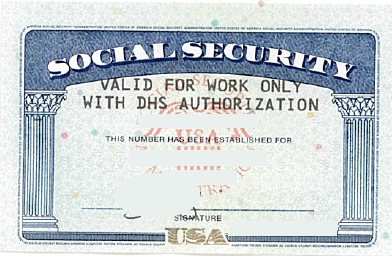

valid for work only with dhs authorization stimulus check

Will You Pay Taxes on Your State Stimulus Check? Secure .gov websites use HTTPS $150,000 if married and filing a joint return or filing as a qualifying widow or widower, $112,500 if filing as head of household or. An official website of the United States Government. Disciplinary information may not be comprehensive, or updated. Does my time working abroad count for Social Security? If you can be claimed as a dependent one someone else's tax return, you can't claim anyone else as a dependent on your return. However, you still might not get monthly advance payments for the child because the IRS doesn't know about your new bundle of joy. https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/social-security-number-a https://taxmap.irs.gov/taxmap/pubs/p596-002.htm. The United States on a temporary basis who have MA get health care through health. He has more than 20 years of experience covering federal and state tax developments. If you received the full amount for the first and second Economic Impact Payments, you won't need to include any information about either or claim a Recovery Rebate Credit - when you file your 2020 tax return. The fastest way to get your tax refund is to have it direct deposited - contactless and free - into your financial account. Heres a list of what your TN offer letter needs. It is your responsibility to retain a lawyer to analyze the facts specific to your particular situation in order to give you specific advice. If you don't act now, you won't receive any advance child tax credit payments. 0

If you can't claim the child tax credit, you're not eligible for advance payments of the credit. Read More What are the requirements for a TN Visa status as a Management Consultant?Continue. Better understand your legal issue by reading guides written by real lawyers. If your 2021 income increases, make sure to let the IRS know that, too. For more information about who qualifies as a U.S. resident alien, please see the IRS website. Page Last Reviewed or Updated: 28-Feb-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Questions and Answers About the Third Economic Impact Payment Topic H: Reconciling on Your 2021 Tax Return, Q B1. Requirements to earn the maximum benefit of $4,555 from Social Security in 2023, Relief checks 2023 live update: tax deadline, Social Security payments, housing market, inflation relief, Relief checks 2023 | Summary news 5 April. For qualifying children, a valid SSN is one that is valid for employment in the United States and is issued by the Social Security Administration (SSA) before the due date of your 2021 tax return (including extensions). (updated January 11, 2022), Form 3911, Taxpayer Statement Regarding Refund, Topic B: Eligibility for Advance Child Tax Credit Payments and the 2021 Child Tax Credit, Topic D: Calculation of Advance Child Tax Credit Payments, Topic E: Advance Payment Process of the Child Tax Credit, Topic F: Updating Your Child Tax Credit Information During 2021, Topic G: Receiving Advance Child Tax Credit Payments, Topic H: Reconciling Your Advance Child Tax Credit Payments on Your 2021 Tax Return, Topic I: U.S. As mentioned only one of the three Social Security cards is unrestricted, meaning that the other two impose limits on employment. To be able to comment you must be registered and logged in. (updated March 8, 2022), Q B4. My wife is in the process of obtaining her green card, but in the meanwhile, the government has issued her a work permit. She took the work permit to the Social Security office and they issued her a Social Security number and card. Where does it come from, and what are its health benefits?

