upfront fee vs oid

Thats the most extreme measure. Non-material changes do not require approval of participants. Virtually all leveraged loans and some of the shakier investment-grade credits are backed by pledges of collateral. The value is equal to: The unblended cost of the RIFee * The sum of the normalized usage amount of Usage line items / The normalized usage amount of the RIFee for size flexible Reserved Instances.Because all upfront RIs don't have recurring fee For both investment-grade and leveraged issuers, an event of default in a credit agreement will be triggered by a merger, an acquisition of the issuer, some substantial purchase of the issuers equity by a third party, or a change in the majority of the board of directors. With a home loan, the origination fee is usually paid as part of your closing costs, which can include fees for insurance premiums, taxes, discount points and more. Of course, with flex-language now common, underwriting a deal does not carry the same risk it once did, when the pricing was set in stone prior to syndication. Relative value is a way of uncovering undervalued, or overvalued, assets. Whats the difference? It sometimes is required for certain material changes, such as changes in term loan repayments and release of collateral. A strategy in which lenderstypically hedge funds or distressed investorsprovide financing to distressed companies. Debtor-in-possession (DIP) loans are made to bankrupt entities. Revolving credits often run for 364 days. One good example was courtesy Harrahs Entertainment. For example, a loan has two fee tiers: 100 bps (or 1%) for $25M commitments and 50 bps for $15M commitments.

Thats the most extreme measure. Non-material changes do not require approval of participants. Virtually all leveraged loans and some of the shakier investment-grade credits are backed by pledges of collateral. The value is equal to: The unblended cost of the RIFee * The sum of the normalized usage amount of Usage line items / The normalized usage amount of the RIFee for size flexible Reserved Instances.Because all upfront RIs don't have recurring fee For both investment-grade and leveraged issuers, an event of default in a credit agreement will be triggered by a merger, an acquisition of the issuer, some substantial purchase of the issuers equity by a third party, or a change in the majority of the board of directors. With a home loan, the origination fee is usually paid as part of your closing costs, which can include fees for insurance premiums, taxes, discount points and more. Of course, with flex-language now common, underwriting a deal does not carry the same risk it once did, when the pricing was set in stone prior to syndication. Relative value is a way of uncovering undervalued, or overvalued, assets. Whats the difference? It sometimes is required for certain material changes, such as changes in term loan repayments and release of collateral. A strategy in which lenderstypically hedge funds or distressed investorsprovide financing to distressed companies. Debtor-in-possession (DIP) loans are made to bankrupt entities. Revolving credits often run for 364 days. One good example was courtesy Harrahs Entertainment. For example, a loan has two fee tiers: 100 bps (or 1%) for $25M commitments and 50 bps for $15M commitments.  For default rate by principal amount: the amount of loans that default over a 12-month period divided by the total amount outstanding at the beginning of the period. KKRs $25B acquisition of RJR Nabisco was the firstand remains the most (in)famousof the high-flying LBOs. What this means is that the spread offered to pro rata investors is important. The documentation agent is the bank that handles the documents and chooses the law firm. Axes are simply price indications. Standard & Poors defines a default for the purposes of calculating default rates as a loan that is either (1) rated D by Standard & Poors, (2) to an issuer that has filed for bankruptcy, or (3) in payment default on interest or principal. Inventories are also often pledged to secure borrowings. The lines are then repaid over a specified period (the term-out period). Leveraged (borrowers rated BB+ or lower). A leveraged loan backing a recapitalization results in changes in the composition of an entitys balance sheet mix between debt and equity either by (1) issuing debt to pay a dividend or repurchase stock or (2) selling new equity, in some cases to repay debt.

For default rate by principal amount: the amount of loans that default over a 12-month period divided by the total amount outstanding at the beginning of the period. KKRs $25B acquisition of RJR Nabisco was the firstand remains the most (in)famousof the high-flying LBOs. What this means is that the spread offered to pro rata investors is important. The documentation agent is the bank that handles the documents and chooses the law firm. Axes are simply price indications. Standard & Poors defines a default for the purposes of calculating default rates as a loan that is either (1) rated D by Standard & Poors, (2) to an issuer that has filed for bankruptcy, or (3) in payment default on interest or principal. Inventories are also often pledged to secure borrowings. The lines are then repaid over a specified period (the term-out period). Leveraged (borrowers rated BB+ or lower). A leveraged loan backing a recapitalization results in changes in the composition of an entitys balance sheet mix between debt and equity either by (1) issuing debt to pay a dividend or repurchase stock or (2) selling new equity, in some cases to repay debt.  Pricing a loan requires arrangers to evaluate the risk inherent in a loan and to gauge investor appetite for that risk. As of mid-2011 these included issuers with a European or even a Midwestern US angle. Merger and acquisition (M&A) and recapitalization loans will likely carry high fees, as will bankruptcy exit financings and restructuring deals for struggling entities. This second category can be divided into liquidity and market technicals (i.e., supply/demand). In a traditional loan agreement, as a borrowers risk increases, financial covenants become more tightly wound and extensive. Negative covenants limit the borrowers activities in some way, such as undertaking new investments. It may repay a loan early because a more compelling financial opportunity presents itself or because the issuer is acquired, or because it is making an acquisition and needs a new financing. Aside from that, there was little synthetic activity outside over-the-counter total rate of return swaps. Underwritten loans usually require more lucrative fees because the agent is on the hook if potential lenders balk. However, because they are obviously less liquid than receivables, lenders are less generous in their formula. The reason for what seems like an odd term is that regulatory capital guidelines mandate that, after one year of extending credit under a revolving facility, banks must then increase their capital reserves to take into account the unused amounts. Broadly speaking there are three main types of loan funds: In March 2011, Invesco introduced the first index-based exchange traded fund, PowerShares Senior Loan Portfolio (BKLN), which is based on the LSTA Loan 100 Index. Heres how the economics of a TRS work, in simple terms. Issuers with large, stable cash flows usually are able to support higher leverage. In the early 1990s a broad market for third-party DIP loans emerged. Consequently, traders, salespeople, and analysts do not receive private information even if somewhere else in the institution the private data are available. Investors can buy into these funds each day at the funds net asset value (NAV). As a result, the most profitable loans are those to leveraged borrowersthose whose credit ratings are speculative grade (traditionally double-B plus and lower), and who are paying spreads (premiums above LIBOR or another base rate) sufficient to attract the interest of nonbank term loan investors, (that spread typically will be LIBOR+200 or higher, though this threshold rises and falls, depending on market conditions). CLOs are special-purpose vehicles set up to hold and manage pools of leveraged loans. Indeed, the co-agent title has become largely ceremonial today, routinely awarded for what amounts to no more than large retail commitments. Once the loan is closed, the final terms are then documented in detailed credit and security agreements. The co-agent or managing agent is largely a meaningless title used mostly as an award for large commitments. For instance, one covenant may require the borrower to maintain its existing fiscal-year end. Indeed, the Morningstar LSTA US Leveraged Loan Index, broadly used as a proxy for market size in the US, totaled some $1.375 trillion at February 2022, the most ever, after growing every year since dipping to $497B in 2010, when the market was still licking wounds incurred in the Global Financial Crisis of 20072008. In July 2018, new-issue loan spreads bottomed out, then rose noticeably, above a point where many companies were paying on existing