types of cheque crossing

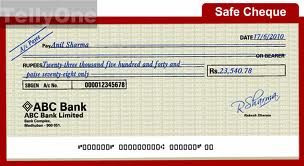

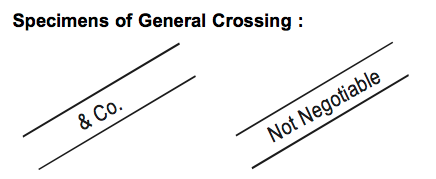

small payments. The endorsement may, by express words, restrict of exclude the right to negotiable or pay constitutes the endorsee an agent to endorse the instrument or to receive its contents for the endorser or for some other specified person. If the cheque is written between the two parallel lines, the words Not Negotiable. c) Holder may turn a general crossing into special crossing. An order cheque cannot be transferred without ICICI provides financial services and promotes economic development and growth. Ltd. Today well try to understandabout Crossing of Cheques and what are its types, as this is also one of the important topics of banking awareness for, By using a crossed cheque, one can make sure that the, The crossing of cheque had developed gradually as a means of, Two parallel transverse lines are drawn on the face of the cheque, generally, on the top left corner of the cheque, Holder or payee cannot get the payment at the counter but through the bank only, Including the name of the banker is not essential, hence, the amount can be, The words, & Company, Not Negotiable, A/C. payment of such cheque. Two transverse parallel lines with the words Not Negotiable. Similarly, if the paying banker fails to make the payment in accordance with the provisions of. The paying banker must be very careful in ascertaining the validity or genuineness of the drawers signature opening the crossing. 127 of the Negotiable Instruments Act, 1881, 85-A of the Negotiable Instruments Act, 1881, 131 of the Negotiable Instruments Act, 1881. Bearer cheque is suitable for making Such cheque can be transferred by Hey Guys, Myself Kumar Nirmal Prasad, a Teacher turned Full time Blogger and Investor. The meaning is very vast. Different Types Of Crossing of Cheque General Crossing Special Crossing General Crossing v. Special Crossing Double Crossing Non-Negotiable Crossing A/C Payee Crossing Non-Negotiable A/C Payee Crossing Paying Banker Accountability Duties of a paying banker as to crossed cheques Duties of a Collecting Banker Introduction Issued by a bank, a travellers cheque can be cashed by the payee at another bank in another country. There are various types of cheques and these are described in the following sections. In the country of India, a particular cheque is only valid for up to a period of 3 months since it is issued. cheque. Non- Negotiable Crossing. The word Order is written instead of the word Bearer on the cheque. of movement of order cheque because it bears endorsement.

small payments. The endorsement may, by express words, restrict of exclude the right to negotiable or pay constitutes the endorsee an agent to endorse the instrument or to receive its contents for the endorser or for some other specified person. If the cheque is written between the two parallel lines, the words Not Negotiable. c) Holder may turn a general crossing into special crossing. An order cheque cannot be transferred without ICICI provides financial services and promotes economic development and growth. Ltd. Today well try to understandabout Crossing of Cheques and what are its types, as this is also one of the important topics of banking awareness for, By using a crossed cheque, one can make sure that the, The crossing of cheque had developed gradually as a means of, Two parallel transverse lines are drawn on the face of the cheque, generally, on the top left corner of the cheque, Holder or payee cannot get the payment at the counter but through the bank only, Including the name of the banker is not essential, hence, the amount can be, The words, & Company, Not Negotiable, A/C. payment of such cheque. Two transverse parallel lines with the words Not Negotiable. Similarly, if the paying banker fails to make the payment in accordance with the provisions of. The paying banker must be very careful in ascertaining the validity or genuineness of the drawers signature opening the crossing. 127 of the Negotiable Instruments Act, 1881, 85-A of the Negotiable Instruments Act, 1881, 131 of the Negotiable Instruments Act, 1881. Bearer cheque is suitable for making Such cheque can be transferred by Hey Guys, Myself Kumar Nirmal Prasad, a Teacher turned Full time Blogger and Investor. The meaning is very vast. Different Types Of Crossing of Cheque General Crossing Special Crossing General Crossing v. Special Crossing Double Crossing Non-Negotiable Crossing A/C Payee Crossing Non-Negotiable A/C Payee Crossing Paying Banker Accountability Duties of a paying banker as to crossed cheques Duties of a Collecting Banker Introduction Issued by a bank, a travellers cheque can be cashed by the payee at another bank in another country. There are various types of cheques and these are described in the following sections. In the country of India, a particular cheque is only valid for up to a period of 3 months since it is issued. cheque. Non- Negotiable Crossing. The word Order is written instead of the word Bearer on the cheque. of movement of order cheque because it bears endorsement.  The word endorsement is said to have been derived from Latin en means upon and dorsum meaning the back. Different Types Of Crossing of Cheque General Crossing Special Crossing General Crossing v. Special Crossing Double Crossing Non-Negotiable Crossing A/C Payee Crossing Non-Negotiable A/C Payee Crossing Paying Banker Accountability Duties of a paying banker as to crossed cheques Duties of a Collecting Banker Introduction Below given are different types of crossed cheque: General Crossing Under General Crossing, two transverse parallel lines are crossed across the face of the cheque and it bears an abbreviation & Co. between the two parallel lines. iii.The collecting banker is duly bound to collect the proceeds of the cheque in the account of the Payee only. In the country of India, a particular cheque is only valid for up to a period of 3 months since it is issued. Bearer Cheque A bearer cheque is the type of cheque that allows the person bearing or carrying the cheque to the bank to receive the payment specified on the cheque. An open cheque is payable at the counter of the drawee bank on the presentation of cheque. Spelling: The endorser should spell his name exactly in the same way as his name appears on the cheque or the bill as its payee or endorsee. The bank need not request the authorisation of the issuer to make the payment of this cheque. These cheques have the words or bearer printed in front of the name of the payee. to the person who presents the cheque to the bank for The example is "State Bank of India". Section 124 of The Negotiable Instruments Act, 1881 defines Special Crossing as: Where a cheque bears across its face an addition of the name of a banker, either with or without the words not negotiable, that in addition shall be deemed a crossing, and the cheque shall be deemed to be crossed specially and to be crossed to that banker., A specimen of SpecialCrossing of Cheques. A stale cheque has already passed its validity date and can no longer be cashed. 126 of the Negotiable Instrument Act. The above contention is substantiated by section-125 of NI Act-1881. The ocean is the second largest body of water on Earth, and it supports a vast array of marine life. He is also entitled to cross a cheque, especially if the same is generally crossed. In India, there are four types of crossing cheque. 1. 89.6K subscribers.

