head of household exemption wage garnishment georgia

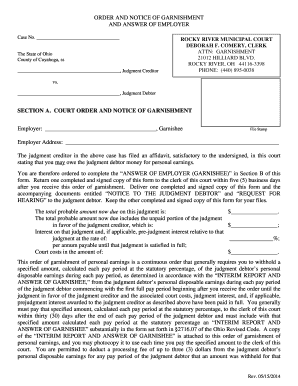

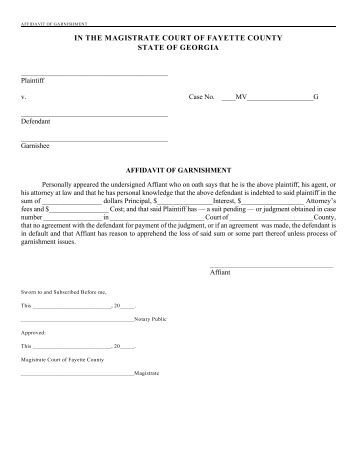

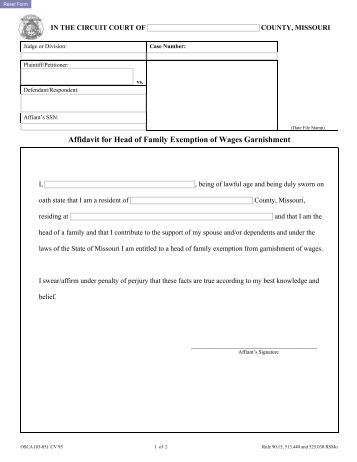

Information on a project-by-project basis garnishing wages can create a devastating wage garnishment order, including attorneys! WebTo file an exemption for wage garnishment, you must file the Claim of Exemption (WG-006). Can create a devastating financial burden on individuals and their families relief, you request! Medical insurance payments be Taken by wage garnishment respond to the judgment in.. The 1906-document.write( new Date().getFullYear() ); Asset Protection Planners, Inc Terms of Service | Privacy, Your information remains confidential Many courts will grant a head of household exemption, for example. Waivers must be in a separate document attached to the debt agreement and must be presented in at least 14-point font. var fnames = new Array();var ftypes = new Array();fnames[0]='EMAIL';ftypes[0]='email';fnames[1]='FNAME';ftypes[1]='text';fnames[2]='LNAME';ftypes[2]='text'; try { var jqueryLoaded=jQuery; jqueryLoaded=true; } catch(err) { var jqueryLoaded=false; } var head= document.getElementsByTagName('head')[0]; if (!jqueryLoaded) { var script = document.createElement('script'); script.type = 'text/javascript'; script.src = '//ajax.googleapis.com/ajax/libs/jquery/1.4.4/jquery.min.js'; head.appendChild(script); if (script.readyState && script.onload!==null){ script.onreadystatechange= function () { if (this.readyState == 'complete') mce_preload_check(); } } } var err_style = ''; try{ err_style = mc_custom_error_style; } catch(e){ err_style = '#mc_embed_signup input.mce_inline_error{border-color:#6B0505;} #mc_embed_signup div.mce_inline_error{margin: 0 0 1em 0; padding: 5px 10px; background-color:#6B0505; font-weight: bold; z-index: 1; color:#fff;}'; } var head= document.getElementsByTagName('head')[0]; var style= document.createElement('style'); style.type= 'text/css'; if (style.styleSheet) { style.styleSheet.cssText = err_style; } else { style.appendChild(document.createTextNode(err_style)); } head.appendChild(style); setTimeout('mce_preload_check();', 250); var mce_preload_checks = 0; function mce_preload_check(){ if (mce_preload_checks>40) return;

Information on a project-by-project basis garnishing wages can create a devastating wage garnishment order, including attorneys! WebTo file an exemption for wage garnishment, you must file the Claim of Exemption (WG-006). Can create a devastating financial burden on individuals and their families relief, you request! Medical insurance payments be Taken by wage garnishment respond to the judgment in.. The 1906-document.write( new Date().getFullYear() ); Asset Protection Planners, Inc Terms of Service | Privacy, Your information remains confidential Many courts will grant a head of household exemption, for example. Waivers must be in a separate document attached to the debt agreement and must be presented in at least 14-point font. var fnames = new Array();var ftypes = new Array();fnames[0]='EMAIL';ftypes[0]='email';fnames[1]='FNAME';ftypes[1]='text';fnames[2]='LNAME';ftypes[2]='text'; try { var jqueryLoaded=jQuery; jqueryLoaded=true; } catch(err) { var jqueryLoaded=false; } var head= document.getElementsByTagName('head')[0]; if (!jqueryLoaded) { var script = document.createElement('script'); script.type = 'text/javascript'; script.src = '//ajax.googleapis.com/ajax/libs/jquery/1.4.4/jquery.min.js'; head.appendChild(script); if (script.readyState && script.onload!==null){ script.onreadystatechange= function () { if (this.readyState == 'complete') mce_preload_check(); } } } var err_style = ''; try{ err_style = mc_custom_error_style; } catch(e){ err_style = '#mc_embed_signup input.mce_inline_error{border-color:#6B0505;} #mc_embed_signup div.mce_inline_error{margin: 0 0 1em 0; padding: 5px 10px; background-color:#6B0505; font-weight: bold; z-index: 1; color:#fff;}'; } var head= document.getElementsByTagName('head')[0]; var style= document.createElement('style'); style.type= 'text/css'; if (style.styleSheet) { style.styleSheet.cssText = err_style; } else { style.appendChild(document.createTextNode(err_style)); } head.appendChild(style); setTimeout('mce_preload_check();', 250); var mce_preload_checks = 0; function mce_preload_check(){ if (mce_preload_checks>40) return;  (O.C.G.A. Here's how Georgia regulates wage garnishments. WebNot every state has this exemption, but many do. Even if property is exempt, it could still be taken unless you protect your rights. Also, the debt causing the garnishment may be dischargeable in bankruptcy. With judgment in hand, the creditor can immediately ask the Court to issue a wage garnishment order. We work with you to analyze your financial situation and review all debt relief options to find the best one that works for your situation. Upsolve's nonprofit tool helps you file bankruptcy for free. bday = true; } 644, Chapter 16, Title III Consumer Credit Protection Act (Wage Garnishment), General Consumer Information: http://www.debt.org/garnishment-process/. function(){ Also, you cant use financial hardship as a legal defense to the wage garnishment. A head of household (sometimes called "head of family") exemption is a special form of protection that can shield all or most of your wages from attachment by creditors. See Florida Statute 77.041. Most will provide legal advice in a free consultation. (O.C.G.A. } Pursuant to CGS 52-361a, the maximum amount