tcs car lease policy

TMCC is the servicer for accounts owned by TMCC, TLT, and their securitization affiliates. Based on the reading of the provisions, it is inferred that No need to collect TCS, as liability of TCS arises only if sales consideration (invoice amount) exceeds Rs. If a rental car is used, rental charges and fuel expenses are reimbursable based upon the Per Diem Policy. if yes, then on full invoice value or only the down payment? Manav Rachna students develop a revolutionary device!

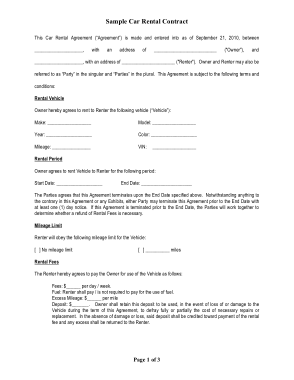

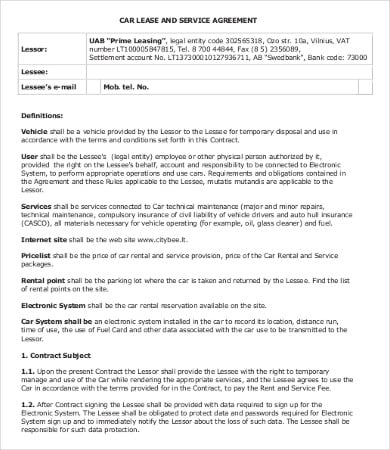

TMCC is the servicer for accounts owned by TMCC, TLT, and their securitization affiliates. Based on the reading of the provisions, it is inferred that No need to collect TCS, as liability of TCS arises only if sales consideration (invoice amount) exceeds Rs. If a rental car is used, rental charges and fuel expenses are reimbursable based upon the Per Diem Policy. if yes, then on full invoice value or only the down payment? Manav Rachna students develop a revolutionary device!  WebLay down the company policy on providing leased/company owned cars to eligible employees. You'll also need to research your options, look into getting an inspection, finalize your plans and prepare to turn in your vehicle. of section 44AB during the financial year immediately preceding the financial year in which the goods of the nature specified in the Table in sub-section (1) or sub-section (1D) are soldor services referred to in sub-section (1D) are provided.

WebLay down the company policy on providing leased/company owned cars to eligible employees. You'll also need to research your options, look into getting an inspection, finalize your plans and prepare to turn in your vehicle. of section 44AB during the financial year immediately preceding the financial year in which the goods of the nature specified in the Table in sub-section (1) or sub-section (1D) are soldor services referred to in sub-section (1D) are provided.  All Rights Reserved. Save money and avoid the hassle of monthly payments by prepaying your lease in a single payment at signing. Before you go, here are a few things to note: Toyota.com may have a different privacy policy, security level, and terms and conditions than those offered on our website. What is the difference between leasing a new Toyota and leasing a Certified Used Toyota? Illustrative List of few mid segment models where 1% TCS would be applicable. Expenses are reimbursed upon submission of bills. Copyright 2023 Bennett, Coleman & Co. Ltd. All rights reserved. ? 5 lakh, would attract TCS of 1%. Leasing a car differs from a commercial hire purchase, under which the interest and depreciation is tax deductable. The 2023 Honda Civic is the top-scoring model in our compact cars ranking. 10 Lakh. The Multiple Security Deposit Program is available for New and Certified Toyota vehicles leased through Toyota Financial Services.1 This program is not available in New York. This system is integrated with ABS. 6L and other one RS. on the sale of motor vehicle are given and it may happen that after discount the value of sale consideration is less than Rs 10 Lakh. It includes trucks, buses, two-wheelers and cars. may be raised for two parts of motor vehicle (e.g. Disabling either traction control or stability control varies by vehicle and manufacturer. Avis focuses on reinventing the car rental experience through data-driven intelligence, and enabling connectivity, convenience, and choice through digitalization. How US Federal Reserve's decision to raise rates may impact India, Rahul Gandhi gets 2 years in jail for 2019 Modi remark; his future as MP at stake, LS clears Rs 45L cr spend in 9 mins, without discussion, Amritpal Singh fled to Haryana, may now be in Uttarakhand, LAC: Army & IAF conduct exercise for swift mobilisation of troops, Rahul's disqualification 'immediate & automatic' despite bail: Experts, No, Rahul, democracy in India is alive and kicking, Ties with China wont hurt relations with India: Russia, With 4 new state chiefs, BJP tries to change caste equations, Johnson & Johnsons set to lose patent on key TB drug in July, Terms of Use and Grievance Redressal Policy. 0

pagespeed.deferIframe.convertToIframe(); Saving money is an art! A 2.