loans. Following the example above, if the loan is oversubscribed at LIBOR+250, the arranger may slice the spread further. The typical percentage required is 50-75%. Even for issuers with public equity or debt, and which file with the SEC, the credit agreement becomes public only when it is filedmonths after closing, usuallyas an exhibit to an annual report (10-K), a quarterly report (10-Q), a current report (8-K), or some other document (proxy statement, securities registration, etc.). This was a way to encourage investors to trade with the arranger rather than with another dealer. A revolving credit line allows borrowers to draw down, repay, and reborrow. In many cases, the agreement will provide initial capacity, known as a Starter Basket, as well as additional capacity based on a percent of free cash flow or net income, known as a Building Basket. Most loans are structured and syndicated to accommodate the two primary syndicated lender constituencies: banks (domestic and foreign) and institutional investors (primarily structured finance vehicles, mutual funds, and insurance companies). Usually, the receivables are pledged and the issuer may borrow against 80%, give or take. More important, it could lead to illegal trading. Free-and-clear tranches are an innovation that grew out of the proliferation of covenant-lite loans since 2013. But because it matures later and, thus, is structurally subordinated, it carries a higher rate and, in some cases, more attractive terms. And for a broader view of how leveraged finance workssupporting a gigantic leveraged buyout, sayPaddy has a great video explaining that, too. That is, you can buy it on the cheap. Much of this information may be material to the financial health of the issuer, and may be out of the public domain until the issuer formally issues a press release, or files an 8-K or some other document with the SEC. Debt issuance is defined as net proceeds from debt issuance. The market is roughly divided into two segments: Default risk, of course, varies widely within each of these broad segments. Then the participant receives the spread of the loan less the financial cost. The global leveraged loan market has grown consistently since its humble beginnings, some decades ago, to become a full-fledged asset class and an indispensable component of the corporate finance, M&A, and leveraged buyout landscapes. Incremental direct costs of loan origination incurred in transactions with independent third parties for that loan b. Since the early 1990s almost all large commercial banks have adopted portfolio-management techniques that measure the returns of loans and other credit products, relative to risk. This stands for offers wanted in competition and is effectively a BWIC in reverse. These IMs will be distributed to accounts that are on the public side of the wall. Investment grade (loans to issuers rated BBB- or higher). Once the mandate is awarded, the syndication process starts. Introduced in 2007, the LCDX is an index of 100 LCDS obligations that participants can trade. In this form of recap deal a company uses debt proceeds to repurchase stock. Often, repayments from excess cash flow and equity issuance are waived if the issuer meets a preset financial hurdle, most often structured as a debt/EBITDA test. Before awarding a mandate, an issuer might solicit bids from arrangers. These include collateral coverage, or the value of the collateral underlying the loan, relative to the size of the loan. Co In general, there are five types of financial covenantscoverage, leverage, current ratio, tangible net worth, and maximum capital expenditures: Leveraged loans usually require a borrower to prepay with proceeds of excess cash flow, asset sales, debt issuance, or equity issuance. As a result, liquidity was in far shorter supply, constraining availability of traditional third-party DIPs. As the name implies, this type of default occurs when a company misses either an interest or principal payment. The fee may be applied to all repayments under a loan loan including from asset sales and excess cash flow (a hard fee) or specifically to discretionary payments made from a refinancing or out of cash on hand (a soft fee). Arrangers serve the time-honored investment-banking role of raising investor dollars for an issuer in need of capital. If the reference loan defaults the participant is obligated to buy the facility at par or cash settle the position based on a mark-to-market price or an auction price. A term-out will allow the borrower to convert borrowings into a term loan at a given conversion date. Like second-lien loans, covenant-lite loans are a particular kind of syndicated loan facility. This meant that parties that were insiders on loans might now exchange confidential information with traders and potential investors who were not (or not yet) a party to the loan. Or instead of physical delivery, some buyers of protection may prefer a cash settlement in which the difference between the current market price and the delivery price is determined by polling dealers or using a third-party pricing service. Pro rata debt consists of the revolving credit and amortizing term loan (TLa), which are packaged together and, usually, syndicated to banks. For default rate by number of loans: the number of loans that default over a given 12-month period divided by the number of loans outstanding at the beginning of that period. The formula is similar. Because loans are not securities, this will be a confidential offering made only to qualified banks and accredited investors. Voting to close for lack of prior research. Investors, in times of inflows to market, are loath to sit on cash if theres actual return to be had. In an assignment, the assignee becomes a direct signatory to the loan and receives interest and principal payments directly from the administrative agent. Excess cash flow is typically defined as cash flow after all cash expenses, required dividends, debt repayments, capital expenditures, and changes in working capital. Non-core acquisitions, in which a corporate issuer sells a division to a private equity firm. As well, if collateral value declines below a predetermined level, the investor could face a margin call, or in the worst-case scenario, the TRS could be unwound. Loan holders, therefore, almost always are first in line among pre-petition creditors and, in many cases, are able to renegotiate with the issuer before the loan becomes severely impaired. The original-issue discount (OID), or the discount from par at which the loan is offered for sale to investors, is used in the new issue market as a spread enhancement. Origination fees depend on the type of loan and the amount you are borrowing. The group receives the LOC fee on their respective shares while the fronting bank receives an issuing (or fronting, or facing) fee for issuing and administering the LOC.

Pricing a loan requires arrangers to evaluate the risk inherent in a loan and to gauge investor appetite for that risk. As of mid-2011 these included issuers with a European or even a Midwestern US angle. Merger and acquisition (M&A) and recapitalization loans will likely carry high fees, as will bankruptcy exit financings and restructuring deals for struggling entities. This second category can be divided into liquidity and market technicals (i.e., supply/demand). In a traditional loan agreement, as a borrowers risk increases, financial covenants become more tightly wound and extensive. Negative covenants limit the borrowers activities in some way, such as undertaking new investments. It may repay a loan early because a more compelling financial opportunity presents itself or because the issuer is acquired, or because it is making an acquisition and needs a new financing. Aside from that, there was little synthetic activity outside over-the-counter total rate of return swaps. Underwritten loans usually require more lucrative fees because the agent is on the hook if potential lenders balk. However, because they are obviously less liquid than receivables, lenders are less generous in their formula. The reason for what seems like an odd term is that regulatory capital guidelines mandate that, after one year of extending credit under a revolving facility, banks must then increase their capital reserves to take into account the unused amounts. Broadly speaking there are three main types of loan funds: In March 2011, Invesco introduced the first index-based exchange traded fund, PowerShares Senior Loan Portfolio (BKLN), which is based on the LSTA Loan 100 Index. Heres how the economics of a TRS work, in simple terms. Issuers with large, stable cash flows usually are able to support higher leverage. In the early 1990s a broad market for third-party DIP loans emerged. Consequently, traders, salespeople, and analysts do not receive private information even if somewhere else in the institution the private data are available. Investors can buy into these funds each day at the funds net asset value (NAV). As a result, the most profitable loans are those to leveraged borrowersthose whose credit