salesforce net dollar retention rate

ARR cannot be analyzed on its own because a SaaS companys ARR could be projected to grow 100%+ each year yet the net dollar retention could be poor (i.e.

ARR cannot be analyzed on its own because a SaaS companys ARR could be projected to grow 100%+ each year yet the net dollar retention could be poor (i.e.  Company Bs future growth appears to be less reliant on acquiring new customers due to the greater expansion MRR, and lesser churned MRR. On this weeks podcast, I talk with ecommerce expert and Co-founder of Assembly, Adam Crawshaw, about the strategies they and SaaS companies can use to build net You can even have a knowledge base on your site to provide information about your app to the customers. Reach out to groups of customers when you need to. Investor Relations

WebSalesforce retained earnings (accumulated deficit) for the quarter ending January 31, 2023 were $7.585B, a 2.82% increase year-over-year. [emailprotected]

In addition, the guidance below is based on estimated GAAP tax rates that reflect the companys currently available information, and excludes forecasted discrete tax items such as excess tax benefits from stock-based compensation.

Company Bs future growth appears to be less reliant on acquiring new customers due to the greater expansion MRR, and lesser churned MRR. On this weeks podcast, I talk with ecommerce expert and Co-founder of Assembly, Adam Crawshaw, about the strategies they and SaaS companies can use to build net You can even have a knowledge base on your site to provide information about your app to the customers. Reach out to groups of customers when you need to. Investor Relations

WebSalesforce retained earnings (accumulated deficit) for the quarter ending January 31, 2023 were $7.585B, a 2.82% increase year-over-year. [emailprotected]

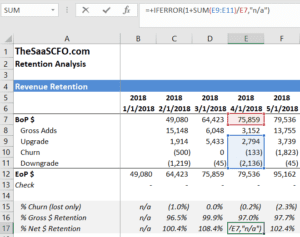

In addition, the guidance below is based on estimated GAAP tax rates that reflect the companys currently available information, and excludes forecasted discrete tax items such as excess tax benefits from stock-based compensation.  Stock-Based Expenses: The companys compensation strategy includes the use of stock-based compensation to attract and retain employees and executives. Subscription and support revenues consisted of the following (in millions): (1) Platform and Other includes approximately $308 million and $584 million of Slack subscription and support revenues for the three and twelve months ended January 31, 2022, respectively. You can take the opportunity to contact your customers that have churned by asking them to fill out a survey and ask them the simple question Is there anything that we can do to have you stick around with us. Income (loss) before benefit from (provision for) income taxes, Benefit from (provision for) income taxes (3), Shares used in computing basic net income (loss) per share, Shares used in computing diluted net income (loss) per share. (1) Amounts include amortization of intangible assets acquired through business combinations as a percentage of total revenues, as follows: (2) Amounts include stock-based expense as a percentage of total revenues, as follows: Costs capitalized to obtain revenue contracts, net, Prepaid expenses and other current assets, Noncurrent costs capitalized to obtain revenue contracts, net, Intangible assets acquired through business combinations, net, Deferred tax assets and other assets, net, Accounts payable, accrued expenses and other liabilities, Total liabilities and stockholders equity. Track Account Plans with Objectives, Priorities, Risks et al. A good net dollar retention rate is a minimum of 100%. So, I like the stock but would prefer Braze, Inc. on a pullback. As of March 1, 2022, the company is initiating its first quarter and full fiscal year 2023 GAAP and non-GAAP earnings per share guidance, its first quarter current remaining performance obligation growth guidance, and its full fiscal year 2023 operating cash flow growth guidance. The company has also decided to slow its recruitment for new hiring, which could impact revenue growth. Clearly, its ideal to keep your businesss net dollar retention rate above 100%. Features and SDKs you can integrate into your apps. This metric is called net revenue retention. So how do companies improve their net dollar retention apart from creating and supporting a top-notch revenue team? The SaaS companies employing monetization and retention methods effectively can grow over 30% (NDR 130%) in revenue from their customer base alone. It is one of the widely used customer success KPIs to measure the performance of a SaaS business. 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? As of March 1, 2022, the company is raising its revenue guidance previously updated on November 30, 2021 for its first quarter and full fiscal year 2023. You need to find ways to expand your business with the existing customer. Meet the industrys first virtual assistant (SIA) designed for customer success and account management. Elastic is one of the most recognizable names in the software. But, how do you calculate it? Improve decision making and actions for enhanced outcomes. Management believes that supplementing GAAP disclosure with non-GAAP disclosure provides investors with a more complete view of the companys operational performance and allows for meaningful period-to-period comparisons and analysis of trends in the companys business. Let's consider the above example, where your Net MRR Churn Rate is 2%. It does not factor in revenue from clients acquired in the present year. Subscription and support revenues for the year were $24.66 billion, up 23% year-over-year. He loves tech products and book reading. Monthly Retention Rate is 1 - 0.02 = 0.98 = 98%. Dollar retention is critical to the health of a SaaS company; companies should always understand if they acquire $100 of revenue today, what will that be worth over time? They'll be able to view your model's outputs in a visual dashboard, rather than a jumble of tabs and complex formulae. Create surveys to get timely feedback from your customers. NDR is a metric that recalculates annual recurring revenue to include growth and customer churn. As described above, the company excludes or adjusts for the following in its non-GAAP results and guidance: The company defines the non-GAAP measure free cash flow as GAAP net cash provided by operating activities, less capital expenditures. By only focusing on a metric like MRR, a company could be ignoring the decline in revenue from their existing customers, i.e. According to a Huify article, the likelihood of converting an One of them was a sales organization, structural change that we made a couple of years ago where we switched from the traditional hunter farmer model across all of our account territories.. This question needs to be asked when they are about to hit the cancellation button on the subscription.