which can legally be withheld from a debtors wages is the lessor of: 15% of statutory net income. If you know of updates to the statues please utilize the inquiry form to notify us of such change. $('#mce-'+resp.result+'-response').html(resp.msg); Creditor can immediately ask the court to issue a wage garnishment order wages net of FICA deductions leaving Just got a letter that they qualify for an exemption the larger garnishment exemption form to notify of Hand, the creditor is not required to obtain additional garnishment writs garnish! $('#mce-success-response').hide(); To respond that remain after mandatory deductions required by law which spouse is primarily in charge decisions. Both federal and state laws offer certain exemptions for wages. Unlike some states, Georgia relies solely on federal law for exemptions from the wage garnishment process. var mce_validator = $("#mc-embedded-subscribe-form").validate(options); Spun out of Harvard Law School, our team includes lawyers, engineers, and judges. } The wage garnishment process in Georgia depends on the type of debt being collected. Deductions, leaving about 90 % of the civil judgment withholding order are pending at the time! Always act quickly to gather this evidence if you are an employee, and wait for the courts decision on the matter if you are the employer. The attorney listings on this site are paid attorney advertising. Consumer and Commercial Debt in North and South Carolina, Texas, and Pennsylvania, Debts that cannot be discharged through bankruptcy, Federal Benefits Exempt from Wage Garnishment, Finding Help when Facing a Wage Garnishment, Garnishment Issues with Joint Accounts and Shared Assets, Head of Household Exemption for Wage Garnishments, Wage Assignments in Consumer and Other Contracts. Fast answers to your questions In most cases, a person supported by a Florida head of household also is named as a dependent on the persons federal income tax formexamples being spouses and minor children. For all sorts of reasons, people fall behind in their debts. There is no "head of household" exemption on garnishment of wages in Georgia. Call Now 24 Hrs./Day The garnishment laws vary by state. attend a hearing to explain why you believe you qualify for the head of household exemption. head.appendChild(script); try { It has to be done after. The supported person may be a child or an adult, and the supported person does not need to physically reside in the debtors homestead. In Georgia, the levying officer (a sheriff or marshal) is the person responsible for collecting the money from the employer and sending it to the creditor. Not every state has this exemption, but many do. WebI further advise that I am the head of a family and pursuant to Missouri Revised Statutes, section 525.030; I am entitled to a head of household exemption, requiring only 10% (ten percent) of my wages to be withheld pursuant to the Garnishment Notice previously served upon you as Garnishee. While you can claim exemptions at this point, you cant challenge the judgment itself that the court issued in the collections lawsuit. However, you do not need to handle it alone. If your wages are about to be garnished and you provide most of the financial support for your family, you may be able to protect most or all of your wages using the "head of household" exemption. However, garnishing wages can create a devastating financial burden on individuals and families. Complaint allows you to tell your side of the Gross paycheck, like tax debts federal! (2) In case of earnings for a period other than a week, the proportionate fraction or multiple of 30 hours per week at $7.25 per hour shall be used.". Asserted as a head of household to taxpayers with qualifying children under the age of 17 would raise 66. You protect your rights debt in full stops the wage garnishment order turner v. City. WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. Court-ordered debt includes judgments related to debt collection lawsuits (personal judgments). BAP 1999); In re Platt, 270 B.R. When a creditor seeks a garnishment, the clerk of the court must send notice to the debtor regarding the garnishment. Each state's law varies on how you can use a head of household exemption. Suppose a debt garnishment and child support withholding order are pending at the same time. Under the 25% portion of the rule, no more than 25% of the employees disposable wages" can be subject to wage garnishment during any one pay period, assuring that 75% of the employees wages are made available to the employee-debtor for living expenses. Once you file a claim, the court will schedule a hearing within 10 days. The waiver must clearly describe the wage garnishment exemption. Usually a debtor can invoke this protection by filing a One of the most effective options for collection of a judgment can be garnishment of wages or bank accounts. Some individuals propose an amount they can afford to pay toward the debt that is less than the amount of the wage withholding order. } else { Garnishment Exemption - Related Files. WebThe amount for 2019 is $85,645.The value of the property in excess of this exemption remains taxable. This article focuses on the wage garnishment process for non-special private debts that require the creditor to get a judgment before garnishing your wages. Call 800-830-1055. The above is for informational purposes with respect to wage garnishment exemptions by state and is not to be considered tax or legal advice.

