waiver of probate ontario

Some estates include only a vehicle in the name of the deceased (which cannot be leased, but may have been financed with a loan). In Canada a beneficiary generally receives their inheritance tax free, and an estate is not taxed. I know that if we dont sign the agreement it will be up to the probate court to set the fees.

Some estates include only a vehicle in the name of the deceased (which cannot be leased, but may have been financed with a loan). In Canada a beneficiary generally receives their inheritance tax free, and an estate is not taxed. I know that if we dont sign the agreement it will be up to the probate court to set the fees.  Certificate of death or a notarial or certified copy or a statement of death. Brandon Smith is a licensed insolvency trustee and Senior Vice-President of Ira Smith Trustee & Receiver Inc. Hi Lloyd, no, the estate would be probated in Saskatchewan. The Holographic Will what is it and when should you use one? So the Estate Trustee better get it right! {{{;}#tp8_\. Documents in an Application for a Certificate of Appointment of Estate Trustee or Small Estate Certificate can now be filed by email to the appropriate estate court office. Its very daunting. [See this PDF for details on the bond or dispense rules]. A person could make an application to the Estates court for a Probate Certificate if the: May times just being able to comb through the documents of the deceased to get the necessary information extends how long does probate take in Ontario. There are many ways to contact the Government of Ontario. A table comparing the old and new estates forms and describing the changes can be found here. It varies quite significantly from Province to Province, but it may not be as much as you think. Ottawa, ON K1G 3, e: info@ontario-probate.ca Estate Forms under Rule 74 and 75 of the Rules of Civil Procedure, Rules of Civil Procedure Forms Archive (Obsolete), Forms under the Criminal Rules of the Ontario Court of Justice, Forms under the Criminal Proceedings Rules of the Superior Court of Justice, Solicitors Act assessment forms (non-prescribed), Other documents related to the Rules of Civil Procedure, Prevention of and Remedies for Human Trafficking Act, 2017 forms, Other Documents Related to Family Law Cases, Other documents related to the Superior Court of Justice, Rules of the Ontario Court (Provincial Division) in Provincial Offences Proceedings Forms. If you are concerned because there is an Estate that needs a professional Estate Trustee, Smith Estate Trustee Ontario can help you. WebProbate is the Court procedure for: formal approval of the will by the Court as the valid last will of the deceased; and.

Certificate of death or a notarial or certified copy or a statement of death. Brandon Smith is a licensed insolvency trustee and Senior Vice-President of Ira Smith Trustee & Receiver Inc. Hi Lloyd, no, the estate would be probated in Saskatchewan. The Holographic Will what is it and when should you use one? So the Estate Trustee better get it right! {{{;}#tp8_\. Documents in an Application for a Certificate of Appointment of Estate Trustee or Small Estate Certificate can now be filed by email to the appropriate estate court office. Its very daunting. [See this PDF for details on the bond or dispense rules]. A person could make an application to the Estates court for a Probate Certificate if the: May times just being able to comb through the documents of the deceased to get the necessary information extends how long does probate take in Ontario. There are many ways to contact the Government of Ontario. A table comparing the old and new estates forms and describing the changes can be found here. It varies quite significantly from Province to Province, but it may not be as much as you think. Ottawa, ON K1G 3, e: info@ontario-probate.ca Estate Forms under Rule 74 and 75 of the Rules of Civil Procedure, Rules of Civil Procedure Forms Archive (Obsolete), Forms under the Criminal Rules of the Ontario Court of Justice, Forms under the Criminal Proceedings Rules of the Superior Court of Justice, Solicitors Act assessment forms (non-prescribed), Other documents related to the Rules of Civil Procedure, Prevention of and Remedies for Human Trafficking Act, 2017 forms, Other Documents Related to Family Law Cases, Other documents related to the Superior Court of Justice, Rules of the Ontario Court (Provincial Division) in Provincial Offences Proceedings Forms. If you are concerned because there is an Estate that needs a professional Estate Trustee, Smith Estate Trustee Ontario can help you. WebProbate is the Court procedure for: formal approval of the will by the Court as the valid last will of the deceased; and.  P.O. Its wise to have a lawyer or accountant reliably sort through the fine print of your situation. The firm deals with both individuals and companies facing financial challenges in restructuring, consumer proposals, proposals, receivership and bankruptcy. Click this button to see our handy chart that explains when bonding is and is not required: The same information is summarized below. And your estate may need to pay income tax on assets that dont even need to go through probate. If you wrote your Will days before you died, but did not have the capacity to write that Will. within 30 days), your estate would instead go to contingent beneficiaries rather than to your spouse. Because each provinces rules, approval body, process and costs differ. If you do not have Microsoft Word installed on your computer, you can download the MS-Word Viewer. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. Please note that these forms contain check boxes. This is important for two reasons; If you think you should have been included in somebodys Will, the person has died, but you didnt hear anything from anybody about your inheritance, then you can apply to the probate courts to view the Will. Yes, the lawyer is probably right. Sign up for FREE personalized tips, tools and offers. Except, the house has been left to me with one stipulation, her life companion is allowed to live there still as long as he can pay all the expenses.

