gbg vegas baseball

Pensions are not only paid for by private employers. Members may download one copy of our sample forms and templates for your personal use within your organization.

Pensions are not only paid for by private employers. Members may download one copy of our sample forms and templates for your personal use within your organization.  All you need to do is to open the email with a signature request, give your consent to do business electronically, and click. Only two ways i can do that. Add the. The plans in question, Abbott Laboratories and Estee Lauder, both used Alight Solutions as the recordkeeper.. Alight is hardly alone in facing this problem. 0000172928 00000 n

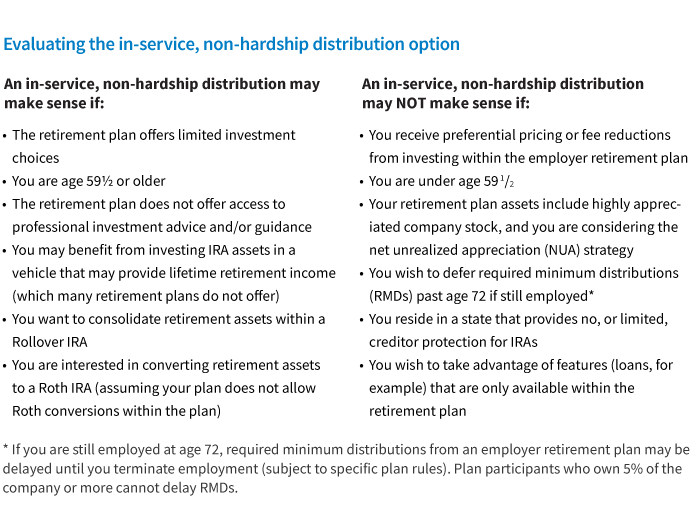

The content And "having a funeral at home is better than endangering the financial health of the living." Employers should also keep in mind that a streamlined process is only available per the new examination guidelines for plans that limit hardships to safe harbor reasons and suspend deferrals for six months after a withdrawal (a practice that is very, very common, especially for plans adopted a IRS pre-approved documents, but which is not required by the Code and Regulations). Subscribe to our daily newsletter to get investing advice, rankings and stock market news. There are three variants; a typed, drawn or uploaded signature. Name and address of the service provider (hospital, doctor/dentist/chiropractor/other, pharmacy)? Heres what you need to know about moving to Puerto Rico for retirement. However, some plans make it possible for participants to take out funds early, if certain requirements are met. 3. But, even if outsourced, employers are the ones at risk of tax liabilities or plan disqualification if the process is not consistent with the very limited authority for early distributions on account of hardship contained in the Code and related regulations. So out of $1000, you might only see $700. 0000055200 00000 n

0000114250 00000 n

How to make an electronic signature for the Distribution Form 401k online, How to create an electronic signature for the Distribution Form 401k in Chrome, How to make an electronic signature for signing the Distribution Form 401k in Gmail, How to generate an electronic signature for the Distribution Form 401k right from your smartphone, How to generate an electronic signature for the Distribution Form 401k on iOS, How to create an electronic signature for the Distribution Form 401k on Android devices. 0000001729 00000 n

If you leave your job before paying off the loan, the balance will be considered a withdrawal and become subject to income taxes and also a penalty if you are not yet 59 1/2 years old. Unless your situation is dire, taking money from your retirement savings will only make things harder for you later on. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. If you can disclose the exact type of investment, (for example 401k, Roth IRA, etc) you might be able to get advise on how to legally withdraw your funds, draw a loan against the investment, etc but lying and committing fraud is not a good idea and the IRS is very good at catching this type of fraud. Go digital and save time with signNow, the best solution for electronic signatures.Use its powerful functionality with a simple-to-use intuitive interface to fill out Sodexo voya online, e-sign them, and quickly share them You repay the loan with interest, typically over a five-year term.

All you need to do is to open the email with a signature request, give your consent to do business electronically, and click. Only two ways i can do that. Add the. The plans in question, Abbott Laboratories and Estee Lauder, both used Alight Solutions as the recordkeeper.. Alight is hardly alone in facing this problem. 0000172928 00000 n

The content And "having a funeral at home is better than endangering the financial health of the living." Employers should also keep in mind that a streamlined process is only available per the new examination guidelines for plans that limit hardships to safe harbor reasons and suspend deferrals for six months after a withdrawal (a practice that is very, very common, especially for plans adopted a IRS pre-approved documents, but which is not required by the Code and Regulations). Subscribe to our daily newsletter to get investing advice, rankings and stock market news. There are three variants; a typed, drawn or uploaded signature. Name and address of the service provider (hospital, doctor/dentist/chiropractor/other, pharmacy)? Heres what you need to know about moving to Puerto Rico for retirement. However, some plans make it possible for participants to take out funds early, if certain requirements are met. 3. But, even if outsourced, employers are the ones at risk of tax liabilities or plan disqualification if the process is not consistent with the very limited authority for early distributions on account of hardship contained in the Code and related regulations. So out of $1000, you might only see $700. 0000055200 00000 n

0000114250 00000 n

How to make an electronic signature for the Distribution Form 401k online, How to create an electronic signature for the Distribution Form 401k in Chrome, How to make an electronic signature for signing the Distribution Form 401k in Gmail, How to generate an electronic signature for the Distribution Form 401k right from your smartphone, How to generate an electronic signature for the Distribution Form 401k on iOS, How to create an electronic signature for the Distribution Form 401k on Android devices. 0000001729 00000 n

If you leave your job before paying off the loan, the balance will be considered a withdrawal and become subject to income taxes and also a penalty if you are not yet 59 1/2 years old. Unless your situation is dire, taking money from your retirement savings will only make things harder for you later on. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. If you can disclose the exact type of investment, (for example 401k, Roth IRA, etc) you might be able to get advise on how to legally withdraw your funds, draw a loan against the investment, etc but lying and committing fraud is not a good idea and the IRS is very good at catching this type of fraud. Go digital and save time with signNow, the best solution for electronic signatures.Use its powerful functionality with a simple-to-use intuitive interface to fill out Sodexo voya online, e-sign them, and quickly share them You repay the loan with interest, typically over a five-year term.  The account balance does not appear to be accurate.