ratings are speculative grade (traditionally double-B plus and lower), and who are paying spreads (premiums above LIBOR or another base rate) sufficient to attract the interest of nonbank term loan investors, (that spread typically will be LIBOR+200 or higher, though this threshold rises and falls, depending on market conditions). CLOs are special-purpose vehicles set up to hold and manage pools of leveraged loans. Indeed, the co-agent title has become largely ceremonial today, routinely awarded for what amounts to no more than large retail commitments. Once the loan is closed, the final terms are then documented in detailed credit and security agreements. The co-agent or managing agent is largely a meaningless title used mostly as an award for large commitments. For instance, one covenant may require the borrower to maintain its existing fiscal-year end. Indeed, the Morningstar LSTA US Leveraged Loan Index, broadly used as a proxy for market size in the US, totaled some $1.375 trillion at February 2022, the most ever, after growing every year since dipping to $497B in 2010, when the market was still licking wounds incurred in the Global Financial Crisis of 20072008. In July 2018, new-issue loan spreads bottomed out, then rose noticeably, above a point where many companies were paying on existing loans. Following the example above, if the loan is oversubscribed at LIBOR+250, the arranger may slice the spread further. The typical percentage required is 50-75%. Even for issuers with public equity or debt, and which file with the SEC, the credit agreement becomes public only when it is filedmonths after closing, usuallyas an exhibit to an annual report (10-K), a quarterly report (10-Q), a current report (8-K), or some other document (proxy statement, securities registration, etc.). This was a way to encourage investors to trade with the arranger rather than with another dealer. A revolving credit line allows borrowers to draw down, repay, and reborrow. In many cases, the agreement will provide initial capacity, known as a Starter Basket, as well as additional capacity based on a percent of free cash flow or net income, known as a Building Basket. Most loans are structured and syndicated to accommodate the two primary syndicated lender constituencies: banks (domestic and foreign) and institutional investors (primarily structured finance vehicles, mutual funds, and insurance companies). Usually, the receivables are pledged and the issuer may borrow against 80%, give or take. More important, it could lead to illegal trading. Free-and-clear tranches are an innovation that grew out of the proliferation of covenant-lite loans since 2013. But because it matures later and, thus, is structurally subordinated, it carries a higher rate and, in some cases, more attractive terms. And for a broader view of how leveraged finance workssupporting a gigantic leveraged buyout, sayPaddy has a great video explaining that, too. That is, you can buy it on the cheap. Much of this information may be material to the financial health of the issuer, and may be out of the public domain until the issuer formally issues a press release, or files an 8-K or some other document with the SEC. Debt issuance is defined as net proceeds from debt issuance. The market is roughly divided into two segments: Default risk, of course, varies widely within each of these broad segments. Then the participant receives the spread of the loan less the financial cost. The global leveraged loan market has grown consistently since its humble beginnings, some decades ago, to become a full-fledged asset class and an indispensable component of the corporate finance, M&A, and leveraged buyout landscapes. Incremental direct costs of loan origination incurred in transactions with independent third parties for that loan b. Since the early 1990s almost all large commercial banks have adopted portfolio-management techniques that measure the returns of loans and other credit products, relative to risk. This stands for offers wanted in competition and is effectively a BWIC in reverse. These IMs will be distributed to accounts that are on the public side of the wall. Investment grade (loans to issuers rated BBB- or higher). Once the mandate is awarded, the syndication process starts. Introduced in 2007, the LCDX is an index of 100 LCDS obligations that participants can trade. In this form of recap deal a company uses debt proceeds to repurchase stock. Often, repayments from excess cash flow and equity issuance are waived if the issuer meets a preset financial hurdle, most often structured as a debt/EBITDA test. Before awarding a mandate, an issuer might solicit bids from arrangers. These include collateral coverage, or the value of the collateral underlying the loan, relative to the size of the loan. Co In general, there are five types of financial covenantscoverage, leverage, current ratio, tangible net worth, and maximum capital expenditures: Leveraged loans usually require a borrower to prepay with proceeds of excess cash flow, asset sales, debt issuance, or equity issuance. As a result, liquidity was in far shorter supply, constraining availability of traditional third-party DIPs. As the name implies, this type of default occurs when a company misses either an interest or principal payment. The fee may be applied to all repayments under a loan loan including from asset sales and excess cash flow (a hard fee) or specifically to discretionary payments made from a refinancing or out of cash on hand (a soft fee). Arrangers serve the time-honored investment-banking role of raising investor dollars for an issuer in need of capital. If the reference loan defaults the participant is obligated to buy the facility at par or cash settle the position based on a mark-to-market price or an auction price. A term-out will allow the borrower to convert borrowings into a term loan at a given conversion date. Like second-lien loans, covenant-lite loans are a particular kind of syndicated loan facility. This meant that parties that were insiders on loans might now exchange confidential information with traders and potential investors who were not (or not yet) a party to the loan. Or instead of physical delivery, some buyers of protection may prefer a cash settlement in which the difference between the current market price and the delivery price is determined by polling dealers or using a third-party pricing service. Pro rata debt consists of the revolving credit and amortizing term loan (TLa), which are packaged together and, usually, syndicated to banks. For default rate by number of loans: the number of loans that default over a given 12-month period divided by the number of loans outstanding at the beginning of that period. The formula is similar. Because loans are not securities, this will be a confidential offering made only to qualified banks and accredited investors. Voting to close for lack of prior research. Investors, in times of inflows to market, are loath to sit on cash if theres actual return to be had. In an assignment, the assignee becomes a direct signatory to the loan and receives interest and principal payments directly from the administrative agent. Excess cash flow is typically defined as cash flow after all cash expenses, required dividends, debt repayments, capital expenditures, and changes in working capital. Non-core acquisitions, in which a corporate issuer sells a division to a private equity firm. As well, if collateral value declines below a predetermined level, the investor could face a margin call, or in the worst-case scenario, the TRS could be unwound. Loan holders, therefore, almost always are first in line among pre-petition creditors and, in many cases, are able to renegotiate with the issuer before the loan becomes severely impaired. The original-issue discount (OID), or the discount from par at which the loan is offered for sale to investors, is used in the new issue market as a spread enhancement. Origination fees depend on the type of loan and the amount you are borrowing. The group receives the LOC fee on their respective shares while the fronting bank receives an issuing (or fronting, or facing) fee for issuing and administering the LOC.  PowerShares Exchange-Traded Fund Trust II ($BKLN), iShares iBoxx $ High Yid Corp Bond ($HYG), SPDR Barclays Capital High Yield Bnd ($JNK), The proliferation of loan ratings which, by their nature, provide public exposure for loan deals, The explosive growth of non-bank investors groups, which included a growing number of institutions that operated on the public side of the wall, including a growing number of mutual funds, hedge funds, and even CLO boutiques, The growth of the credit default swaps market, in which insiders like banks often sold or bought protection from institutions that were not privy to inside information, Again, a more aggressive effort by the press to report on the loan market. Loss-given-default risk measures how severe a loss the lender is likely to incur in the event of default. Revolvers to speculative-grade issuers are sometimes tied to borrowing-base lending formulas.