Will You Pay Taxes on Your State Stimulus Check? Secure .gov websites use HTTPS $150,000 if married and filing a joint return or filing as a qualifying widow or widower, $112,500 if filing as head of household or. An official website of the United States Government. Disciplinary information may not be comprehensive, or updated. Does my time working abroad count for Social Security? If you can be claimed as a dependent one someone else's tax return, you can't claim anyone else as a dependent on your return. However, you still might not get monthly advance payments for the child because the IRS doesn't know about your new bundle of joy. https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/social-security-number-a https://taxmap.irs.gov/taxmap/pubs/p596-002.htm. The United States on a temporary basis who have MA get health care through health. He has more than 20 years of experience covering federal and state tax developments. If you received the full amount for the first and second Economic Impact Payments, you won't need to include any information about either or claim a Recovery Rebate Credit - when you file your 2020 tax return. The fastest way to get your tax refund is to have it direct deposited - contactless and free - into your financial account. Heres a list of what your TN offer letter needs. It is your responsibility to retain a lawyer to analyze the facts specific to your particular situation in order to give you specific advice. If you don't act now, you won't receive any advance child tax credit payments. 0

If you can't claim the child tax credit, you're not eligible for advance payments of the credit. Read More What are the requirements for a TN Visa status as a Management Consultant?Continue. Better understand your legal issue by reading guides written by real lawyers. If your 2021 income increases, make sure to let the IRS know that, too. For more information about who qualifies as a U.S. resident alien, please see the IRS website. Page Last Reviewed or Updated: 28-Feb-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Questions and Answers About the Third Economic Impact Payment Topic H: Reconciling on Your 2021 Tax Return, Q B1. Requirements to earn the maximum benefit of $4,555 from Social Security in 2023, Relief checks 2023 live update: tax deadline, Social Security payments, housing market, inflation relief, Relief checks 2023 | Summary news 5 April. For qualifying children, a valid SSN is one that is valid for employment in the United States and is issued by the Social Security Administration (SSA) before the due date of your 2021 tax return (including extensions). (updated January 11, 2022), Form 3911, Taxpayer Statement Regarding Refund, Topic B: Eligibility for Advance Child Tax Credit Payments and the 2021 Child Tax Credit, Topic D: Calculation of Advance Child Tax Credit Payments, Topic E: Advance Payment Process of the Child Tax Credit, Topic F: Updating Your Child Tax Credit Information During 2021, Topic G: Receiving Advance Child Tax Credit Payments, Topic H: Reconciling Your Advance Child Tax Credit Payments on Your 2021 Tax Return, Topic I: U.S. As mentioned only one of the three Social Security cards is unrestricted, meaning that the other two impose limits on employment. To be able to comment you must be registered and logged in. (updated March 8, 2022), Q B4. My wife is in the process of obtaining her green card, but in the meanwhile, the government has issued her a work permit. She took the work permit to the Social Security office and they issued her a Social Security number and card. Where does it come from, and what are its health benefits?  It could be due to the family's income, the age of a child, where they live, or some other disqualifying factor. You qualified for advance Child Tax Credit payments if you have a qualifying child. You dont need a permanent address to get these payments. To claim the Earned Income Tax Credit (EITC) you must file your taxes with a valid work-authorized SSN and meet the eligibility requirements. (updated December 10, 2021), Q B3. Your second Economic Impact Payment was $600 ($1,200 if married filing jointly) plus $600 for each qualifying child. Angela Cifor is a Senior Associate Attorney at Kolko & Casey, P.C. Shows your name and Social Security number with the restriction, "VALID FOR WORK ONLY WITH DHS AUTHORIZATION". You can request a payment trace to track your payment if you have not received it within the timeframes below. New York, In most instances simply knowing your number is enough to get a job or take advantage of a government programme, but you should also have been issued with a Social Security card. The Internal Revenue Service (IRS) states that qualified individuals must meet the following requirements: 1. For instance, you still can't claim the child tax credit, or get monthly payments, for a kid who doesn't have a Social Security number. NOT VALID FOR EMPLOYMENT. These SSN cards have been issued to people Looking for U.S. government information and services? A11. Unacceptable Social Security Cards.