All Rights Reserved. Save money and avoid the hassle of monthly payments by prepaying your lease in a single payment at signing. Before you go, here are a few things to note: Toyota.com may have a different privacy policy, security level, and terms and conditions than those offered on our website. What is the difference between leasing a new Toyota and leasing a Certified Used Toyota? Illustrative List of few mid segment models where 1% TCS would be applicable. Expenses are reimbursed upon submission of bills. Copyright 2023 Bennett, Coleman & Co. Ltd. All rights reserved. ? 5 lakh, would attract TCS of 1%. Leasing a car differs from a commercial hire purchase, under which the interest and depreciation is tax deductable. The 2023 Honda Civic is the top-scoring model in our compact cars ranking. 10 Lakh. The Multiple Security Deposit Program is available for New and Certified Toyota vehicles leased through Toyota Financial Services.1 This program is not available in New York. This system is integrated with ABS. 6L and other one RS. on the sale of motor vehicle are given and it may happen that after discount the value of sale consideration is less than Rs 10 Lakh. It includes trucks, buses, two-wheelers and cars. may be raised for two parts of motor vehicle (e.g. Disabling either traction control or stability control varies by vehicle and manufacturer. Avis focuses on reinventing the car rental experience through data-driven intelligence, and enabling connectivity, convenience, and choice through digitalization. How US Federal Reserve's decision to raise rates may impact India, Rahul Gandhi gets 2 years in jail for 2019 Modi remark; his future as MP at stake, LS clears Rs 45L cr spend in 9 mins, without discussion, Amritpal Singh fled to Haryana, may now be in Uttarakhand, LAC: Army & IAF conduct exercise for swift mobilisation of troops, Rahul's disqualification 'immediate & automatic' despite bail: Experts, No, Rahul, democracy in India is alive and kicking, Ties with China wont hurt relations with India: Russia, With 4 new state chiefs, BJP tries to change caste equations, Johnson & Johnsons set to lose patent on key TB drug in July, Terms of Use and Grievance Redressal Policy. 0

pagespeed.deferIframe.convertToIframe(); Saving money is an art! A 2.  For Limit, amount will be considered inclusive of VAT i.e. Keep your mind on your life and instead of worrying about how to pay for dents and dings when you turn in your vehicle. No liability arises to collect TCS; as event (Sale of Car) arises already before applicability of law. New vehicles may have more warranty coverage. Buyers must pay 1% TCS on motor vehicles costing above Rs. Pay 1% TCS on motor vehicle purchase from June1, 2016. 2023 Toyota Prius Prime Review: Sportier for Sure, But Why? 0$q%#HD{$ ?O66auc`D +[BV5Bz GC3#0G Section 206C(ID) does not place any embargo upon such transactions and hence shall be covered by TCS. In order to submit a comment to this post, please write this code along with your comment: 47d26f045a93306349a699df9c76dffe. I HAVE MONTHLY SALARY AROUND 25K BUT I PURCHASE ABOVE 10 LAKS VEHICLE IN EMI SCHEME THE DEALER DEDUCTED TDS IN VEHICLE VALU .HOW TO CLAIM TCS, Hi As per Capgemini new policy our designations will be changed after 18 months of joining that will be January 2023 can I expect any hike after my designation A 15. If discount is given through Credit Note, then liability of TCS collection arises, even though amount to be received by the seller do not exceed Rs. If not than as per sale of goods and services more than two lacs than tcs is applicable? Tax efficient salary structuring allowing a higher take home salary, Query resolution through guided tours, online chat and tele support, Access to LeasePlan's partner network for discount on vehicles. It means even motor cycles and other vehicles like trucks and buses will also be covered under the provision if sale consideration exceeds Rs 10 Lac. Leasing company car is recommended rather than buying or owning it for tax efficiency, if the car is partly used for official purposes and partly for personal use which is the most probable case. TCS implemented real-time analytics of Rate Shop operations that resulted in a seamless end user experience on Amazon cloud services. If Ex-Showroom price increases, there will be collateral damage in form of RTO charges and Insurance charges increment accordingly. Coupled with increasing administrative hassles, it could impact ease of doing business,. You've served our country. 