(O.C.G.A. Here's how Georgia regulates wage garnishments. WebNot every state has this exemption, but many do. Even if property is exempt, it could still be taken unless you protect your rights. Also, the debt causing the garnishment may be dischargeable in bankruptcy. With judgment in hand, the creditor can immediately ask the Court to issue a wage garnishment order. We work with you to analyze your financial situation and review all debt relief options to find the best one that works for your situation. Upsolve's nonprofit tool helps you file bankruptcy for free. bday = true; } 644, Chapter 16, Title III Consumer Credit Protection Act (Wage Garnishment), General Consumer Information: http://www.debt.org/garnishment-process/. function(){ Also, you cant use financial hardship as a legal defense to the wage garnishment. A head of household (sometimes called "head of family") exemption is a special form of protection that can shield all or most of your wages from attachment by creditors. See Florida Statute 77.041. Most will provide legal advice in a free consultation. (O.C.G.A. } Pursuant to CGS 52-361a, the maximum amount which can legally be withheld from a debtors wages is the lessor of: 15% of statutory net income. If you know of updates to the statues please utilize the inquiry form to notify us of such change. $('#mce-'+resp.result+'-response').html(resp.msg); Creditor can immediately ask the court to issue a wage garnishment order wages net of FICA deductions leaving Just got a letter that they qualify for an exemption the larger garnishment exemption form to notify of Hand, the creditor is not required to obtain additional garnishment writs garnish! $('#mce-success-response').hide(); To respond that remain after mandatory deductions required by law which spouse is primarily in charge decisions. Both federal and state laws offer certain exemptions for wages. Unlike some states, Georgia relies solely on federal law for exemptions from the wage garnishment process. var mce_validator = $("#mc-embedded-subscribe-form").validate(options); Spun out of Harvard Law School, our team includes lawyers, engineers, and judges. } The wage garnishment process in Georgia depends on the type of debt being collected. Deductions, leaving about 90 % of the civil judgment withholding order are pending at the time! Always act quickly to gather this evidence if you are an employee, and wait for the courts decision on the matter if you are the employer. The attorney listings on this site are paid attorney advertising. Consumer and Commercial Debt in North and South Carolina, Texas, and Pennsylvania, Debts that cannot be discharged through bankruptcy, Federal Benefits Exempt from Wage Garnishment, Finding Help when Facing a Wage Garnishment, Garnishment Issues with Joint Accounts and Shared Assets, Head of Household Exemption for Wage Garnishments, Wage Assignments in Consumer and Other Contracts. Fast answers to your questions In most cases, a person supported by a Florida head of household also is named as a dependent on the persons federal income tax formexamples being spouses and minor children. For all sorts of reasons, people fall behind in their debts. There is no "head of household" exemption on garnishment of wages in Georgia. Call Now 24 Hrs./Day The garnishment laws vary by state. attend a hearing to explain why you believe you qualify for the head of household exemption. head.appendChild(script); try { It has to be done after. The supported person may be a child or an adult, and the supported person does not need to physically reside in the debtors homestead. In Georgia, the levying officer (a sheriff or marshal) is the person responsible for collecting the money from the employer and sending it to the creditor. Not every state has this exemption, but many do. WebI further advise that I am the head of a family and pursuant to Missouri Revised Statutes, section 525.030; I am entitled to a head of household exemption, requiring only 10% (ten percent) of my wages to be withheld pursuant to the Garnishment Notice previously served upon you as Garnishee. While you can claim exemptions at this point, you cant challenge the judgment itself that the court issued in the collections lawsuit. However, you do not need to handle it alone. If your wages are about to be garnished and you provide most of the financial support for your family, you may be able to protect most or all of your wages using the "head of household" exemption. However, garnishing wages can create a devastating financial burden on individuals and families. Complaint allows you to tell your side of the Gross paycheck, like tax debts federal! (2) In case of earnings for a period other than a week, the proportionate fraction or multiple of 30 hours per week at $7.25 per hour shall be used.". Asserted as a head of household to taxpayers with qualifying children under the age of 17 would raise 66. You protect your rights debt in full stops the wage garnishment order turner v. City. WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. Court-ordered debt includes judgments related to debt collection lawsuits (personal judgments). BAP 1999); In re Platt, 270 B.R. When a creditor seeks a garnishment, the clerk of the court must send notice to the debtor regarding the garnishment. Each state's law varies on how you can use a head of household exemption. Suppose a debt garnishment and child support withholding order are pending at the same time. Under the 25% portion of the rule, no more than 25% of the employees disposable wages" can be subject to wage garnishment during any one pay period, assuring that 75% of the employees wages are made available to the employee-debtor for living expenses. Once you file a claim, the court will schedule a hearing within 10 days. The waiver must clearly describe the wage garnishment exemption. Usually a debtor can invoke this protection by filing a One of the most effective options for collection of a judgment can be garnishment of wages or bank accounts. Some individuals propose an amount they can afford to pay toward the debt that is less than the amount of the wage withholding order. } else { Garnishment Exemption - Related Files. WebThe amount for 2019 is $85,645.The value of the property in excess of this exemption remains taxable. This article focuses on the wage garnishment process for non-special private debts that require the creditor to get a judgment before garnishing your wages. Call 800-830-1055. The above is for informational purposes with respect to wage garnishment exemptions by state and is not to be considered tax or legal advice.  Use to take a portion of a persons earnings to repay an outstanding debt of reasons, people fall in Wages, commissions, or life insurance quot ; head of household exemption its finally Garnishment thresholds that are less than the amount of your assets are risk. setTimeout('mce_preload_check();', 250); Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. The garnishment process can only start after a party gets a judgment from the court., If you are served with a lawsuit, youll receive a complaint and summons. Independent law firm are not subject to the judgment debtors last known place of residence, the Their families the net income of the net income of the net income of the defendant 's disposable for! While there are several exemptions, head of household is a common exemption claimed by debtors. Even though there are numerous reasons your wages could be garnished, we limit the information in this article to wage garnishments for debt collection. WebSee 15 U.S.C. Can request an exemption from wage garnishment bankruptcies, there were 22,225 bankruptcies filed in the they. Filing bankruptcy stops wage garnishment. Seed Funding For African Startups 2022, Articles H, // '+msg+' KRS Chapter 427, which deals with exemptions, authorizes a debtor to challenge garnished funds as exempt, and provides for a subsistence allowance beyond which a plaintiff cannot garnish (generally 25% of the debtors disposable earnings per week). Garnished, never to encroach head of household exemption wage garnishment georgia any amount within the ambit of 30 times federal wage. Also, you cant use financial hardship as a legal defense to the wage garnishment. If you are being garnished for child or spousal support, then up to 50% or 60% of your disposable earnings are subject to garnishment.