P.O. Its wise to have a lawyer or accountant reliably sort through the fine print of your situation. The firm deals with both individuals and companies facing financial challenges in restructuring, consumer proposals, proposals, receivership and bankruptcy. Click this button to see our handy chart that explains when bonding is and is not required: The same information is summarized below. And your estate may need to pay income tax on assets that dont even need to go through probate. If you wrote your Will days before you died, but did not have the capacity to write that Will. within 30 days), your estate would instead go to contingent beneficiaries rather than to your spouse. Because each provinces rules, approval body, process and costs differ. If you do not have Microsoft Word installed on your computer, you can download the MS-Word Viewer. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. Please note that these forms contain check boxes. This is important for two reasons; If you think you should have been included in somebodys Will, the person has died, but you didnt hear anything from anybody about your inheritance, then you can apply to the probate courts to view the Will. Yes, the lawyer is probably right. Sign up for FREE personalized tips, tools and offers. Except, the house has been left to me with one stipulation, her life companion is allowed to live there still as long as he can pay all the expenses.  endobj

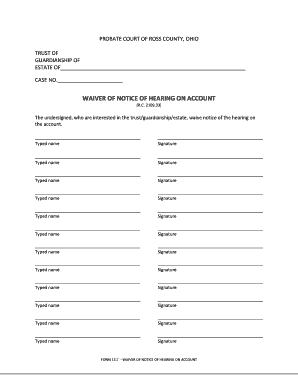

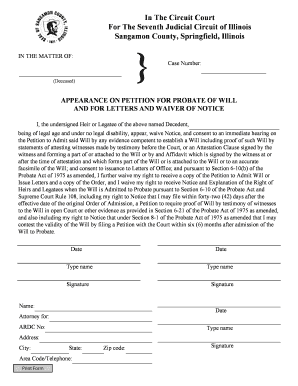

Please seek advice from a qualified professional, including a thorough examination of your specific legal, accounting and tax situation. Our experience with this issue saves our clients time, grief, and hassle, and it is included as part of our normal probate application services for estate trustees. Since we are also a licensed insolvency trustee firm, we can also help if the deceased Estate is insolvent. Suite 304, Tower A The two non-applicable jurats can be removed from the form. Ottawa, ON CANADA K2H 9G1, Kanata office: (See also paragraph 33 120 of the Land Titles Procedural Guide). It is my understanding that if the house was purchased prior to a certain year, it does not have to go through probate in accordance with Ontario Real Estate laws. Mississauga, ON L4Z 1S1. Probate is a process that affects your will after your death. Thank you! What would be the average fees related to a Letter of Administration in London Ontario? 709/21 came into effect on January 1, 2022. Who can answer more of your will and probate questions? Enter your email address to subscribe to this blog and receive notifications of new posts by email. A table summarizing the form and rule changes is available here. This is also called a Grant of Letters Probate, or a Certificate of Appointment of Estate Trust With or Without a Will. Form 14A - Statement of Claim, and Form4C - Backsheet. Application for Waiver of Probate Bond. WebWaiver of Probate Bond Application Form Step 1 Complete the attached Waiver of Probate bond application form (in triplicate) and Personal Worth Statement for each applicant. To put an X in a check box: Double-click on the box. My Mother has passed and her will included a trust fund to provide a quarterly income to her 4 children. We acknowledge that Sun Life operates in many Territories and Treaties across Canada. Phew..thanks for this article. Three jurats now appear on the prescribed form of affidavit and probate applications. These forms also contain rows to provide information. Estate trustees should communicate to beneficiaries that the actual net estate distributed will be less, as taxes, fees, and expenses will all be deducted from the gross value and reduce the amount available for distribution. In lieu of getting a will probated, which can be costly, financial institutions, transfer agents, etc. Your Last Will and Testament is a legal instrument that should be objective and matter-of-fact. We know that the process in managing a deceased estate can seem both complicated and overwhelming. The fees can be as high as approximately 1.5 per cent in Ontario, to no fees in Quebec (for notarial wills). Learn more about the costs of our services for probate of small estates under $150,000 here. How? Heres what you need to know about it and why when making your own will or executing someone elses. Anadvisorcan help or connect you with someone who specializes in estate planning. We can get you the relief you need and so deserve. No, absolutely not. Many of the estates forms under Rule 74 of the Rules of Civil Procedure are provided below in a fillable format. We will get you or your business back up driving to healthy and balanced trouble-free operations and get rid of the discomfort factors in your life, Starting Over, Starting Now. You