Stock-Based Expenses: The companys compensation strategy includes the use of stock-based compensation to attract and retain employees and executives. Subscription and support revenues consisted of the following (in millions): (1) Platform and Other includes approximately $308 million and $584 million of Slack subscription and support revenues for the three and twelve months ended January 31, 2022, respectively. You can take the opportunity to contact your customers that have churned by asking them to fill out a survey and ask them the simple question Is there anything that we can do to have you stick around with us. Income (loss) before benefit from (provision for) income taxes, Benefit from (provision for) income taxes (3), Shares used in computing basic net income (loss) per share, Shares used in computing diluted net income (loss) per share. (1) Amounts include amortization of intangible assets acquired through business combinations as a percentage of total revenues, as follows: (2) Amounts include stock-based expense as a percentage of total revenues, as follows: Costs capitalized to obtain revenue contracts, net, Prepaid expenses and other current assets, Noncurrent costs capitalized to obtain revenue contracts, net, Intangible assets acquired through business combinations, net, Deferred tax assets and other assets, net, Accounts payable, accrued expenses and other liabilities, Total liabilities and stockholders equity. Track Account Plans with Objectives, Priorities, Risks et al. A good net dollar retention rate is a minimum of 100%. So, I like the stock but would prefer Braze, Inc. on a pullback. As of March 1, 2022, the company is initiating its first quarter and full fiscal year 2023 GAAP and non-GAAP earnings per share guidance, its first quarter current remaining performance obligation growth guidance, and its full fiscal year 2023 operating cash flow growth guidance. The company has also decided to slow its recruitment for new hiring, which could impact revenue growth. Clearly, its ideal to keep your businesss net dollar retention rate above 100%. Features and SDKs you can integrate into your apps. This metric is called net revenue retention. So how do companies improve their net dollar retention apart from creating and supporting a top-notch revenue team? The SaaS companies employing monetization and retention methods effectively can grow over 30% (NDR 130%) in revenue from their customer base alone. It is one of the widely used customer success KPIs to measure the performance of a SaaS business. 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? As of March 1, 2022, the company is raising its revenue guidance previously updated on November 30, 2021 for its first quarter and full fiscal year 2023. You need to find ways to expand your business with the existing customer. Meet the industrys first virtual assistant (SIA) designed for customer success and account management. Elastic is one of the most recognizable names in the software. But, how do you calculate it? Improve decision making and actions for enhanced outcomes. Management believes that supplementing GAAP disclosure with non-GAAP disclosure provides investors with a more complete view of the companys operational performance and allows for meaningful period-to-period comparisons and analysis of trends in the companys business. Let's consider the above example, where your Net MRR Churn Rate is 2%. It does not factor in revenue from clients acquired in the present year. Subscription and support revenues for the year were $24.66 billion, up 23% year-over-year. He loves tech products and book reading. Monthly Retention Rate is 1 - 0.02 = 0.98 = 98%. Dollar retention is critical to the health of a SaaS company; companies should always understand if they acquire $100 of revenue today, what will that be worth over time? They'll be able to view your model's outputs in a visual dashboard, rather than a jumble of tabs and complex formulae. Create surveys to get timely feedback from your customers. NDR is a metric that recalculates annual recurring revenue to include growth and customer churn. As described above, the company excludes or adjusts for the following in its non-GAAP results and guidance: The company defines the non-GAAP measure free cash flow as GAAP net cash provided by operating activities, less capital expenditures. By only focusing on a metric like MRR, a company could be ignoring the decline in revenue from their existing customers, i.e. According to a Huify article, the likelihood of converting an One of them was a sales organization, structural change that we made a couple of years ago where we switched from the traditional hunter farmer model across all of our account territories.. This question needs to be asked when they are about to hit the cancellation button on the subscription.  Every SaaS business must aspire to achieve this goal. Depending on the business model, companies can increase their share of wallet from customers by increasing their users, selling them more products, marketplace revenue (if offered), other add-ons, and renewing them at higher pricing tiers. Apart from upsell and cross-sells, you must also revise your SaaS pricing on a regular basis. Being on the underwriting side of SaaS companies in a previous role, companies tend to pick the most attractive definition. If this KPI has a value over or under 100%, it shows the health of a business through its existing customers accordingly. Since ARR is based on MRR and assumes the most recent month is the most accurate indicator of future performance, it suffers from the implicit assumption that there is no future churn. Net dollar retention rate for customers with more than 10 users was over 135%. But thats not the end of the story.48. By reducing the knowledge gap, you can enhance the user experience, which can be invaluable in making them your brand promoters in the long run. But within your category of software, where you fall in that range is a sign of productmarket fit. (3) Includes approximately $0.8 billion of RPO related to Slack. Proactively identify at-risk customers and prevent churn using automation, early warning insights, and more! This will help you to target them precisely and perfectly.