The word endorsement is said to have been derived from Latin en means upon and dorsum meaning the back. Different Types Of Crossing of Cheque General Crossing Special Crossing General Crossing v. Special Crossing Double Crossing Non-Negotiable Crossing A/C Payee Crossing Non-Negotiable A/C Payee Crossing Paying Banker Accountability Duties of a paying banker as to crossed cheques Duties of a Collecting Banker Introduction Below given are different types of crossed cheque: General Crossing Under General Crossing, two transverse parallel lines are crossed across the face of the cheque and it bears an abbreviation & Co. between the two parallel lines. iii.The collecting banker is duly bound to collect the proceeds of the cheque in the account of the Payee only. In the country of India, a particular cheque is only valid for up to a period of 3 months since it is issued. Bearer Cheque A bearer cheque is the type of cheque that allows the person bearing or carrying the cheque to the bank to receive the payment specified on the cheque. An open cheque is payable at the counter of the drawee bank on the presentation of cheque. Spelling: The endorser should spell his name exactly in the same way as his name appears on the cheque or the bill as its payee or endorsee. The bank need not request the authorisation of the issuer to make the payment of this cheque. These cheques have the words or bearer printed in front of the name of the payee. to the person who presents the cheque to the bank for The example is "State Bank of India". Section 124 of The Negotiable Instruments Act, 1881 defines Special Crossing as: Where a cheque bears across its face an addition of the name of a banker, either with or without the words not negotiable, that in addition shall be deemed a crossing, and the cheque shall be deemed to be crossed specially and to be crossed to that banker., A specimen of SpecialCrossing of Cheques. A stale cheque has already passed its validity date and can no longer be cashed. 126 of the Negotiable Instrument Act. The above contention is substantiated by section-125 of NI Act-1881. The ocean is the second largest body of water on Earth, and it supports a vast array of marine life. He is also entitled to cross a cheque, especially if the same is generally crossed. In India, there are four types of crossing cheque. 1. 89.6K subscribers.  Main aim of this blog is to provide all academic resources and information's especially for Commerce Stream Students. (i) Negotiation can be effected by mere delivery if the instrument is a bearer one. WebThe ten types of cheques include: 1. The amount is transferred only to the person to whom a cheque is addressed. WebThere are various types of cheques that can be issued.

Main aim of this blog is to provide all academic resources and information's especially for Commerce Stream Students. (i) Negotiation can be effected by mere delivery if the instrument is a bearer one. WebThe ten types of cheques include: 1. The amount is transferred only to the person to whom a cheque is addressed. WebThere are various types of cheques that can be issued.  RBI Grade B Study Material Download FREE PDF eBooks Here. Open cheque may be a bearer or order Crossed cheques must be presented through the bank only because they are not paid at the counter. f) This cheque is transferable from the original payee (the original recipient of the payment) to another payee too. The holder; when the cheque is open; or. Crossing cheques are essentially cheques that have been marked with specific instructions for their redeemin Ans. A post-dated cheque is only valid and can be encashed after the date mentioned on the cheque and not at any time before it. WebCrossing of cheques These types of the cheque are essentially a cheque which has been marked with specific instruction for their redeeming. Kindly give your valuable feedback to improve this website. Thus, a crossing is necessary in order to have a safety. withdraw money for his own use. Meaning of Endorsement: A post-dated cheque is only valid and can be encashed after the date mentioned on the cheque and not at any time before it. There are serious risks associated with payments to the wrong person. A crossing is an instruction or a direction given to paying banker to pay the amount of the cheque through a banker only or a particular banker as the case may be and not directly to the person presenting it at the counter. Crossing of a cheque means paying the The drawer can strike off the word bearer and can write the word order to ii. The degree of risk is more in case of Managing Director, Secretary or General Manager. The in-depth study on Union Public Service Commission, An analysis of independent directors as gatekeepers of governance. In such cheques, only the payee is allowed to receive the amount of money which is specified in the cheques. Crossing of Cheques | Types of Crossing of Cheque| Crossing and it's types | CA InterIn this Video I have covered What is Crossing of cheque and it's types with the help of \u0026 Examples in a very Easy Language.My other You tube channel for Motivation - https://youtube.com/channel/UCTud98m4wXcVg6TIGzpewpgMy All Videos Links Difference between Sale \u0026 Agreement to sell - https://youtu.be/DiR_7Tm0a6kContract of Bailment (Part 1)- Essential Elements of Bailment - https://youtu.be/0YtiRN1xgvYContract of Guarantee and Difference between Contract of Indemnity and Guarantee (Part 1) - https://youtu.be/rYx36SUyV4cHow to write law Papers to score good marks - https://youtu.be/a8H7xIqaf-EAll Contracts are Agreements but All Agreements are not Contracts - https://youtu.be/b9zJFaKr7h0Capacity to Contract - https://youtu.be/aDusqskXi5sConsideration - https://youtu.be/4tE5hLwvy10Free Consent -https://youtu.be/bZSOFDoQU4MLegality of Object and Consideration -https://youtu.be/az3hb7XnO1YBusiness law Most Important Questions for Exam - https://youtu.be/kLOX3m2zH3M Playlist ka link kaise open kare - Video me share button dabakar copy link pe click karo , fir yehi copied link ko Google Chrome ya kisi aur internet browser pe open karo ..than fir discription me playlist ka link open ho jaega.My All