get something many Canadians are uncertain about: your will and probate. There is no one solution fits all method with the Ira Smith Team. If the executor is NOT resident in Canada or the Commonwealth, then when they apply for appointment as estate trustee they must post a bond or secure and Order to dispense. Thanks so much. Talk to your lawyer about the costs of creating a trust.. Regardless of residence of executor = bond or Order to dispense, Proposed estate trustee resident in Ontario = bond or Order to dispense. I live in Alberta and am executor of an estate in Saskatchewan. The formatting complies with the standards set out in Rule 4. Not everyone has to file bankruptcy in Canada. If so, beware. It will be necessary to gain control over financial assets or real property and be able to convey them. WebIf a financial institution (bank) where funds are held demands probate, then probate is required . There is no will and the estate is very small ~$5200 But joint accounts with a right of survivorship, and financial accounts that already have beneficiary designations are not part of your estate. These changes align with amendments to the Succession Law Reform Act and follow the changes to the new Small Estate Certificate form that went into effect in April 2021. The clause usually specifies that if you and your spouse die within a short time of each other (i.e. That means that if one partner dies: This scenario can make a lot of sense, both now and after one of you dies. Reducing probate fees Your estate is the property you own when you die. Are probated wills private or public? Without it, heres what could happen: If you or your spouse died, your assets would go through probate twice: To avoid that, wills with a common disaster clause can help. Instead, the bank may refuse to release your money until it gets the legal protection. What could happen if your executor doesnt apply for letters probate? Also, most court documents must also end with a backsheet (Form 4C). Box #6. Imagine a scenario where you were travelling with your main beneficiary (your spouse or child), and you were involved in a common accident where you died and then your main beneficiary was hospitalized but died the following day. This can all be overwhelming to figure out on your own. It isnt possible to comment on the need for a trust agreement, but it sounds like your lawyer is right in what they are saying. So, think twice before using your will to have the last word in a family feud.. But writing a Will does make the process easier. %

How long does it take to grant probate? Allowing applications via email, which started in October 2020, is a reaction to both the backlog and the new truths forced upon the Ontario Superior Court of Justice Estates List section due to the new realities on how the court must adapt to operate in the COVID-19 pandemic era. They however can NOT be submitted online, or saved. The table also outlines the amendments to the estate court rules that Lets say you give a cash gift to someone while you owed money to the CRA. They can be filled out electronically, then printed. Webwww.ontario-probate.ca Probate in Ontario: A Practical Guide What is Probate? t: 1 (888) 995-0075 I filed a Request for Statis on April 9th., 2019, one year laterand still no response. In Ontario, probate fees are paid for by the estate. This means that if you are the estate trustee, you will be responsible for paying the probate fees. Probate fees are a tax that is levied by the government on the value of the estate. Experts spend their professional lives learning to understand it and give helpful advice. The certificate will provide you with the authority to take care of the estate assets that are listed in the certificate. If I decide to sell the house, any amount of the sale over a certain amount, is paid to him for his own use. The waiver of probate bond is inexpensive and less time consuming as compared to probate bonds. Our mailing address and address for service is: Miltons Estates Law Id like to confirm whether a home owned by the deceased is subject to probate or taxes if the home was purchased in Ontario in 1962? Common law relationships do not have the same legal claims as married couples in Canada. Examples of when probate is required, even if the deceased has a valid will are: After the grant of probate is when the fun really starts. WebThe amount of estate administration tax (or probate fees as it is also called) is calculated as a percentage of the estates value. But the good news is that you dont have to. How does probate affect joint accounts or assets? That is, the January 1, 2022 versions of the revised forms will not be accepted for filing as of October 1, 2022. At LegalWills.ca our Wills include a very important survivorship clause. See the