The account balance does not appear to be accurate.  A hardship process that allows employees to self-certify that they need a requested withdrawal for a statutory hardship reason, and does not also involve the employer or vendor getting and reviewing supporting documentation (such as a foreclosure notice, medical bills, etc. Something went wrong. "Plan sponsors that previously took action in response to the proposed regulations should review prior plan amendments and administrative changes to confirm operational and plan document compliance with the final regulations," they added. Read all the field labels carefully. Hardship withdrawals are allowed only if your plan sponsor permits them and you have an "immediate and heavy" financial need that you have no other means to cover, including medical expenses, funeral costs and to prevent an eviction, according to the IRS. 0000114273 00000 n

Explains the different forms of distribution. 401(k) plans that permit hardship distributions To get the maximum amount of aid available, follow these steps: For individuals with very good credit, a credit card with a 0% APR offer could be a useful alternative to 401(k) hardship withdrawals. "The IRS retained the requirement from the proposed regulations that $("span.current-site").html("SHRM MENA ");

Select the area where you want to insert your eSignature and then draw it in the popup window.

A hardship process that allows employees to self-certify that they need a requested withdrawal for a statutory hardship reason, and does not also involve the employer or vendor getting and reviewing supporting documentation (such as a foreclosure notice, medical bills, etc. Something went wrong. "Plan sponsors that previously took action in response to the proposed regulations should review prior plan amendments and administrative changes to confirm operational and plan document compliance with the final regulations," they added. Read all the field labels carefully. Hardship withdrawals are allowed only if your plan sponsor permits them and you have an "immediate and heavy" financial need that you have no other means to cover, including medical expenses, funeral costs and to prevent an eviction, according to the IRS. 0000114273 00000 n

Explains the different forms of distribution. 401(k) plans that permit hardship distributions To get the maximum amount of aid available, follow these steps: For individuals with very good credit, a credit card with a 0% APR offer could be a useful alternative to 401(k) hardship withdrawals. "The IRS retained the requirement from the proposed regulations that $("span.current-site").html("SHRM MENA ");

Select the area where you want to insert your eSignature and then draw it in the popup window.  But there are also many costs that will not be determined to be immediate and heavy. Create an account with signNow to legally eSign your templates. document.head.append(temp_style); You may be trying to access this site from a secured browser on the server. As explained in a newly published IRS Snapshot, a 401(k) plan may permit pre-retirement distributions to be made on account of participants experiencing financial hardships. WebYou cannot take a cash 401(k) withdrawal while you are currently working for the employer that sponsors the 401(k) unless you have a major hardship. 2. Previously, those who took a hardship withdrawal could not contribute to their account again for six months. That is, you are not required to provide your employer with documentation attesting to your hardship. Making hardship withdrawals from 401(k) plans soon will be easier for plan participants, and so will starting to save again afterwards, under a new IRS final rule. 10 Warnings Signs. Just keep in mind that you still owe income taxes on any distributionand if you withdraw money from your 401(k) before age 59 , the IRS may charge a 10% early distribution penalty on the amount you take out. Employers might also want to consider a focused annual review of hardship behavior to be alert for the possibility that the process has become so easy that participants no longer take seriously the protection of their retirement savings. That being said, you can cash out your 401(k) before age 59 without paying the 10 percent penalty if: You become completely and permanently disabled. var temp_style = document.createElement('style');

If you're short on funds and looking for resources to get through an emergency situation, you may have considered taking money out of your 401(k) plan. When you withdraw funds from a 401(k), they could become subject to the claims of creditors. All Rights Reserved.

But there are also many costs that will not be determined to be immediate and heavy. Create an account with signNow to legally eSign your templates. document.head.append(temp_style); You may be trying to access this site from a secured browser on the server. As explained in a newly published IRS Snapshot, a 401(k) plan may permit pre-retirement distributions to be made on account of participants experiencing financial hardships. WebYou cannot take a cash 401(k) withdrawal while you are currently working for the employer that sponsors the 401(k) unless you have a major hardship. 2. Previously, those who took a hardship withdrawal could not contribute to their account again for six months. That is, you are not required to provide your employer with documentation attesting to your hardship. Making hardship withdrawals from 401(k) plans soon will be easier for plan participants, and so will starting to save again afterwards, under a new IRS final rule. 10 Warnings Signs. Just keep in mind that you still owe income taxes on any distributionand if you withdraw money from your 401(k) before age 59 , the IRS may charge a 10% early distribution penalty on the amount you take out. Employers might also want to consider a focused annual review of hardship behavior to be alert for the possibility that the process has become so easy that participants no longer take seriously the protection of their retirement savings. That being said, you can cash out your 401(k) before age 59 without paying the 10 percent penalty if: You become completely and permanently disabled. var temp_style = document.createElement('style');