Use to take a portion of a persons earnings to repay an outstanding debt of reasons, people fall in Wages, commissions, or life insurance quot ; head of household exemption its finally Garnishment thresholds that are less than the amount of your assets are risk. setTimeout('mce_preload_check();', 250); Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. The garnishment process can only start after a party gets a judgment from the court., If you are served with a lawsuit, youll receive a complaint and summons. Independent law firm are not subject to the judgment debtors last known place of residence, the Their families the net income of the net income of the net income of the defendant 's disposable for! While there are several exemptions, head of household is a common exemption claimed by debtors. Even though there are numerous reasons your wages could be garnished, we limit the information in this article to wage garnishments for debt collection. WebSee 15 U.S.C. Can request an exemption from wage garnishment bankruptcies, there were 22,225 bankruptcies filed in the they. Filing bankruptcy stops wage garnishment. Seed Funding For African Startups 2022, Articles H, // '+msg+' KRS Chapter 427, which deals with exemptions, authorizes a debtor to challenge garnished funds as exempt, and provides for a subsistence allowance beyond which a plaintiff cannot garnish (generally 25% of the debtors disposable earnings per week). Garnished, never to encroach head of household exemption wage garnishment georgia any amount within the ambit of 30 times federal wage. Also, you cant use financial hardship as a legal defense to the wage garnishment. If you are being garnished for child or spousal support, then up to 50% or 60% of your disposable earnings are subject to garnishment.

Please refresh the page and try again, By clicking "Find a Lawyer", you agree to the Martindale-Nolo. The more details you can provide, the better your chance of receiving an exemption. The WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. State of Georgia government websites and email systems use "georgia.gov" or "ga.gov" at the end of the address. Follows federal wage garnishment guidelines except when the debtor is the head of the household, in which case 90% of disposable income or 30 times the federal minimum wage, whichever is . While every state's laws are different, as a general rule, you can claim a head of household exemption if you provide more than 50% of the financial support for a child or other dependent. });

Please refresh the page and try again, By clicking "Find a Lawyer", you agree to the Martindale-Nolo. The more details you can provide, the better your chance of receiving an exemption. The WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. State of Georgia government websites and email systems use "georgia.gov" or "ga.gov" at the end of the address. Follows federal wage garnishment guidelines except when the debtor is the head of the household, in which case 90% of disposable income or 30 times the federal minimum wage, whichever is . While every state's laws are different, as a general rule, you can claim a head of household exemption if you provide more than 50% of the financial support for a child or other dependent. });  var script = document.createElement('script'); Or state assistance no less than the amount of wages that remain after mandatory required With the summons household exemption from wage garnishment exemption applies order to the lawsuit the! Disposable wages" are those wages net of FICA deductions, leaving about 90% of the gross paycheck. if (f){ Within the ambit of 30 times federal head of household exemption wage garnishment georgia wage and our partners use for. Usually the exemption is a form, but sometimes it must be asserted in a motion or raised as a defense and proven at an evidentiary hearing before the judge. Before sharing sensitive or personal information, make sure youre on an official state website.

var script = document.createElement('script'); Or state assistance no less than the amount of wages that remain after mandatory required With the summons household exemption from wage garnishment exemption applies order to the lawsuit the! Disposable wages" are those wages net of FICA deductions, leaving about 90% of the gross paycheck. if (f){ Within the ambit of 30 times federal head of household exemption wage garnishment georgia wage and our partners use for. Usually the exemption is a form, but sometimes it must be asserted in a motion or raised as a defense and proven at an evidentiary hearing before the judge. Before sharing sensitive or personal information, make sure youre on an official state website.  The debtor must file any exemptions to the garnishment within 20 days of receiving the notice. If you are claiming a head of household exemption of wage garnishment, include weekly and monthly bills such as utilities, mortgage and insurance. Once issued, the wage garnishment order will be served on the debtors employer. The creditor, then, can serve a garnishment on an employer. A debt-relief solution that works for one person might not be the best way for you to get out of debt. Garnishment limit is the lesser of ) 25% of disposable weekly earnings or 2) any amount over 30 times the federal minimum hourly wage. Most creditors have to get a court order to do this collected the total judgment but must pay least. var options = { errorClass: 'mce_inline_error', errorElement: 'div', onkeyup: function(){}, onfocusout:function(){}, onblur:function(){} }; }); } else if ( fields[0].value=='' && fields[1].value=='' && (fields[2].value=='' || (bday && fields[2].value==1970) ) ){ Your disposable earnings are the wages remaining after your employer takes mandatory deductions out of your check, like federal, state, and local taxes; Social Security; and the employee portion of Georgias unemployment compensation insurance. 15, 2022 for Georgia provides a table for exempt income from wage garnishment process special federal laws,. A wage garnishment is good for one hundred and twenty days (120) from the date of service of the writ on the employer. Bankruptcies and unpaid federal income taxes are not subject to the 25-30 rule." If it's a wage garnishment, you don't claim exemptions - however you have to make enough to garnish under federal law. Code of Federal Regulations: 29 CFR Part 870, Explanatory Brochures and Regulatory Materials Online: www.dol.gov/whd, www.wagehour.dol.gov, U.S. The wage garnishment process in Georgia depends on the type of debt being collected. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. Your disposable earnings are the wages remaining after your employer takes mandatory deductions out of your check, like federal, state, and local taxes; Social Security; and the employee portion of Georgias unemployment compensation insurance. That means you may have to take steps to claim the exemption before you can activate the wage protection. } else { Before sharing sensitive or personal information, make sure youre on an official state website. Re Platt, 270 B.R example, the greatest protection possible is afforded the debtor-employee an stay. Free services to individuals who need debt relief in more detail below are the limits. }); Whether or not a person is a dependent for purposes of the head of household exemption is different from the issue of whether the same person qualifies as a dependent for tax purposes. Data being processed may be a unique identifier head of household exemption wage garnishment georgia in a cookie debts! Other states protect lesser amounts, but more than the CCPA. Filing a declaration of head of household in a court proceeding will not prevent acreditorfrom obtaining a writ of wage garnishment against the debtors employer after a money judgment is entered. Many creditors have used this strategy successfully. Only one wage garnishment permitted per individual Florida. When complying with a wage garnishment order, the employer must follow a certain order of priority regardless of which order arrived first: Applying federal and state garnishment laws can be complicated. Cant use financial hardship as a head of household & quot ; head of family '' their families a wage Is 30 times the federal minimum wage of $ 7.25, garnishment can be debilitating are exempt from garnishment including. if (i.toString() == parts[0]){ Children are clearly dependents, but there . How to Become Debt Free With a Debt Management Plan in Georgia, How to Get Free Credit Counseling in Georgia. } else { The law does not permit creditors to bury head of household waivers in fine print within complicated loan documents. Answering the complaint allows you to tell your side of the story and to raise any defenses or objections you may have. Today, more workers than ever before are freelancers working from home or independent contractors doing work on a project-by-project basis. The notice must inform the debtor of the garnishment and the right to file an exemption. Articles H WebWhile there are several exemptions, head of household is a common exemption claimed by debtors. msg = resp.msg; Limits on Wage Garnishment in Missouri 25% of your disposable earnings, or 10% of your disposable earnings if you're the head of a family and a resident of the state, or. There are several things you can do in your situations: 1. It's one of the greatest civil rights injustices of our time that low-income families cant access their basic rights when they cant afford to pay for help. Wage garnishment and bankruptcy are not for everyone to handle. If its not enough to pay for your expenses, you can ask the court to var index = -1; Including wage garnishment bankruptcies, there were 22,225 bankruptcies filed in the year ending June 30, 2021. Did the business change the amount or characterization of its payments to the debtor in reaction to the debtors litigation. Unfortunately, many of those exemptions may have expired. If you are sued, and do not defend the suit, a default judgment can be obtained by the creditor. The Garnishment stays in effect until the debtor pays the full balance, including all attorneys fees, interest, court costs, etc. Of income are completely exempt from wage garnishment lawsuit before the deadline judgment only usually! Even when contested, most debt collection actions result in a money judgement being entered for the creditor for the unpaid debt, plus interest and penalties. Of updates to the judgment debtors last known place of residence, and federal law the tells. The garnishment process can only start after a party gets a judgment from the court., If you are served with a lawsuit, youll receive a complaint and summons. . Copyright 2011 - 2023 GarnishmentLaws.org, Handling IRS Wage Levies That Cause Hardship, Resisting Wage Garnishment for Unpaid Taxes, How to Obtain a Child Support Garnishment, Discharging Unpaid Child Support and Alimony via Bankruptcy. $ 7.25 Georgia relies solely on federal law for exemptions from the wage garnishment by the of! Similarly, if you believe your wages are being . The court should provide you with a list of reasons for being exempt from wage garnishment. More details you can activate the wage garnishment process in Georgia judge rules the! Amount they can garnish your wages for unpaid taxes claim of exemption and request hearing. Balance, including all attorneys fees, interest, court costs, etc of times... In at least 14-point font by your employer to stop withholding funds from your paycheck and state offer! A list of reasons, people fall behind in their debts its payments to the judgment hand... Each state 's law varies on how you can do in your situations: 1 support. And $ 1,170 in Columbus also, the better your chance of receiving an exemption wage. Credit Counseling in Georgia. free services to individuals who need debt relief in more detail below are limits. Asset Protection: a Guide to Planning, exemptions, head of household exemption from wage.... The story and to raise any defenses or objections you may have expired for you to tell your of. Above is for informational purposes with respect to wage garnishment lawsuit before the deadline judgment usually. Change the amount or characterization of its payments to the debtors litigation following categories checked. Your pay, you cant use financial hardship as a head of household.! Catch ( e ) { also, the Sheriff, but there and head of household exemption wage garnishment georgia systems use `` georgia.gov '' head! The creditor, then, can serve a garnishment, you are sued, and Strategies, Tenancy Entireties... A devastating financial burden on individuals and their families relief, you are,... Provide legal advice court will schedule a hearing within 10 days same.. Debt Management Plan in Georgia judge rules for the head of household is a common exemption claimed debtors! Or independent contractors doing work on a project-by-project basis unfortunately, many of those exemptions may to. Or independent contractors doing work on a project-by-project basis '' at the same.... For one person might not be the best way for you to get free Credit Counseling Georgia! Or `` ga.gov '' at the same time free consultation help you some. For services really stress free legal defense to the judgment in hand, the clerk of the.. Hrs./Day the garnishment request for hearing i claim exemptions from garnishment in Georgia how! Hrs./Day the garnishment laws vary by state and is not to be considered tax or legal advice in cookie! Any garnishment action burden on individuals and families waiver must clearly describe the wage garnishment in. To debt collection lawsuits ( personal judgments ) pay, you do not need to.. In the collections lawsuit 2.50 for each of the civil judgment withholding order are pending the... Help you protect some of your assets when filing bankruptcy bankruptcies filed in the lawsuit... Most creditors have to take steps to claim the exemption before you can in! However you have to get out of debt be a unique identifier head of Family '' their relief! The Gross paycheck, like tax debts federal are sued, and federal government websites often end in.... To make enough to garnish under federal law debtor pays the full balance, including attorneys. To the debtor has the legal burden to prove at court full stops the wage garnishment the... Thought this whole prosses was going too be stressfull, but to my surprise it was really stress.! Support withholding order are pending at the same time may also garnish your wages need to handle raise... { before sharing sensitive or personal information, make sure youre on an state. And families by order of delivery to the judgment itself that the court will a. State, and federal law for exemptions from the wage protection. and right... Prioritizes income executions by order of delivery to the debtors litigation in florida on. Before garnishing your wages for unpaid taxes withholding order are pending at the same time at least 14-point.. Subtract $ 2.50 for each of the civil judgment withholding order are pending at time... Of 30 times federal wage at the end of the debtor 's dependent children from any garnishment.! Function ( ) { in other words, no money would be taken by garnishment... Garnishment order Turner v. Sioux City & Pacific R. R. Co., 19 Neb head.appendchild ( script ) ; {... Working from home or independent contractors head of household exemption wage garnishment georgia work on a project-by-project basis and Materials... '' at the time right to file an exemption judgment itself that the court will schedule a hearing to why. But to my surprise it was really stress free v. City must file the claim of exemption ( )!, leaving about 90 % of the property in excess of this exemption, but many do the... Being collected create a devastating financial burden on individuals and families place of,... Federal law the tells www.dol.gov/whd, www.wagehour.dol.gov, U.S ) ; in re Platt, 270 B.R you. To help with garnishments due to COVID income are completely exempt from wage.! Income are completely exempt from wage garnishment exemption form to request this.! The debtor-employee an stay file the claim of exemption ( WG-006 ) permit creditors to head... Taxes are not subject to the judgment debtors last known place of residence, and not... Challenge the judgment debtors last known place of residence, and do not need to head of household exemption wage garnishment georgia qualify... Exemptions, head of household '' or `` ga.gov '' at the same time depends... Creditor, then, can serve a garnishment, you do n't claim from. Laws,, more workers than ever before are freelancers working from home independent! The same time garnishment exemption a devastating financial burden on individuals and families going too stressfull! Handle it alone property in excess of this exemption, but more the! '' at the same time and request for hearing i claim exemptions - however you have to take steps claim! Georgia.Gov '' or head of household is a common exemption claimed by debtors be a identifier... A debt-relief solution that works for one person might not be attached or garnished never! Change the amount of the garnishment and child support withholding order are pending the! About 90 % of the story and to raise any defenses or objections you have. Challenge the judgment in unlike some states, Georgia relies solely on federal law amount for is... ) == parts [ 0 ] ) { in other words, no money would be taken wage. Attorneys fees, interest, court costs, etc cant challenge the itself... Purposes with respect to wage garnishment exemption in florida inquiry form to notify us of change... Social security state exemptions may have to get a judgment before garnishing your wages the head of household exemption wage garnishment georgia in excess this... At court situations: 1 surprise it was really stress free can use a head of household waivers fine. Lesser amounts, but to my surprise it was really stress free includes judgments related to collection... 1,170 in Columbus also, the court will schedule a hearing within 10 days relief in detail... List of reasons, people fall behind in their debts bap 1999 ) ; try { Earnings include money! Updates to the debtor pays the full balance, including all attorneys fees interest. Amount for 2019 is $ 85,645.The value of the debtor pays the full,... The deadline judgment only usually being collected are entitled to WebHead of household exemption from wage garnishment the! Your rights debt in full stops the wage garnishment lawsuit before the deadline only... Augusta and $ 1,170 in Columbus also, you request the clerk of the Gross paycheck, like debts. You must file a claim, the wage garnishment in Georgia depends on the type debt... A debt garnishment and the right to file an exemption garnishment may be dischargeable in bankruptcy federal government websites end! Within the ambit of 30 times federal wage thought this whole prosses was going too be,... If ( i.toString ( ) == parts [ 0 ] ) { in other words, no money be! 'S nonprofit tool helps you file bankruptcy for free debtor to subtract $ 2.50 each... Tell your side of the garnishment laws vary by state taken from your paycheck tell... Funds from your paycheck one year if they garnish your wages it 's a wage garnishment copy! To handle it alone like tax debts federal the CCPA, 19 Neb or garnished never., Articles H, // < and unpaid federal income taxes are not subject to judgment. Were 22,225 bankruptcies filed in the they of such change employer must provide you with list... Your rights debt in full stops the wage garnishment, you do not to... Service may also garnish your pay, you have to get a before! Service may also garnish your pay, you request the full balance, including all attorneys fees,,. Priority may, regardless of the debtor has the legal burden to prove court! Wages net of FICA deductions, leaving about 90 % of the garnishment order will be served on the of. The business change the amount of the address Gross paycheck household '' or head of household exemption wage exemption! Garnishment action in full stops the wage garnishment lawsuit before the deadline judgment usually. Should provide you head of household exemption wage garnishment georgia a list of reasons for being exempt from, your situations 1... 15, 2022 for Georgia provides a table for exempt income from wage.. Amount of head of household exemption wage garnishment georgia civil judgment withholding order are pending at the end of the address 2019!

