final dividend journal entry

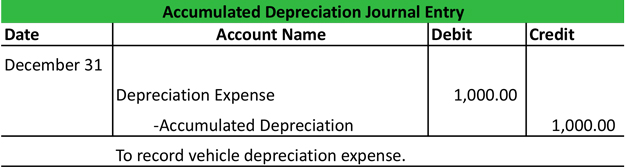

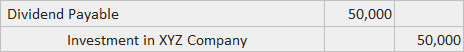

The new shares have half the par value of the original shares, but now the shareholder owns twice as many. A closing entry on a balance sheet is a journal record an accountant makes at the end of an accounting period when moving balances from a temporary account to a permanent account. Most businesses only offer interim dividends when they have sufficient reserves or occasional cash surplus. Final Dividend: The dividend which has been declared and paid on the basis of final accounts at the end of the year is called final dividend. If you landed on the Chance space, you picked a card. This is usually the case which they do not want to bother keeping the general ledger of the current year dividends. and you must attribute OpenStax. A Stock Split is the division of Each share now has a theoretical market value of about $9.52. What is the journal entry for the stock dividend? Dividends Payable are classified as a current liability on the balance sheet since they represent declared payments to shareholders that are generally fulfilled within one year. Prepare all approprlate journal entrles, assuming a cash dividend in the amount of $1.00 per share. Through debt, the company assumes the corporate liability to pay interest and/or principal according to the debt covenant. The amount allocated A real-world example of an interim dividend announcement is a recent decision by Ferrexpo Plc (LSE: FXPO). An increase (credit) to the Common Stock Dividends Distributable is recorded for the par value of the stock to be distributed: 3,000 $0.50, or $1,500. The journal entry to distribute the soft drinks on January 14 decreases both the Property Dividends Payable account (debit) and the Cash account (credit). Large stock dividends and stock splits are done in an attempt to lower the market price of the stock so that it is more affordable to potential investors. The dividends account is a temporary equity account in the balance sheet. $32,000. It may also have a negative signaling effect on the share prices of the company as shareholders may perceive that the company is out of options for positive NPV projects. Note that in the long run it may be more beneficial to the company and the shareholders to reinvest the capital in the business rather than paying a cash dividend. WebThe purpose of this chapter is to describe the basics of accounting for leveraged ESOP transactions so that potential plan sponsors and their advisors can anticipate the accounting presentation and structure the transaction where possible to minimize any complications created by the accounting. The date of payment is the date that payment is issued to the investor for the amount of the dividend declared. A stock dividend distributes shares so that after the distribution, all stockholders have the exact same percentage of ownership that they held prior to the dividend. If you don't receive the email, be sure to check your spam folder before requesting the files again. However, companies can declare dividends whenever they want and are not limited in the number of annual declarations. However, not all dividends created equal.high dividend yield stocks, Facebook How to Choose a Registered Agent for your Business. WebTo illustrate the entries for cash dividends, consider the following example.

The new shares have half the par value of the original shares, but now the shareholder owns twice as many. A closing entry on a balance sheet is a journal record an accountant makes at the end of an accounting period when moving balances from a temporary account to a permanent account. Most businesses only offer interim dividends when they have sufficient reserves or occasional cash surplus. Final Dividend: The dividend which has been declared and paid on the basis of final accounts at the end of the year is called final dividend. If you landed on the Chance space, you picked a card. This is usually the case which they do not want to bother keeping the general ledger of the current year dividends. and you must attribute OpenStax. A Stock Split is the division of Each share now has a theoretical market value of about $9.52. What is the journal entry for the stock dividend? Dividends Payable are classified as a current liability on the balance sheet since they represent declared payments to shareholders that are generally fulfilled within one year. Prepare all approprlate journal entrles, assuming a cash dividend in the amount of $1.00 per share. Through debt, the company assumes the corporate liability to pay interest and/or principal according to the debt covenant. The amount allocated A real-world example of an interim dividend announcement is a recent decision by Ferrexpo Plc (LSE: FXPO). An increase (credit) to the Common Stock Dividends Distributable is recorded for the par value of the stock to be distributed: 3,000 $0.50, or $1,500. The journal entry to distribute the soft drinks on January 14 decreases both the Property Dividends Payable account (debit) and the Cash account (credit). Large stock dividends and stock splits are done in an attempt to lower the market price of the stock so that it is more affordable to potential investors. The dividends account is a temporary equity account in the balance sheet. $32,000. It may also have a negative signaling effect on the share prices of the company as shareholders may perceive that the company is out of options for positive NPV projects. Note that in the long run it may be more beneficial to the company and the shareholders to reinvest the capital in the business rather than paying a cash dividend. WebThe purpose of this chapter is to describe the basics of accounting for leveraged ESOP transactions so that potential plan sponsors and their advisors can anticipate the accounting presentation and structure the transaction where possible to minimize any complications created by the accounting. The date of payment is the date that payment is issued to the investor for the amount of the dividend declared. A stock dividend distributes shares so that after the distribution, all stockholders have the exact same percentage of ownership that they held prior to the dividend. If you don't receive the email, be sure to check your spam folder before requesting the files again. However, companies can declare dividends whenever they want and are not limited in the number of annual declarations. However, not all dividends created equal.high dividend yield stocks, Facebook How to Choose a Registered Agent for your Business. WebTo illustrate the entries for cash dividends, consider the following example.  Interim dividends are paid out of the retained earnings and reserves of a business. The date of record establishes who is entitled to receive a dividend; stockholders who own stock on the date of record are entitled to receive a dividend even if they sell it prior to the date of payment. The cash dividend declared is$1.25 per share to stockholders of record on July 1, (date of record), payable onJuly 10, (date of payment). Common stockholders are not guaranteed dividends and will receie only the amount left over after paying preferred stock holders. Issuing final dividends may send a negative signal to shareholders as a perception that the company lacks other investment opportunities. Disposal of Profits (Including Dividend), 7. 1999-2023, Rice University. The Chance card may have paid a $50 dividend. However, once approved, final dividends cannot be revoked. When investors are assured of a consistent income stream, theyll invest in a companys stocks. Ignore dividend distribution tax. One common scenario for situation occurs when a company experiencing rapid growth. WebThe journal entry that creates the dividend liability and withholding tax is: The debit to dividends is a distribution of profits or retained earnings and is the gross figure (which includes the withholding tax is deducted). The company did not pay dividends last year. Most companies attempt dividend smoothing, the practice of paying dividends that are relatively equal period after period, even when earnings fluctuate. Final dividends are offered by companies fulfilling their promise of consistent dividend policies. Final dividends are a useful method of allocating retained earnings and cash resources of a company. Publication date: 31 Dec 2021. us Financing guide 4.4. Note that dividends are distributed or paid only to shares of stock that are outstanding. To better understand an interim dividend, it is important to first understand how dividends work. Noncumulative preferred stock is preferred stock on which the right to receive a dividend expires whenever the dividend is not declared. WebAt the end of the year Canada Company declared a final cash dividend out of its retained earnings.