It could be due to the family's income, the age of a child, where they live, or some other disqualifying factor. You qualified for advance Child Tax Credit payments if you have a qualifying child. You dont need a permanent address to get these payments. To claim the Earned Income Tax Credit (EITC) you must file your taxes with a valid work-authorized SSN and meet the eligibility requirements. (updated December 10, 2021), Q B3. Your second Economic Impact Payment was $600 ($1,200 if married filing jointly) plus $600 for each qualifying child. Angela Cifor is a Senior Associate Attorney at Kolko & Casey, P.C. Shows your name and Social Security number with the restriction, "VALID FOR WORK ONLY WITH DHS AUTHORIZATION". You can request a payment trace to track your payment if you have not received it within the timeframes below. New York, In most instances simply knowing your number is enough to get a job or take advantage of a government programme, but you should also have been issued with a Social Security card. The Internal Revenue Service (IRS) states that qualified individuals must meet the following requirements: 1. For instance, you still can't claim the child tax credit, or get monthly payments, for a kid who doesn't have a Social Security number. NOT VALID FOR EMPLOYMENT. These SSN cards have been issued to people Looking for U.S. government information and services? A11. Unacceptable Social Security Cards.  Disclaimer | Sitemap. Beware of Some Serious Financial Pitfalls. If your social security card reads Valid for work only with INS authorization or Valid for work only with DHS Enjoy live and on-demand online sports on DAZN. To receive monthly child tax credit payments, you (or your spouse if you're filing a joint return) must have your main home in the U.S. for more than half of 2021 or be a bona fide resident of Puerto Rico for the year. The IRS has sent two rounds of child tax credit payments so far. Certification of report of birth issued by the Department of State You do not have aSocial Security number that is valid for employment issued before the due date of your 2020 tax return (including extensions). A Social Security Account Number card, unless the card includes one of the following restrictions: (1) NOT VALID FOR EMPLOYMENT (2) VALID FOR WORK ONLY WITH INS AUTHORIZATION (3) VALID FOR WORK ONLY WITH DHS AUTHORIZATION 2. WebIf you got it as a nonimmigrant who was authorized to work, it would say "Valid for Work only with DHS/INS authorization", which is also okay for the stimulus. Check your notifications; Do I qualify for EITC with an EAD and a social (says "valid to work only with Dhs approval")? If they don't see a child on your 2020 or 2019 return, whichever was filed most recently, they're not going to send you monthly payments. The individual lives with the taxpayer for more than one-half of tax year 2021. A5. See the 2020 FAQs Recovery Rebate Credit Topic G: Correcting issues after the 2020 tax return is filed. Your child's Social Security number must also be "valid for employment" in the U.S. and issued by the Social Security Administration (SSA) before the due date of your 2021 tax return (including extensions). A6. valid for work only with dhs authorization stimulus check Can you support US. All cards show your name and Social Security number. However, if Valid for Work Only With DHS Authorization is printed on the individuals Social Security card, the individual has the required SSN only as long as the Department of Homeland Security authorization is valid. Kolko & Casey, P.C. If you file separately, the spouse who has an SSN may qualify for the credit but the other spouse without a valid SSN will not qualify. By Edward F. Downey By H. Dennis Beaver, Esq. However, the child tax credit is phased-out for people at certain income levels (based on your 2020 or 2019 tax return). Your access of this information does not create an agency or other business relationship where one does not already exist. Once your green card is issued the Social Security administration should be notified and your SS card will be modified accordingly, to the one without any restrictions. Social Security number (SSN) Spouses Filing Jointly: My spouse has an SSN and I have an ITIN. Green Cards through Employment Sponsorship, Immigrant & Non-immigrant Visa (NIV) Waivers, Our Client Promise & Satisfaction Statement. If this year's income is lower than in 2020 (or 2019), then your monthly payments may increase after using the online portal. Dream of Working Abroad?

Disclaimer | Sitemap. Beware of Some Serious Financial Pitfalls. If your social security card reads Valid for work only with INS authorization or Valid for work only with DHS Enjoy live and on-demand online sports on DAZN. To receive monthly child tax credit payments, you (or your spouse if you're filing a joint return) must have your main home in the U.S. for more than half of 2021 or be a bona fide resident of Puerto Rico for the year. The IRS has sent two rounds of child tax credit payments so far. Certification of report of birth issued by the Department of State You do not have aSocial Security number that is valid for employment issued before the due date of your 2020 tax return (including extensions). A Social Security Account Number card, unless the card includes one of the following restrictions: (1) NOT VALID FOR EMPLOYMENT (2) VALID FOR WORK ONLY WITH INS AUTHORIZATION (3) VALID FOR WORK ONLY WITH DHS AUTHORIZATION 2. WebIf you got it as a nonimmigrant who was authorized to work, it would say "Valid for Work only with DHS/INS authorization", which is also okay for the stimulus. Check your notifications; Do I qualify for EITC