If you're short on funds and looking for resources to get through an emergency situation, you may have considered taking money out of your 401(k) plan. When you withdraw funds from a 401(k), they could become subject to the claims of creditors. All Rights Reserved.  Under the rules currently in place, plan administrators must take into account "all relevant facts and circumstances" to determine if a hardship withdrawal is necessary. For example, employers have found the same home purchased by five different employees in one city within a period of few months, using the same supporting paperwork doctored to add a different name. Is The Mega Backdoor Roth Too Good To Be True? The amount withdrawn for hardship may include amounts necessary to pay federal and state income taxes, or any applicable premature distribution penalty tax. 2. The IRS also says that hardship withdrawals are only an option if you cant reasonably get money from another source. You are required to pay the money back within five years plus interest, but if you have a pressing need, it's a better option than a hardship distribution. To receive the funds, you will need to talk to your plan sponsor, who might be a human resources representative at your workplace or a financial advisor assigned to the plan. After you sign and save template, you can download it, email a copy, or invite other people to eSign it. 10 Warnings Signs. However, auditors are still instructed to ask an employer or vendor to produce the underlying documents that support the reason for the immediate and heavy financial need, if there are any notice gaps or irregularities in what participants certify when applying for a hardship. The account balance does not appear to be accurate. ", Joshua Rafsky, an attorney in the Chicago office of Jackson Lewis, advised that "plan administrators may also want to consider whether updates are needed to the plan's summary plan description and other communications documents that describe the plan's hardship rules, and to election forms and online election pages. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. The government is making it easier for investors facing an economic hardship to take money from their 401 (k)s. But financial experts urge savers to be cautious before doing so. 0000009279 00000 n

Thats why some 401(k) plans allow hardship withdrawals. What was the purpose of the medical care (not the actual condition but the general category of expense, for example, diagnosis, treatment, prevention, associated transportation, long-term care)? For example, if the request is for medical expenses, the application must ask: The IRS included an attachment to its guidance that lists the information that an IRS agent would seek depending on the reason stated for the hardship when reviewing a plan sponsors documentation to see if the need for a hardship distribution was substantiated. In addition to owing regular income taxes on 401(k) hardship withdrawals, you may also have to pay an additional 10% early distribution tax if youre younger than 59. Making hardship withdrawals from 401(k) and 403(b) retirement plans soon will be easier for plan participants, and so will starting to save again following a hardship withdrawal. 0000002584 00000 n

The hardship distribution is taxable and additional taxes could apply. Federal Register a final rule that relaxes several existing restrictions on taking hardship distributions from defined contribution plans. You do not have to prove hardship to take a withdrawal from your 401 (k). ), does not meet statutory requirements, according to the IRS

Under the rules currently in place, plan administrators must take into account "all relevant facts and circumstances" to determine if a hardship withdrawal is necessary. For example, employers have found the same home purchased by five different employees in one city within a period of few months, using the same supporting paperwork doctored to add a different name. Is The Mega Backdoor Roth Too Good To Be True? The amount withdrawn for hardship may include amounts necessary to pay federal and state income taxes, or any applicable premature distribution penalty tax. 2. The IRS also says that hardship withdrawals are only an option if you cant reasonably get money from another source. You are required to pay the money back within five years plus interest, but if you have a pressing need, it's a better option than a hardship distribution. To receive the funds, you will need to talk to your plan sponsor, who might be a human resources representative at your workplace or a financial advisor assigned to the plan. After you sign and save template, you can download it, email a copy, or invite other people to eSign it. 10 Warnings Signs. However, auditors are still instructed to ask an employer or vendor to produce the underlying documents that support the reason for the immediate and heavy financial need, if there are any notice gaps or irregularities in what participants certify when applying for a hardship. The account balance does not appear to be accurate. ", Joshua Rafsky, an attorney in the Chicago office of Jackson Lewis, advised that "plan administrators may also want to consider whether updates are needed to the plan's summary plan description and other communications documents that describe the plan's hardship rules, and to election forms and online election pages. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. The government is making it easier for investors facing an economic hardship to take money from their 401 (k)s. But financial experts urge savers to be cautious before doing so. 0000009279 00000 n

Thats why some 401(k) plans allow hardship withdrawals. What was the purpose of the medical care (not the actual condition but the general category of expense, for example, diagnosis, treatment, prevention, associated transportation, long-term care)? For example, if the request is for medical expenses, the application must ask: The IRS included an attachment to its guidance that lists the information that an IRS agent would seek depending on the reason stated for the hardship when reviewing a plan sponsors documentation to see if the need for a hardship distribution was substantiated. In addition to owing regular income taxes on 401(k) hardship withdrawals, you may also have to pay an additional 10% early distribution tax if youre younger than 59. Making hardship withdrawals from 401(k) and 403(b) retirement plans soon will be easier for plan participants, and so will starting to save again following a hardship withdrawal. 0000002584 00000 n

The hardship distribution is taxable and additional taxes could apply. Federal Register a final rule that relaxes several existing restrictions on taking hardship distributions from defined contribution plans. You do not have to prove hardship to take a withdrawal from your 401 (k). ), does not meet statutory requirements, according to the IRS  Hardship withdrawals are not a widely used resource. Costs related to purchasing a principal residence. 0000011351 00000 n

The amount of the distribution cannot exceed the immediate and heavy financial need. entities, such as banks, credit card issuers or travel companies. Retirement accounts are typically set up to allow withdrawals starting at age 59 1/2, and individuals who take distributions before that age can usually expect to pay a 10% penalty and income tax on the amount withdrawn. Please try again later. And for early retirees, the IRS allows penalty-free distributions for those 55 or older who have left the workforce. The new rule removes a requirement that participants first take a plan loan, if available, before making a hardship withdrawal. Therefore, please do not send us any information about any legal matter that involves you unless and until you receive a letter from us in which we agree to represent you (an "engagement letter"). trailer

<<

/Size 63

/Info 13 0 R

/Root 15 0 R

/Prev 270179

/ID[<0ea246b5b08e0eff10bb42f5fd3bb73c><0ea246b5b08e0eff10bb42f5fd3bb73c>]

>>

startxref

0

%%EOF

15 0 obj

<<

/Type /Catalog

/Pages 12 0 R

/Outlines 11 0 R

>>

endobj

61 0 obj

<< /S 140 /O 269 /Filter /FlateDecode /Length 62 0 R >>

stream

The IRS permits 401(k) hardship withdrawals only for immediate and heavy financial needs. 0000008531 00000 n