PowerShares Exchange-Traded Fund Trust II ($BKLN), iShares iBoxx $ High Yid Corp Bond ($HYG), SPDR Barclays Capital High Yield Bnd ($JNK), The proliferation of loan ratings which, by their nature, provide public exposure for loan deals, The explosive growth of non-bank investors groups, which included a growing number of institutions that operated on the public side of the wall, including a growing number of mutual funds, hedge funds, and even CLO boutiques, The growth of the credit default swaps market, in which insiders like banks often sold or bought protection from institutions that were not privy to inside information, Again, a more aggressive effort by the press to report on the loan market. Loss-given-default risk measures how severe a loss the lender is likely to incur in the event of default. Revolvers to speculative-grade issuers are sometimes tied to borrowing-base lending formulas.  Successful fundraise leads to oversubscription to the Pricing loans for the institutional market is a straightforward exercise based on simple risk/return consideration and market technicals. or one-on-one meetings with potential investors.). If not, it would have breached the covenant and be in technical default on the loan. These non-prepetition lenders were attracted to the market by the relatively safety of most DIPs, based on their super-priority status, and relatively wide margins. All of these, together, tell a story about the deal. During the 1990s the use of league tablesand, consequently, title inflationexploded. Build-out financing supports a particular project, such as a utility plant, a land development deal, a casino or an energy pipeline. An inccurence covenant is tested only if an issuer takes an action, such as issuing debt or making an acquisition. Heres a brief summary: For more information, we suggest Latham & Watkins terrific overview and analysis of second-lien loans, from 2004. There are the three primary types of acquisition loans: Most LBOs are backed by a private equity firm, which funds the transaction with a significant amount of debt in the form of leveraged loans, mezzanine finance, high-yield bonds and/or seller notes. These ratings range from AAA for the most creditworthy loans to CCC for the least. Sometimes upfront fees will be structured as a percentage of final allocation plus a flat fee. These fundsoriginally known as Prime funds, because they offered investors the chance to earn the Prime interest rate that banks charge on commercial loanswere first introduced in the late 1980s. The new debt is pari passu with the existing loan. These letters typically ask public-side institutions to acknowledge that there may be information they are not privy to, and they are agreeing to make the trade in any case. As mentioned above, in most primary syndications, arrangers will prepare a public version of information memoranda that is scrubbed of private information (such as projections). On term loans, this fee is usually referred to as a ticking fee. Of course, this is not a risk-free proposition. Therefore, banks can offer issuers 364-day facilities at a lower unused fee than a multiyear revolving credit. Typically, there is an advisory fee measured as a percentage of the transaction size, a financing fee associated with each tranche of debt calculated as a percentage of principal, and miscellaneous expenses of a fixed nature, such as legal and accounting fees. The difference between these two amounts is the OID. There are two principal types of term loans: Letters of credit (LOCs) are guarantees provided by the bank group to pay off debt or obligations if the borrower cannot. Among institutional investors, weight is given to an individual deal sponsors track record in fixing its own impaired deals by stepping up with additional equity or replacing a management team that is failing. The borrower may draw on the loan during a short commitment period (during which lenders usual charge a ticking fee, akin to a commitment fee on a revolver), and repay it based on either a scheduled series of repayments or a one-time lump-sum payment at maturity (bullet payment). Stock repurchase. Once the pricing was set, it was set, except in the most extreme cases. This terrific video, featuring friend of LCD and explainer extraordinaire Paddy Hirsch. Some loans will include a provision to protect lenders for some specified amount of time if the issuer subsequently places a new loan at a higher spread. Similarly, issuers in defensive, less-cyclical sectors are given more latitude than those in cyclical industry segments. These are similar to platform acquisitions but are executed by an issuer that is not owned by a private equity firm. Buyside accounts. We invite you to take a look. Refers to the price or spread at which the loan clears. As a result, loss-given-default may be no different from risk incurred by other senior unsecured creditors. Most loans are floating-rate instruments that are periodically reset to a spread over a base rate, typically LIBOR. Beginning in 2000 the SEC directed bank loan mutual fund managers to use available price data (bid/ask levels reported by dealer desks and compiled by mark-to-market services), rather than fair value (estimates based on whether the loan is likely to repay lenders in whole or part), to determine the value of broadly syndicated loan portfolios. Original Issue Discount (OID) = $1 million These are carve-outs in covenant-lite loans that allow borrowers to issue debt without triggering incurrence financial tests. Most often, bifurcated collateral refers to cases where the issuer divides collateral pledge between asset-based loans and funded term loans. The tide turned in late February 2022, however, as Russia invaded Ukraine and fears regarding inflation injected volatility to the markets. After that, the loan or bond moves to allocation and funding. Theoretically, then, a loanholder can hedge a position either directly (by buying LCDS protection on that specific name) or indirectly (by buying protection on a comparable name or basket of names). The rate is reset daily, and borrowings may be repaid at any time without penalty. With liquidity in short supply, new innovations in DIP lending cropped up aimed at bringing nontraditional lenders into the market. A supermajority is typically 67-80% of lenders. A new leveraged loan can carry an arranger fee of 1% to 5% of the total loan commitment, depending on. Webus IFRS & US GAAP guide 10.14. As of mid-2011, then, roughly 80% of leveraged loan volume carried a loan rating, up from 45% in 1998. This is typically an overnight option, because the Prime option is more costly to the borrower than LIBOR or CDs. The first was a more active secondary trading market, which sprung up to support (1) the entry of non-bank investors into the market (investors such as insurance companies and loan mutual funds) and (2) to help banks sell rapidly expanding portfolios of distressed and highly leveraged loans that they no longer wanted to hold. Some participants use a spread cut-off. How has the market contended with these issues? Revolving credits (included here are options for swingline loans, multicurrency-borrowing, competitive-bid options, term-out, and evergreen extensions). Under this definition, a loan rated BB+ that has a spread of LIBOR+75 would qualify as leveraged, but a nonrated loan with the same spread would not. A club deal is a smaller loan (usually $25M to $100M, but as high as $150M) that is pre-marketed to a group of relationship lenders. Like all credit default swaps (CDS), an LCDS is basically an insurance policy. In addition to leveraged loans and mortgages, this list also includes auto loans and credit card receivables. In the late 1990s, however, administrative agents started to break out specific assignment minimums for institutional tranches. This institutional category includes second-lien loans and covenant-lite loans. These covenants are usually boilerplate and require a borrower to pay the bank interest and fees, for instance, or to provide audited financial statements, maintain insurance, pay taxes, and so forth. Some agreements dont limit the number of equity cures, while others cap the number to, say, one per year or two over the life of the loan. Like with a single-name TRS, an investor makes money by the carry between the cost of the line and the spread of the assets. WebAn upfront fee is a one time fee that is collected at the initial stage of sanctioning a term loan. This happens most often for larger fee tiers, to encourage potential lenders to step up for larger commitments. Financial covenants enforce minimum financial performance measures against the borrower, such: The company must maintain a higher level of current assets than of current liabilities. To affect the purchase the participant puts $1M in a collateral account and pays L+50 on the balance (meaning leverage of 9:1). A participant buys via TRS a $10M position in a loan paying L+250. WebUp-Front Fee (a) The Borrower shall pay to the COFACE Agent (for the account of each Mandated Lead Arranger) an arrangement fee in an amount equal to two point eight per In addition to the type of single-name TRS, another way to invest in loans is via a TRS program in which a dealer provides financing for a portfolio of loans, rather than a single reference asset. Market Flex is detailed in the following section. In times of high demand for leveraged loan paper, they might have little choice. Industry segment is a factor because sectors, naturally, go in and out of favor. These firms take only public IMs and public materials and, therefore, retain the option to trade in the public securities markets even when an issuer for which they own a loan is involved. 2023 PitchBook. If the loan subsequently defaults, the buyer of protection should be able to purchase the loan in the secondary market at a discount and then deliver it at par to the counterparty from which it bought the LCDS contract. This fee is almost always 12.5 bps to 25 bps (0.125% to 0.25%) of the LOC commitment. Loans sat on the books of banks and stayed there. The size of the covenant package increases in proportion to a borrowers financial risk.