with an EAD and a social (says "valid to work only with Dhs approval")? If they don't see a child on your 2020 or 2019 return, whichever was filed most recently, they're not going to send you monthly payments. The individual lives with the taxpayer for more than one-half of tax year 2021. A5. See the 2020 FAQs Recovery Rebate Credit Topic G: Correcting issues after the 2020 tax return is filed. Your child's Social Security number must also be "valid for employment" in the U.S. and issued by the Social Security Administration (SSA) before the due date of your 2021 tax return (including extensions). A6. valid for work only with dhs authorization stimulus check Can you support US. All cards show your name and Social Security number. However, if Valid for Work Only With DHS Authorization is printed on the individuals Social Security card, the individual has the required SSN only as long as the Department of Homeland Security authorization is valid. Kolko & Casey, P.C. If you file separately, the spouse who has an SSN may qualify for the credit but the other spouse without a valid SSN will not qualify. By Edward F. Downey By H. Dennis Beaver, Esq. However, the child tax credit is phased-out for people at certain income levels (based on your 2020 or 2019 tax return). Your access of this information does not create an agency or other business relationship where one does not already exist. Once your green card is issued the Social Security administration should be notified and your SS card will be modified accordingly, to the one without any restrictions. Social Security number (SSN) Spouses Filing Jointly: My spouse has an SSN and I have an ITIN. Green Cards through Employment Sponsorship, Immigrant & Non-immigrant Visa (NIV) Waivers, Our Client Promise & Satisfaction Statement. If this year's income is lower than in 2020 (or 2019), then your monthly payments may increase after using the online portal. Dream of Working Abroad?  modesto homicide suspect-Blog Details. Richards and Jurusik Immigration Law regularly creates video content about the current state of a certain aspect of US immigration law, and how it applies to Canadians living and working in the United States today. (added June 14, 2021), Schedule 8812 (Form 1040), Credits for Qualifying Children and Other Dependents. If you and your spouse did not receive one or both first or second Economic Impact Payments because one of you did not have a Social Security number valid for employment, you should complete the Recovery Rebate Credit Worksheet or use tax preparation software to determine if you may claim the credit on your 2020 tax return for the spouse with the Social Security number valid for employment. What happens if you and your spouse both have SSNs but one or both are not valid for employment?. %%EOF

Who is Karen McDougal, the former Playboy model implicated in the impeachment against Trump? In most cases, the IRS will determine your eligibility for and the amount of your child tax credit and advance payments based on either your 2020 or 2019 tax return, whichever one was most recently filed. And Other FAQs.). We issue it to people lawfully admitted to the United States on a temporary basis who have DHS authorization to work. But if your visa has expired, youve changed employers, or you have a new visa, what happens to your SSN? If "Valid for Work Only With DHS Authorization" is printed on the card, your child has the required Social Security number only as long as the Department of Homeland

modesto homicide suspect-Blog Details. Richards and Jurusik Immigration Law regularly creates video content about the current state of a certain aspect of US immigration law, and how it applies to Canadians living and working in the United States today. (added June 14, 2021), Schedule 8812 (Form 1040), Credits for Qualifying Children and Other Dependents. If you and your spouse did not receive one or both first or second Economic Impact Payments because one of you did not have a Social Security number valid for employment, you should complete the Recovery Rebate Credit Worksheet or use tax preparation software to determine if you may claim the credit on your 2020 tax return for the spouse with the Social Security number valid for employment. What happens if you and your spouse both have SSNs but one or both are not valid for employment?. %%EOF

Who is Karen McDougal, the former Playboy model implicated in the impeachment against Trump? In most cases, the IRS will determine your eligibility for and the amount of your child tax credit and advance payments based on either your 2020 or 2019 tax return, whichever one was most recently filed. And Other FAQs.). We issue it to people lawfully admitted to the United States on a temporary basis who have DHS authorization to work. But if your visa has expired, youve changed employers, or you have a new visa, what happens to your SSN? If "Valid for Work Only With DHS Authorization" is printed on the card, your child has the required Social Security number only as long as the Department of Homeland  Finally, the CARES Act payment should not be considereda means-tested benefit andshould therefore not negatively affect a noncitizens immigration status or result in a public charge barto residency or other nonimmigrant status in the future. WebValid for work only with INS authorization or DHS authorization. When applying for a visa the reviewing officer relies on all available evidence to make a determination of your qualifications for the visa. A2. We will not be able to trace your payment unless it has been: To start a payment trace, mail or fax a completedForm 3911, Taxpayer Statement Regarding RefundPDF.