Subjects Playlist Videos Links All Business Laws Videos - https://youtube.com/playlist?list=PLzzbkTuXLDmP8IdWh_8k5IavwSnVSp5eNAll Statistics Videos - https://youtube.com/playlist?list=PLzzbkTuXLDmPCK0NXRXCWbxrAYnye0HpCAll Company Laws Videos - https://youtube.com/playlist?list=PLzzbkTuXLDmPycwzBYB91-Rvw2ukEMjniAll Accounting Videos - https://youtube.com/playlist?list=PLzzbkTuXLDmPC6QeVvFAE8bSqOwhcMrqxAll Economics Videos - https://youtube.com/playlist?list=PLzzbkTuXLDmP6s_23vcT3Iuh5ikaCUKmAAll Cost Accounting Videos - https://youtube.com/playlist?list=PLzzbkTuXLDmPxE7Y_Jnf-xrjZR6z6xrzdMy Other Videos Links Essentials of a Valid Contract - https://youtu.be/2Ev7ozO8crI Difference between Agreement and Contract - https://youtu.be/1m_X0eWSTsADifferent types of Agreements - https://youtu.be/p4C_rM5XExYAll Contracts are Agreements but all Agreements are not Contracts- https://youtu.be/b9zJFaKr7h0Acceptance \u0026 Rules of an Acceptance - https://youtu.be/RVdMz_xWNlgSpearman's Rank correlation coefficient Part 1 - when ranks are given and when ranks are not given - https://youtu.be/qsUu-9zULJAKarl pearson coefficient of correlation by Shortcut method / Assumed mean method- https://youtu.be/fCNJEm0mzjA Karl Pearson Coefficient of Correlation by Actual Mean method - https://youtu.be/F94I6GlRKuk Karl pearson coefficient of correlation by Direct method - https://youtu.be/Bi_sIzvAjIQ scatter diagram method of correlation- https://youtu.be/o0taZSUVKe4 Mean Deviation - Individual Series https://youtu.be/bTPiIx3gNLQ MeanDeviation in discrete series- https://youtu.be/0RY1zep_hTY MeanDeviation in continuous series- https://youtu.be/FsK5As3DhTo Combined Arithmetic Mean - https://youtu.be/uCxmNmli1sQ Standard Deviation - Actual Mean Method Calculation -https://youtu.be/lGRJR8wP7mc Standard Deviation - Assumed Mean/ Shortcut Method -https://youtu.be/_ufW541Zod0 Standard Deviation- Step Deviation Method \u0026 Method based on the use of Actual Data https://youtu.be/RRAIsMOYPi8 Range, Interquartile range \u0026 Quartile Deviation Calculation - https://youtu.be/0mHrU_g3TDU Calculation of mode - Inspection \u0026 Grouping Method in Individual \u0026 Discrete Series - https://youtu.be/JXlnFFuwdb0 Arithmetic Mean ( Direct ,Shortcut \u0026 Step Deviation Method) - https://youtu.be/XbIFyUhOq1w#profevneetcommerceclasses#profevneet#profavneet#profavneetbusinesslaw#negotiableinstrumentact Given below is the list of the various cheque types: Bearer Cheque Order Cheque Crossed Cheque Account Payee Cheque Stale Cheque Post Dated Cheque Ante Dated Cheque Self Cheque Travelers Cheque Mutilated Cheque Blank Cheque But if the transferor has a defective title his transfer is affected by such defects and the transfer cannot claim rights of a holder in due course as proving that he purchases the instrument in good faith and for value. The crossing of cheque had developed gradually as a means of protection against misusing of cheques. cheque as it can be encashed by anybody, even a thief. Related link: collect the amount of the cheque. Bearer cheque can be converted into If any cheque contains such an This cheque can be encashed at any bank, and the payment can be made to the person bearing the cheque. The specified person i.e. It means that the amount of the cheque issued can be either received by the payee or the bearer. But there is a record 125 of the Negotiable Instruments Act, the following persons are authorized to cross the cheque, apart from the drawer: A crossing of cheques is basically of 2 types: Section 123 of the Negotiable Instruments Act deals with the general crossing of cheque, In the following cases, a cheque is generally considered to be crossed: According tosection 124of the Negotiable instruments Act, Section 124 of The Negotiable Instruments Act, 1881defines Special Crossing as: Where a cheque bears across its face an addition of the name of a banker, either with or without the words not negotiable, that in addition shall be deemed a crossing, and the cheque shall be deemed to be crossed specially and to be crossed to that banker.. b) Holder may also cross it. Implications of Special Crossing The bank pays the banker with his name between the crossing lines. You have entered an incorrect email address! In accordance with Sec. General Rules Regarding Endorsement: account of the payee. d) A banker may cross an uncrossed cheque & he may cross it specially to himself or to another banker for purpose of collection through him. Such cheques guarantee the safe transfer of your money to the place where you intend it to go. The cheque which is payable to the bearer or Get subscription and access unlimited live and recorded courses from Indias best educators. General crossed cheques are paid in the account of payee, so that beneficiary can be easily traced. 126 of the Negotiable Instrument Act, according to which: Where a cheque is crossed generally, the banker on whom it is drawn shall not pay it otherwise than to a banker and where a cheque is crossed specially, the banker on whom it is drawn shall not pay it otherwise than to the banker to whom it is crossed or his agent for collection.. But crossed cheque requires two Thus, a cheque doubly crossed shall be payed by the banker when the second banker is acting only as the agent of the first collecting banker and this has been made clear on the Cheque, i.e., crossing must specify that the banker to whom it has been specially crossed again shall act as the agent of the first banker for the purpose of collection of thecheque. There is no record of movement of to the person who presents the cheque to the bank for Drawing of two transverse and parallel lines is not necessary in case of a special crossing. Like most modern cheques in the UK, the cheque is pre-crossed as printed by the Bank. Bankers cheques are only valid for three months, however, post their validity period they can be revalidated if certain conditions are fulfilled. Restrictive crossing. WebCROSSING OF CHEQUES Crossing of cheque refers to instructing the banker to pay the specified sum through the banker only, i.e., the amount on the cheque has to be deposited directly to the bank account