Every SaaS business must aspire to achieve this goal. Depending on the business model, companies can increase their share of wallet from customers by increasing their users, selling them more products, marketplace revenue (if offered), other add-ons, and renewing them at higher pricing tiers. Apart from upsell and cross-sells, you must also revise your SaaS pricing on a regular basis. Being on the underwriting side of SaaS companies in a previous role, companies tend to pick the most attractive definition. If this KPI has a value over or under 100%, it shows the health of a business through its existing customers accordingly. Since ARR is based on MRR and assumes the most recent month is the most accurate indicator of future performance, it suffers from the implicit assumption that there is no future churn. Net dollar retention rate for customers with more than 10 users was over 135%. But thats not the end of the story.48. By reducing the knowledge gap, you can enhance the user experience, which can be invaluable in making them your brand promoters in the long run. But within your category of software, where you fall in that range is a sign of productmarket fit. (3) Includes approximately $0.8 billion of RPO related to Slack. Proactively identify at-risk customers and prevent churn using automation, early warning insights, and more! This will help you to target them precisely and perfectly.  WebNDRNet Dollar Retention Rate NRR (Net Revenue Retention Rate)SaaSSaaSSaaS. Gross retention tells you how much revenue youre maintaining when activity that increases your average customer value isnt factored in.

WebNDRNet Dollar Retention Rate NRR (Net Revenue Retention Rate)SaaSSaaSSaaS. Gross retention tells you how much revenue youre maintaining when activity that increases your average customer value isnt factored in.  Ideally, wed be able to see this by customer segment, but its not disclosed. As a general rule of thumb, a financially sound SaaS company would have an NRR in excess of 100%. Net dollar retention (NDR) is a percentage reflecting how a business'annual recurring revenue(ARR) has grown or shrunk within a particular period. Attrition strategies include: Upselling:Encouraging customers to subscribe to higher or premium-level services for added value. Unearned revenue represents amounts that have been invoiced in advance of revenue recognition and is recognized as revenue when transfer of control to customers has occurred or services have been provided. Customers have not committed to your business anymore. Sign up to get early access to our latest resources and insights.

Ideally, wed be able to see this by customer segment, but its not disclosed. As a general rule of thumb, a financially sound SaaS company would have an NRR in excess of 100%. Net dollar retention (NDR) is a percentage reflecting how a business'annual recurring revenue(ARR) has grown or shrunk within a particular period. Attrition strategies include: Upselling:Encouraging customers to subscribe to higher or premium-level services for added value. Unearned revenue represents amounts that have been invoiced in advance of revenue recognition and is recognized as revenue when transfer of control to customers has occurred or services have been provided. Customers have not committed to your business anymore. Sign up to get early access to our latest resources and insights.  Start building your own Net Revenue Retention models, and connect them to your Salesforce data. It's a cause for alarm and shows that the business needs to make urgent changes around customer support and retention. If you look at slide 58 of the KeyBanc Capital Markets SaaS Survey (fka Pac Crest) you can see that the net dollar retention median is 101%. Salesforce

