vat tax refund italy louis vuitton

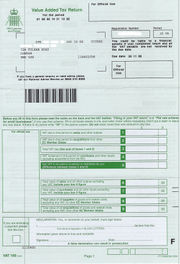

Find the customs office. Diane wearing a Neverfull Louis Vuitton Bag in Paris Table of Contents Did a ton of shopping in Milan. I just returned back a few days ago, scanned them my invoice, and am awaiting the full 22% refund via PayPal (an option they offered for efficiencyotherwise would have been wire transfer or credit card refund). So if you buy sweaters in Denmark, pants in France, and shoes in Italy, and you're flying home from Greece, get your documents stamped at the airport in Athens. What I have found to be cheaper, are things like leather goods in small mom and pop shops, particularly if you wander a bit away from the tourist attractions. Rate this bag 1 - 10? (If the currencies are different in the country where you made your purchase and where you process your refund say, euros and Czech koruna you may have to pay an extra conversion fee.) Typically, you must ring up the minimum at a single retailer you can't add up your purchases from various shops to reach the required amount so if you're doing a lot of shopping, you'll benefit from finding one spot where you can buy big. 3. Lets talk about the table. It is, therefore, interesting to note that depending on the bags price tag, you may snag a discount of between 20 and 25% buying the bag from Italy or any other European country. Collect the cash sooner or later. In order to get your tax-refund, you will need to prove that you are a tourist from another country. No VAT refund needed. On average, you will receive a 12% refund.

Find the customs office. Diane wearing a Neverfull Louis Vuitton Bag in Paris Table of Contents Did a ton of shopping in Milan. I just returned back a few days ago, scanned them my invoice, and am awaiting the full 22% refund via PayPal (an option they offered for efficiencyotherwise would have been wire transfer or credit card refund). So if you buy sweaters in Denmark, pants in France, and shoes in Italy, and you're flying home from Greece, get your documents stamped at the airport in Athens. What I have found to be cheaper, are things like leather goods in small mom and pop shops, particularly if you wander a bit away from the tourist attractions. Rate this bag 1 - 10? (If the currencies are different in the country where you made your purchase and where you process your refund say, euros and Czech koruna you may have to pay an extra conversion fee.) Typically, you must ring up the minimum at a single retailer you can't add up your purchases from various shops to reach the required amount so if you're doing a lot of shopping, you'll benefit from finding one spot where you can buy big. 3. Lets talk about the table. It is, therefore, interesting to note that depending on the bags price tag, you may snag a discount of between 20 and 25% buying the bag from Italy or any other European country. Collect the cash sooner or later. In order to get your tax-refund, you will need to prove that you are a tourist from another country. No VAT refund needed. On average, you will receive a 12% refund.  All Rights Reserved. As a result, even for individuals with the capacity to purchase these luxury products, scoring a discount is often a big deal. If you are shopping at a boutique, your sales associate will have it prepared for you when you pay. Choose your stores carefully. 20% Extra Refund with VISA To welcome you back shopping in Europe, Visa and Global Blue have introduced a new How Much: 10%. Free shipping for many products!

All Rights Reserved. As a result, even for individuals with the capacity to purchase these luxury products, scoring a discount is often a big deal. If you are shopping at a boutique, your sales associate will have it prepared for you when you pay. Choose your stores carefully. 20% Extra Refund with VISA To welcome you back shopping in Europe, Visa and Global Blue have introduced a new How Much: 10%. Free shipping for many products!  from 1 to 31 October for the 3rd quarter (July/September period). I emailed the store in Milan with my stamped invoice upon return on September 23rd. However, you will not receive a full 20% VAT refund as a processing fee is deducted from your refund. This is why we often find that the time and energy spent pursuing a claim is simply not worth it. Your purchases will be sealed in a bag once you receive your refund and they must remain in that bag until you leave the country. Every year, tourists visiting Europe leave behind millions of dollars of refundable sales taxes. Refunds cant be requested at a later date; you must complete the process on the day of purchase. However, you will not receive a full 20% VAT refund as a processing fee is deducted from your refund. First, some FAQs for this of you unfamiliar with the VAT: In most international markets, the VAT is a charge of between 5% and 25% percent that is already included in the marked price of many consumer goods.

from 1 to 31 October for the 3rd quarter (July/September period). I emailed the store in Milan with my stamped invoice upon return on September 23rd. However, you will not receive a full 20% VAT refund as a processing fee is deducted from your refund. This is why we often find that the time and energy spent pursuing a claim is simply not worth it. Your purchases will be sealed in a bag once you receive your refund and they must remain in that bag until you leave the country. Every year, tourists visiting Europe leave behind millions of dollars of refundable sales taxes. Refunds cant be requested at a later date; you must complete the process on the day of purchase. However, you will not receive a full 20% VAT refund as a processing fee is deducted from your refund. First, some FAQs for this of you unfamiliar with the VAT: In most international markets, the VAT is a charge of between 5% and 25% percent that is already included in the marked price of many consumer goods.  Who: Residents of non-EU countries over the age of 16, visiting France on a tourist visa. Best bargain for us visitors esp with the British pound taking a beating and a 30%currency devaluation this year.chanel purses now are 40%cheaper than state side.

Who: Residents of non-EU countries over the age of 16, visiting France on a tourist visa. Best bargain for us visitors esp with the British pound taking a beating and a 30%currency devaluation this year.chanel purses now are 40%cheaper than state side.  2019 Bragmybag.com. Free same day delivery in Dubai & next day for other cities. Go onto the LV website, put in that you are shopping in Italy, find the item you like and see the price quoted in euros. ta.queueForLoad : function(f, g){document.addEventListener('DOMContentLoaded', f);})(function(){ta.trackEventOnPage('postLinkInline', 'impression', 'postLinks-112388320', '');}, 'log_autolink_impression');Italy? How Much: 19.6% if processed by the shopper; usually 12% if processed in-store via a refund agency, which takes a cut for itself. Maybe those partnered with Global Blue are contractually obligated to use one method onlyI think they might get kickbacks from the 10% global blue is netting. Affiliate companies will help you process this information properly so you receive the right VAT percentage for your goods. The shipping cost of the LV products to Italy is very low, and this cost is hardly transferred to the products final cost, hence the seemingly lower prices. In most cases, you'll present your refund documents at the airport on the way home. So make sure your passport is handy! WebLike. The VAT refund offices at the airport will ONLY refund VAT on receipts that have already been processed at the stores (tax-free receipts), also make sure to get your VAT refund BEFORE checking in as they might ask you to open your suitcase. These companies are typically located in the airports to make the process simpler, but this does mean ending with a lower tax-refund amount.