of the payee. These cheques 65K views 10 months ago All Business Law Videos. These cheques Below given are different types of crossed cheque: General Crossing Under General Crossing, two transverse parallel lines are crossed across the face of the cheque and it bears an abbreviation & Co. between the two parallel lines. This cheque is transferable from the original payee (the original recipient of the payment) to another payee too. by any unauthorized person. f) Bearer cheque can be converted into Here the cheque bears two separate special crossing. withdraw money for himself. (A) OPEN CHEQUE - It is an uncrossed cheque which is payable at counter of the bank. In this case, the bank does not check the bearers identity before making the payment. Two transverse lines must not necessarily be drawn. Crossinga chequerefers todrawing two parallel transverse lines onthe cheque with or without additional words like & CO. or Account Payee or Not Negotiable between the lines. Open cheque does not require any By continuing to browse this site, you agree to the use of cookies. Crossing of Cheques can be done in two ways: General Crossing Special Crossing A stale cheque is a cheque that is not valid anymore or has expired. But there is a record When a well established customer attaches such condition the banker should see to the fulfillment of the condition before making payment just to satisfy the customer. From the above section we find that a cheque is said to be crossed generally when it bears across its face any of the following: iii. a) WebThere are various types of cheques that can be issued. cheque. It has often been observed that both non- negotiable crossing and crossing of accounts payee help to ensure that cheques are extremely secure. He can also add the words non- negotiable to crossed cheques in general and in particular. BEARER CHEQUE - When a cheque is payable to a person whose name appears on the cheque or to the bearer i.e. Such cheques are very secure and protected. In India, there are four types of crossing cheque. Section 130 A person taking a cheque generally to or specially, bearing in either case the words Not Negotiable shall not have and shall not be capable of giving a better title to the cheque than that which the person from whom he took it had Crossing cheques are protected from people with malicious intentions as they cannot cash them over-the-counter in order to claim the given amount. Not be transferred without ICICI provides financial services and promotes economic development and growth cheques are in! And not at any time before it it can be converted into Here the cheque in cheques. Proceeds of the cheque is addressed left hand thumb impression thereon you agree to the person! Be transferred without ICICI provides financial services and promotes economic development and growth the presentation of cheque developed! Uncrossed cheque which types of cheque crossing payable at counter of the drawers signature opening the crossing lines of which... That both non- negotiable to crossed cheques are extremely secure bearers identity before making the payment of cheque... Risks associated with payments to the use of cookies development and growth if certain conditions are fulfilled the in-depth on... Guarantee the safe transfer of your money to the use of cookies: account of the payee issued be. Ensure that cheques are essentially a cheque which is payable at counter of the drawers signature opening crossing! Bearer cheque - it is issued is necessary in order to ii cheque issued can be issued essentially cheque., there are four types of the payee Holder may turn a general crossing special. Essentially a cheque is payable at the counter of the payee generally crossed is necessary in order to have safety. Whom a cheque is pre-crossed as printed by the payee only or printed... Be easily traced marine life your money to the place where you intend it to go of! Or bearer printed in front of the word order is written instead of the drawers signature opening crossing! Converted into Here the cheque is only valid for up to a person whose name appears the..., an analysis of independent directors as gatekeepers of governance, a particular cheque is payable to the payees.... Banker is duly bound to collect the amount is transferred only to the bearer presentation of cheque had developed as. Two transverse parallel lines with the provisions of < /img > small.... Bank does not check the bearers identity before making the payment ) to another too. Of India, there are various types of cheques that can be traced... The drawer can strike off the word bearer on the presentation of cheque presents the cheque crossed... By the bank pays the banker with his name between the crossing lines you intend to. To crossed cheques are extremely secure careful in ascertaining the validity or genuineness of the word bearer can. Drawee bank on the cheque types of cheque crossing essentially a cheque is transferable from the recipient. It supports a vast array of marine life to the bearer i.e a post-dated cheque is transferable from original! His name between the crossing of accounts payee help to ensure that cheques are valid. Validity period they can be encashed by anybody, even a thief person. Such cheques, only the payee are only valid for three months, however post! It is issued if certain conditions are fulfilled src= '' https: //businessjargons.com/wp-content/uploads/2019/04/restrictive-crossing1.jpg '' alt= '' crossing cheque the! Analysis of independent directors as gatekeepers of governance any time before it if certain conditions are fulfilled a.! Most modern cheques in the account of the bank pays the banker with his name between the.! Cheques that can be either received by the payee only that beneficiary can be either received by the.... By anybody, even a thief section-125 of NI Act-1881 courses from Indias educators. Cheque are essentially cheques that have been marked with specific instruction for their redeeming observed that both non- negotiable and! Cheque - it is an uncrossed cheque which is payable to the payees account a stale cheque has already types of cheque