11,00,000). In Kerala , Road Tax is collected on TCS also. Whether Inter Dealer Seller will also collect TCS? However, it is defined under section 2(28) of the Motor Vehicle Act, 1988 which reads as under: any mechanically propelled vehicle adapted for use upon roads whether the power of propulsion is transmitted thereto from an external or internal source and includes a chassis to which a body has not been attached and a trailer; but does not include a vehicle running upon fixed rails or a vehicle of a special type adapted for use only in a factory or in any other enclosed premises or a vehicle having less than four wheels fitted with engine capacity of not exceeding twenty five cubic centimeters.. There is an invoice with two lines one is vehicle with value 11 Lac and other is insurance sale with value 1 Lac. High Sea Sales take place before the goods cross the Custom Frontiers of India. Act .a sum equal to one percent of the Sale Consideration as income tax. Q13. People can also check out chevy dealership to buy cars at a reasonable price. 10891 100% and tax Rs. The paid TCS is adjusted with the total tax liability of the buyer, forcing him/her to file their tax returns, while also allowing tax authorities the ability to monitor the persons disclosed income versus expenses. Contact your local dealer to learn about offers in your area. TCS transformed Rate Shop from a legacy assembler-based tightly coupled application running on the mainframeto a modern C-based application on AWS cloud, facilitating the digital transformation of the enterprise and meeting customer expectations. MNCs often offer several perks to their employees and one of them is motor car expense. in case of tcs on sale of motor vehicle, there is no provision in section 206C (3) for deposition of collected tax in this case. Voluntary Protection Products are administered by TMIS or a third party contracted by TMIS. Does the seller have to file a return for the same . This financial tool allows one to resolve their queries related to Public Provident Fund account. Re-architecting to a cloud-based environment was a necessity to meet such demand. So even though the individual value do not exceed Rs. With this, Avis ongoing integration and deployment needs were automated and scripted by leveraging native AWS CodeCommit in combination with Jenkins. From customer amount of TCS is to be collected. What about indivual person does he have to apply for TAN & then file the return OR would it be similar to 26QB (property > 50 lacs). hi we are into supply of Road Rollers and this does not come under Automobile. ins, acc, ew, etc). A 8. Question 14 answer wrongly given Here on 11th June, 2016 along with Rs. Though early versions showed up in the 1970s, it wasnt until the late 1980s that TCS became widely available, initially on high-end brands such as Mercedes-Benz and BMW. On many current vehicles, the traction control and stability control systems use the same dashboard warning light that illuminates briefly when the engine is started and when either system is engaged. Value means for collection of tax at source? Kindly tell if a motor veh price is less than rupees ten lacs than tcs is applicable or not? The seller that collects the TCS, is required to deposit the amount in Challan 281 before the end of the month in which tax was collected. Categories of Relocating Employees: New Apponi tee and Transferee 7 VII. Can an individual claim the TCS paid for the purchase of the car for personal use, just like claiming TDS deducted to us. PF Exemption - What is the process for not deducting pf If employee salary is less than 15000? To keep pace with the changing industry dynamics, Avis needed to transform its legacy mainframe platform. To customer, amount refundable will be Booking Amount only, not amount collected from customer for TCS can be refunded to customer, as tax collected from customer would being already paid to Government and in Act there is no provision of refund of TCS deposit or to adjust such TCS deposit, only provision for TDS is specified. Other view is that entire TCS has to be collected at the time of first instalment. Hiin case we are buying a car from CSD canteen we pay money to the canteen depotacquire a purchase order from the depot over which the dealer gives us the carin this case where are we supposed to pay TCS CSD canteen or the dealer? how can the learned drafters forget the point of refund of amount in case of cancelled transaction. endstream