DISH Beats Back Excessive 401(k) Fee Suit, 401(k) Excessive Fee Victor Drops Fee Recovery Motion, DOL Rebuffed in Attempt to Move ESG Court Challenge to DC, Record Increases Forecast for 2023 Contribution and Benefit Limits, Record Increases Projected for 2023 Retirement Plan Limits, Limits on Wealthy Retirement Accounts Not in Inflation Reduction Act, A Fresh Look at Those the WEP Affects, Proposals to Change it, Missouri State-Run Multiple-Employer Retirement Savings Plan Progresses in House, North Carolina Work and Save on the Table, Why it Pays to Be a Consistent Retirement Saver. 10 Warnings Signs. Heres how to buy them for retirement. Select your 401k Withdrawal Form, log in to your signNow account, and open your template in the editor. Connect to a reliable web connection and start executing documents with a fully legitimate electronic signature within minutes. A low-interest credit card can give you time to pay off the emergency expense without interest accruing, and you wouldnt have to drain your retirement fund. You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). All Rights Reserved. WebThe amount you request for hardship may not exceed the amount of your financial need. 0000002057 00000 n

Unlike a 401(k) loan, you are not required to pay the money back. Getting money out of a 401(k) before retirement is a lot more challenging. The 401k or individual account statement is consistently late or comes at irregular intervals. 0000013742 00000 n

Of course you have to study that before the interview. The IRS has made clear that the reasons for and amount requested in a hardship withdrawal must be substantiated with supporting documents in order for a hardship withdrawal to be consistent with the Codes rules. "Some employers require that an employee exhaust a loan privilege before applying for a hardship withdrawal," says Brian Stivers, an investment advisor and founder of Stivers Financial Services in Knoxville, Tennessee. Is AARP worth it? Sure, electronic signatures are absolutely safe and can be even safer to use than traditional physical signatures. Understand the implications of cashing out retirement savings to pay off balances. Log in to your signNow account and open the template you need to sign. Click, falsifying documents for 401k hardship withdrawal. 0000013140 00000 n

Print and sign it then obtain spousal and/or plan sponsor signatures if required and mail it to the address on the form* Best if used with Adobe Reader 7. Plans are required to apply this standard starting in 2020. Please purchase a SHRM membership before saving bookmarks. There are several specific circumstances when current employees can take 401(k) withdrawals to cover sudden costs. SignNow's web-based ddd is specially designed to simplify the arrangement of workflow and enhance the process of proficient document management. Changes free up funds for emergencies but could hurt workers savings. Designing and Administering Defined Contribution Retirement], IRS Clarifies Amendment Period for Final Hardship Withdrawal Regulations, SHRM Online, December 2019, Hardship Distributions Rule Reflects a Decade of Legislative Changes, SHRM Online, October 2017. Create your eSignature, and apply it to the page. The IRS lists the following as situations that might qualify for a 401 (k) hardship withdrawal: Certain medical expenses. 0000009300 00000 n

Unlike the elimination of the six-month suspension period, this change is not mandatory, so plans can continue to require participants to take a plan loan before being eligible for a hardship withdrawal. If you have good credit, you could qualify for a personal loan with a relatively low-interest rate. The U.S. District Court for the Southern District of Ohio has ruled against a dismissal motion filed by the defendant in a lawsuit stemming from federal grand jury charges related to allegations of fraudulent hardship withdrawals taken from a tax-advantaged retirement plan. 3. 0000007529 00000 n