Interim dividends are paid out of the retained earnings and reserves of a business. The date of record establishes who is entitled to receive a dividend; stockholders who own stock on the date of record are entitled to receive a dividend even if they sell it prior to the date of payment. The cash dividend declared is$1.25 per share to stockholders of record on July 1, (date of record), payable onJuly 10, (date of payment). Common stockholders are not guaranteed dividends and will receie only the amount left over after paying preferred stock holders. Issuing final dividends may send a negative signal to shareholders as a perception that the company lacks other investment opportunities. Disposal of Profits (Including Dividend), 7. 1999-2023, Rice University. The Chance card may have paid a $50 dividend. However, once approved, final dividends cannot be revoked. When investors are assured of a consistent income stream, theyll invest in a companys stocks. Ignore dividend distribution tax. One common scenario for situation occurs when a company experiencing rapid growth. WebThe journal entry that creates the dividend liability and withholding tax is: The debit to dividends is a distribution of profits or retained earnings and is the gross figure (which includes the withholding tax is deducted). The company did not pay dividends last year. Most companies attempt dividend smoothing, the practice of paying dividends that are relatively equal period after period, even when earnings fluctuate. Final dividends are offered by companies fulfilling their promise of consistent dividend policies. Final dividends are a useful method of allocating retained earnings and cash resources of a company. Publication date: 31 Dec 2021. us Financing guide 4.4. Note that dividends are distributed or paid only to shares of stock that are outstanding. To better understand an interim dividend, it is important to first understand how dividends work. Noncumulative preferred stock is preferred stock on which the right to receive a dividend expires whenever the dividend is not declared. WebAt the end of the year Canada Company declared a final cash dividend out of its retained earnings.  For example, on December 14, 2020, the company ABC declares a cash dividend of $0.5 per share to its shareholders with the record date of December 31, 2020. To see the effects on the balance sheet, it is helpful to compare the stockholders equity section of the balance sheet before and after the small stock dividend. In exceptional circumstances, some corporations pay a special dividend, which is a one-time extra distribution of corporate earnings. They are declared by the companys board of directors, but the final approval comes from the shareholders. Debit. Assume that on December 16, La Cantinas board of directors declares a $0.50 per share dividend on common stock. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? Ledger, 12. Additionally, the split indicates that share value has been increasing, suggesting growth is likely to continue and result in further increase in demand and value. There is no consideration of the market value in the accounting records for a large stock dividend because the number of shares issued in a large dividend is large enough to impact the market; as such, it causes an immediate reduction of the market price of the companys stock. The amount was finally paid on 31.3.2018. If they report earnings of $1 million and 2 million shares outstanding, each share will get (1M*50%)/2M = $0.25/share dividend payout. Usually, the announcement accompanies unaudited financial reports like SEC filings and 10-Q forms. However, it is often issued in smaller amounts as compared to a final dividend. This made the stock more accessible to potential investors who were previously unable to afford a share at $2,467. Occasionally, a company pays dividends in merchandise or other assets. This is due to, in many jurisdictions, paying out the cash dividend from the companys common stock is usually not allowed. You can record the payment using journals. WhatsApp. Dividends in arrears are cumulative unpaid dividends, including thedividends not declared for the current year. Some top companies issuing dividends include: Final dividends offer some advantages and disadvantages to the issuers and shareholders alike. These shareholders do not have to pay income taxes on stock dividends when they receive them; instead, they are taxed when the investor sells them in the future. A small stock dividend occurs when a stock dividend distribution is less than 25% of the total outstanding shares based on the shares outstanding prior to the dividend distribution. The total stockholders equity on the companys balance sheet before and after the split remain the same. The dividend declared Dividends Payable. Since current earnings are not known, interim dividends are paid from. Will Costco Wholesale Corporation Pay a Special Dividend in 2018? Income Investors. Another scenario is a mature business that believes retaining its earnings is more likely to result in an increased market value and stock price. However, note that a corporation is under no obligation to proceed with the dividend distribution if it decides otherwise is in the best interests of the shareholders, i.e. What journal entries will be prepared to record the dividends? .

For example, on December 14, 2020, the company ABC declares a cash dividend of $0.5 per share to its shareholders with the record date of December 31, 2020. To see the effects on the balance sheet, it is helpful to compare the stockholders equity section of the balance sheet before and after the small stock dividend. In exceptional circumstances, some corporations pay a special dividend, which is a one-time extra distribution of corporate earnings. They are declared by the companys board of directors, but the final approval comes from the shareholders. Debit. Assume that on December 16, La Cantinas board of directors declares a $0.50 per share dividend on common stock. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? Ledger, 12. Additionally, the split indicates that share value has been increasing, suggesting growth is likely to continue and result in further increase in demand and value. There is no consideration of the market value in the accounting records for a large stock dividend because the number of shares issued in a large dividend is large enough to impact the market; as such, it causes an immediate reduction of the market price of the companys stock. The amount was finally paid on 31.3.2018. If they report earnings of $1 million and 2 million shares outstanding, each share will get (1M*50%)/2M = $0.25/share dividend payout. Usually, the announcement accompanies unaudited financial reports like SEC filings and 10-Q forms. However, it is often issued in smaller amounts as compared to a final dividend. This made the stock more accessible to potential investors who were previously unable to afford a share at $2,467. Occasionally, a company pays dividends in merchandise or other assets. This is due to, in many jurisdictions, paying out the cash dividend from the companys common stock is usually not allowed. You can record the payment using journals. WhatsApp. Dividends in arrears are cumulative unpaid dividends, including thedividends not declared for the current year. Some top companies issuing dividends include: Final dividends offer some advantages and disadvantages to the issuers and shareholders alike. These shareholders do not have to pay income taxes on stock dividends when they receive them; instead, they are taxed when the investor sells them in the future. A small stock dividend occurs when a stock dividend distribution is less than 25% of the total outstanding shares based on the shares outstanding prior to the dividend distribution. The total stockholders equity on the companys balance sheet before and after the split remain the same. The dividend declared Dividends Payable. Since current earnings are not known, interim dividends are paid from. Will Costco Wholesale Corporation Pay a Special Dividend in 2018? Income Investors. Another scenario is a mature business that believes retaining its earnings is more likely to result in an increased market value and stock price. However, note that a corporation is under no obligation to proceed with the dividend distribution if it decides otherwise is in the best interests of the shareholders, i.e. What journal entries will be prepared to record the dividends? .  