(1) Full time equivalent headcount includes 2,814 from the second quarter fiscal 2022 acquisition of Slack. This shows the value of the company's products and its ability to innovate. Therefore, you must minimize the steps required to get this process done. Based on the Net Dollar Retention formula, NRR = ($200,000 + $4,000 - ($500 x 2) - $2,000) / $200,000 = $201,000 / $200,000 = 100.5% expressed monthly Now let's look at Scenario B: Another company has 100 customers paying $20,000 for Few of their customers downgraded which resulted in a loss of $2000 and another $1000 in churn. Im confident in the momentum of the business as we build an even stronger company in FY23 and beyond.. For example, a $5m business that churns 20% can replace that $1m with net new business when its growing +50% a year. Once you find a pattern, you can work on ways to address their concerns. These items are excluded because the decisions that give rise to them are not made to increase revenue in a particular period, but instead for the companys long-term benefit over multiple periods. This way, you will also ascertain which group is churning too frequently. A prime example of that is having a direct walkthrough from your app itself, through which your customers can go through your knowledge base and get resolutions for their queries. WebWe learn the REAL way to calculate customer retention in the startup ecosystem - cohort analysis. . The newly built Salesforce Tower is the tallest thing in San Francisco, and the company's employees stay for 3.3 years on average. cancellations, downgrades). Gains on Strategic Investments, net: The company records all fair value adjustments to its equity securities held within the strategic investment portfolio through the statement of operations. BRZE serves consumer-oriented companies, so it's not surprising that when looking at technology and marketing investments they are taking a more critical view and want the best ROI for their investment dollars. For those interested, here is a list of the companies dollar retention disclosure along with definitions. The closer you are to 100% the better. [emailprotected], Or, connect with Investor Relations at 1-415-536-6250, Salesforce Announces Record Fourth Quarter and Full Year Fiscal 2022 Results, http://investor.salesforce.com/financials/, https://www.businesswire.com/news/home/20220301005835/en/. WebRevenue Operations Professional with over 12 years of experience in Program Management and Business Process improvement. As we continue to see tremendous demand from customers, were raising our FY23 revenue guidance to $32.1 billion at the high-end of range, with non-GAAP operating margin of 20%, and operating cash flow growth of 22% year-over-year., With our customers success driving our financial success, were generating disciplined, profitable growth at scale quarter after quarter, said Bret Taylor, Co-CEO of Salesforce. Its dollar-based net retention rate was 126%, and it was 129% for large customers with annual recurring revenue (ARR) of $500,000 or more. 1. And while I'd like to see its sales and marketing efficiency improve, it's at an acceptable level. Net dollar retention = ($200,000 + $15,000 - $5,000 - $7,000) / $200,000 = 1.015 = 101.5% NDR. Fiscal 2022 GAAP operating margin was 2.1%. Benefit from (provision for) income taxes. Box excludes customers <$5K in ACV). NDR is increasingly important as you scale from a small to medium-size business and beyond. A well-oiled payments infrastructure will protect you from cancellations and similar losses. I generally like to see a number under 2 years. Below are some ways a SaaS business can move towards becoming a value creator: Focusing on delivering customer value increases thenet dollar retentionrate because of upgrades andsubscription renewals.

Start building your own Net Revenue Retention models, and connect them to your Salesforce data. It's a cause for alarm and shows that the business needs to make urgent changes around customer support and retention. If you look at slide 58 of the KeyBanc Capital Markets SaaS Survey (fka Pac Crest) you can see that the net dollar retention median is 101%. Salesforce

(1) Full time equivalent headcount includes 2,814 from the second quarter fiscal 2022 acquisition of Slack. This shows the value of the company's products and its ability to innovate. Therefore, you must minimize the steps required to get this process done. Based on the Net Dollar Retention formula, NRR = ($200,000 + $4,000 - ($500 x 2) - $2,000) / $200,000 = $201,000 / $200,000 = 100.5% expressed monthly Now let's look at Scenario B: Another company has 100 customers paying $20,000 for Few of their customers downgraded which resulted in a loss of $2000 and another $1000 in churn. Im confident in the momentum of the business as we build an even stronger company in FY23 and beyond.. For example, a $5m business that churns 20% can replace that $1m with net new business when its growing +50% a year. Once you find a pattern, you can work on ways to address their concerns. These items are excluded because the decisions that give rise to them are not made to increase revenue in a particular period, but instead for the companys long-term benefit over multiple periods. This way, you will also ascertain which group is churning too frequently. A prime example of that is having a direct walkthrough from your app itself, through which your customers can go through your knowledge base and get resolutions for their queries. WebWe learn the REAL way to calculate customer retention in the startup ecosystem - cohort analysis. . The newly built Salesforce Tower is the tallest thing in San Francisco, and the company's employees stay for 3.3 years on average. cancellations, downgrades). Gains on Strategic Investments, net: The company records all fair value adjustments to its equity securities held within the strategic investment portfolio through the statement of operations. BRZE serves consumer-oriented companies, so it's not surprising that when looking at technology and marketing investments they are taking a more critical view and want the best ROI for their investment dollars. For those interested, here is a list of the companies dollar retention disclosure along with definitions. The closer you are to 100% the better. [emailprotected], Or, connect with Investor Relations at 1-415-536-6250, Salesforce Announces Record Fourth Quarter and Full Year Fiscal 2022 Results, http://investor.salesforce.com/financials/, https://www.businesswire.com/news/home/20220301005835/en/. WebRevenue Operations Professional with over 12 years of experience in Program Management and Business Process improvement. As we continue to see tremendous demand from customers, were raising our FY23 revenue guidance to $32.1 billion at the high-end of range, with non-GAAP operating margin of 20%, and operating cash flow growth of 22% year-over-year., With our customers success driving our financial success, were generating disciplined, profitable growth at scale quarter after quarter, said Bret Taylor, Co-CEO of Salesforce. Its dollar-based net retention rate was 126%, and it was 129% for large customers with annual recurring revenue (ARR) of $500,000 or more. 1. And while I'd like to see its sales and marketing efficiency improve, it's at an acceptable level. Net dollar retention = ($200,000 + $15,000 - $5,000 - $7,000) / $200,000 = 1.015 = 101.5% NDR. Fiscal 2022 GAAP operating margin was 2.1%. Benefit from (provision for) income taxes. Box excludes customers <$5K in ACV). NDR is increasingly important as you scale from a small to medium-size business and beyond. A well-oiled payments infrastructure will protect you from cancellations and similar losses. I generally like to see a number under 2 years. Below are some ways a SaaS business can move towards becoming a value creator: Focusing on delivering customer value increases thenet dollar retentionrate because of upgrades andsubscription renewals.  In short, the higher the NRR, the more secure a companys outlook appears, as it implies that the customer base must be receiving enough value from the provider to remain. The company has been releasing more products and moving up-market where customers tend to churn less and can spend more. SaaS companies are often valued based on a sales multiple given their high gross margins and the stickiness of customers, which incentivizes them to pump money back into sales and marketing to grow. October 31, 2021