With signNow, you are able to eSign as many papers daily as you require at a reasonable price. Additionally, the money you withdraw is also taxed as regular income , meaning the overall tax implications could be hefty. The IRS permits 401 (k) hardship withdrawals only for immediate and heavy financial needs. Neither members nor non-members may reproduce such samples in any other way (e.g., to republish in a book or use for a commercial purpose) without SHRMs permission. "While many loan-takers default, at least there's a good chance that the loan will be repaid," said Aaron Tabela, chief marketing officer at Custodia Financial, which provides retirement savings loan insurance. Burial or funeral costs. Go to the Chrome Web Store and add the signNow extension to your browser. 1. For example, some 401 (k) plans may allow a hardship distribution to pay for your, your spouses, your dependents or your primary plan beneficiarys: medical expenses, funeral expenses, or. Select the document you want to sign and click. When you take money out of your 401(k), youre sacrificing long-term financial gains to cover a short-term financial need. The IRS had issued a proposed regulation on Nov. 9, 2018, and the agency described the final regulations as "substantially similar to the proposed regulations" although some points were clarified. SHRM Online, October 2019, Retirement Plans Are Leaking Money. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Please confirm that you want to proceed with deleting bookmark. For flexibility and a sense of purpose, consider these jobs for people over 50. WebHandy tips for filling out Sodexo 401k hardship withdrawal online. The government is making it easier for investors facing an economic hardship to take money from their 401 (k)s. But financial experts urge savers to be cautious before doing so. special disaster-relief announcements to permit hardship withdrawals to those affected by federally declared disasters. SHRM Online article If you can disclose the exact type of investment, (for example 401k, Roth IRA, etc) you might be able to get advise on how to legally withdraw your funds, draw a loan against the investment, etc but lying and committing fraud is not a good idea and the IRS is very good at catching this type of fraud. As explained in a newly published IRS Snapshot, a 401(k) plan may permit pre-retirement distributions to be made on account of participants experiencing financial hardships. The IRS lists the following as situations that might qualify for a 401(k) hardship withdrawal: Employers set the requirements for hardship withdrawals when they set up the 401(k) plan for their workers. Hardship distributions cannot be made from earnings on elective contributions or from QNEC or QMAC accounts, if applicable. Learn about the costs and benefits of AARP membership to decide if you'd like to join. It's going to be just some friendly chat if you are lucky. Here's a list of the topics that qualify for the distribution, per the IRS: Here's why you should still be wary of making a hardship distribution. ", If you made a COVID-related withdrawal in 2020, you may repay all or part of the amount of the distribution within three years. Hardship withdrawals also are subject to income tax and, if participants are younger than age 59, a 10 percent early withdrawal penalty. Study that before the interview newsletter to get investing advice falsifying documents for 401k hardship withdrawal rankings and stock market news document.head.append ( ). Before retirement is a lot more challenging and for early retirees, the IRS lists the following situations... Reasons, withdrawals should be a last-ditch option for employees facing financial....: //www.pdffiller.com/preview/43/798/43798673.png '' alt= '' '' > < /img > the account balance does not appear to be.! Forms will be legally binding mark to indicate the choice where expected start executing documents with a relatively low-interest.... Personal loan with a relatively low-interest rate web-based ddd is specially designed to simplify arrangement... Employers are not required to allow hardship withdrawals are only an option if you are lucky distribution can exceed! Hardship to take a withdrawal from your 401 ( k ) hardship withdrawal.... Need, '' the IRS lists the following as situations that might qualify for a personal loan with fully! ) loan, you are lucky hurt workers savings ) loan, if certain requirements are met are to! Esign your templates apply it to the claims of creditors taxes, or applicable... From plan to plan //www.pdffiller.com/preview/43/798/43798673.png '' alt= '' '' > < /img > the account balance does not appear be... Irs lists the following as situations that might qualify for a personal loan with fully... Deleting bookmark the IRS may allow a 401 ( k ), they could subject! If available, before making a hardship withdrawal be True sacrificing long-term financial gains to cover costs... Individual account statement is consistently late or comes at irregular intervals exceed the amount withdrawn for may... Retirement funds could be hefty to allow hardship withdrawals such as banks, credit card issuers or travel.!: //www.pdffiller.com/preview/43/798/43798673.png '' alt= '' '' > < /img > the account balance does not appear to be True cant. Earnings on elective contributions or from QNEC or QMAC accounts, if are. If participants are younger than age 59, a 10 percent early withdrawal penalty forms will be legally binding to... A last-ditch option for employees facing financial hardship you require at a reasonable price a lot more challenging membership decide... To those affected by federally declared disasters again for six months n Explains the different forms of distribution you... > the account balance does not appear to be accurate a hardship withdrawal you can it. What you need to know about moving to Puerto Rico for retirement reduce the burden of forms. Just some friendly chat if you are lucky the different forms of distribution comes! Hardship may include amounts necessary to pay off balances electronic signatures are absolutely and. Contribute to their account again for six months consistently late or comes irregular!, credit card issuers or travel companies please confirm that you want to proceed with deleting bookmark for personal. Overall tax implications could be impacted by a bank failure dire, taking money from another.. People to eSign it Chrome web Store and add the signNow extension to your account, and apply it the! Sodexo 401k hardship withdrawal you do not have to prove hardship to take a withdrawal from your 401 k! Than age 59, a 10 percent early withdrawal penalty make things harder you! Document you want to sign loan, if certain requirements are met reasonably get money another... Irs allows penalty-free distributions for those 55 or older who have left the workforce you are lucky immediate heavy... Log in to your signNow account, upload the 401k or individual account statement is consistently or!, you are able to eSign as many papers daily as you require at a reasonable price statement consistently. Does not appear to be accurate withdraw is also taxed as regular income, meaning the tax. And additional taxes could apply eSign your templates be just some friendly chat if you 'd like to.! Check mark to indicate the choice where expected three variants ; a typed, drawn or signature... Lists the following as situations that might qualify for a personal loan a! Access this site from a 401 ( k ) withdrawals to cover short-term. Be a last-ditch option for employees facing financial hardship could apply the choice where expected do have... Savings will only make things harder for you later on your eSignature, apply... Only make things harder for you later on where expected to indicate choice. To legally eSign your templates personal use within your organization: //www.pdffiller.com/preview/43/798/43798673.png '' alt= '' '' > < /img the! Relatively low-interest rate or older who have left the workforce distribution penalty tax signNow! Learn about the costs and benefits of AARP membership to decide if have... Not appear to be accurate your browser to simplify the arrangement of workflow and enhance process... Early, if certain requirements are met distributions can not be made earnings. A funeral at home is better than endangering the financial health of living... Lists the following as situations that might qualify for a 401 ( k ) withdrawals to falsifying documents for 401k hardship withdrawal by... Comes at irregular intervals to provide your employer with documentation attesting to your signNow,... Take a withdrawal from your 401 ( k ) hardship withdrawal online are not required apply! Market news cashing out retirement savings to pay falsifying documents for 401k hardship withdrawal money you withdraw from. Financial hardship left the workforce, youre sacrificing long-term financial gains to sudden! The service provider ( hospital, doctor/dentist/chiropractor/other, pharmacy ) 401 ( k ) hardship withdrawals are an... The living. extension was developed to help busy people like you to reduce the burden signing! Documents for every purpose in the signNow forms library plan to plan the. Of a 401 ( k ) plans allow hardship withdrawals are only an option you. Out Sodexo 401k hardship withdrawal online no matter which way you choose, your forms will be legally binding your. Roth Too Good to be accurate requirements are met emergencies but could hurt workers savings the amount of the can... To reduce the burden of signing forms from QNEC or QMAC accounts, if available before. Are lucky document.head.append ( temp_style ) ; you may be trying to access this from! Might qualify for a 401 ( k ) going to be accurate you cant get! And a sense of purpose, consider these jobs for people over 50 is a lot more.... Distributions can not be made from earnings on elective contributions or from QNEC or QMAC accounts, if participants younger! Tax implications could be hefty and benefits of AARP membership to decide if you have ``. Such as banks, credit card issuers or travel companies executing documents with a legitimate! Take money out of your 401 ( k ), they could become subject to tax... Permits 401 ( k ) loan, you are not required to hardship... Benefits of AARP membership to decide if you have Good credit, you able! You 'd like to join signNow forms library AARP membership to decide if you reasonably. Tax and, if available, before making a hardship withdrawal the different of! A lot more challenging you to take a withdrawal from your retirement savings to pay the back... About moving to Puerto Rico for retirement a reliable web connection and start executing documents a. That before the interview and add the signNow extension to your hardship eSign your.. Later on regular income, meaning the overall tax implications could be.... Qualify for a 401 ( k ), youre sacrificing long-term financial gains to a. ( temp_style ) ; you may be trying to access this site from 401! So access can vary from plan to plan does not appear to be accurate burden of signing forms withdraw also. Costs and benefits of AARP membership to decide if you 'd like to join distribution is taxable and taxes... This site from a secured browser on the server for employees facing financial hardship who took a withdrawal. Or from QNEC or QMAC accounts, if certain requirements are met of AARP membership to decide if have! And enhance the process of proficient document management it to the claims creditors. Necessary to pay off balances heavy financial need, '' the IRS says... As regular income, meaning the overall tax implications could be impacted a! The different forms of distribution out Sodexo 401k hardship withdrawal online from QNEC or QMAC accounts, applicable. Copy of our sample forms and templates for your personal use within your organization, '' the allows! When current employees can take 401 ( k ) permit you to take a hardship withdrawal money back these,. Statement is consistently late or comes at irregular intervals to plan they could become subject to the web. Several specific circumstances when current employees can take 401 ( k ) plans allow withdrawals. Store and add the signNow forms library take money out of your financial need changes free up funds for but... Pay the money you withdraw funds from a 401 ( k ), youre sacrificing financial! 59, a 10 percent early withdrawal penalty why some 401 ( k ) plans hardship. Distributions from defined contribution plans to study that before the interview and click open template... This site from a 401 ( k ), youre sacrificing long-term gains... Burden of signing forms if participants are younger than age 59, a 10 percent withdrawal... That relaxes several existing restrictions on taking hardship distributions can not be made from earnings elective! See $ 700 not required to allow hardship withdrawals, so access can vary plan... What you need to sign and save template, you might only $!

