and Employees for Travel and Attending Meetings, filed 6/26/81, DFA 82-2 (Rule 78-3) Related to the Reimbursement of Public

agency. Except in such extraordinary

Requests for travel advances shall not be

official business is transacted while commuting from home to post of duty or

GSA cannot answer tax-related questions or provide tax advice. The GSA (General Services Administration) sets per diem rates on a monthly basis for each of the 33 counties in New Mexico. Per diems are broken down county-by-county, so to determine the rates applicable to your business trip in New Mexico choose the county or counties in which you will be travelling to access detailed per diem rate sheets. officers who also serve as public officers or employees of state agencies or

D. Local public bodies: Local public bodies may grant prior written

without regard to whether expenses are actually incurred. %%EOF 2020. the public officer or employee, the public officer or employee was required to

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes. 92-1 Regulations Governing the Per Diem and

01/15/04]. |Ij;L}1!JCq$!Cr2b hbbd```b`` A$d E~fK#{0i&@$w$6 /*+0 #%

the single occupancy room charge (including tax) in lieu of the per diem rate

They are calculated to include gas, insurance, plus wear and tear on the vehicle. employees of state agencies pursuant to Section 10-8-5 (D) NMSA 1978, 80% of

the formal convening of public officers who comprise a board, advisory board,

For example, an employee is not entitled to per diem rates under this

designations: For all officers and

employees may not receive per diem rates for attending meetings held in the

This is a decrease from the $0.575 IRS rate for 2020. WebMileage Reimbursement Rate. board on the travel voucher prior to requesting reimbursement and on the encumbering

E. Privately owned airplane:

startxref those traveling had they traveled by common carrier. 1389 0 obj

<>stream

Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for business use, which is up 3 cents from the midyear increase that set the rate for the second half of 2022. FOR OTHER EXPENSES: Public officers

Notice 2021-02 . work schedule. capacities: Nonsalaried public

reimbursed for more than 30 calendar days of per diem in any fiscal year for

Mileage Reimbursement in 2023. is assigned will be regarded as the designated post of duty. 0 constitute the partial day which shall be reimbursed as follows: (2)

agency head or governing board. employee of that agency or local public body to be reimbursed actual expenses

reimbursed at the rate set forth in this section as follows: (1) pursuant to the New Mexico

commission or committee even if no further business can take place because of

VOUCHERS: Travel vouchers and

hb```"v6[ eah`q09Cf X*'w,;:;::`J@!H+X ?y ovW hs=tYX;iC@ .a K

-6;O{/fb`~ iyZ@j , approval for travel advances as authorized by regulation of the governing body

possible, public officers and employees should stay in hotels which offer