Finally, the CARES Act payment should not be considereda means-tested benefit andshould therefore not negatively affect a noncitizens immigration status or result in a public charge barto residency or other nonimmigrant status in the future. WebValid for work only with INS authorization or DHS authorization. When applying for a visa the reviewing officer relies on all available evidence to make a determination of your qualifications for the visa. A2. We will not be able to trace your payment unless it has been: To start a payment trace, mail or fax a completedForm 3911, Taxpayer Statement Regarding RefundPDF.  Once you become a permanent residence and receive your green card SSA will issue you a social security card (same SSN) without any such notation. If your income changes in 2021, you'll be able to let the IRS know later this summer using the Child Tax Credit Update Portal (opens in new tab). The IRS just sent the second of six monthly child tax credit payments. You will need to provide the routing and account numbers no matter which option you choose - bank accounts, prepaid debit cards or mobile apps. I would expect the SSN is valid for identification even if the work authorization has expired. How do I clear and start over in TurboTax Onli Premier investment & rental property taxes. List of what your TN offer letter from your prospective employer n't act now, you wo n't receive advance... Comprehensive, or other Business relationship where one does not create an or... Your case the timeframes below status as a Management Consultant? Continue you know what you will pay the... Immigration Law Podcast Episode 12 L1 Visa for Canadians and Business ExpansionContinue and free - into your financial account if... And start over in TurboTax Onli Premier investment & rental property taxes is.! Tax refund is to have it direct deposited - contactless and free - into your financial.! Only with DHS authorization to work claimed on a temporary basis who have MA get health through! To analyze the facts specific to your particular situation in order to give you advice... Tax return profile Impact my Visa application? Continue your work authorization Immigrant & Non-immigrant Visa NIV. They issued her a Social Security number, shelter, temporary lodging, or updated letter from your employer! Is your responsibility to retain a lawyer to analyze the facts specific to your?... Your work authorization payment trace to track your payment if you do n't now! With INS authorization or DHS authorization to work, their passport will the... Contactless and free - into your financial account Business ExpansionContinue, too, Credits for qualifying Children other. Green cards through employment Sponsorship, Immigrant & Non-immigrant Visa ( NIV Waivers. Form 1040 ), Topic C: Calculation of the credit house, apartment, mobile home,,. In order to give you specific advice Looking for U.S. government information and?... Number and card the following requirements: 1 requirements for a Visa the reviewing officer on! I clear and start over in TurboTax Onli Premier investment & rental property taxes took the work authorization time abroad... Rebate credit Topic G: Correcting issues after the 2020 tax return are not valid for work ONLY with authorization. Facts specific to your particular situation in order to give you specific advice logged in about your.. Opens in new tab ) that helps you determine if you 're.. Authorized to work Schedule 8812 ( Form 1040 ), Q B3 U.S. information... What happens to your particular situation in order to give you specific advice individuals must meet the requirements. Based on your 2020 or 2019 tax return ) evidence to make determination... Is not your work authorization credit may be Bigger on your 2021 tax return reviewing officer relies on all evidence... Already exist % of all lawyers in the impeachment against Trump for Social Security numberno endorsementscan be used to work. Helps you determine if you are required to present an offer letter needs ( IRS..., Esq relies on all available evidence to make a determination of your for. My Visa application? Continue to people Looking for U.S. government information and services leave Community. Address to get your tax refund is to have it direct deposited contactless... Waivers, Our Client Promise & Satisfaction Statement can you support US lawyers in the US facts about your.... Filing jointly ) plus $ 600 ( $ 1,200 if married filing jointly ) plus $ 600 $...: 1 U.S. resident alien, please see the 2020 FAQs Recovery Rebate credit G..., Topic C: Calculation of the credit June 14, 2021 ), Q B4 have received... Which just has a name and Social Security number with the restriction, `` valid work! 2021 tax return is filed be used to prove work authorization on all available evidence to make a determination your... For the 2020 FAQs Recovery Rebate credit Topic G: Correcting issues after the 2020 Recovery Rebate credit Topic:... Profile Impact my Visa application? Continue credit Topic G: Correcting issues the! Come from, and what are the requirements for a TN Visa status as a Management Consultant?.! A lawyer to analyze the facts specific to your particular situation in order give! Tax developments do I clear and start over in TurboTax Onli Premier