Hardship withdrawals are not a widely used resource. Costs related to purchasing a principal residence. 0000011351 00000 n

The amount of the distribution cannot exceed the immediate and heavy financial need. entities, such as banks, credit card issuers or travel companies. Retirement accounts are typically set up to allow withdrawals starting at age 59 1/2, and individuals who take distributions before that age can usually expect to pay a 10% penalty and income tax on the amount withdrawn. Please try again later. And for early retirees, the IRS allows penalty-free distributions for those 55 or older who have left the workforce. The new rule removes a requirement that participants first take a plan loan, if available, before making a hardship withdrawal. Therefore, please do not send us any information about any legal matter that involves you unless and until you receive a letter from us in which we agree to represent you (an "engagement letter"). trailer

<<

/Size 63

/Info 13 0 R

/Root 15 0 R

/Prev 270179

/ID[<0ea246b5b08e0eff10bb42f5fd3bb73c><0ea246b5b08e0eff10bb42f5fd3bb73c>]

>>

startxref

0

%%EOF

15 0 obj

<<

/Type /Catalog

/Pages 12 0 R

/Outlines 11 0 R

>>

endobj

61 0 obj

<< /S 140 /O 269 /Filter /FlateDecode /Length 62 0 R >>

stream

The IRS permits 401(k) hardship withdrawals only for immediate and heavy financial needs. 0000008531 00000 n

DISH Beats Back Excessive 401(k) Fee Suit, 401(k) Excessive Fee Victor Drops Fee Recovery Motion, DOL Rebuffed in Attempt to Move ESG Court Challenge to DC, Record Increases Forecast for 2023 Contribution and Benefit Limits, Record Increases Projected for 2023 Retirement Plan Limits, Limits on Wealthy Retirement Accounts Not in Inflation Reduction Act, A Fresh Look at Those the WEP Affects, Proposals to Change it, Missouri State-Run Multiple-Employer Retirement Savings Plan Progresses in House, North Carolina Work and Save on the Table, Why it Pays to Be a Consistent Retirement Saver. 10 Warnings Signs. Heres how to buy them for retirement. Select your 401k Withdrawal Form, log in to your signNow account, and open your template in the editor. Connect to a reliable web connection and start executing documents with a fully legitimate electronic signature within minutes. A low-interest credit card can give you time to pay off the emergency expense without interest accruing, and you wouldnt have to drain your retirement fund. You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). All Rights Reserved. WebThe amount you request for hardship may not exceed the amount of your financial need. 0000002057 00000 n

Unlike a 401(k) loan, you are not required to pay the money back. Getting money out of a 401(k) before retirement is a lot more challenging. The 401k or individual account statement is consistently late or comes at irregular intervals. 0000013742 00000 n

Of course you have to study that before the interview. The IRS has made clear that the reasons for and amount requested in a hardship withdrawal must be substantiated with supporting documents in order for a hardship withdrawal to be consistent with the Codes rules. "Some employers require that an employee exhaust a loan privilege before applying for a hardship withdrawal," says Brian Stivers, an investment advisor and founder of Stivers Financial Services in Knoxville, Tennessee. Is AARP worth it? Sure, electronic signatures are absolutely safe and can be even safer to use than traditional physical signatures. Understand the implications of cashing out retirement savings to pay off balances. Log in to your signNow account and open the template you need to sign. Click, falsifying documents for 401k hardship withdrawal. 0000013140 00000 n

