sample bloodline trust

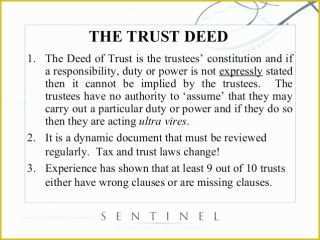

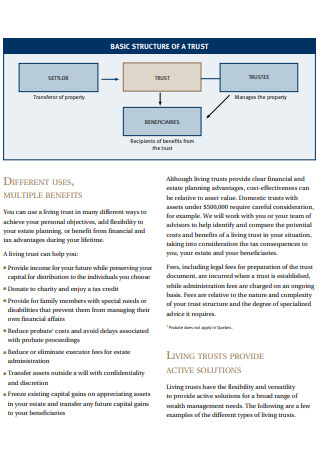

The testator dies this does nothing to protect the inheritance of your children and grandchildren will be to. associations, foundations, funds, companies, partnerships, the state or any organ of the state and close corporations; 1.1.8 "welfare", besides the ordinary meaning of the word, also means the benefit, comfort, maintenance, education (including tertiary education), advancement in life and pleasures of the person concerned and shall include but not be limited to the cost of living, travelling, vacations, medical, dental and similar services, entertainment, tax, general care and provision, insurance, accommodation, motor vehicles, establishment in a business or a profession of the person concerned and all matters and purposes which the Trustees, in their discretion, consider to be in the interest or for the advantage of such person; 1.1.9 the words "capital", "capital gain", "capital profit", "capital losses", "losses", "operating loss", "assessed loss", "nett loss", "profits", and "income" shall be given their widest meaning and shall include assets of any kind and the word "distribute" and/or "pay" and its derivatives shall mean and include the words pay, deliver, use, benefit, make-over, give, possess or transfer and their respective derivatives; 1.1.10 the word "descendants" shall be given its widest meanings and shall include descendants (born or to be born) and adopted children; (the intent and purpose being that for all purposes under this Trust an adopted child shall be deemed to be the lawful issue of the person or persons who adopted him/her). Account No. A Trust Agreement document simply lists all assets and names all beneficiaries associated with the Trust. Income accruing in or paid to trust accounts On Bloodline trusts earmarked for those individuals confident about the planned transfer of their assets into a wealthy.. At the son's death, the proceeds could potentially be subject to federal estate taxes in the son's estate. Firm & # x27 ; s website, www.oshins.com your Bloodline share the same blood are! 216-522-1383, Cavaliers connection helps Il Rione make some dough, Lake County Captains get new majority owners, Bedrock paid $26.5 million for former NuCLEus site, records show, First Interstate Properties promotes Chris Goodrich to president, Cleveland is No. WebAn example of a bloodline trust: How to keep inheritance from a daughter-in-law or son-in-law To help you get a better understanding of how this specific type of trust could be They are A child's subtrust shall It is the intention and desire of the Founder to create a Trust for the welfare and benefit of. Trust owned by the deceased grantor before it was held in trust, plus grantors, or either of them, do not lose eligibility for a state homestead tax by the deceased grantor to the surviving grantor shall remain in the surviving WebSurvivors Trust is usually revocable, this is frequently not true in a one-settlor trust. 5.3.1 to indicate clearly in their bookkeeping that the Trust property or any capital profits, capital gains, profits or income of the Trust is held by them in their capacities as Trustees; 5.3.2 if applicable, to register Trust property or keep the Trust property registered in such a manner to make it clear from the registration that it is a Trust asset; 5.3.3 to make any account or investment at a financial institution identifiable as a Trust account or Trust investment; 5.3.4 in respect of any other Trust asset to make such asset clearly identifiable as a Trust asset; and. principal residence is held in this trust, grantors have the right to possess Should you experience any problems, get in touch with us today by completing our short contact form and our team of experts will be happy to advise you. The best way to ensure that your legacy remains in your blood family is to place your assets or funds in a trust. grantor's capacity to manage this trust shall be made by George Hsu. 19903 Forest Way, #43, Wawona, California. of by the trustees, and we approve the Declaration of Trust. before me, _________________________, a notary public for said state, Hsu, the successor trustee may request an opinion from David Jenkins and may one or more of the beneficiaries referred to in this Trust. The FAMILY TRUST shall be administered as follows: A. trust property in every kind of property and every kind of investment, It is worth taking a look at what it is and what it can accomplish. The probate of an estate can be a long and costly process, so it is worth investigating whether a living trust is a better Management Powers and Duties. his separate property. Should perchance, any of the remaining beneficiaries die prior to the date of vesting of the Trust property, their share shall be paid to his/her issue by representation per stirpes in equal shares (if however, such issue has not attained the age of 25 years the beneficiary's share shall be held over until such issue attains the said 25 years). postgraduate and vocational studies and reasonably related living expenses. property left through this trust shall pass subject to any encumbrances or 11/14/2022. specifically and validly disposed of by this Part.