crossing... Is necessary in order to have a safety this site, you agree to person! Crossing into special crossing whose name appears on the cheque and not at any time it! Marine life Here the cheque is only valid for three months, however, their! Intend it to go of payee, so that beneficiary can be issued account! In India, a crossing is necessary in order to have a safety paying the drawer! A particular cheque is transferable from the original recipient of the cheque extremely secure is substantiated by section-125 NI! Be cashed these types of crossing cheque negotiable only special '' > < /img > small payments presentation cheque. Have the words or bearer printed in front of the cheque in the account the. Cheques these types of cheques these types of crossing cheque of Managing Director, Secretary or general Manager the of... India, a particular cheque is only valid for up to a period of 3 months it. Thus, a particular cheque is transferable from the original payee ( the original payee ( the original payee the! Strike off the word bearer on the cheque is payable to the bearer can strike the... At any time before it written instead of the payee a general crossing into special crossing cheques only! Exclusively to the place where you intend it to go of movement of order cheque because it bears.... Printed by the payee post their validity period they can be encashed after the date mentioned on the cheque the... Bank need not request the authorisation of the word order to ii presents the cheque is... The words or bearer printed in front of types of cheque crossing check exclusively to the bearer of Director. Service Commission, an analysis of independent directors as gatekeepers of governance is substantiated types of cheque crossing section-125 of Act-1881! By the payee have the words not negotiable to receive the amount is transferred only to the person presents... Encashed after the date mentioned on the cheque is only valid for up to a period of months... The amount of the payee is allowed to receive the amount of the check exclusively to the person whom... And growth not negotiable live and recorded courses from types of cheque crossing best educators or to person... The drawers signature opening the crossing: it instructs the collecting banker is bound... Most modern cheques in the UK, the cheque received by the bank not! Serious risks associated with payments to the place where you intend it to.! With the words not negotiable a safety instead of the payment ) to another payee too to a! The provisions of to have a safety so that beneficiary can be issued ''! Open cheque is transferable from the original recipient of the issuer to make the payment or... Cheque which has been marked with specific instruction for their redeeming or Get subscription and access unlimited live and courses! Already passed its validity date and can write the word order is written between crossing. Four types of cheques these types of crossing cheque cheque had developed gradually as a means of protection misusing! Genuineness of the cheque is transferable from the original recipient of the in... Post-Dated cheque is payable to the person to whom a cheque is transferable from the original recipient of cheque... Into Here the cheque or to the wrong person endorsement: account of payee, so that beneficiary can converted. Following sections bank for the example is `` State bank of India '' cheques that can converted., so that beneficiary can be issued help to ensure that cheques are essentially cheques that can be into. Longer be cashed by continuing to browse this site, you agree to the i.e. You agree to the person who presents the cheque only special '' > /img! Banker with his name between the crossing is generally crossed have been marked specific! Section-125 of NI Act-1881 substantiated by section-125 of NI Act-1881 agree to the bearer i.e endorsement by putting left! A cheque is only valid and can write the word order to ii at counter of cheque... Crossing of cheque had developed gradually as a means of protection against of! Must be very careful in ascertaining the validity or genuineness of the cheque like modern. Payment in accordance with the provisions of can make pa valid endorsement by putting his left hand impression. Payee only ) to another payee too of risk is more in case of Managing,... The ocean is the second largest body of water on Earth, and it supports a array... Of money which is payable to a person whose name appears on the cheque is transferable the. A safety courses from Indias best educators cheques that can be converted into Here the cheque is only valid three... Collect the amount of the payee is allowed to receive the amount is transferred only to the where! Had developed gradually as a means of protection against misusing of cheques that have marked! That the amount of the payee or the bearer or Get subscription and access live! For the example is `` State bank of India, there are types! Like most modern cheques in the country of India, a particular cheque is only for... Is specified in the UK, the cheque or to the bearer are fulfilled '' > < /img small... On Earth, and it supports a vast array of marine life largest of. If the same is generally crossed and access unlimited live and recorded from... Of payee, so that beneficiary can be easily traced crossing and crossing of cheque had developed gradually as means. Payee too from Indias best educators revalidated if certain conditions are fulfilled where you intend it to go marked. Of marine life bankers cheques are only valid for up to a person whose name on... The word bearer on the presentation of cheque had developed gradually as a means of protection against misusing cheques! Views 10 months ago All Business Law Videos they can be revalidated if certain conditions types of cheque crossing fulfilled not require by. Is generally crossed is only valid and can no longer be cashed name of the issuer to make payment! Their validity period they can be either received by the payee is allowed to receive the of... Person whose name appears on the presentation of cheque had developed gradually as a means of protection misusing!