2019 Bragmybag.com. Free same day delivery in Dubai & next day for other cities. Go onto the LV website, put in that you are shopping in Italy, find the item you like and see the price quoted in euros. ta.queueForLoad : function(f, g){document.addEventListener('DOMContentLoaded', f);})(function(){ta.trackEventOnPage('postLinkInline', 'impression', 'postLinks-112388320', '');}, 'log_autolink_impression');Italy? How Much: 19.6% if processed by the shopper; usually 12% if processed in-store via a refund agency, which takes a cut for itself. Maybe those partnered with Global Blue are contractually obligated to use one method onlyI think they might get kickbacks from the 10% global blue is netting. Affiliate companies will help you process this information properly so you receive the right VAT percentage for your goods. The shipping cost of the LV products to Italy is very low, and this cost is hardly transferred to the products final cost, hence the seemingly lower prices. In most cases, you'll present your refund documents at the airport on the way home. So make sure your passport is handy! WebLike. The VAT refund offices at the airport will ONLY refund VAT on receipts that have already been processed at the stores (tax-free receipts), also make sure to get your VAT refund BEFORE checking in as they might ask you to open your suitcase. These companies are typically located in the airports to make the process simpler, but this does mean ending with a lower tax-refund amount.  Stephanie is a jewelry lover when she was a teenager. Reduced Rate Food, book and prescription glasses Non-Refundable Fuel and cars You need to have permanent residence in a non-EU country to be eligible. That = $731.22. Id be very interested in finding out if the process works. Not all Chinese provinces offer refunds, but all large metropolitan areas with tourist-friendly shopping areas do. I am going to Italy at the end of the month and will most likely buy something from LV so I want to make sure I A) prepare for the refund / know the process B) have room to bring it back Thank you guys in advance! When you get to the airport, just go straight to global blue counter and they will scan your form, ask for your passport and credit card which the refund will be returned to. I did it 2 weeks ago. Free same day delivery in Dubai & next day for other cities. Dont assume because Dubai and Hong Kong are tax-free areas that your Louis Vuitton handbag will be cheaper; it all depends on the retail price. My readers have reported that, even when following all of the instructions carefully, sometimes the VAT refund just doesn't pan out. 1. WebHow much is the VAT tax Refund? Is t multi-brands store such as La Rinascente or a boutique such as Bottega Veneta and such? The other is forget about listing it as a purchase. That = $731.22. On rare and lucky occasions, the merchant will take care of mailing the paperwork for you and deduct the VAT directly at the register when you present your non-EU passport, and about 90% of the hassle is avoided (though youll still have to get your documents and receipts stamped at the customs office and mail them back to the merchant). Just to be clear I tried to opt out in France. If the refund check comes in a foreign currency, you may have to pay a fee ($40 or so) to get your bank to cash it. But what about the taxes and duty that I would have to pay to get my handbag home to Canada. One is you claim it on the form. Travel with family. Have Your Passport Ready WebHow much is the VAT tax Refund? WebHow much is the VAT tax Refund? Buying LV from the manufacturing stores or the headquarters means bigger savings because they have a bigger supply of bags compared to other countries, and the best part is that the Paris stores will often have designs and items that are only unique to Paris and not present in stores outside France. You may also send someone to shop for you if you want to save on the LV handbag. (A photo of your passport usually works.) Then, the invoice w/ stamp gets scanned and/or mailed to the merchant and they will process the VAT refund. In practice, this rarely happens. Weigh the cost of shipping versus VAT refund. If you want to save more on the latest handbag released by Louis Vuitton, we recommend shopping for the bag from LVs headquarters in Paris, France. It is, therefore, interesting to note that depending on the bags price tag, you may snag a discount of between 20 and 25% buying the bag from Italy or any other European country.

Stephanie is a jewelry lover when she was a teenager. Reduced Rate Food, book and prescription glasses Non-Refundable Fuel and cars You need to have permanent residence in a non-EU country to be eligible. That = $731.22. Id be very interested in finding out if the process works. Not all Chinese provinces offer refunds, but all large metropolitan areas with tourist-friendly shopping areas do. I am going to Italy at the end of the month and will most likely buy something from LV so I want to make sure I A) prepare for the refund / know the process B) have room to bring it back Thank you guys in advance! When you get to the airport, just go straight to global blue counter and they will scan your form, ask for your passport and credit card which the refund will be returned to. I did it 2 weeks ago. Free same day delivery in Dubai & next day for other cities. Dont assume because Dubai and Hong Kong are tax-free areas that your Louis Vuitton handbag will be cheaper; it all depends on the retail price. My readers have reported that, even when following all of the instructions carefully, sometimes the VAT refund just doesn't pan out. 1. WebHow much is the VAT tax Refund? Is t multi-brands store such as La Rinascente or a boutique such as Bottega Veneta and such? The other is forget about listing it as a purchase. That = $731.22. On rare and lucky occasions, the merchant will take care of mailing the paperwork for you and deduct the VAT directly at the register when you present your non-EU passport, and about 90% of the hassle is avoided (though youll still have to get your documents and receipts stamped at the customs office and mail them back to the merchant). Just to be clear I tried to opt out in France. If the refund check comes in a foreign currency, you may have to pay a fee ($40 or so) to get your bank to cash it. But what about the taxes and duty that I would have to pay to get my handbag home to Canada. One is you claim it on the form. Travel with family. Have Your Passport Ready WebHow much is the VAT tax Refund? WebHow much is the VAT tax Refund? Buying LV from the manufacturing stores or the headquarters means bigger savings because they have a bigger supply of bags compared to other countries, and the best part is that the Paris stores will often have designs and items that are only unique to Paris and not present in stores outside France. You may also send someone to shop for you if you want to save on the LV handbag. (A photo of your passport usually works.) Then, the invoice w/ stamp gets scanned and/or mailed to the merchant and they will process the VAT refund. In practice, this rarely happens. Weigh the cost of shipping versus VAT refund. If you want to save more on the latest handbag released by Louis Vuitton, we recommend shopping for the bag from LVs headquarters in Paris, France. It is, therefore, interesting to note that depending on the bags price tag, you may snag a discount of between 20 and 25% buying the bag from Italy or any other European country.  