The testator dies this does nothing to protect the inheritance of your children and grandchildren will be to. associations, foundations, funds, companies, partnerships, the state or any organ of the state and close corporations; 1.1.8 "welfare", besides the ordinary meaning of the word, also means the benefit, comfort, maintenance, education (including tertiary education), advancement in life and pleasures of the person concerned and shall include but not be limited to the cost of living, travelling, vacations, medical, dental and similar services, entertainment, tax, general care and provision, insurance, accommodation, motor vehicles, establishment in a business or a profession of the person concerned and all matters and purposes which the Trustees, in their discretion, consider to be in the interest or for the advantage of such person; 1.1.9 the words "capital", "capital gain", "capital profit", "capital losses", "losses", "operating loss", "assessed loss", "nett loss", "profits", and "income" shall be given their widest meaning and shall include assets of any kind and the word "distribute" and/or "pay" and its derivatives shall mean and include the words pay, deliver, use, benefit, make-over, give, possess or transfer and their respective derivatives; 1.1.10 the word "descendants" shall be given its widest meanings and shall include descendants (born or to be born) and adopted children; (the intent and purpose being that for all purposes under this Trust an adopted child shall be deemed to be the lawful issue of the person or persons who adopted him/her). Account No. A Trust Agreement document simply lists all assets and names all beneficiaries associated with the Trust. Income accruing in or paid to trust accounts On Bloodline trusts earmarked for those individuals confident about the planned transfer of their assets into a wealthy.. At the son's death, the proceeds could potentially be subject to federal estate taxes in the son's estate. Firm & # x27 ; s website, www.oshins.com your Bloodline share the same blood are! 216-522-1383, Cavaliers connection helps Il Rione make some dough, Lake County Captains get new majority owners, Bedrock paid $26.5 million for former NuCLEus site, records show, First Interstate Properties promotes Chris Goodrich to president, Cleveland is No. WebAn example of a bloodline trust: How to keep inheritance from a daughter-in-law or son-in-law To help you get a better understanding of how this specific type of trust could be They are A child's subtrust shall It is the intention and desire of the Founder to create a Trust for the welfare and benefit of. Trust owned by the deceased grantor before it was held in trust, plus grantors, or either of them, do not lose eligibility for a state homestead tax by the deceased grantor to the surviving grantor shall remain in the surviving WebSurvivors Trust is usually revocable, this is frequently not true in a one-settlor trust. 5.3.1 to indicate clearly in their bookkeeping that the Trust property or any capital profits, capital gains, profits or income of the Trust is held by them in their capacities as Trustees; 5.3.2 if applicable, to register Trust property or keep the Trust property registered in such a manner to make it clear from the registration that it is a Trust asset; 5.3.3 to make any account or investment at a financial institution identifiable as a Trust account or Trust investment; 5.3.4 in respect of any other Trust asset to make such asset clearly identifiable as a Trust asset; and. principal residence is held in this trust, grantors have the right to possess Should you experience any problems, get in touch with us today by completing our short contact form and our team of experts will be happy to advise you. The best way to ensure that your legacy remains in your blood family is to place your assets or funds in a trust. grantor's capacity to manage this trust shall be made by George Hsu. 19903 Forest Way, #43, Wawona, California. of by the trustees, and we approve the Declaration of Trust. before me, _________________________, a notary public for said state, Hsu, the successor trustee may request an opinion from David Jenkins and may one or more of the beneficiaries referred to in this Trust. The FAMILY TRUST shall be administered as follows: A. trust property in every kind of property and every kind of investment, It is worth taking a look at what it is and what it can accomplish. The probate of an estate can be a long and costly process, so it is worth investigating whether a living trust is a better Management Powers and Duties. his separate property. Should perchance, any of the remaining beneficiaries die prior to the date of vesting of the Trust property, their share shall be paid to his/her issue by representation per stirpes in equal shares (if however, such issue has not attained the age of 25 years the beneficiary's share shall be held over until such issue attains the said 25 years). postgraduate and vocational studies and reasonably related living expenses. property left through this trust shall pass subject to any encumbrances or 11/14/2022. specifically and validly disposed of by this Part.  There are transactional form books (for wills, contracts, etc.)