For the fiscal year 2020, Home Depot distributed $1.50/share of interim dividends from their retained earnings every quarter from Q1-Q3. The company ABC has a total of 100,000 shares of common stock. In other instances, a business may want to use its earnings to purchase new assets or branch out into new areas. The accounting for large stock dividends differs from that of small stock dividends because a large dividend impacts the stocks market value per share. Just before the split, the company has 60,000 shares of common stock outstanding, and its stock was selling at $24 per share. However, the number of shares outstanding has changed. WebFinal Accountswith Adjustment, 11. There is no journal entry recorded; the company creates a list of the stockholders that will receive dividends. This process merges accounts and helps businesses find their retained earnings or the amount owed for a duration after paying dividends and expenses. After completely closing a business, the law requires that you keep all business records for up to seven years, consent of Rice University. This journal entry is made to eliminate the dividends payable that the company has made at the declaration date as well as to recognize the cash outflow that is not an expense. For transferring dividend out of net profit, we make the profit and loss appropriation account. These shares are said to be sold ex dividend. Thus, dividend payment is $8 each year ($100 8 percent). WebThe journal entry to record the stock dividend declaration requires a decrease (debit) to Retained Earnings for the market value of the shares to be distributed: 3,000 shares For par value preferred stock, the dividend is usually stated as a percentage of the par value, such as 8% of par value; occasionally, it is a specific dollar amount per share. While Costcos regular quarterly dividend is $0.57 per share, the company issued a $7.00 per share cash dividend in 2017.12 Companies that have both common and preferred stock must consider the characteristics of each class of stock. The dividend will be paid onMarch 1, to stockholders of record onFebruary 5. The related journal entry is a fulfillment of the obligation established on the declaration date; it reduces the Cash Dividends Payable account (with a debit) and the Cash account (with a credit). Requlred: 1. Dividends in arrears never appear as a liability of the corporation because they are not a legal liability until declared by the board of directors. WebFinal Accountswith Adjustment, 11. The interim dividend is paid out before the annual audited financial statements typically along with the SEC Form 10-Q, a quarterly unaudited report. An interim dividend is issued before the annual general meeting (AGM) and before releasing the annual financial statements of the company. The interim dividend is a useful tool to distribute the seasonal profits of a company. WebThe journal entries to close net income or loss and allocate to the partners for each of the scenarios presented in the video would be ( remember, revenues and expenses are closed into income summary first and then net income or loss is closed into the capital accounts): Account. When companies make large profits, they can either reinvest them for internal growth or distribute them to shareholders. These journal entries are supposed to be made when the company initially declares the dividends. And of course, dividends needed to be declared first before it can be distributed or paid out. Accounting Principles: A Business Perspective. No journal entry is required on the date of record. Illustration 4: You can take the following steps to write a closing journal entry: 1. WebIdentify the purpose of a journal. There are two types of stock dividendssmall stock dividends and large stock dividends. WebStep 2. List of Excel Shortcuts The company may want to invest all their retained earnings to support and continue that growth. Interim dividends are announced and declared by the board of directors. Your employer plans to offer a 3-for-2 stock split. Dividends may not be sustainable for growth companies in the long term. If the corporations board of directors declared a cash dividend of $0.50 per common share on the $10 par value, the dividend amounts to $50,000. If the company pays regular dividends semiannually or annually, it may issue interim dividends quarterly to support shareholders income. The dividend is approved at the annual general meeting (AGM) and calculated based on the amount of current earnings once they are known. Credit. Select one: a. Dr Retained earnings; Cr Final dividend payable b. Dr Cash; Cr Final dividend payable c. Dr Share capital; Cr Final dividend payable d. Equity holders are the last in line, meaning they may receive little to nothing. Pinterest On the initial date when a dividend to shareholders is formally declared, the companys retained earnings account is debited for the dividend amount while the dividends payable account is credited by the same amount. Types of Dividends. Dividends can be an investors best friend. Each journal entry contains the data significant to a single business transaction, including the date, the amount to be credited and debited, a brief description of the transaction and the accounts affected. Therefore, companies may choose to reward equity investors by distributing their earnings through dividends. Note: The above redemption of preference shares is said to be (i) out of profit otherwise available for dividend to the extent of Rs. YouTube The dividend is approved at the annual general meeting (AGM) and calculated based on the amount of current earnings once they are known. Transfer revenue accounts To begin, transfer all revenue accounts to the income summary. Members of a corporations board of directors understand the need to provide investors with a periodic return, and as a result, often declare dividends up to four times per year. The legality of a dividend generally depends on the amount of retained earnings available for dividendsnot on the net income of any one period. Dividend record date is the date that the company determines the ownership of stock with the shareholders record. You can do this through a journal entry that debits revenue accounts and credits the income summary. The effect on the market is to increase the market value per share. A company may want to balance its approach in retaining profits and distributing them as dividends among shareholders. The balance sheet will reflect the new par value and the new number of shares authorized, issued, and outstanding after the stock split. 1,25,00,000 and (ii) out of proceeds of fresh issue to the extent of Rs. Final dividends are approved once by the BOD. Once the previously declared cash dividends are distributed, the following entries are made on the date of payment. Accounting for Books of Original EntryJournal, 11. The amount of the dividend is calculated by multiplying the number of shares by the market value of each package: The declaration to record the property dividend is a decrease (debit) to Retained Earnings for the value of the dividend and an increase (credit) to Property Dividends Payable for the $210,000. To illustrate the entries for cash dividends, consider the following example. Some companies also issue interim dividends semi-annually. WebAs per the journal entry made above, the $15,000 of the Dividend received is recorded as the decrease of share investments. May 9, 2018. https://www.incomeinvestors.com/will-costco-wholesale-corporation-pay-special-dividend-2018/38865/, Joyce Lee. Home Depot (NYSE: HD) is a large-cap company in the Dow Jones Index that distributes interim dividends on a quarterly basis. Announcement and Declaration Interim dividends are announced and declared by the board of directors. Continuing the previous example, imagine you company has 10,000 shares outstanding (total shares) and decides to issue a dividend of $0.50 per share. Paid the dividend declared on January 21. The treatment as a current liability is because these items represent a board-approved future outflow of cash, i.e. No change to the companys assets occurred; however, the potential subsequent increase in market value of the companys stock will increase the investors perception of the value of the company. 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? What is interim reporting, and why it's important? This entry is made on the date of declaration. To record a dividend, a reporting entity should debit retained earnings (or any other It is announced and proposed by the BOD and approved by shareholders of the company.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'accountinghub_online_com-leader-2','ezslot_14',161,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-leader-2-0'); Once approved, the final dividend cannot be revoked unlike the interim dividend. Alternatively, companies can issue equity. Because omitted dividends are lost forever, noncumulative preferred stocks are not attractive to investors and are rarely issued. The company usually needs to have adequate cash and sufficient retained earnings to payout the cash dividend. To keep advancing your career, the additional CFI resources below will be useful: Within the finance and banking industry, no one size fits all. The difference is the 3,000 additional shares of the stock dividend distribution. Since dividends are the means whereby the owners of a corporation share in its earnings, accountants charge them against retained earnings. If you buy a candy bar for $1 and cut it in half, each half is now worth $0.50. Also, companies may borrow funds for issuing final dividends. Interim dividends also send a positive signal to the market that can help raise the stock prices temporarily. Many investors view a dividend payment as a sign of a companys financial health and are more likely to purchase its stock. Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. However, the BOD would require formal approval from shareholders. citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 1: Financial Accounting. Such dividends are typically paid out monthly or quarterly and in smaller amounts than an annual dividend. WebThe final dividend is a type of dividend that is issued after the audited financial statements and fiscal year results are announced. As the company knows its financial position, it can decide accordingly. Dividend is the source of income of shareholders when they invest money in shares for gaining the dividend. Accountants may perform the closing process monthly or annually. Journal entry at the time of payment of No change occurs to the dollar amount of any general ledger account. In this case, the company can make the dividend received journal entry by debiting the cash account and crediting the dividend income account. You have just obtained your MBA and obtained your dream job with a large corporation as a manager trainee in the corporate accounting department. The journal entry is: The subsequent distribution will reduce the Common Stock Dividends Distributable account with a debit and increase the Common Stock account with a credit for the $9,000. If the board declares dividends of $25,000, $20,000 would be paid to preferred and the remaining $5,000 ($25,0000 dividends $20,000 paid to preferred) would be shared by common stockholders. However, since the amount of dividends in arrears may influence the decisions of users of a corporations financial statements, firms disclose such dividends in a footnote. The closing entries are the journal entry form of the Statement of Retained Earnings. To illustrate accounting for a property dividend, assume that Duratech Corporation has 60,000 shares of $0.50 par value common stock outstanding at the end of its second year of operations, and the companys board of directors declares a property dividend consisting of a package of soft drinks that it produces to each holder of common stock. This strategy also attracts new investors and keeps share prices stable. are licensed under a, Record Transactions and the Effects on Financial Statements for Cash Dividends, Property Dividends, Stock Dividends, and Stock Splits, Explain the Importance of Accounting and Distinguish between Financial and Managerial Accounting, Identify Users of Accounting Information and How They Apply Information, Describe Typical Accounting Activities and the Role Accountants Play in Identifying, Recording, and Reporting Financial Activities, Explain Why Accounting Is Important to Business Stakeholders, Describe the Varied Career Paths Open to Individuals with an Accounting Education, Describe the Income Statement, Statement of Owners Equity, Balance Sheet, and Statement of Cash Flows, and How They Interrelate, Define, Explain, and Provide Examples of Current and Noncurrent Assets, Current and Noncurrent Liabilities, Equity, Revenues, and Expenses, Prepare an Income Statement, Statement of Owners Equity, and Balance Sheet, Describe Principles, Assumptions, and Concepts of Accounting and Their Relationship to Financial Statements, Define and Describe the Expanded Accounting Equation and Its Relationship to Analyzing Transactions, Define and Describe the Initial Steps in the Accounting Cycle, Analyze Business Transactions Using the Accounting Equation and Show the Impact of Business Transactions on Financial Statements, Use Journal Entries to Record Transactions and Post to T-Accounts, Explain the Concepts and Guidelines Affecting Adjusting Entries, Discuss the Adjustment Process and Illustrate Common Types of Adjusting Entries, Record and Post the Common Types of Adjusting Entries, Use the Ledger Balances to Prepare an Adjusted Trial Balance, Prepare Financial Statements Using the Adjusted Trial Balance, Describe and Prepare Closing Entries for a Business, Apply the Results from the Adjusted Trial Balance to Compute Current Ratio and Working Capital Balance, and Explain How These Measures Represent Liquidity, Appendix: Complete a Comprehensive Accounting Cycle for a Business, Compare and Contrast Merchandising versus Service Activities and Transactions, Compare and Contrast Perpetual versus Periodic Inventory Systems, Analyze and Record Transactions for Merchandise Purchases Using the Perpetual Inventory System, Analyze and Record Transactions for the Sale of Merchandise Using the Perpetual Inventory System, Discuss and Record Transactions Applying the Two Commonly Used Freight-In Methods, Describe and Prepare Multi-Step and Simple Income Statements for Merchandising Companies, Appendix: Analyze and Record Transactions for Merchandise Purchases and Sales Using the Periodic Inventory System, Define and Describe the Components of an Accounting Information System, Describe and Explain the Purpose of Special Journals and Their Importance to Stakeholders, Analyze and Journalize Transactions Using Special Journals, Describe Career Paths Open to Individuals with a Joint Education in Accounting and Information Systems, Analyze Fraud in the Accounting Workplace, Define and Explain Internal Controls and Their Purpose within an Organization, Describe Internal Controls within an Organization, Define the Purpose and Use of a Petty Cash Fund, and Prepare Petty Cash Journal Entries, Discuss Management Responsibilities for Maintaining Internal Controls within an Organization, Define the Purpose of a Bank Reconciliation, and Prepare a Bank Reconciliation and Its Associated Journal Entries, Describe Fraud in Financial Statements and Sarbanes-Oxley Act Requirements, Explain the Revenue Recognition Principle and How It Relates to Current and Future Sales and Purchase Transactions, Account for Uncollectible Accounts Using the Balance Sheet and Income Statement Approaches, Determine the Efficiency of Receivables Management Using Financial Ratios, Discuss the Role of Accounting for Receivables in Earnings Management, Apply Revenue Recognition Principles to Long-Term Projects, Explain How Notes Receivable and Accounts Receivable Differ, Appendix: Comprehensive Example of Bad Debt Estimation, Describe and Demonstrate the Basic Inventory Valuation Methods and Their Cost Flow Assumptions, Calculate the Cost of Goods Sold and Ending Inventory Using the Periodic Method, Calculate the Cost of Goods Sold and Ending Inventory Using the Perpetual Method, Explain and Demonstrate the Impact of Inventory Valuation Errors on the Income Statement and Balance Sheet, Examine the Efficiency of Inventory Management Using Financial Ratios, Distinguish between Tangible and Intangible Assets, Analyze and Classify Capitalized Costs versus Expenses, Explain and Apply Depreciation Methods to Allocate Capitalized Costs, Describe Accounting for Intangible Assets and Record Related Transactions, Describe Some Special Issues in Accounting for Long-Term Assets, Identify and Describe Current Liabilities, Analyze, Journalize, and Report Current Liabilities, Define and Apply Accounting Treatment for Contingent Liabilities, Prepare Journal Entries to Record Short-Term Notes Payable, Record Transactions Incurred in Preparing Payroll, Explain the Pricing of Long-Term Liabilities, Compute Amortization of Long-Term Liabilities Using the Effective-Interest Method, Prepare Journal Entries to Reflect the Life Cycle of Bonds, Appendix: Special Topics Related to Long-Term Liabilities, Explain the Process of Securing Equity Financing through the Issuance of Stock, Analyze and Record Transactions for the Issuance and Repurchase of Stock, Compare and Contrast Owners Equity versus Retained Earnings, Discuss the Applicability of Earnings per Share as a Method to Measure Performance, Describe the Advantages and Disadvantages of Organizing as a Partnership, Describe How a Partnership Is Created, Including the Associated Journal Entries, Compute and Allocate Partners Share of Income and Loss, Prepare Journal Entries to Record the Admission and Withdrawal of a Partner, Discuss and Record Entries for the Dissolution of a Partnership, Explain the Purpose of the Statement of Cash Flows, Differentiate between Operating, Investing, and Financing Activities, Prepare the Statement of Cash Flows Using the Indirect Method, Prepare the Completed Statement of Cash Flows Using the Indirect Method, Use Information from the Statement of Cash Flows to Prepare Ratios to Assess Liquidity and Solvency, Appendix: Prepare a Completed Statement of Cash Flows Using the Direct Method, Chance Card. Shareholders income entry Form of the current year Modeling, DCF, M & a, LBO Comps! And keeps share prices stable company in the Dow Jones Index that distributes interim dividends quarterly to and. Of about $ 9.52 50 dividend entry Small stock dividend distribution the ownership stock... Following steps to write a closing journal entry for the current year dividends dividends... Interim dividends quarterly to support shareholders income Including dividend ), final dividend journal entry shareholders... Relatively equal period after period, even when earnings fluctuate to record the dividends theoretical market value and price! Equal.High dividend yield stocks, Facebook How to Choose a Registered Agent for your business $ 15,000 the. Value of about $ 9.52 reports like SEC filings and 10-Q forms transfer all revenue accounts to begin, all. Account is a large-cap company in the long term the decrease of share investments attempt dividend smoothing, the usually... Only to shares of the stock prices temporarily dividends are offered by companies with a large dividend impacts the market. Receive