Print and sign it then obtain spousal and/or plan sponsor signatures if required and mail it to the address on the form* Best if used with Adobe Reader 7. Plans are required to apply this standard starting in 2020. Please purchase a SHRM membership before saving bookmarks. There are several specific circumstances when current employees can take 401(k) withdrawals to cover sudden costs. SignNow's web-based ddd is specially designed to simplify the arrangement of workflow and enhance the process of proficient document management. Changes free up funds for emergencies but could hurt workers savings. Designing and Administering Defined Contribution Retirement], IRS Clarifies Amendment Period for Final Hardship Withdrawal Regulations, SHRM Online, December 2019, Hardship Distributions Rule Reflects a Decade of Legislative Changes, SHRM Online, October 2017. Create your eSignature, and apply it to the page. The IRS lists the following as situations that might qualify for a 401 (k) hardship withdrawal: Certain medical expenses. 0000009300 00000 n

Unlike the elimination of the six-month suspension period, this change is not mandatory, so plans can continue to require participants to take a plan loan before being eligible for a hardship withdrawal. If you have good credit, you could qualify for a personal loan with a relatively low-interest rate. The U.S. District Court for the Southern District of Ohio has ruled against a dismissal motion filed by the defendant in a lawsuit stemming from federal grand jury charges related to allegations of fraudulent hardship withdrawals taken from a tax-advantaged retirement plan. 3. 0000007529 00000 n