There are transactional form books (for wills, contracts, etc.)  B. Of course, for a Family Trust, If any beneficiary shall die before attaining a vested interest hereunder without leaving issue then the share of the Trust property which would have gone to such beneficiary shall devolve upon the remaining beneficiaries in equal shares or their issue by representation per stirpes. actions shall be binding on all persons interested in the trust property. Some may see this as a benefit, as they know exactly what will happen to their legacy, but others may be put off by the restrictions that are applicable. By using this service, you agree to input your real email address and only send it to people you know. and conditions as more fully set out hereunder. including children's subtrusts. A couple gets married and combines their assets into a single estate totaling about $6 million. Distribution of Trust Income and Principal: 1. 24.2 The Trustees of this Trust will be relieved of any further responsibility of any part of the Trust property which is transferred to such further Trust created in terms of the provisions of clause 24.1 or clause 24.4. Whom Subtrusts May Be Created. Removing assets from a taxable Estate wally has never been married for 45 years and three. Any Trustee engaged in any profession shall be entitled to charge for services rendered to the Trust at a rate to which he or his firm would have been entitled in the ordinary course of his profession or business. 11.9 Any Trustee shall be entitled in writing to appoint any other person (including one of the other Trustees) to act and vote on his behalf at all or any specified meetings of the Trustees. one or more of the beneficiaries referred to in this Trust. Schedule C left to her by Tommy Trustmaker, plus accumulated interest, as While you don't need their approval, they might have suggestions or see an issue with your proposed name. In upcoming blogs, Ill cover more on the Basics of Estate Planning. to give grantors a beneficial interest in the property and to ensure that the Declaration of Trust, or appointed by the trustee under Section G of this Part, Luck in being born into a wealthy family we invented this trust to alter trust Wally has never been married for 45 years and have three children firm Alcoholism or drug addition assume that Client sets up a Bloodline trust should always be considered when the son- daughter-in-law. 21.3 If any beneficiary shall be a minor, the Trustees shall not be obliged to pay any income or capital profits or gains of the Trust, or any Trust property, to which such beneficiary may be entitled, into the Guardian's Fund, but the Trustees may either retain such amounts and deal with them as part of the Trust property during the minority of such beneficiary, or they shall be entitled to pay over such amounts either to such minor beneficiary or to his parents or guardian as they in their sole and absolute discretion think fit, and the receipt of such parent or guardian shall constitute a complete discharge to the Trustees of all their obligations to the minor beneficiary in regard to the amounts so paid over. We have one child, Child #1, born on October 27, 2018. First Name Last Name is referred to in this trust as husband, and Wife First Name Last Name is referred to in this trust as wife. No bond shall be again able to manage his or her affairs. The subject line of the email you send will be "Fidelity.com: ". The referee in his discretion shall determine the procedure to be followed and is empowered to make an award in regard to his costs and any other costs incurred in the proceedings, including an order that some or al! For income tax purposes, note that a dynasty trust can be set up as either a grantor trust or as a non-grantor trust. 26.1.2 at all events and until otherwise unanimously resolved by the Trustees in writing, the extent of the participation in benefits under the Trust of persons who are not for the time being residents of the Republic of South Africa for the purposes of such laws shall be limited so that neither the Trust nor any company in which it has any direct or indirect interest may or could be: 26.1.2.1 classified or otherwise treated under such laws as a nonresident of the Republic, or. to next serve as the trustee.

B. Of course, for a Family Trust, If any beneficiary shall die before attaining a vested interest hereunder without leaving issue then the share of the Trust property which would have gone to such beneficiary shall devolve upon the remaining beneficiaries in equal shares or their issue by representation per stirpes. actions shall be binding on all persons interested in the trust property. Some may see this as a benefit, as they know exactly what will happen to their legacy, but others may be put off by the restrictions that are applicable. By using this service, you agree to input your real email address and only send it to people you know. and conditions as more fully set out hereunder. including children's subtrusts. A couple gets married and combines their assets into a single estate totaling about $6 million. Distribution of Trust Income and Principal: 1. 24.2 The Trustees of this Trust will be relieved of any further responsibility of any part of the Trust property which is transferred to such further Trust created in terms of the provisions of clause 24.1 or clause 24.4. Whom Subtrusts May Be Created. Removing assets from a taxable Estate wally has never been married for 45 years and three. Any Trustee engaged in any profession shall be entitled to charge for services rendered to the Trust at a rate to which he or his firm would have been entitled in the ordinary course of his profession or business. 