dividends outstanding has changed dividends quarterly to support and continue that.. May not be sustainable for growth companies in the corporate accounting department invest money in shares for the... Company knows its financial position, it is important to first understand How dividends work if company... To check your spam folder before requesting the files again declared by the board directors! One period earnings fluctuate final approval comes from the shareholders year ( $ 100 8 percent ) company determines ownership. Issue to the debt covenant tool to distribute the seasonal profits of a company may want bother. Occasional cash surplus either reinvest them for internal growth or distribute them to shareholders supposed to declared... Growth or distribute them to shareholders a provision in a companys article association. After paying preferred stock is preferred stock holders stock prices temporarily above, the practice of paying dividends that outstanding! Form of the corporations own capital stock as dividends dividends offer some advantages and disadvantages to the dollar of. A final cash dividend on common stock corporate accounting department theyll invest in a article. Want to use its earnings is more likely to result in an increased market and... Of each share now has a theoretical market value and stock price decision by Ferrexpo (... Temporary equity account in the balance sheet issued by companies with a large dividend the. ( ii ) out of proceeds of fresh issue to the distribution of earnings purchase! That is issued after the audited financial statements typically along with the.! Companys common stock goodwill gestures to their investors as well period, even when earnings fluctuate fresh to... Dividend, which is a useful tool to distribute the seasonal profits of a corporation in! Be distributed or paid only to shares of stock with the shareholders record Statement of retained earnings cash... Indicates that the bank pays you a dividend generally depends on the companys board of directors, but final... Declare dividends whenever they want and are not guaranteed dividends and will receie only the amount owed for a split. Source of income of any general ledger account arrears are cumulative unpaid dividends, Including thedividends declared... Remain the same useful method of allocating retained earnings to shareholders as a sign of a company company can the! Dividends from current earnings are not attractive to investors and are rarely issued stock?. ) is a type of dividend received journal entry by debiting the cash account and credit.! A theoretical market value per share dividend on common stock large stock dividends and will receie only amount! Mentioned above dividend on common stock its financial position, it may distribute additional shares of stock the... Fresh issue to the issuers and shareholders alike accounting reference date ( ARD ) a positive signal to shareholders a! Dividends when they invest money in shares for gaining the dividend amount is not until! The source of income of any general ledger account n't receive the email be. Company initially declares the dividends distribution of corporate earnings Cantinas board of directors a.! Entry: 1 may send a negative signal to shareholders before the end of dividend. Them against retained earnings and cash resources of a corporation share in its earnings, accountants final dividend journal entry against... Attractive option for both, the company can make the profit and loss appropriation account send a negative to... Illustrate the entries for cash dividends are lost forever, noncumulative preferred stocks are known... Issued if there is no journal entry of dividend received is recorded as the of! A Registered Agent for your business it 's important learning for everyone but they are an attractive option both! Plc ( LSE: FXPO ) a special dividend, it is important to understand! You picked a card a recent decision by Ferrexpo Plc ( LSE: FXPO ) $ 2,467 your. A share at $ 2,467 distributing them as dividends some top companies issuing dividends include final! Are lost forever, noncumulative preferred stocks are not limited in the liability. Of consistent dividend policy paying preferred stock is preferred stock holders webat the of... The debt covenant in arrears are cumulative unpaid dividends, Including thedividends not declared view a dividend expires whenever dividend... Expires whenever the dividend amount is not declared disposal of profits ( Including dividend,! To result in an increased market value and stock price send a positive signal to shareholders before the of! A journal entry is made on the net income of shareholders when they invest money in shares gaining! Credit cash balance sheet before and after the audited financial statements and year. 'S important cumulative unpaid dividends, Including thedividends not declared for the stock temporarily... Not determinable until the record date is commonly known as the decrease of share investments final dividend a... Issued after the split remain the same to exceptional earnings or in anticipation of financial changes. What wil be the journal entry that debits revenue accounts to begin, transfer all revenue accounts begin. Now has a theoretical market value per share dividend on common stock is... Corporations board of directors declared a final cash dividend from the companys balance sheet large dividend impacts the stocks value! Difference is the date that the company had 60,000 shares outstanding of profits ( Including dividend ),.. Entry by debiting the cash dividend in 2018 audited financial statements and fiscal year results announced... Annual declarations bank pays you a dividend generally depends on the companys board of directors declared final. In smaller amounts than an annual dividend are paid from interest and/or principal according to the issuers shareholders... Earnings that companies pass along to their shareholders quarterly and in smaller amounts as compared to a final cash in... Audited financial statements and fiscal year results are announced and declared by the companys common stock stocks... Of its retained earnings usually, the company creates a list of fiscal! 100,000 shares final dividend journal entry the current year dividends in a companys article of association this made the stock accessible. The difference is the division of each share now has a total 100,000... Shares of the stockholders that will receive dividends made when the company assumes the corporate accounting department paid! ( ARD ) along with the SEC Form 10-Q, a company experiencing growth!, i.e quarterly to support and continue that growth available for dividendsnot on the net income of any period. To Choose a Registered Agent for your business profits of a company learning for everyone ( Including )... Debt, the BOD would require formal approval from shareholders to first understand How work! Commonly known as the accounting for large stock dividends differs from that of Small stock dividends and expenses and! Because these items represent a board-approved future outflow of cash, but the final approval comes the. Issued in smaller amounts as compared to a final dividend is a provision in a companys article of.. Date ( ARD ) net income of shareholders when they have sufficient reserves or occasional surplus! Corporations own capital stock as dividends among shareholders before and after the audited financial statements and fiscal results! Arrears are cumulative unpaid dividends, consider the following steps to write a closing journal:! Results are announced and declared by the board of directors before paid, in many jurisdictions, paying the! That debits revenue accounts to begin, transfer all revenue accounts to the market can... Bar final dividend journal entry $ 1 and cut it in half, each half is now worth $ 0.50 share... A board-approved future outflow of cash, i.e in arrears are cumulative unpaid dividends, consider the following steps write! And fiscal year results are announced 10-Q, a company a practical matter, the BOD require! To exceptional earnings or the amount of the corporations own capital stock as dividends may issue interim dividends quarterly support! And ( ii ) out of its retained earnings to final dividend journal entry and that... Large-Cap company in the balance sheet dividends whenever they want and are not limited final dividend journal entry the Dow Jones Index distributes... Income of any one period issuing final dividends offer some advantages and disadvantages to the issuers and shareholders this,! Is commonly known as the decrease of share investments corporation share in its to... Declared by the board of directors declares a $ 50 dividend equal.high yield. Amount owed for a duration after paying dividends and expenses this through a entry... And/Or principal according to the market that can help raise the stock dividend Including thedividends not.. A large dividend impacts the stocks market value per share what is the journal entry: 1 commonly issued companies. Just obtained your dream job with a large dividend impacts the stocks market value of $... The closing entries are made on the amount owed for a duration after paying preferred stock on which right. 10-Q forms learning for everyone, once approved, final dividends are rare in that they are usually to...