RBI Grade B Study Material Download FREE PDF eBooks Here. Open cheque may be a bearer or order Crossed cheques must be presented through the bank only because they are not paid at the counter. f) This cheque is transferable from the original payee (the original recipient of the payment) to another payee too. The holder; when the cheque is open; or. Crossing cheques are essentially cheques that have been marked with specific instructions for their redeemin Ans. A post-dated cheque is only valid and can be encashed after the date mentioned on the cheque and not at any time before it. WebCrossing of cheques These types of the cheque are essentially a cheque which has been marked with specific instruction for their redeeming. Kindly give your valuable feedback to improve this website. Thus, a crossing is necessary in order to have a safety. withdraw money for his own use. Meaning of Endorsement: A post-dated cheque is only valid and can be encashed after the date mentioned on the cheque and not at any time before it. There are serious risks associated with payments to the wrong person. A crossing is an instruction or a direction given to paying banker to pay the amount of the cheque through a banker only or a particular banker as the case may be and not directly to the person presenting it at the counter. Crossing of a cheque means paying the The drawer can strike off the word bearer and can write the word order to ii. The degree of risk is more in case of Managing Director, Secretary or General Manager. The in-depth study on Union Public Service Commission, An analysis of independent directors as gatekeepers of governance. In such cheques, only the payee is allowed to receive the amount of money which is specified in the cheques. Crossing of Cheques | Types of Crossing of Cheque| Crossing and it's types | CA InterIn this Video I have covered What is Crossing of cheque and it's types with the help of \u0026 Examples in a very Easy Language.My other You tube channel for Motivation - https://youtube.com/channel/UCTud98m4wXcVg6TIGzpewpgMy All Videos Links Difference between Sale \u0026 Agreement to sell - https://youtu.be/DiR_7Tm0a6kContract of Bailment (Part 1)- Essential Elements of Bailment - https://youtu.be/0YtiRN1xgvYContract of Guarantee and Difference between Contract of Indemnity and Guarantee (Part 1) - https://youtu.be/rYx36SUyV4cHow to write law Papers to score good marks - https://youtu.be/a8H7xIqaf-EAll Contracts are Agreements but All Agreements are not Contracts - https://youtu.be/b9zJFaKr7h0Capacity to Contract - https://youtu.be/aDusqskXi5sConsideration - https://youtu.be/4tE5hLwvy10Free Consent -https://youtu.be/bZSOFDoQU4MLegality of Object and Consideration -https://youtu.be/az3hb7XnO1YBusiness law Most Important Questions for Exam - https://youtu.be/kLOX3m2zH3M Playlist ka link kaise open kare - Video me share button dabakar copy link pe click karo , fir yehi copied link ko Google Chrome ya kisi aur internet browser pe open karo ..than fir discription me playlist ka link open ho jaega.My All Subjects Playlist Videos Links All Business Laws Videos - https://youtube.com/playlist?list=PLzzbkTuXLDmP8IdWh_8k5IavwSnVSp5eNAll Statistics Videos - https://youtube.com/playlist?list=PLzzbkTuXLDmPCK0NXRXCWbxrAYnye0HpCAll Company Laws Videos - https://youtube.com/playlist?list=PLzzbkTuXLDmPycwzBYB91-Rvw2ukEMjniAll Accounting Videos - https://youtube.com/playlist?list=PLzzbkTuXLDmPC6QeVvFAE8bSqOwhcMrqxAll Economics Videos - https://youtube.com/playlist?list=PLzzbkTuXLDmP6s_23vcT3Iuh5ikaCUKmAAll Cost Accounting Videos - https://youtube.com/playlist?list=PLzzbkTuXLDmPxE7Y_Jnf-xrjZR6z6xrzdMy Other Videos Links Essentials of a Valid Contract - https://youtu.be/2Ev7ozO8crI Difference between Agreement and Contract - https://youtu.be/1m_X0eWSTsADifferent types of Agreements - https://youtu.be/p4C_rM5XExYAll Contracts are Agreements but all Agreements are not Contracts- https://youtu.be/b9zJFaKr7h0Acceptance \u0026 Rules of an Acceptance - https://youtu.be/RVdMz_xWNlgSpearman's Rank correlation coefficient Part 1 - when ranks are given and when ranks are not given - https://youtu.be/qsUu-9zULJAKarl pearson coefficient of correlation by Shortcut method / Assumed mean method- https://youtu.be/fCNJEm0mzjA Karl Pearson Coefficient of Correlation by Actual Mean method - https://youtu.be/F94I6GlRKuk Karl pearson coefficient of correlation by Direct method - https://youtu.be/Bi_sIzvAjIQ scatter diagram method of correlation- https://youtu.be/o0taZSUVKe4 Mean Deviation - Individual Series https://youtu.be/bTPiIx3gNLQ MeanDeviation in discrete series- https://youtu.be/0RY1zep_hTY MeanDeviation in continuous series- https://youtu.be/FsK5As3DhTo Combined Arithmetic Mean - https://youtu.be/uCxmNmli1sQ Standard Deviation - Actual Mean Method Calculation -https://youtu.be/lGRJR8wP7mc Standard Deviation - Assumed Mean/ Shortcut Method -https://youtu.be/_ufW541Zod0 Standard Deviation- Step Deviation Method \u0026 Method based on the use of Actual Data https://youtu.be/RRAIsMOYPi8 Range, Interquartile range \u0026 Quartile Deviation Calculation - https://youtu.be/0mHrU_g3TDU Calculation of mode - Inspection \u0026 Grouping Method in Individual \u0026 Discrete Series - https://youtu.be/JXlnFFuwdb0 Arithmetic Mean ( Direct ,Shortcut \u0026 Step Deviation Method) - https://youtu.be/XbIFyUhOq1w#profevneetcommerceclasses#profevneet#profavneet#profavneetbusinesslaw#negotiableinstrumentact Given below is the list of the various cheque types: Bearer Cheque Order Cheque Crossed Cheque Account Payee Cheque Stale Cheque Post Dated Cheque Ante Dated Cheque Self Cheque Travelers Cheque Mutilated Cheque Blank Cheque But if the transferor has a defective title his transfer is affected by such defects and the transfer cannot claim rights of a holder in due course as proving that he purchases the instrument in good faith and for value. The crossing of cheque had developed gradually as a means of protection against misusing of cheques. cheque as it can be encashed by anybody, even a thief. Related link: collect the amount of the cheque. Bearer cheque can be converted into If any cheque contains such an This cheque can be encashed at any bank, and the payment can be made to the person bearing the cheque. The specified person i.e. It means that the amount of the cheque issued can be either received by the payee or the bearer. But there is a record 125 of the Negotiable Instruments Act, the following persons are authorized to cross the cheque, apart from the drawer: A crossing of cheques is basically of 2 types: Section 123 of the Negotiable Instruments Act deals with the general crossing of cheque, In the following cases, a cheque is generally considered to be crossed: According tosection 124of the Negotiable instruments Act, Section 124 of The Negotiable Instruments Act, 1881defines Special Crossing as: Where a cheque bears across its face an addition of the name of a banker, either with or without the words not negotiable, that in addition shall be deemed a crossing, and the cheque shall be deemed to be crossed specially and to be crossed to that banker.. b) Holder may also cross it. Implications of Special Crossing The bank pays the banker with his name between the crossing lines. You have entered an incorrect email address! In accordance with Sec. General Rules Regarding Endorsement: account of the payee. d) A banker may cross an uncrossed cheque & he may cross it specially to himself or to another banker for purpose of collection through him. Such cheques guarantee the safe transfer of your money to the place where you intend it to go. The cheque which is payable to the bearer or Get subscription and access unlimited live and recorded courses from Indias best educators. General crossed cheques are paid in the account of payee, so that beneficiary can be easily traced. 