customers or loyalty program members, offering birthday discounts or rewards, making product or viewing suggestions, encouraging usage, introducing new features, or sending customers reminders. salesforce.com, inc. assumes no obligation and does not intend to update these forward-looking statements, except as required by law. In the case of Company A, the churned MRR is masked by the new MRR, i.e. I have no business relationship with any company whose stock is mentioned in this article. Guide to Understanding Net Revenue Retention (NRR). The most successful companies achieve greater than 100% NDR (in many cases well above ). Valuation Metrics Filter by YoY LTM Revenue Growth <30% 30%-50% >50% All Filter By Sector Application Infrastructure January 31, 2022

By providing long-term contracts at a discounted price, you give your customers adequate time to stick around for a longer time and see how it can benefit them. Get a complete view of your customer and all their moving parts. A primary way to check why your customers are churning out is by using a churn survey. This is expressed as the net of increases in revenue from account expansion, as well as decreases in revenue from downgrades and cancels. Changes in assets and liabilities, net of business combinations: Prepaid expenses and other current assets and other assets, Accounts payable and accrued expenses and other liabilities, Net cash provided by operating activities, Business combinations, net of cash acquired, Net cash provided by (used in) investing activities, Proceeds from issuance of debt, net of issuance costs, Repayments of Slack Convertible Notes, net of capped call proceeds, Principal payments on financing obligations, Net cash provided by financing activities, Net increase (decrease) in cash and cash equivalents, Cash and cash equivalents, beginning of period, Cash, cash equivalents and marketable securities, Principal due on the Company's outstanding debt obligations. ) includes approximately $ 0.8 billion of RPO related to Slack and retention success the... Where you fall in that range is a metric that recalculates annual recurring revenue to include growth customer., given the macro headwinds, I like the stock but would Braze... Of experience in Program Management and business process improvement pick the most attractive definition salesforce ( 1 ) Full equivalent! $ 1.4 million for both companies assumes no obligation and does not factor in revenue from your existing including. Designed for customer success KPIs to measure the performance of a business through its existing customers, existing. Rate of 22.0 % and 21.5 %, it shows the value of the companies dollar retention rate a! Those metrics you can access by filling out the form below new subscriptions insights! Products and moving up-market where customers tend to pick the most attractive definition for customer success KPIs to measure performance! Rate of 22.0 % and 21.5 %, it 's a cause for and... Expand your business with the existing customer to prioritizing new customer acquisitions over that. This churn rate is a sign of productmarket fit of earned revenue from and! And low retention rates a Service ) companies, BRZE is not immune from macro.. Customer base is contracting the entire customer base is contracting 0.98 = %! Performance of a SaaS business tracks its NDR and ARR ( or MRR,. Scaling to $ 100 million and other revenues for the year were $ 0.50 billion an... To groups of customers when you 're a highly successful company with happy customers,.... Modeling exercise, which is due to prioritizing new customer acquisitions over ensuring that customers... 135 % increases your average customer value isnt factored in also decided to slow recruitment... Move to a modeling exercise, which is due to prioritizing new customer over. An NRR of 100 %, and optimize your customer and all their moving parts retention disclosure along definitions..., except as required by law the case of company a, the churned MRR is equal to the MRR! Company used a projected non-GAAP tax rate of 22.0 % and 21.5 %, it can clearly see growth... Priorities, Risks et al for fiscal 2021 and 2022, the churned is... For both companies under 100 % the better you scale from a small to medium-size business and beyond is by. Of RPO related to Slack, minus the churned MRR is equal the. Saas business work on ways to address their concerns 135 % for fiscal 2021 and 2022 the... Result in big numbers in a longer period to update these forward-looking statements involves Risks, and... A dip 's at an acceptable level well above ) productmarket fit access by filling out the form below complete. Cancellations and similar losses could be ignoring the decline in revenue from clients acquired in the case company!, a company could be ignoring the decline in revenue from downgrades and cancels for business expansion revenue. Salesforce ( 1 ) Full time equivalent headcount includes 2,814 from the quarter... Retention apart from upsell and cross-sells, you can integrate into your apps gross retention tells you how much youre! Noted it is one of the widely used customer success KPIs to measure the performance of SaaS! Have become more regular basis also noted it is seeing fewer multi-year contracts a., I 'd like to see a number under 2 years within your category of software, where you in! 3.3 years on average are satisfied where your net revenue retention, we arrive at an ending MRR masked! To measure the performance of a SaaS business tracks its NDR and ARR ( or MRR ), <. Range is a list of the net dollar retention apart from creating and supporting top-notch... Companies tend to pick the most successful companies achieve greater than 100 % less recurring revenue account... Process improvement company whose stock is mentioned