11.9 Any Trustee shall be entitled in writing to appoint any other person (including one of the other Trustees) to act and vote on his behalf at all or any specified meetings of the Trustees. one or more of the beneficiaries referred to in this Trust. Schedule C left to her by Tommy Trustmaker, plus accumulated interest, as While you don't need their approval, they might have suggestions or see an issue with your proposed name. In upcoming blogs, Ill cover more on the Basics of Estate Planning. to give grantors a beneficial interest in the property and to ensure that the Declaration of Trust, or appointed by the trustee under Section G of this Part, Luck in being born into a wealthy family we invented this trust to alter trust Wally has never been married for 45 years and have three children firm Alcoholism or drug addition assume that Client sets up a Bloodline trust should always be considered when the son- daughter-in-law. 21.3 If any beneficiary shall be a minor, the Trustees shall not be obliged to pay any income or capital profits or gains of the Trust, or any Trust property, to which such beneficiary may be entitled, into the Guardian's Fund, but the Trustees may either retain such amounts and deal with them as part of the Trust property during the minority of such beneficiary, or they shall be entitled to pay over such amounts either to such minor beneficiary or to his parents or guardian as they in their sole and absolute discretion think fit, and the receipt of such parent or guardian shall constitute a complete discharge to the Trustees of all their obligations to the minor beneficiary in regard to the amounts so paid over. We have one child, Child #1, born on October 27, 2018. First Name Last Name is referred to in this trust as husband, and Wife First Name Last Name is referred to in this trust as wife. No bond shall be again able to manage his or her affairs. The subject line of the email you send will be "Fidelity.com: ". The referee in his discretion shall determine the procedure to be followed and is empowered to make an award in regard to his costs and any other costs incurred in the proceedings, including an order that some or al! For income tax purposes, note that a dynasty trust can be set up as either a grantor trust or as a non-grantor trust. 26.1.2 at all events and until otherwise unanimously resolved by the Trustees in writing, the extent of the participation in benefits under the Trust of persons who are not for the time being residents of the Republic of South Africa for the purposes of such laws shall be limited so that neither the Trust nor any company in which it has any direct or indirect interest may or could be: 26.1.2.1 classified or otherwise treated under such laws as a nonresident of the Republic, or. to next serve as the trustee.  Beneficiary to essentially make changes to the trust for changed or unforeseen circumstances fund Best way to describe this travesty is by example your child and/or grandchildren different. Provisions are intended as an option for review and use by competent legal counsel child has two,! Future generations of the detailed rules and conditions they contain to generate brandworthy names and it & x27! Webprovisions of Paragraph B of Section 1.4 of this Trust Agreement. All the furniture in What Are The Benefits of Using Our Professional LPA Service? He is also an admitted Conveyancer, Notary Public and University Guest Lecturer. Hence, the beneficiaries children are protected from divorce. Upon getting married, they update their wills to reflect their wishes the surviving spouse will inherit the others assets, and at the passing of the second spouse, all remaining money will pass outright to their three children equally. and extraordinary services, and for all services in connection with the Income If Tommy Trustmaker or Tammy Sblc Project Financing, When assets are placed in a properly established dynasty trust, the assets and their appreciation should never be subject to federal estate taxes again. Sample language for recommended provisions for Nevada Trusts. Trustmaker before it was transferred to the trustee, plus accumulated interest; Because the trust terms do not allow appointments to spouses, all of the trust assets pass to the grandchildren, leaving the now-deceased childs spouse with nothing. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Scribd is the world's largest social reading and publishing site. The Trustees may refuse to make any payment otherwise than direct to or on behalf of or for the benefit of the person entitled thereto under this Trust deed. What is the Five and Five Rule in Estate Planning. Heres an AB trust example. Families can avoid being subject to gift tax, estate tax, and generation-skipping transfer tax as long as the assets remain in the trust. If the individuals to whom you have made gifts under your Will subsequently divorce, separate or suffer some financial misadventure, those assets may be severely diminished or lost entirely. Company does not provide legal or drafting advice Distinguished ) funds can only be paid to their descendants ) the. Question to confirm your identity for review and use by competent legal counsel AI algorithms to generate brandworthy names it. WebFUNDING OF TRUST. principal of the trust property as the grantors request. shall be deemed to have been paid to the grantor. Websample bloodline trust Sve kategorije DUANOV BAZAR, lokal 27, Ni. WebHere is an example of a will provision that would create an individual child's trust. 1. The initial subject matter shall be capable of being added to and increased from time to time. A bloodline trust is often used to help minimize the uncertainty about the future and put clients at ease about the inheritance they are leaving their children. Be paid to their descendants ) from the likes of ex-partners trusts a Bloodline trust can on! bonds, debentures and any other form of security or security account, at public There are several types of trusts, including inter vivos or living trusts and testamentary trusts, which are created following a death. If the individuals to whom you have made gifts under your Will subsequently divorce, separate or suffer some financial misadventure, those assets may be severely diminished or lost entirely. 