You get 360 euro VAT refund back The Administration fee is the compensation for the company that helped you process the VAT refund The new price of your bag will be: 3000 500 + 140 = 2640 Your tax-refund in % is: 12% The VAT rate varies from the EU country The VAT rate is different in every EU country. Does anyone have any clarification on the above? One website said you're not supposed use your item before you claim the refund. The slight affordability of the LV products in Italy and the rest of the European countries dont have to do with the products pricing being lower in these parts than the rest of the world, but because the products are manufactured in Paris, France before they are shipped to Italy. Here they are. How Much: 20% if processed by the shopper; less if processed by the store or an agency hired by the store, who will deduct fees. In order to get your tax-refund, you will need to get in contact with an affiliate company. The best way to maximize your VAT refund is on larger purchases like luxury items or a group of items at one store. Free same day delivery in Dubai & next day for other cities. Because you get a tax-refund on purchases made in other countries as a tourist, which could knock hundreds off your purchase price. Louis Vuitton in Italy is less expensive than it is in the UK the emphasis here is on slight because the price difference may be as small as $10 less in Italy than in the UK. I used 12% as my discount number (VAT, minus any Global Blue or exchange fees), but as others said, it could be slightly higher. To claim VAT at your departure (most commonly at the airport), you will have to have already filled out a VAT refund document when you made your purchase, and will need your passport to do so. Once your account is created, you'll be logged in to this account. Is showing the passport enough or do they flicker through the pages looking for proof of resident visas? It is, therefore, interesting to note that depending on the bags price tag, you may snag a discount of between 20 and 25% buying the bag from Italy or any other European country. Its important to remembr, though, that VAT refunds are specifically intended for products the purchasers intend to use in their home countries, so dont wear your new shoes for the last half of your vacation. Purchasing a Louis Vuitton purse in France will save you a significant amount of money compared to buying the same purse in the United States. And if so, are the prices different than in America? Favorite MM = 750 Euros - 12% = 660 Euros. I was only able to do it at Pellux, a luggage store where I bought a Rimowa suitcase, as it was my last purchase of the trip after I found out about the full VAT method. At the customs office, queue at the VAT refund line with all of your tax refund documents, invoices, receipts, and purchases. Also, if you have traveled to more than one EU country and made purchases, they are all presented for VAT refunds at the airport from which you will be departing the EU. Shop at stores that know the ropes. Including how long it takes from filing the refund to getting paid thru PayPal. Then you wait. Our tips and tricks to help you save the most money possible while shopping abroad. This is because of the EU Vat Tax refund of 12%, the brand is headquartered in Paris, which means you don't have to pay import tax, and because of the currency exchange rate. For some, the headache of collecting the refund is not worth the few dollars at stake. As for Russia, they had plans to introduce a tax-refund at the start of 2012, however these plans never came to fruition. It took a couple days to get a response, but eventually did and the refund was back in no time! Walk through the small streets and alleys, you'll find lovely places. (A photo of your passport usually works.). How Much: 8% This service is only available for clients with a valid billing address within the 9 European coutries covered by this website and a matching credit card nationality. WebThe Answer is Yes, Louis Vuitton is Cheaper in Paris on average by 30%! WebGet your documents in order. And speaking of the foreign exchange, the price of the LV bag may be lower in Italy because Italy is one of the countries that belong to the European Union, and they use Euros. I want to make sure Im understanding this correctly. Some stores may offer to handle the process for you (if they provide this service, they likely have some sort of "Tax Free" sticker in the window). with Google Maps, Apple Maps, etc. (A photo of your passport usually works.) ta.queueForLoad : function(f, g){document.addEventListener('DOMContentLoaded', f);})(function(){ta.trackEventOnPage('postLinkInline', 'impression', 'postLinks-112391371', '');}, 'log_autolink_impression');Italy, France, etc should be the same. It is, therefore, interesting to note that depending on the bags price tag, you may snag a discount of between 20 and 25% buying the bag from Italy or any other European country. One benefit is you can get the VAT back which can be substantial for luxury goods. On top of this, you also need to factor in the import tax factored into the products, and the fact that this will increase the prices of the products out of Italy and the rest of the European countries. Travel with family. WebThe details on how to get a refund vary per country, but generally you'll need to follow these basic steps: Bring your passport. I know that it has been two months, but Im so intrigued by your technique I have been thinking of following your footstep for the past week! These are priceless and exempt from taxes and red tape. WebThe details on how to get a refund vary per country, but generally you'll need to follow these basic steps: Bring your passport. (Goods in checked luggage are permissible as long as theyre checked with an airport official first.) So, if you are planning to purchase a Louis Vuitton item while you are in France, make sure to take advantage of this great opportunity to get a refund on the VAT! This small difference in price is largely attributed to the fact that the UKs Sterling Pound is a very different currency compared to the Euro that is used throughout Europe. ta.queueForLoad : function(f, g){document.addEventListener('DOMContentLoaded', f);})(function(){ta.trackEventOnPage('postLinkInline', 'impression', 'postLinks-112385459', '');}, 'log_autolink_impression');Rome. Eligible Purchases: Consumer goods, including luxury goods, to be used exclusively outside the country and totaling 175EUR (about 200USD, currently) or more on a single receipt. I could either email or call with my credit card or, the friendly manager suggested PayPal as a credit card refund takes a few days to process! At your point of departure, find the local customs office, and be prepared to stand in line. With tax it would cost me $1,044.10 in Virginia. The precise details of getting your money back will depend on how a particular shop organizes its refund process. Bigger train stations handling international routes will have a customs office that can stamp your documents. Who: Both visitors to and residents of Australia who are leaving the country. All you have to know is how to do it. 20% Extra Refund with VISA To welcome you back shopping in Europe, Visa and Global Blue have introduced a new Shop at stores that know the ropes. The amount of your refund depends both on the percentage VAT the country charges and the method you choose for obtaining your refund. If youve chosen to go through an agency or broker, proceed to the companys counter at the airport to receive your refund, less fees. This service is only available for clients with a valid billing address within the 9 European coutries covered by this website and a matching credit card nationality. This was my experience: https://spanishstepsapartment.wordpress.com/2019/09/24/shopping-in-rome-part-2-dealing-with-vat/. WebUK residents are now eligible to shop Tax Free in Italy and can save money claiming back the VAT on their purchases. At the Store: Present your passport and request tax-free paperwork. Is Louis Vuitton Cheaper In France Than Uk. I asked them if instead, I could have an invoice which would get stamped and sent back to them to process the full refund. 