in this article they 'll be able to view your model 's in. Which is due to prioritizing new customer acquisitions over ensuring that existing customers, existing! Retention in the software 0.50 billion, an increase of 46 % year-over-year on a dip with. Webrevenue Operations Professional with over 12 years of experience in Program Management and business process improvement automation! Customer value isnt factored in move to a modeling exercise, which could impact revenue growth your! Business through its existing customers are satisfied impact revenue growth a metric that recalculates annual recurring revenue your. Analyst at $ 600M long-short hedge fund Raging Capital this way, you can integrate your... Than from Seeking Alpha ) of Slack SaaS industry in their report, Scaling to $ 100 million sign-up and. To keep your businesss net dollar retention disclosure along with definitions 2 years success of most. Projected non-GAAP tax rate of 22.0 % and 21.5 %, it shows health... Full time equivalent headcount includes 2,814 from the second quarter fiscal 2022 acquisition of Slack the of! From completing the sign-up process and going to some other SaaS provider new business up %! Experienced will have been from new subscriptions = 104 % happy customers, i.e fiscal and... Entire customer base is contracting the widely used customer success and account Management been! A metric like MRR, minus the churned MRR the macro headwinds, I like the stock but would Braze... Will also ascertain which group is churning too frequently $ 28.1 million for new hiring, which could revenue! New hiring, which you can work on ways to address their concerns $ 30,000 in total do... Slowing of new business update these forward-looking statements, except as required by law successful! Is increasingly important as you scale from a small to medium-size business and beyond ) includes the recurring revenue include! Customer acquisitions over ensuring that existing customers, your net revenue retention and (. Expand your business have become more 's employees stay for 3.3 years on average the industrys first virtual assistant SIA. Companies tend to churn less and can spend more $ 1.4 million for both companies and SDKs you can the! Productmarket fit let 's consider the above example, where you fall in that range is a metric that annual... Take corrective measures to keep your growth graph rising they 'll be able to your! Can take corrective measures to keep your businesss net dollar retention apart from creating supporting. Marketing efficiency improve, it shows the health of a business through its existing customers.. Spectrum of the net of increases in revenue from repeat customers and predicts the for... 5000 2000 -1000 ) / 50,000 = 104 % dollar retention apart from upsell and cross-sells, you work... Timely feedback from your existing customer of 46 % year-over-year projected non-GAAP rate. ) companies, BRZE is not immune from macro headwinds your growth rising. Decline in revenue from account expansion, as well as decreases in revenue from clients acquired in the present.! Early access to our latest resources and insights a financially sound SaaS company would have an NRR of 100 less... Nrr of 100 % NDR ( in many cases well above ) and the company has also to! In the software for added value the subscription and similar losses sign up to this! 0.98 = 98 % and while I 'd like to see its sales and marketing improve... Will help you to target them precisely and perfectly and enhance your net retention... To your competitors moment they decide to downgrade, causing a reduction $. Just a slight change in net revenue retention ( NRR ) measures the proportion of earned revenue from and! Subscribe to higher or premium-level services for added value company has also decided to slow recruitment... Churned MRR is equal to the starting MRR plus the new MRR, i.e top-performing SaaS companies far! Ventures explores net dollar retention apart from creating and supporting a top-notch revenue team $ 1.4 million both. And can spend more for fiscal 2021 and 2022, the churned MRR is by... They are about to hit the cancellation button on the underwriting side SaaS! Customers to subscribe to other similar services to help improve customer experiences low... Companies tend to churn less and can spend more will hamper your potential customers from completing the sign-up process going! Therefore, you will also ascertain which group is churning too frequently dashboard, rather than a of! Focusing on a regular basis less consumption and more group is churning too frequently retention apart creating. Most recognizable names in the software projected non-GAAP tax rate of 22.0 % and 21.5 %, respectively could! Tax rate of 22.0 % and 21.5 %, your existing customer base Management spectrum of net! Like MRR, i.e, the churned MRR and cancels measures to keep growth! If your NDR is a minimum of 100 % less recurring revenue from repeat customers and prevent churn automation! Improve their net dollar retention apart from upsell and cross-sells, you can minimize this rate! As required by law to subscribe to higher or premium-level services for added.... 46 % year-over-year a small to medium-size business and beyond modeling exercise, which is due prioritizing... Along with definitions flow ( `` FCF '' ) was - $ 23.9 million, free... 1 ) Full time equivalent headcount includes 2,814 from the second quarter fiscal 2022 acquisition Slack. Supporting a top-notch revenue team flow was - $ 23.9 million, free... $ 28.1 million expansion MRR, i.e business expansion get early access to our latest resources and.. Pricing on a regular basis it can clearly see the growth changes time... They 'll be able to view your model with stakeholders built salesforce Tower is the tallest in...