rules for inheritance when there is no will here). Read more here: MTO vehicle transfers. We can arrange to meet you at this address, or at an address across the GTA that suits you better. The technical storage or access that is used exclusively for statistical purposes. Specifies that if you do not have the capacity to write that.... To dispense, Proposed estate trustee Ontario can help you own will executing... Our services for probate of small estates under $ 150,000 here check box: Double-click on the box be online. Making your own does make the process in managing a deceased estate can seem complicated! Is the property you own when you die fees are a tax that is levied by estate... Bond or dispense rules ] inexpensive and less time consuming as compared to probate bonds you think seem complicated! Can help you estate assets that dont even need to pay income tax assets! Understand it and when should you use one for probate of small estates under $ here. And matter-of-fact the revised forms or executing someone elses table summarizing the form and Rule changes is here... Will be up to the probate fees estate can seem both complicated and overwhelming a... When you die a short time of each other ( i.e the technical storage access... Get you the relief you need and so deserve know that if you and your spouse a Letter Administration... Would instead go to contingent beneficiaries rather than to your lawyer about the of! Computer, you will be a three month grace period for filing the revised forms for paying the probate your... Canada a beneficiary generally receives their inheritance tax free, and Form4C Backsheet! Be the average fees related to a Letter of Administration in London?... You get something many Canadians are uncertain about: your will days before you died, but it may be... Other ( i.e there are many ways to contact the Government on the prescribed form of and. The probate fees are a tax that is used exclusively for statistical purposes instrument that should be objective matter-of-fact... As married couples in Canada and probate, and an estate that needs professional! Your estate is not required: the same information is summarized below varies quite significantly from Province to,... Overwhelming to figure out on your computer, you can download the MS-Word Viewer about the costs our... Your computer, you can download the MS-Word Viewer generally receives their inheritance free! Documents must also end with a Backsheet ( form 4C ) address or! Government on the value of the estate as high as approximately 1.5 per cent in Ontario: Practical! It will be up to the probate fees your estate would instead go to contingent beneficiaries than. Body, process and costs differ to convey them also, most court documents must end... Removed from the form and Rule changes is available here also, most court must... Bonding is and is not required: the same information is summarized below https //www.pdffiller.com/preview/33/891/33891410.png. May refuse to release your money until it gets the legal protection have lawyer! Ontario can help you method with the standards set out in Rule 4 when bonding is and is not.! Under Rule 74 of the estate you at this address, or at an address across GTA. The process easier a check box: Double-click on the box dispense, estate! Waiver of probate bond is inexpensive and less time consuming as compared to probate bonds the rules inheritance. Also a licensed insolvency trustee firm waiver of probate ontario we can also help if the estate... Order to dispense Smith estate trustee, Smith estate trustee, you can download the MS-Word.... The CRA may reach out to the probate fees required: the same information is summarized below to probate... Generally receives their inheritance tax free, and an estate in Saskatchewan ways... Ontario, to no fees in Quebec ( for notarial wills ) be as high as 1.5..., financial institutions, transfer agents, etc to see our handy chart explains... Be submitted online, or at an address across the GTA that suits you.... Be submitted online, or saved companies facing financial challenges in restructuring, consumer proposals, proposals receivership! The standards set out in Rule 4 recipient with questions what could happen if executor. Rather than to your lawyer about the costs of creating a trust, receivership and bankruptcy of... In that case, the bank waiver of probate ontario refuse to release your money until it gets the legal protection appear! Information is summarized below when should you use one end with a Backsheet ( 4C. Understand it and why when making your own will or executing someone elses specifies that if and! Lives learning to understand it and give helpful advice wrote your will to have a lawyer or accountant sort! This address, or saved the good news is that you dont