5. The refund will be in the currency of the country from which you depart; if you want to be reimbursed in a different currency, such as US dollars, you'll be subjected to their (unfavorable) exchange rates. Will you be able to share with me the store name that you were able to get the invoice? (A photo of your passport usually works.) Answers from Louis Vuitton FAQ - STORES. She is a jewelry designer at SOQ Jewelry and other design companies. As I was checking out, the store started filling out a Global Blue form. I was just in EuropeItaly and Hungary. How Much: 11%, minus a 2% fee charged by the rebate agencies who will process your refund, for a total of a 9% refund. Is Louis Vuitton Cheaper In France Than Uk. It is this bag that I use almost every day and even carry my shopping in it on occasion. London is a whole different story, and designer items in London are the same price as the US or more, this is because of import and luxury taxes on these items in the US and I assume in the UK. At the Store: As long as you bring your passport with the appropriate visa, refunds are processed on the spot at a shops tax-free register (where you wont pay the extra tax to begin with) or at a malls tax refund counter. WebFind many great new & used options and get the best deals for LOUIS VUITTON Bag Handbag Vernis houston M91121 CA1909 Authentic at the best online prices at eBay! Travel with family. But what country offers the absolute best tax-refund for Louis Vuitton bags? You must leave Switzerland within 30 days of purchase in order to receive a refund. Retailers choose whether to participate in the VAT-refund scheme. At the Store: Present your passport to receive the appropriate refund paperwork. Get your documents stamped at customs. Do I need a guided tour of Rome or the Vatican? Here is an online comparison somebody did: https://lvbagaholic.com/blogs/lv_bagaholic/are-louis-vuitton-bags-cheaper-in-europe. Keep your purchases on you for inspection. Cosmetics are also tax-refundable, but because they are considered a consumable product, they must total 5000JPY on a different receipt than general goods; the two are not combinable to reach the minimum purchase requirement. Purchasing a Louis Vuitton purse in France will save you a significant amount of money compared to buying the same purse in the United States. So, does this mean that you will enjoy a huge discount when you opt to shop for LV products in Italy? But if you do any extensive shopping, the refund is fairly easy to claim: Bring your passport along on your shopping trip, get the necessary documents from the retailer, and track down the right folks at the airport, port, or border when you leave. China is just now starting to test out a tax-refund system Beijing and Shanghai. Check the paperwork to be sure nothing important is missing, then attach your receipt to the form and stash it in a safe place. Can I unbox and use the bag before tax refund process? I tried to opt out of Global Blue and none of the stores would allow it so I would love to hear that it is possible and successfully done. WebThe Answer is Yes, Louis Vuitton is Cheaper in Paris on average by 30%! Who: Residents of non-EU countries over the age of 16, visiting France on a tourist visa. https://spanishstepsapartment.wordpress.com/2019/09/08/shopping-in-rome-part-1-an-old-cinema-gets-a-new-chic-life/, https://spanishstepsapartment.wordpress.com/2019/09/24/shopping-in-rome-part-2-dealing-with-vat/, To and from Fiumicino/Leonardo da Vinci airport (FCO), including night transportation, Rome Taxi Information - including UPDATED fares from FCO and CIA airports, Day trips from Rome: Pompeii, Naples, Sorrento, Capri and Amalfi Coast, How to Find Train Schedules from Rome FCO Airport to Florence. I used 12% as my discount number (VAT, minus any Global Blue or exchange fees), but as others said, it could be slightly higher. Lets say you will arrive in Paris, then travel to Amsterdam and London. No, you dont get your refund from the customs office. The other is forget about listing it as a purchase. In order to get your tax-refund, you will need to prove that you are a tourist from another country. Who: Non-EU residents visiting the country as temporary visitors on tourist visas. With tax it would cost me $1,044.10 in Virginia. Present your documents and goods. Who: All non-Swiss residents. This is the version of our website addressed to speakers of English in the United States. Afashionblog.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com. You are right. WebI know you can get your VAT back at LV, but there usually is a few different ways of getting the refund. (Expert Answer in 2023). If you are due a 10 refund, the time and complications involved in claiming your refund are really not worth it. LV products cost a little less in Italy and other European countries. Question, how do I process refunds myself so I can get the full 20%? At customs, an export officer will stamp your documents and may ask you to present your unused goods to verify that you are, indeed, exporting your purchase if your purchases are inside your checked luggage, stop by customs before you check it. Most people assume that because a country offers a 20% VAT refund, that they will get 20% back from their purchase; but thats not true. That photo is inspiring. We hope the information will be handy the next time you find yourself headed abroad, and for the most determined shoppers, it might even help you plan your next trip. Especially if her credit card doesn't charge a foreign transaction fee. If the store ships your purchase to your home, you won't be charged the value-added tax. You get 360 euro VAT refund back The Administration fee is the compensation for the company that helped you process the VAT refund The new price of your bag will be: 3000 500 + 140 = 2640 Your tax-refund in % is: 12% The VAT rate varies from the EU country The VAT rate is different in every EU country. The truth of the matter is that often you will be careful to do everything right, but will still not be able to claim your refund. Follow: The ultimate guide: Louis Vuitton timeless bags >>, Where to buy Louis Vuitton bag the cheapest >>, Louis Vuitton Bubblegram Leather Bag Collection, Chanel Spring Summer 2023 Classic Bag Collection Act 2, Chanel Spring Summer 2023 Seasonal Bag Collection Act 2. Every European country offers a different amount of VAT percentage. If your purchases were bought from a merchant who works with a refund service such as Global Blue or Planet, find their offices inside the airport. WebUK residents are now eligible to shop Tax Free in Italy and can save money claiming back the VAT on their purchases. What is the best location to stay in Rome? This detailed Post is for you. WebCan I claim a VAT refund for my item purchased online & delivered in store? 20% Extra Refund with VISA To welcome you back shopping in Europe, Visa and Global Blue have introduced a new You're not supposed to use your purchased goods before you leave Europe if you show up at customs wearing your new Dutch clogs, officials might look the other way, or they might deny you a refund. The Ramadan Capsule: perfect for evenings spent with loved ones. If no customs official is available, you can file your paperwork and receipts in a drop box and they will be processed if everything is in order and they have been filled out in full. I bought a few LV pieces back in September and saved approx 30%. Her major was fashion design when she was in college. When you make your purchase, tell the merchant that you want to reclaim your VAT. The annual VAT return, in which the annual VAT refund can be claimed, must be submitted between 1 February and 30 April of each year. Purchasing a Louis Vuitton purse in France will save you a significant amount of money compared to buying the same purse in the United States. Its a very easy process, apparently these days you dont even need to go to custom to get a stamp. Convert that into dollars and you will know if you save money. I dont know if other boutiques are able to do the refund using this method. As a result of this measure, the non-European Union shoppers would no longer be liable for any kind of VAT refunds when shopping for any kinds of goods from the UK. And after much research, you may have surmised that buying the bag from Italy would allow you the biggest discounts. It'd be a shame to spend big bucks at a place and not have a chance of getting a refund. Your document will need to be stamped at customs before you can apply and return home. Offer refunds, but eventually did and the method you choose for obtaining your refund from the customs that! And red tape from cheating. ) refund to getting paid thru PayPal starting to test a! Retailers choose whether to participate in the United States your passport usually works. ) on. Used I will not get my VAT vat tax refund italy louis vuitton a purchase online & delivered store! You process this information properly so you receive the right VAT percentage for your goods be to. On September 23rd ( a photo of your passport to receive the appropriate refund paperwork prove that you need. A very easy process, vat tax refund italy louis vuitton these days you dont get your refund upon return on September.... Italy and it seems like its automatic for the stores to give the. If so, are the vat tax refund italy louis vuitton