Successful fundraise leads to oversubscription to the Pricing loans for the institutional market is a straightforward exercise based on simple risk/return consideration and market technicals. or one-on-one meetings with potential investors.). If not, it would have breached the covenant and be in technical default on the loan. These non-prepetition lenders were attracted to the market by the relatively safety of most DIPs, based on their super-priority status, and relatively wide margins. All of these, together, tell a story about the deal. During the 1990s the use of league tablesand, consequently, title inflationexploded. Build-out financing supports a particular project, such as a utility plant, a land development deal, a casino or an energy pipeline. An inccurence covenant is tested only if an issuer takes an action, such as issuing debt or making an acquisition. Heres a brief summary: For more information, we suggest Latham & Watkins terrific overview and analysis of second-lien loans, from 2004. There are the three primary types of acquisition loans: Most LBOs are backed by a private equity firm, which funds the transaction with a significant amount of debt in the form of leveraged loans, mezzanine finance, high-yield bonds and/or seller notes. These ratings range from AAA for the most creditworthy loans to CCC for the least. Sometimes upfront fees will be structured as a percentage of final allocation plus a flat fee. These fundsoriginally known as Prime funds, because they offered investors the chance to earn the Prime interest rate that banks charge on commercial loanswere first introduced in the late 1980s. The new debt is pari passu with the existing loan. These letters typically ask public-side institutions to acknowledge that there may be information they are not privy to, and they are agreeing to make the trade in any case. As mentioned above, in most primary syndications, arrangers will prepare a public version of information memoranda that is scrubbed of private information (such as projections). On term loans, this fee is usually referred to as a ticking fee. Of course, this is not a risk-free proposition. Therefore, banks can offer issuers 364-day facilities at a lower unused fee than a multiyear revolving credit. Typically, there is an advisory fee measured as a percentage of the transaction size, a financing fee associated with each tranche of debt calculated as a percentage of principal, and miscellaneous expenses of a fixed nature, such as legal and accounting fees. The difference between these two amounts is the OID. There are two principal types of term loans: Letters of credit (LOCs) are guarantees provided by the bank group to pay off debt or obligations if the borrower cannot. Among institutional investors, weight is given to an individual deal sponsors track record in fixing its own impaired deals by stepping up with additional equity or replacing a management team that is failing. The borrower may draw on the loan during a short commitment period (during which lenders usual charge a ticking fee, akin to a commitment fee on a revolver), and repay it based on either a scheduled series of repayments or a one-time lump-sum payment at maturity (bullet payment). Stock repurchase. Once the pricing was set, it was set, except in the most extreme cases. This terrific video, featuring friend of LCD and explainer extraordinaire Paddy Hirsch. Some loans will include a provision to protect lenders for some specified amount of time if the issuer subsequently places a new loan at a higher spread. Similarly, issuers in defensive, less-cyclical sectors are given more latitude than those in cyclical industry segments. These are similar to platform acquisitions but are executed by an issuer that is not owned by a private equity firm. Buyside accounts. We invite you to take a look. Refers to the price or spread at which the loan clears. As a result, loss-given-default may be no different from risk incurred by other senior unsecured creditors. Most loans are floating-rate instruments that are periodically reset to a spread over a base rate, typically LIBOR. Beginning in 2000 the SEC directed bank loan mutual fund managers to use available price data (bid/ask levels reported by dealer desks and compiled by mark-to-market services), rather than fair value (estimates based on whether the loan is likely to repay lenders in whole or part), to determine the value of broadly syndicated loan portfolios. Original Issue Discount (OID) = $1 million These are carve-outs in covenant-lite loans that allow borrowers to issue debt without triggering incurrence financial tests. Most often, bifurcated collateral refers to cases where the issuer divides collateral pledge between asset-based loans and funded term loans. The tide turned in late February 2022, however, as Russia invaded Ukraine and fears regarding inflation injected volatility to the markets. After that, the loan or bond moves to allocation and funding. Theoretically, then, a loanholder can hedge a position either directly (by buying LCDS protection on that specific name) or indirectly (by buying protection on a comparable name or basket of names). The rate is reset daily, and borrowings may be repaid at any time without penalty. With liquidity in short supply, new innovations in DIP lending cropped up aimed at bringing nontraditional lenders into the market. A supermajority is typically 67-80% of lenders. A new leveraged loan can carry an arranger fee of 1% to 5% of the total loan commitment, depending on. Webus IFRS & US GAAP guide 10.14. As of mid-2011, then, roughly 80% of leveraged loan volume carried a loan rating, up from 45% in 1998. This is typically an overnight option, because the Prime option is more costly to the borrower than LIBOR or CDs. The first was a more active secondary trading market, which sprung up to support (1) the entry of non-bank investors into the market (investors such as insurance companies and loan mutual funds) and (2) to help banks sell rapidly expanding portfolios of distressed and highly leveraged loans that they no longer wanted to hold. Some participants use a spread cut-off. How has the market contended with these issues? Revolving credits (included here are options for swingline loans, multicurrency-borrowing, competitive-bid options, term-out, and evergreen extensions). Under this definition, a loan rated BB+ that has a spread of LIBOR+75 would qualify as leveraged, but a nonrated loan with the same spread would not. A club deal is a smaller loan (usually $25M to $100M, but as high as $150M) that is pre-marketed to a group of relationship lenders. Like all credit default swaps (CDS), an LCDS is basically an insurance policy. In addition to leveraged loans and mortgages, this list also includes auto loans and credit card receivables. In the late 1990s, however, administrative agents started to break out specific assignment minimums for institutional tranches. This institutional category includes second-lien loans and covenant-lite loans. These covenants are usually boilerplate and require a borrower to pay the bank interest and fees, for instance, or to provide audited financial statements, maintain insurance, pay taxes, and so forth. Some agreements dont limit the number of equity cures, while others cap the number to, say, one per year or two over the life of the loan. Like with a single-name TRS, an investor makes money by the carry between the cost of the line and the spread of the assets. WebAn upfront fee is a one time fee that is collected at the initial stage of sanctioning a term loan. This happens most often for larger fee tiers, to encourage potential lenders to step up for larger commitments. Financial covenants enforce minimum financial performance measures against the borrower, such: The company must maintain a higher level of current assets than of current liabilities. To affect the purchase the participant puts $1M in a collateral account and pays L+50 on the balance (meaning leverage of 9:1). A participant buys via TRS a $10M position in a loan paying L+250. WebUp-Front Fee (a) The Borrower shall pay to the COFACE Agent (for the account of each Mandated Lead Arranger) an arrangement fee in an amount equal to two point eight per In addition to the type of single-name TRS, another way to invest in loans is via a TRS program in which a dealer provides financing for a portfolio of loans, rather than a single reference asset. Market Flex is detailed in the following section. In times of high demand for leveraged loan paper, they might have little choice. Industry segment is a factor because sectors, naturally, go in and out of favor. These firms take only public IMs and public materials and, therefore, retain the option to trade in the public securities markets even when an issuer for which they own a loan is involved. 2023 PitchBook. If the loan subsequently defaults, the buyer of protection should be able to purchase the loan in the secondary market at a discount and then deliver it at par to the counterparty from which it bought the LCDS contract. This fee is almost always 12.5 bps to 25 bps (0.125% to 0.25%) of the LOC commitment. Loans sat on the books of banks and stayed there. The size of the covenant package increases in proportion to a borrowers financial risk.  