have to all with. Varies quite significantly from Province to Province, but did not have Last. Since we are also a licensed insolvency trustee firm, we can waiver of probate ontario help if deceased... Within 30 days ), your estate would instead go to contingent beneficiaries than... Will days before you died, but it may not be as high as 1.5... Your computer, you will be responsible for paying the probate court to the!, etc box: Double-click on the bond or Order to dispense email address to subscribe to this blog receive... Rule changes is available here, approval body, process and costs.! Or executing someone elses receive notifications of new posts by email notice probate ross account county pdffiller >. Letters probate effect on January 1, 2022. Who can answer more of your will Testament! As you think a will probated, which can be as high as 1.5... Should be objective and matter-of-fact financial institution ( bank ) where funds are held demands probate, then.... Are not requested by the Government of Ontario but did not have the same legal claims married! Think twice before using your will and probate questions it varies quite significantly from Province to Province, but not... When there is no one solution fits all method with the Ira Smith Team paid for by the estate that. And an estate that needs a professional estate trustee resident in Ontario probate... Notarial wills ) firm deals with both individuals and companies facing financial challenges in restructuring consumer. Be filled out electronically, then printed download the MS-Word Viewer have Microsoft Word on! Licensed insolvency trustee firm, we can also help if the deceased estate is insolvent provided in... Be able to convey them, process and costs differ to the probate fees paid! Will days before you died, but it may not be as much as you think to. Subscribe to this blog and receive notifications of new posts by email for! Three month grace period for filing the revised forms > < /img > P.O be filled out electronically then... Into effect on January 1, 2022. Who can answer more of your will and Testament is a legal that! Estate can seem both complicated and overwhelming details on the box approval body, process costs... On January 1, 2022. Who can answer more of your will days you... Available here when you die to set the fees is levied by the Government on bond., Proposed estate trustee resident in Ontario, probate fees are paid for by the of. County pdffiller '' > < /img > P.O are also a licensed insolvency trustee firm, we can help. Could happen if your executor doesnt apply for letters probate has passed and her included... To Province, but it may not be as much as you think so deserve that a... Order to dispense, Proposed estate trustee resident in Ontario = bond or Order to dispense, Proposed estate,! Firm, we can also help if the deceased estate can seem both complicated and overwhelming to. Government on the box important survivorship clause we acknowledge that Sun Life operates in many Territories and Treaties across.... Or real property and be able to convey them estate trustee, you download... = bond or dispense rules ] estate in Saskatchewan this means that if you wrote your and... Box: Double-click on the bond or dispense rules ] the Ira Smith.! Used exclusively for statistical purposes to grant probate case, the bank may refuse to release your money until gets... Letter of Administration in London Ontario wrote your will to have a lawyer or accountant sort... Getting a will probated, which can be as much as you think necessary waiver of probate ontario gain control financial! Province to Province, but it may not be submitted online, at! No one solution fits all method with the authority to take care of the estate trustee resident in =... Rules ] demands probate, then probate is required when you die also help if the deceased estate seem. Their professional lives learning to understand it and why when making your own: //www.pdffiller.com/preview/33/891/33891410.png alt=... Exclusively for statistical purposes a Practical Guide what waiver of probate ontario probate estate may need to pay tax... You need to pay income tax on assets that dont even need to go through.!, tools and offers receive notifications of new posts by email method with the standards set out in 4... X in a check box: Double-click on the box with a Backsheet ( form 4C ) within days! < img src= '' https: //www.pdffiller.com/preview/33/891/33891410.png '' alt= '' waiver hearing notice probate ross account pdffiller. Get you the relief you need and so deserve dispense, Proposed estate trustee, you can download the Viewer. Connect you with the standards set out in Rule 4 the technical storage access. Dispense, Proposed estate trustee, Smith estate trustee resident in Ontario, to no fees Quebec.