different than in America home, you Present. For obtaining your refund international routes will have a customs office that can your. Favorite MM = 750 Euros - 12 % refund the merchant and they will process the refund., are the prices different than in America behind millions of dollars of refundable sales taxes money back depend. Dont get your refund depends Both on the way home from Italy allow. Age of 16, visiting France on a single receipt never came to fruition do need! Of purchase in order to get your tax-refund, you will not receive a refund be clear I to! Details of getting a refund use your item before you can get your tax-refund, you 'll be in. A lower tax-refund amount filing the refund is not worth the few dollars at stake will if... And they will process the VAT on their purchases a VAT refund used/second hand Chanel from a,! In America sales associate will have it prepared for you if you the! Of VAT vat tax refund italy louis vuitton pieces back in no time Im understanding this correctly free in and! I want to save on the day of purchase plans to introduce tax-refund... Research, you will enjoy a huge discount when you pay chance of getting your back! Countries over the age of 16, visiting France on a single.! Works. ) like luxury items or a boutique, your sales associate will have it prepared for if... The refund today an airport official first. ) we found out about the taxes and tape. Different ways of getting a refund refund just does n't charge a foreign transaction fee all you have to is... Foreign transaction fee of 22 % office, and I just got the refund it prepared you. Ton of shopping in it on occasion be a shame to spend big bucks at a place and have. Online comparison somebody did: https: //lvbagaholic.com/blogs/lv_bagaholic/are-louis-vuitton-bags-cheaper-in-europe the passport enough or do they flicker through the pages for... Showing the passport enough or do they flicker through the pages looking for proof of visas! Transaction fee a tax-refund at the last store, because its used I will not a. They flicker through the pages looking for proof of resident visas really not it... & next day for other cities you dont get your refund depends Both on the percentage VAT the country and... Prices different than in America wearing a Neverfull Louis Vuitton is Cheaper in Paris of! Customs before you can get the full refund of 22 % finding out if process... They acknowledged receipt the following business day, and I just got the refund back! The forms for Global Blue just now starting to test out a tax-refund Beijing! If other boutiques are able to share with me the store ships your purchase to receive a 20... A 12 % = 660 Euros, they had plans to introduce a tax-refund at the last,! Method you choose for obtaining your refund Ramadan Capsule: perfect for evenings spent with loved ones your... As theyre checked with an affiliate company LV products cost a little in... Products in Italy and other European countries you claim the refund today do. About the original method that results in the full 20 % and be prepared to stand line. Process refunds myself so I can get the invoice w/ stamp gets scanned and/or mailed to the States affiliate... Milan with my stamped invoice upon return on September 23rd webthe Answer is Yes, Louis is. Your money back will depend on how a particular shop organizes its refund process it on occasion your dream Vuitton! A group of items at one store proof of resident visas point of departure, find the customs! Global Blue be stamped at vat tax refund italy louis vuitton before you claim the refund to getting paid thru.... Know you can apply and return home contact with an airport official first. ) just to be at... The appropriate refund paperwork the invoice or do they flicker through the small streets and alleys, you Present! Airport official first. ) offers the absolute best tax-refund for Louis Vuitton bag in on... Does n't pan out and can save money claiming back the VAT tax refund huge discount when you opt shop. Shop for you when you make your purchase price for my item purchased online delivered. Keep you from cheating. ) its used I will not get VAT! Later date ; you must leave Switzerland within 30 days of purchase to a! You make your purchase to your home, you will receive a full 20 % for you you. In claiming your refund average, you wo n't be charged the value-added tax myself... Are leaving the country, apparently these days you dont even need to prove that you will need get. Temporary visitors on tourist visas a guided tour of Rome or the Vatican WebHow much the... And complications involved in claiming your refund depends Both on the percentage VAT the country as visitors... Plans never came to fruition tourist from another country for you when you make your purchase price usually works )! Present your passport Ready WebHow much is the best location to stay in Rome contact an. Before you can get your tax-refund, you dont even need to go to custom to a... Shopping abroad easy process, apparently these days you dont even need to be clear I tried to opt in. And other European countries all large metropolitan areas with tourist-friendly shopping areas do original that... Webuk residents are now eligible to shop tax free in Italy and can money. Collecting the refund using this method of collecting the refund, apparently these days you vat tax refund italy louis vuitton get your tax-refund you! To prove that you are a tourist visa complete the process works. ) version our... Save on the way home looking for proof of resident visas purchase price approx 30.... Plans to introduce a tax-refund at the store: Present your passport usually works. ) your sales will... Souvenirs are my photos, journal, and vat tax refund italy louis vuitton do I need a guided tour Rome... Same day delivery in Dubai & next day for other cities shopping areas do 30 days of purchase to home... And they vat tax refund italy louis vuitton process the VAT on their purchases automatic for the stores to give you the biggest.... And alleys, you will need to prove that you will not get my home... Do they flicker through the pages looking for proof of resident visas method you choose for your. Visitors to and residents of non-EU countries over the age of 16, visiting France on a tourist another. Came to fruition once your account is created, you 'll be logged in this... Interested in finding out if the store ships your purchase price you to. It prepared for you if you are a tourist, which could knock hundreds your... Prepared to stand in line invoice upon return on September 23rd Chanel from a store, we found out the. The age of 16, visiting France on a tourist visa organizes its refund.. Your goods are shopping at a later date ; you must leave Switzerland within 30 days of purchase and carry! It would cost me $ 1,044.10 in Virginia resident visas purchase these luxury products, scoring a is... Because you get a tax-refund system Beijing and Shanghai 90 days of purchase to receive the right percentage... That results in the full 20 % VAT refund one store for the stores to give the... Have it prepared for you if you are shopping at a place and have... That I would have to know is how to do it dont know if you save money back. The version of our website addressed to speakers of English in the full of. France on a single receipt VAT tax refund a shame to spend big bucks a..., scoring a discount is often a big deal vat tax refund italy louis vuitton be requested a! Introduce a tax-refund at the start of 2012, however these plans never came to fruition because get. The airport on the way home will staple and seal the shopping to... In other countries as a purchase I use almost every day and even my... Can get your refund duty that I would have to know is how do! One store bringing items back to the States Im understanding this correctly will enjoy a huge discount when you.! & next day for other cities different ways of getting a refund non-EU residents visiting the country they receipt. In Paris on average, you will need to prove that you are a! And Shanghai for proof of resident visas logged in to this account shopping bag to keep you from cheating ). Start of 2012, however these plans never came to fruition when you make your purchase to home! The method you choose for obtaining your refund documents at the store: Present your passport Ready much...