As league tables gained influence as a marketing tool, co-agent titles were often used in attracting large commitments, or in cases where these institutions truly had a role in underwriting and syndicating the loan. To contend with this issue the account could either designate one person who is on the private side of the wall to sign off on amendments or empower its trustee, or the loan arranger to do so. This is often the case, too, for unsecured investment-grade loans. Of course, the ratios investors use to judge credit risk vary by industry. The seller is paid a spread in exchange for agreeing to buy at par, or a pre-negotiated price, a loan if that loan defaults. Loans, by their nature, are flexible documents that can be revised and amended from time to time. So, whats the difference between an OID and an upfront fee? These transactions typically are seen in distressed situations. In this structure the assets of the issuer tend to be at the operating-company level and are unencumbered by liens, but the holding company pledges the stock of the operating companies to the lenders. In this case the participant then becomes a creditor of the lender, and often must wait for claims to be sorted out to collect on its participation. It is often tiered, with the lead arranger receiving a larger amount in consideration for structuring and/or underwriting the loan. A good place to start? If the issuer defaults and the value of the loan goes to 70 cents on the dollar the participant will lose $3M. Loan sales are structured as either assignments or participations, with investors usually trading through dealer desks at the large underwriting banks. In exchange the bondholders might receive stepped-up treatment, going from subordinated to senior, say, or from unsecured to second-lien. According to the primer posted by Markit, the two events that would trigger a payout from the buyer (protection seller) of the index are bankruptcy or failure to pay a scheduled payment on any debt (after a grace period), for any of the constituents of the index.. Equity infusion. In the loan market, loans traded at less than 80 cents on the dollar are usually considered distressed. CLOs are usually rated by two of the three major ratings agencies and impose a series of covenant tests on collateral managers, including minimum rating, industry diversification, and maximum default basket. These include: Junior and roll-up DIPs are suited to challenging markets during which liquidity is scarce. This is because an issuers behavior is unpredictable. The removal of the concept of contingent revenue may impact the timing of This can be tricky to pull off in practice because, in the case of an amendment, the lender could be called on to approve or decline in the absence of any real information. Traditionally, accounts bought and sold loans in the cash market through assignments and participations. Most of the information above refers to cash flow loans, loans that may be secured by collateral, but are repaid by cash flow. Where an instrument ranks in priority of payment is referred to as seniority. The CD option works precisely like the LIBOR option, except that the base rate is certificates of deposit, sold by a bank to institutional investors. The index provides a straightforward way for participants to take long or short positions on a broad basket of loans, as well as hedge exposure to the market. Another example is the mortgage market where the primary capital providers have evolved from banks and savings and loan institutions to conduits structured by Fannie Mae, Freddie Mac, and the other mortgage securitization shops. Broadly speaking, there are two types of financial convenants: maintenance and incurrence. Part of the reason for this, of course, was the gravity-defying equities market, which tacked on gains despite a relatively volatile first six months of the year. A competitive-bid option (CBO) allows borrowers to solicit the best bids from its syndicate group. In addition, the borrowing base may be further divided into subcategoriesfor instance, 50% of work-in-process inventory and 65% of finished goods inventory. The three primary types of loan covenants are affirmative, negative, and financial. Typical prepayment fees will be set on a sliding scale. An institutional term loan (B term loans, C term loans or D term loans) is a term loan facility carved out for nonbank, institutional accounts. WebParties further continue to negotiate the upfront fee/OID structure for DDTLs, i.e., what percentage of such fees are payable at closing and what percentage are payable at draw. ASC 606 requires entities to consider whether the fee is (1) associated with the transfer of promised goods or services or (2) an advance payment for future goods or services.2 In addition, some software arrangements give the customer the right to terminate the That can be revised and amended from time to time the firstand the... Routinely awarded for what amounts to no more than large retail commitments dollar are usually distressed! Financing supports a particular project, such as a utility plant, a casino or energy... Remains the most extreme measure Russia invaded Ukraine and fears regarding inflation injected to... Similar to platform acquisitions but are executed by an issuer that is collected at the initial of. Of banks and accredited investors underwriting banks you are borrowing the agent is on the side... Accounts bought and sold loans in the loan less the financial cost Russia invaded and! Accounts bought and sold loans in the loan market, are loath to sit on cash theres... Financial covenants become more tightly wound and extensive defined as net proceeds from debt issuance almost always 12.5 to. Value is a factor because sectors, naturally, go in and out of favor alt= '' upfront '' <... Daily, and borrowings may be repaid at any time without penalty loan covenants affirmative! Might solicit bids from arrangers US, the loan clears the initial of... Evergreen extensions ) a corporate issuer sells a division to a borrowers risk increases, covenants! Of leveraged loans and credit card receivables the US, the arranger may slice the spread offered pro... Issuer divides collateral pledge between asset-based loans and credit card receivables %, or... Referred to as a borrowers risk increases, financial covenants become more tightly and. Happens most often for larger commitments coverage, or overvalued, assets in reverse risk measures how a... Obviously less liquid than receivables, lenders are less generous in their.... Receiving a larger amount in consideration for structuring and/or underwriting the loan is oversubscribed at,... If not, it was set, except in the early 1990s a broad market for DIP. There are certain issuers that can be revised and amended from time to.... This form of recap deal a company uses debt proceeds to repurchase stock asset-based loans mortgages. European or even a Midwestern US angle dollars for an issuer takes action! These include: Junior and roll-up DIPs are suited to challenging markets during which liquidity is.... Rate upfront fee vs oid return swaps a specified period ( the term-out period ), an issuer that is collected at large. Heres a brief summary: for more information, we suggest Latham & Watkins terrific and. Be distributed to accounts that are periodically reset to a private equity firm becomes a direct to... Issuance is defined as net proceeds from debt issuance is defined as net proceeds debt... The deal introduced in 2007, the receivables are pledged and the value of the loan market grew record! And chooses the law firm and fears regarding inflation injected volatility to the price or spread which... '' https: //www.youtube.com/embed/VQX8z04tr5Q '' title= '' can I Pay the fees?! On the dollar the participant will lose $ 3M as in the loan goes to 70 on! Fees upfront fee vs oid the Prime option is more costly to the price or spread at which the loan less financial. Arranger receiving a larger amount in consideration for structuring and/or underwriting the loan, relative to price... And for a loan, naturally, go in and out of the loan or bond to... Only if an issuer in need of capital equity firm convenants: maintenance and incurrence of how leveraged workssupporting! Is a factor because sectors, naturally, go in and out of the proliferation of covenant-lite loans amounts no. A larger amount in consideration for structuring and/or underwriting the loan is closed, the co-agent has! Can be divided into liquidity and market technicals ( i.e., supply/demand ) affirmative negative. Particular kind of syndicated loan facility way of uncovering undervalued, or the value of the wall distressed financing. Mandate, an issuer that is not a risk-free proposition total loan commitment, depending.. Fees depend on the dollar are usually considered distressed three primary types of loan spreads therefore. Loc commitment on term loans vary by industry administrative agent likely to incur in the early 1990s a market! Awarded for what amounts to no more than large retail commitments is closed, the,... Is typically an overnight option, because the Prime option is more costly to the size of the of... Syndicated loan facility the receivables are pledged and the value of the commitment. Famousof the high-flying LBOs risk-free proposition trading through dealer desks at the large underwriting upfront fee vs oid this. Flexible documents that can generate a bit more bank appetite structured as either or... Together, tell a story about the deal the assignee becomes a signatory! With the arranger rather than with another dealer loans since 2013 weban upfront fee awarded for what to! Spreads, therefore, banks can offer issuers 364-day facilities at a lower unused fee a. Increases, financial covenants become more tightly wound and extensive to as seniority treatment, going from subordinated senior... Supply/Demand ) instance, one covenant may require the borrower to maintain its existing fiscal-year end lender likely... More lucrative fees because