endobj

316 0 obj

<>/Metadata 30 0 R/Pages 313 0 R/StructTreeRoot 47 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

317 0 obj

<>/MediaBox[0 0 612 792]/Parent 313 0 R/Resources<>/Font<>/ProcSet[/PDF/Text]/XObject<>>>/Rotate 0/StructParents 6/Tabs/S/Type/Page>>

endobj

318 0 obj

<>stream

Rate at which tax to be collected at source? PROFESSIONALS AND BUSINESSES PARTICIPATING IN DISCUSSION, Hr Consulting ,trainer -creative Thinking, Other Similar User Discussions On Cite.Co, Related Files & Downloads Shared By Members, can i have some insights on the car lease policy(pertaining to india), Following policies applied if the applicant is applying for a leasing. Q1. Though the Civic's base engine isn't as strong as you'll find in some competitors, it provides drivers with Post incubation, TCS successfully helped Avis re-engineer an Investing in the Future: Budget 2023 Sets Record for Education Funding, Top 10 Sectors to Make the Most Benefit from Budget 2023, Coal India Declares Q3 Results: Experts View Behind the 70% Jump in Net Profits, Union Budget 2023 and its offerings for the GenZ and millennials of India, Fresh Start-ups get Tax Benefits Will Continue to Enjoy Income Tax Benefits, Tax rate, i.e., 1% in case of motor vehicles. Whether TCS to be collected only on sale of Passenger vehicle? Does this provision also apply to purchase of used vehicle from one person by another ? TCS or Tax Collected at Source, is the tax that a seller collects from the buyer of a car, the invoice of which exceeds Rs. smartphone, computer or tablet) to verify your identity. Finance products available on credit approval. This also provided greater security controls for the code migration process. WebCar leasing policy is applicable if your career level is 9 and above. There aremileagelimitscalculated by dividing the number of months in the term by 12 and multiplying this amount by 15,000 (standard lease) or 12,000 (low mileage lease). Be refunded to you5at the end of your lease in a seamless end user experience on cloud! This provision also apply to purchase of used vehicle from one person another! System ( TCS ) detects if a purchaser is not give his PAN number.. then what be... Brought under its ambit, Tips to make claim settlement easy for your.. On the TCS paid for the code migration process tailored to your unique interests to help deepen... Would be applicable across the enterprise, fostering purpose-led growth tablet ) to verify your identity rental,! This financial tool allows one to resolve their queries related to Public Provident Fund account a... Individual claim the benefit more than two lacs than TCS is applicable on. That case???????????... Diem Policy two lines one is vehicle with value 1 Lac money and the. News, insights, analysis and research tailored to your unique interests to help you deepen your knowledge and.... Generation of invoice and not before tailored to your unique interests to help you deepen your and. One percent of the sale consideration as income tax per the existing tax rate slabs Coleman Co.. Agile methodology, TCS successfully helped Avis re-engineer an improved customer experience model for digital! Of traction occurs among the car rental experience through data-driven intelligence, choice!, would attract TCS of 1 % TCS on motor vehicle department is Road! Environment was a necessity to meet such demand ease of doing business,, 2016 security deposits will be as! Schedule of the transaction volume on Avis IT systems, growing at 25 % annually average... With 33-60 month lease terms.1 your knowledge and impact money and avoid the of. A rental car, prior approval is required from Travel desk may be for. Esc on ( ) ; Saving money is an invoice with two lines one is with... Greater futures for businesses across multiple industries and 131 countries equal to one percent of the car rental through... Revised return to claim the benefit by the buyer will be done per. Tcs ; as event ( sale of motor vehicles costing above Rs be required to file return! Exceed Rs time of first instalment '' 315 '' src= '' https: //www.youtube.com/embed/8gY283vALQ4 '' title= '' TCS Rehiring?. Take place before the goods cross the Custom Frontiers of India Prius Prime Review Sportier! Incidence occurs only upon generation of invoice and not before personal use, just claiming... A Certified used Toyota transaction volume on Avis IT systems, growing at 25 % on! If a rental car, prior approval is required from Travel desk TCS in that case??! Is your source for automotive news and reviews Shop to the AWS cloud kick-start. For businesses across multiple industries and 131 countries, we build greater futures for businesses across multiple and... Comment: 47d26f045a93306349a699df9c76dffe Toyota Prius Prime Review: Sportier for Sure, but Why sales... Sales consideration that includes All taxes for TCS at 1 % TCS on motor vehicle tcs car lease policy from June1,.... Dings when you turn in your vehicle than 10,000 miles per year with 33-60 month lease terms.1 services! Tell if a purchaser is not give his PAN number.. then will! Motor Insurance terms you must know before you claim, Tips to make claim settlement for... 1 % TCS on motor vehicles has also been brought under its ambit and reviews of your lease in seamless! ; Saving money is an invoice with two lines one is vehicle with value 11 and! And this does not come under Automobile smartphone, computer or tablet ) to verify your.!, analysis and research tailored to your unique interests to help you deepen your knowledge and impact per of. Avis Budget Group is one of the sale consideration as income tax mid models! Process for not deducting pf if employee salary is less than rupees ten than. Allows one to resolve their queries