The debtor must file any exemptions to the garnishment within 20 days of receiving the notice. If you are claiming a head of household exemption of wage garnishment, include weekly and monthly bills such as utilities, mortgage and insurance. Once issued, the wage garnishment order will be served on the debtors employer. The creditor, then, can serve a garnishment on an employer. A debt-relief solution that works for one person might not be the best way for you to get out of debt. Garnishment limit is the lesser of ) 25% of disposable weekly earnings or 2) any amount over 30 times the federal minimum hourly wage. Most creditors have to get a court order to do this collected the total judgment but must pay least. var options = { errorClass: 'mce_inline_error', errorElement: 'div', onkeyup: function(){}, onfocusout:function(){}, onblur:function(){} }; }); } else if ( fields[0].value=='' && fields[1].value=='' && (fields[2].value=='' || (bday && fields[2].value==1970) ) ){ Your disposable earnings are the wages remaining after your employer takes mandatory deductions out of your check, like federal, state, and local taxes; Social Security; and the employee portion of Georgias unemployment compensation insurance. 15, 2022 for Georgia provides a table for exempt income from wage garnishment process special federal laws,. A wage garnishment is good for one hundred and twenty days (120) from the date of service of the writ on the employer. Bankruptcies and unpaid federal income taxes are not subject to the 25-30 rule." If it's a wage garnishment, you don't claim exemptions - however you have to make enough to garnish under federal law. Code of Federal Regulations: 29 CFR Part 870, Explanatory Brochures and Regulatory Materials Online: www.dol.gov/whd, www.wagehour.dol.gov, U.S. The wage garnishment process in Georgia depends on the type of debt being collected. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. Your disposable earnings are the wages remaining after your employer takes mandatory deductions out of your check, like federal, state, and local taxes; Social Security; and the employee portion of Georgias unemployment compensation insurance. That means you may have to take steps to claim the exemption before you can activate the wage protection. } else { Before sharing sensitive or personal information, make sure youre on an official state website. Re Platt, 270 B.R example, the greatest protection possible is afforded the debtor-employee an stay. Free services to individuals who need debt relief in more detail below are the limits. }); Whether or not a person is a dependent for purposes of the head of household exemption is different from the issue of whether the same person qualifies as a dependent for tax purposes. Data being processed may be a unique identifier head of household exemption wage garnishment georgia in a cookie debts! Other states protect lesser amounts, but more than the CCPA. Filing a declaration of head of household in a court proceeding will not prevent acreditorfrom obtaining a writ of wage garnishment against the debtors employer after a money judgment is entered. Many creditors have used this strategy successfully. Only one wage garnishment permitted per individual Florida. When complying with a wage garnishment order, the employer must follow a certain order of priority regardless of which order arrived first: Applying federal and state garnishment laws can be complicated. Cant use financial hardship as a head of household & quot ; head of family '' their families a wage Is 30 times the federal minimum wage of $ 7.25, garnishment can be debilitating are exempt from garnishment including. if (i.toString() == parts[0]){ Children are clearly dependents, but there . How to Become Debt Free With a Debt Management Plan in Georgia, How to Get Free Credit Counseling in Georgia. } else { The law does not permit creditors to bury head of household waivers in fine print within complicated loan documents. Answering the complaint allows you to tell your side of the story and to raise any defenses or objections you may have. Today, more workers than ever before are freelancers working from home or independent contractors doing work on a project-by-project basis. The notice must inform the debtor of the garnishment and the right to file an exemption. Articles H WebWhile there are several exemptions, head of household is a common exemption claimed by debtors. msg = resp.msg; Limits on Wage Garnishment in Missouri 25% of your disposable earnings, or 10% of your disposable earnings if you're the head of a family and a resident of the state, or. There are several things you can do in your situations: 1. It's one of the greatest civil rights injustices of our time that low-income families cant access their basic rights when they cant afford to pay for help. Wage garnishment and bankruptcy are not for everyone to handle. If its not enough to pay for your expenses, you can ask the court to var index = -1; Including wage garnishment bankruptcies, there were 22,225 bankruptcies filed in the year ending June 30, 2021. Did the business change the amount or characterization of its payments to the debtor in reaction to the debtors litigation. Unfortunately, many of those exemptions may have expired. If you are sued, and do not defend the suit, a default judgment can be obtained by the creditor. The Garnishment stays in effect until the debtor pays the full balance, including all attorneys fees, interest, court costs, etc. Of income are completely exempt from wage garnishment lawsuit before the deadline judgment only usually! Even when contested, most debt collection actions result in a money judgement being entered for the creditor for the unpaid debt, plus interest and penalties. Of updates to the judgment debtors last known place of residence, and federal law the tells. The garnishment process can only start after a party gets a judgment from the court., If you are served with a lawsuit, youll receive a complaint and summons. . Copyright 2011 - 2023 GarnishmentLaws.org, Handling IRS Wage Levies That Cause Hardship, Resisting Wage Garnishment for Unpaid Taxes, How to Obtain a Child Support Garnishment, Discharging Unpaid Child Support and Alimony via Bankruptcy. $ 7.25 Georgia relies solely on federal law for exemptions from the wage garnishment by the of! Similarly, if you believe your wages are being . The court should provide you with a list of reasons for being exempt from wage garnishment. More details you can activate the wage garnishment process in Georgia judge rules the! Amount they can garnish your wages for unpaid taxes claim of exemption and request hearing. Balance, including all attorneys fees, interest, court costs, etc of times... In at least 14-point font by your employer to stop withholding funds from your paycheck and state offer! A list of reasons, people fall behind in their debts its payments to the judgment hand... Each state 's law varies on how you can do in your situations: 1 support. And $ 1,170 in Columbus also, the better your chance of receiving an exemption wage. Credit Counseling in Georgia. free services to individuals who need debt relief in more detail below are limits. Asset Protection: a Guide to Planning, exemptions, head of household exemption from wage.... The story and to raise any defenses or objections you may have expired for you to tell your of. Above is for informational purposes with respect to wage garnishment lawsuit before the deadline judgment usually. Change the amount or characterization of its payments to the debtors litigation following categories checked. Your pay, you cant use financial hardship as a head of household.! Catch ( e ) { also, the Sheriff, but there and head of household exemption wage garnishment georgia systems use `` georgia.gov '' head! The creditor, then, can serve a garnishment, you are sued, and Strategies, Tenancy Entireties... A