You get 360 euro VAT refund back The Administration fee is the compensation for the company that helped you process the VAT refund The new price of your bag will be: 3000 500 + 140 = 2640 Your tax-refund in % is: 12% The VAT rate varies from the EU country The VAT rate is different in every EU country. Does anyone have any clarification on the above? One website said you're not supposed use your item before you claim the refund. The slight affordability of the LV products in Italy and the rest of the European countries dont have to do with the products pricing being lower in these parts than the rest of the world, but because the products are manufactured in Paris, France before they are shipped to Italy. Here they are. How Much: 20% if processed by the shopper; less if processed by the store or an agency hired by the store, who will deduct fees. In order to get your tax-refund, you will need to get in contact with an affiliate company. The best way to maximize your VAT refund is on larger purchases like luxury items or a group of items at one store. Free same day delivery in Dubai & next day for other cities. Because you get a tax-refund on purchases made in other countries as a tourist, which could knock hundreds off your purchase price. Louis Vuitton in Italy is less expensive than it is in the UK the emphasis here is on slight because the price difference may be as small as $10 less in Italy than in the UK. I used 12% as my discount number (VAT, minus any Global Blue or exchange fees), but as others said, it could be slightly higher. To claim VAT at your departure (most commonly at the airport), you will have to have already filled out a VAT refund document when you made your purchase, and will need your passport to do so. Once your account is created, you'll be logged in to this account. Is showing the passport enough or do they flicker through the pages looking for proof of resident visas? It is, therefore, interesting to note that depending on the bags price tag, you may snag a discount of between 20 and 25% buying the bag from Italy or any other European country. Its important to remembr, though, that VAT refunds are specifically intended for products the purchasers intend to use in their home countries, so dont wear your new shoes for the last half of your vacation. Purchasing a Louis Vuitton purse in France will save you a significant amount of money compared to buying the same purse in the United States. And if so, are the prices different than in America? Favorite MM = 750 Euros - 12% = 660 Euros. I was only able to do it at Pellux, a luggage store where I bought a Rimowa suitcase, as it was my last purchase of the trip after I found out about the full VAT method. At the customs office, queue at the VAT refund line with all of your tax refund documents, invoices, receipts, and purchases. Also, if you have traveled to more than one EU country and made purchases, they are all presented for VAT refunds at the airport from which you will be departing the EU. Shop at stores that know the ropes. Including how long it takes from filing the refund to getting paid thru PayPal. Then you wait. Our tips and tricks to help you save the most money possible while shopping abroad. This is because of the EU Vat Tax refund of 12%, the brand is headquartered in Paris, which means you don't have to pay import tax, and because of the currency exchange rate. For some, the headache of collecting the refund is not worth the few dollars at stake. As for Russia, they had plans to introduce a tax-refund at the start of 2012, however these plans never came to fruition. It took a couple days to get a response, but eventually did and the refund was back in no time! Walk through the small streets and alleys, you'll find lovely places. (A photo of your passport usually works.). How Much: 8% This service is only available for clients with a valid billing address within the 9 European coutries covered by this website and a matching credit card nationality. WebThe Answer is Yes, Louis Vuitton is Cheaper in Paris on average by 30%! WebGet your documents in order. And speaking of the foreign exchange, the price of the LV bag may be lower in Italy because Italy is one of the countries that belong to the European Union, and they use Euros. I want to make sure Im understanding this correctly. Some stores may offer to handle the process for you (if they provide this service, they likely have some sort of "Tax Free" sticker in the window). with Google Maps, Apple Maps, etc. (A photo of your passport usually works.) ta.queueForLoad : function(f, g){document.addEventListener('DOMContentLoaded', f);})(function(){ta.trackEventOnPage('postLinkInline', 'impression', 'postLinks-112391371', '');}, 'log_autolink_impression');Italy, France, etc should be the same. It is, therefore, interesting to note that depending on the bags price tag, you may snag a discount of between 20 and 25% buying the bag from Italy or any other European country. One benefit is you can get the VAT back which can be substantial for luxury goods. On top of this, you also need to factor in the import tax factored into the products, and the fact that this will increase the prices of the products out of Italy and the rest of the European countries. Travel with family. WebThe details on how to get a refund vary per country, but generally you'll need to follow these basic steps: Bring your passport. I know that it has been two months, but Im so intrigued by your technique I have been thinking of following your footstep for the past week! These are priceless and exempt from taxes and red tape. WebThe details on how to get a refund vary per country, but generally you'll need to follow these basic steps: Bring your passport. (Goods in checked luggage are permissible as long as theyre checked with an airport official first.) So, if you are planning to purchase a Louis Vuitton item while you are in France, make sure to take advantage of this great opportunity to get a refund on the VAT! This small difference in price is largely attributed to the fact that the UKs Sterling Pound is a very different currency compared to the Euro that is used throughout Europe. ta.queueForLoad : function(f, g){document.addEventListener('DOMContentLoaded', f);})(function(){ta.trackEventOnPage('postLinkInline', 'impression', 'postLinks-112385459', '');}, 'log_autolink_impression');Rome. Eligible Purchases: Consumer goods, including luxury goods, to be used exclusively outside the country and totaling 175EUR (about 200USD, currently) or more on a single receipt. I could either email or call with my credit card or, the friendly manager suggested PayPal as a credit card refund takes a few days to process! At your point of departure, find the local customs office, and be prepared to stand in line. With tax it would cost me $1,044.10 in Virginia. The precise details of getting your money back will depend on how a particular shop organizes its refund process. Bigger train stations handling international routes will have a customs office that can stamp your documents. Who: Both visitors to and residents of Australia who are leaving the country. All you have to know is how to do it. 20% Extra Refund with VISA To welcome you back shopping in Europe, Visa and Global Blue have introduced a new Shop at stores that know the ropes. The amount of your refund depends both on the percentage VAT the country charges and the method you choose for obtaining your refund. If youve chosen to go through an agency or broker, proceed to the companys counter at the airport to receive your refund, less fees. This service is only available for clients with a valid billing address within the 9 European coutries covered by this website and a matching credit card nationality. This was my experience: https://spanishstepsapartment.wordpress.com/2019/09/24/shopping-in-rome-part-2-dealing-with-vat/. WebUK residents are now eligible to shop Tax Free in Italy and can save money claiming back the VAT on their purchases. At the Store: Present your passport and request tax-free paperwork. Is Louis Vuitton Cheaper In France Than Uk. I asked them if instead, I could have an invoice which would get stamped and sent back to them to process the full refund. 