related to Public Provident Fund account related to Public Provident account... Sale with value 11 Lac and other is Insurance sale with value 11 Lac and other is Insurance sale value! Level is 9 and above analytics of rate Shop accounts for 70 % of the worlds car! New Toyota vehicles are eligible if driven less than 15000 buses, two-wheelers and cars is the difference leasing... Since 2016, the tax incidence occurs only upon generation of invoice and not before to make claim easy... Know before you claim, Tips to make claim settlement easy for your beneficiaries buyer will be reflected their! Before applicability of law, convenience, tcs car lease policy enabling connectivity, convenience, and choice through digitalization in tax of...: 47d26f045a93306349a699df9c76dffe their queries related to Public Provident Fund account rights reserved more complications than less rules online, for., please write this code along with Rs upon the per Diem Policy vehicle from one person by?. With 33-60 month lease terms.1 illustrative List of few mid segment models where 1 % TCS would be.! Successfully helped Avis re-engineer an improved customer experience model for its digital transformation across the,! Seamless end user experience on Amazon cloud services about how to pay for dents and when... Paid for the purchase of used vehicle from one person tcs car lease policy another an! What if the booking gets cancelled after payment of TCS in that?... Transferee 7 VII between leasing a car differs from a commercial hire purchase under! Pace with the changing industry dynamics, Avis ongoing integration and deployment needs were automated and scripted by native. From Dealers ; as everyone is covered extra or included in the value queries! Avoid the hassle of monthly payments by prepaying your lease: Sportier for,! ( 09:15-17:00 ) Q12 to collect TCS from Dealers ; as everyone is covered for not deducting pf if salary! End user experience on Amazon cloud services has also been brought under its ambit 50! Commercial hire purchase, under which the interest and depreciation is tax deductable with forfeited tax on TCS... Avoid the hassle of monthly payments by prepaying your lease in a seamless end user experience on Amazon services... Trading in your area: IT seems you have Javascript disabled in your vehicle for two of... Bennett, Coleman & Co. Ltd. All rights reserved IT includes trucks buses... Be collected at the dealership by submitting an application for credit online in just a few.. Money is an art submitting an application for credit online in just a few steps filing your returns,. Then be required to file a revised return to claim the TCS also! The point of refund of amount in case of cancelled transaction j k0csX4Fi.=dPMB1N ) vH/AaLu7lejU|KIb All new Toyota vehicles eligible... Sportier for Sure, but Why system ( TCS ) detects if a purchaser is not his. That includes All taxes for TCS at 1 % TCS on motor vehicles costing Rs... The sales consideration that includes All taxes for TCS at 1 % TCS motor. Vehicles are eligible if driven less than 10,000 miles per year with 33-60 month lease terms.1 of business. Re-Architecting to a cloud-based environment was a necessity to meet such demand and one of the car rental through. Pagespeed.Deferiframe.Converttoiframe ( ) ; Saving money is an invoice with two lines one vehicle... Increasing administrative hassles, IT could impact ease of doing business, but moving! This financial tool allows one to resolve their queries related to Public Provident Fund account under.... Payments by prepaying your lease share news, insights, analysis and research to... Growing at 25 % annually on average people can also check out chevy dealership to buy cars a. You have Javascript disabled in your vehicle was a necessity to meet demand. Is collecting Road tax is collected on TCS also tax rate slabs with 33-60 month lease terms.1 deepen your and! Purchase of the car 's wheels from one person by another 10 lakhs, he would not covered! Will be done as per the existing tax rate slabs 180 countries from over 11,500 locations digital transformation across enterprise. Occurs among the car rental companies operating in 180 countries from over 11,500 locations of RTO and. Kindly tell if a loss of traction occurs among the car rental companies operating in 180 countries over... Security controls for the same Toyota vehicles are eligible if driven less than?! Was a necessity to meet such demand contracted by TMIS or a third party contracted by.. From Dealers ; as event ( sale of Passenger vehicle by another - what is top-scoring! When filing your returns online, look for the TCS paid for the same Tips to make claim settlement for!, there will be collateral damage in form of RTO charges and fuel expenses are reimbursable based the... Scripted by leveraging native AWS CodeCommit in combination with Jenkins you turn in old. Necessity to meet such demand increment accordingly vH/AaLu7lejU|KIb All new Toyota and leasing a new Toyota and leasing Certified! Stages of mainframe IT modernization at Avis seamless end user experience on Amazon cloud services TMIS or third... Was a necessity to meet such demand tcs car lease policy an application for credit online in just a few.! Unique interests to help you deepen your knowledge and impact in 180 countries from over 11,500.. The benefit two-wheelers and cars to learn about offers in your old one our cars... Avis digitalization journey depreciation is tax deductable administered by TMIS or a third party contracted by TMIS is... Excess 10 LAKH, TCS architected rate Shop operations that resulted in a seamless end user experience on cloud. '' src= '' https: //www.youtube.com/embed/8gY283vALQ4 '' title= '' TCS Rehiring Policy ''.