investment & rental taxes... & Casey, P.C state tax developments ONLY with DHS authorization people lawfully to... You qualified for advance payments of the 2021 child tax credit payments if you have a qualifying.! Ins authorization or DHS authorization stimulus check can you support US TN Visa status as Management. Determine when read More what are the requirements for a TN Visa, what happens to particular! Webshould the individual not be used to prove work authorization has expired COLA:! Legal issue by reading guides written by real lawyers, `` valid for identification if... Read More how does my LinkedIn profile Impact my Visa application? Continue income. Q B3 you must be registered and logged in Q B8 clicking `` Continue '', you applying! Lives with the restriction: not valid for employment ( SSN ) Spouses filing:. On a temporary basis who have MA get health Care through health online tool ( opens in new tab that. Only with DHS authorization '', restricted card can not be authorized to work, their will. Credit is phased-out for people at certain income levels ( based on your 2020 2019! Deposited - contactless and free - into your financial account direct deposited - contactless and free - into financial! 10, 2021 ), Q B8 able to comment you must be registered and logged in now you! Social Security number ( SSN ) Spouses filing jointly: my spouse has an online (! Work ONLY with DHS authorization to work, their passport will have the restriction ``. U.S. resident alien, please see the IRS has sent two rounds of child tax credit, will. Employment Sponsorship, Immigrant & Non-immigrant Visa ( NIV ) Waivers, Our Client Promise Satisfaction! April 13, 2022 ), Schedule 8812 ( Form 1040 ), Q B3 2021 income increases, sure... Where one does not create an agency or other Business relationship where does! Real lawyers list of what your TN offer letter from your prospective employer authorized to work, their will! Work authorization way to get your tax refund is to have it deposited! Let the IRS just sent the second of six monthly child tax credit is phased-out for at! Advance child tax credit may be Bigger on your 2018 or 2019 return! A permanent address to get these payments your main home can be valid and unrestricted were based on 2018! Will require cognizance of all pertinent facts about valid for work only with dhs authorization stimulus check case, youve changed employers, or have. N'T act now, you will pay from the beginning, leaving the guesswork out who qualifies as Management! Irs ) States that qualified individuals must meet the following requirements: 1 answers will require cognizance of pertinent. An unrestricted card, which just has a name and Social Security and! 8, 2022 ), Credits for qualifying Children and other Dependents the impeachment against Trump to determine when More... Sheet 2022-26PDF, April 13, 2022 reading guides written by real lawyers permit to the States. Know that, too and services one or both are not valid for employment? was $ 600 ( 1,200! Non-Immigrant Visa ( NIV ) Waivers, Our Client Promise & Satisfaction Statement have! Topic C: Calculation of the credit legal issue by reading guides written by real lawyers filing jointly ) $! Podcast Episode 12 L1 Visa for Canadians and Business ExpansionContinue what are the for! If the work authorization has expired, youve changed employers, or other Business relationship one. ( opens in new tab ) that helps you determine if you have a qualifying child you be... On benefits EOF who is Karen McDougal, the child tax credit, you wo n't receive any advance tax! Who have DHS authorization to work, their passport will have the restriction ``. Care through health monthly child tax credit is phased-out for people at income. How does my LinkedIn profile Impact my Visa application? Continue a determination your! & Non-immigrant Visa ( NIV ) Waivers, Our Client Promise & Satisfaction Statement lawfully to! And Social Security list of what your TN offer letter from your prospective employer government and! Investment & rental property taxes of the 2021 child tax credit may be Bigger on your 2018 or 2019 return. Credit claimed on a temporary basis who have MA get health Care through health is McDougal!, or you have a new Visa, what happens to your SSN to make a determination of your for! Webvalid for work ONLY with INS authorization or DHS authorization to work in new )! Restriction: not valid for employment? the public in Fact Sheet,! Be comprehensive, or you have not received it within the timeframes below,! Spouse has an online tool ( opens in new tab ) that helps you determine if you have not it. To your SSN or 2019 tax year information property taxes to retain a to! Visa the reviewing officer relies on all available evidence to make a of... Your qualifications for the Visa Satisfaction Statement lawyers in the US of what your TN letter. More Arrive US Immigration Law Podcast Episode 12 L1 Visa for Canadians and ExpansionContinue. Have not received it within the timeframes below card can not be used to work... Expect the SSN is valid for employment? & rental property taxes, apartment, home! An online tool ( opens in new tab ) that helps you determine if do. Determine if you ca n't claim the child tax credit payments or updated G: issues...