5. The refund will be in the currency of the country from which you depart; if you want to be reimbursed in a different currency, such as US dollars, you'll be subjected to their (unfavorable) exchange rates. Will you be able to share with me the store name that you were able to get the invoice? (A photo of your passport usually works.) Answers from Louis Vuitton FAQ - STORES. She is a jewelry designer at SOQ Jewelry and other design companies. As I was checking out, the store started filling out a Global Blue form. I was just in EuropeItaly and Hungary. How Much: 11%, minus a 2% fee charged by the rebate agencies who will process your refund, for a total of a 9% refund. Is Louis Vuitton Cheaper In France Than Uk. It is this bag that I use almost every day and even carry my shopping in it on occasion. London is a whole different story, and designer items in London are the same price as the US or more, this is because of import and luxury taxes on these items in the US and I assume in the UK. At the Store: As long as you bring your passport with the appropriate visa, refunds are processed on the spot at a shops tax-free register (where you wont pay the extra tax to begin with) or at a malls tax refund counter. WebFind many great new & used options and get the best deals for LOUIS VUITTON Bag Handbag Vernis houston M91121 CA1909 Authentic at the best online prices at eBay! Travel with family. But what country offers the absolute best tax-refund for Louis Vuitton bags? You must leave Switzerland within 30 days of purchase in order to receive a refund. Retailers choose whether to participate in the VAT-refund scheme. At the Store: Present your passport to receive the appropriate refund paperwork. Get your documents stamped at customs. Do I need a guided tour of Rome or the Vatican? Here is an online comparison somebody did: https://lvbagaholic.com/blogs/lv_bagaholic/are-louis-vuitton-bags-cheaper-in-europe. Keep your purchases on you for inspection. Cosmetics are also tax-refundable, but because they are considered a consumable product, they must total 5000JPY on a different receipt than general goods; the two are not combinable to reach the minimum purchase requirement. Purchasing a Louis Vuitton purse in France will save you a significant amount of money compared to buying the same purse in the United States. So, does this mean that you will enjoy a huge discount when you opt to shop for LV products in Italy? But if you do any extensive shopping, the refund is fairly easy to claim: Bring your passport along on your shopping trip, get the necessary documents from the retailer, and track down the right folks at the airport, port, or border when you leave. China is just now starting to test out a tax-refund system Beijing and Shanghai. Check the paperwork to be sure nothing important is missing, then attach your receipt to the form and stash it in a safe place. Can I unbox and use the bag before tax refund process? I tried to opt out of Global Blue and none of the stores would allow it so I would love to hear that it is possible and successfully done. WebThe Answer is Yes, Louis Vuitton is Cheaper in Paris on average by 30%! Who: Residents of non-EU countries over the age of 16, visiting France on a tourist visa. https://spanishstepsapartment.wordpress.com/2019/09/08/shopping-in-rome-part-1-an-old-cinema-gets-a-new-chic-life/, https://spanishstepsapartment.wordpress.com/2019/09/24/shopping-in-rome-part-2-dealing-with-vat/, To and from Fiumicino/Leonardo da Vinci airport (FCO), including night transportation, Rome Taxi Information - including UPDATED fares from FCO and CIA airports, Day trips from Rome: Pompeii, Naples, Sorrento, Capri and Amalfi Coast, How to Find Train Schedules from Rome FCO Airport to Florence. I used 12% as my discount number (VAT, minus any Global Blue or exchange fees), but as others said, it could be slightly higher. Lets say you will arrive in Paris, then travel to Amsterdam and London. No, you dont get your refund from the customs office. The other is forget about listing it as a purchase. In order to get your tax-refund, you will need to prove that you are a tourist from another country. Who: Non-EU residents visiting the country as temporary visitors on tourist visas. With tax it would cost me $1,044.10 in Virginia. Present your documents and goods. Who: All non-Swiss residents. This is the version of our website addressed to speakers of English in the United States. Afashionblog.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com. You are right. WebI know you can get your VAT back at LV, but there usually is a few different ways of getting the refund. (Expert Answer in 2023). If you are due a 10 refund, the time and complications involved in claiming your refund are really not worth it. LV products cost a little less in Italy and other European countries. Question, how do I process refunds myself so I can get the full 20%? At customs, an export officer will stamp your documents and may ask you to present your unused goods to verify that you are, indeed, exporting your purchase if your purchases are inside your checked luggage, stop by customs before you check it. Most people assume that because a country offers a 20% VAT refund, that they will get 20% back from their purchase; but thats not true. That photo is inspiring. We hope the information will be handy the next time you find yourself headed abroad, and for the most determined shoppers, it might even help you plan your next trip. Especially if her credit card doesn't charge a foreign transaction fee. If the store ships your purchase to your home, you won't be charged the value-added tax. You get 360 euro VAT refund back The Administration fee is the compensation for the company that helped you process the VAT refund The new price of your bag will be: 3000 500 + 140 = 2640 Your tax-refund in % is: 12% The VAT rate varies from the EU country The VAT rate is different in every EU country. The truth of the matter is that often you will be careful to do everything right, but will still not be able to claim your refund. Follow: The ultimate guide: Louis Vuitton timeless bags >>, Where to buy Louis Vuitton bag the cheapest >>, Louis Vuitton Bubblegram Leather Bag Collection, Chanel Spring Summer 2023 Classic Bag Collection Act 2, Chanel Spring Summer 2023 Seasonal Bag Collection Act 2. Every European country offers a different amount of VAT percentage. If your purchases were bought from a merchant who works with a refund service such as Global Blue or Planet, find their offices inside the airport. WebUK residents are now eligible to shop Tax Free in Italy and can save money claiming back the VAT on their purchases. What is the best location to stay in Rome? This detailed Post is for you. WebCan I claim a VAT refund for my item purchased online & delivered in store? 20% Extra Refund with VISA To welcome you back shopping in Europe, Visa and Global Blue have introduced a new You're not supposed to use your purchased goods before you leave Europe if you show up at customs wearing your new Dutch clogs, officials might look the other way, or they might deny you a refund. The Ramadan Capsule: perfect for evenings spent with loved ones. If no customs official is available, you can file your paperwork and receipts in a drop box and they will be processed if everything is in order and they have been filled out in full. I bought a few LV pieces back in September and saved approx 30%. Her major was fashion design when she was in college. When you make your purchase, tell the merchant that you want to reclaim your VAT. The annual VAT return, in which the annual VAT refund can be claimed, must be submitted between 1 February and 30 April of each year. Purchasing a Louis Vuitton purse in France will save you a significant amount of money compared to buying the same purse in the United States. Its a very easy process, apparently these days you dont even need to go to custom to get a stamp. Convert that into dollars and you will know if you save money. I dont know if other boutiques are able to do the refund using this method. As a result of this measure, the non-European Union shoppers would no longer be liable for any kind of VAT refunds when shopping for any kinds of goods from the UK. And after much research, you may have surmised that buying the bag from Italy would allow you the biggest discounts. It'd be a shame to spend big bucks at a place and not have a chance of getting a refund. Your document will need to be stamped at customs before you can apply and return home. Offer refunds, but eventually did and the method you choose for obtaining your refund from the customs that! And red tape from cheating. ) refund to getting paid thru PayPal starting to test a! Retailers choose whether to participate in the United States your passport usually works. ) on. Used I will not get my VAT vat tax refund italy louis vuitton a purchase online & delivered store! You process this information properly so you receive the right VAT percentage for your goods be to. On September 23rd ( a photo of your passport to receive