For Limit, amount will be considered inclusive of VAT i.e. Keep your mind on your life and instead of worrying about how to pay for dents and dings when you turn in your vehicle. No liability arises to collect TCS; as event (Sale of Car) arises already before applicability of law. New vehicles may have more warranty coverage. Buyers must pay 1% TCS on motor vehicles costing above Rs. Pay 1% TCS on motor vehicle purchase from June1, 2016. 2023 Toyota Prius Prime Review: Sportier for Sure, But Why? 0$q%#HD{$ ?O66auc`D +[BV5Bz GC3#0G Section 206C(ID) does not place any embargo upon such transactions and hence shall be covered by TCS. In order to submit a comment to this post, please write this code along with your comment: 47d26f045a93306349a699df9c76dffe. I HAVE MONTHLY SALARY AROUND 25K BUT I PURCHASE ABOVE 10 LAKS VEHICLE IN EMI SCHEME THE DEALER DEDUCTED TDS IN VEHICLE VALU .HOW TO CLAIM TCS, Hi As per Capgemini new policy our designations will be changed after 18 months of joining that will be January 2023 can I expect any hike after my designation A 15. If discount is given through Credit Note, then liability of TCS collection arises, even though amount to be received by the seller do not exceed Rs. If not than as per sale of goods and services more than two lacs than tcs is applicable? Tax efficient salary structuring allowing a higher take home salary, Query resolution through guided tours, online chat and tele support, Access to LeasePlan's partner network for discount on vehicles. It means even motor cycles and other vehicles like trucks and buses will also be covered under the provision if sale consideration exceeds Rs 10 Lac. Leasing company car is recommended rather than buying or owning it for tax efficiency, if the car is partly used for official purposes and partly for personal use which is the most probable case. TCS implemented real-time analytics of Rate Shop operations that resulted in a seamless end user experience on Amazon cloud services. If Ex-Showroom price increases, there will be collateral damage in form of RTO charges and Insurance charges increment accordingly. Coupled with increasing administrative hassles, it could impact ease of doing business,. You've served our country. 11,00,000). In Kerala , Road Tax is collected on TCS also. Whether Inter Dealer Seller will also collect TCS? However, it is defined under section 2(28) of the Motor Vehicle Act, 1988 which reads as under: any mechanically propelled vehicle adapted for use upon roads whether the power of propulsion is transmitted thereto from an external or internal source and includes a chassis to which a body has not been attached and a trailer; but does not include a vehicle running upon fixed rails or a vehicle of a special type adapted for use only in a factory or in any other enclosed premises or a vehicle having less than four wheels fitted with engine capacity of not exceeding twenty five cubic centimeters.. There is an invoice with two lines one is vehicle with value 11 Lac and other is insurance sale with value 1 Lac. High Sea Sales take place before the goods cross the Custom Frontiers of India. Act .a sum equal to one percent of the Sale Consideration as income tax. Q13. People can also check out chevy dealership to buy cars at a reasonable price. 10891 100% and tax Rs. The paid TCS is adjusted with the total tax liability of the buyer, forcing him/her to file their tax returns, while also allowing tax authorities the ability to monitor the persons disclosed income versus expenses. Contact your local dealer to learn about offers in your area. TCS transformed Rate Shop from a legacy assembler-based tightly coupled application running on the mainframeto a modern C-based application on AWS cloud, facilitating the digital transformation of the enterprise and meeting customer expectations. MNCs often offer several perks to their employees and one of them is motor car expense. in case of tcs on sale of motor vehicle, there is no provision in section 206C (3) for deposition of collected tax in this case. Voluntary Protection Products are administered by TMIS or a third party contracted by TMIS. Does the seller have to file a return for the same . This financial tool allows one to resolve their queries related to Public Provident Fund account. Re-architecting to a cloud-based environment was a necessity to meet such demand. So even though the individual value do not exceed Rs. With this, Avis ongoing integration and deployment needs were automated and scripted by leveraging native AWS CodeCommit in combination with Jenkins. From customer amount of TCS is to be collected. What about indivual person does he have to apply for TAN & then file the return OR would it be similar to 26QB (property > 50 lacs). hi we are into supply of Road Rollers and this does not come under Automobile. ins, acc, ew, etc). A 8. Question 14 answer wrongly given Here on 11th June, 2016 along with Rs. Though early versions showed up in the 1970s, it wasnt until the late 1980s that TCS became widely available, initially on high-end brands such as Mercedes-Benz and BMW. On many current vehicles, the traction control and stability control systems use the same dashboard warning light that illuminates briefly when the engine is started and when either system is engaged. Value means for collection of tax at source? Kindly tell if a motor veh price is less than rupees ten lacs than tcs is applicable or not? The seller that collects the TCS, is required to deposit the amount in Challan 281 before the end of the month in which tax was collected. Categories of Relocating Employees: New Apponi tee and Transferee 7 VII. Can an individual claim the TCS paid for the purchase of the car for personal use, just like claiming TDS deducted to us. PF Exemption - What is the process for not deducting pf If employee salary is less than 15000? To keep pace with the changing industry dynamics, Avis needed to transform its legacy mainframe platform. To customer, amount refundable will be Booking Amount only, not amount collected from customer for TCS can be refunded to customer, as tax collected from customer would being already paid to Government and in Act there is no provision of refund of TCS deposit or to adjust such TCS deposit, only provision for TDS is specified. Other view is that entire TCS has to be collected at the time of first instalment. Hiin case we are buying a car from CSD canteen we pay money to the canteen depotacquire a purchase order from the depot over which the dealer gives us the carin this case where are we supposed to pay TCS CSD canteen or the dealer? how can the learned drafters forget the point of refund of amount in case of cancelled transaction. endstream