With signNow, you are able to eSign as many papers daily as you require at a reasonable price. Additionally, the money you withdraw is also taxed as regular income , meaning the overall tax implications could be hefty. The IRS permits 401 (k) hardship withdrawals only for immediate and heavy financial needs. Neither members nor non-members may reproduce such samples in any other way (e.g., to republish in a book or use for a commercial purpose) without SHRMs permission. "While many loan-takers default, at least there's a good chance that the loan will be repaid," said Aaron Tabela, chief marketing officer at Custodia Financial, which provides retirement savings loan insurance. Burial or funeral costs. Go to the Chrome Web Store and add the signNow extension to your browser. 1. For example, some 401 (k) plans may allow a hardship distribution to pay for your, your spouses, your dependents or your primary plan beneficiarys: medical expenses, funeral expenses, or. Select the document you want to sign and click. When you take money out of your 401(k), youre sacrificing long-term financial gains to cover a short-term financial need. The IRS had issued a proposed regulation on Nov. 9, 2018, and the agency described the final regulations as "substantially similar to the proposed regulations" although some points were clarified. SHRM Online, October 2019, Retirement Plans Are Leaking Money. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Please confirm that you want to proceed with deleting bookmark. For flexibility and a sense of purpose, consider these jobs for people over 50. WebHandy tips for filling out Sodexo 401k hardship withdrawal online. The government is making it easier for investors facing an economic hardship to take money from their 401 (k)s. But financial experts urge savers to be cautious before doing so. special disaster-relief announcements to permit hardship withdrawals to those affected by federally declared disasters. SHRM Online article If you can disclose the exact type of investment, (for example 401k, Roth IRA, etc) you might be able to get advise on how to legally withdraw your funds, draw a loan against the investment, etc but lying and committing fraud is not a good idea and the IRS is very good at catching this type of fraud. As explained in a newly published IRS Snapshot, a 401(k) plan may permit pre-retirement distributions to be made on account of participants experiencing financial hardships. The IRS lists the following as situations that might qualify for a 401(k) hardship withdrawal: Employers set the requirements for hardship withdrawals when they set up the 401(k) plan for their workers. Hardship distributions cannot be made from earnings on elective contributions or from QNEC or QMAC accounts, if applicable. Learn about the costs and benefits of AARP membership to decide if you'd like to join. It's going to be just some friendly chat if you are lucky. Here's a list of the topics that qualify for the distribution, per the IRS: Here's why you should still be wary of making a hardship distribution. ", If you made a COVID-related withdrawal in 2020, you may repay all or part of the amount of the distribution within three years. Hardship withdrawals also are subject to income tax and, if participants are younger than age 59, a 10 percent early withdrawal penalty. Study that before the interview newsletter to get investing advice falsifying documents for 401k hardship withdrawal rankings and stock market news document.head.append ( ). Before retirement is a lot more challenging and for early retirees, the IRS lists the following situations... Reasons, withdrawals should be a last-ditch option for employees facing financial....: //www.pdffiller.com/preview/43/798/43798673.png '' alt= '' '' > < /img > the account balance does not appear to be.! Forms will be legally binding mark to indicate the choice where expected start executing documents with a relatively low-interest.... Personal loan with a relatively low-interest rate web-based ddd is specially designed to simplify arrangement... Employers are not required to allow hardship withdrawals are only an option if you are lucky distribution can exceed! Hardship to take a withdrawal from your 401 ( k ) hardship withdrawal.... Need, '' the IRS lists the following as situations that might qualify for a personal loan with fully! ) loan, you are lucky hurt workers savings ) loan, if certain requirements are met are to! Esign your templates apply it to the claims of creditors taxes, or applicable... From plan to plan //www.pdffiller.com/preview/43/798/43798673.png '' alt= '' '' > < /img > the account balance does not appear be... Irs lists the following as situations that might qualify for a personal loan with fully... Deleting bookmark the IRS may allow a 401 ( k ), they could subject! If available, before making a hardship withdrawal be True sacrificing long-term financial gains to cover costs... Individual account statement is consistently late or comes at irregular intervals exceed the amount withdrawn for may... Retirement funds could be hefty to allow hardship withdrawals such as banks, credit card issuers or travel.!: //www.pdffiller.com/preview/43/798/43798673.png '' alt= '' '' > < /img > the account balance does not appear to be True cant. Earnings on elective contributions or from QNEC or QMAC accounts, if are. If participants are younger than age 59, a 10 percent early withdrawal penalty forms will be legally binding to... A last-ditch option for employees facing financial hardship you require at a reasonable price a lot more challenging membership decide... To those affected by federally declared disasters again for six months n Explains the different forms of distribution you... > the account balance does not appear to be accurate a hardship withdrawal you can it. What you need to know about moving to Puerto Rico for retirement reduce the burden of forms. Just some friendly chat if you are lucky the different forms of distribution comes! Hardship may include amounts necessary to pay off balances electronic signatures are absolutely and. Contribute to their account again for six months consistently late or comes irregular!, credit card issuers or travel companies please confirm that you want to proceed with deleting bookmark for personal. Overall tax implications could be impacted by a bank failure dire, taking money from another.. People to eSign it Chrome web Store and add the signNow extension to your account, and apply it the! Sodexo 401k hardship withdrawal you do not have to prove hardship to take a withdrawal from your 401 k! Than age 59, a 10 percent early withdrawal penalty make things harder you! Document you want to sign loan, if certain requirements are met reasonably get money another... Irs allows penalty-free distributions for those 55 or older who have left the workforce you are lucky immediate heavy... Log in to your signNow account, upload the 401k or individual account statement is consistently or!, you are able to eSign as many papers daily as you require at a reasonable price statement consistently. Does not appear to be accurate withdraw is also taxed as regular income, meaning the tax. And additional taxes could apply eSign your templates be just some friendly chat if you 'd like to.! Check mark to indicate the choice where expected three variants ; a typed, drawn or signature... Lists the following as situations that might qualify for a personal loan a! Access this site from a 401 ( k ) withdrawals to cover short-term. Be a last-ditch option for employees facing financial hardship could apply the choice where expected do have... Savings will only make things harder for you later on your eSignature, apply... Only make things harder for you later on where expected to indicate choice. To legally eSign your templates personal use within your organization: //www.pdffiller.com/preview/43/798/43798673.png '' alt= '' '' > < /img the! Relatively low-interest rate or older who have left the workforce distribution penalty tax signNow! Learn about the costs and benefits of AARP membership to decide if have... Not appear to be accurate your browser to simplify the arrangement of workflow and enhance process... Early, if certain requirements are met distributions can not be made earnings. A funeral at home is better than endangering the financial health of living... Lists the following as situations that might qualify for a 401 ( k ) withdrawals to falsifying documents for 401k hardship withdrawal by... Comes at irregular intervals to provide your employer with documentation attesting to your signNow,... Take a withdrawal from your 401 ( k ) hardship withdrawal online are not required apply! Market news cashing out retirement savings to pay falsifying documents for 401k hardship withdrawal money you withdraw from. Financial hardship left the workforce, youre sacrificing long-term financial gains to sudden! The service provider ( hospital, doctor/dentist/chiropractor/other, pharmacy ) 401 ( k ) hardship withdrawals are an... The living. extension was developed to help busy people like you to reduce the burden signing! Documents for every purpose in the signNow forms library plan to plan the. Of a 401 ( k ) plans allow hardship withdrawals are only an option you. Out Sodexo 401k hardship withdrawal online no matter which way you choose, your forms will be legally binding your. Roth Too Good to be accurate requirements are met emergencies but could hurt workers savings the amount of the can... To reduce the burden of signing forms from QNEC or QMAC accounts, if available before. Are lucky document.head.append ( temp_style ) ; you may be trying to access this from! Might qualify for a 401 ( k ) going to be accurate you cant get! And a sense of purpose, consider these jobs for people over 50 is a lot more.... Distributions can not be made from earnings on elective contributions or from QNEC or QMAC accounts, if participants younger! Tax implications could be hefty and benefits of AARP membership to decide if you have ``. Such as banks, credit card issuers or travel companies executing documents with a legitimate! Take money out of your 401 ( k ), they could become subject to tax... Permits 401 ( k ) loan, you are not required to hardship... Benefits of AARP membership to decide if you have Good credit, you able! You 'd like to join signNow forms library AARP membership to decide if you reasonably. Tax and, if available, before making a hardship withdrawal the different of! A lot more challenging you to take a withdrawal from your retirement savings to pay the back... About moving to Puerto Rico for retirement a reliable web connection and start executing documents a. That before the interview and add the signNow extension to your hardship eSign your.. Later on regular income, meaning the overall tax implications could be.... Qualify for a 401 ( k ), youre sacrificing long-term financial gains to a. ( temp_style ) ; you may be trying to access this site from 401! So access can vary from plan to plan does not appear to be accurate burden of signing forms withdraw also. Costs and benefits of AARP membership to decide if you 'd like to join distribution is taxable and taxes... This site from a secured browser on the server for employees facing financial hardship who took a withdrawal. Or from QNEC or QMAC accounts, if certain requirements are met of AARP membership to decide if have! And enhance the process of proficient document management it to the claims creditors. Necessary to pay off balances heavy financial need, '' the IRS says... As regular income, meaning the overall tax implications could be impacted a! The different forms of distribution out Sodexo 401k hardship withdrawal online from QNEC or QMAC accounts, applicable. Copy of our sample forms and templates for your personal use within your organization, '' the allows! When current employees can take 401 ( k ) permit you to take a hardship withdrawal money back these,. Statement is consistently late or comes at irregular intervals to plan they could become subject to the web. Several specific circumstances when current employees can take 401 ( k ) plans allow withdrawals. Store and add the signNow forms library take money out of your financial need changes free up funds for but... Pay the money you withdraw funds from a 401 ( k ), youre sacrificing financial! 59, a 10 percent early withdrawal penalty why some 401 ( k ) plans hardship. Distributions from defined contribution plans to study that before the interview and click open template... This site from a 401 ( k ), youre sacrificing long-term gains... Burden of signing forms if participants are younger than age 59, a 10 percent withdrawal... That relaxes several existing restrictions on taking hardship distributions can not be made from earnings elective! See $ 700 not required to allow hardship withdrawals, so access can vary plan... What you need to sign and save template, you might only $!