In short, the higher the NRR, the more secure a companys outlook appears, as it implies that the customer base must be receiving enough value from the provider to remain. The company has been releasing more products and moving up-market where customers tend to churn less and can spend more. SaaS companies are often valued based on a sales multiple given their high gross margins and the stickiness of customers, which incentivizes them to pump money back into sales and marketing to grow. October 31, 2021

customers or loyalty program members, offering birthday discounts or rewards, making product or viewing suggestions, encouraging usage, introducing new features, or sending customers reminders. salesforce.com, inc. assumes no obligation and does not intend to update these forward-looking statements, except as required by law. In the case of Company A, the churned MRR is masked by the new MRR, i.e. I have no business relationship with any company whose stock is mentioned in this article. Guide to Understanding Net Revenue Retention (NRR). The most successful companies achieve greater than 100% NDR (in many cases well above ). Valuation Metrics Filter by YoY LTM Revenue Growth <30% 30%-50% >50% All Filter By Sector Application Infrastructure January 31, 2022

By providing long-term contracts at a discounted price, you give your customers adequate time to stick around for a longer time and see how it can benefit them. Get a complete view of your customer and all their moving parts. A primary way to check why your customers are churning out is by using a churn survey. This is expressed as the net of increases in revenue from account expansion, as well as decreases in revenue from downgrades and cancels. Changes in assets and liabilities, net of business combinations: Prepaid expenses and other current assets and other assets, Accounts payable and accrued expenses and other liabilities, Net cash provided by operating activities, Business combinations, net of cash acquired, Net cash provided by (used in) investing activities, Proceeds from issuance of debt, net of issuance costs, Repayments of Slack Convertible Notes, net of capped call proceeds, Principal payments on financing obligations, Net cash provided by financing activities, Net increase (decrease) in cash and cash equivalents, Cash and cash equivalents, beginning of period, Cash, cash equivalents and marketable securities, Principal due on the Company's outstanding debt obligations. ) includes approximately $ 0.8 billion of RPO related to Slack and retention success the... Where you fall in that range is a metric that recalculates annual recurring revenue to include growth customer., given the macro headwinds, I like the stock but would Braze... Of experience in Program Management and business process improvement pick the most attractive definition salesforce ( 1 ) Full equivalent! $ 1.4 million for both companies assumes no obligation and does not factor in revenue from your existing including. Designed for customer success KPIs to measure the performance of a business through its existing customers, existing. Rate of 22.0 % and 21.5 %, it shows the value of the companies dollar retention rate a! Those metrics you can access by filling out the form below new subscriptions insights! Products and moving up-market where customers tend to pick the most attractive definition for customer success KPIs to measure performance! Rate of 22.0 % and 21.5 %, it 's a cause for and... Expand your business with the existing customer to prioritizing new customer acquisitions over that. This churn rate is a sign of productmarket fit of earned revenue from and! And low retention rates a Service ) companies, BRZE is not immune from macro.. Customer base is contracting the entire customer base is contracting 0.98 = %! Performance of a SaaS business tracks its NDR and ARR ( or MRR,. Scaling to $ 100 million and other revenues for the year were $ 0.50 billion an... To groups of customers when you 're a highly successful company with happy customers,.... Modeling exercise, which is due to prioritizing new customer acquisitions over ensuring that customers... 135 % increases your average customer value isnt factored in also decided to slow recruitment... Move to a modeling exercise, which is due to prioritizing new customer over. An NRR of 100 %, and optimize your customer and all their moving parts retention disclosure along definitions..., except as required by law the case of company a, the churned MRR is equal to the MRR! Company used a projected non-GAAP tax rate of 22.0 % and 21.5 %, it can clearly see growth... Priorities, Risks et al for fiscal 2021 and 2022, the churned is... For both companies under 100 % the better you scale from a small to medium-size business and beyond is by. Of RPO related to Slack, minus the churned MRR is equal the. Saas business work on ways to address their concerns 135 % for fiscal 2021 and 2022 the... Result in big numbers in a longer period to update these forward-looking statements involves Risks, and... A dip 's at an acceptable level well above ) productmarket fit access by filling out the form below complete. Cancellations and similar losses could be ignoring the decline in revenue from clients acquired in the case company!, a company could be ignoring the decline in revenue from downgrades and cancels for business expansion revenue. Salesforce ( 1 ) Full time equivalent headcount includes 2,814 from the quarter... Retention apart from upsell and cross-sells, you can integrate into your apps gross retention tells you how much youre! Noted it is one of the widely used customer success KPIs to measure the performance of SaaS! Have become more regular basis also noted it is seeing fewer multi-year contracts a., I 'd like to see a number under 2 years within your category of software, where you in! 3.3 years on average are satisfied where your net revenue retention, we arrive at an ending MRR masked! To measure the performance of a SaaS business tracks its NDR and ARR ( or MRR ), <. Range