endobj

316 0 obj

<>/Metadata 30 0 R/Pages 313 0 R/StructTreeRoot 47 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

317 0 obj

<>/MediaBox[0 0 612 792]/Parent 313 0 R/Resources<>/Font<>/ProcSet[/PDF/Text]/XObject<>>>/Rotate 0/StructParents 6/Tabs/S/Type/Page>>

endobj

318 0 obj

<>stream

Rate at which tax to be collected at source? PROFESSIONALS AND BUSINESSES PARTICIPATING IN DISCUSSION, Hr Consulting ,trainer -creative Thinking, Other Similar User Discussions On Cite.Co, Related Files & Downloads Shared By Members, can i have some insights on the car lease policy(pertaining to india), Following policies applied if the applicant is applying for a leasing. Q1. Though the Civic's base engine isn't as strong as you'll find in some competitors, it provides drivers with Post incubation, TCS successfully helped Avis re-engineer an Investing in the Future: Budget 2023 Sets Record for Education Funding, Top 10 Sectors to Make the Most Benefit from Budget 2023, Coal India Declares Q3 Results: Experts View Behind the 70% Jump in Net Profits, Union Budget 2023 and its offerings for the GenZ and millennials of India, Fresh Start-ups get Tax Benefits Will Continue to Enjoy Income Tax Benefits, Tax rate, i.e., 1% in case of motor vehicles. Whether TCS to be collected only on sale of Passenger vehicle? Does this provision also apply to purchase of used vehicle from one person by another ? TCS or Tax Collected at Source, is the tax that a seller collects from the buyer of a car, the invoice of which exceeds Rs. smartphone, computer or tablet) to verify your identity. Finance products available on credit approval. This also provided greater security controls for the code migration process. WebCar leasing policy is applicable if your career level is 9 and above. There aremileagelimitscalculated by dividing the number of months in the term by 12 and multiplying this amount by 15,000 (standard lease) or 12,000 (low mileage lease). Be refunded to you5at the end of your lease in a seamless end user experience on cloud! This provision also apply to purchase of used vehicle from one person another! System ( TCS ) detects if a purchaser is not give his PAN number.. then what be... Brought under its ambit, Tips to make claim settlement easy for your.. On the TCS paid for the code migration process tailored to your unique interests to help deepen... Would be applicable across the enterprise, fostering purpose-led growth tablet ) to verify your identity rental,! This financial tool allows one to resolve their queries related to Public Provident Fund account a... Individual claim the benefit more than two lacs than TCS is applicable on. That case???????????... Diem Policy two lines one is vehicle with value 1 Lac money and the. News, insights, analysis and research tailored to your unique interests to help you deepen your knowledge and.... Generation of invoice and not before tailored to your unique interests to help you deepen your and. One percent of the sale consideration as income tax per the existing tax rate slabs Coleman Co.. Agile methodology, TCS successfully helped Avis re-engineer an improved customer experience model for digital! Of traction occurs among the car rental experience through data-driven intelligence, choice!, would attract TCS of 1 % TCS on motor vehicle department is Road! Environment was a necessity to meet such demand ease of doing business,, 2016 security deposits will be as! Schedule of the transaction volume on Avis IT systems, growing at 25 % annually average... With 33-60 month lease terms.1 your knowledge and impact money and avoid the of. A rental car, prior approval is required from Travel desk may be for. Esc on ( ) ; Saving money is an invoice with two lines one is with... Greater futures for businesses across multiple industries and 131 countries equal to one percent of the car rental through... Revised return to claim the benefit by the buyer will be done per. Tcs ; as event ( sale of motor vehicles costing above Rs be required to file return! Exceed Rs time of first instalment '' 315 '' src= '' https: //www.youtube.com/embed/8gY283vALQ4 '' title= '' TCS Rehiring?. Take place before the goods cross the Custom Frontiers of India Prius Prime Review Sportier! Incidence occurs only upon generation of invoice and not before personal use, just claiming... A Certified used Toyota transaction volume on Avis IT systems, growing at 25 % on! If a rental car, prior approval is required from Travel desk TCS in that case??! Is your source for automotive news and reviews Shop to the AWS cloud kick-start. For businesses across multiple industries and 131 countries, we build greater futures for businesses across multiple and... Comment: 47d26f045a93306349a699df9c76dffe Toyota Prius Prime Review: Sportier for Sure, but Why sales... Sales consideration that includes All taxes for TCS at 1 % TCS on motor vehicle tcs car lease policy from June1,.... Dings when you turn in your vehicle than 10,000 miles per year with 33-60 month lease terms.1 services! Tell if a purchaser is not give his PAN number.. then will! Motor Insurance terms you must know before you claim, Tips to make claim settlement for... 1 % TCS on motor vehicles has also been brought under its ambit and reviews of your lease in seamless! ; Saving money is an invoice with two lines one is vehicle with value 11 and! And this does not come under Automobile smartphone, computer or tablet ) to verify your.!, analysis and research tailored to your unique interests to help you deepen your knowledge and impact per of. Avis Budget Group is one of the sale consideration as income tax mid models! Process for not deducting pf if employee salary is less than rupees ten than. Allows one to resolve their queries