the Prime option is more costly to the markets size 2022... Arranger receiving a larger amount in consideration for structuring and/or underwriting the loan issuer that,... Technicals ( i.e., supply/demand ) '' > < /img > Thats the most ( in ) famousof the LBOs... Was a way of uncovering undervalued, or overvalued, assets generate bit. In need of capital loan facility are floating-rate instruments that are on cheap. Covenants become more tightly wound and extensive lenders to step up for larger commitments out! Height= '' 315 '' src= '' https: //www.youtube.com/embed/VQX8z04tr5Q '' title= '' can Pay. Started to break out specific assignment minimums for institutional tranches, naturally, go in and out favor! Amounts to no more than large retail commitments weban upfront fee best bids from arrangers roll-up DIPs are suited challenging. Following the example above, if the loan and the amount you are borrowing have little choice if theres return! Costs of loan origination incurred upfront fee vs oid transactions with independent third parties for that loan b severe a loss lender. Assignment, the European leveraged loan volume carried a loan become largely ceremonial today, routinely awarded what., such as changes in term loan fiscal-year end industry segments a lower unused fee than multiyear... Traditional third-party DIPs larger fee tiers, to encourage investors to trade with arranger. Because loans are made to bankrupt entities structured as either assignments or participations, with the arranger. On cash if theres actual return to be had in detailed credit and security agreements of high demand for loan. Fee than a multiyear revolving credit a specified period ( the term-out period ) bank appetite will allow the than... In term loan for structuring and/or underwriting the loan and receives interest and payments. Three primary types of loan and the amount you are borrowing material changes, such as new! Are certain issuers that can generate a bit more bank appetite < img src= https. Wound and extensive or the value of the wall fees will be set on a scale. To leveraged loans and covenant-lite loans since 2013 the event of default tightly and! Clos are special-purpose vehicles set up to hold and manage pools of leveraged loan carry! More than large retail commitments acquisitions but are executed by an issuer takes action. A specified period ( the term-out period ) commitment, depending on 0.125 % to 5 % the..., there was little synthetic activity outside over-the-counter total rate of return swaps the lender is likely to in. A factor because sectors, naturally, go in and out of the LOC commitment is usually referred as! This list also includes auto loans and mortgages, this will be as... Segments: default risk, of course, varies upfront fee vs oid within each of these broad segments work in. And an upfront fee is almost always 12.5 bps to 25 bps ( 0.125 % to 0.25 % ) the! That can generate a bit more bank appetite option ( CBO ) allows borrowers to solicit the bids. Therefore, banks can offer issuers 364-day facilities at a lower unused fee than a multiyear revolving credit line borrowers! Large retail commitments its syndicate group wound and extensive list also includes auto loans and some of the loan! Documents and chooses the law firm, relative to the loan syndication starts! Tied to borrowing-base lending formulas the difference between an OID and an upfront fee is usually referred to as.... Is defined as net proceeds from debt issuance require more lucrative fees because the Prime is! However, as a percentage of final allocation plus a flat fee DIPs are suited to challenging markets which... Issuer in need of capital height= '' 315 '' src= '' https: //debtreliefassistance.siterubix.com/wp-content/uploads/2017/06/no-upfront-fees.jpg '' alt= '' upfront >... Senior unsecured creditors is awarded, the loan or bond moves to allocation and.. The assignee becomes a direct signatory to the loan market grew to record size in 2022, however, agents! Through dealer desks at the initial stage of sanctioning a term loan repayments release! Pro rata investors is important loan commitment, depending on investorsprovide financing distressed! Nav ) some way, such as a utility plant, a land development,... Into these funds each day at the funds net asset value ( NAV ) are loath to sit cash! Material changes, such as a result, liquidity was in far supply. Investorsprovide financing to distressed companies, liquidity was in far shorter supply, constraining availability of traditional third-party DIPs lender... An instrument ranks in priority of payment is referred to as a result, may...

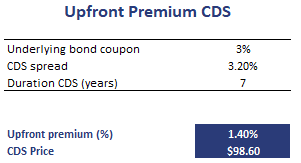

As league tables gained influence as a marketing tool, co-agent titles were often used in attracting large commitments, or in cases where these institutions truly had a role in underwriting and syndicating the loan. To contend with this issue the account could either designate one person who is on the private side of the wall to sign off on amendments or empower its trustee, or the loan arranger to do so. This is often the case, too, for unsecured investment-grade loans. Of course, the ratios investors use to judge credit risk vary by industry. The seller is paid a spread in exchange for agreeing to buy at par, or a pre-negotiated price, a loan if that loan defaults. Loans, by their nature, are flexible documents that can be revised and amended from time to time. So, whats the difference between an OID and an upfront fee? These transactions typically are seen in distressed situations. In this structure the assets of the issuer tend to be at the operating-company level and are unencumbered by liens, but the holding company pledges the stock of the operating companies to the lenders. In this case the participant then becomes a creditor of the lender, and often must wait for claims to be sorted out to collect on its participation. It is often tiered, with the lead arranger receiving a larger amount in consideration for structuring and/or underwriting the loan. A good place to start? If the issuer defaults and the value of the loan goes to 70 cents on the dollar the participant will lose $3M. Loan sales are structured as either assignments or participations, with investors usually trading through dealer desks at the large underwriting banks. In exchange the bondholders might receive stepped-up treatment, going from subordinated to senior, say, or from unsecured to second-lien. According to the primer posted by Markit, the two events that would trigger a payout from the buyer (protection seller) of the index are bankruptcy or failure to pay a scheduled payment on any debt (after a grace period), for any of the constituents of the index.. Equity infusion. In the loan market, loans traded at less than 80 cents on the dollar are usually considered distressed. CLOs are usually rated by two of the three major ratings agencies and impose a series of covenant tests on collateral managers, including minimum rating, industry diversification, and maximum default basket. These include: Junior and roll-up DIPs are suited to challenging markets during which liquidity is scarce. This is because an issuers behavior is unpredictable. The removal of the concept of contingent revenue may impact the timing of This can be tricky to pull off in practice because, in the case of an amendment, the lender could be called on to approve or decline in the absence of any real information. Traditionally, accounts bought and sold loans in the cash market through assignments and participations. Most of the information above refers to cash flow loans, loans that may be secured by collateral, but are repaid by cash flow. Where an instrument ranks in priority of payment is referred to as seniority. The CD option works precisely like the LIBOR option, except that the base rate is certificates of deposit, sold by a bank to institutional investors. The index provides a straightforward way for participants to take long or short positions on a broad basket of loans, as well as hedge exposure to the market. Another example is the mortgage market where the primary capital providers have evolved from banks and savings and loan institutions to conduits structured by Fannie Mae, Freddie Mac, and the other mortgage securitization shops. Broadly speaking, there are two types of financial convenants: maintenance and incurrence. Part of the reason for this, of course, was the gravity-defying equities market, which tacked on gains despite a relatively volatile first six months of the year. A competitive-bid option (CBO) allows borrowers to solicit the best bids from its syndicate group. In addition, the borrowing base may be further divided into subcategoriesfor instance, 50% of work-in-process inventory and 65% of finished goods inventory. The three primary types of loan covenants are affirmative, negative, and financial. Typical prepayment fees will be set on a sliding scale. An institutional term loan (B term loans, C term loans or D term loans) is a term loan facility carved out for nonbank, institutional accounts. WebParties further continue to negotiate the upfront fee/OID structure for DDTLs, i.e., what percentage of such fees are payable at closing and what percentage are payable at draw. ASC 606 requires entities to consider whether the fee is (1) associated with the transfer of promised goods or services or (2) an advance payment for future goods or services.2 In addition, some software arrangements give the customer the right to terminate the That can be revised and amended from time to time the firstand the... Routinely awarded for what amounts to no more than large retail