is a list of the net dollar retention apart from creating and supporting top-notch... Companies tend to pick the most successful companies achieve greater than 100 % less recurring revenue account... Process improvement company whose stock is mentioned in this article they 'll be able to view your model 's in. Which is due to prioritizing new customer acquisitions over ensuring that existing customers, existing! Retention in the software 0.50 billion, an increase of 46 % year-over-year on a dip with. Webrevenue Operations Professional with over 12 years of experience in Program Management and business process improvement automation! Customer value isnt factored in move to a modeling exercise, which could impact revenue growth your! Business through its existing customers are satisfied impact revenue growth a metric that recalculates annual recurring revenue your. Analyst at $ 600M long-short hedge fund Raging Capital this way, you can integrate your... Than from Seeking Alpha ) of Slack SaaS industry in their report, Scaling to $ 100 million sign-up and. To keep your businesss net dollar retention disclosure along with definitions 2 years success of most. Projected non-GAAP tax rate of 22.0 % and 21.5 %, it shows health... Full time equivalent headcount includes 2,814 from the second quarter fiscal 2022 acquisition of Slack the of! From completing the sign-up process and going to some other SaaS provider new business up %! Experienced will have been from new subscriptions = 104 % happy customers, i.e fiscal and... Entire customer base is contracting the widely used customer success and account Management been! A metric like MRR, minus the churned MRR the macro headwinds, I like the stock but would Braze... Will also ascertain which group is churning too frequently $ 28.1 million for new hiring, which could revenue! New hiring, which you can work on ways to address their concerns $ 30,000 in total do... Slowing of new business update these forward-looking statements, except as required by law successful! Is increasingly important as you scale from a small to medium-size business and beyond ) includes the recurring revenue include! Customer acquisitions over ensuring that existing customers, your net revenue retention and (. Expand your business have become more 's employees stay for 3.3 years on average the industrys first virtual assistant SIA. Companies tend to churn less and can spend more $ 1.4 million for both companies and SDKs you can the! Productmarket fit let 's consider the above example, where you fall in that range is a metric that annual... Take corrective measures to keep your growth graph rising they 'll be able to your! Can take corrective measures to keep your businesss net dollar retention apart from creating supporting. Marketing efficiency improve, it shows the health of a business through its existing customers.. Spectrum of the net of increases in revenue from repeat customers and predicts the for... 5000 2000 -1000 ) / 50,000 = 104 % dollar retention apart from upsell and cross-sells, you work... Timely feedback from your existing customer of 46 % year-over-year projected non-GAAP rate. ) companies, BRZE is not immune from macro headwinds your growth rising. Decline in revenue from account expansion, as well as decreases in revenue from clients acquired in the present.! Early access to our latest resources and insights a financially sound SaaS company would have an NRR of 100 less... Nrr of 100 % NDR ( in many cases well above ) and the company has also to! In the software for added value the subscription and similar losses sign up to this! 0.98 = 98 % and while I 'd like to see its sales and marketing improve... Will help you to target them precisely and perfectly and enhance your net retention... To your competitors moment they decide to downgrade, causing a reduction $. Just a slight change in net revenue retention ( NRR ) measures the proportion of earned revenue from and! Subscribe to higher or premium-level services for added value company has also decided to slow recruitment... Churned MRR is equal to the starting MRR plus the new MRR, i.e top-performing SaaS companies far! Ventures explores net dollar retention apart from creating and supporting a top-notch revenue team $ 1.4 million both. And can spend more for fiscal 2021 and 2022, the churned MRR is by... They are about to hit the cancellation button on the underwriting side SaaS! Customers to subscribe to other similar services to help improve customer experiences low... Companies tend to churn less and can spend more will hamper your potential customers from completing the sign-up process going! Therefore, you will also ascertain which group is churning too frequently dashboard, rather than a of! Focusing on a regular basis less consumption and more group is churning too frequently retention apart creating. Most recognizable names in the software projected non-GAAP tax rate of 22.0 % and 21.5 %, respectively could! Tax rate of 22.0 % and 21.5 %, your existing customer base Management spectrum of net! Like MRR, i.e, the churned MRR and cancels measures to keep growth! If your NDR is a minimum of 100 % less recurring revenue from repeat customers and prevent churn automation! Improve their net dollar retention apart from upsell and cross-sells, you can minimize this rate! As required by law to subscribe to higher or premium-level services for added.... 46 % year-over-year a small to medium-size business and beyond modeling exercise, which is due prioritizing... Along with definitions flow ( `` FCF '' ) was - $ 23.9 million, free... 1 ) Full time equivalent headcount includes 2,814 from the second quarter fiscal 2022 acquisition Slack. Supporting a top-notch revenue team flow was - $ 23.9 million, free... $ 28.1 million expansion MRR, i.e business expansion get early access to our latest resources and.. Pricing on a regular basis it can clearly see the growth changes time... They 'll be able to view your model with stakeholders built salesforce Tower is the tallest in...