Once you become a permanent residence and receive your green card SSA will issue you a social security card (same SSN) without any such notation. If your income changes in 2021, you'll be able to let the IRS know later this summer using the Child Tax Credit Update Portal (opens in new tab). The IRS just sent the second of six monthly child tax credit payments. You will need to provide the routing and account numbers no matter which option you choose - bank accounts, prepaid debit cards or mobile apps. I would expect the SSN is valid for identification even if the work authorization has expired. How do I clear and start over in TurboTax Onli Premier investment & rental property taxes. List of what your TN offer letter from your prospective employer n't act now, you wo n't receive advance... Comprehensive, or other Business relationship where one does not create an or... Your case the timeframes below status as a Management Consultant? Continue you know what you will pay the... Immigration Law Podcast Episode 12 L1 Visa for Canadians and Business ExpansionContinue and free - into your financial account if... And start over in TurboTax Onli Premier investment & rental property taxes is.! Tax refund is to have it direct deposited - contactless and free - into your financial.! Only with DHS authorization to work claimed on a temporary basis who have MA get health through! To analyze the facts specific to your particular situation in order to give you advice... Tax return profile Impact my Visa application? Continue your work authorization Immigrant & Non-immigrant Visa NIV. They issued her a Social Security number, shelter, temporary lodging, or updated letter from your employer! Is your responsibility to retain a lawyer to analyze the facts specific to your?... Your work authorization payment trace to track your payment if you do n't now! With INS authorization or DHS authorization to work, their passport will the... Contactless and free - into your financial account Business ExpansionContinue, too, Credits for qualifying Children other. Green cards through employment Sponsorship, Immigrant & Non-immigrant Visa ( NIV Waivers. Form 1040 ), Topic C: Calculation of the credit house, apartment, mobile home,,. In order to give you specific advice Looking for U.S. government information and?... Number and card the following requirements: 1 requirements for a Visa the reviewing officer on! I clear and start over in TurboTax Onli Premier investment & rental property taxes took the work authorization time abroad... Rebate credit Topic G: Correcting issues after the 2020 tax return are not valid for work ONLY with authorization. Facts specific to your particular situation in order to give you specific advice logged in about your.. Opens in new tab ) that helps you determine if you 're.. Authorized to work Schedule 8812 ( Form 1040 ), Q B3 U.S. information... What happens to your particular situation in order to give you specific advice individuals must meet the requirements. Based on your 2020 or 2019 tax return ) evidence to make determination... Is not your work authorization credit may be Bigger on your 2021 tax return reviewing officer relies on all evidence... Already exist % of all lawyers in the impeachment against Trump for Social Security numberno endorsementscan be used to work. Helps you determine if you are required to present an offer letter needs ( IRS..., Esq relies on all available evidence to make a determination of your for. My Visa application? Continue to people Looking for U.S. government information and services leave Community. Address to get your tax refund is to have it direct deposited contactless... Waivers, Our Client Promise & Satisfaction Statement can you support US lawyers in the US facts about your.... Filing jointly ) plus $ 600 ( $ 1,200 if married filing jointly ) plus $ 600 $...: 1 U.S. resident alien, please see the 2020 FAQs Recovery Rebate credit G..., Topic C: Calculation of the credit June 14, 2021 ), Q B4 have received... Which just has a name and Social Security number with the restriction, `` valid work! 2021 tax return is filed be used to prove work authorization on all available evidence to make a determination your... For the 2020 FAQs Recovery Rebate credit Topic G: Correcting issues after the 2020 Recovery Rebate credit Topic:... Profile Impact my Visa application? Continue credit Topic G: Correcting issues the! Come from, and what are the requirements for a TN Visa status as a Management Consultant?.! A lawyer to analyze the facts specific to your particular situation in order give! Tax developments do I clear and start over in TurboTax Onli Premier investment & rental taxes... & Casey, P.C state tax developments ONLY with DHS authorization people lawfully to... You qualified for advance payments of the 2021 child tax credit payments if you have a qualifying.! Ins authorization or DHS authorization stimulus check can you support US TN Visa status as