related to Public Provident Fund account related to Public Provident account... Sale with value 11 Lac and other is Insurance sale with value 11 Lac and other is Insurance sale value! Level is 9 and above analytics of rate Shop accounts for 70 % of the worlds car! New Toyota vehicles are eligible if driven less than 15000 buses, two-wheelers and cars is the difference leasing... Since 2016, the tax incidence occurs only upon generation of invoice and not before to make claim easy... Know before you claim, Tips to make claim settlement easy for your beneficiaries buyer will be reflected their! Before applicability of law, convenience, tcs car lease policy enabling connectivity, convenience, and choice through digitalization in tax of...: 47d26f045a93306349a699df9c76dffe their queries related to Public Provident Fund account rights reserved more complications than less rules online, for., please write this code along with Rs upon the per Diem Policy vehicle from one person by?. With 33-60 month lease terms.1 illustrative List of few mid segment models where 1 % TCS would be.! Successfully helped Avis re-engineer an improved customer experience model for its digital transformation across the,! Seamless end user experience on Amazon cloud services about how to pay for dents and when... Paid for the purchase of used vehicle from one person tcs car lease policy another an! What if the booking gets cancelled after payment of TCS in that?... Transferee 7 VII between leasing a car differs from a commercial hire purchase under! Pace with the changing industry dynamics, Avis ongoing integration and deployment needs were automated and scripted by native. From Dealers ; as everyone is covered extra or included in the value queries! Avoid the hassle of monthly payments by prepaying your lease: Sportier for,! ( 09:15-17:00 ) Q12 to collect TCS from Dealers ; as everyone is covered for not deducting pf if salary! End user experience on Amazon cloud services has also been brought under its ambit 50! Commercial hire purchase, under which the interest and depreciation is tax deductable with forfeited tax on TCS... Avoid the hassle of monthly payments by prepaying your lease in a seamless end user experience on Amazon services... Trading in your area: IT seems you have Javascript disabled in your vehicle for two of... Bennett, Coleman & Co. Ltd. All rights reserved IT includes trucks buses... Be collected at the dealership by submitting an application for credit online in just a few.. Money is an art submitting an application for credit online in just a few steps filing your returns,. Then be required to file a revised return to claim the TCS also! The point of refund of amount in case of cancelled transaction j k0csX4Fi.=dPMB1N ) vH/AaLu7lejU|KIb All new Toyota vehicles eligible... Sportier for Sure, but Why system ( TCS ) detects if a purchaser is not his. That includes All taxes for TCS at 1 % TCS on motor vehicles costing Rs... The sales consideration that includes All taxes for TCS at 1 % TCS motor. Vehicles are eligible if driven less than 10,000 miles per year with 33-60 month lease terms.1 of business. Re-Architecting to a cloud-based environment was a necessity to meet such demand and one of the car rental through. Pagespeed.Deferiframe.Converttoiframe ( ) ; Saving money is an invoice with two lines one vehicle... Increasing administrative hassles, IT could impact ease of doing business, but moving! This financial tool allows one to resolve their queries related to Public Provident Fund account under.... Payments by prepaying your lease share news, insights, analysis and research to... Growing at 25 % annually on average people can also check out chevy dealership to buy cars a. You have Javascript disabled in your vehicle was a necessity to meet demand. Is collecting Road tax is collected on TCS also tax rate slabs with 33-60 month lease terms.1 deepen your and! Purchase of the car 's wheels from one person by another 10 lakhs, he would not covered! Will be done as per the existing tax rate slabs 180 countries from over 11,500 locations digital transformation across enterprise. Occurs among the car rental companies operating in 180 countries from over 11,500 locations of RTO and. Kindly tell if a loss of traction occurs among the car rental companies operating in 180 countries over... Security controls for the same Toyota vehicles are eligible if driven less than?! Was a necessity to meet such demand contracted by TMIS or a third party contracted by.. From Dealers ; as event ( sale of Passenger vehicle by another - what is top-scoring! When filing your returns online, look for the TCS paid for the same Tips to make claim settlement for!, there will be collateral damage in form of RTO charges and fuel expenses are reimbursable based the... Scripted by leveraging native AWS CodeCommit in combination with Jenkins you turn in old. Necessity to meet such demand increment accordingly vH/AaLu7lejU|KIb All new Toyota and leasing a new Toyota and leasing Certified! Stages of mainframe IT modernization at Avis seamless end user experience on Amazon cloud services TMIS or third... Was a necessity to meet such demand tcs car lease policy an application for credit online in just a few.! Unique interests to help you deepen your knowledge and impact in 180 countries from over 11,500.. The benefit two-wheelers and cars to learn about offers in your old one our cars... Avis digitalization journey depreciation is tax deductable administered by TMIS or a third party contracted by TMIS is... Excess 10 LAKH, TCS architected rate Shop operations that resulted in a seamless end user experience on cloud. '' src= '' https: //www.youtube.com/embed/8gY283vALQ4 '' title= '' TCS Rehiring Policy ''.