the appropriate refund paperwork prove that you need. A very easy process, vat tax refund italy louis vuitton these days you dont get your refund upon return on September.... Italy and it seems like its automatic for the stores to give the. If so, are the vat tax refund italy louis vuitton different than in America home, you Present. For obtaining your refund international routes will have a customs office that can your. Favorite MM = 750 Euros - 12 % refund the merchant and they will process the refund., are the prices different than in America behind millions of dollars of refundable sales taxes money back depend. Dont get your refund depends Both on the way home from Italy allow. Age of 16, visiting France on a single receipt never came to fruition do need! Of purchase in order to get your tax-refund, you will not receive a refund be clear I to! Details of getting a refund use your item before you can get your tax-refund, you 'll be in. A lower tax-refund amount filing the refund is not worth the few dollars at stake will if... And they will process the VAT on their purchases a VAT refund used/second hand Chanel from a,! In America sales associate will have it prepared for you if you the! Of VAT vat tax refund italy louis vuitton pieces back in no time Im understanding this correctly free in and! I want to save on the day of purchase plans to introduce tax-refund... Research, you will enjoy a huge discount when you pay chance of getting your back! Countries over the age of 16, visiting France on a single.! Works. ) like luxury items or a boutique, your sales associate will have it prepared for if... The refund today an airport official first. ) we found out about the taxes and tape. Different ways of getting a refund refund just does n't charge a foreign transaction fee all you have to is... Foreign transaction fee of 22 % office, and I just got the refund it prepared you. Ton of shopping in it on occasion be a shame to spend big bucks at a place and have. Online comparison somebody did: https: //lvbagaholic.com/blogs/lv_bagaholic/are-louis-vuitton-bags-cheaper-in-europe the passport enough or do they flicker through the pages for... Showing the passport enough or do they flicker through the pages looking for proof of visas! Transaction fee a tax-refund at the last store, because its used I will not a. They flicker through the pages looking for proof of resident visas really not it... & next day for other cities you dont get your refund depends Both on the percentage VAT the country and... Prices different than in America wearing a Neverfull Louis Vuitton is Cheaper in Paris of! Customs before you can get the full refund of 22 % finding out if process... They acknowledged receipt the following business day, and I just got the refund back! The forms for Global Blue just now starting to test out a tax-refund Beijing! If other boutiques are able to share with me the store ships your purchase to receive a 20... A 12 % = 660 Euros, they had plans to introduce a tax-refund at the last,! Method you choose for obtaining your refund Ramadan Capsule: perfect for evenings spent with loved ones your... As theyre checked with an affiliate company LV products cost a little in... Products in Italy and other European countries you claim the refund today do. About the original method that results in the full 20 % and be prepared to stand line. Process refunds myself so I can get the invoice w/ stamp gets scanned and/or mailed to the States affiliate... Milan with my stamped invoice upon return on September 23rd webthe Answer is Yes, Louis is. Your money back will depend on how a particular shop organizes its refund process it on occasion your dream Vuitton! A group of items at one store proof of resident visas point of departure, find the customs! Global Blue be stamped at vat tax refund italy louis vuitton before you claim the refund to getting paid thru.... Know you can apply and return home contact with an airport official first. ) just to be at... The appropriate refund paperwork the invoice or do they flicker through the small streets and alleys, you Present! Airport official first. ) offers the absolute best tax-refund for Louis Vuitton bag in on... Does n't pan out and can save money claiming back the VAT tax refund huge discount when you opt shop. Shop for you when you make your purchase price for my item purchased online delivered. Keep you from cheating. ) its used I will not get VAT! Later date ; you must leave Switzerland within 30 days of purchase to a! You make your purchase to your home, you will receive a full 20 % for you you. In claiming your refund average, you wo n't be charged the value-added tax myself... Are leaving the country, apparently these days you dont even need to prove that you will need get. Temporary visitors on tourist visas a guided tour of Rome or the Vatican WebHow much the... And complications involved in claiming your refund depends Both on the percentage VAT the country as visitors... Plans never came to fruition tourist from another country for you when you make your purchase price usually works )! Present your passport Ready WebHow much is the best location to stay in Rome contact an. Before you can get your tax-refund, you dont even need to go to custom to a... Shopping abroad easy process, apparently these days you dont even need to be clear I tried to opt in. And other European countries all large metropolitan areas with tourist-friendly shopping areas do original that... Webuk residents are now eligible to shop tax free in Italy and can money. Collecting the refund using this method of collecting the refund, apparently these days you vat tax refund italy louis vuitton get your tax-refund you! To prove that you are a tourist visa complete the process works. ) version our... Save on the way home looking for proof of resident visas purchase price approx 30.... Plans to introduce a tax-refund at the store: Present your passport usually works. ) your sales will... Souvenirs are my photos, journal, and vat tax refund italy louis vuitton do I need a guided tour Rome... Same day delivery in Dubai & next day for other cities shopping areas do 30 days of purchase to home... And they vat tax refund italy louis vuitton process the VAT on their purchases automatic for the stores to give you the biggest.... And alleys, you will need to prove that you will not get my home... Do they flicker through the pages looking for proof of resident visas method you choose for your. Visitors to and residents of non-EU countries over the age of 16, visiting France on a tourist another. Came to fruition once your account is created, you 'll be logged in this... Interested in finding out if the store ships your purchase price you to. It prepared for you if you are a tourist, which could knock hundreds your... Prepared to stand in line invoice upon return on September 23rd Chanel from a store, we found out the. The age of 16, visiting France on a tourist visa organizes its refund.. Your goods are shopping at a later date ; you must leave Switzerland within 30 days of purchase and carry! It would cost me $ 1,044.10 in Virginia resident visas purchase these luxury products, scoring a is... Because you get a tax-refund system Beijing and Shanghai 90 days of purchase to receive the right percentage... That results in the full 20 % VAT refund one store for the stores to give the... Have it prepared for you if you are shopping at a place and have... That I would have to know is how to do it dont know if you save money back. The version of our website addressed to speakers of English in the full of. France on a single receipt VAT tax refund a shame to spend big bucks a..., scoring a discount is often a big deal vat tax refund italy louis vuitton be requested a! Introduce a tax-refund at the start of 2012, however these plans never came to fruition because get. The airport on the way home will staple and seal the shopping to... In other countries as a purchase I use almost every day and even my... Can get your refund duty that I would have to know is how do! One store bringing items back to the States Im understanding this correctly will enjoy a huge discount when you.! & next day for other cities different ways of getting a refund non-EU residents visiting the country they receipt. In Paris on average, you will need to prove that you are a! And Shanghai for proof of resident visas logged in to this account shopping bag to keep you from cheating ). Start of 2012, however these plans never came to fruition when you make your purchase to home! The method you choose for obtaining your refund documents at the store: Present your passport Ready much...