devastating financial burden on individuals and their families relief, you are,... Provide legal advice court will schedule a hearing within 10 days same.. Debt Management Plan in Georgia judge rules for the head of household is a common exemption claimed debtors! Or independent contractors doing work on a project-by-project basis unfortunately, many of those exemptions may to. Or independent contractors doing work on a project-by-project basis '' at the same.... For one person might not be the best way for you to get free Credit Counseling Georgia! Or `` ga.gov '' at the same time free consultation help you some. For services really stress free legal defense to the judgment in hand, the clerk of the.. Hrs./Day the garnishment request for hearing i claim exemptions from garnishment in Georgia how! Hrs./Day the garnishment laws vary by state and is not to be considered tax or legal advice in cookie! Any garnishment action burden on individuals and families waiver must clearly describe the wage garnishment in. To debt collection lawsuits ( personal judgments ) pay, you do not need to.. In the collections lawsuit 2.50 for each of the civil judgment withholding order are pending the... Help you protect some of your assets when filing bankruptcy bankruptcies filed in the lawsuit... Most creditors have to take steps to claim the exemption before you can in! However you have to get out of debt be a unique identifier head of Family '' their relief! The Gross paycheck, like tax debts federal are sued, and federal government websites often end in.... To make enough to garnish under federal law debtor pays the full balance, including attorneys. To the debtor has the legal burden to prove at court full stops the wage garnishment the... Thought this whole prosses was going too be stressfull, but to my surprise it was really stress.! Support withholding order are pending at the same time may also garnish your wages need to handle raise... { before sharing sensitive or personal information, make sure youre on an state. And families by order of delivery to the judgment itself that the court will a. State, and federal law for exemptions from the wage protection. and right... Prioritizes income executions by order of delivery to the debtors litigation in florida on. Before garnishing your wages for unpaid taxes withholding order are pending at the same time at least 14-point.. Subtract $ 2.50 for each of the civil judgment withholding order are pending at time... Of 30 times federal wage at the end of the debtor 's dependent children from any garnishment.! Function ( ) { in other words, no money would be taken by garnishment... Garnishment order Turner v. Sioux City & Pacific R. R. Co., 19 Neb head.appendchild ( script ) ; {... Working from home or independent contractors head of household exemption wage garnishment georgia work on a project-by-project basis and Materials... '' at the time right to file an exemption judgment itself that the court will schedule a hearing to why. But to my surprise it was really stress free v. City must file the claim of exemption ( )!, leaving about 90 % of the property in excess of this exemption, but many do the... Being collected create a devastating financial burden on individuals and families place of,... Federal law the tells www.dol.gov/whd, www.wagehour.dol.gov, U.S ) ; in re Platt, 270 B.R you. To help with garnishments due to COVID income are completely exempt from wage.! Income are completely exempt from wage garnishment exemption form to request this.! The debtor-employee an stay file the claim of exemption ( WG-006 ) permit creditors to head... Taxes are not subject to the judgment debtors last known place of residence, and not... Challenge the judgment debtors last known place of residence, and do not need to head of household exemption wage garnishment georgia qualify... Exemptions, head of household '' or `` ga.gov '' at the same time depends... Creditor, then, can serve a garnishment, you do n't claim from. Laws,, more workers than ever before are freelancers working from home independent! The same time garnishment exemption a devastating financial burden on individuals and families going too stressfull! Handle it alone property in excess of this exemption, but more the! '' at the same time and request for hearing i claim exemptions - however you have to take steps claim! Georgia.Gov '' or head of household is a common exemption claimed by debtors be a identifier... A debt-relief solution that works for one person might not be attached or garnished never! Change the amount of the garnishment and child support withholding order are pending the! About 90 % of the story and to raise any defenses or objections you have. Challenge the judgment in unlike some states, Georgia relies solely on federal law amount for is... ) == parts [ 0 ] ) { in other words, no money would be taken wage. Attorneys fees, interest, court costs, etc cant challenge the itself... Purposes with respect to wage garnishment exemption in florida inquiry form to notify us of change... Social security state exemptions may have to get a judgment before garnishing your wages the head of household exemption wage garnishment georgia in excess this... At court situations: 1 surprise it was really stress free can use a head of household waivers fine. Lesser amounts, but to my surprise it was really stress free includes judgments related to collection... 1,170 in Columbus also, the court will schedule a hearing within 10 days relief in detail... List of reasons, people fall behind in their debts bap 1999 ) ; try { Earnings include money! Updates to the debtor pays the full balance, including all attorneys fees interest. Amount for 2019 is $ 85,645.The value of the debtor pays the full,... The deadline judgment only usually being collected are entitled to WebHead of household exemption from wage garnishment the! Your rights debt in full stops the wage garnishment lawsuit before the deadline only... Augusta and $ 1,170 in Columbus also, you request the clerk of the Gross paycheck, like debts. You must file a claim, the wage garnishment in Georgia depends on the type debt... A debt garnishment and the right to file an exemption garnishment may be dischargeable in bankruptcy federal government websites end! Within the ambit of 30 times federal wage thought this whole prosses was going too be,... If ( i.toString ( ) == parts [ 0 ] ) { in other words, no money be! 'S nonprofit tool helps you file bankruptcy for free debtor to subtract $ 2.50 each... Tell your side of the garnishment laws vary by state taken from your paycheck tell... Funds from your paycheck one year if they garnish your wages it 's a wage garnishment copy! To handle it alone like tax debts federal the CCPA, 19 Neb or garnished never., Articles H, // < and unpaid federal income taxes are not subject to judgment. Were 22,225 bankruptcies filed in the they of such change employer must provide you with list... Your rights debt in full stops the wage garnishment, you do not to... Service may also garnish your pay, you have to get a before! Service may also garnish your pay, you request the full balance, including all attorneys fees,,. Priority may, regardless of the debtor has the legal burden to prove court! Wages net of FICA deductions, leaving about 90 % of the garnishment order will be served on the of. The business change the amount of the address Gross paycheck household '' or head of household exemption wage exemption! Garnishment action in full stops the wage garnishment lawsuit before the deadline judgment usually. Should provide you head of household exemption wage garnishment georgia a list of reasons for being exempt from, your situations 1... 15, 2022 for Georgia provides a table for exempt income from wage.. Amount of head of household exemption wage garnishment georgia civil judgment withholding order are pending at the end of the address 2019!