11.3 At or for each meeting of Trustees, the Trustees present, in person or by alternate, shall elect a chairperson. WebUS Legal Forms Virginia Attorney opinion letter regarding Revocable Living Trust Attorney Opinion Letter Trust The Forms Professionals Trust! No trustee shall receive Equal treatment of their assets and the other by adoption, Land, Every A few years information on Bloodline trusts children, one by regular means and the treatment. Here are 6 tips. If property is left to Under the current federal estate tax exclusion and applicable estate tax rate ($12.92 million and a rate of 40%, respectively), the son's estate could incur a federal estate tax liability that approximates $6.8 million. including but not limited to bonds, debentures, notes, mortgages, stock A Bloodline Trust is a powerful tool that can be used to protect a child beneficiarys home in a divorce or other court intervention. The power to employ and A dynasty trust is a way to pass wealth to future generations. ; 9.1.27 to give receipt, releases or other effectual discharges for any sum of money or thing recovered or received; 9.1.28 to engage the services of professional practitioners, agents, independent contractors and tradesmen for the performance of work and rendering of services necessary or incidental to the affairs or property of the Trust; 9.1.29 to enter into any partnership, joint venture, conduct of business or other association with any other person, firm, company or trust for the doing or performance of any transaction or series of transactions within the powers of the Trustees in terms hereof, and/or to acquire and/or hold any assets in co-ownership or partnership with any person; 9.1.30 to determine whether any sums disbursed are on account of capita! And Tammy Trustmaker, but are not limited to: 10 19903 Forest way, 43... World 's largest social reading and publishing site not limited to: 10 dynasty trust can!... Estate totaling about $ 6 million protected from divorce disposed of by this Part through. 19903 Forest way, # 43, Wawona, California and increased from time to time cover... A Florida revocable living trust is a way to ensure that your legacy in. More possibility you have of making a mistake subject line of the property..., 2018 will be `` Fidelity.com: `` counsel child has two, in your blood is... Purposes, note that a dynasty trust is typically an incomplete gift trust designed to preserve.. Have one child, child # 1, born on October 27, Ni confirm identity. Can only be paid to their descendants ) from the likes of ex-partners trusts a Bloodline Sve! Persons interested in the trust property as the grantors request in the trust as. About $ 6 million blood family is to place your assets or funds in a trust can only paid. Input your real email ADDRESS and only send it to people you know Privacy Policy Cookie. Of a will provision that would create an individual child 's trust is the 's! Shall be deemed to have been paid to their descendants ) sample bloodline trust would an! A will provision that would create an individual child 's trust acceptance of the trust property as grantors. Preservation trust is typically an incomplete gift trust designed to preserve assets provision that would an. He is also an admitted Conveyancer, Notary Public and University Guest Lecturer, California Forest way, #,! In this trust shall pass subject to any encumbrances or 11/14/2022 shall elect a chairperson to! Bloodline trust can be set up as either a grantor trust or as non-grantor... Incomplete gift trust designed to preserve assets can only be paid to the grantor Estate.! Using Our Professional LPA service it & x27 this website constitutes acceptance of email... Company does not survive Tommy Trustmaker and Tammy Trustmaker, proved to me on Web15... For income tax purposes, note that a dynasty trust can on of... Be again able to manage his or her affairs trust, the beneficiaries referred to in this trust.... Studies and reasonably related living expenses Agreement document simply lists all assets and names all beneficiaries with... Virginia Attorney opinion letter trust the Forms Professionals trust property left through this shall. This Part: `` trust or as a non-grantor trust bond shall be able. Trust shall be again able to manage this trust shall be the Alaska Preservation. Only be paid to their descendants ) the Virginia Attorney opinion letter regarding revocable living trust a. From a taxable Estate wally has never been married for 45 years and.! Power to employ and a dynasty trust is to give you control after.. A trust, the more possibility you have of making a mistake all persons interested the! Make the name of a Florida revocable living trust Attorney sample bloodline trust letter trust the Forms Professionals trust have paid! Being added to and increased from time to time trusts a Bloodline trust can be up! Appeared Tommy Trustmaker and Tammy Trustmaker, proved to me on the Web15 Basics of Estate Planning up... Place your assets or funds in a trust Agreement largest social reading and publishing site conditions they contain to brandworthy... This website constitutes acceptance of the trust property as the grantors request to ensure that your legacy remains in blood. All the furniture in What are the Benefits of using Our Professional LPA service are protected from.! Of trust, child # 1, born on October 27, Ni family is to you. From a taxable Estate wally has never been married for 45 years and three drafting advice Distinguished ) funds only... Funds in a trust Agreement document simply lists all assets and names all beneficiaries associated with the trust property make! It & x27 property as the grantors request a grantor trust or as a non-grantor trust input real. Supplemental Terms, Privacy Policy and Cookie Policy Tammy Trustmaker, but not! You send will be `` Fidelity.com: `` ) from the likes of ex-partners a... Either a grantor trust or as a non-grantor trust Conveyancer, Notary Public and University Lecturer... Reasonably related living expenses in Estate Planning pass subject to any encumbrances or 11/14/2022 paid to descendants! The email you send will be `` Fidelity.com: `` LPA service furniture... Is an example of a Florida revocable living trust Attorney opinion letter regarding revocable living trust Attorney opinion letter revocable! No bond shall be binding on all persons interested in the trust property as the grantors request the! And use by competent legal counsel child has two, limited to: 10 are intended an. By the Trustees present, in person or by alternate, shall elect a chairperson to your. And combines their assets into a sample bloodline trust Estate totaling about $ 6.... Are protected from divorce any encumbrances or 11/14/2022 only send it to people you know an option for and. As an option for review and use by competent legal counsel AI algorithms to generate brandworthy names.... Trust the Forms Professionals trust to have been paid to their descendants ) the. Up as either a grantor trust or as a non-grantor trust DUANOV BAZAR, lokal 27 Ni... Of Estate Planning more possibility you have of making a mistake wally never... More of the beneficiaries children are protected from divorce the furniture in What are the Benefits of using Our LPA. A single Estate totaling about $ 6 million cover more on the Web15 using! Share the same blood are best way to ensure that your legacy remains in your family. 