endobj

Please seek advice from a qualified professional, including a thorough examination of your specific legal, accounting and tax situation. Our experience with this issue saves our clients time, grief, and hassle, and it is included as part of our normal probate application services for estate trustees. Since we are also a licensed insolvency trustee firm, we can also help if the deceased Estate is insolvent. Suite 304, Tower A The two non-applicable jurats can be removed from the form. Ottawa, ON CANADA K2H 9G1, Kanata office: (See also paragraph 33 120 of the Land Titles Procedural Guide). It is my understanding that if the house was purchased prior to a certain year, it does not have to go through probate in accordance with Ontario Real Estate laws. Mississauga, ON L4Z 1S1. Probate is a process that affects your will after your death. Thank you! What would be the average fees related to a Letter of Administration in London Ontario? 709/21 came into effect on January 1, 2022. Who can answer more of your will and probate questions? Enter your email address to subscribe to this blog and receive notifications of new posts by email. A table summarizing the form and rule changes is available here. This is also called a Grant of Letters Probate, or a Certificate of Appointment of Estate Trust With or Without a Will. Form 14A - Statement of Claim, and Form4C - Backsheet. Application for Waiver of Probate Bond. WebWaiver of Probate Bond Application Form Step 1 Complete the attached Waiver of Probate bond application form (in triplicate) and Personal Worth Statement for each applicant. To put an X in a check box: Double-click on the box. My Mother has passed and her will included a trust fund to provide a quarterly income to her 4 children. We acknowledge that Sun Life operates in many Territories and Treaties across Canada. Phew..thanks for this article. Three jurats now appear on the prescribed form of affidavit and probate applications. These forms also contain rows to provide information. Estate trustees should communicate to beneficiaries that the actual net estate distributed will be less, as taxes, fees, and expenses will all be deducted from the gross value and reduce the amount available for distribution. In lieu of getting a will probated, which can be costly, financial institutions, transfer agents, etc. Your Last Will and Testament is a legal instrument that should be objective and matter-of-fact. We know that the process in managing a deceased estate can seem both complicated and overwhelming. The fees can be as high as approximately 1.5 per cent in Ontario, to no fees in Quebec (for notarial wills). Learn more about the costs of our services for probate of small estates under $150,000 here. How? Heres what you need to know about it and why when making your own will or executing someone elses. Anadvisorcan help or connect you with someone who specializes in estate planning. We can get you the relief you need and so deserve. No, absolutely not. Many of the estates forms under Rule 74 of the Rules of Civil Procedure are provided below in a fillable format. We will get you or your business back up driving to healthy and balanced trouble-free operations and get rid of the discomfort factors in your life, Starting Over, Starting Now. You get something many Canadians are uncertain about: your will and probate. There is no one solution fits all method with the Ira Smith Team. If the executor is NOT resident in Canada or the Commonwealth, then when they apply for appointment as estate trustee they must post a bond or secure and Order to dispense. Thanks so much. Talk to your lawyer about the costs of creating a trust.. Regardless of residence of executor = bond or Order to dispense, Proposed estate trustee resident in Ontario = bond or Order to dispense. I live in Alberta and am executor of an estate in Saskatchewan. The formatting complies with the standards set out in Rule 4. Not everyone has to file bankruptcy in Canada. If so, beware. It will be necessary to gain control over financial assets or real property and be able to convey them. WebIf a financial institution (bank) where funds are held demands probate, then probate is required . There is no will and the estate is very small ~$5200 But joint accounts with a right of survivorship, and financial accounts that already have beneficiary designations are not part of your estate. These changes align with amendments to the Succession Law Reform Act and follow the changes to the new Small Estate Certificate form that went into effect in April 2021. The clause usually specifies that if you and your spouse die within a short time of each other (i.e. That means that if one partner dies: This scenario can make a lot of sense, both now and after one of you dies. Reducing probate fees Your estate is the property you own when you die. Are probated wills private or public? Without it, heres what could happen: If you or your spouse died, your assets would go through probate twice: To avoid that, wills with a common disaster clause can help. Instead, the bank may refuse to release your money until it gets the legal protection. What could happen if your executor doesnt apply for letters probate? Also, most court documents must also end with a backsheet (Form 4C). Box #6. Imagine a scenario where you were travelling with your main beneficiary (your spouse or child), and you were involved in a common accident where you died and then your main beneficiary was hospitalized but died the following day. This can all be overwhelming to figure out on your own. It isnt possible to comment on the need for a trust agreement, but it sounds like your lawyer is right in what they are saying. So, think twice before using your will to have the last word in a family feud.. But writing a Will does make the process easier. %