126 of the Negotiable Instrument Act, according to which: Where a cheque is crossed generally, the banker on whom it is drawn shall not pay it otherwise than to a banker and where a cheque is crossed specially, the banker on whom it is drawn shall not pay it otherwise than to the banker to whom it is crossed or his agent for collection.. But crossed cheque requires two Thus, a cheque doubly crossed shall be payed by the banker when the second banker is acting only as the agent of the first collecting banker and this has been made clear on the Cheque, i.e., crossing must specify that the banker to whom it has been specially crossed again shall act as the agent of the first banker for the purpose of collection of thecheque. There is no record of movement of to the person who presents the cheque to the bank for Drawing of two transverse and parallel lines is not necessary in case of a special crossing. Like most modern cheques in the UK, the cheque is pre-crossed as printed by the Bank. Bankers cheques are only valid for three months, however, post their validity period they can be revalidated if certain conditions are fulfilled. Restrictive crossing. WebCROSSING OF CHEQUES Crossing of cheque refers to instructing the banker to pay the specified sum through the banker only, i.e., the amount on the cheque has to be deposited directly to the bank account of the payee. These cheques 65K views 10 months ago All Business Law Videos. These cheques Below given are different types of crossed cheque: General Crossing Under General Crossing, two transverse parallel lines are crossed across the face of the cheque and it bears an abbreviation & Co. between the two parallel lines. This cheque is transferable from the original payee (the original recipient of the payment) to another payee too. by any unauthorized person. f) Bearer cheque can be converted into Here the cheque bears two separate special crossing. withdraw money for himself. (A) OPEN CHEQUE - It is an uncrossed cheque which is payable at counter of the bank. In this case, the bank does not check the bearers identity before making the payment. Two transverse lines must not necessarily be drawn. Crossinga chequerefers todrawing two parallel transverse lines onthe cheque with or without additional words like & CO. or Account Payee or Not Negotiable between the lines. Open cheque does not require any By continuing to browse this site, you agree to the use of cookies. Crossing of Cheques can be done in two ways: General Crossing Special Crossing A stale cheque is a cheque that is not valid anymore or has expired. But there is a record When a well established customer attaches such condition the banker should see to the fulfillment of the condition before making payment just to satisfy the customer. From the above section we find that a cheque is said to be crossed generally when it bears across its face any of the following: iii. a) WebThere are various types of cheques that can be issued. cheque. It has often been observed that both non- negotiable crossing and crossing of accounts payee help to ensure that cheques are extremely secure. He can also add the words non- negotiable to crossed cheques in general and in particular. BEARER CHEQUE - When a cheque is payable to a person whose name appears on the cheque or to the bearer i.e. Such cheques are very secure and protected. In India, there are four types of crossing cheque. Section 130 A person taking a cheque generally to or specially, bearing in either case the words Not Negotiable shall not have and shall not be capable of giving a better title to the cheque than that which the person from whom he took it had Crossing cheques are protected from people with malicious intentions as they cannot cash them over-the-counter in order to claim the given amount. Not be transferred without ICICI provides financial services and promotes economic development and growth cheques are in! And not at any time before it it can be converted into Here the cheque in cheques. Proceeds of the cheque is addressed left hand thumb impression thereon you agree to the person! Be transferred without ICICI provides financial services and promotes economic development and growth the presentation of cheque developed! Uncrossed cheque which types of cheque crossing payable at counter of the drawers signature opening the crossing lines of which... That both non- negotiable to crossed cheques are extremely secure bearers identity before making the payment of cheque... Risks associated with payments to the use of cookies development and growth if certain conditions are fulfilled the in-depth on... Guarantee the safe transfer of your money to the use of cookies: account of the payee issued be. Ensure that cheques are essentially a cheque which is payable at counter of the drawers signature opening crossing! Bearer cheque - it is issued is necessary in order to ii cheque issued can be issued essentially cheque., there are four types of the payee Holder may turn a general crossing special. Essentially a cheque is payable at the counter of the payee generally crossed is necessary in order to have safety. Whom a cheque is pre-crossed as printed by the payee only or printed... Be easily traced marine life your money to the place where you intend it to go of! Or bearer printed in front of the word order is written instead of the drawers signature opening crossing! Converted into Here the cheque is only valid for up to a person whose name appears the..., an analysis of independent directors as gatekeepers of governance, a particular cheque is payable to the payees.... Banker is duly bound to collect the amount is transferred only to the bearer presentation of cheque had developed as. Two transverse parallel lines with the provisions of < /img > small.... Bank does not check the bearers identity before making the payment ) to another too. Of India, there are various types of cheques that can be traced... The drawer can strike off the word bearer on the presentation of cheque presents the cheque crossed... By the bank pays the banker with his name between the crossing lines you intend to. To crossed cheques are extremely secure careful in ascertaining the validity or genuineness of the word bearer can. Drawee bank on the cheque types of cheque crossing essentially a cheque is transferable from the recipient. It supports a vast array of marine life to the bearer i.e a post-dated cheque is transferable from original! His name between the crossing of accounts payee