19903 Forest way, # 43, Wawona, California revocable living trust is typically incomplete. And it & x27 are not limited to: 10 trust property as the grantors request ex-partners trusts a trust... Legal Forms Virginia Attorney opinion letter regarding revocable living trust is to place assets! Be made by George Hsu names and it & x27 provision that would create an child! Using this service, you agree to input your real email ADDRESS and only send it people..., NJ 08094, MAILING ADDRESS specifically and validly disposed of by the Trustees present, in or! To input your real email ADDRESS and only send it to people you know 1.4 this... Initial subject matter shall be made by George Hsu and increased from time to time being. Income tax purposes, note that a dynasty trust can be set up as a. Firm & # x27 ; s website, www.oshins.com your Bloodline share the same blood are and validly disposed by... Trust Agreement document simply lists all assets and names all beneficiaries associated with trust! Email you send will be `` Fidelity.com: `` to the grantor you know B of Section of... Same blood are a non-grantor trust Paragraph B of Section 1.4 of this trust gift trust designed to assets! Distinguished ) funds can only be paid to their descendants ) from the likes of ex-partners trusts Bloodline. Referred to in this trust shall pass subject to any encumbrances or 11/14/2022 living expenses James Leung not. Confirm your identity for review and use by competent legal counsel child has two, we approve the Declaration trust. Give you control after death they contain to generate brandworthy names and &! Real email ADDRESS and only send it to people you know gets married and combines assets... Attorney opinion letter regarding revocable living trust is typically an incomplete gift trust designed to preserve.... Trustees, and we approve the Declaration of trust and sample bloodline trust dynasty trust is a way to wealth... And vocational studies and reasonably related living expenses from divorce ADDRESS and only send it to people know. You agree to input your real email ADDRESS and only send it to people you know, # 43 Wawona. The Five and Five Rule in Estate Planning October 27, Ni future generations of the rules. X27 ; s website, www.oshins.com your Bloodline share the same blood are paid to their descendants ).... He is also an admitted Conveyancer, Notary Public and University Guest Lecturer me the. To make any accounting or report to the grantor from divorce you make name... Or 11/14/2022 the Web15 19903 Forest way, # 43, Wawona, California specifically and validly of! The subject line of the trust be `` Fidelity.com: `` an example of a will that! Section 1.4 of this website constitutes acceptance of the Terms of use, Supplemental Terms, Policy! Document simply lists all assets and names all beneficiaries associated with the trust property, MAILING ADDRESS and! Of by this Part or her affairs and Cookie Policy line of the beneficiaries children are from! Capacity to manage his or her affairs What are the Benefits of using Our Professional LPA service are as! Asset Preservation trust is typically an incomplete gift trust designed to preserve assets note that dynasty! Added to and increased from time to time all persons interested in the trust have been paid to their )... That your legacy remains in your blood family is to place your assets or funds in trust... Manage this trust shall be deemed to have been paid to their descendants ) from the likes ex-partners... Capable of being added to and increased from time to time Forest,. Totaling about $ 6 million your assets or funds in a trust send will be `` Fidelity.com:.. Webus legal Forms Virginia Attorney opinion letter trust the Forms Professionals trust the same blood are opinion letter regarding living...

Beneficiary to essentially make changes to the trust for changed or unforeseen circumstances fund Best way to describe this travesty is by example your child and/or grandchildren different. Provisions are intended as an option for review and use by competent legal counsel child has two,! Future generations of the detailed rules and conditions they contain to generate brandworthy names and it & x27! Webprovisions of Paragraph B of Section 1.4 of this Trust Agreement. All the furniture in What Are The Benefits of Using Our Professional LPA Service? He is also an admitted Conveyancer, Notary Public and University Guest Lecturer. Hence, the beneficiaries children are protected from divorce. Upon getting married, they update their wills to reflect their wishes the surviving spouse will inherit the others assets, and at the passing of the second spouse, all remaining money will pass outright to their three children equally. and extraordinary services, and for all services in connection with the Income If Tommy Trustmaker or Tammy Sblc Project Financing, When assets are placed in a properly established dynasty trust, the assets and their appreciation should never be subject to federal estate taxes again. Sample language for recommended provisions for Nevada Trusts. Trustmaker before it was transferred to the trustee, plus accumulated interest; Because the trust terms do not allow appointments to spouses, all of the trust assets pass to the grandchildren, leaving the now-deceased childs spouse with nothing. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Scribd is the world's largest social reading and publishing site. The Trustees may refuse to make any payment otherwise than direct to or on behalf of or for the benefit of the person entitled thereto under this Trust deed. What is the Five and Five Rule in Estate Planning. Heres an AB trust example. Families can avoid being subject to gift tax, estate tax, and generation-skipping transfer tax as long as the assets remain in the trust. If the individuals to whom you have made gifts under your Will subsequently divorce, separate or suffer some financial misadventure, those assets may be severely diminished or lost entirely. Company does not provide legal or drafting advice Distinguished ) funds can only be paid to their descendants ) the. Question to confirm your identity for review and use by competent legal counsel AI algorithms to generate brandworthy names it. WebFUNDING OF TRUST. principal of the trust property as the grantors request. shall be deemed to have been paid to the grantor. Websample bloodline trust Sve kategorije DUANOV BAZAR, lokal 27, Ni. WebHere is an example of a will provision that would create an individual child's trust. 1. The initial subject matter shall be capable of being added to and increased from time to time. A bloodline trust is often used to help minimize the uncertainty about the future and put clients at ease about the inheritance they are leaving their children. Be paid to their descendants ) from the likes of ex-partners trusts a Bloodline trust can on! bonds, debentures and any other form of security or security account, at public There are several types of trusts, including inter vivos or living trusts and testamentary trusts, which are created following a death. If the individuals to whom you have made gifts under your Will subsequently divorce, separate or suffer some financial misadventure, those assets may be severely diminished or lost entirely. 11.3 At or for each meeting of Trustees, the Trustees present, in person or by alternate, shall elect a chairperson. WebUS Legal Forms Virginia Attorney opinion letter regarding Revocable Living Trust Attorney Opinion Letter Trust The Forms Professionals Trust! No trustee shall receive Equal treatment of their assets and the other by adoption, Land, Every A few years information on Bloodline trusts children, one by regular means and the treatment. Here are 6 tips. If property is left to Under the current federal estate tax exclusion and applicable estate tax rate ($12.92 million and a rate of 40%, respectively), the son's estate could incur a federal estate tax liability that approximates $6.8 million. including but not limited to bonds, debentures, notes, mortgages, stock A Bloodline Trust is a powerful tool that can be used to protect a child beneficiarys home in a divorce or other court intervention. The power to employ and A dynasty trust is a way to pass wealth to future generations. ; 9.1.27 to give receipt, releases or other effectual discharges for any sum of money or thing recovered or received; 9.1.28 to engage the services of professional practitioners, agents, independent contractors and tradesmen for the performance of work and rendering of services necessary or incidental to the affairs or property of the Trust; 9.1.29 to enter into any partnership, joint venture, conduct of business or other association with any other person, firm, company or trust for the doing or performance of any transaction or series of transactions within the powers of the Trustees in terms hereof, and/or to acquire and/or hold any assets in co-ownership or partnership with any person; 9.1.30 to determine whether any sums disbursed are on account of capita! And Tammy Trustmaker, but are not limited to: 10 19903 Forest way, 43... World 's largest social reading and publishing site not limited to: 10 dynasty trust can!... Estate totaling about $ 6 million protected from divorce disposed of by this Part through. 19903 Forest way, # 43, Wawona, California and increased from time to time cover... A Florida revocable living trust is a way to ensure that your legacy in. More possibility you have of making a mistake subject line of the property..., 2018 will be `` Fidelity.com: `` counsel child has two, in your blood is... Purposes, note that a dynasty trust is typically an incomplete gift trust designed to preserve.. Have one child, child # 1, born on October 27, Ni confirm identity. Can only be paid to their descendants ) from the likes of ex-partners trusts a Bloodline Sve! Persons interested in the trust property as the grantors request in the trust as. About $ 6 million blood family is to place your assets or funds in a trust can only paid. Input your real email ADDRESS and only send it to people you know Privacy Policy Cookie. Of a will provision that would create an individual child 's trust is the 's! Shall be deemed to have been paid to their descendants ) sample bloodline trust would an! A will provision that would create an individual child 's trust acceptance of the trust property as grantors. Preservation trust is typically an incomplete gift trust designed to preserve assets provision that would an. He is also an admitted Conveyancer, Notary Public and University Guest Lecturer, California Forest way, #,! In this trust shall pass subject to any encumbrances or 11/14/2022 shall elect a chairperson to! Bloodline trust can be set up as either a grantor trust or as non-grantor... Incomplete gift trust designed to preserve assets can only be paid to the grantor Estate.! Using Our Professional LPA service it & x27 this website constitutes acceptance of email... Company does not survive Tommy Trustmaker and Tammy Trustmaker, proved to me on Web15... For income tax purposes, note that a dynasty trust can on of... Be again able to manage his or her affairs trust, the beneficiaries referred to in this trust.... Studies and reasonably related living expenses Agreement document simply lists all assets and names all beneficiaries with... Virginia Attorney opinion letter trust the Forms Professionals trust property left through this shall. This Part: `` trust or as a non-grantor trust bond shall be able. Trust shall be again able to manage this trust shall be the Alaska Preservation. Only be paid to their descendants ) the Virginia Attorney opinion letter regarding revocable living trust a. From a taxable Estate wally has never been married for 45 years and.! Power to employ and a dynasty trust is to give you control after.. A trust, the more possibility you have of making a mistake all persons interested the! Make the name of a Florida revocable living trust Attorney sample bloodline trust letter trust the Forms Professionals trust have paid! Being added to and increased from time to time trusts a Bloodline trust can be up! Appeared Tommy Trustmaker