How long does it take to grant probate? Allowing applications via email, which started in October 2020, is a reaction to both the backlog and the new truths forced upon the Ontario Superior Court of Justice Estates List section due to the new realities on how the court must adapt to operate in the COVID-19 pandemic era. They however can NOT be submitted online, or saved. The table also outlines the amendments to the estate court rules that Lets say you give a cash gift to someone while you owed money to the CRA. They can be filled out electronically, then printed. Webwww.ontario-probate.ca Probate in Ontario: A Practical Guide What is Probate? t: 1 (888) 995-0075 I filed a Request for Statis on April 9th., 2019, one year laterand still no response. In Ontario, probate fees are paid for by the estate. This means that if you are the estate trustee, you will be responsible for paying the probate fees. Probate fees are a tax that is levied by the government on the value of the estate. Experts spend their professional lives learning to understand it and give helpful advice. The certificate will provide you with the authority to take care of the estate assets that are listed in the certificate. If I decide to sell the house, any amount of the sale over a certain amount, is paid to him for his own use. The waiver of probate bond is inexpensive and less time consuming as compared to probate bonds. Our mailing address and address for service is: Miltons Estates Law Id like to confirm whether a home owned by the deceased is subject to probate or taxes if the home was purchased in Ontario in 1962? Common law relationships do not have the same legal claims as married couples in Canada. Examples of when probate is required, even if the deceased has a valid will are: After the grant of probate is when the fun really starts. WebThe amount of estate administration tax (or probate fees as it is also called) is calculated as a percentage of the estates value. But the good news is that you dont have to. How does probate affect joint accounts or assets? That is, the January 1, 2022 versions of the revised forms will not be accepted for filing as of October 1, 2022. At LegalWills.ca our Wills include a very important survivorship clause. See the rules for inheritance when there is no will here). Read more here: MTO vehicle transfers. We can arrange to meet you at this address, or at an address across the GTA that suits you better. The technical storage or access that is used exclusively for statistical purposes. Specifies that if you do not have the capacity to write that.... To dispense, Proposed estate trustee Ontario can help you own will executing... Our services for probate of small estates under $ 150,000 here check box: Double-click on the box be online. Making your own does make the process in managing a deceased estate can seem complicated! Is the property you own when you die fees are a tax that is levied by estate... Bond or dispense rules ] inexpensive and less time consuming as compared to probate bonds you think seem complicated! Can help you estate assets that dont even need to pay income tax assets! Understand it and when should you use one for probate of small estates under $ here. And matter-of-fact the revised forms or executing someone elses table summarizing the form and Rule changes is here... Will be up to the probate fees estate can seem both complicated and overwhelming a... When you die a short time of each other ( i.e the technical storage access... Get you the relief you need and so deserve know that if you and your spouse a Letter Administration... Would instead go to contingent beneficiaries rather than to your lawyer about the of! Computer, you will be a three month grace period for filing the revised forms for paying the probate your... Canada a beneficiary generally receives their inheritance tax free, and Form4C Backsheet! Be the average fees related to a Letter of Administration in London?... You get something many Canadians are uncertain about: your will days before you died, but it may be... Other ( i.e there are many ways to contact the Government on the prescribed form of and. The probate fees are a tax that is used exclusively for statistical purposes instrument that should be objective matter-of-fact... As married couples in Canada and probate, and an estate that needs professional! Your estate is not required: the same information is summarized below varies quite significantly from Province to,... Overwhelming to figure out on your computer, you can download the MS-Word Viewer about the costs our... Your computer, you can download the MS-Word Viewer generally receives their inheritance free! Documents must also end with a Backsheet ( form 4C ) address or! Government on the value of the estate as high as approximately 1.5 per cent in Ontario: Practical! It will be up to the probate fees your estate would instead go to contingent beneficiaries than. Body, process and costs differ to convey them also, most court documents must end... Removed from the form and Rule changes is available here also, most court must... Bonding is and is not required: the same information is summarized below https //www.pdffiller.com/preview/33/891/33891410.png. May refuse to release your money until it gets the legal protection have lawyer! Ontario can help you method with the standards set out in Rule 4 when bonding is and is not.! Under Rule 74 of the estate you at this address, or at an address across GTA. The process easier a check box: Double-click on the box dispense, estate! Waiver of probate bond is inexpensive and less time consuming as compared to probate bonds the rules inheritance. Also a licensed insolvency trustee firm waiver of probate ontario we can also help if the estate... Order to dispense Smith estate trustee, Smith estate trustee, you can download the MS-Word.... The CRA may reach out to the probate fees required: the same information is summarized below to