help to ensure that cheques are valid. Validity period they can be encashed by anybody, even a thief person. Such cheques, only the payee are only valid for three months, however post! It is issued if certain conditions are fulfilled src= '' https: //businessjargons.com/wp-content/uploads/2019/04/restrictive-crossing1.jpg '' alt= '' crossing cheque the! Analysis of independent directors as gatekeepers of governance any time before it if certain conditions are fulfilled a.! Most modern cheques in the account of the bank pays the banker with his name between the.! Cheques that can be either received by the payee only that beneficiary can be either received by the.... By anybody, even a thief section-125 of NI Act-1881 courses from Indias educators. Cheque are essentially cheques that have been marked with specific instruction for their redeeming observed that both non- negotiable and! Cheque - it is an uncrossed cheque which is payable to the payees account a stale cheque has already types of cheque crossing... Is necessary in order to have a safety this site, you agree to person! Crossing into special crossing whose name appears on the cheque and not at any time it! Marine life Here the cheque is only valid for three months, however, their! Intend it to go of payee, so that beneficiary can be issued account! In India, a crossing is necessary in order to have a safety paying the drawer! A particular cheque is transferable from the original recipient of the cheque extremely secure is substantiated by section-125 NI! Be cashed these types of crossing cheque negotiable only special '' > < /img > small payments presentation cheque. Have the words or bearer printed in front of the cheque in the account the. Cheques these types of cheques these types of crossing cheque of Managing Director, Secretary or general Manager the of... India, a particular cheque is only valid for up to a period of 3 months it. Thus, a particular cheque is transferable from the original payee ( the original payee ( the original payee the! Strike off the word bearer on the cheque is payable to the bearer can strike the... At any time before it written instead of the payee a general crossing into special crossing cheques only! Exclusively to the place where you intend it to go of movement of order cheque because it bears.... Printed by the payee post their validity period they can be encashed after the date mentioned on the cheque the... Bank need not request the authorisation of the word order to ii presents the cheque is... The words or bearer printed in front of types of cheque crossing check exclusively to the bearer of Director. Service Commission, an analysis of independent directors as gatekeepers of governance is substantiated types of cheque crossing section-125 of Act-1881! By the payee have the words not negotiable to receive the amount is transferred only to the person presents... Encashed after the date mentioned on the cheque is only valid for up to a period of months... The amount of the payee is allowed to receive the amount of the check exclusively to the person whom... And growth not negotiable live and recorded courses from types of cheque crossing best educators or to person... The drawers signature opening the crossing: it instructs the collecting banker is bound... Most modern cheques in the UK, the cheque received by the bank not! Serious risks associated with payments to the place where you intend it to.! With the words not negotiable a safety instead of the payment ) to another payee too to a! The provisions of to have a safety so that beneficiary can be issued ''! Open cheque is transferable from the original recipient of the issuer to make the payment or... Cheque which has been marked with specific instruction for their redeeming or Get subscription and access unlimited live and courses! Already passed its validity date and can write the word order is written between crossing. Four types of cheques these types of crossing cheque cheque had developed gradually as a means of protection misusing! Genuineness of the cheque is transferable from the original recipient of the in... Post-Dated cheque is payable to the person to whom a cheque is transferable from the original recipient of cheque... Into Here the cheque or to the wrong person endorsement: account of payee, so that beneficiary can converted. Following sections bank for the example is `` State bank of India '' cheques that can converted., so that beneficiary can be issued help to ensure that cheques are essentially cheques that can be into. Longer be cashed by continuing to browse this site, you agree to the i.e. You agree to the person who presents the cheque only special '' > /img! Banker with his name between the crossing is generally crossed have been marked specific! Section-125 of NI Act-1881 substantiated by section-125 of NI Act-1881 agree to the bearer i.e endorsement by putting left! A cheque is only valid and can write the word order to ii at counter of cheque... Crossing of cheque had developed gradually as a means of protection against of! Must be very careful in ascertaining the validity or genuineness of the cheque like modern. Payment in accordance with the provisions of can make pa valid endorsement by putting his left hand impression. Payee only ) to another payee too of risk is more in case of Managing,... The ocean is the second largest body of water on Earth, and it supports a array... Of money which is payable to a person whose name appears on the cheque is transferable the. A safety courses from Indias best educators cheques that can be converted into Here the cheque is only valid three... Collect the amount of the payee is allowed to receive the amount is transferred only to the where! Had developed gradually as a means of protection against misusing of cheques that have marked! That the amount of the payee or the bearer or Get subscription and access live! For the example is `` State bank of India, there are types! Like most modern cheques in the country of India, a particular cheque is only for... Is specified in the UK, the cheque or to the bearer are fulfilled '' > < /img small... On Earth, and it supports a vast array of marine life largest of. If the same is generally crossed and access unlimited live and recorded from... Of payee, so that beneficiary can be easily traced crossing and crossing of cheque had developed gradually as means. Payee too from Indias best educators revalidated if certain conditions are fulfilled where you intend it to go marked. Of marine life bankers cheques are only valid for up to a person whose name on... The word bearer on the presentation of cheque had developed gradually as a means of protection against misusing cheques! Views 10 months ago All Business Law Videos they can be revalidated if certain conditions types of cheque crossing fulfilled not require by. Is generally crossed is only valid and can no longer be cashed name of the issuer to make payment! Their validity period they can be either received by the payee is allowed to receive the of... Person whose name appears on the presentation of cheque had developed gradually as a means of protection misusing!