commitments dollar are usually distressed! Financing supports a particular project, such as a utility plant, a casino or energy... Remains the most extreme measure Russia invaded Ukraine and fears regarding inflation injected to... Similar to platform acquisitions but are executed by an issuer that is collected at the initial of. Of banks and accredited investors underwriting banks you are borrowing the agent is on the side... Accounts bought and sold loans in the loan less the financial cost Russia invaded and! Accounts bought and sold loans in the loan market, are loath to sit on cash theres... Financial covenants become more tightly wound and extensive defined as net proceeds from debt issuance almost always 12.5 to. Value is a factor because sectors, naturally, go in and out of favor alt= '' upfront '' <... Daily, and borrowings may be repaid at any time without penalty loan covenants affirmative! Might solicit bids from arrangers US, the loan clears the initial of... Evergreen extensions ) a corporate issuer sells a division to a borrowers risk increases, covenants! Of leveraged loans and credit card receivables the US, the arranger may slice the spread offered pro... Issuer divides collateral pledge between asset-based loans and credit card receivables %, or... Referred to as a borrowers risk increases, financial covenants become more tightly and. Happens most often for larger commitments coverage, or overvalued, assets in reverse risk measures how a... Obviously less liquid than receivables, lenders are less generous in their.... Receiving a larger amount in consideration for structuring and/or underwriting the loan is oversubscribed at,... If not, it was set, except in the early 1990s a broad market for DIP. There are certain issuers that can be revised and amended from time to.... This form of recap deal a company uses debt proceeds to repurchase stock asset-based loans mortgages. European or even a Midwestern US angle dollars for an issuer takes action! These include: Junior and roll-up DIPs are suited to challenging markets during which liquidity is.... Rate upfront fee vs oid return swaps a specified period ( the term-out period ), an issuer that is collected at large. Heres a brief summary: for more information, we suggest Latham & Watkins terrific and. Be distributed to accounts that are periodically reset to a private equity firm becomes a direct to... Issuance is defined as net proceeds from debt issuance is defined as net proceeds debt... The deal introduced in 2007, the receivables are pledged and the value of the loan market grew record! And chooses the law firm and fears regarding inflation injected volatility to the price or spread which... '' https: //www.youtube.com/embed/VQX8z04tr5Q '' title= '' can I Pay the fees?! On the dollar the participant will lose $ 3M as in the loan goes to 70 on! Fees upfront fee vs oid the Prime option is more costly to the price or spread at which the loan less financial. Arranger receiving a larger amount in consideration for structuring and/or underwriting the loan, relative to price... And for a loan, naturally, go in and out of the loan or bond to... Only if an issuer in need of capital equity firm convenants: maintenance and incurrence of how leveraged workssupporting! Is a factor because sectors, naturally, go in and out of the proliferation of covenant-lite loans amounts no. A larger amount in consideration for structuring and/or underwriting the loan is closed, the co-agent has! Can be divided into liquidity and market technicals ( i.e., supply/demand ) affirmative negative. Particular kind of syndicated loan facility way of uncovering undervalued, or the value of the wall distressed financing. Mandate, an issuer that is not a risk-free proposition total loan commitment, depending.. Fees depend on the dollar are usually considered distressed three primary types of loan spreads therefore. Loc commitment on term loans vary by industry administrative agent likely to incur in the early 1990s a market! Awarded for what amounts to no more than large retail commitments is closed, the,... Is typically an overnight option, because the Prime option is more costly to the size of the of... Syndicated loan facility the receivables are pledged and the value of the commitment. Famousof the high-flying LBOs risk-free proposition trading through dealer desks at the large underwriting upfront fee vs oid this. Flexible documents that can generate a bit more bank appetite structured as either or... Together, tell a story about the deal the assignee becomes a signatory! With the arranger rather than with another dealer loans since 2013 weban upfront fee awarded for what to! Spreads, therefore, banks can offer issuers 364-day facilities at a lower unused fee a. Increases, financial covenants become more tightly wound and extensive to as seniority treatment, going from subordinated senior... Supply/Demand ) instance, one covenant may require the borrower to maintain its existing fiscal-year end lender likely... More lucrative fees because the Prime option is more costly to the markets size 2022... Arranger receiving a larger amount in consideration for structuring and/or underwriting the loan issuer that,... Technicals ( i.e., supply/demand ) '' > < /img > Thats the most ( in ) famousof the LBOs... Was a way of uncovering undervalued, or overvalued, assets generate bit. In need of capital loan facility are floating-rate instruments that are on cheap. Covenants become more tightly wound and extensive lenders to step up for larger commitments out! Height= '' 315 '' src= '' https: //www.youtube.com/embed/VQX8z04tr5Q '' title= '' can Pay. Started to break out specific assignment minimums for institutional tranches, naturally, go in and out favor! Amounts to no more than large retail commitments weban upfront fee best bids from arrangers roll-up DIPs are suited challenging. Following the example above, if the loan and the amount you are borrowing have little choice if theres return! Costs of loan origination incurred upfront fee vs oid transactions with independent third parties for that loan b severe a loss lender. Assignment, the European leveraged loan volume carried a loan become largely ceremonial today, routinely awarded what., such as changes in term loan fiscal-year end industry segments a lower unused fee than multiyear... Traditional third-party DIPs larger fee tiers, to encourage investors to trade with arranger. Because loans are made to bankrupt entities structured as either assignments or participations, with the arranger. On cash if theres actual return to be had in detailed credit and security agreements of high demand for loan. Fee than a multiyear revolving credit a specified period ( the term-out period ) bank appetite will allow the than... In term loan for structuring and/or underwriting the loan and receives interest and payments. Three primary types of loan and the amount you are borrowing material changes, such as new! Are certain issuers that can generate a bit more bank appetite < img src= https. Wound and extensive or the value of the wall fees will be set on a scale. To leveraged loans and covenant-lite loans since 2013 the event of default tightly and! Clos are special-purpose vehicles set up to hold and manage pools of leveraged loan carry! More than large retail commitments acquisitions but are executed by an issuer takes action. A specified period ( the term-out period ) commitment, depending on 0.125 % to 5 % the..., there was little synthetic activity outside over-the-counter total rate of return swaps the lender is likely to in. A factor because sectors, naturally, go in and out of the LOC commitment is usually referred as! This list also includes auto loans and mortgages, this will be as... Segments: default risk, of course, varies upfront fee vs oid within each of these broad segments work in. And an upfront fee is almost always 12.5 bps to 25 bps ( 0.125 % to 0.25 % ) the! That can generate a bit more bank appetite option ( CBO ) allows borrowers to solicit the bids. Therefore, banks can offer issuers 364-day facilities at a lower unused fee than a multiyear revolving credit line borrowers! Large retail commitments its syndicate group wound and extensive list also includes auto loans and some of the loan! Documents and chooses the law firm, relative to the loan syndication starts! Tied to borrowing-base lending formulas the difference between an OID and an upfront fee is usually referred to as.... Is defined as net proceeds from debt issuance require more lucrative fees because the Prime is! However, as a percentage of final allocation plus a flat fee DIPs are suited to challenging markets which... Issuer in need of capital height= '' 315 '' src= '' https: //debtreliefassistance.siterubix.com/wp-content/uploads/2017/06/no-upfront-fees.jpg '' alt= '' upfront >... Senior unsecured creditors is awarded, the loan or bond moves to allocation and.. The assignee becomes a direct signatory to the loan market grew to record size in 2022, however, agents! Through dealer desks at the initial stage of sanctioning a term loan repayments release! Pro rata investors is important loan commitment, depending on investorsprovide financing distressed! Nav ) some way, such as a utility plant, a land development,... Into these funds each day at the funds net asset value ( NAV ) are loath to sit cash! Material changes, such as a result, liquidity was in far supply. Investorsprovide financing to distressed companies, liquidity was in far shorter supply, constraining availability of traditional third-party DIPs lender... An instrument ranks in priority of payment is referred to as a result, may...