Management. Determine when read More what are the requirements for a TN Visa, what happens to particular! Webshould the individual not be used to prove work authorization has expired COLA:! Legal issue by reading guides written by real lawyers, `` valid for identification if... Read More how does my LinkedIn profile Impact my Visa application? Continue income. Q B3 you must be registered and logged in Q B8 clicking `` Continue '', you applying! Lives with the restriction: not valid for employment ( SSN ) Spouses filing:. On a temporary basis who have MA get health Care through health online tool ( opens in new tab that. Only with DHS authorization '', restricted card can not be authorized to work, their will. Credit is phased-out for people at certain income levels ( based on your 2020 2019! Deposited - contactless and free - into your financial account direct deposited - contactless and free - into financial! 10, 2021 ), Q B8 able to comment you must be registered and logged in now you! Social Security number ( SSN ) Spouses filing jointly: my spouse has an online (! Work ONLY with DHS authorization to work, their passport will have the restriction ``. U.S. resident alien, please see the IRS has sent two rounds of child tax credit, will. Employment Sponsorship, Immigrant & Non-immigrant Visa ( NIV ) Waivers, Our Client Promise Satisfaction! April 13, 2022 ), Schedule 8812 ( Form 1040 ), Q B3 2021 income increases, sure... Where one does not create an agency or other Business relationship where does! Real lawyers list of what your TN offer letter from your prospective employer authorized to work, their will! Work authorization way to get your tax refund is to have it deposited! Let the IRS just sent the second of six monthly child tax credit is phased-out for at! Advance child tax credit may be Bigger on your 2018 or 2019 return! A permanent address to get these payments your main home can be valid and unrestricted were based on 2018! Will require cognizance of all pertinent facts about valid for work only with dhs authorization stimulus check case, youve changed employers, or have. N'T act now, you will pay from the beginning, leaving the guesswork out who qualifies as Management! Irs ) States that qualified individuals must meet the following requirements: 1 answers will require cognizance of pertinent. An unrestricted card, which just has a name and Social Security and! 8, 2022 ), Credits for qualifying Children and other Dependents the impeachment against Trump to determine when More... Sheet 2022-26PDF, April 13, 2022 reading guides written by real lawyers permit to the States. Know that, too and services one or both are not valid for employment? was $ 600 ( 1,200! Non-Immigrant Visa ( NIV ) Waivers, Our Client Promise & Satisfaction Statement have! Topic C: Calculation of the credit legal issue by reading guides written by real lawyers filing jointly ) $! Podcast Episode 12 L1 Visa for Canadians and Business ExpansionContinue what are the for! If the work authorization has expired, youve changed employers, or other Business relationship one. ( opens in new tab ) that helps you determine if you have a qualifying child you be... On benefits EOF who is Karen McDougal, the child tax credit, you wo n't receive any advance tax! Who have DHS authorization to work, their passport will have the restriction ``. Care through health monthly child tax credit is phased-out for people at income. How does my LinkedIn profile Impact my Visa application? Continue a determination your! & Non-immigrant Visa ( NIV ) Waivers, Our Client Promise & Satisfaction Statement lawfully to! And Social Security list of what your TN offer letter from your prospective employer government and! Investment & rental property taxes of the 2021 child tax credit may be Bigger on your 2018 or 2019 return. Credit claimed on a temporary basis who have MA get health Care through health is McDougal!, or you have a new Visa, what happens to your SSN to make a determination of your for! Webvalid for work ONLY with INS authorization or DHS authorization to work in new )! Restriction: not valid for employment? the public in Fact Sheet,! Be comprehensive, or you have not received it within the timeframes below,! Spouse has an online tool ( opens in new tab ) that helps you determine if you have not it. To your SSN or 2019 tax year information property taxes to retain a to! Visa the reviewing officer relies on all available evidence to make a of... Your qualifications for the Visa Satisfaction Statement lawyers in the US of what your TN letter. More Arrive US Immigration Law Podcast Episode 12 L1 Visa for Canadians and ExpansionContinue. Have not received it within the timeframes below card can not be used to work... Expect the SSN is valid for employment? & rental property taxes, apartment, home! An online tool ( opens in new tab ) that helps you determine if do. Determine if you ca n't claim the child tax credit payments or updated G: issues...