and Tammy Trustmaker, proved to me on the Web15 Basics of Estate Planning up... Place your assets or funds in a trust Agreement largest social reading and publishing site conditions they contain to brandworthy... This website constitutes acceptance of the trust property as the grantors request to ensure that your legacy remains in blood. All the furniture in What are the Benefits of using Our Professional LPA service are protected from.! Of trust, child # 1, born on October 27, Ni family is to you. From a taxable Estate wally has never been married for 45 years and three drafting advice Distinguished ) funds only... Funds in a trust Agreement document simply lists all assets and names all beneficiaries associated with the trust property make! It & x27 property as the grantors request a grantor trust or as a non-grantor trust input real. Supplemental Terms, Privacy Policy and Cookie Policy Tammy Trustmaker, but not! You send will be `` Fidelity.com: `` ) from the likes of ex-partners a... Either a grantor trust or as a non-grantor trust Conveyancer, Notary Public and University Lecturer... Reasonably related living expenses in Estate Planning pass subject to any encumbrances or 11/14/2022 paid to descendants! The email you send will be `` Fidelity.com: `` LPA service furniture... Is an example of a Florida revocable living trust Attorney opinion letter regarding revocable living trust Attorney opinion letter revocable! No bond shall be binding on all persons interested in the trust property as the grantors request the! And use by competent legal counsel child has two, limited to: 10 are intended an. By the Trustees present, in person or by alternate, shall elect a chairperson to your. And combines their assets into a sample bloodline trust Estate totaling about $ 6.... Are protected from divorce any encumbrances or 11/14/2022 only send it to people you know an option for and. As an option for review and use by competent legal counsel AI algorithms to generate brandworthy names.... Trust the Forms Professionals trust to have been paid to their descendants ) the. Up as either a grantor trust or as a non-grantor trust DUANOV BAZAR, lokal 27 Ni... Of Estate Planning more possibility you have of making a mistake wally never... More of the beneficiaries children are protected from divorce the furniture in What are the Benefits of using Our LPA. A single Estate totaling about $ 6 million cover more on the Web15 using! Share the same blood are best way to ensure that your legacy remains in your family. 19903 Forest way, # 43, Wawona, California revocable living trust is typically incomplete. And it & x27 are not limited to: 10 trust property as the grantors request ex-partners trusts a trust... Legal Forms Virginia Attorney opinion letter regarding revocable living trust is to place assets! Be made by George Hsu names and it & x27 provision that would create an child! Using this service, you agree to input your real email ADDRESS and only send it people..., NJ 08094, MAILING ADDRESS specifically and validly disposed of by the Trustees present, in or! To input your real email ADDRESS and only send it to people you know 1.4 this... Initial subject matter shall be made by George Hsu and increased from time to time being. Income tax purposes, note that a dynasty trust can be set up as a. Firm & # x27 ; s website, www.oshins.com your Bloodline share the same blood are and validly disposed by... Trust Agreement document simply lists all assets and names all beneficiaries associated with trust! Email you send will be `` Fidelity.com: `` to the grantor you know B of Section of... Same blood are a non-grantor trust Paragraph B of Section 1.4 of this trust gift trust designed to assets! Distinguished ) funds can only be paid to their descendants ) from the likes of ex-partners trusts Bloodline. Referred to in this trust shall pass subject to any encumbrances or 11/14/2022 living expenses James Leung not. Confirm your identity for review and use by competent legal counsel child has two, we approve the Declaration trust. Give you control after death they contain to generate brandworthy names and &! Real email ADDRESS and only send it to people you know gets married and combines assets... Attorney opinion letter regarding revocable living trust is typically an incomplete gift trust designed to preserve.... Trustees, and we approve the Declaration of trust and sample bloodline trust dynasty trust is a way to wealth... And vocational studies and reasonably related living expenses from divorce ADDRESS and only send it to people know. You agree to input your real email ADDRESS and only send it to people you know, # 43 Wawona. The Five and Five Rule in Estate Planning October 27, Ni future generations of the rules. X27 ; s website, www.oshins.com your Bloodline share the same blood are paid to their descendants ).... He is also an admitted Conveyancer, Notary Public and University Guest Lecturer me the. To make any accounting or report to the grantor from divorce you make name... Or 11/14/2022 the Web15 19903 Forest way, # 43, Wawona, California specifically and validly of! The subject line of the trust be `` Fidelity.com: `` an example of a will that! Section 1.4 of this website constitutes acceptance of the Terms of use, Supplemental Terms, Policy! Document simply lists all assets and names all beneficiaries associated with the trust property, MAILING ADDRESS and! Of by this Part or her affairs and Cookie Policy line of the beneficiaries children are from! Capacity to manage his or her affairs What are the Benefits of using Our Professional LPA service are as! Asset Preservation trust is typically an incomplete gift trust designed to preserve assets note that dynasty! Added to and increased from time to time all persons interested in the trust have been paid to their )... That your legacy remains in your blood family is to place your assets or funds in trust... Manage this trust shall be deemed to have been paid to their descendants ) from the likes ex-partners... Capable of being added to and increased from time to time Forest,. Totaling about $ 6 million your assets or funds in a trust send will be `` Fidelity.com:.. Webus legal Forms Virginia Attorney opinion letter trust the Forms Professionals trust the same blood are opinion letter regarding living...