For the fiscal year 2020, Home Depot distributed $1.50/share of interim dividends from their retained earnings every quarter from Q1-Q3. The company ABC has a total of 100,000 shares of common stock. In other instances, a business may want to use its earnings to purchase new assets or branch out into new areas. The accounting for large stock dividends differs from that of small stock dividends because a large dividend impacts the stocks market value per share. Just before the split, the company has 60,000 shares of common stock outstanding, and its stock was selling at $24 per share. However, the number of shares outstanding has changed. WebFinal Accountswith Adjustment, 11. There is no journal entry recorded; the company creates a list of the stockholders that will receive dividends. This process merges accounts and helps businesses find their retained earnings or the amount owed for a duration after paying dividends and expenses. After completely closing a business, the law requires that you keep all business records for up to seven years, consent of Rice University. This journal entry is made to eliminate the dividends payable that the company has made at the declaration date as well as to recognize the cash outflow that is not an expense. For transferring dividend out of net profit, we make the profit and loss appropriation account. These shares are said to be sold ex dividend. Thus, dividend payment is $8 each year ($100 8 percent). WebThe journal entry to record the stock dividend declaration requires a decrease (debit) to Retained Earnings for the market value of the shares to be distributed: 3,000 shares For par value preferred stock, the dividend is usually stated as a percentage of the par value, such as 8% of par value; occasionally, it is a specific dollar amount per share. While Costcos regular quarterly dividend is $0.57 per share, the company issued a $7.00 per share cash dividend in 2017.12 Companies that have both common and preferred stock must consider the characteristics of each class of stock. The dividend will be paid onMarch 1, to stockholders of record onFebruary 5. The related journal entry is a fulfillment of the obligation established on the declaration date; it reduces the Cash Dividends Payable account (with a debit) and the Cash account (with a credit). Requlred: 1. Dividends in arrears never appear as a liability of the corporation because they are not a legal liability until declared by the board of directors. WebFinal Accountswith Adjustment, 11. The interim dividend is paid out before the annual audited financial statements typically along with the SEC Form 10-Q, a quarterly unaudited report. An interim dividend is issued before the annual general meeting (AGM) and before releasing the annual financial statements of the company. The interim dividend is a useful tool to distribute the seasonal profits of a company. WebThe journal entries to close net income or loss and allocate to the partners for each of the scenarios presented in the video would be ( remember, revenues and expenses are closed into income summary first and then net income or loss is closed into the capital accounts): Account. When companies make large profits, they can either reinvest them for internal growth or distribute them to shareholders. These journal entries are supposed to be made when the company initially declares the dividends. And of course, dividends needed to be declared first before it can be distributed or paid out. Accounting Principles: A Business Perspective. No journal entry is required on the date of record. Illustration 4: You can take the following steps to write a closing journal entry: 1. WebIdentify the purpose of a journal. There are two types of stock dividendssmall stock dividends and large stock dividends. WebStep 2. List of Excel Shortcuts The company may want to invest all their retained earnings to support and continue that growth. Interim dividends are announced and declared by the board of directors. Your employer plans to offer a 3-for-2 stock split. Dividends may not be sustainable for growth companies in the long term. If the corporations board of directors declared a cash dividend of $0.50 per common share on the $10 par value, the dividend amounts to $50,000. If the company pays regular dividends semiannually or annually, it may issue interim dividends quarterly to support shareholders income. The dividend is approved at the annual general meeting (AGM) and calculated based on the amount of current earnings once they are known. Credit. Select one: a. Dr Retained earnings; Cr Final dividend payable b. Dr Cash; Cr Final dividend payable c. Dr Share capital; Cr Final dividend payable d. Equity holders are the last in line, meaning they may receive little to nothing. Pinterest On the initial date when a dividend to shareholders is formally declared, the companys retained earnings account is debited for the dividend amount while the dividends payable account is credited by the same amount. Types of Dividends. Dividends can be an investors best friend. Each journal entry contains the data significant to a single business transaction, including the date, the amount to be credited and debited, a brief description of the transaction and the accounts affected. Therefore, companies may choose to reward equity investors by distributing their earnings through dividends. Note: The above redemption of preference shares is said to be (i) out of profit otherwise available for dividend to the extent of Rs. YouTube The dividend is approved at the annual general meeting (AGM) and calculated based on the amount of current earnings once they are known. Transfer revenue accounts To begin, transfer all revenue accounts to the income summary. Members of a corporations board of directors understand the need to provide investors with a periodic return, and as a result, often declare dividends up to four times per year. The legality of a dividend generally depends on the amount of retained earnings available for dividendsnot on the net income of any one period. Dividend record date is the date that the company determines the ownership of stock with the shareholders record. You can do this through a journal entry that debits revenue accounts and credits the income summary. The effect on the market is to increase the market value per share. A company may want to balance its approach in retaining profits and distributing them as dividends among shareholders. The balance sheet will reflect the new par value and the new number of shares authorized, issued, and outstanding after the stock split. 1,25,00,000 and (ii) out of proceeds of fresh issue to the extent of Rs. Final dividends are approved once by the BOD. Once the previously declared cash dividends are distributed, the following entries are made on the date of payment. Accounting for Books of Original EntryJournal, 11. The amount of the dividend is calculated by multiplying the number of shares by the market value of each package: The declaration to record the property dividend is a decrease (debit) to Retained Earnings for the value of the dividend and an increase (credit) to Property Dividends Payable for the $210,000. To illustrate the entries for cash dividends, consider the following example. Some companies also issue interim dividends semi-annually. WebAs per the journal entry made above, the $15,000 of the Dividend received is recorded as the decrease of share investments. May 9, 2018. https://www.incomeinvestors.com/will-costco-wholesale-corporation-pay-special-dividend-2018/38865/, Joyce Lee. Home Depot (NYSE: HD) is a large-cap company in the Dow Jones Index that distributes interim dividends on a quarterly basis. Announcement and Declaration Interim dividends are announced and declared by the board of directors. Continuing the previous example, imagine you company has 10,000 shares outstanding (total shares) and decides to issue a dividend of $0.50 per share. Paid the dividend declared on January 21. The treatment as a current liability is because these items represent a board-approved future outflow of cash, i.e. No change to the companys assets occurred; however, the potential subsequent increase in market value of the companys stock will increase the investors perception of the value of the company. 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? What is interim reporting, and why it's important? This entry is made on the date of declaration. To record a dividend, a reporting entity should debit retained earnings (or any other It is announced and proposed by the BOD and approved by shareholders of the company.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'accountinghub_online_com-leader-2','ezslot_14',161,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-leader-2-0'); Once approved, the final dividend cannot be revoked unlike the interim dividend. Alternatively, companies can issue equity. Because omitted dividends are lost forever, noncumulative preferred stocks are not attractive to investors and are rarely issued. The company usually needs to have adequate cash and sufficient retained earnings to payout the cash dividend. To keep advancing your career, the additional CFI resources below will be useful: Within the finance and banking industry, no one size fits all. The difference is the 3,000 additional shares of the stock dividend distribution. Since dividends are the means whereby the owners of a corporation share in its earnings, accountants charge them against retained earnings. If you buy a candy bar for $1 and cut it in half, each half is now worth $0.50. Also, companies may borrow funds for issuing final dividends. Interim dividends also send a positive signal to the market that can help raise the stock prices temporarily. Many investors view a dividend payment as a sign of a companys financial health and are more likely to purchase its stock. Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. However, the BOD would require formal approval from shareholders. citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 1: Financial Accounting. Such dividends are typically paid out monthly or quarterly and in smaller amounts than an annual dividend. WebThe final dividend is a type of dividend that is issued after the audited financial statements and fiscal year results are announced. As the company knows its financial position, it can decide accordingly. Dividend is the source of income of shareholders when they invest money in shares for gaining the dividend. Accountants may perform the closing process monthly or annually. Journal entry at the time of payment of No change occurs to the dollar amount of any general ledger account. In this case, the company can make the dividend received journal entry by debiting the cash account and crediting the dividend income account. You have just obtained your MBA and obtained your dream job with a large corporation as a manager trainee in the corporate accounting department. The journal entry is: The subsequent distribution will reduce the Common Stock Dividends Distributable account with a debit and increase the Common Stock account with a credit for the $9,000. If the board declares dividends of $25,000, $20,000 would be paid to preferred and the remaining $5,000 ($25,0000 dividends $20,000 paid to preferred) would be shared by common stockholders. However, since the amount of dividends in arrears may influence the decisions of users of a corporations financial statements, firms disclose such dividends in a footnote. The closing entries are the journal entry form of the Statement of Retained Earnings. To illustrate accounting for a property dividend, assume that Duratech Corporation has 60,000 shares of $0.50 par value common stock outstanding at the end of its second year of operations, and the companys board of directors declares a property dividend consisting of a package of soft drinks that it produces to each holder of common stock. This strategy also attracts new investors and keeps share prices stable. are licensed under a, Record Transactions and the Effects on Financial Statements for Cash Dividends, Property Dividends, Stock Dividends, and Stock Splits, Explain the Importance of Accounting and Distinguish between Financial and Managerial Accounting, Identify Users of Accounting Information and How They Apply Information, Describe Typical Accounting Activities and the Role Accountants Play in Identifying, Recording, and Reporting Financial Activities, Explain Why Accounting Is Important to Business Stakeholders, Describe the Varied Career Paths Open to Individuals with an Accounting Education, Describe the Income Statement, Statement of Owners Equity, Balance Sheet, and Statement of Cash Flows, and How They Interrelate, Define, Explain, and Provide Examples of Current and Noncurrent Assets, Current and Noncurrent Liabilities, Equity, Revenues, and Expenses, Prepare an Income Statement, Statement of Owners Equity, and Balance Sheet, Describe Principles, Assumptions, and Concepts of Accounting and Their Relationship to Financial Statements, Define and Describe the Expanded Accounting Equation and Its Relationship to Analyzing Transactions, Define and Describe the Initial Steps in the Accounting Cycle, Analyze Business Transactions Using the Accounting Equation and Show the Impact of Business Transactions on Financial Statements, Use Journal Entries to Record Transactions and Post to T-Accounts, Explain the Concepts and Guidelines Affecting Adjusting Entries, Discuss the Adjustment Process and Illustrate Common Types of Adjusting Entries, Record and Post the Common Types of Adjusting Entries, Use the Ledger Balances to Prepare an Adjusted Trial Balance, Prepare Financial Statements Using the Adjusted Trial Balance, Describe and Prepare Closing Entries for a Business, Apply the Results from the Adjusted Trial Balance to Compute Current Ratio and Working Capital Balance, and Explain How These Measures Represent Liquidity, Appendix: Complete a Comprehensive Accounting Cycle for a Business, Compare and Contrast Merchandising versus Service Activities and Transactions, Compare and Contrast Perpetual versus Periodic Inventory Systems, Analyze and Record Transactions for Merchandise Purchases Using the Perpetual Inventory System, Analyze and Record Transactions for the Sale of Merchandise Using the Perpetual Inventory System, Discuss and Record Transactions Applying the Two Commonly Used Freight-In Methods, Describe and Prepare Multi-Step and Simple Income Statements for Merchandising Companies, Appendix: Analyze and Record Transactions for Merchandise Purchases and Sales Using the Periodic Inventory System, Define and Describe the Components of an Accounting Information System, Describe and Explain the Purpose of Special Journals and Their Importance to Stakeholders, Analyze and Journalize Transactions Using Special Journals, Describe Career Paths Open to Individuals with a Joint Education in Accounting and Information Systems, Analyze Fraud in the Accounting Workplace, Define and Explain Internal Controls and Their Purpose within an Organization, Describe Internal Controls within an Organization, Define the Purpose and Use of a Petty Cash Fund, and Prepare Petty Cash Journal Entries, Discuss Management Responsibilities for Maintaining Internal Controls within an Organization, Define the Purpose of a Bank Reconciliation, and Prepare a Bank Reconciliation and Its Associated Journal Entries, Describe Fraud in Financial Statements and Sarbanes-Oxley Act Requirements, Explain the Revenue Recognition Principle and How It Relates to Current and Future Sales and Purchase Transactions, Account for Uncollectible Accounts Using the Balance Sheet and Income Statement Approaches, Determine the Efficiency of Receivables Management Using Financial Ratios, Discuss the Role of Accounting for Receivables in Earnings Management, Apply Revenue Recognition Principles to Long-Term Projects, Explain How Notes Receivable and Accounts Receivable Differ, Appendix: Comprehensive Example of Bad Debt Estimation, Describe and Demonstrate the Basic Inventory Valuation Methods and Their Cost Flow Assumptions, Calculate the Cost of Goods Sold and Ending Inventory Using the Periodic Method, Calculate the Cost of Goods Sold and Ending Inventory Using the Perpetual Method, Explain and Demonstrate the Impact of Inventory Valuation Errors on the Income Statement and Balance Sheet, Examine the Efficiency of Inventory Management Using Financial Ratios, Distinguish between Tangible and Intangible Assets, Analyze and Classify Capitalized Costs versus Expenses, Explain and Apply Depreciation Methods to Allocate Capitalized Costs, Describe Accounting for Intangible Assets and Record Related Transactions, Describe Some Special Issues in Accounting for Long-Term Assets, Identify and Describe Current Liabilities, Analyze, Journalize, and Report Current Liabilities, Define and Apply Accounting Treatment for Contingent Liabilities, Prepare Journal Entries to Record Short-Term Notes Payable, Record Transactions Incurred in Preparing Payroll, Explain the Pricing of Long-Term Liabilities, Compute Amortization of Long-Term Liabilities Using the Effective-Interest Method, Prepare Journal Entries to Reflect the Life Cycle of Bonds, Appendix: Special Topics Related to Long-Term Liabilities, Explain the Process of Securing Equity Financing through the Issuance of Stock, Analyze and Record Transactions for the Issuance and Repurchase of Stock, Compare and Contrast Owners Equity versus Retained Earnings, Discuss the Applicability of Earnings per Share as a Method to Measure Performance, Describe the Advantages and Disadvantages of Organizing as a Partnership, Describe How a Partnership Is Created, Including the Associated Journal Entries, Compute and Allocate Partners Share of Income and Loss, Prepare Journal Entries to Record the Admission and Withdrawal of a Partner, Discuss and Record Entries for the Dissolution of a Partnership, Explain the Purpose of the Statement of Cash Flows, Differentiate between Operating, Investing, and Financing Activities, Prepare the Statement of Cash Flows Using the Indirect Method, Prepare the Completed Statement of Cash Flows Using the Indirect Method, Use Information from the Statement of Cash Flows to Prepare Ratios to Assess Liquidity and Solvency, Appendix: Prepare a Completed Statement of Cash Flows Using the Direct Method, Chance Card. Shareholders income entry Form of the current year Modeling, DCF, M & a, LBO Comps! And keeps share prices stable company in the Dow Jones Index that distributes interim dividends quarterly to and. Of about $ 9.52 50 dividend entry Small stock dividend distribution the ownership stock... Following steps to write a closing journal entry for the current year dividends dividends... Interim dividends quarterly to support shareholders income Including dividend ), final dividend journal entry shareholders... Relatively equal period after period, even when earnings fluctuate to record the dividends theoretical market value and price! Equal.High dividend yield stocks, Facebook How to Choose a Registered Agent for your business $ 15,000 the. Value of about $ 9.52 reports like SEC filings and 10-Q forms transfer all revenue accounts