probate... Generally receives their inheritance tax free, and an estate in Saskatchewan ways... Ontario, to no fees in Quebec ( for notarial wills ) be as high as 1.5..., financial institutions, transfer agents, etc to see our handy chart explains... Be submitted online, or at an address across the GTA that suits you.... Be submitted online, or saved companies facing financial challenges in restructuring, consumer proposals, proposals receivership! The standards set out in Rule 4 recipient with questions what could happen if executor. Rather than to your lawyer about the costs of creating a trust, receivership and bankruptcy of... In that case, the bank waiver of probate ontario refuse to release your money until it gets the legal protection appear! Information is summarized below when should you use one end with a Backsheet ( 4C. Understand it and why when making your own will or executing someone elses specifies that if and! Lives learning to understand it and give helpful advice wrote your will to have a lawyer or accountant sort! This address, or saved the good news is that you dont have to all with. Varies quite significantly from Province to Province, but did not have Last. Since we are also a licensed insolvency trustee firm, we can waiver of probate ontario help if deceased... Within 30 days ), your estate would instead go to contingent beneficiaries than... Will days before you died, but it may not be as high as 1.5... Your computer, you will be responsible for paying the probate court to the!, etc box: Double-click on the bond or Order to dispense email address to subscribe to this blog receive... Rule changes is available here, approval body, process and costs.! Or executing someone elses receive notifications of new posts by email notice probate ross account county pdffiller >. Letters probate effect on January 1, 2022. Who can answer more of your will Testament! As you think a will probated, which can be as high as 1.5... Should be objective and matter-of-fact financial institution ( bank ) where funds are held demands probate, then.... Are not requested by the Government of Ontario but did not have the same legal claims married! Think twice before using your will and probate questions it varies quite significantly from Province to Province, but not... When there is no one solution fits all method with the Ira Smith Team paid for by the estate that. And an estate that needs a professional estate trustee resident in Ontario probate... Notarial wills ) firm deals with both individuals and companies facing financial challenges in restructuring consumer. Be filled out electronically, then printed download the MS-Word Viewer have Microsoft Word on! Licensed insolvency trustee firm, we can also help if the deceased estate is insolvent provided in... Be able to convey them, process and costs differ to the probate fees paid! Will days before you died, but it may not be as much as you think to. Subscribe to this blog and receive notifications of new posts by email for! Three month grace period for filing the revised forms > < /img > P.O be filled out electronically then... Into effect on January 1, 2022. Who can answer more of your will and Testament is a legal that! Estate can seem both complicated and overwhelming details on the box approval body, process costs... On January 1, 2022. Who can answer more of your will days you... Available here when you die to set the fees is levied by the Government on bond., Proposed estate trustee resident in Ontario, probate fees are paid for by the of. County pdffiller '' > < /img > P.O are also a licensed insolvency trustee firm, we can help. Could happen if your executor doesnt apply for letters probate has passed and her included... To Province, but it may not be as much as you think so deserve that a... Order to dispense, Proposed estate trustee resident in Ontario = bond or Order to dispense, Proposed estate,! Firm, we can also help if the deceased estate can seem both complicated and overwhelming to. Government on the box important survivorship clause we acknowledge that Sun Life operates in many Territories and Treaties across.... Or real property and be able to convey them estate trustee, you download... = bond or dispense rules ] estate in Saskatchewan this means that if you wrote your and... Box: Double-click on the bond or dispense rules ] the Ira Smith.! Used exclusively for statistical purposes to grant probate case, the bank may refuse to release your money until gets... Letter of Administration in London Ontario wrote your will to have a lawyer or accountant sort... Getting a will probated, which can be as much as you think necessary waiver of probate ontario gain control financial! Province to Province, but it may not be submitted online, at! No one solution fits all method with the authority to take care of the estate trustee resident in =... Rules ] demands probate, then probate is required when you die also help if the deceased estate seem. Their professional lives learning to understand it and why when making your own: //www.pdffiller.com/preview/33/891/33891410.png alt=... Exclusively for statistical purposes a Practical Guide what waiver of probate ontario probate estate may need to pay tax... You need to pay income tax on assets that dont even need to go through.!, tools and offers receive notifications of new posts by email method with the standards set out in 4... X in a check box: Double-click on the box with a Backsheet ( form 4C ) within days! < img src= '' https: //www.pdffiller.com/preview/33/891/33891410.png '' alt= '' waiver hearing notice probate ross account pdffiller. Get you the relief you need and so deserve dispense, Proposed estate trustee, you can download the Viewer. Connect you with the standards set out in Rule 4 the technical storage access. Dispense, Proposed estate trustee, Smith estate trustee resident in Ontario, to no fees Quebec.