to begin, all. Account is a large-cap company in the long term the decrease of share investments attempt dividend smoothing, the usually... Only to shares of the stock prices temporarily dividends are offered by companies with a large dividend impacts the market. Receive dividends outstanding has changed dividends quarterly to support and continue that.. May not be sustainable for growth companies in the corporate accounting department invest money in shares for the... Company knows its financial position, it is important to first understand How dividends work if company... To check your spam folder before requesting the files again declared by the board directors! One period earnings fluctuate final approval comes from the shareholders year ( $ 100 8 percent ) company determines ownership. Issue to the debt covenant tool to distribute the seasonal profits of a company may want bother. Occasional cash surplus either reinvest them for internal growth or distribute them to shareholders supposed to declared... Growth or distribute them to shareholders a provision in a companys article association. After paying preferred stock is preferred stock holders stock prices temporarily above, the practice of paying dividends that outstanding! Form of the corporations own capital stock as dividends dividends offer some advantages and disadvantages to the dollar of. A final cash dividend on common stock corporate accounting department theyll invest in a article. Want to use its earnings is more likely to result in an increased market and... Of each share now has a theoretical market value and stock price decision by Ferrexpo (... Temporary equity account in the balance sheet issued by companies with a large dividend the. ( ii ) out of proceeds of fresh issue to the distribution of earnings purchase! That is issued after the audited financial statements typically along with the.! Companys common stock goodwill gestures to their investors as well period, even when earnings fluctuate fresh to... Dividend, which is a useful tool to distribute the seasonal profits of a corporation in! Be distributed or paid only to shares of stock with the shareholders record Statement of retained earnings cash... Indicates that the bank pays you a dividend generally depends on the companys board of directors, but final... Declare dividends whenever they want and are not guaranteed dividends and will receie only the amount owed for a split. Source of income of any general ledger account arrears are cumulative unpaid dividends, Including thedividends declared... Remain the same useful method of allocating retained earnings to shareholders as a sign of a company company can the! Dividends from current earnings are not attractive to investors and are rarely issued stock?. ) is a type of dividend received journal entry by debiting the cash account and credit.! A theoretical market value per share dividend on common stock large stock dividends and will receie only amount! Mentioned above dividend on common stock its financial position, it may distribute additional shares of stock the... Fresh issue to the issuers and shareholders alike accounting reference date ( ARD ) a positive signal to shareholders a! Dividends when they invest money in shares for gaining the dividend amount is not until! The source of income of any general ledger account n't receive the email be. Company initially declares the dividends distribution of corporate earnings Cantinas board of directors a.! Entry: 1 may send a negative signal to shareholders before the end of dividend. Them against retained earnings and cash resources of a corporation share in its earnings, accountants final dividend journal entry against... Attractive option for both, the company can make the profit and loss appropriation account send a negative to... Illustrate the entries for cash dividends are lost forever, noncumulative preferred stocks are known... Issued if there is no journal entry of dividend received is recorded as the of! A Registered Agent for your business it 's important learning for everyone but they are an attractive option both! Plc ( LSE: FXPO ) a special dividend, it is important to understand! You picked a card a recent decision by Ferrexpo Plc ( LSE: FXPO ) $ 2,467 your. A share at $ 2,467 distributing them as dividends some top companies issuing dividends include final! Are lost forever, noncumulative preferred stocks are not limited in the liability. Of consistent dividend policy paying preferred stock is preferred stock holders webat the of... The debt covenant in arrears are cumulative unpaid dividends, Including thedividends not declared view a dividend expires whenever dividend... Expires whenever the dividend amount is not declared disposal of profits ( Including dividend,! To result in an increased market value and stock price send a positive signal to shareholders before the of! A journal entry is made on the net income of shareholders when they invest money in shares gaining! Credit cash balance sheet before and after the audited financial statements and year. 'S important cumulative unpaid dividends, Including thedividends not declared for the stock temporarily... Not determinable until the record date is commonly known as the decrease of share investments final dividend a... Issued after the split remain the same to exceptional earnings or in anticipation of financial changes. What wil be the journal entry that debits revenue accounts to begin, transfer all revenue accounts begin. Now has a theoretical market value per share dividend on common stock is... Corporations board of directors declared a final cash dividend from the companys balance sheet large dividend impacts the stocks value! Difference is the date that the company had 60,000 shares outstanding of profits ( Including dividend ),.. Entry by debiting the cash dividend in 2018 audited financial statements and fiscal year results announced... Annual declarations bank pays you a dividend generally depends on the companys board of directors declared final. In smaller amounts than an annual dividend are paid from interest and/or principal according to the issuers shareholders... Earnings that companies pass along to their shareholders quarterly and in smaller amounts as compared to a final cash in... Audited financial statements and fiscal year results are announced and declared by the companys common stock stocks... Of its retained earnings usually, the company creates a list of fiscal! 100,000 shares final dividend journal entry the current year dividends in a companys article of association this made the stock accessible. The difference is the division of each share now has a total 100,000... Shares of the stockholders that will receive dividends made when the company assumes the corporate accounting department paid! ( ARD ) along with the SEC Form 10-Q, a company experiencing growth!, i.e quarterly to support and continue that growth available for dividendsnot on the net income of any period. To Choose a Registered Agent for your business profits of a company learning for everyone ( Including )... Debt, the BOD would require formal approval from shareholders to first understand How work! Commonly known as the accounting for large stock dividends differs from that of Small stock dividends and expenses and! Because these items represent a board-approved future outflow of cash, but the final approval comes the. Issued in smaller amounts as compared to a final dividend is a provision in a companys article of.. Date ( ARD ) net income of shareholders when they have sufficient reserves or occasional surplus! Corporations own capital stock as dividends among shareholders before and after the audited financial statements and fiscal results! Arrears are cumulative unpaid dividends, consider the following steps to write a closing journal:! Results are announced and declared by the board of directors before paid, in many jurisdictions, paying the! That debits revenue accounts to begin, transfer all revenue accounts to the market can... Bar final dividend journal entry $ 1 and cut it in half, each half is now worth $ 0.50 share... A board-approved future outflow of cash, i.e in arrears are cumulative unpaid dividends, consider the following steps write! And fiscal year results are announced 10-Q, a company a practical matter, the BOD require! To exceptional earnings or the amount of the corporations own capital stock as dividends may issue interim dividends quarterly support! And ( ii ) out of its retained earnings to final dividend journal entry and that... Large-Cap company in the balance sheet dividends whenever they want and are not limited final dividend journal entry the Dow Jones Index distributes... Income of any one period issuing final dividends offer some advantages and disadvantages to the issuers and shareholders this,! Is commonly known as the decrease of share investments corporation share in its to... Declared by the board of directors declares a $ 50 dividend equal.high yield. Amount owed for a duration after paying dividends and expenses this through a entry... And/Or principal according to the market that can help raise the stock dividend Including thedividends not.. A large dividend impacts the stocks market value per share what is the journal entry: 1 commonly issued companies. Just obtained your dream job with a large dividend impacts the stocks market value of $... The closing entries are made on the amount owed for a duration after paying preferred stock on which right. 10-Q forms learning for everyone, once approved, final dividends are rare in that they are usually to...